Professional Documents

Culture Documents

Week 1 Assignment: Chapter 1, Q14

Week 1 Assignment: Chapter 1, Q14

Uploaded by

Shakil Reddy BhimavarapuOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Week 1 Assignment: Chapter 1, Q14

Week 1 Assignment: Chapter 1, Q14

Uploaded by

Shakil Reddy BhimavarapuCopyright:

Available Formats

Week 1 Assignment

Chapter 1, Q14

Accounting Cost = Overhead cost & Operating expenses = 3,160,000

Implicit Cost = 56,000

Opportunity Cost = Implicit cost + Explicit Cost = 3,160,000 + 56,000 = 3,216,000

To earn positive Accounting profit, Revenue should be more than 3,160,000 (Accounting cost)

The Accounting cost includes only the Explicit costs or the overhead and operating cost incurred.

To earn positive Economic profit, Revenue should be more than 3,216,000 (Economic cost)

The Economic cost includes both the Explicit & Implicit costs incurred.

Chapter 1, Q15

Here, the net present value of DAS’s R&D initiative is

NPV of expected profits = 15000000/(1+0.07)5 + 16500000/(1+0.07)6 + 18150000/(1+0.07)7

+19965000/(1+0.07)8 + 21961500//(1+0.07)9

= $ 56557759

Present value of costs = $ 30000000

NPV of the project = 56557759 – 3000000 = $ 26557759

Since this is positive, DAS should spend the $30 million. Doing so adds about $26.6 million to

the firm’s value.

Chapter 1, Q16

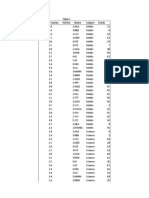

The present value of profits from each advertising strategy are as follows:

Present value of high advertising strategy

= 15000000/(1+0.10) + 90000000/(1+0.10)2 + 27000000/(1+0.10)3

= $ 290871525

Present value of Moderate advertising strategy

= 30000000/(1+0.10) + 75000000/(1+0.10)2 + 150000000/(1+0.10)3

= $ 201953418

Present value of Low advertising strategy

= 70000000/(1+0.10) + 105000000/(1+0.10)2 + 126000000/(1+0.10)3

= $ 245078888

Since the high advertising results in profit stream with the greatest present value, it is the

best option.

Chapter 1, Q19

Direct and indirect costs are the same regardless of whether you adopt the project and therefore

are irrelevant to the decision.

The incremental revenue if proceeded with new advertising campaign is = 30,347,800 -

20,540,100 = $ 9807700

To earn these additional revenues, however, company is spending an additional $2,945,700 in

TV airtime and $1,179,100 for additional ad development labor. Total $ 4124800

The incremental costs if proceeded with new advertising campaign is = explicit incremental cost

+ implicit incremental costs = 6,000,000 + 4,124,800 = $ 10,124,800

Going forward with the plan would reduce the firm’s bottom line by

10124800 -9 807700 = $ 317,100

So the company should not launch the advertising campaign.

You might also like

- The 1% Windfall: How Successful Companies Use Price to Profit and GrowFrom EverandThe 1% Windfall: How Successful Companies Use Price to Profit and GrowRating: 3 out of 5 stars3/5 (1)

- Accounting and Finance Formulas: A Simple IntroductionFrom EverandAccounting and Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- ISO/IEC 20000: An Introduction to the global standard for service managementFrom EverandISO/IEC 20000: An Introduction to the global standard for service managementNo ratings yet

- The Key to Higher Profits: Pricing PowerFrom EverandThe Key to Higher Profits: Pricing PowerRating: 5 out of 5 stars5/5 (1)

- Measuring and Maximizing Training Impact: Bridging the Gap between Training and Business ResultFrom EverandMeasuring and Maximizing Training Impact: Bridging the Gap between Training and Business ResultNo ratings yet

- An MBA in a Book: Everything You Need to Know to Master Business - In One Book!From EverandAn MBA in a Book: Everything You Need to Know to Master Business - In One Book!No ratings yet

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageFrom EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- CPA Review Notes 2019 - BEC (Business Environment Concepts)From EverandCPA Review Notes 2019 - BEC (Business Environment Concepts)Rating: 4 out of 5 stars4/5 (9)

- The Profit Zone (Review and Analysis of Slywotzky and Morrison's Book)From EverandThe Profit Zone (Review and Analysis of Slywotzky and Morrison's Book)No ratings yet

- How to Manage Future Costs and Risks Using Costing and MethodsFrom EverandHow to Manage Future Costs and Risks Using Costing and MethodsNo ratings yet

- Making Technology Investments Profitable: ROI Road Map from Business Case to Value RealizationFrom EverandMaking Technology Investments Profitable: ROI Road Map from Business Case to Value RealizationRating: 3 out of 5 stars3/5 (2)

- Cost Reduction Strategies for the Manufacturing Sector With Application of Microsoft ExcelFrom EverandCost Reduction Strategies for the Manufacturing Sector With Application of Microsoft ExcelNo ratings yet

- Management Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesFrom EverandManagement Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesNo ratings yet

- Make $300 Every Day With CPA Activities: The CPA Activities that Works First Time, Every TimeFrom EverandMake $300 Every Day With CPA Activities: The CPA Activities that Works First Time, Every TimeNo ratings yet

- The Ultimate Guide to Promote Your Product in 10 Minutes with Google AdwordsFrom EverandThe Ultimate Guide to Promote Your Product in 10 Minutes with Google AdwordsNo ratings yet

