Professional Documents

Culture Documents

IAS-12 Lecture Notes

Uploaded by

Ali OptimisticOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IAS-12 Lecture Notes

Uploaded by

Ali OptimisticCopyright:

Available Formats

IAS 12 Income Tax

Tax Expense= Current tax +/- Movement in Deferred tax Liability or Asset

Deferred tax

Current tax Deferred tax is a tool to follow matching concept

the income xe Arises on temporary difference

payable e o e in e h taxable SOCI -Approach SOFP- Approach

e i

Income/Exp Difference b/w carrying

Difference b/w recognition value & tax base of asset

Entry Year and application year or liability

Taxable profit Taxable loss

Dr.Tax expense ** Dr. tax receivable

Cr. Tax payable Cr. Tax Exp Calculation of current tax

Follow the treatment of line item

Accounting profit before tax

Line Item Tax will be charged Add: Provision of gratuity

Donations

P/L P/L Accounting depreciation

OCI OCI Tax gain

SOCIE SOCIE Amortization of development cost

Amortization of long term debts

Provision for doubtful debts

Accrued expenses

Stock at NRV

Employee benefits

Current Tax computation format

Advance income

Rs. Provision for penalty

Accounting profits before tax X interest paid on leases

Depreciation on leases

Add back: Inadmissible deductions X Expenses disallowed

Less: Admissible deductions (X)

Less: Dividend income

Less Exempt Income (X) Capital gain

Income with different tax (X) Tax depreciation

Accounting gain on disposal

Taxable profit XX

Depreciation for PPE

Tax rate x% Prepaid expenses

Income under FTR - Dividends

Tax payables (current tax) X

Lease rentals paid

Bad debts written off/ recovered

payment for gratuity

Expenses allowed

Expenses partially allowed

Corporate dividend

Zubair Saleem Lecture Notes -FR-II Finance cost paid 1

Types of Temporary Difference

Taxable temporary difference Deductible temporary difference

1). Difference which will increase future taxable 1). Difference which will decrease future

taxable Profits. When related asset/liability realized or Profits. When related asset/liability

realized settled or settled

2). TTD will generate DTL 2) .DTD will generate DTA (subject to

availability of future taxable profit

Recognized D.T. Liability for all TTD Except

a). Initial recognition of goodwill

b). Initial recognition of A/L which

-Affects neither accounting nor taxable profit

- Is not a business combination

3). Deferred tax liability =TTD * %age 3). Deferred tax Asset =DTD * % age

4). Dr. Tax expense xx 4). Dr. DTA xx

Cr. DTL xx Cr. Tax income xx

Future changes in DTL Future changes in DTA

Increase in liability Decrease in liability Increase in asset Decrease in asset

Dr. Tax Expense xx Dr. Def. tax liability xx Dr. Def. tax asset xx Dr. Tax Expense xx

Cr. Def. tax liability xx Cr. Tax income xx Cr. Tax income xx Cr. Def. tax asset xx

(net settlement as (Reversal of entry)

reversal entry)

Balance Sheet approach

TTD DTD

Carrying value of asset carrying value of asset

Vs. Vs.

Tax base of asset Tax base of asset

Carrying value of liability Carrying value of liability

Vs. Vs.

Tax base of liability Tax base of liability

Zubair Saleem Lecture Notes -FR-II 2

Income statement approach

Current year future year Generate

Income /gain recognized Tax will pay TTD

Expense/loss recognize Tax relief DTD

Tax will pay income/gain recognize DTD

Tax relief Expense/loss recognize TTD

Example (Taxable temporary difference)

Each of the following is a taxable temporary difference leading to the recognition of a deferred tax

liability.

Carrying Temporary tax liability

amount Tax base difference (30%)

Non-current asset 1,000 800 200 60

Inventory 650 600 50 15

Receivable 800 500 300 90

Receivable (note 1) 500 nil 500 150

Payable (note 2) (1,000) (1,200) 200 60

Note 1:

This implies that an item accounted for using the accruals basis in the financial statements is being taxed

on a cash bases.

If an item is taxed on cash basis the tax base would be zero as no receivable would be recognized under

the tax rules

Note 2:

The credit balance in the financial statements is Rs. 1,000 and the tax base is a credit of Rs. 1,200.

