Professional Documents

Culture Documents

Trading Psychology

Uploaded by

Julia Reid0 ratings0% found this document useful (0 votes)

4 views7 pagesCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views7 pagesTrading Psychology

Uploaded by

Julia ReidCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 7

Trading Psychology

Your mental state is crucial to success in the markets

Losing trades are a part of the game, we need to

Dealing With Losing Trades learn from them without destroying our accounts

● Losing trades are a part of trading,

even the best traders have

losses

● Good traders manage their losing

trades fast

● Never let a small loss turn into a

big loss

● When a trade is not doing what you

planned, cut the trade

● Don’t allow a losing trade to affect

your mental state for the next trade

Winning trades will happen, we need to prevent

Dealing With Winning Trades ourselves from getting overconfident and reckless

● Winning trades can be just as bad

as losing trades for newer traders

● Good traders don’t allow winning

trades to effect their mental state

● Don’t allow a winning trade to

make you overconfident

● When a trade has hit your exit

target, take profits

● Don’t allow a winning trade to affect

your mental state for the next trade

We need to think of ourselves as if we were an

Trading Like A Robot advanced AI trading algorithm

● As successful traders, we don’t

trade based on our emotions

● Trades should be placed on our

trading system (supply and

demand)

● We take our profits the same way

we cut our losses, emotionless

● We are constantly monitoring the

market for the next setup that our

trading system provides us

In trading, we are our own worst enemy, more

Ignoring Emotions specifically our emotions cause us to take bad trades

● Emotional trading is why the market

moves up and down

● Poor traders trade based on their

emotions and pay the price

● As good traders, we need to learn

to ignore our emotions and trade

solely based on our edge (supply

and demand)

● If you catch yourself being

emotional, step away from the

screen and write down the reasons

in your journal

Overtrading happens to all traders, we need to become

Prevent Over Trading aware of it and stop it before it destroys our account

● Overtrading is when we start placing bad

trades one after another, usually to get

back at the market

● Overtrading usually happens when we

become emotional after a winning or

losing trade

● It is crucial to understand when we are

overtrading so we can take a step back

and re-evaluate the market with a clear

mind

● One way to counter overtrading is to close

your trading platform and open up a paper

trading or simulator account

Key Takeaways

● Losing trades are a part of the game, they will happen and we need to learn

from them without destroying our account

● Winning trades will happen, but we cannot let them make us overconfident

and reckless in our trading

● We need to think of ourselves as advanced AI trading robots that place

trades based on our trading system and not on our emotions

● Emotions are what makes the market go up and down, emotional trading will

only lead to losses and more emotional trading

● Overtrading is a result of emotional trading and should be avoided at all costs

You might also like

- Lesson 6 Psychology of Winning Traders: by Adam KhooDocument20 pagesLesson 6 Psychology of Winning Traders: by Adam Khoodaysan88% (8)

- Point To Be Kept in Mind While Doing TradingDocument15 pagesPoint To Be Kept in Mind While Doing TradingAshish Singh100% (1)

- Overcome Your Fear in Trading: Trading Psychology Made Easy, #3From EverandOvercome Your Fear in Trading: Trading Psychology Made Easy, #3Rating: 4.5 out of 5 stars4.5/5 (3)

- Psychology Wall - AmritDocument6 pagesPsychology Wall - AmritStellamaris MutukuNo ratings yet

- How To Think Like A Professional TraderDocument7 pagesHow To Think Like A Professional TraderL100% (8)

- Aug 1 WebinarDocument13 pagesAug 1 Webinarjohanjojo.10cNo ratings yet

- Lesson 4 - How Emotions Can Affect Your Trading ResultsDocument1 pageLesson 4 - How Emotions Can Affect Your Trading Resultsleslie woodsNo ratings yet

- Rules For Forex TradingDocument22 pagesRules For Forex Tradinglever70No ratings yet

- Inside A Traders MindDocument28 pagesInside A Traders MindOmobolaji OKELANANo ratings yet

