Professional Documents

Culture Documents

Customs Case Laws

Customs Case Laws

Uploaded by

srinivas nallakunta0 ratings0% found this document useful (0 votes)

15 views2 pages1) The key case laws discussed relate to determining the date of importation and taxable event for customs duty purposes.

2) Some rulings specify that the taxable event occurs when the goods cross customs barriers and the bill of entry for home consumption is filed, rather than the date of contract.

3) Exemptions cannot be denied due to non-compliance with conditions outside an importer's control, such as a government department not issuing a certificate on time.

Original Description:

Original Title

Customs case laws

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1) The key case laws discussed relate to determining the date of importation and taxable event for customs duty purposes.

2) Some rulings specify that the taxable event occurs when the goods cross customs barriers and the bill of entry for home consumption is filed, rather than the date of contract.

3) Exemptions cannot be denied due to non-compliance with conditions outside an importer's control, such as a government department not issuing a certificate on time.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

15 views2 pagesCustoms Case Laws

Customs Case Laws

Uploaded by

srinivas nallakunta1) The key case laws discussed relate to determining the date of importation and taxable event for customs duty purposes.

2) Some rulings specify that the taxable event occurs when the goods cross customs barriers and the bill of entry for home consumption is filed, rather than the date of contract.

3) Exemptions cannot be denied due to non-compliance with conditions outside an importer's control, such as a government department not issuing a certificate on time.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

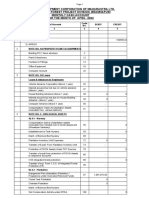

Customs Important Case Laws

Garden Silk Mills When goods cleared for home consumption

import commenses when goods cross the but completes

when goods teach customs barriers and BOE for home

consumption is filed Taxable event

Kiran Hills In case goods cleared for

spinning of

warehousing taxable event ours when BOE for

home consumption ex bond is filed

Aban Lloyd Chilies Offshore ltd Goods

imported on

oil situated on EEZ which is deemed to be

rigs

part of India attracts import duty

Petrochemicals Ctd is levied

Mangalore Refinery Duty

on actual crude oil received and

quantity of

not on shown in Bill

quantity of lading

Bharat Surfacants Put Ad The rate and

of duty

valuation would be done on the date

tariff of

the

final entry of ship

Rajkumar knitting Mills Put Ctd Date importation is

and

of

relevant not the date contract

of

Sun Industries vessel crossed TWI and then returned

due to damages Treated Export as Twa crossed

Rajindra Dyeing and Printing Mills Ctd If vessel

left

from port but sank in TWI Not export

Associated cement Companies Ctd Drawings designs

manuals technical materials imported are also goods

liable to custom

duty

Tirupati Udyog Ltd Supply from DTA to SEZ will

not attract export Duty

any

Manic Era Textile Ad There was no restrictive clause

in the notification and hence there is no violation

Manic Era Textile with respect to surplus electricity

by

sold in Dea

after using it for specified purpose

BPL Display Devices Ltd cannot

Benefit of notifications

be denied in which intended

respect of goods are

for use

of manufacture of final product

but could

not be used due to shortage leakage

Tullow India Operations ltd claim

Imposter's for

exemption cannot be rejected

owing to non compliance

a condition not within his power control

of

Gout Dept did not issue certificate on time

not in importer's hands

CA Riddhi

Baghmar

You might also like

- Report - No - 9 - of - 2017 - On - Compliance - Audit - Observations - Union - Government PDFDocument262 pagesReport - No - 9 - of - 2017 - On - Compliance - Audit - Observations - Union - Government PDFravindrarao_mNo ratings yet

- Bartleby The ScrivenerDocument58 pagesBartleby The ScrivenerMrEvidenceLove100% (1)

- Plaintiff's Responsive Brief in Opposition To Defendant's Motion For Summary JudgmentDocument23 pagesPlaintiff's Responsive Brief in Opposition To Defendant's Motion For Summary JudgmentDylanGoldman100% (1)

- D85 Presentation Template1Document8 pagesD85 Presentation Template1shweta bambuwalaNo ratings yet

