Professional Documents

Culture Documents

N5 Financial Accounting November 2016

Uploaded by

TsholofeloCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

N5 Financial Accounting November 2016

Uploaded by

TsholofeloCopyright:

Available Formats

N560(E)(N22)H

NOVEMBER EXAMINATION

NATIONAL CERTIFICATE

FINANCIAL ACCOUNTING N5

(4010175)

22 November 2016 (X-Paper)

09:00–12:00

Calculators may be used.

This question paper consists of 10 pages and an answer book of 9 pages.

Copyright reserved Please turn over

(4010175) -2- N560(E)(N22)H

DEPARTMENT OF HIGHER EDUCATION AND TRAINING

REPUBLIC OF SOUTH AFRICA

NATIONAL CERTIFICATE

FINANCIAL ACCOUNTING N5

TIME: 3 HOURS

MARKS: 200

INSTRUCTIONS AND INFORMATION

1. Answer ALL the questions.

2. Read ALL the questions carefully.

3. Answer ALL the questions in the attached ANSWER BOOK.

4. Write your EXAMINATION NUMBER and CENTRE NUMBER on every page

of the attached ANSWER BOOK.

5. Show ALL calculations in brackets, where applicable.

6. Financial statements MUST be according to the 2001 syllabus.

7. Use only blue or black ink.

8. Tipp-Ex may NOT be used.

9. Write neatly and legibly.

Copyright reserved Please turn over

(4010175) -3- N560(E)(N22)H

QUESTION 1

The information presented below is from the records of KayCo Stores for the financial

year ended 29 February 2016. KayCo Stores is a partnership with partners Kayt and

Corrie.

PREADJUSTMENT TRIAL BALANCE AS AT 29 FEBRUARY 2016

Debit Credit

Balance sheet account section

Capital: Kayt 264 000

Corrie 176 000

Current : Kayt 7 880

Corrie 10 200

Drawings: Kayt 6 880

Corrie 19 310

Land and buildings 420 000

Equipment 62 030

Accumulative depreciation on equipment 26 250

Trading inventory 71 010

Debtors control 22 220

Creditors control 51 680

Loan: Partner Corrie (12%) 68 000

Cash and cash equivalents 4 020

Nominal accounts section

Sales 432 210

Cost of sales 270 130

Rent income 37 200

Salary: Kayt 60 000

Corrie 60 000

Salaries and wages 34 080

Insurance 6 980

Stationery 7 430

Water and electricity 13 460

Bad debts 1 850

Discount received 1 740

1 067 280 1 067 280

Take the following adjustments into account:

A debtor who owed R580 was declared insolvent. His estate paid 35% of his debt, and

this has been correctly recorded. The remaining balance must be written off as a bad

debt.

The rent increased by R200 on 1 December 2015. The tenant has paid the rent until

the end of March 2016.

Depreciation on equipment of R12 406 must be taken into account.

Copyright reserved Please turn over

(4010175) -4- N560(E)(N22)H

During a burglary at the shop, stock costing R24 000 was stolen. The insurance

company has agreed to pay out an amount of R18 000, but this has not yet been

received.

The physical count at 29 February 2016 revealed the following on hand:

Trading stock R45 210

Stationery R620

The loan from Corrie is reduced by R5 000 on 31 July of each year.

The partnership agreement made provision for the following:

Kayt is entitled to an annual salary allowance of R90 000.

Corrie receives a monthly salary of R6 000 per month.

Interest on capital is calculated at 8% per annum on capital balances.

Interest on current accounts will be levied at 7,5% per annum.

The remaining profit or loss is distributed in the ratio 2:1 between Kayt and Corrie.

REQUIRED

1.1. Complete the Income and Appropriation Statement for the year ended

29 February 2016. (33)

1.2. Prepare the note to the Balance Sheet for the current accounts of the

partners. (17)

[50]

Copyright reserved Please turn over

(4010175) -5- N560(E)(N22)H

QUESTION 2

2.1 KZ Traders has a branch in Kwakwatsi. Stock is dispatched to the branch at

cost price. Cash is transferred to head office at the end of each month.

