Professional Documents

Culture Documents

Think Together 2101 E 4Th ST B Suite 200 Santa Ana, Ca 92705

Uploaded by

Humayon MalekOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Think Together 2101 E 4Th ST B Suite 200 Santa Ana, Ca 92705

Uploaded by

Humayon MalekCopyright:

Available Formats

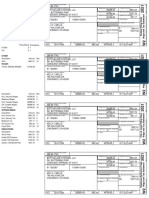

a Employee’s social security number This information is being furnished to the Internal Revenue Service.

If you

617-29-7426 OMB No. 1545-0008 are required to file a tax return, a negligence penalty or other sanction

may be imposed on you if this income is taxable and you fail to report it.

b Employer identification number (EIN) 1 Wages, tips, other compensation 2 Federal income tax withheld

33-0781751 71760.00 10447.20

c Employer’s name, address, and ZIP code 3 Social security wages 4 Social security tax withheld

THINK TOGETHER 71760.00 4449.12

2101 E 4TH ST B SUITE 200

SANTA ANA, CA 92705 5 Medicare wages and tips 6 Medicare tax withheld

71760.00 1040.52

7 Social security tips 8 Allocated tips

d Control number 9 10 Dependent care benefits

e Employee’s first name and initial Last name Suff. 11 Nonqualified plans 12a See instructions for box 12

C

o

d

SHANIYA TATUM e

13 Statutory Retirement Third-party 12b

employee plan sick pay C

o

d

f Employee’s address and ZIP code e

1434 BITTERSWEET DRIVE 14 Other 12c

C

BEAUMONT, CA 92223 o

d

e

12d

C

o

d

e

15 State Employer’s state ID number 16 State wages, tips, etc. 17 State income tax 18 Local wages, tips, etc. 19 Local income tax 20 Locality name

CA 33-0781751 71760.00 3552.22

W-2

Department of the Treasury—Internal Revenue Service

Wage and Tax

Form Statement

Copy C—For EMPLOYEE’S RECORDS (See Notice to

2022 Safe, accurate,

FAST! Use

Employee on the back of Copy B.)

You might also like

- 20306.87 20306.87 IN IN 637.90 637.90: Notice To EmployeeDocument2 pages20306.87 20306.87 IN IN 637.90 637.90: Notice To EmployeeWillie Davis0% (1)

- Notice To Employee: WWW - Irs.gov/efileDocument2 pagesNotice To Employee: WWW - Irs.gov/efileRODRIGO GRIJALBA CABREJOSNo ratings yet

- Copy B - To Be Filed With Employee's FEDERAL Tax Return. Copy 2 - To Be Filed With Employee's State, City or Local Income Tax ReturnDocument1 pageCopy B - To Be Filed With Employee's FEDERAL Tax Return. Copy 2 - To Be Filed With Employee's State, City or Local Income Tax ReturnmaliktaimoorsurahNo ratings yet

- FTF 2023-02-11 1676146567403 PDFDocument19 pagesFTF 2023-02-11 1676146567403 PDFJohn100% (3)

- Adeccow 215Document2 pagesAdeccow 215ier362No ratings yet

- W-2 Wage and Tax Statement: This Information Is Being Furnished To The Internal Revenue ServiceDocument2 pagesW-2 Wage and Tax Statement: This Information Is Being Furnished To The Internal Revenue ServiceJunk BoxNo ratings yet

- Tax Return 2022 Mardik MardikianDocument23 pagesTax Return 2022 Mardik Mardikianyusuf Fajar100% (3)

- Wage and Tax Statement: Copy C-For Employee'S RecordsDocument1 pageWage and Tax Statement: Copy C-For Employee'S RecordslidiaNo ratings yet

- Melinda Flowers 1040 PDFDocument2 pagesMelinda Flowers 1040 PDFCHRISTIAN RODRIGUEZ50% (4)

- Return Postage Guaranteed: Employee Reference Copy Wage and Tax StatementDocument2 pagesReturn Postage Guaranteed: Employee Reference Copy Wage and Tax StatementEvelin De NunezNo ratings yet