- 6208734-I-Rfq-001 PLC RFQ R1Document26 pages6208734-I-Rfq-001 PLC RFQ R1KarthikeyanNo ratings yet

- Mergers & Acquisitions: The Ultimate Guide OnDocument23 pagesMergers & Acquisitions: The Ultimate Guide Onsrinivas nallakunta100% (2)

- 0 Method Statement-Trench Cutter FinalDocument36 pages0 Method Statement-Trench Cutter FinalGobinath GovindarajNo ratings yet

- Grade 6 Performance Task Mapeh Fourth Quarter: - : - Teacher: Jasmin M. Nietes MUSIC: Performance Task 1Document4 pagesGrade 6 Performance Task Mapeh Fourth Quarter: - : - Teacher: Jasmin M. Nietes MUSIC: Performance Task 1Jas Mine100% (2)

- MTF 380KV Hyn SS 004 PDFDocument22 pagesMTF 380KV Hyn SS 004 PDFMohamed ZokmatNo ratings yet

- Vat InvoiceDocument2 pagesVat Invoiceإدريس البحريNo ratings yet

- OCP - AKPPL Bitumen Rev.ADocument252 pagesOCP - AKPPL Bitumen Rev.ASumantrra Chattopadhyay100% (1)

- Queer Theory: A Rough Introduction: DifferencesDocument3 pagesQueer Theory: A Rough Introduction: DifferencesmikiNo ratings yet

- Deed of Transfer of RightsDocument1 pageDeed of Transfer of RightsLeonard Bryan AlejandroNo ratings yet

- Trade Union 2Document9 pagesTrade Union 2asif OahidNo ratings yet

- Union Compliance Report 21 2015 Volume 2 PDFDocument135 pagesUnion Compliance Report 21 2015 Volume 2 PDFpr_abhatNo ratings yet

- Till 23.08.2023. TATA HITACHIDocument20 pagesTill 23.08.2023. TATA HITACHIRaj Kumar LodhaNo ratings yet

- DR 03-02-2019Document26 pagesDR 03-02-2019Yousab JacobNo ratings yet

- Financial Management Project Group 7Document8 pagesFinancial Management Project Group 7Vivek RanaNo ratings yet

- Boe No.2003648Document2 pagesBoe No.2003648pareshdheda41No ratings yet

- The Sym Times: Construction of International Airport in Viman Nagar Approved. 11% Returns On Fixed Deposit A/c.: SBIDocument5 pagesThe Sym Times: Construction of International Airport in Viman Nagar Approved. 11% Returns On Fixed Deposit A/c.: SBILokesh AhujaNo ratings yet

- DR 04-02-2019Document26 pagesDR 04-02-2019Yousab JacobNo ratings yet

- PWC News Alert 5 December 2013 KBD Sugars and Distilleries LTDDocument4 pagesPWC News Alert 5 December 2013 KBD Sugars and Distilleries LTDCcapealNo ratings yet

- DR 02-02-2019Document26 pagesDR 02-02-2019Yousab JacobNo ratings yet

- Electric AarDocument14 pagesElectric AarrajanbardiaNo ratings yet

- IIB Loss Cost Rates-New Rates 01 Dec 19Document4 pagesIIB Loss Cost Rates-New Rates 01 Dec 19akshay.gupta993207No ratings yet

- DIPKA20220125065554660Document3 pagesDIPKA20220125065554660Aditya Kumar KaushikNo ratings yet

- Servicing Office:: Iffco - Tokio General Insurance Co. LTDDocument1 pageServicing Office:: Iffco - Tokio General Insurance Co. LTDsahu.aashish03No ratings yet

- Taxation of Cross Border Mergers and Acquisitions: D. Satya Siva Darshan, Iv LL.B, Ils Law College, PuneDocument23 pagesTaxation of Cross Border Mergers and Acquisitions: D. Satya Siva Darshan, Iv LL.B, Ils Law College, PuneD.Satya Siva DarshanNo ratings yet

- Business Line Chennai 18.11.2019Document16 pagesBusiness Line Chennai 18.11.2019Kalai ArasiNo ratings yet