- Technical Analysis of Stock Market for BeginnersFrom EverandTechnical Analysis of Stock Market for BeginnersRating: 3.5 out of 5 stars3.5/5 (25)

- Trading Psychology: Why We TradeDocument6 pagesTrading Psychology: Why We TradeMarco Benk100% (1)

- Rules For Forex Trading: A Practical Guide To Keeping Your Shirt and Compounding Your AccountDocument22 pagesRules For Forex Trading: A Practical Guide To Keeping Your Shirt and Compounding Your AccountFORKOMSEL FORUM KOMUNIKASI WARGA SELAKAUNo ratings yet

- Good Trade That Lost Money Good Trade That Won Money Bad Trade That Lost Money Bad Trade That Won MoneyDocument3 pagesGood Trade That Lost Money Good Trade That Won Money Bad Trade That Lost Money Bad Trade That Won MoneyShubhashish SaxenaNo ratings yet

- The Psychology of Trading 'In The Zone': Master Your Emotions When TradingDocument8 pagesThe Psychology of Trading 'In The Zone': Master Your Emotions When TradingDaniel Agbaje100% (1)

- Day Trading: " Less Is More "Document82 pagesDay Trading: " Less Is More "raydipanjan100% (1)

- Trading For Beginners Part 2 - Sample-Trade-Plan-2Document8 pagesTrading For Beginners Part 2 - Sample-Trade-Plan-2Domingos AlbertoNo ratings yet

- Overcoming The 3 Hidden Obstacles To GoodDocument2 pagesOvercoming The 3 Hidden Obstacles To GoodDnyaneshwar DesaiNo ratings yet

- Inside A Traders Brain 2Document5 pagesInside A Traders Brain 2Big BomberNo ratings yet

- Steve Allen PNL en 7 DíasDocument13 pagesSteve Allen PNL en 7 DíasDev_EdgarNo ratings yet

- The Winning Trading Journal TemplateDocument1 pageThe Winning Trading Journal TemplateUdaya KumarNo ratings yet

- Mastery Program Module FiveDocument39 pagesMastery Program Module FiveJinNo ratings yet

- Mark Douglas PointsDocument43 pagesMark Douglas PointssuneetaNo ratings yet

- The Winning Trading JournalDocument9 pagesThe Winning Trading JournalMuhammad Ahmad RazaNo ratings yet

- Trading With The Emotions of Fear and GreedDocument1 pageTrading With The Emotions of Fear and GreedAKSHAYA AKSHAYANo ratings yet

- @RTA Market PsychologyDocument10 pages@RTA Market PsychologyPerfect Seboke100% (1)

- Trader Psychology: Trade To Trade TomorrowDocument11 pagesTrader Psychology: Trade To Trade Tomorrowtawhid anam100% (4)

- Trading Rules:: Top 10 Day Trading Most Effective RulesFrom EverandTrading Rules:: Top 10 Day Trading Most Effective RulesRating: 4 out of 5 stars4/5 (6)

- ThePerfectTrade PDFDocument9 pagesThePerfectTrade PDFLatari100% (1)

- 15 Keys of Succesful TradingDocument4 pages15 Keys of Succesful TradingKucingRockMixNo ratings yet

- Sober Trading Book v1Document110 pagesSober Trading Book v1Nil Pakhi100% (5)

- Trading EdgeDocument10 pagesTrading EdgeConnor CranstonNo ratings yet

- How To Think Like A Professional Trader by Mark Douglas NotesDocument7 pagesHow To Think Like A Professional Trader by Mark Douglas NotesScribdTranslations100% (1)

- Market Wizards Summary 1Document5 pagesMarket Wizards Summary 1Sam Soran100% (1)

- CONTROLLING. Your TRADES, MONEY& EMOTIONS. by Chris VermeulenDocument11 pagesCONTROLLING. Your TRADES, MONEY& EMOTIONS. by Chris VermeulenfrankkinunghiNo ratings yet

- Session 1 OutlineDocument4 pagesSession 1 Outlinesaludbienestar34No ratings yet

