Professional Documents

Culture Documents

Book 3 CH 1

Uploaded by

TanayOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Book 3 CH 1

Uploaded by

TanayCopyright:

Available Formats

Chapter 1 FINANCIAL STATEMENTS OF A COMPANY

1. Meaning of Financial Statements.

2. Characteristics and Nature of Financial Statements.

3. Content of Annual Report: -

A. Report by the Board of Directors.

B. Auditors Report to the Shareholders.

C. Financial Statements: -

a. Balance Sheet

b. Statement of Profit and Loss

c. Note to Accounts

d. Cash Flow Statement

4. Objectives of Financial Statements.

5. Essentials of Financial Statements.

6. Parties Interested in Financial Statements or Users of Financial Statements.

7. Limitations of Financial Statements.

Balance Sheet of.................

as at....................

Particular Note Previous Year Current Year

No. (Rs.) (Rs.)

A B

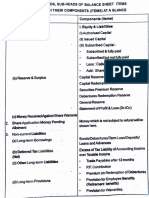

I. Equity and Liabilities

1. Shareholders’ Funds: -

(a) Share Capital

(b) Reserves and Surplus

(c) Money received against Share Warrants

2. Share application money pending Allotment

3. Non-current Liabilities: -

(a) Long – term Borrowings

(b) Deferred Tax Liabilities (Net)

(c) Other Long – Term Liabilities

(d) Long – term Provisions

4. Current Liabilities: -

(a) Short – term Borrowings

(b) Trade Payables

(c) Other Current Liabilities

(d) Short-term Provisions

Total

II Assets

1. Non-current Assets: -

(a) Property, Plant and Equipment and

Intangible Assets

(i) Property, Plant and Equipment

(ii) Intangible Assets

(iii) Capital Work – in – Progress

(iv) Other Non – current Assets

(b) Non-current Investments

(c) Deferred Tax Assets (Net)

(d) Long-term Loans and Advances

(e) Other Non – Current Assets

2. Current Assets: -

(a) Current Investments

(b) Inventories

(c) Trade Receivables

(d) Cash and Cash Equivalents

(e) Short – term Loans and Advances

(f) Other Current Assets

Total

EQUITY AND LIABILITIES

HEAD SUB-HEAD ITEM

1. SHAREHOLDER’S {a} Share Capital: - As per note to account

FUNDS {b} Reserves and Surplus: - [i] Capital Reserve

[ii] Capital Redemption Reserve

[iii] Securities Premium Reserve

[iv] Debenture Redemption Reserve

[v] Revaluation Reserve

[vi] Share Option Outstanding Reserve

[vii] Other Reserves

[viii] Surplus i.e. Balance in Statement of Profit and

Loss

{c} Money Received Against Nil

Share Warrants: -

2. SHARE Nil Nil

APPLICATION

MONEY PENDING

ALLOTMENT

3. NON-CURRENT {a} Long Term Borrowings: - [i] Debentures

LIABILITIES [ii] Bonds

[iii] Term Loans (From Banks/Others)

[iv] Public Deposits

[v] Other Loans and Advances

{b} Deferred Tax Liabilities Nil

(Net)

{c} Other Long-Term [i] Trade Payables (Sundry Creditors and Bills

Liabilities Payables)

[ii] Others (if they are payable after 12 months)

{d} Long- Term Provisions [i] Provision for Retirement Benefits

[ii] Provisions for Warranty Claims

[iii] Provisions for Gratuity

[iv] Provisions for Earned Leave

4. CURRENT {a} Short-Term Borrowings [i] Loan repayable on demand

LIABILITIES [ii] Bank Overdraft or Cash Credit from Bank

[iii] Current Maturities of Long – term Debts

[iv] Loans from other parties

[v] Deposits

[vi] Other Loans and Advances

{b} Trade Payables [i] Sundry Creditors

[ii] Bills payables

{c} Other Current Liabilities [i] Interest Accrued but not Due on Borrowings

[ii] Interest Accrued and Due on Borrowings

[iii] Income Received in Advance

[iv] Unpaid Dividend

[v] Excess application money (due for refund and

interest thereon)

[vi] Unpaid matured deposits and interest accrued

thereon

[vii] Unpaid matured Debentures and interest

accrued thereon

[viii] Calls in Advance

[ix] Other Payables (Due for payment within 12

month i.e. O/S expenses, any output GST,

Provident fund payable.)