- Screenshot 2023-06-01 at 12.15.32 AMDocument25 pagesScreenshot 2023-06-01 at 12.15.32 AMsachin GourNo ratings yet

- Chapter 6 - Profits and Gains From Business or Profession - NotesDocument66 pagesChapter 6 - Profits and Gains From Business or Profession - NotesMuskan Jha100% (1)

- Arnav Bawa - 04 - IBLDocument40 pagesArnav Bawa - 04 - IBLAshu SinghNo ratings yet

- August 2021 - Shipping Corporation of India LTD by Corporate ProfessionalsDocument10 pagesAugust 2021 - Shipping Corporation of India LTD by Corporate ProfessionalsBhavin SagarNo ratings yet

- DR 30-01-2019Document26 pagesDR 30-01-2019Yousab JacobNo ratings yet

- 4733 - 00646 Service CARGO CONTROL CONSOLE at Dry Dock 2022Document3 pages4733 - 00646 Service CARGO CONTROL CONSOLE at Dry Dock 2022engineeringyusufNo ratings yet

- LAB ASSIGNMENT - Case Study UploadDocument4 pagesLAB ASSIGNMENT - Case Study Uploadbruce wayneNo ratings yet

- Amendment No 56 To The SOP of RVNLDocument2 pagesAmendment No 56 To The SOP of RVNLRVNLPKG6B VBL-GTLM100% (1)

- 13 - Revised CCR EntryDocument21 pages13 - Revised CCR EntryJean Claude EidNo ratings yet

- IndexDocument1 pageIndexaman malhotraNo ratings yet

- Standalone Motor Own Damage Cover - Private Car: Certificate of Insurance Cum Policy ScheduleDocument4 pagesStandalone Motor Own Damage Cover - Private Car: Certificate of Insurance Cum Policy ScheduleRajiv FalodiyaNo ratings yet

- Unknown (1) HTTPS://WWW - Scribd.com/doc/67851365Document1 pageUnknown (1) HTTPS://WWW - Scribd.com/doc/67851365jay bheunathNo ratings yet

- DR 27-01-2019Document26 pagesDR 27-01-2019Yousab JacobNo ratings yet

- Motor Insurance - Two Wheeler Comprehensive PolicyDocument3 pagesMotor Insurance - Two Wheeler Comprehensive PolicyRishi MangalNo ratings yet

- Forest Development Corporation of Maharastra Ltd. Bramhapuri Forest Project Division, Bramhapuri Monthly Cash Account For The Month of April - 2022Document5 pagesForest Development Corporation of Maharastra Ltd. Bramhapuri Forest Project Division, Bramhapuri Monthly Cash Account For The Month of April - 2022Divisional Manager BramhapuriNo ratings yet

- Southeast Bank Limited: (LDO/TD) 100%: 112.43%Document7 pagesSoutheast Bank Limited: (LDO/TD) 100%: 112.43%MD Meftahul AlamNo ratings yet

- DR 07-02-2019Document26 pagesDR 07-02-2019Yousab JacobNo ratings yet

- Worksheet Ques of GST 1 QuesDocument9 pagesWorksheet Ques of GST 1 Queslipika goelNo ratings yet

- Certificate of Insurance Marine Inland PolicyDocument1 pageCertificate of Insurance Marine Inland PolicypriyankaNo ratings yet

- Insurance Pump ICICI Policy 240821 143402Document18 pagesInsurance Pump ICICI Policy 240821 143402expert2advisoryNo ratings yet

- Technical Note On Grout TrialsDocument18 pagesTechnical Note On Grout TrialsRitwik NandiNo ratings yet

- Private Car Package Policy: Certificate of Insurance Cum Policy ScheduleDocument2 pagesPrivate Car Package Policy: Certificate of Insurance Cum Policy Scheduleam.ve93No ratings yet

- Till 23.08.2024 TATA HITACHIDocument18 pagesTill 23.08.2024 TATA HITACHIRaj Kumar LodhaNo ratings yet

