Professional Documents

Culture Documents

Exec Sum

Uploaded by

Agnes DizonOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Exec Sum

Uploaded by

Agnes DizonCopyright:

Available Formats

WORLDECONOMIC

WORLD ECONOMIC OUTLOOK:

OUTLOOK: MANAGING

TENSIONS FROM THEDIVERGENT RECOVERIES

TWO-SPEED RECOVERY

EXECUTIVE SUMMARY

One year into the COVID-19 pandemic, the the crisis in a precarious fiscal situation and with less

accumulating human toll continues to raise concerns, capacity to mount major health care policy responses

even as growing vaccine coverage lifts sentiment. High or support livelihoods. The projected recovery follows

uncertainty surrounds the global economic outlook, a severe contraction that has had particularly adverse

primarily related to the path of the pandemic. The employment and earnings impacts on certain groups.

contraction of activity in 2020 was unprecedented in Youth, women, workers with relatively lower educa-

living memory in its speed and synchronized nature. tional attainment, and the informally employed have

But it could have been a lot worse. Although difficult generally been hit hardest. Income inequality is likely

to pin down precisely, IMF staff estimates suggest that to increase significantly because of the pandemic.

the contraction could have been three times as large Close to 95 million more people are estimated to have

if not for extraordinary policy support. Much remains fallen below the threshold of extreme poverty in 2020

to be done to beat back the pandemic and avoid compared with pre-pandemic projections. Moreover,

divergence in income per capita across economies and learning losses have been more severe in low-income

persistent increases in inequality within countries. and developing countries, which have found it harder

Improved outlook: After an estimated contraction to cope with school closures, and especially for girls

of –3.3 percent in 2020, the global economy is and students from low-income households. Unequal

projected to grow at 6 percent in 2021, moderating setbacks to schooling could further amplify income

to 4.4 percent in 2022. The contraction for 2020 is inequality.

1.1 percentage points smaller than projected in the High uncertainty surrounds the global outlook.

October 2020 World Economic Outlook (WEO), reflect- Future developments will depend on the path of the

ing the higher-than-expected growth outturns in the health crisis, including whether the new COVID-19

second half of the year for most regions after lock- strains prove susceptible to vaccines or they prolong

downs were eased and as economies adapted to new the pandemic; the effectiveness of policy actions to

ways of working. The projections for 2021 and 2022 limit persistent economic damage (scarring); the

are 0.8 percentage point and 0.2 percentage point evolution of financial conditions and commodity

stronger than in the October 2020 WEO, reflecting prices; and the adjustment capacity of the economy.

additional fiscal support in a few large economies and The ebb and flow of these drivers and their interaction

the anticipated vaccine-powered recovery in the second with country-specific characteristics will determine the

half of the year. Global growth is expected to moder- pace of the recovery and the extent of medium-term

ate to 3.3 percent over the medium term—reflecting scarring across countries (Chapter 2). In many aspects,

projected damage to supply potential and forces that this crisis is unique. In certain countries, policy sup-

predate the pandemic, including aging-related slower port and lack of spending opportunities have led to

labor force growth in advanced economies and some large increases in savings that could be unleashed very

emerging market economies. Thanks to unprecedented quickly should uncertainty dissipate. At the same

policy response, the COVID-19 recession is likely to time, it is unclear how much of these savings will

leave smaller scars than the 2008 global financial crisis. be spent, given the deterioration of many firms’ and

However, emerging market economies and low-income households’ balance sheets (particularly among those

developing countries have been hit harder and are with a high propensity to consume out of income)

expected to suffer more significant medium-term losses. and the expiration of loan repayment moratoria. In

Divergent impacts: Output losses have been par- sum, risks are assessed as balanced in the short term,

ticularly large for countries that rely on tourism and but tilted to the upside later on.