- RM Unit 4Document40 pagesRM Unit 4Sachin GodaraNo ratings yet

- This Article Looks at The Most Common Reasons Why Professional and New Forex Traders Lose Money On The Forex MarketDocument46 pagesThis Article Looks at The Most Common Reasons Why Professional and New Forex Traders Lose Money On The Forex MarketZulfiqar AliNo ratings yet

- Nial Course On Price Action ForexDocument57 pagesNial Course On Price Action Forexnishitsardhara100% (2)

- Dharamik Rulebook NotesDocument7 pagesDharamik Rulebook Notesnrcbluemoon27No ratings yet

- Intraday Trading BPDocument3 pagesIntraday Trading BPKeshav Jangra0% (2)

- The Path (Trading Mantra)Document19 pagesThe Path (Trading Mantra)zangar100% (1)

- Money Management and Trading PsychologyDocument7 pagesMoney Management and Trading PsychologyBudi Mulyono100% (1)

- Developing A Trader Mindset For SuccessDocument2 pagesDeveloping A Trader Mindset For SuccessCMS Prime100% (1)

- Forex Trading PlanDocument11 pagesForex Trading Planfitrazmin100% (3)

- Trading Risk Management PDFDocument12 pagesTrading Risk Management PDFGAURAV LATHIGARA86% (7)

- AdvancedCourseBook JanDocument238 pagesAdvancedCourseBook JanXRM090967% (6)

- Embracing Failure in TradingDocument7 pagesEmbracing Failure in TradingHustle GangNo ratings yet

- Zone Breakout'sDocument78 pagesZone Breakout'sPARTH DHULAM100% (2)

- Part 12 The Psychology of Forex TradingDocument4 pagesPart 12 The Psychology of Forex TradingandreNo ratings yet

- 11 Habits of Disciplined TraderDocument7 pages11 Habits of Disciplined TraderKirankumar Tadhawala100% (1)

- Trading QuotesDocument37 pagesTrading QuotesStatusPediaNo ratings yet

- Psychology of Trading - D14Document2 pagesPsychology of Trading - D14Sidharth GummallaNo ratings yet

- FOREX GT. An Introduction To PriceDocument21 pagesFOREX GT. An Introduction To PriceRayNanty100% (1)

- Advanced Course BookDocument164 pagesAdvanced Course BookKelvin Lim Wei Liang100% (4)

- Entering Trades: Financial FreedomDocument9 pagesEntering Trades: Financial FreedomMarian Marius SerbanNo ratings yet

- Day Trading Rules That Makes Successful Trader ADocument6 pagesDay Trading Rules That Makes Successful Trader Aसन्तोष सिंह जादौनNo ratings yet

- Markets in TurmoilDocument9 pagesMarkets in TurmoilkkNo ratings yet

- Money Management and Trading Psychology Some AdviceDocument6 pagesMoney Management and Trading Psychology Some AdviceOladimeji HassanNo ratings yet

- Green BuildingsDocument6 pagesGreen BuildingsAnuja JadhavNo ratings yet

- Navigating The Complexities of Modern SocietyDocument2 pagesNavigating The Complexities of Modern SocietytimikoNo ratings yet

- Promass 63 ManualDocument48 pagesPromass 63 Manualleopoldo alejandro antio gonzalezNo ratings yet

- EXTENSOMETRO United - Loadcells - InstrumentsDocument7 pagesEXTENSOMETRO United - Loadcells - InstrumentsAgustin PerdomoNo ratings yet

- Polartek Plus Eeac331Document84 pagesPolartek Plus Eeac331Sodel MezaNo ratings yet

- Mechanical Engineering Department University of Engineering and Technology, LahoreDocument22 pagesMechanical Engineering Department University of Engineering and Technology, LahoreSyed MunawarNo ratings yet

- Culture Style of InditexDocument3 pagesCulture Style of InditexRufinaNo ratings yet

- My Strengths WorksheetDocument5 pagesMy Strengths WorksheetvilavanadonisNo ratings yet