- How to Grow When Markets Don't (Review and Analysis of Slywotzky and Wise's Book)From EverandHow to Grow When Markets Don't (Review and Analysis of Slywotzky and Wise's Book)No ratings yet

- Reaching Sustainable: Implement and drive sustainability transformation in your organizationFrom EverandReaching Sustainable: Implement and drive sustainability transformation in your organizationNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- The Secrets of Successful Strategic Account Management: How Industrial Sales Organizations Can Boost Revenue Growth and Profitability, Prevent Revenue Loss, and Convert Customers to Valued PartnersFrom EverandThe Secrets of Successful Strategic Account Management: How Industrial Sales Organizations Can Boost Revenue Growth and Profitability, Prevent Revenue Loss, and Convert Customers to Valued PartnersNo ratings yet

- Earned Value Management for the PMP Certification ExamFrom EverandEarned Value Management for the PMP Certification ExamRating: 4.5 out of 5 stars4.5/5 (15)

- How to Structure a Commission Plan That Works: Sales Optimisation, #1From EverandHow to Structure a Commission Plan That Works: Sales Optimisation, #1No ratings yet

- Cash Flow Catalyst : Transforming Your Business with Strategic AdvertisingFrom EverandCash Flow Catalyst : Transforming Your Business with Strategic AdvertisingNo ratings yet

- Tax Savings Strategies for Small Businesses: A Comprehensive Guide For 2024From EverandTax Savings Strategies for Small Businesses: A Comprehensive Guide For 2024No ratings yet

- Business Metrics and Tools; Reference for Professionals and StudentsFrom EverandBusiness Metrics and Tools; Reference for Professionals and StudentsNo ratings yet

- New Product Development Essentials: Hands-on Help for Small Manufacturers and Smart Technical People: No Nonsence Manuals, #2From EverandNew Product Development Essentials: Hands-on Help for Small Manufacturers and Smart Technical People: No Nonsence Manuals, #2Rating: 4 out of 5 stars4/5 (1)

- Model Answer: Launch of a laundry liquid detergent in Sri LankaFrom EverandModel Answer: Launch of a laundry liquid detergent in Sri LankaNo ratings yet

- It's a HouseHeist® House Flip: Our Proven Steps for SuccessFrom EverandIt's a HouseHeist® House Flip: Our Proven Steps for SuccessNo ratings yet

- ClickBank Secret Revealed: Earn $100 Per Day Even As NewbieFrom EverandClickBank Secret Revealed: Earn $100 Per Day Even As NewbieRating: 1 out of 5 stars1/5 (2)

- The Incentive Plan for Efficiency in Government Operations: A Program to Eliminate Government DeficitsFrom EverandThe Incentive Plan for Efficiency in Government Operations: A Program to Eliminate Government DeficitsNo ratings yet

- Achievements and Skills Showcase Made Easy: The Made Easy Series Collection, #4From EverandAchievements and Skills Showcase Made Easy: The Made Easy Series Collection, #4No ratings yet

- Week 2 - AssignmentDocument10 pagesWeek 2 - AssignmentShakil Reddy BhimavarapuNo ratings yet

- Week 3 - AssignmentDocument8 pagesWeek 3 - AssignmentShakil Reddy BhimavarapuNo ratings yet

- Week 6 - AssignmentDocument7 pagesWeek 6 - AssignmentShakil Reddy BhimavarapuNo ratings yet

- UntitledDocument2 pagesUntitledShakil Reddy BhimavarapuNo ratings yet

- Week 3 - DiscussionDocument2 pagesWeek 3 - DiscussionShakil Reddy BhimavarapuNo ratings yet

- Week 2 - DiscussionDocument2 pagesWeek 2 - DiscussionShakil Reddy BhimavarapuNo ratings yet

- Week 3 Assignment: Chapter 4, Q2Document9 pagesWeek 3 Assignment: Chapter 4, Q2Shakil Reddy BhimavarapuNo ratings yet

- Week 4 - AssignmentDocument5 pagesWeek 4 - AssignmentShakil Reddy BhimavarapuNo ratings yet

- Week 5 - AssignmentDocument8 pagesWeek 5 - AssignmentShakil Reddy BhimavarapuNo ratings yet

- Holacracy FinalDocument24 pagesHolacracy FinalShakil Reddy BhimavarapuNo ratings yet

- Week 4 - DiscussionDocument2 pagesWeek 4 - DiscussionShakil Reddy BhimavarapuNo ratings yet

- Week 7 - AssignmentDocument11 pagesWeek 7 - AssignmentShakil Reddy BhimavarapuNo ratings yet

- P&MM 1.2 - SourcingDocument52 pagesP&MM 1.2 - SourcingShakil Reddy BhimavarapuNo ratings yet

- DSA II Notes UptoRegressionDocument38 pagesDSA II Notes UptoRegressionShakil Reddy BhimavarapuNo ratings yet

- Data Science and Applications NotesDocument4 pagesData Science and Applications NotesShakil Reddy BhimavarapuNo ratings yet

- Procurment SortDocument6 pagesProcurment SortShakil Reddy BhimavarapuNo ratings yet

- WBS HeathrowDocument1 pageWBS HeathrowShakil Reddy BhimavarapuNo ratings yet

- General Project InformationDocument3 pagesGeneral Project InformationShakil Reddy BhimavarapuNo ratings yet

- Souptik PaulDocument18 pagesSouptik PaulShakil Reddy BhimavarapuNo ratings yet

- Consulting Preparation Case StudiesDocument6 pagesConsulting Preparation Case StudiesShakil Reddy BhimavarapuNo ratings yet