commodity exports and for those with limited policy Considering the large uncertainty surrounding

space to respond. Many of these countries entered the outlook, policymakers should prioritize policies

xvi International Monetary Fund | April 2021

Executive Summary

that would be prudent, regardless of the state of the tainty. Therefore, when support is eventually scaled

world that prevails—for instance, strengthening social back, it should be done in ways that avoid sudden

protection with wider eligibility for unemployment cliffs (for instance, gradually reducing the government’s

insurance to cover the self-employed and informally share of wages covered under furlough and short-time

employed (see Chapter 2 of the April 2020 WEO); work programs while increasing hiring subsidies to

ensuring adequate resources for health care, early child- enable reallocation as needed). All the while, long-term

hood development programs, education, and voca- challenges—boosting productivity, improving policy

tional training; and investing in green infrastructure frameworks, and addressing climate change—cannot

to hasten the transition to lower carbon dependence. be ignored. Differential recovery speeds across coun-

Moreover, as discussed in Chapters 2 and 3, they tries may give rise to divergent policy stances, particu-

should be prepared to flexibly adjust policy support, larly if advanced economies benefit sooner than others

for example, by shifting from lifelines to reallocation as from wide vaccine coverage. Clear forward guidance

the pandemic evolves, and linked to improvements in and communication from advanced economy central

activity, while they safeguard social spending and avoid banks is particularly crucial, and not just for calibrating

locking in inefficient spending outlays. It is important the appropriate domestic monetary accommodation.

to anchor short-term support in credible medium-term It also vitally bears on external financial conditions

frameworks (see the April 2021 Fiscal Monitor). Where in emerging markets and the impact that divergent

elevated debt levels limit scope for action, effort should policy stances have on capital flows (Chapter 4).

also be directed at creating space through increased Strong international cooperation is vital for achieving

revenue collection (fewer breaks, better coverage of these objectives and ensuring that emerging market

registries, and switching to well-designed value-added economies and low-income developing countries con-

taxes), greater tax progressivity, and by reducing waste- tinue to narrow the gap between their living standards

ful subsidies. and those of high-income countries. On the health

Policy priorities: The factors shaping the appropriate care front, this means ensuring adequate worldwide

stance of policy vary by country, especially progress vaccine production and universal distribution at

toward normalization. Hence, countries will need to affordable prices—including through sufficient fund-

tailor their policy responses to the stage of the pan- ing for the COVAX facility—so that all countries can

demic, strength of the recovery, and structural char- quickly and decisively beat back the pandemic. The

acteristics of the economy. Once vaccination becomes international community also needs to work together

widespread and spare capacity in health care systems to ensure that financially constrained economies have

is generally restored to pre-COVID-19 levels, restric- adequate access to international liquidity so that they

tions can begin to be lifted. While the pandemic can continue needed health care, other social, and

continues, policies should first focus on escaping the infrastructure spending required for development and

crisis, prioritizing health care spending, providing convergence to higher levels of income per capita.

well-targeted fiscal support, and maintaining accom- Countries should also work closely to redouble climate

modative monetary policy while monitoring financial change mitigation efforts. Moreover, strong coopera-

stability risks. Then, as the recovery progresses, policy- tion is needed to resolve economic issues underlying

makers will need to limit long-term economic scarring trade and technology tensions (as well as gaps in the

with an eye toward boosting productive capacity (for rules-based multilateral trading system). Building on

example, public investment) and increasing incentives recent advances in international tax policy, efforts

for an efficient allocation of productive resources. It is should continue to focus on limiting cross-border

a delicate balance, especially given the prevailing uncer- profit shifting, tax avoidance, and tax evasion.