{d} Short-Term Provisions [i] Provision for Employees Benefits

[ii] Provision for Expenses

[iii] Provision for Tax

[iv] Other Provisions

ASSETS

1. NON-CURRENT {a} Property, Plant and [i] Property, Plant and Equipment

ASSETS Equipment and Intangible [ii] Intangible Assets

Assets: [iii] Capital Work in Progress

[iv] Intangible Assets under Development

{b} Non-current Investments: [i] Investment in Property

[ii] Investment in Equity Instruments

[iii] Investment in Preference Shares

[iv] Investment in Government or Trust Securities

[v] Investment in Debentures or Bonds

[vi] Investment in Mutual Funds

[vii] Investment in Partnership Firms

[viii] Other non-current Investments

{c} Deferred Tax Assets (Net): Nil

-

{d} Long-term Loans and [i] Capital Advances

Advances: [ii] Other Loans and Advances

{e} Other Non-current Assets: [i] Security Deposits

[ii] Long-term Trade Receivables

[iii] Others

[iv] Insurance claim receivable

2. CURRENT ASSET {a} Current Investments: - [i] Investment in Equity Instruments

[ii] Investment in Preference Shares

[iii] Investment in Government or Trust Securities

[iv] Investment in Debentures or Bonds

[v] Investment in Mutual Funds

[vi] Investment in Partnership Firms

[vii] Other non-current Investments

{b} Inventories: - [i] Raw Materials

[ii] Work in Progress

[iii] Finished Goods

[iv] Stock in Trade

[v] Stores and Spares

[vi] Loose Tools

{c} Trade Receivables: - [i] Debtors

[ii] Bills Receivables

{d} Cash and Cash [i] Cash in hand

equivalents: - [ii] Balances with Banks

[iii] Cheques, Drafts in hand

[iv] Earmarked balances with Banks

[v] Balance with Banks held as Margin Money

[vi] Bank Deposits with less than 12 months

maturity

[vii] Others

{e} Short-term Loans and [to be realised within 12 months]

Advances: -

{f} Other Current Assets: - [i] Prepaid expenses

[ii] Accrued Income

[iii] Dividend receivables

[iv]Advance Taxes

Note to Accounts

Particular Rs. Current year Rs. Previous Year

Share Capital: -

Authorised Capital

--------- Equity Shares of Rs. ----- each

--------- Preference Share of Rs. ----- each

Issued Capital

--------- Equity Shares of Rs. ----- each

--------- Preference Share of Rs. ----- each

Subscribed Capital

Subscribed and fully paid-up

--------- Equity Shares of Rs. ----- each

--------- Preference Share of Rs. ----- each

Subscribed but not fully paid-up

--------- Equity Shares of Rs. ----- each

Less – Calls in arrear

--------- Preference Share of Rs. ----- each

Lass – Calls in arrear

Balance of Forfeited Share Account

Note – Contingent Liabilities and Commitments are not recorded in the books of accounts: -

Contingent Liabilities is not recorded in the books of accounts but is disclosed in the Notes to accounts for the

information of the users. It is to be classified into: -

[1] Claim against the company not acknowledged as debts.

[2] Bills Receivables discounted from Bank not yet due for payment.

[3] Proposed Dividend (Current Year)

[4] Other Claims for which the company is contingently liable.

Commitments mean financial commitments due to activities agreed to by the company to be undertaken by it in

future. They are classified into: -

[1] Estimated amounts of contracts remaining to be executed on Capital Account and not provided for.

[2] Uncalled liability on shares and other investments partly paid.

[3] Other commitments.

STATEMENT OF PROFIT AND LOSS

1. REVENUE: -

[A] Revenue from operations

[B] Other incomes

2. EXPENSES: -

[A] Cost of material consumed

[B] Purchases of Stock-in-Trade

[C] Changes of inventories of Finished Goods, Work-in-Progress and Stock-in-Trade

[D] Employees Benefit Expenses

[E] Finance Cost

[F] Depreciation and Amortisation Expenses

[G] Other Expenses

Statement of Profit and Loss of.................

for the year ended..................

