Professional Documents

Culture Documents

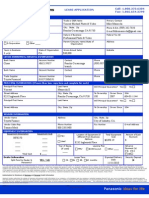

FINE PRINT - Pay Stub

Uploaded by

Jofred Collazo CarrilloOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FINE PRINT - Pay Stub

Uploaded by

Jofred Collazo CarrilloCopyright:

Available Formats

NGPF Activity Bank

Career

Virtual Adaptation Ideas

FINE PRINT: Pay Stub

Teacher Tip: If you prefer to administer this activity using a Google Form, please see the

answer key for the Google form link. You can find this on the Unit Page this resource is in.

In this activity, you will explore a pay stub in more detail to understand its various components.

Then, you will answer questions using the sample pay stub below.

Part I: Read The Fine Print

Analyze this sample pay stub and answer the questions that follow.

1. About how frequently does Hope receive a paycheck?

a. Daily

b. Weekly

c. Every two weeks

d. Monthly

2. Assuming that Hope receives a paycheck at regular intervals similar to the stub shown, how

many pay periods has Hope had year-to-date (YTD)?

a. 2

b. 3

c. 8

d. 9

www.ngpf.org Last updated: 3/3/21

1

3. Which statement below accurately describes Hope’s gross wages?

a. Gross wages are calculated by multiplying Hope’s hourly rate by the number of hours

she worked

b. Gross wages are Hope’s fixed salary, which she receives for every pay period

c. Gross wages are calculated by subtracting all of Hope’s deductions from her gross

income

d. Gross wages are how much Hope has earned over the course of the entire year

4. What was the largest deduction for this pay period?

a. FICA Medicare Tax

b. FICA Social Security Tax

c. Federal Tax

d. NC State Tax

5. Look at the lines that say HEALTH, DENTAL, and RETIREMENT. Which statement below is

accurate?

a. Those lines represent taxes that Hope paid to the Federal government

b. Those lines represent taxes that Hope paid to the state government

c. Those lines represent benefits that the employer is paying to Hope in addition to her

wages

d. Those lines represent insurance and retirement plans that Hope funds directly from

her paycheck

6. Hope's contribution to her RETIREMENT plan...

a. is a post-tax contribution on which she pays federal income taxes

b. is pre-tax and therefore not included in federal income taxes

c. Is a contribution to her Social Security

d. is taxed at a rate of 15%

7. What was the TOTAL amount deducted from Hope's latest paycheck?

a. $90.00

b. $284.79

c. $315.21

d. $600.00

8. One of Hope’s coworkers quits, and during the next pay period Hope works 60 hours

instead of 40 to help cover the shifts. Which of Hope’s deductions will definitely change as a

result?

a. Her Federal tax

b. Her health

c. Her dental

d. Her retirement

www.ngpf.org Last updated: 3/3/21

2

9. Which of the following statements is TRUE?

a. Hope has had more deductions this year than take home pay

b. Hope has had more take home pay this year than deductions

c. Hope has had equal amounts of take home pay and deductions this year

d. Hope’s paystub only shows deductions and take home pay for this pay period, not

the entire year to date

10. Hope's employer deposits her paycheck directly into her checking account. How much

would her employer have deposited into Hope's checking account on the most recent

payday of 5/21/20?

a. $40.00

b. $284.79

c. $315.21

d. $600.00

Part II: What Did You Learn?

Use what you learned from analyzing the pay stub to answer this question.

11. What important information is available on a pay stub?

how your total earnings were distributed.

www.ngpf.org Last updated: 3/3/21

3

You might also like

- BoA - Deposit Form 05731Document2 pagesBoA - Deposit Form 05731Coy IngramNo ratings yet

- Broadcast ApplicationDocument1 pageBroadcast Applicationmikeinverizon84No ratings yet

- Form 941 Tax Filing GuideDocument4 pagesForm 941 Tax Filing GuidegopaljiiNo ratings yet

- Maur I E J Murray: Application For Survivors' and Dependents' Educational AssistanceDocument7 pagesMaur I E J Murray: Application For Survivors' and Dependents' Educational AssistancecherrlynnNo ratings yet

- Direct Deposit FormDocument1 pageDirect Deposit Formmichaelmonique010No ratings yet

- AZ Argan Ventures LTDDocument20 pagesAZ Argan Ventures LTDBarangaySanLuisNo ratings yet