International Monetary Fund | April 2021 xvii

You might also like

- Surviving the Aftermath of Covid-19:How Business Can Survive in the New EraFrom EverandSurviving the Aftermath of Covid-19:How Business Can Survive in the New EraNo ratings yet

- IMF Report Summary 2020Document3 pagesIMF Report Summary 2020JOAONo ratings yet

- Executive SummaryDocument2 pagesExecutive SummaryHerry SusantoNo ratings yet

- Executive Summary: Chapter 1: Fiscal Policies To Address The COVID-19 PandemicDocument3 pagesExecutive Summary: Chapter 1: Fiscal Policies To Address The COVID-19 PandemicVdasilva83No ratings yet

- tdr2021ch1 enDocument44 pagestdr2021ch1 envbn7rdkkntNo ratings yet

- Foreword: Economic Outlook, Are The Main Drivers of This DevelDocument2 pagesForeword: Economic Outlook, Are The Main Drivers of This DevelVdasilva83No ratings yet

- World Economic OutlookDocument6 pagesWorld Economic OutlookRudni MedinaNo ratings yet

- Foreword PDFDocument2 pagesForeword PDFTushar DoshiNo ratings yet

- Ch1 PDFDocument26 pagesCh1 PDFrhizelle19No ratings yet

- The Future of Emerging Markets Duttagupta and PazarbasiogluDocument6 pagesThe Future of Emerging Markets Duttagupta and PazarbasiogluMarkoNo ratings yet

- GEP June 2023 ForewordDocument2 pagesGEP June 2023 ForewordKong CreedNo ratings yet

- World Economic Outlook Update: July 2021Document21 pagesWorld Economic Outlook Update: July 2021ctNo ratings yet

- Covid 19Document6 pagesCovid 19Ngọc Thảo NguyễnNo ratings yet

- The Economic Impact of The PandemicDocument5 pagesThe Economic Impact of The Pandemick.agnes12No ratings yet

- Weoeng202006 PDFDocument20 pagesWeoeng202006 PDFAndrewNo ratings yet

- Chapter 6Document20 pagesChapter 6Nikhil ShuklaNo ratings yet

- Tdr2023ch1 enDocument31 pagesTdr2023ch1 enSuhrobNo ratings yet

- An Empirical Evidence of Economic Recovery During The Pandemic Period Into World EconomyDocument10 pagesAn Empirical Evidence of Economic Recovery During The Pandemic Period Into World EconomyIJAR JOURNALNo ratings yet

- Final Exam-ECO720-2112-1&2 VSDocument4 pagesFinal Exam-ECO720-2112-1&2 VSanurag soniNo ratings yet

- World Economic OutlookDocument6 pagesWorld Economic OutlookKEZIAH REVE B. RODRIGUEZNo ratings yet

- جائحة كوروناDocument17 pagesجائحة كوروناMaEstro MoHamedNo ratings yet

- Global Trends 2020-2025 - KearneyDocument25 pagesGlobal Trends 2020-2025 - KearneySuvam ChakrabartyNo ratings yet

- Eafm - 27 May 2020 - 1600Document11 pagesEafm - 27 May 2020 - 1600emon hossainNo ratings yet

- الاستجابة لأزمة كوفيد-19 في بلدان الشرق الأوسط وشمال أفريقياDocument39 pagesالاستجابة لأزمة كوفيد-19 في بلدان الشرق الأوسط وشمال أفريقياsm3977263No ratings yet

- I. Global Economic ReviewDocument2 pagesI. Global Economic ReviewAhmad IshtiaqNo ratings yet

- Global Financial Stability Report - 2020Document43 pagesGlobal Financial Stability Report - 2020Xara ChamorroNo ratings yet

- IMF Fiscal MonitorDocument42 pagesIMF Fiscal MonitorqonijoNo ratings yet

- Economic and Monetary ReviewDocument133 pagesEconomic and Monetary ReviewAravindAgueroNo ratings yet

- Ketels-Competitiv Upgrading Covid - April 2020Document24 pagesKetels-Competitiv Upgrading Covid - April 2020professionalNo ratings yet

- WORLD ECONOMIC OUTLOOK UPDATE - International Monetary Fund 2021Document11 pagesWORLD ECONOMIC OUTLOOK UPDATE - International Monetary Fund 2021کتابخانه آشنا کتابتونNo ratings yet