- DR 29-01-2019Document26 pagesDR 29-01-2019Yousab JacobNo ratings yet

- Revised IIB Rates 1-12-2019Document4 pagesRevised IIB Rates 1-12-2019Sourav100% (1)

- Goods Delivery Note - DLV200008641Document1 pageGoods Delivery Note - DLV200008641benignusNo ratings yet

- Two Wheeler Standalone OD Only: Certificate of Insurance Cum Policy ScheduleDocument3 pagesTwo Wheeler Standalone OD Only: Certificate of Insurance Cum Policy Scheduleprasanth adabalaNo ratings yet

- Tinplate Company of IndiaDocument19 pagesTinplate Company of IndiaariefakbarNo ratings yet

- MTL Annual 2017Document180 pagesMTL Annual 2017Angel RockNo ratings yet

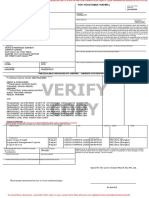

- Verify Copy: Particulars Furnished by Shipper - Carrier Not ResponsibleDocument2 pagesVerify Copy: Particulars Furnished by Shipper - Carrier Not ResponsibleThant ZinNo ratings yet

- Coretrax, P.O Box 7639, Dammam 34325, Kingdom of Saudi Arabia Phone +966 13 833 0919Document1 pageCoretrax, P.O Box 7639, Dammam 34325, Kingdom of Saudi Arabia Phone +966 13 833 0919Tahir Iqbal. Kharpa RehanNo ratings yet

- Taxcraft Advisors - Custom Bonded WarehouseDocument10 pagesTaxcraft Advisors - Custom Bonded Warehousevishal2205No ratings yet

- Happy Forgings Limited - IPO NotexbdjdjdjdjDocument9 pagesHappy Forgings Limited - IPO NotexbdjdjdjdjAnkit VyasNo ratings yet

- Bombay DyeingDocument17 pagesBombay Dyeingparas_bhatnagar89No ratings yet

- DR 28-01-2019Document26 pagesDR 28-01-2019Yousab JacobNo ratings yet

- IDT Saar CA Final CH 8 Input Tax Credit by CA Mahesh Gour Handwritten NotesDocument27 pagesIDT Saar CA Final CH 8 Input Tax Credit by CA Mahesh Gour Handwritten NotesRonita DuttaNo ratings yet

- Bajaj Allianz General Insurance Company Limited: 2 Page 1 ofDocument2 pagesBajaj Allianz General Insurance Company Limited: 2 Page 1 ofSeven StarNo ratings yet

- Investment Management: Assignment-1Document1 pageInvestment Management: Assignment-1srinivas nallakuntaNo ratings yet

- UntitledDocument1 pageUntitledsrinivas nallakuntaNo ratings yet

- DocScanner Dec 25, 2022 12-31 PMDocument10 pagesDocScanner Dec 25, 2022 12-31 PMsrinivas nallakuntaNo ratings yet

- Vijaya PG College: Assignment-IDocument2 pagesVijaya PG College: Assignment-Isrinivas nallakuntaNo ratings yet

- Project - Work - Synopsis (Iii - Sem-Sics) (1) Venkat MF 2023Document6 pagesProject - Work - Synopsis (Iii - Sem-Sics) (1) Venkat MF 2023srinivas nallakuntaNo ratings yet

- E-Business A-1 & A-2Document21 pagesE-Business A-1 & A-2srinivas nallakuntaNo ratings yet

- Letter of Intimation (Final) - STUDENT SECTIONDocument1 pageLetter of Intimation (Final) - STUDENT SECTIONsrinivas nallakuntaNo ratings yet

- TQM IMP Questions - MBA III Semester-OUDocument2 pagesTQM IMP Questions - MBA III Semester-OUsrinivas nallakuntaNo ratings yet

- Karthik ResumeDocument2 pagesKarthik Resumesrinivas nallakuntaNo ratings yet

- Nasdaq Tsla 2018 PDFDocument418 pagesNasdaq Tsla 2018 PDFsrinivas nallakuntaNo ratings yet