The following information relates to branch transactions for the year ending

29 February 2016:

Stock on 1 March 2015 3 520

Stock on 29 February 2016 3 270

Cash in bank on 1 March 2015 12 060

Cash in bank on 29 February 2016 10 500

Sundry debtors on 1 March 2015 8 080

Goods received from head office 11 280

Returns to head office 280

Cash sales 7 840

Credit sales 13 780

Discount to customers 310

Returns from customers 240

Cash received from debtors 13 800

Expenses paid by the branch:

Wages 600

Telephone 3 690

Municipal expenses 4 270

Branch expenses paid by head office:

Salaries 9 800

Sundry expenses 3 700

REQUIRED

Use the information given and prepare the following accounts in the general

ledger of the head office. Balance the accounts on 29 February 2016, the

end of the financial year.

2.1.1 Branch stock (8)

2.1.2 Branch debtors (6)

2.1.3 Branch bank (8)

2.1.4 Goods to branch (3)

2.1.5 Branch profit and loss (8)

Copyright reserved Please turn over

(4010175) -6- N560(E)(N22)H

2.2 Toyland has its head office in Pretoria and a branch in Petit.

The head office keeps only one account in its books in which all transactions

with regard to the branch are entered.

The following is a summary of these transactions.

Balance due by the branch on 1 March 2015 60 800

A desk transferred from the head office to the branch 2 400

Goods supplied by head office to the branch 43 200

Branch salaries paid by head office 32 600

The branch sent cash to head office 88 200

On 29 February 2016 the profit and loss account of the branch

showed a net profit 5 500

REQUIRED

Show the branch account in the general ledger of head office. Balance the

account on 29 February 2016, the end of the financial year. (7)

[40]

QUESTION 3

February 2015

1 Stock on hand 180 items @ R28,80

8 Purchased 560 items @ R29,50

12 Sold 130 items @ R46,60

16 Sold 370 items @ R47,20

22 Purchased 760 items @ R30,60

25 Sold 140 items @ R48,00

26 Sold 530 items @ R50,30

Enter the following transactions on the stock cards of Wandile Traders for

February 2015 if the following stock systems were used:

3.1 FIFO (20)

3.2 Average cost price (20)

[40]

Copyright reserved Please turn over

(4010175) -7- N560(E)(N22)H

QUESTION 4

Mr P Nkomo of Prime Stores does not keep full records of all transactions.

TRIAL BALANCE ON 28 FEBRUARY 2015

Capital 192 000

Drawings 59 400

Profit and loss 251 000

Vehicles 240 000

Accumulated depreciation: Vehicles 72 000

Stock 294 410

Debtors control 28 200

Loan: My Bank (12%) 78 000

Creditors control 42 900

Provision for bad debts 1 410

Bank 15 300

637 310 637 310

A new vehicle was bought on credit for R180 000 on 1 October 2015. Mr Nkomo also

paid to have a sound system installed costing R10 000. Vehicles are depreciated by

15% per annum on cost.

A physical count on 29 February 2016 revealed the following on hand:

Trading stock R200 300

Stationery R380

Debtors outstanding balance is R71 000. The provision for bad debts is to be

increased by R2 140.

A supplier has overpaid commission to Prime Stores, R460. This will be offset against

future commission.

Rent income for February 2016, R4 600 is still owed.

The insurance account had a total of R21 750. Included in this, is an amount of

R3 750 paid on an annual insurance contract on 1 November 2015.

The loan was enlarged by R20 000 on 1 December 2015.

The interest on the loan for February 2016 has not been paid yet.

All cash received was banked, except for R500 per month that Mr Nkomo took for

personal use.

Copyright reserved Please turn over

(4010175) -8- N560(E)(N22)H

The February bank statement showed a credit balance of R76 300.

Cheque number 482 for R2 900 (dated 17 March 2016) issued to a creditor, was still

outstanding on the bank statement.

The balance of the creditors control account amounts to R49 900.