- DME ACH Processing in SAP - ExcelDocument3 pagesDME ACH Processing in SAP - ExcelNaveen KumarNo ratings yet

- Answer Key 4th GradeDocument8 pagesAnswer Key 4th GradeHali BeelerNo ratings yet

- TSYS Bank Request Change Document-101Document1 pageTSYS Bank Request Change Document-101Keller Brown JnrNo ratings yet

- Supermarket CodeDocument22 pagesSupermarket CodehassenNo ratings yet

- Cibc Bank Usa Smart Account Agreements and DisclosuresDocument29 pagesCibc Bank Usa Smart Account Agreements and Disclosureshino hinxNo ratings yet

- Resume 28 09 2022 12 58 30 PMDocument1 pageResume 28 09 2022 12 58 30 PMChris GillilandNo ratings yet

- BBBY - 2022 Store Closing List - Jan 30 23Document2 pagesBBBY - 2022 Store Closing List - Jan 30 23Lydia TaylorNo ratings yet

- AirlineReservationSystem - HCI Assignment - Lim Choon Onn - Lai Mei Ting - Leong Xiao Hui - Joanne Ong Yong enDocument8 pagesAirlineReservationSystem - HCI Assignment - Lim Choon Onn - Lai Mei Ting - Leong Xiao Hui - Joanne Ong Yong enCHOON ONN LIMNo ratings yet

- SUMAN BISWAS (4718 XXXX XXXX 4053) : Snapshot Accounts Payments Services Investments Forex Apply NowDocument2 pagesSUMAN BISWAS (4718 XXXX XXXX 4053) : Snapshot Accounts Payments Services Investments Forex Apply NowSayanta Biswas100% (1)

- Carlile Da 4187 Transfer Request TemplateDocument1 pageCarlile Da 4187 Transfer Request Templateapi-242596953No ratings yet

- 2008 Mark and Stephanie Madoff Foundation 990Document60 pages2008 Mark and Stephanie Madoff Foundation 990jpeppardNo ratings yet

- Ymrtc LogDocument62 pagesYmrtc LogOctavi Ikat100% (3)

- Invoice Number: 78111681212Document2 pagesInvoice Number: 78111681212João Victor de OliveiraNo ratings yet

- Savannah Henderson February StatementDocument6 pagesSavannah Henderson February Statementraheemtimo1No ratings yet

- Bank InfoDocument1 pageBank InfoBarnes David100% (2)

- Wire Transfer Instructions Amero AuctionsDocument2 pagesWire Transfer Instructions Amero AuctionsPetros JosephidesNo ratings yet

- HPK3PZDocument7 pagesHPK3PZDiane LeeNo ratings yet

- TD Business Premier Checking: Account # 435-4366572Document1 pageTD Business Premier Checking: Account # 435-4366572Abdelali ArabNo ratings yet

- Methods of Payment - AIU PDFDocument2 pagesMethods of Payment - AIU PDFMasiko MosesNo ratings yet

- Oakland Domain Awareness Center - Invoice Binder Scan 11-06-13 (May 2013) 76pgsDocument76 pagesOakland Domain Awareness Center - Invoice Binder Scan 11-06-13 (May 2013) 76pgsoccupyoaklandNo ratings yet

- April 14 2021 TUIDocument4 pagesApril 14 2021 TUIJimario SullivanNo ratings yet

- Bridgette Matthews Pay StubDocument1 pageBridgette Matthews Pay StubChris GillilandNo ratings yet

- Reno, Nevada - Paycheck Protection Program (PPP) Loans PDFDocument12 pagesReno, Nevada - Paycheck Protection Program (PPP) Loans PDFRenoFraud.orgNo ratings yet

- Please Docusign Admissions Form W Attachment-2Document6 pagesPlease Docusign Admissions Form W Attachment-2Maricela RivasNo ratings yet

- Direct Deposit FormDocument2 pagesDirect Deposit FormCamiloNo ratings yet

- Citibank ElenaDocument8 pagesCitibank ElenaAndre BarrazaNo ratings yet

- Security Bank Online PDFDocument1 pageSecurity Bank Online PDFJesebelle Cuya ToraldeNo ratings yet

- Ez Payment 2 UDocument12 pagesEz Payment 2 USophy Sufian SulaimanNo ratings yet