- GEP January 2023 ForewordDocument2 pagesGEP January 2023 ForewordDhei MelonNo ratings yet

- Appropriate Policies To Overcome From The Economic Crisis Caused by Covid-19: A Global PerspectiveDocument6 pagesAppropriate Policies To Overcome From The Economic Crisis Caused by Covid-19: A Global Perspectiveemon hossainNo ratings yet

- g20 Report On Strong Sustainable Balanced and Inclusive GrowthDocument24 pagesg20 Report On Strong Sustainable Balanced and Inclusive Growthjohn.tomason29No ratings yet

- Management Discussion and AnalysisDocument36 pagesManagement Discussion and AnalysisVidyashree PNo ratings yet

- Macro - Fiscal Policy AssignmentDocument3 pagesMacro - Fiscal Policy AssignmentAravel Jade Dela CruzNo ratings yet

- ECO720 Group ALP Team 7 - ReportDocument9 pagesECO720 Group ALP Team 7 - ReportRita MaranNo ratings yet

- Budget Overview - of - The - Economy 23Document11 pagesBudget Overview - of - The - Economy 23zubairNo ratings yet

- DBRS Morningstar Changes Trend On Uruguay To Positive, Confirms at BBB (Low)Document11 pagesDBRS Morningstar Changes Trend On Uruguay To Positive, Confirms at BBB (Low)SubrayadoHDNo ratings yet

- Contoh BeritaDocument6 pagesContoh BeritaWindy Marsella ApriliantyNo ratings yet

- WASHINGTON, June 8, 2021 - The Global Economy Is Expected To Expand 5.6%Document3 pagesWASHINGTON, June 8, 2021 - The Global Economy Is Expected To Expand 5.6%Huyền TíttNo ratings yet

- Nurfarhanah Binti Abd Aziz IPE Policy Report - 5521286 6069918 1534314148Document14 pagesNurfarhanah Binti Abd Aziz IPE Policy Report - 5521286 6069918 1534314148Aidah Md SaidNo ratings yet

- 2020, A Global Debt Tidal Wave: April 2020Document5 pages2020, A Global Debt Tidal Wave: April 2020anujNo ratings yet

- Fiscal PolicyDocument7 pagesFiscal PolicySara de la SernaNo ratings yet

- Economic Effects of Covid-19 in Luxembourg First Recovid Working Note With Preliminary EstimatesDocument53 pagesEconomic Effects of Covid-19 in Luxembourg First Recovid Working Note With Preliminary EstimatesShaman WhisperNo ratings yet

- Chief Economists Outlook: Centre For The New Economy and SocietyDocument22 pagesChief Economists Outlook: Centre For The New Economy and SocietycantuscantusNo ratings yet

- Fiscal Sustainability of Assam - 13Document20 pagesFiscal Sustainability of Assam - 13rakesh.rnbdjNo ratings yet

- IMF - United Kingdom - Priazqani RampaditoDocument4 pagesIMF - United Kingdom - Priazqani RampaditoPriazqani RampaditoNo ratings yet

- g20 Minimizing Scarring From The PandemicDocument30 pagesg20 Minimizing Scarring From The PandemicAbdullah BazaNo ratings yet

- Two Major Issues of Fiscal Policy and Potential Harms To The EconomyDocument10 pagesTwo Major Issues of Fiscal Policy and Potential Harms To The Economysue patrickNo ratings yet

- RI - RecoveringandStructuringAfterCOVID19 IssueBrief 202010Document16 pagesRI - RecoveringandStructuringAfterCOVID19 IssueBrief 202010ArgonzNo ratings yet

- Policymakers Need Steady Hand As Storm Clouds Gather Over Global EconomyDocument11 pagesPolicymakers Need Steady Hand As Storm Clouds Gather Over Global EconomyNúriaNo ratings yet