REQUIRED

From the information above obtained on 29 February 2016:

4.1 Draw up the balance sheet (9)

4.2 The notes at that date (31)

[40]

QUESTION 5

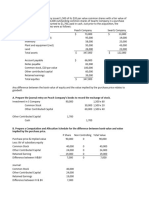

5.1 The following information was obtained from the financial records of Pringle

Traders on 30 April 2015 and 2016:

2016 2015

Credit sales 1 140 000 720 000

Cost of goods sold 576 000 444 000

Net profit 48 000 36 000

Debtors control 108 000 90 000

Stock 240 000 144 000

Creditors control 54 000 39 000

Cash purchases 116 000 119 000

Capital 300 000 204 000

Current assets 428 000 284 000

• The business maintains a gross profit percentage of 55% on turnover.

• For the year ended 30 April 2016 80% of sales and 80% of purchases

were on credit.

• The business allowed 60 days credit to debtors and received 90 days

credit from creditors.

REQUIRED

Calculate the following ratios for the year ended 30 April 2016:

5.1.1 Net profit percentage on turnover (5)

5.1.2 Average payment period to creditors (days) (5)

Copyright reserved Please turn over

(4010175) -9- N560(E)(N22)H

5.2 Various options are given as possible answers to the following questions.

Choose the answer based on the financial year ended 30 April 2016 and write

only the letter (A–D) next to the question number (5.2.1–5.2.5) in the

ANSWER BOOK.

5.2.1 The formula for the solvency ratio is:

A Current assets : Current liabilities

B Total assets: Total liabilities

C Current assets minus stock : Current liabilities

D Total assets : Current assets

5.2.2 The return on owner's equity, 48 000 × 100 is equal to:

252 000 1

A 19

B 19 : 1

C 19%

D 19 times

5.2.3 According to banking practice the ratio for the acid test should be

at least …

A 2:2

B 2:1

C 1:2

D 1:1

5.2.4 The gross profit percentage on turnover is 60%.

A This is better than expected.

B This is poorer than expected.

5.2.5 In the formula for gross profit percentage on turnover, the sales

amount is …

A 1 140 000.

B 720 000.

C 1 425 000.

D 285 000.

(5 × 2) (10)

Copyright reserved Please turn over

(4010175) -10- N560(E)(N22)H

5.3 Calculate the following based on the financial year ended 30 April 2016. Write

only the answer in rand value:

5.3.1 Cash sales equals …

5.3.2 Total purchases equals …

5.3.3 Average stock equals …

5.3.4 Gross profit equals …

5.3.5 Cash and cash equivalents equals …

(5 × 2) (10)

[30]

TOTAL: 200

Copyright reserved

You might also like

- Securities Brokerage Revenues World Summary: Market Values & Financials by CountryFrom EverandSecurities Brokerage Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- N5 Financial Accounting June 2018Document18 pagesN5 Financial Accounting June 2018Anil HarichandreNo ratings yet

- N5 Financial Accounting November 2019Document7 pagesN5 Financial Accounting November 2019Anil HarichandreNo ratings yet

- Financial Accounting N5: National CertificateDocument9 pagesFinancial Accounting N5: National CertificateHonorine Ngum NibaNo ratings yet

- This Paper Is Not To Be Removed From The Examination HallsDocument48 pagesThis Paper Is Not To Be Removed From The Examination Hallsduong duongNo ratings yet

- Accounting Grade 12 Test 1Document4 pagesAccounting Grade 12 Test 1Ryno de BeerNo ratings yet

- DSR Mock Test - 1 - Ca FoundationDocument5 pagesDSR Mock Test - 1 - Ca Foundationmaskguy001No ratings yet

- Incomplete Accounting RecordsDocument5 pagesIncomplete Accounting RecordsTawanda Tatenda Herbert100% (1)

- MAC 102 201905 Foundations of Accounting II.Document6 pagesMAC 102 201905 Foundations of Accounting II.Angellah Batiraishe MoyoNo ratings yet

- Csec Poa January 2012 p2Document9 pagesCsec Poa January 2012 p2Renelle RampersadNo ratings yet

- Accounting P1 Nov 2021 EngDocument12 pagesAccounting P1 Nov 2021 EngnicholasvhahangweleNo ratings yet

- O Level Accounts Important QuestionsDocument55 pagesO Level Accounts Important QuestionsibrahoNo ratings yet

- CAT 2 Urgent DBM EveningDocument3 pagesCAT 2 Urgent DBM EveningCollins WandatiNo ratings yet

- A Level Incomplete Records Practice QuestionsDocument9 pagesA Level Incomplete Records Practice QuestionsMUSTHARI KHANNo ratings yet