- Random Process Analysis With R Marco Bittelli All ChapterDocument67 pagesRandom Process Analysis With R Marco Bittelli All Chapterdorothy.rehberg545100% (3)

- Breeding Objectives, Selection Criteria and Breeding System of Indigenous Goat Types in Bale Zone, Oromia, EthiopiaDocument10 pagesBreeding Objectives, Selection Criteria and Breeding System of Indigenous Goat Types in Bale Zone, Oromia, EthiopiareinpolyNo ratings yet

- 41 SAfrican LJ269Document6 pages41 SAfrican LJ269Ruchira JoshiNo ratings yet

- Spelling Homework 3rd GradeDocument6 pagesSpelling Homework 3rd Gradeafnaxdxtloexll100% (1)

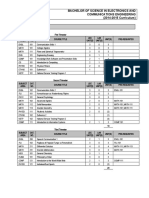

- Program Structure: Bachelor of Science in Electronics and Communications Engineering (2014-2015 Curriculum)Document5 pagesProgram Structure: Bachelor of Science in Electronics and Communications Engineering (2014-2015 Curriculum)Zainab KadhemNo ratings yet

- Applications: Functions andDocument350 pagesApplications: Functions andJason UchennnaNo ratings yet

- The Power Rule and Other Rules For DifferentiationDocument23 pagesThe Power Rule and Other Rules For DifferentiationAngel EngbinoNo ratings yet

- Ifc 8thconf 4c4papDocument29 pagesIfc 8thconf 4c4papgauravpassionNo ratings yet

- An Analysis of "Limited and Selective Effect Theory" and "Uses and Gratification Theory" From Perspective of Mass Media ResearchDocument6 pagesAn Analysis of "Limited and Selective Effect Theory" and "Uses and Gratification Theory" From Perspective of Mass Media ResearchIAEME PublicationNo ratings yet

- Identification of The Best Model and Parameters For T-Y-X Equilibrium Data of Ethanol-Water MixtureDocument7 pagesIdentification of The Best Model and Parameters For T-Y-X Equilibrium Data of Ethanol-Water MixtureMeghana SNo ratings yet

- BSBSUS601 Ass Task 1 - v2.1Document4 pagesBSBSUS601 Ass Task 1 - v2.1Nupur VermaNo ratings yet

- Factoring Perfect Square Trinomials: Lesson 4Document29 pagesFactoring Perfect Square Trinomials: Lesson 4Jessa A.No ratings yet

- MT Evenness Tester 2341 EN 2022-03Document4 pagesMT Evenness Tester 2341 EN 2022-03Quynh TrangNo ratings yet

- Oral Dosage Forms BrochureDocument20 pagesOral Dosage Forms Brochureselvi aklailia rosaNo ratings yet

- Degrees of Plagiarism Activity PDFDocument20 pagesDegrees of Plagiarism Activity PDFDhamma_StorehouseNo ratings yet

- Appendix A 2Document7 pagesAppendix A 2MUNKIN QUINTERONo ratings yet

- ANNEX A. Integrated Planning ProcessDocument3 pagesANNEX A. Integrated Planning Processcarlito alvarezNo ratings yet

- Test Bank For Parent Child Relations Context Research and Application 4th by HeathDocument24 pagesTest Bank For Parent Child Relations Context Research and Application 4th by HeathMichaelNguyenwgok100% (44)

- Influence of Drying and Hydrothermal Treatment of Corn On The Denaturationof Salt-Soluble Proteins and Color ParametersDocument10 pagesInfluence of Drying and Hydrothermal Treatment of Corn On The Denaturationof Salt-Soluble Proteins and Color ParametersShania GintingNo ratings yet

- Test Bank For Economic Development The Pearson Series in Economics 11th Edition Michael P TodaroDocument24 pagesTest Bank For Economic Development The Pearson Series in Economics 11th Edition Michael P TodaroRebeccaRodriguezcqgf100% (49)

- SBC 506Document10 pagesSBC 506Amr HassanNo ratings yet

- Vibration InstrucationDocument12 pagesVibration Instrucationzain140No ratings yet