- ExecsumDocument3 pagesExecsumYar Zar AungNo ratings yet

- Lessons For The Private Equity Industry Amidst Rising Global InflationDocument8 pagesLessons For The Private Equity Industry Amidst Rising Global InflationMarcos LalorNo ratings yet

- Pre Budget Report 2021-2022 Final Revised 19 Jan 21Document43 pagesPre Budget Report 2021-2022 Final Revised 19 Jan 21Anonymous UpWci5No ratings yet

- World Economic Outlook: UpdateDocument16 pagesWorld Economic Outlook: UpdateMihai RadulescuNo ratings yet

- Evaluating The Effects of The Economic Response To COVID 19Document79 pagesEvaluating The Effects of The Economic Response To COVID 19Willian CarvalhoNo ratings yet

- Enspecial Series On Covid19monetary and Financial Policy Responses For Emerging Market and DevelopinDocument5 pagesEnspecial Series On Covid19monetary and Financial Policy Responses For Emerging Market and DevelopinAlip FajarNo ratings yet

- UN - Global Green New DealDocument15 pagesUN - Global Green New DealDJNo ratings yet

- Thinking Aloud: Editor's DeskDocument4 pagesThinking Aloud: Editor's Deskসাদিক মাহবুব ইসলামNo ratings yet

- ExecsumDocument2 pagesExecsumKashf ShabbirNo ratings yet

- Five Ways Retail Has Changed and How Businesses Can Adapt - Articles - ZRHMZWV PDFDocument4 pagesFive Ways Retail Has Changed and How Businesses Can Adapt - Articles - ZRHMZWV PDFAgnes DizonNo ratings yet

- 06 Budgeting Problem 20Document4 pages06 Budgeting Problem 20Agnes DizonNo ratings yet

- Sovereign Risk and Natural Disasters in Emerging MarketsDocument17 pagesSovereign Risk and Natural Disasters in Emerging MarketsAgnes DizonNo ratings yet

- Economic Development and Natural Disasters A Satellite Data AnalysisDocument22 pagesEconomic Development and Natural Disasters A Satellite Data AnalysisAgnes DizonNo ratings yet

- Natural Disasters in Developing CountriesDocument37 pagesNatural Disasters in Developing CountriesAgnes DizonNo ratings yet

- 06 Budgeting Theory 40Document4 pages06 Budgeting Theory 40Agnes DizonNo ratings yet

- Natural DisastersDocument17 pagesNatural DisastersPaul BasaNo ratings yet

- Law On Oblicon Identification 2Document3 pagesLaw On Oblicon Identification 2Agnes DizonNo ratings yet

- Oblicon Multiple Choice 3Document2 pagesOblicon Multiple Choice 3Agnes DizonNo ratings yet

- 1/1 Autonomy of ContractsDocument1 page1/1 Autonomy of ContractsAgnes DizonNo ratings yet

- Pure Capitalism: Communism Mixed Economy SocialismDocument2 pagesPure Capitalism: Communism Mixed Economy SocialismAgnes DizonNo ratings yet

- 1/1 IntimidationDocument1 page1/1 IntimidationAgnes DizonNo ratings yet

- FalseDocument2 pagesFalseAgnes DizonNo ratings yet

- Which of The Following Is Not An Ordering Cost?Document2 pagesWhich of The Following Is Not An Ordering Cost?Agnes DizonNo ratings yet

- Relatively Elastic Supply Relatively Inelastic SupplyDocument3 pagesRelatively Elastic Supply Relatively Inelastic SupplyAgnes DizonNo ratings yet

- Heat, Light, and Power Commercial Expenses: Variable Factory OverheadDocument2 pagesHeat, Light, and Power Commercial Expenses: Variable Factory OverheadAgnes DizonNo ratings yet

- Oblicon Multiple Choice 1Document2 pagesOblicon Multiple Choice 1Agnes DizonNo ratings yet