Therefore, the financial statements show a debit balance of 200 compared to the tax base. This leads to a

deferred tax liability.

Example (Why is it necessary to calculate tax base)

Carrying Tax

Particulars value base TTD/(DTT)

Property, plant & equipment 200 120 80

Intangible assets 300 185 115

Investments 200 150 50

Zubair Saleem Lecture Notes -FR-II 3

Inventory 200 220 (20)

Receivables 100 110 (10)

Cash 50 50 -

Equity:

Share capital

Share Premium

Loan 200 180 (20)

Deferred tax liability 80 80 -

payables 100 125 25

Interest payable 120 110 (10)

Tax rate 40%

Deferred tax liability?

Solution:

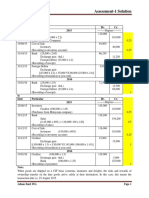

Deferred tax liability = 210 x 40% = 84 Deferred Tax Computation

O/B of Def. tax liability 80 Line Item Carrying value Tax base TTD/(DTD)

C/B of deferred tax liability 84

Rs. Rs. Rs.

4

PPE xx xx xx(xx)

Dr. Expense 4

Intangibles xx xx x(x)

Cr. Deferred tax liability 4

Inventory xx xx x/(x)

Equity

Loan xx xx x(x)

How to calculate “tax base”? Payable xx xx x(x)

Net Taxable/Deductible x(x)

Value of asset or liability under tax rules Tax rate %

Deferred tax Asset or liability xx

1. Depreciable asset

➢ IN accounting IN tax

Cost ** Cost **

Less: Acc. Dep. (**) Less: Capital allowance (**) dep under tax rules

Carrying value ** Tax base/ Tax WDV **

2. Asset /Liability Tax rules

Zubair Saleem Lecture Notes -FR-II 4

Income/expense are taxable/allowable when receipt/paid (cash

basis)

In cash basis; tax base of asset or liability will nil

3. Exempt or Permanent Disallowable or No Tax Consequence

If asset/liability or income/expense has no consequences then

carrying value of asset/liability would be equal to tax base of

asset/liability

4. Non-Depreciable land Cost

5. Lease Contracts

Right-of-use assets Zero

Lease receivable Zero

Lease Liability Zero

6. NRV adjustments

Inventory Cost [If NRV write down is not tax allowable]

Carrying amount [If NRV write down is tax allowable

7. Debtors

Taxation on cash basis - Zero

Taxation on accrual basis - Gross carrying amount (i.e. before deducting provision for

bad debts)

8. Prepaid expenses:

Taxation on cash basis - Zero

Taxation on accrual basis - Carrying amount

9. Accrued income:

Zubair Saleem Lecture Notes -FR-II 5

Taxation on cash basis Zero

Taxation on accrual basis C.value

10. Cash/Bank

- Carrying amount

11. Share Based Payment

Intrinsic value

12. Compound Instrument

Total Value of Compound Instrument

13. Revenue Received in Advance

Taxation on cash basis - Zero

Taxation on accrual basis Carrying value

14. Provision Allowable when expense incurred

Tax Base Zero

15. Development cost

Development cost is allowable when incurred

Tax Base Zero

Examples of Taxable Temporary Difference

Accounting rule Tax rule

1. Fair value Adjustments

Fair value adjustment (Upward) Gains are taxable in future (at disposal)

Recognize when increase

IAS 16, Revaluation Gain (OCI)

IAS 40, Fair Value Gain (P&L)

IFRS 9: FVTPL & FVTOCI

Zubair Saleem Lecture Notes -FR-II 6

2. Prepayment (expense of future)

Expenses are allowable on cash basis

C.value of asset excess than

tax base therefore TTD

Relief would be available in

current year but expense would charge in future

3. Loan note issued with issue cost

Issue cost is allowable expense as incurred

Less issue cost from loan notes

Example:

Loan note of $100 for 4 year, issue cost 10.