- Understanding Your Exam Result: © 2018 CFA Institute. All Rights ReservedDocument9 pagesUnderstanding Your Exam Result: © 2018 CFA Institute. All Rights Reservedsrinivas nallakuntaNo ratings yet

- FS Stock PDFDocument12 pagesFS Stock PDFsrinivas nallakuntaNo ratings yet

- Consent FormDocument2 pagesConsent FormCR RaghavNo ratings yet

- Danh Mục Tổng Hợp Sách Tiếng ViệtDocument373 pagesDanh Mục Tổng Hợp Sách Tiếng ViệtKhanh Trần VTNo ratings yet

- Instructions For AssignmentDocument7 pagesInstructions For AssignmentJawadNo ratings yet

- Business Development Director Job DescriptionDocument2 pagesBusiness Development Director Job DescriptionKeith ColeNo ratings yet

- Miracle in Cell No.7 Film Review: "7-Beon-Bang-Ui Seon-Mul"Document5 pagesMiracle in Cell No.7 Film Review: "7-Beon-Bang-Ui Seon-Mul"Bernadeth BaligodNo ratings yet

- Consumer Behavior Matin Khan - Models of CBDocument4 pagesConsumer Behavior Matin Khan - Models of CBAnkit DubeyNo ratings yet

- NSTP 1: Input 1: History of NSTPDocument5 pagesNSTP 1: Input 1: History of NSTPpehikNo ratings yet

- Complaint Against Barnevernet: The International Criminal Court in The HagueDocument3 pagesComplaint Against Barnevernet: The International Criminal Court in The Hagueтатьяна васильковаNo ratings yet

- Stakeholder Relationship ManagementDocument7 pagesStakeholder Relationship Managementchrisdi08No ratings yet

- 2016-436 IA Guidance Part 1 061418 - Draft Mitigation StrategiesDocument94 pages2016-436 IA Guidance Part 1 061418 - Draft Mitigation StrategiesRetno PalupiNo ratings yet

- Surecut ShearsDocument1 pageSurecut ShearsMilan BarcaNo ratings yet

- Sample Paper - 2011 Class - IX Subject - Social ScienceDocument5 pagesSample Paper - 2011 Class - IX Subject - Social SciencePaartha AggarwalNo ratings yet

- Econs Monetary Policy TableDocument11 pagesEcons Monetary Policy Tableregine sunNo ratings yet

- Syllabus IGTDocument5 pagesSyllabus IGTnishat.nssoNo ratings yet

- DirectionsDocument91 pagesDirectionsLaura MartinezNo ratings yet

- Pocahontas: by Le Thu GiangDocument20 pagesPocahontas: by Le Thu GiangGiang Le ThuNo ratings yet

- Prestige Peace - DEAR DIARY - SOCIAL ECONOMIC GOALSDocument2 pagesPrestige Peace - DEAR DIARY - SOCIAL ECONOMIC GOALSPrestige BallardNo ratings yet

- 4 0 Hadith On The Loss of ChildrenDocument134 pages4 0 Hadith On The Loss of ChildrenAli LarakiNo ratings yet

- Digital Library Infrastructure and ArchitectureDocument8 pagesDigital Library Infrastructure and ArchitecturerohitmahaliNo ratings yet

- Children's Literature - History, Literature in The Lives of Children, Environment, Awards - York, Books, Illustrated, and ReadingDocument13 pagesChildren's Literature - History, Literature in The Lives of Children, Environment, Awards - York, Books, Illustrated, and ReadingJoshua LagonoyNo ratings yet

- Dear Pooja and GroupDocument3 pagesDear Pooja and GroupVijay YadavNo ratings yet

- Net Question Paper 2Document12 pagesNet Question Paper 2DEBKANTA PATRANo ratings yet

- Asian Age - Delhi - 2019-05-02 PDFDocument16 pagesAsian Age - Delhi - 2019-05-02 PDFNguwruw Chungpha Moyon100% (1)

- Financial Inclusion Account Opening FormDocument1 pageFinancial Inclusion Account Opening FormNDTV100% (1)