- Costacc Quiz 3Document2 pagesCostacc Quiz 3Agnes DizonNo ratings yet

- Cost MCQ AnsDocument2 pagesCost MCQ AnsAgnes DizonNo ratings yet

- Oblicon Multiple Choice 2Document3 pagesOblicon Multiple Choice 2Agnes DizonNo ratings yet

- Costacc Quiz 1Document2 pagesCostacc Quiz 1Agnes DizonNo ratings yet

- Costacc Quiz 2Document2 pagesCostacc Quiz 2Agnes DizonNo ratings yet

- The Method For Allocating Service Department Costs That Requires The Least Clerical Work IsDocument2 pagesThe Method For Allocating Service Department Costs That Requires The Least Clerical Work IsAgnes DizonNo ratings yet

- 005-Method Statement For FencingDocument6 pages005-Method Statement For FencingEng AliNo ratings yet

- Glossaryof TermsDocument11 pagesGlossaryof Termsjan clyde codasNo ratings yet

- Quiz 2 AbcDocument15 pagesQuiz 2 AbcMa. Lou Erika BALITENo ratings yet

- New Delhi Institute of Management: PGDM 2020-22 Semester-III Paper 2 (Set-B)Document2 pagesNew Delhi Institute of Management: PGDM 2020-22 Semester-III Paper 2 (Set-B)bhushanNo ratings yet

- 1 Session - Overfiew of FSADocument45 pages1 Session - Overfiew of FSAAbhishek SwarnkarNo ratings yet

- RLB Profile Nov'19 PDFDocument16 pagesRLB Profile Nov'19 PDFGoli Boy dot comNo ratings yet

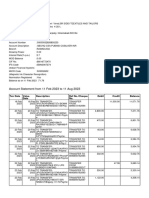

- Account Statement From 11 Feb 2023 To 11 Aug 2023Document8 pagesAccount Statement From 11 Feb 2023 To 11 Aug 2023vinodbommadeniNo ratings yet

- UNIT IV Material ManagementDocument3 pagesUNIT IV Material ManagementHIMANSHU DARGANNo ratings yet

- ALERT LIST (Asof 24october2023) - EnglishDocument14 pagesALERT LIST (Asof 24october2023) - EnglishLuqman MohammadNo ratings yet

- Instrument of Transfer SampleDocument1 pageInstrument of Transfer Samplehazel_tm0% (1)

- Pemenang Lomba Karya Ilmiah Stabilitas Sistem Keuangan 2021Document2 pagesPemenang Lomba Karya Ilmiah Stabilitas Sistem Keuangan 2021Rezha Nursina YuniNo ratings yet

- "A Study On The Financial Performance of Hindustan Unilever Limited"Document60 pages"A Study On The Financial Performance of Hindustan Unilever Limited"career pathNo ratings yet

- FILE - 20211108 - 150658 - Unit 4 - Supplementary ExercisesDocument4 pagesFILE - 20211108 - 150658 - Unit 4 - Supplementary ExercisesNguyen T. Tú AnhNo ratings yet

- Lesson 05 - Fiscal Policy and StabilizationDocument48 pagesLesson 05 - Fiscal Policy and StabilizationMetoo ChyNo ratings yet

- 2021 OctDocument64 pages2021 OctAhm Ferdous100% (1)

- Supplier Business Plan 1Document10 pagesSupplier Business Plan 1Bipana SapkotaNo ratings yet

- 500 WordsDocument2 pages500 WordsKristyl Ivy PingolNo ratings yet

- Characteristics of Competitive Markets The Mode... - Chegg - ComhhDocument3 pagesCharacteristics of Competitive Markets The Mode... - Chegg - ComhhBLESSEDNo ratings yet

- Asian RegionalismDocument18 pagesAsian RegionalismJewdaly Lagasca Costales60% (10)