Particular Note Previous Current Absolute Percentage

No. Year Year Change Change

(Rs.) (Rs.) (Rs.) (%)

A B C = A – B D= C ×

A

100

1. Revenue from Operations

2. Other Incomes

3.Total (1 + 2)

4. Expenses: -

(a) Cost of Material Consumed

(b) Purchases of Stock-in-Trade

(c) Changes in Inventories

(d) Employees Benefit Expenses

(e) Finance Cost

(f) Depreciation and Amortisation

(g) Other Expenses

5.Total Expenses

6.Profit before Tax (3 – 5)

7. Income Tax [% on PBT]

8. Profit after Tax (6 – 7)

Formulas: -

1. Cost of Material Consumed =

Opening Inventory of Materials + Purchases of Material – Closing Inventory of Materials

2. Chang in Inventory = Opening Inventory – Closing Inventory

You might also like

- Balance Sheet of XYZ LTD.: (SRM) S R M (Fanci Dress Le Lo) (TICI) T I C IDocument4 pagesBalance Sheet of XYZ LTD.: (SRM) S R M (Fanci Dress Le Lo) (TICI) T I C ISampada Bassi100% (1)

- Scdedule IIIDocument4 pagesScdedule IIIAryan VermaNo ratings yet

- Balance Sheet ProformaDocument2 pagesBalance Sheet ProformakeziafernandesNo ratings yet

- Assets Equity and Liabilities: Abbreviated Balance SheetDocument2 pagesAssets Equity and Liabilities: Abbreviated Balance SheetMark HallNo ratings yet

- Assignment 4: PART 1 - Balance SheetDocument3 pagesAssignment 4: PART 1 - Balance SheetGauravTiwariNo ratings yet

- Form 060503Document5 pagesForm 060503deepakgupta.arNo ratings yet

- How To Read BS PDFDocument16 pagesHow To Read BS PDFAkankshya PanigrahiNo ratings yet

- Financial Statement Sums - 230329 - 001857Document26 pagesFinancial Statement Sums - 230329 - 001857AppleNo ratings yet

- Comparative Schedule VIDocument23 pagesComparative Schedule VIRajkumar MathurNo ratings yet

- Corporate Financial Reporting: Preparing and Understanding Balance SheetDocument76 pagesCorporate Financial Reporting: Preparing and Understanding Balance SheetArty Drill100% (1)

- Balance Sheet Format 01Document6 pagesBalance Sheet Format 01Vivek SinglaNo ratings yet

- Revised Schedule VIDocument89 pagesRevised Schedule VIChirag MalhotraNo ratings yet

- CBSE Class 12 Acc Notes Financial Statements of A CompanyDocument16 pagesCBSE Class 12 Acc Notes Financial Statements of A CompanyDevanshi Agarwal100% (1)

- Krishna AccountssDocument12 pagesKrishna Accountsskrishnamakwana9605No ratings yet

- Jasch Industires LTDDocument6 pagesJasch Industires LTDAnugya GuptaNo ratings yet

- Financial StatementDocument5 pagesFinancial StatementRonybrine 096No ratings yet

- Excel 01Document6 pagesExcel 01shivamsahniji750No ratings yet

- Balance Sheet Format 01Document6 pagesBalance Sheet Format 01RHS Production100% (1)

- Analysis and Interpretation of AccountsDocument15 pagesAnalysis and Interpretation of AccountsYOXENo ratings yet

- Balance Sheet TemplateDocument4 pagesBalance Sheet TemplatesenthilNo ratings yet

- Cash Flow StatementDocument1 pageCash Flow Statementpre.meh21No ratings yet

- NHTM 1 ĐÃ DÒ NHƯNGNG VẪN CÒN ROA BQ 2021 1Document14 pagesNHTM 1 ĐÃ DÒ NHƯNGNG VẪN CÒN ROA BQ 2021 1ngochanhime0906No ratings yet

- Balance SheetDocument45 pagesBalance SheetGautam MNo ratings yet

- Vol - III Chapter 1 (II)Document15 pagesVol - III Chapter 1 (II)Pranadhika KNo ratings yet

- Manual On Financial and Banking StatisticsDocument2 pagesManual On Financial and Banking StatisticsI MNo ratings yet

- A Statement Showing AssetsDocument2 pagesA Statement Showing AssetsNeha jainNo ratings yet

- P&L and Balance SheetDocument3 pagesP&L and Balance Sheetamitabh kumarNo ratings yet

- MA 2.1-Financial StatementDocument57 pagesMA 2.1-Financial Statementvini2710100% (1)

- On Sch-III Ucc - Division-IDocument58 pagesOn Sch-III Ucc - Division-IAman MiddhaNo ratings yet

