Professional Documents

Culture Documents

AT Code of Ethics

Uploaded by

Princes0 ratings0% found this document useful (0 votes)

37 views10 pagesat code of ethics

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentat code of ethics

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

37 views10 pagesAT Code of Ethics

Uploaded by

Princesat code of ethics

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 10

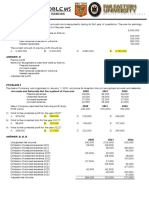

AT: Code of Ethics

feta

> Handbook of the International Code of Ethies for Professional Accountants (including International Independence

Standards) by the IFAC - 2021 ed.

> IAESBAE-Code

Set of moral principles, rules of conducts or values:

Effectivity Date (Latest): December 31, 2021 (2020 and 2021 ed.)

> Part 1 | Complying with the Code, Fundamental Principles and Conceptual Framework

Part2 _ | Professional Accountants in Business (PAIBs)

© Part3 _ [Professional Accountants in Public Practice (PAPPs)

> Part 4A_| independence for Audit and Review Engagements

> Part 4B [independence for Assurance Engagements other than Audit and Review Engagements

> Glossary

The need for a Code of Ethics

> Adistinguishing mark of the accountancy profession is its acceptance of responsibilty to the public.

> All recognized professions have developed codes of professional ethics.

> The profession's attempt to achieve a number of common interests and by its observance of certain fundamental

principles for that purpose.

Pace os

More User-Friendly Comprehensive Integrated Suite Significant Upgrades

» New design Increased focus on compliance wi | > Enhanced conceptual framework

>» Completely re-written fundamental principles > Clearer and more robust

» More accessible and > Includes NOCLAR and Long safeguards

digestible Associations provisions New section about “pressure”

» Easily understandable » Tied more tightly w/ Conceptual > Strengthened requirements when

> New user guide and glossary | Framework preparing or presenting information

> More prominent Professional > Inducements

Accountants in Business (PAIB) and

Independence provisions

Cerner tere

» Revisions to Part 4B of the Code to refiect terms and concepts used in the IAASB's International Standard on

Assurance Engagements (ISAE) 3000 (Revised).

Geo

Fundamental Principles Conceptual Framework International Independence

‘Standards

Standard of Behavior (COBID) [> Comply w/ fundamental principles | > For audit, reviews and other

+ Confidentiality > Identiy, evaluate and address assurance engagements

> Objectivity threats to compliance > Threats to independence

> Professional Behavior

> Integrity

> Professional Competence and

Due Care

Part 1: Complying with the Code, Fundamental Principles and Conceptual Framework

‘Compliance Breach of Independence Standards

Ref: Parts 4A and 4B of any other provisions of the Code

Code of Ethics vs. [Laws and Regulations [> Evaluate the significance and impact of the breach

Laws and Regulations | prevail > Take whatever actions might be available to address the

Conflicting ly stricter consequences

Reauivemantor2 | eeurctante > Determine whether to report the breach to relevant parties

countries

Fundamental Principles (COBID)

> Confidentiality | To respect the confidentiality of information acquired as a result of professional and

business relationships

Objectivity To exercise professional or business judgment without being compromised by:

* Bias * Individuals

* Conflict of interest = Organizations

Undue Influence of * Technology

+ Undue Reliance on + Other Factors

> Professional

To comply with relevant laws and regulations, behave in a manner consistent w/ the

Behavior profession's responsibly to act in the public interest in all professional activities and

business relationships and avoid any conduct that the professional accountant knows or

should know might discredit the profession.

> Integrity ‘To be straightforward and honest in all professional and business relationships

® Professional Professional | To attain and maintain professional knowledge and skill at the level

Competence and | Competence | required to ensure that a client or employing organization receives

Due Care competent professional service

Due Care | To act diligently and in accordance w/ applicable technical and professional

standards

Conceptual Framework

> Have an inquiring mind | » Consider the source, relevance, and sufficiency

formation obtained

> Be open and alert to a need for further investigation or action

> Exercise Professional | > Apply relevant training, knowledge and experience in making decisions

Judgment

> Consult experts or regulatory bodies when needed

> Use the reasonable

‘and | > Aperson (not necessarily an accountant) who weighs all the relevant facts and

informed third party test | circumstances that the accountant knows, or could reasonably be expected to

know, at the time that the conclusions are made

Identify Threats to

wi Fundamental

‘Address the threats by

Paneipiee Evaluate the threats identified eliminating or reducing them to

‘an acceptable level

LFASS

[Acceptable Level Eliminating he

> Intimidation

> Eamiliarity

» Advocacy

> Selt-Review

> Selt-interest

circumstances.