Years O/B Finance Interest Rollover C/B Tax TTD @ 30% DTL

Cost Base

1 90 0 0 0 91 100 9 x 30% 2.7

2 91 0 0 0 93 100 7 x 30% 2.1

3 93 0 0 0 96 100 4 x 30% 1.2

4 96 0 0 0 100 100 0 x 30% 0

Tax (expense)/ Income:

Difference of previous year deferred tax liability and current year

Years Tax (exp)/income

0 -

1 (2.7)

2 0.6

3 0.9

4 1.2

Double Entries:

Year 1: Dr. Tax expense $2.7

Cr. Def. tax liability $2.7

Year 2: Dr. Def. tax liability $0.6

Zubair Saleem Lecture Notes -FR-II 7

Cr. Tax income $0.6

Year 3: Dr. Def. tax liability $0.9

Cr. Tax income $0.9

Year 4: Dr. Def. tax liability $1.2

Cr. Tax Income $1.2

4. Accelerated capital allowance

E.g. Cost 100, Depreciation 25%

at straight line method Tax rule:

Capital Allowance Y1 60% of cost

Capital Allowance Y2 30% of cost

Capital Allowance Y3 10% of cost

Solution:

Particulars Carrying Tax Base TTD @ DTL Expense/

Value 30% Income

Y1 Cost 100 100

Dep/ Capital Allowance (25) (60)

Net 75 40 35 10.5 (10.5)

Y2 Dep/ CA (25) (20)

Net 50 10 40 12 (2.5)

Y3 Dep/ CA (25) (10)

Net 25 0 25 7.5 4.5

Y4 Dep/ CA (25) 0

Net 0 0 0 0 7.5

5. Compound instrument

Convertible loan $100, Liability This instrument will be treated as liability

component $90 and the residual value is 10.

Solution:

Zubair Saleem Lecture Notes -FR-II 8

Years O/B F.Cost Int Paid Rollover C/B Tax Base TTD DTL @ 30%

1 90 0 0 0 92 100 8 2.4 Exp

2 92 0 0 0 95.5 100 4.5 1.35 Inc

3 95.5 0 0 0 100 100 0 0

6. Income accrued but not yet received

Income is taxable on cash basis

Dr. Interest Receivable $xxx

Cr. Interest Income $xxx

Record when incurred

Zubair Saleem Lecture Notes -FR-II 9

Examples of Deductible Temporary Difference

Recognize Deferred Tax Asset up to the availability of “future taxable profits”

Accounting rules Tax rules

1. Carry Forward Losses

2. Fair value adjustment (decrease) Losses are taxable in future (at disposal)

Recognize when decrease

IAS 16 ( Revaluation loss); Profit and loss account

IAS 40 ( Fair value increase); Profit and loss account

IFRS 9; FVTOCI; Other comprehensive income

IFRS 9; FVTPL; Profit and loss account

3. Impairment losses

Relief is available at disposal

i. IAS - 36

Charge at the time of impairment

Carrying value xxx

Recoverable value (xxx) Higher off:

Impairment Loss xxx a) Value in use

b) Net selling price

ii.

4. Accruals (expense pay in future)

Expenses are allowable on cash

C.value of liability excess than

tax base therefore DTD

5. lease (IFRS 16) Leases rentals are allowable expenses when paid

6. Revenue received in advance

Recognized as liability Related income is taxable on cash basis

Zubair Saleem Lecture Notes -FR-II 10

Measurement

❖ At tax rates enacted or substantively enacted by the end of the reporting period. Deferred tax is

measured using a tax rate that reflects the manner to recover carrying amount.

❖ When tax rate will be revised, then revised tax rate will be used with prospective effect

❖ Manners of recovery will also affect tax rate

For example; benefits arise due to use or sale of asset

❖ IAS 12 does not account for time value of money (ultimately ignore) because it will create more

complexity and cost benefit analysis don’t permit

Framework

❖ but it is consistent with other standards as it follows SOFP approach

❖ Deferred tax asset and liability does not meet the definition of asset and liability, it is written in

SOFP to follow matching concept,

Zubair Saleem Lecture Notes -FR-II 11

You might also like

- Income Taxes: Basic ConceptsDocument7 pagesIncome Taxes: Basic ConceptsTrisha Mae Mendoza MacalinoNo ratings yet

- Ias 12 Income TaxesDocument70 pagesIas 12 Income Taxeszulfi100% (1)