- Complete Merchant Application DocumentsDocument1 pageComplete Merchant Application DocumentsHeaven HawkinsNo ratings yet

- Bayshore Properties, Inc Lambros Riverwoods Complex 2018 Val Obj PDFDocument1 pageBayshore Properties, Inc Lambros Riverwoods Complex 2018 Val Obj PDFLinda FreibergerNo ratings yet

- 73e8ab49-e63b-48d0-9dc5-2459547fe32aDocument1 page73e8ab49-e63b-48d0-9dc5-2459547fe32arexhvelajdiamantNo ratings yet

- Colombian Student Visa Application for US StudyDocument3 pagesColombian Student Visa Application for US StudyJose Antonio Valero AtuestaNo ratings yet

- Direct Deposit InfoDocument1 pageDirect Deposit Infojeffreygiovanni3No ratings yet

- Adobe Scan 16-Dec-2022Document8 pagesAdobe Scan 16-Dec-2022PRADEEP PHOTOGRAPHY AND JOB NOTIFICATIONNo ratings yet

- Visa StatementsDocument1 pageVisa Statementsdchristensen5No ratings yet

- Bank SynopsisDocument2 pagesBank SynopsisShreya AgrawalNo ratings yet

- Updated Personal Guarantor FormDocument1 pageUpdated Personal Guarantor FormAaron ThompsonNo ratings yet

- Ach FormDocument1 pageAch FormHimanshu Motiyani100% (1)

- Redacted NSF ChecksDocument2 pagesRedacted NSF ChecksDarren Adam HeitnerNo ratings yet

- CVV Fullz InfoDocument1 pageCVV Fullz InfoChester MorrisonNo ratings yet

- Wire Transfer Quick Reference Guide For CustomersDocument2 pagesWire Transfer Quick Reference Guide For Customersash_iitrNo ratings yet

- Dec 11Document4 pagesDec 11Ileana D cruzNo ratings yet

- RTMF 990Document49 pagesRTMF 990Craig MaugerNo ratings yet

- GFL Credit Application 25012023 - SignedDocument1 pageGFL Credit Application 25012023 - SignedBell-Winn-Cal- Victoria-londonNo ratings yet

- Direct DepositDocument1 pageDirect DepositMike BelmoreNo ratings yet

- AsdfghjklDocument2 pagesAsdfghjklAdventurous FreakNo ratings yet

- Device: Red AlertDocument2 pagesDevice: Red Alertsonaiya software solutionsNo ratings yet

- Pushvisions IncDocument6 pagesPushvisions Inc76xzv4kk5vNo ratings yet

- Customers 20230406175033708274Document2 pagesCustomers 20230406175033708274Ardi TamaNo ratings yet

- 1 May 2020 To 23 May 2020: Account Statement ForDocument1 page1 May 2020 To 23 May 2020: Account Statement ForSuvam MohapatraNo ratings yet

- TX IRS Revocations 6.9Document716 pagesTX IRS Revocations 6.9jcdwyerNo ratings yet

- Review of Some SMS Verification Services and Virtual Debit/Credit Cards Services for Online Accounts VerificationsFrom EverandReview of Some SMS Verification Services and Virtual Debit/Credit Cards Services for Online Accounts VerificationsNo ratings yet

- Methods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeFrom EverandMethods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeNo ratings yet

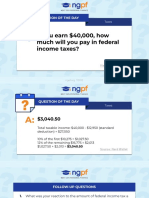

- Taxes QoD - If You Make $40,000, How Much Will You Pay in Federal Income TaxesDocument3 pagesTaxes QoD - If You Make $40,000, How Much Will You Pay in Federal Income TaxesJofred Collazo CarrilloNo ratings yet

- Down SyndromeDocument1 pageDown SyndromeJofred Collazo CarrilloNo ratings yet

- INTERACTIVE - Compounding Cat InsanityDocument3 pagesINTERACTIVE - Compounding Cat InsanityJofred Collazo CarrilloNo ratings yet

- READ - Bankrupt at 23Document2 pagesREAD - Bankrupt at 23Jofred Collazo CarrilloNo ratings yet

- DEBATE - Should College Students Have Credit CardsDocument6 pagesDEBATE - Should College Students Have Credit CardsJofred Collazo CarrilloNo ratings yet