- Ts GrewalDocument92 pagesTs GrewalShyamal NarangNo ratings yet

- T.S. Grewal Book Part 3Document189 pagesT.S. Grewal Book Part 3Thami K96% (23)

- Name of The Company . Balance Sheet As atDocument2 pagesName of The Company . Balance Sheet As atKris BubnaNo ratings yet

- Word 03Document66 pagesWord 03Raja AdhikariNo ratings yet

- 004 - Final SCH III - Indicative Template FinalDocument54 pages004 - Final SCH III - Indicative Template FinalAbhishek YadavNo ratings yet

- TS Grewal Question and Answer - CH 1-Financial Ststement of A Company-VoliiiDocument14 pagesTS Grewal Question and Answer - CH 1-Financial Ststement of A Company-VoliiiSanjeev GuptaNo ratings yet

- Bankruptcy Starter OLDocument30 pagesBankruptcy Starter OLN AaNo ratings yet

- Financial Statements of A CompanyDocument12 pagesFinancial Statements of A CompanyRiddhi SharmaNo ratings yet

- Financial Statement ReportingDocument20 pagesFinancial Statement ReportingAshwini Khare0% (1)

- In The Books of . Balance Sheet As at 31 March (As Per Scheduleiii of Companies Act 2013) Particulars Note No Rs. RsDocument2 pagesIn The Books of . Balance Sheet As at 31 March (As Per Scheduleiii of Companies Act 2013) Particulars Note No Rs. RsSnigdha HazraNo ratings yet

- Dignity LTDDocument2 pagesDignity LTDManish SinhaNo ratings yet

- Balance Sheet and Profit and Loss Account FormatDocument11 pagesBalance Sheet and Profit and Loss Account Formatpre.meh21No ratings yet

- 004 - Final SCH III - Indicative Template FinalDocument54 pages004 - Final SCH III - Indicative Template FinalmadhanNo ratings yet

- Financial StatementsDocument13 pagesFinancial StatementsAbhijay AnoopNo ratings yet

- Key-Terms and Chapter Summary-1Document11 pagesKey-Terms and Chapter Summary-1Neel DudhatNo ratings yet

- q3 Deva LimitedDocument8 pagesq3 Deva Limitedayusha chandrikapureNo ratings yet

- IND AS On Cash Flow StatementDocument1 pageIND AS On Cash Flow Statementchandrakumar k pNo ratings yet

- CBSE Class 12 Accountancy Financial Statements of Company PDFDocument10 pagesCBSE Class 12 Accountancy Financial Statements of Company PDFishita gargNo ratings yet

- Financial Statements - TemplateDocument11 pagesFinancial Statements - TemplateBakir PeljtoNo ratings yet

- Balance Sheet CompanyDocument16 pagesBalance Sheet CompanyNidhi ShahNo ratings yet

- Company Accounts-Issue of Debentures: Meaning of Key Terms Used in The ChapterDocument9 pagesCompany Accounts-Issue of Debentures: Meaning of Key Terms Used in The ChapterKanakpreetNo ratings yet

- Worksheet 03Document4 pagesWorksheet 03LuckyNo ratings yet

- Press 'CTRL' + ' (' On The Next Cell For Notes To Accounts: III. Total Revenue (I + II)Document28 pagesPress 'CTRL' + ' (' On The Next Cell For Notes To Accounts: III. Total Revenue (I + II)Anoushka LakhotiaNo ratings yet

- BookDocument190 pagesBookAnonymous e4KPPyl100% (1)

- Chemalite Group - Cash Flow Statement - PBTDocument8 pagesChemalite Group - Cash Flow Statement - PBTAmit Shukla100% (1)

- Part A-Bs: Zenit - A KDK Software Software ProductDocument2 pagesPart A-Bs: Zenit - A KDK Software Software Productkunjal mistryNo ratings yet

- Term 1 Part BDocument47 pagesTerm 1 Part BFitness ChiselersNo ratings yet

- A. Short-Term Assets A LiabilitiesDocument2 pagesA. Short-Term Assets A LiabilitiesKhánh LinhNo ratings yet

- Format Due DiligenceDocument48 pagesFormat Due DiligenceUmeshNo ratings yet

- ch14 MCDocument13 pagesch14 MCSusan CornelNo ratings yet

- Ratio ANALYSIS OF CEAT TYRESDocument37 pagesRatio ANALYSIS OF CEAT TYRESS92_neha100% (1)