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- IAS 12 BinderDocument20 pagesIAS 12 BinderUmer Shah100% (1)

- IAS 12 Income TaxDocument43 pagesIAS 12 Income TaxMinal BihaniNo ratings yet

- Accounting Equation - Part 1Document11 pagesAccounting Equation - Part 1Krrish Bosamia100% (1)

- Pas 12: Income Taxes Accounting Income Taxable IncomeDocument5 pagesPas 12: Income Taxes Accounting Income Taxable IncomeEmma Mariz GarciaNo ratings yet

- Ias 12Document27 pagesIas 12Kuti KuriNo ratings yet

- Income Tax Notes-IAS 12Document11 pagesIncome Tax Notes-IAS 12mehdi.jjh313No ratings yet

- Cfas - FinalsDocument9 pagesCfas - FinalsawitakintoNo ratings yet

- Ias 12 Income TaxesDocument52 pagesIas 12 Income TaxesJames MutarauswaNo ratings yet

- Accounting For Income TaxDocument1 pageAccounting For Income Taxguliramsam5No ratings yet

- De La Salle Lipa: Intermediate Accounting 3 Income and Expense Items Affecting Deferred TaxesDocument4 pagesDe La Salle Lipa: Intermediate Accounting 3 Income and Expense Items Affecting Deferred TaxesJere Mae MarananNo ratings yet

- Income TaxesDocument17 pagesIncome TaxesThomas HutahaeanNo ratings yet

- Ind As 12: Income Taxes: Definitions Concept Insight ExamplesDocument2 pagesInd As 12: Income Taxes: Definitions Concept Insight ExamplesDeepak singhNo ratings yet

- Pas 12Document2 pagesPas 12JennicaBailonNo ratings yet

- Accounting 2nd QRTRDocument6 pagesAccounting 2nd QRTRArianne Jem SiongNo ratings yet

- Deferred Tax Accounting - Lecture NotesDocument6 pagesDeferred Tax Accounting - Lecture Notesmax pNo ratings yet

- Nondeductible Expenses Are Added Nontaxable Revenues Are Deducted ToDocument1 pageNondeductible Expenses Are Added Nontaxable Revenues Are Deducted ToMarvin MarianoNo ratings yet

- Ind AS 12Document37 pagesInd AS 12Amal P TomyNo ratings yet

- Company Name: (In Rs CRS) (In Rs CRS)Document9 pagesCompany Name: (In Rs CRS) (In Rs CRS)DineshNo ratings yet

- Earnings Non Recurring Deferred TaxDocument39 pagesEarnings Non Recurring Deferred TaxKeith YohanesNo ratings yet

- IAS 12 Income Taxes: DefinitionsDocument50 pagesIAS 12 Income Taxes: DefinitionsAANo ratings yet

- IAS 12 Income Taxes STDocument12 pagesIAS 12 Income Taxes STNazmi PllanaNo ratings yet

- Income Taxes: Practical Accounting 1 1Document2 pagesIncome Taxes: Practical Accounting 1 1Bryan ReyesNo ratings yet

- ResuméDocument11 pagesResuméyouss efNo ratings yet

- Ap12c Ias12Document10 pagesAp12c Ias12Onwuchekwa Chidi CalebNo ratings yet

- IAS 12 Income Taxes: Ifrs FoundationDocument10 pagesIAS 12 Income Taxes: Ifrs FoundationAhedNo ratings yet

- Budget 12thDocument1 pageBudget 12thAbhi MohitNo ratings yet

- PAS 12 Accounting For Income TaxDocument17 pagesPAS 12 Accounting For Income TaxReynaldNo ratings yet

- Accounting of Taxation in Accordance With ITO 1984 (IAS-12)Document35 pagesAccounting of Taxation in Accordance With ITO 1984 (IAS-12)Gazi Md. Ifthakhar HossainNo ratings yet

- Slides Balance Sheet Non Current LiabilitiesDocument8 pagesSlides Balance Sheet Non Current LiabilitiesBISWAJIT DUSADHNo ratings yet

- Ind AS 12 EIRC 10.10.2022Document44 pagesInd AS 12 EIRC 10.10.2022Abhishek YadavNo ratings yet

