0% found this document useful (0 votes)

727 views7 pagesFull-Time Trader Success Guide

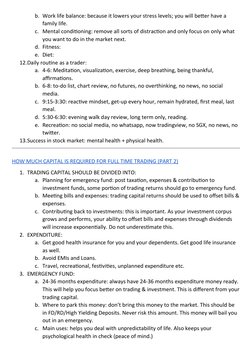

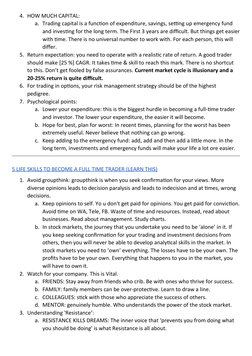

The document provides advice for becoming a successful full-time trader. It emphasizes the importance of developing strong mental discipline through visualization, maintaining a healthy lifestyle with proper diet, exercise, and rest, and establishing a consistent daily routine. It also stresses having sufficient capital, generating realistic returns, diversifying income sources, and cultivating characteristics like grit, adaptability, and optimism to withstand market drawdowns.

Uploaded by

Vishal ZambareCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

727 views7 pagesFull-Time Trader Success Guide

The document provides advice for becoming a successful full-time trader. It emphasizes the importance of developing strong mental discipline through visualization, maintaining a healthy lifestyle with proper diet, exercise, and rest, and establishing a consistent daily routine. It also stresses having sufficient capital, generating realistic returns, diversifying income sources, and cultivating characteristics like grit, adaptability, and optimism to withstand market drawdowns.

Uploaded by

Vishal ZambareCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

- The Art of Visualization and Self Improvement

- Trading Capital Requirements

- Life Skills for Full-Time Traders

- Importance of Diversified Income

- Full Time Trader: My Journey