- Tarc Acc t4Document2 pagesTarc Acc t4Shirley VunNo ratings yet

- Cbse Ix-X Social Science 2022-23 PisDocument52 pagesCbse Ix-X Social Science 2022-23 PisAditi JaniNo ratings yet

- Road Maintenance in Nepal - Most Neglected Aspect - The Himalayan TimesDocument3 pagesRoad Maintenance in Nepal - Most Neglected Aspect - The Himalayan TimesShambhu SahNo ratings yet

- 56148917999019339Document2 pages56148917999019339gajendraNo ratings yet

- Plastic Storage ContainerDocument1 pagePlastic Storage ContainerSanjhanaNo ratings yet

- International Trade Barriers: By: Sugandh MittalDocument7 pagesInternational Trade Barriers: By: Sugandh MittalnoorNo ratings yet

- Chap 4 Managing in The Global ArenaDocument13 pagesChap 4 Managing in The Global Arenaamer DanounNo ratings yet

- Lecture 1-3Document3 pagesLecture 1-3Riot SkinNo ratings yet

- Project 4Document16 pagesProject 4Jai GauravNo ratings yet

- WazirX Competitive LandscapeDocument7 pagesWazirX Competitive Landscapevenkatesh.iyer1989No ratings yet

- Collection Disbursement ReportDocument6 pagesCollection Disbursement Reportmkmohit991No ratings yet

- Stonewalled: My Fight for Truth Against the Forces of Obstruction, Intimidation, and Harassment in Obama's WashingtonFrom EverandStonewalled: My Fight for Truth Against the Forces of Obstruction, Intimidation, and Harassment in Obama's WashingtonRating: 4.5 out of 5 stars4.5/5 (21)

- The Courage to Be Free: Florida's Blueprint for America's RevivalFrom EverandThe Courage to Be Free: Florida's Blueprint for America's RevivalNo ratings yet

- The Smear: How Shady Political Operatives and Fake News Control What You See, What You Think, and How You VoteFrom EverandThe Smear: How Shady Political Operatives and Fake News Control What You See, What You Think, and How You VoteRating: 4.5 out of 5 stars4.5/5 (16)

- The Russia Hoax: The Illicit Scheme to Clear Hillary Clinton and Frame Donald TrumpFrom EverandThe Russia Hoax: The Illicit Scheme to Clear Hillary Clinton and Frame Donald TrumpRating: 4.5 out of 5 stars4.5/5 (11)

- Thomas Jefferson: Author of AmericaFrom EverandThomas Jefferson: Author of AmericaRating: 4 out of 5 stars4/5 (107)

- Modern Warriors: Real Stories from Real HeroesFrom EverandModern Warriors: Real Stories from Real HeroesRating: 3.5 out of 5 stars3.5/5 (3)

- Commander In Chief: FDR's Battle with Churchill, 1943From EverandCommander In Chief: FDR's Battle with Churchill, 1943Rating: 4 out of 5 stars4/5 (16)

- Nine Black Robes: Inside the Supreme Court's Drive to the Right and Its Historic ConsequencesFrom EverandNine Black Robes: Inside the Supreme Court's Drive to the Right and Its Historic ConsequencesNo ratings yet

- Crimes and Cover-ups in American Politics: 1776-1963From EverandCrimes and Cover-ups in American Politics: 1776-1963Rating: 4.5 out of 5 stars4.5/5 (26)

- Game Change: Obama and the Clintons, McCain and Palin, and the Race of a LifetimeFrom EverandGame Change: Obama and the Clintons, McCain and Palin, and the Race of a LifetimeRating: 4 out of 5 stars4/5 (572)

- The Shadow War: Inside Russia's and China's Secret Operations to Defeat AmericaFrom EverandThe Shadow War: Inside Russia's and China's Secret Operations to Defeat AmericaRating: 4.5 out of 5 stars4.5/5 (12)