- Quiz - 2 - BAAB1014 - (Sept2022) AnswerDocument8 pagesQuiz - 2 - BAAB1014 - (Sept2022) AnswerTheresa AnneNo ratings yet

- 0438-Principles of AccountingDocument7 pages0438-Principles of AccountingHuma IjazNo ratings yet

- Accounting P1 NSC Nov 2020 EngDocument11 pagesAccounting P1 NSC Nov 2020 EngSweetness MakaLuthando LeocardiaNo ratings yet

- Tutorial On Inventory and FSDocument3 pagesTutorial On Inventory and FSNcediswaNo ratings yet

- BF 120Document11 pagesBF 120Dixie Cheelo100% (1)

- Accounting P1 NSC Nov 2020 EngDocument12 pagesAccounting P1 NSC Nov 2020 EngTlhago PitseNo ratings yet

- 18.01.2022 11 ACCOUNTS POST MID TERM 2021-22 CC Post Mid Acc 11Document3 pages18.01.2022 11 ACCOUNTS POST MID TERM 2021-22 CC Post Mid Acc 11Jr.No ratings yet

- Introduction To Accounting Bba 2103Document6 pagesIntroduction To Accounting Bba 2103Elisha JoelNo ratings yet

- Advanced Financial Reporting Key HighlightsDocument8 pagesAdvanced Financial Reporting Key HighlightssmlingwaNo ratings yet

- Prepare Financial Statements for a Partnership and Sole TraderDocument9 pagesPrepare Financial Statements for a Partnership and Sole TraderZahid Hussain KhokharNo ratings yet

- 2022 Grade 10 Controlled Test 3 QP EngDocument5 pages2022 Grade 10 Controlled Test 3 QP EngkellzylesediNo ratings yet

- Business Administration, Managemnt& Commercial Sciences Accounting 512 Assignment 2 SEMESTER - 2017Document6 pagesBusiness Administration, Managemnt& Commercial Sciences Accounting 512 Assignment 2 SEMESTER - 2017NomaSonto NaMakoNo ratings yet

- Abfa1513 220518Document6 pagesAbfa1513 220518CRYSTAL NGNo ratings yet

- Question - Test Acc106 Mac 2021 - 2july2021Document4 pagesQuestion - Test Acc106 Mac 2021 - 2july2021Fara husnaNo ratings yet

- Management Accounting QBDocument31 pagesManagement Accounting QBrising dragonNo ratings yet

- ACCE 212 EXAMPLE 3.2 Supa Stores QP_ASDocument6 pagesACCE 212 EXAMPLE 3.2 Supa Stores QP_ASnazmirakaderNo ratings yet

- Page 1 Of5 University of Swaziland Department of Accounting Exam Paper - SemesterDocument5 pagesPage 1 Of5 University of Swaziland Department of Accounting Exam Paper - SemesterThuli MagagulaNo ratings yet

- Nkhunga Group Consolidated SOFPDocument158 pagesNkhunga Group Consolidated SOFPDixie Cheelo100% (1)

- FS Accounting Grade 11 November 2022 P1 and MemoDocument23 pagesFS Accounting Grade 11 November 2022 P1 and MemoEsihle LwakheNo ratings yet

- ACCT 101 - Assignment Question (13861)Document5 pagesACCT 101 - Assignment Question (13861)Aneziwe ShangeNo ratings yet

- Auditing Practice Problem 5Document2 pagesAuditing Practice Problem 5Maria Fe FerrarizNo ratings yet

- HPS 2202HBC 2104 Financial Accounting Iiintroduction To Accounting IiDocument6 pagesHPS 2202HBC 2104 Financial Accounting Iiintroduction To Accounting IiFRANCISCA AKOTHNo ratings yet

- FINANCIAL ACCOUNTING Time Allowed  2 Hours Total ... - ICABDocument4 pagesFINANCIAL ACCOUNTING Time Allowed  2 Hours Total ... - ICABrumelrashid.66No ratings yet