- Abbl3144 Tutorial 3 AnswerDocument9 pagesAbbl3144 Tutorial 3 AnswerSooXueJiaNo ratings yet

- Sources of FinanceDocument39 pagesSources of Financemohammedakbar88No ratings yet

- FIN202Document21 pagesFIN202Thịnh Lưu Thiện HưngNo ratings yet

- In Case of Manufacturing Enterprises The Calculations of Original Cost ofDocument12 pagesIn Case of Manufacturing Enterprises The Calculations of Original Cost ofVimal kumarNo ratings yet

- CK Foods Significant Accounting PoliciesDocument9 pagesCK Foods Significant Accounting PoliciesA YoungNo ratings yet

- ETF Vs Index FundsDocument2 pagesETF Vs Index FundsNishi Avasthi100% (1)

- Financial & Corporate Reporting Time Allowed - 3 Hours Total Marks - 100Document5 pagesFinancial & Corporate Reporting Time Allowed - 3 Hours Total Marks - 100Laskar REAZNo ratings yet

- H105 Relevant CostingDocument15 pagesH105 Relevant CostingKiaNo ratings yet

- Edexcel IGCSE Accounting Student S Book Answers PDFDocument92 pagesEdexcel IGCSE Accounting Student S Book Answers PDFArshad Bashir100% (1)

- Overview IASDocument12 pagesOverview IASButt ArhamNo ratings yet

- Module 15 - Investments in Joint Ventures: IFRS Foundation: Training Material For The IFRSDocument55 pagesModule 15 - Investments in Joint Ventures: IFRS Foundation: Training Material For The IFRSKathy CeracasNo ratings yet

- JMP Securities - ORCC - Initiation - Initiating Coverage of Industry - 50 PagesDocument50 pagesJMP Securities - ORCC - Initiation - Initiating Coverage of Industry - 50 PagesSagar PatelNo ratings yet

- IAS 40 Investment PropertyDocument12 pagesIAS 40 Investment PropertyIrfan AhmedNo ratings yet

- FA2 Syllabus and Study Guide - Sept 22-Aug 23Document14 pagesFA2 Syllabus and Study Guide - Sept 22-Aug 23Ahmed RazaNo ratings yet

- ESD Forms of Business. - 054422Document9 pagesESD Forms of Business. - 054422Kudakwashe ChareraNo ratings yet

- PalamonDocument6 pagesPalamonRyan Teichmann75% (8)

- Chapter 15 Forex Currency Translation (Students)Document18 pagesChapter 15 Forex Currency Translation (Students)Kelvin Chu JYNo ratings yet

- Finance Analyst - Finance All in One BundleDocument16 pagesFinance Analyst - Finance All in One Bundleyogesh patilNo ratings yet

- CH 3 Curente LiablitiesDocument15 pagesCH 3 Curente LiablitiesNatnael AsfawNo ratings yet

- Financial Accounting Study GuideDocument3 pagesFinancial Accounting Study GuideGyermie Ross CarpesoNo ratings yet

- Cee 108 ReportDocument9 pagesCee 108 ReportMisael Masauring BasiaNo ratings yet

- Fundamentals of ABM1 - Q4 - LAS7 DRAFTDocument15 pagesFundamentals of ABM1 - Q4 - LAS7 DRAFTSitti Halima Amilbahar AdgesNo ratings yet

- IA 1 Valix 2020 Ver. Problem 27-3 - Problem 27-4Document4 pagesIA 1 Valix 2020 Ver. Problem 27-3 - Problem 27-4Ariean Joy Dequiña100% (1)

- Cashflow SheetDocument1 pageCashflow SheetFrank Ferrao100% (6)

- BADM 2001 - Fall 2019 - Assignment 3Document2 pagesBADM 2001 - Fall 2019 - Assignment 3Vanessa M. EzzatNo ratings yet

- KPROJ Capital Increase ProspectusDocument468 pagesKPROJ Capital Increase ProspectusAbdo ElbannaNo ratings yet

- A Primer On Reading Annual ReportsDocument229 pagesA Primer On Reading Annual ReportsTomas AriasNo ratings yet

- Chapter 22: Retained Earnings (Dividends)Document12 pagesChapter 22: Retained Earnings (Dividends)Illion IllionNo ratings yet