- U.S. Individual Income Tax Return: Filing StatusDocument28 pagesU.S. Individual Income Tax Return: Filing StatusSenae Lopez100% (3)

- W2 & Earnings: Kelly L WellsDocument5 pagesW2 & Earnings: Kelly L Wellshala100% (1)

- Income Tax ReturnDocument5 pagesIncome Tax Returnevalle13100% (1)

- OMB No. 1545-0008 OMB No. 1545-0008Document2 pagesOMB No. 1545-0008 OMB No. 1545-0008Robert Taylor50% (2)

- W 2Document3 pagesW 2Bar ChenNo ratings yet

- W 2Document3 pagesW 2Bar ChenNo ratings yet

- Sean 2022 Tax ReturnDocument18 pagesSean 2022 Tax Returnaaakinkumi115100% (1)

- TWC LIS01 LIS - B AU20161205 P: Aqeel Haider 1 Maple Ave APT. #106 Patchogue, Ny 11772Document2 pagesTWC LIS01 LIS - B AU20161205 P: Aqeel Haider 1 Maple Ave APT. #106 Patchogue, Ny 11772sana shahidNo ratings yet

- PDF DocumentDocument1 pagePDF DocumentAngelo DiloneNo ratings yet

- 2021 W-2 Earnings SummaryDocument2 pages2021 W-2 Earnings Summaryrachel sanchezNo ratings yet

- f1040 PDFDocument2 pagesf1040 PDFCHRISTIAN RODRIGUEZNo ratings yet

- Statement For 2022-1Document2 pagesStatement For 2022-1Hengki Yono100% (1)

- July PAY STUB 03Document1 pageJuly PAY STUB 03enudo SolomonNo ratings yet

- MGPTaxReturn 2020Document64 pagesMGPTaxReturn 2020KGW NewsNo ratings yet

- Time For TaxDocument108 pagesTime For TaxCj johnson100% (1)

- Tax FormsDocument2 pagesTax Formswilliam schwartz50% (2)

- 9YWwhh55h5384810244629010109102 PDFDocument2 pages9YWwhh55h5384810244629010109102 PDFDave Yerznkyan100% (1)

- Ioana w2 PDFDocument1 pageIoana w2 PDFBlueberry13KissesNo ratings yet

- STF 2023-03-20 1679339081483Document4 pagesSTF 2023-03-20 1679339081483ayogboloNo ratings yet

- 623 Cce 3 BD 2 FB 0Document1 page623 Cce 3 BD 2 FB 0mondol miaNo ratings yet

- IRS Form W2Document1 pageIRS Form W2nurulamin00023No ratings yet

- Profit or Loss From Business: Schedule C (Form 1040) 09Document2 pagesProfit or Loss From Business: Schedule C (Form 1040) 09JIMOH100% (1)

- W-2 Wage and Tax Statement: Copy B-To Be Filed With Employee's FEDERAL Tax ReturnDocument1 pageW-2 Wage and Tax Statement: Copy B-To Be Filed With Employee's FEDERAL Tax ReturnjeminaNo ratings yet

- form-w2-Ramona-Crawford 2Document9 pagesform-w2-Ramona-Crawford 2Nicole CarutherNo ratings yet

- Maria Baez 1408 Rustic Drive Apt 5 OCEAN NJ 07712Document2 pagesMaria Baez 1408 Rustic Drive Apt 5 OCEAN NJ 0771216baezmcNo ratings yet

- Ajax PDFDocument2 pagesAjax PDFGeorge AndoneNo ratings yet

- Ralston Medina W2Document2 pagesRalston Medina W2bussinesl las100% (1)

- 1099 Form Year 2021Document8 pages1099 Form Year 2021Candy Valentine100% (1)

- Wage and Tax StatementDocument6 pagesWage and Tax StatementNick RubleNo ratings yet

- Dec Boa BusinessDocument7 pagesDec Boa BusinessHumayon Malek100% (1)

- Dec Boa BusinessDocument7 pagesDec Boa BusinessHumayon Malek100% (1)