- INCOMPLETEDocument13 pagesINCOMPLETEOwen Bawlor ManozNo ratings yet

- Class 1 HomeworkDocument10 pagesClass 1 HomeworkAngel MéndezNo ratings yet

- Fa Atd 2 ExamDocument5 pagesFa Atd 2 ExamNelsonMoseMNo ratings yet

- Cambridge International Advanced Subsidiary and Advanced LevelDocument12 pagesCambridge International Advanced Subsidiary and Advanced LevelAnonymous OtUvYI4No ratings yet

- Week 5 Tutorial Solutions PDFDocument19 pagesWeek 5 Tutorial Solutions PDFwainikitiraculeNo ratings yet

- ACC2002 Practice 1Document9 pagesACC2002 Practice 1Đan LêNo ratings yet

- Aug 2022 Final Exam Far 160Document9 pagesAug 2022 Final Exam Far 160adreanamarsyaNo ratings yet

- Finacial Accounting Ii FA260US ASSIGNMENT 1 (5 Group Member Only) Faculty Department Course Course Code Due Date Possible Marks Examiner (S) Moderator InstructionsDocument5 pagesFinacial Accounting Ii FA260US ASSIGNMENT 1 (5 Group Member Only) Faculty Department Course Course Code Due Date Possible Marks Examiner (S) Moderator InstructionsJohanna AseliNo ratings yet

- Completing The Accounting CycleDocument18 pagesCompleting The Accounting CycleKaseyNo ratings yet

- ACCOUNTING P1 GR12 QP JUNE 2023 - EnglishDocument11 pagesACCOUNTING P1 GR12 QP JUNE 2023 - Englishfanelenzima03No ratings yet

- 01 - FINC 0200 IP - Assignment Units 1 - 6 Questions - Winter 2022Document6 pages01 - FINC 0200 IP - Assignment Units 1 - 6 Questions - Winter 2022hermitpassiNo ratings yet

- Acc311 2021 2Document4 pagesAcc311 2021 2hoghidan1No ratings yet

- Baf 1101financial Accounting 1Document3 pagesBaf 1101financial Accounting 1MORRIS GICHININo ratings yet

- F2 Sept 2014 QP Final Version For PrintDocument20 pagesF2 Sept 2014 QP Final Version For PrintFahadNo ratings yet

- 1 B Limited Is A Private Limited Company Trading As A Wholesaler of Garden Equipment. The DraftDocument2 pages1 B Limited Is A Private Limited Company Trading As A Wholesaler of Garden Equipment. The DraftpalashndcNo ratings yet

- IAS 21 Rules Translating Foreign Currency OpsTITLE Super Bears Ltd Foreign Ops Columnar Reports TITLE Rosee Ltd HO & Branch Columnar FinancialsDocument4 pagesIAS 21 Rules Translating Foreign Currency OpsTITLE Super Bears Ltd Foreign Ops Columnar Reports TITLE Rosee Ltd HO & Branch Columnar FinancialsSebastian MlingwaNo ratings yet

- Materi Sebelum UTS Praktikum Akuntansi RemedDocument51 pagesMateri Sebelum UTS Praktikum Akuntansi Remedannisa rochmahNo ratings yet

- M14 Pilot PaperDocument24 pagesM14 Pilot PaperKA LAI SoNo ratings yet

- Sep 2012Document8 pagesSep 2012Kelsey FalzonNo ratings yet

- AC1025 2016 Exam Paper With Comments AC1025 2016 Exam Paper With CommentsDocument74 pagesAC1025 2016 Exam Paper With Comments AC1025 2016 Exam Paper With Comments전민건No ratings yet

- Cedrick Company ExamDocument1 pageCedrick Company Examrose lozanoNo ratings yet

- AFA End Examination 2021-2022Document6 pagesAFA End Examination 2021-2022sebastian mlingwaNo ratings yet

- Resource Booklet Jun 2021Document8 pagesResource Booklet Jun 2021ElenaNo ratings yet

- 1.2 Corporate Accounting PDFDocument6 pages1.2 Corporate Accounting PDFRech MJNo ratings yet

- Firm Valuation: Atty. Ivan Yannick S. Bagayao Cpa, MbaDocument23 pagesFirm Valuation: Atty. Ivan Yannick S. Bagayao Cpa, MbanaddieNo ratings yet