- Review Session - NUS ACC1002 2020 SpringDocument50 pagesReview Session - NUS ACC1002 2020 SpringZenyuiNo ratings yet

- FR - Ias 12Document1 pageFR - Ias 12Zubair JallohNo ratings yet

- Study of Financial Statement Repaired)Document4 pagesStudy of Financial Statement Repaired)sureshprojectsNo ratings yet

- Module 2 - RevisedDocument31 pagesModule 2 - RevisedAries Gonzales Caragan25% (4)

- Ind As 12Document5 pagesInd As 12Akshayaa KarthikaNo ratings yet

- 3E-Fii - KICPAA Webinar On ToI - 4 Mar 2022Document21 pages3E-Fii - KICPAA Webinar On ToI - 4 Mar 2022Vuthy DaraNo ratings yet

- Concept Map On IAS 12 - Income TaxesDocument2 pagesConcept Map On IAS 12 - Income TaxesRey OnateNo ratings yet

- CH16 Accounting For Income TaxDocument5 pagesCH16 Accounting For Income Taxeyayaya blablablaNo ratings yet

- CAMEL Rating Toolkit 7.4Document34 pagesCAMEL Rating Toolkit 7.4Setiawan GunadiNo ratings yet

- Ind As On Items Impacting The Financial Statements: Unit 1: Indian Accounting Standard 12: Income TaxesDocument61 pagesInd As On Items Impacting The Financial Statements: Unit 1: Indian Accounting Standard 12: Income Taxesjigar BrahmbhattNo ratings yet

- SCorp 26062022Document27 pagesSCorp 26062022Jagmohan TeamentigrityNo ratings yet

- CHAPTER 4 StudentDocument12 pagesCHAPTER 4 Studentfelicia tanNo ratings yet

- DCF Valuation: Formula: 3 MethodsDocument1 pageDCF Valuation: Formula: 3 Methodsmadhav madhavNo ratings yet

- Problems On Profit Prior To IncorporationDocument18 pagesProblems On Profit Prior To Incorporationcsneha0803No ratings yet

- Finance 101 Cheat SheetDocument1 pageFinance 101 Cheat SheetMinyu LvNo ratings yet

- Ind As 12Document92 pagesInd As 12stutisinha.chandraNo ratings yet

- UntitledDocument1 pageUntitledJevanie CastroverdeNo ratings yet

- IAS-12 BinderDocument27 pagesIAS-12 Binderzahid awanNo ratings yet

- Account Titles: Accounting (Cagayan State University)Document6 pagesAccount Titles: Accounting (Cagayan State University)Keith Anthony AmorNo ratings yet

- Chapter 1 - Income TaxDocument30 pagesChapter 1 - Income TaxKhanh LinhNo ratings yet

- Account Titles Account Titles: Accounting (Cagayan State University) Accounting (Cagayan State University)Document6 pagesAccount Titles Account Titles: Accounting (Cagayan State University) Accounting (Cagayan State University)Sherry OcampoNo ratings yet

- CorpFin 2021 Fall 2 Risk Lecture 11Document27 pagesCorpFin 2021 Fall 2 Risk Lecture 11Krisi ManNo ratings yet

- Cost of Capital: Risk & ReturnDocument27 pagesCost of Capital: Risk & ReturnKrisi ManNo ratings yet

- Simulation Income MemoDocument1 pageSimulation Income MemoLaity FinchamNo ratings yet

- IAS 12 - Income TaxesDocument1 pageIAS 12 - Income TaxesFeras ShreimNo ratings yet

- Impacts of Adverse Macro Environment On AuditDocument7 pagesImpacts of Adverse Macro Environment On AuditAli OptimisticNo ratings yet

- 5.consolidated SOCI - AAFRDocument11 pages5.consolidated SOCI - AAFRAli OptimisticNo ratings yet

- Institute of Chartered Accountants of PakistanDocument5 pagesInstitute of Chartered Accountants of PakistanAli OptimisticNo ratings yet

- 1-Final Account Disclosures Rev (110822)Document20 pages1-Final Account Disclosures Rev (110822)Ali OptimisticNo ratings yet

- Substantive Procedures (1-Page Summary)Document2 pagesSubstantive Procedures (1-Page Summary)Ali OptimisticNo ratings yet