- Sebastian Desmond PO BOX 1717 West Sacramento Ca 95691 Sebastian Desmond PO BOX 1717 West Sacramento Ca 95691Document2 pagesSebastian Desmond PO BOX 1717 West Sacramento Ca 95691 Sebastian Desmond PO BOX 1717 West Sacramento Ca 95691Deborah Beth DarlingNo ratings yet

- 2022 TaxReturnDocument6 pages2022 TaxReturnLALLOUS KHOURY100% (3)

- 20212Document2 pages20212carriemccabeNo ratings yet

- JanuaryDocument6 pagesJanuaryHumayon MalekNo ratings yet

- Wage and Tax Statement: OMB No. 1545-0008Document7 pagesWage and Tax Statement: OMB No. 1545-0008LUZILLE MEDINANo ratings yet

- Wage and Tax Statement: OMB No. 1545-0008Document7 pagesWage and Tax Statement: OMB No. 1545-0008LUZILLE MEDINANo ratings yet

- 2021 W-2 and Earnings SummaryDocument2 pages2021 W-2 and Earnings SummaryKawljeet Singh KohliNo ratings yet

- W-2 Wage Reconciliation: This Form Details Your Final 2018 Payroll EarningsDocument2 pagesW-2 Wage Reconciliation: This Form Details Your Final 2018 Payroll EarningsRebecca AtesNo ratings yet

- Title MaxDocument1 pageTitle MaxHumayon MalekNo ratings yet

- FTFCS 2022-03-23 1648030351701Document15 pagesFTFCS 2022-03-23 1648030351701Charles Goodwin100% (1)

- Sin TítuloDocument14 pagesSin TítuloTavo MCNo ratings yet

- Electronic Filing Instructions For Your 2019 Federal Tax ReturnDocument31 pagesElectronic Filing Instructions For Your 2019 Federal Tax ReturnJose Miguel Hernandez CarelaNo ratings yet

- Filename PDFDocument3 pagesFilename PDFIvette PizarroNo ratings yet

- 34 Wihh 504331 H 0714320240524151104202Document3 pages34 Wihh 504331 H 0714320240524151104202jamelmhunt22No ratings yet

- Nolasco W2Document2 pagesNolasco W2MARCOS NOLASCONo ratings yet

- FTFCS 2023-04-14 1681510273125 PDFDocument17 pagesFTFCS 2023-04-14 1681510273125 PDFIvel RhaenNo ratings yet

- Boa JanDocument4 pagesBoa JanHumayon Malek40% (5)

- Wage and Tax Statement: OMB No. 1545-0008Document4 pagesWage and Tax Statement: OMB No. 1545-0008jgoldson235No ratings yet

- TX 1Document1 pageTX 1Humayon MalekNo ratings yet

- Matthew Wozniak W2 2021 W2 202233131923Document3 pagesMatthew Wozniak W2 2021 W2 202233131923MwNo ratings yet

- W-2 Tax FormDocument7 pagesW-2 Tax FormMaria HowellNo ratings yet

- March - Gipsol BofADocument8 pagesMarch - Gipsol BofAHumayon Malek100% (1)

- Wage and Tax Statement: Copy B - To Be Filed With Employee's FEDERAL Tax ReturnDocument7 pagesWage and Tax Statement: Copy B - To Be Filed With Employee's FEDERAL Tax ReturnLovely HeartNo ratings yet

- W2 Preview titleDocument1 pageW2 Preview titlemrs merle westonNo ratings yet

- Business Banking: You and Wells FargoDocument4 pagesBusiness Banking: You and Wells Fargobilly barker whiteNo ratings yet

- Wage and Tax Statement: Statutory Employee Retirement Plan Third-Party Sick PayDocument1 pageWage and Tax Statement: Statutory Employee Retirement Plan Third-Party Sick PayJesse Nichols100% (1)

- 2021 Tax Return Prepared OnlineDocument6 pages2021 Tax Return Prepared OnlineSolomonNo ratings yet