- Overview of Financial Reporting, Financial Statement Analysis, and ValuationDocument32 pagesOverview of Financial Reporting, Financial Statement Analysis, and ValuationVũ Việt Vân AnhNo ratings yet

- CMPC Quiz 1Document5 pagesCMPC Quiz 1Mae-shane SagayoNo ratings yet

- Consumer CirDocument41 pagesConsumer CirLAXMIPUTRA JAMADARNo ratings yet

- Bab 3 Chapter 12 PDFDocument4 pagesBab 3 Chapter 12 PDFGrifyn IfyNo ratings yet

- 6th Ed Module 1 Selected Homework AnswersDocument7 pages6th Ed Module 1 Selected Homework AnswersjoshNo ratings yet

- A Study On Working Capital Management at Air IndiaDocument100 pagesA Study On Working Capital Management at Air IndiaKeerthi100% (1)

- Ch. 3 HW ExplanationDocument7 pagesCh. 3 HW ExplanationJalaj GuptaNo ratings yet

- Quiz 4 Fa ReviewerDocument3 pagesQuiz 4 Fa ReviewerKristine Jewel PacursaNo ratings yet

- CH 9 Part 2 RevisionDocument7 pagesCH 9 Part 2 Revisiondima sinnoNo ratings yet

- Feasibility Study for Garment and Tailoring Business in NekemteDocument28 pagesFeasibility Study for Garment and Tailoring Business in Nekemtegemechu100% (1)

- Funds Flow Analysis of Hero MotoCorpDocument89 pagesFunds Flow Analysis of Hero MotoCorpaurorashiva1No ratings yet

- Fast Foods Bussiness PlanDocument16 pagesFast Foods Bussiness PlanDagmawi TesfayeNo ratings yet

- NC 3 Bookkeeping Answer Sheet Perpetual - REVISEDDocument8 pagesNC 3 Bookkeeping Answer Sheet Perpetual - REVISEDGab AguilaNo ratings yet

- Trend Analysis: Income StatementDocument7 pagesTrend Analysis: Income StatementHamza AmjedNo ratings yet

- MODULE 8 Learning ActivitiesDocument5 pagesMODULE 8 Learning ActivitiesChristian Cyrous AcostaNo ratings yet

- Chapter 2 AccountingDocument71 pagesChapter 2 AccountingBen Soderholm50% (2)

- Consolidated Financial Statements Under Purchase AccountingDocument18 pagesConsolidated Financial Statements Under Purchase AccountingtemedebereNo ratings yet

- Consolidated Financial Statement Excercise 3-4Document2 pagesConsolidated Financial Statement Excercise 3-4Winnie TanNo ratings yet

- Turkish Airlines Financial Statements Exel (Hamada SH)Document89 pagesTurkish Airlines Financial Statements Exel (Hamada SH)hamada1992No ratings yet

- Accounting Treatment of Zakah: Additional Evidence From AAOIFIDocument6 pagesAccounting Treatment of Zakah: Additional Evidence From AAOIFIMuhammad SheikhNo ratings yet

- Colgate Ratio Analysis SolvedDocument7 pagesColgate Ratio Analysis SolvedKavitha RagupathyNo ratings yet

- Plant Assets, Natural Resources, and Intangible Assets: Learning ObjectivesDocument66 pagesPlant Assets, Natural Resources, and Intangible Assets: Learning ObjectivesMaidah NaeemNo ratings yet

- Working Capital Management of Odisha State Co-operative BankDocument26 pagesWorking Capital Management of Odisha State Co-operative BankSUBHASMITA SAHUNo ratings yet

- Depreciation Accounting for Machinery PurchaseDocument15 pagesDepreciation Accounting for Machinery PurchaseGulneer LambaNo ratings yet

- CSEC Principles of Accounts January 2020 Paper 2 JkvejfDocument24 pagesCSEC Principles of Accounts January 2020 Paper 2 JkvejfKimi Manzano100% (1)

- Chapter 7 - Leases Part 1Document4 pagesChapter 7 - Leases Part 1JEFFERSON CUTE100% (1)

- Practice Test 1 KeyDocument11 pagesPractice Test 1 KeyAshley Storey100% (1)

- Class 12th Paper 2017Document4 pagesClass 12th Paper 2017AkankshaNo ratings yet