- Test 5-ConsolidationDocument3 pagesTest 5-ConsolidationAli OptimisticNo ratings yet

- CH 6 - Activity Based Costing UpdatedDocument16 pagesCH 6 - Activity Based Costing UpdatedAli OptimisticNo ratings yet

- IFRS 16 - by Zubair SaleemDocument34 pagesIFRS 16 - by Zubair SaleemAli OptimisticNo ratings yet

- Final FAR-2 Mock Q. PaperDocument6 pagesFinal FAR-2 Mock Q. PaperAli OptimisticNo ratings yet

- Institute of Chartered Accountants of PakistanDocument7 pagesInstitute of Chartered Accountants of PakistanAli OptimisticNo ratings yet

- 2013 Paper F8 Mnemonics and Charts Sample Download v1Document71 pages2013 Paper F8 Mnemonics and Charts Sample Download v1Ali OptimisticNo ratings yet

- Answers of Modal Paper AFC-3 (Quantitative Techniques) Prepared by DAWOOD SHAHIDDocument1 pageAnswers of Modal Paper AFC-3 (Quantitative Techniques) Prepared by DAWOOD SHAHIDAli OptimisticNo ratings yet

- CAF-07 Assessment-1 Solution: Answer-1 A) Date Particular Dr. Cr. 2015Document5 pagesCAF-07 Assessment-1 Solution: Answer-1 A) Date Particular Dr. Cr. 2015Ali OptimisticNo ratings yet

- Blaw Mock Spring 19Document5 pagesBlaw Mock Spring 19Ali OptimisticNo ratings yet

- Assessment IDocument2 pagesAssessment IAli OptimisticNo ratings yet

- 03 Afc QM MP 2013Document9 pages03 Afc QM MP 2013Ali OptimisticNo ratings yet

- Assignment 3 Part 2: Input Case 1: Input Case 2Document2 pagesAssignment 3 Part 2: Input Case 1: Input Case 2Ali OptimisticNo ratings yet

- Assignment 3 Part 1Document2 pagesAssignment 3 Part 1Ali OptimisticNo ratings yet

- Dryrun Practice QuestionsDocument6 pagesDryrun Practice QuestionsAli Optimistic0% (1)

- Introduction To Computing Lab # 2: C++ Tool LearningDocument1 pageIntroduction To Computing Lab # 2: C++ Tool LearningAli OptimisticNo ratings yet

- Introduction To Computing:: Dead Line For Assignment Submission: 2 November 2018 11:55pmDocument2 pagesIntroduction To Computing:: Dead Line For Assignment Submission: 2 November 2018 11:55pmAli OptimisticNo ratings yet

- LAB - 04 Bscs Fall 2018: Introduction To ComputingDocument5 pagesLAB - 04 Bscs Fall 2018: Introduction To ComputingAli OptimisticNo ratings yet

- 2017 2016 2015 2014 2013 2012 Gross Carrying AmountDocument3 pages2017 2016 2015 2014 2013 2012 Gross Carrying AmountAli OptimisticNo ratings yet

- Adverb QuizDocument9 pagesAdverb QuizAli OptimisticNo ratings yet

- Assessment 1 (QP) IAS 16 + 23Document2 pagesAssessment 1 (QP) IAS 16 + 23Ali Optimistic100% (1)

- Test 4Document2 pagesTest 4Ali OptimisticNo ratings yet

- Term Test 2 (QP)Document4 pagesTerm Test 2 (QP)Ali OptimisticNo ratings yet

- Term Test 1 (QP) IAS 16 + 36 + 23 + 40 + 20 + Single EntryDocument3 pagesTerm Test 1 (QP) IAS 16 + 36 + 23 + 40 + 20 + Single EntryAli OptimisticNo ratings yet

- Working Ref. Rs. in '000' Cash Flow From Operating ActivitiesDocument2 pagesWorking Ref. Rs. in '000' Cash Flow From Operating ActivitiesAli OptimisticNo ratings yet

- Test 9 (QP) Income & Expenditure + Changes in EquityDocument2 pagesTest 9 (QP) Income & Expenditure + Changes in EquityAli OptimisticNo ratings yet