- IRS W-2 Form TitleDocument1 pageIRS W-2 Form TitleKeller Brown JnrNo ratings yet

- WELS FARGO Bank - Statement - 123123Document7 pagesWELS FARGO Bank - Statement - 123123Alex Nezi50% (2)

- IRS-Form-W2Document3 pagesIRS-Form-W2Smerling PaulinoNo ratings yet

- Wage and Tax Statement: OMB No. 1545-0008 Visit The IRS Website atDocument3 pagesWage and Tax Statement: OMB No. 1545-0008 Visit The IRS Website atcofi kenteNo ratings yet

- Magnum Management Corp 8039 Beach BLVD Buena Park Ca 90620Document7 pagesMagnum Management Corp 8039 Beach BLVD Buena Park Ca 90620SamNo ratings yet

- QN LHENMgv Z6 M D6 D1Document2 pagesQN LHENMgv Z6 M D6 D1Humayon MalekNo ratings yet

- Goodwill Industries Application For EmploymentDocument5 pagesGoodwill Industries Application For EmploymentADMIN HRNo ratings yet

- Employee's W-2 FormDocument1 pageEmployee's W-2 FormDAISY CRAINNo ratings yet

- Hs 2302Document3 pagesHs 2302Diamond WadleyNo ratings yet

- Six Flags Great America Illinois - Retail Team Member - 2023 SummerDocument9 pagesSix Flags Great America Illinois - Retail Team Member - 2023 Summersnadir555No ratings yet

- W2 2023 AaronDocument1 pageW2 2023 Aaronyusufosoba51No ratings yet

- Social Security Term Paper ThesisDocument6 pagesSocial Security Term Paper Thesisgingerschifflifortwayne100% (2)

- Comments On Substitute Eddie Garcia BillDocument2 pagesComments On Substitute Eddie Garcia BillSai PastranaNo ratings yet

- Foreign WorkersDocument1 pageForeign WorkersPUSPADEVI A/P KUPPUSAMY (MOHR)No ratings yet

- Decision of Eligibility For Unemployment Insurance BenefitsDocument1 pageDecision of Eligibility For Unemployment Insurance BenefitsJoachim NosikNo ratings yet

- Completing The Form I9Document1 pageCompleting The Form I9ashwini arulrajhanNo ratings yet

- IRPF 2022 2021 Origi Imagem Declaracao01Document1 pageIRPF 2022 2021 Origi Imagem Declaracao01BVC RoleplayNo ratings yet

- SSS SBDocument20 pagesSSS SBMeireen AnnNo ratings yet

- Main Irs Form W 2 Wage and Tax StatementDocument11 pagesMain Irs Form W 2 Wage and Tax Statementjeffery lamarNo ratings yet

- Company ID Monitoring: No. Name Position Branch Date RemarksDocument4 pagesCompany ID Monitoring: No. Name Position Branch Date RemarksAzelann MirandaNo ratings yet

- UnknownDocument4 pagesUnknownnayla marie santiago cuadradoNo ratings yet

- Position Paper Descalsota Vs Palomar Revised 032418Document4 pagesPosition Paper Descalsota Vs Palomar Revised 032418Isabel HigginsNo ratings yet

- Rental Assistance Program Eligibility RequirementsDocument4 pagesRental Assistance Program Eligibility RequirementsBrian ThompsonNo ratings yet

- Of Wako Book 201910 DGDocument176 pagesOf Wako Book 201910 DGJohn Albert BiscasNo ratings yet

- IRS Form W2Document2 pagesIRS Form W2nurulamin00023No ratings yet

- View FileDocument3 pagesView FileMariah MeyersNo ratings yet

- Code On Social Security 2020Document14 pagesCode On Social Security 2020Moumita GoswamiNo ratings yet

- XXX-XX-1785 18704.00 116.62 18704.00 1159.65 18704.00 271.21 Houston TX 77084Document6 pagesXXX-XX-1785 18704.00 116.62 18704.00 1159.65 18704.00 271.21 Houston TX 77084CR FNo ratings yet