- Low Noise Pseudomorphic HEMT Technical DataDocument4 pagesLow Noise Pseudomorphic HEMT Technical Datahendpraz88No ratings yet

- Predicting Natural Hazards PowerPointDocument29 pagesPredicting Natural Hazards PowerPointZarlene SierraNo ratings yet

- 08 Ch-8 PDFDocument6 pages08 Ch-8 PDFMANJEET SINGHNo ratings yet

- Grade 5. Unit 15Document6 pagesGrade 5. Unit 15Đình ThuậnNo ratings yet

- Jurnal Dermatitis AtopikDocument20 pagesJurnal Dermatitis AtopikchintyaNo ratings yet

- Work Immersion PortfolioDocument15 pagesWork Immersion PortfolioKaye Irish RosauroNo ratings yet

- Recommended Abma & Asme Boiler Water Limits Drum Operating Pressure (Psig) SteamDocument9 pagesRecommended Abma & Asme Boiler Water Limits Drum Operating Pressure (Psig) Steammaoc4vnNo ratings yet

- Volcanic Eruption Types and ProcessDocument18 pagesVolcanic Eruption Types and ProcessRosemarie Joy TanioNo ratings yet

- Boiler Feedwater ControlDocument14 pagesBoiler Feedwater ControlJonas PeraterNo ratings yet

- Basic Science JSS 1 2NDDocument29 pagesBasic Science JSS 1 2NDAdeoye Olufunke100% (2)

- Cast Resin Planning Guidelines GEAFOL PDFDocument24 pagesCast Resin Planning Guidelines GEAFOL PDFtenk_man100% (1)

- Community-Based Forest ManagementDocument7 pagesCommunity-Based Forest ManagementZiazel ThereseNo ratings yet

- Sampling Methods for Terrestrial Amphibians and ReptilesDocument39 pagesSampling Methods for Terrestrial Amphibians and ReptilesBenzu Shawn100% (1)

- Drug study on TegretolDocument2 pagesDrug study on TegretolSophia Kaye AguinaldoNo ratings yet

- Rear Derailleur: Important Notice Names of PartsDocument1 pageRear Derailleur: Important Notice Names of PartsRyan MulyanaNo ratings yet

- Concrete Pump Hose TDSDocument2 pagesConcrete Pump Hose TDSAlaa Abu KhurjNo ratings yet

- Handling Silica in Cooling WaterDocument17 pagesHandling Silica in Cooling WaterLekhamani YadavNo ratings yet

- Wrap Book A4Document27 pagesWrap Book A4doscribe100% (1)

- 3 - 2017 - Superia X 5 StarDocument26 pages3 - 2017 - Superia X 5 Starsomnath serviceNo ratings yet

- 1619928348861forensic Science UNIT - VII 1 PDFDocument159 pages1619928348861forensic Science UNIT - VII 1 PDFVyshnav RNo ratings yet

- 4 ReactorsDocument58 pages4 ReactorsKiran ShresthaNo ratings yet

- WP Stratasys TopFiveReasonsDocument7 pagesWP Stratasys TopFiveReasonscititorulturmentatNo ratings yet

- TS68Document52 pagesTS68finandariefNo ratings yet

- NSEA Solved Paper 2015Document30 pagesNSEA Solved Paper 2015vv12345670% (1)

- Proper Care and Use of Personal Dosimeters: HandlingDocument1 pageProper Care and Use of Personal Dosimeters: HandlingAshley JacksonNo ratings yet

- D1553.140U1 German Braun Speed - Braun Card-Xi'an Yuanhua Instrument Co., LTDDocument2 pagesD1553.140U1 German Braun Speed - Braun Card-Xi'an Yuanhua Instrument Co., LTDTrong Hung NguyenNo ratings yet

- Wartsila Tribo PackDocument7 pagesWartsila Tribo Packsuper_seeker100% (1)

- STD Comparison ChartDocument4 pagesSTD Comparison Chartabu ubaidahNo ratings yet

- Name: Sport: Movement PrepDocument24 pagesName: Sport: Movement PrepS HNo ratings yet

- Ventilation System Comparison - Constant Air Volume (CAV) and Variable Air Volume (VAV)Document15 pagesVentilation System Comparison - Constant Air Volume (CAV) and Variable Air Volume (VAV)ankurNo ratings yet