- The Great Gasbag: An A–Z Study Guide to Surviving Trump WorldFrom EverandThe Great Gasbag: An A–Z Study Guide to Surviving Trump WorldRating: 3.5 out of 5 stars3.5/5 (9)

- The Quiet Man: The Indispensable Presidency of George H.W. BushFrom EverandThe Quiet Man: The Indispensable Presidency of George H.W. BushRating: 4 out of 5 stars4/5 (1)

- An Ordinary Man: The Surprising Life and Historic Presidency of Gerald R. FordFrom EverandAn Ordinary Man: The Surprising Life and Historic Presidency of Gerald R. FordRating: 4 out of 5 stars4/5 (5)

- Power Grab: The Liberal Scheme to Undermine Trump, the GOP, and Our RepublicFrom EverandPower Grab: The Liberal Scheme to Undermine Trump, the GOP, and Our RepublicNo ratings yet

- Witch Hunt: The Story of the Greatest Mass Delusion in American Political HistoryFrom EverandWitch Hunt: The Story of the Greatest Mass Delusion in American Political HistoryRating: 4 out of 5 stars4/5 (6)

- The Red and the Blue: The 1990s and the Birth of Political TribalismFrom EverandThe Red and the Blue: The 1990s and the Birth of Political TribalismRating: 4 out of 5 stars4/5 (29)

- We've Got Issues: How You Can Stand Strong for America's Soul and SanityFrom EverandWe've Got Issues: How You Can Stand Strong for America's Soul and SanityNo ratings yet

- Socialism 101: From the Bolsheviks and Karl Marx to Universal Healthcare and the Democratic Socialists, Everything You Need to Know about SocialismFrom EverandSocialism 101: From the Bolsheviks and Karl Marx to Universal Healthcare and the Democratic Socialists, Everything You Need to Know about SocialismRating: 4.5 out of 5 stars4.5/5 (42)

- The Deep State: How an Army of Bureaucrats Protected Barack Obama and Is Working to Destroy the Trump AgendaFrom EverandThe Deep State: How an Army of Bureaucrats Protected Barack Obama and Is Working to Destroy the Trump AgendaRating: 4.5 out of 5 stars4.5/5 (4)

- The Magnificent Medills: The McCormick-Patterson Dynasty: America's Royal Family of Journalism During a Century of Turbulent SplendorFrom EverandThe Magnificent Medills: The McCormick-Patterson Dynasty: America's Royal Family of Journalism During a Century of Turbulent SplendorNo ratings yet

- Confidence Men: Wall Street, Washington, and the Education of a PresidentFrom EverandConfidence Men: Wall Street, Washington, and the Education of a PresidentRating: 3.5 out of 5 stars3.5/5 (52)

- Hatemonger: Stephen Miller, Donald Trump, and the White Nationalist AgendaFrom EverandHatemonger: Stephen Miller, Donald Trump, and the White Nationalist AgendaRating: 4 out of 5 stars4/5 (5)

- Camelot's Court: Inside the Kennedy White HouseFrom EverandCamelot's Court: Inside the Kennedy White HouseRating: 4 out of 5 stars4/5 (17)

- A Short History of the United States: From the Arrival of Native American Tribes to the Obama PresidencyFrom EverandA Short History of the United States: From the Arrival of Native American Tribes to the Obama PresidencyRating: 3.5 out of 5 stars3.5/5 (19)

- Reading the Constitution: Why I Chose Pragmatism, not TextualismFrom EverandReading the Constitution: Why I Chose Pragmatism, not TextualismNo ratings yet

- The Science of Liberty: Democracy, Reason, and the Laws of NatureFrom EverandThe Science of Liberty: Democracy, Reason, and the Laws of NatureNo ratings yet

- The Last Republicans: Inside the Extraordinary Relationship Between George H.W. Bush and George W. BushFrom EverandThe Last Republicans: Inside the Extraordinary Relationship Between George H.W. Bush and George W. BushRating: 4 out of 5 stars4/5 (6)