Applying Safeguards

Dectining or ending the

activity or engagement

‘Areasonable and informed third

party would conclude that the

accountant is compliant

Threats to compliance w/ the Fundamental Principles (|-FASS)

> Intimidation Threat

> The threat that a professional accountant will be deferred from acting objectively

because of actual or perceived pressures, including attempts to exercise undue

influence over the accountant

> Familiarity Threat

> The threat that due to long or close relationship with a clr

organization, a professional accountant will be too sympath«

or too accepting of their work

F employing

to their interests

> Advocacy Threat

> The threat that a professional accountant will promote a client's or employing

‘organization's position to the point that the accountants objectivity is,

‘compromised

> Self-Review Threat

> The threat that a professional accountant will not appropriately evaluate the results

of a previous judgment made; or an activity performed by the accountant, or by

another individual within the accountant's firm or employing organization, on

which the accountant will not rely when forming a judgment as part of performing a

current activity

> Self-interest Threat

> The threat that a financial or other interest will inappropriately influence a

professional accountant's judgment or behavior

‘Conceptual Framework — Additional Requirements for Assurance Engagements

> Independence > The state of mind that permits the expression of a

conclusion without being affected by influences that

compromise professional judgment, thereby allowing an

individual to act w/ integrity, and exercise objectivity and

professional skepticism

The avoidance of facts and circumstances that are so

significant that a reasonable or informed third party

would be likely to conclude that a firm’s or an audit or

assurance team member's integrity, objectivity or

professional skepticism has been compromised

> Independence of

mind

> Independence of

appearance

> Professional Skepticism | > An attitude that includes a questioning mind, being alert to conditions which

may indicate possible misstatement due to error or fraud, and a critical

assessment of audit evidence

Pine nee)

Main Fundamental

Sec. Circumstances Main Threatls Created Principles atected

210 | Conflict of interest Seltinterest Objectivity

Preparation and Presentation of

229 _| Preparation Selt-interest, Intimidation All

230 | Acting w/ Sufficient Expertise Selt-nterest rcteesioral Competence ane

Due Care

Financial Interests, compensation

zag | Financial ntere Set-nterest Objectivity, and Confidentiality

250 | nducements, including gifts and | Selt-interest, Familiy, Integrity, Objectivity,

hospitality Intimidation Professional Behavior

260 | Responding to NOCLAR Sel-Interest, Intimidation Se eee

Tae) (rescue to breach the Intimidation All

fundamental principles

210. Conflict of interest

> Professional Accountant undertakes a professional activity related to a particular matter for 2 or more parties

whose interests with respect to the matter are in conflict; or

> Interest of a Professional Accountant with respect to a particular matter and the interests of a party for whom the

accountant undertakes a professional activity related to the matter are in conflict

> Conflict identification

> Safeguards to threats created (restructuring, segregation of duties, oversight, etc.)

> Disclose the relevant parties affected

> Obtain consent from relevant parties

> Requirements

220. Preparation and Presentation of Information

> Preparation or presenting information includes recording, maintaining and approving information

* In accordance w/ AFRF (Applicable Financial Reporting Framework)

* Not misleading

* Use professional judgment

+ Not omit material information

> Use of discretion (accounting estimates, FV, etc.)

> Requirements | > Relying on work of others

> Addressing information that is, or might be misleading

230, Acting with Sufficient Expertise

> AProfessional Accountant shall not intentionally mislead an employing of organization as to level of expertise or

experience possessed,

> Only undertakes tasks that Professional Accountant is capable of

Requirements | » Safeguards (assistance or training, ensuring that there is adequate time available for

performing the relevant duties)

~

240. Financial interests, Compensation and Incentives:

7

Having a financial interest, or knowing of a financial interest held by an immediate or close family member might

create a self-interest threat to compliance with the principles of objectivity or confidentiality.

Immediate Family — spouse (or equivalent) or dependents

> Close Family ~ parent, child or sibling who is not an immediate family member

Ty

‘financial interest:

> Owned directly by and under the control of an individual or entity

Direct Financial | (including those managed on a discretionary basis by others); or

Interest > Beneficially owned through a collective investment vehicle, estate, trust

> Guidance or other intermediary over which the individual or entity has control, or

the ability to influence investment decisions

‘Afinancial interest beneficially owned through a collective investment

vehicle, estate, trust or other intermediary over which the individual or

entity has no control or ability to influence investment decisions

Indirect Financial

Interest

250. inducement, including Gifts and Hospitality

> An inducement is an object, situation, or action that is used as a means to influence another individual's behavior,

but not necessarily with the intent to improperly influence that individual's behavior

> Prohibited by laws and regulations — comply w/ requirement

> Not prohibited by law, with intent (based on judgment) to improperly influence behavior

= do not accept

> Not prohibited by law, no intent (based on judgment) to Improperly influence behavior —

Accept only If trivial and inconsequential

» Transparency and reporting

» An inducement is considered as improperly influencing an individual's behavior if it causes

the individual to act in an unethical manner

> Requirements

260, Responding to NOCLAR

> Non-compliance w/ laws and regulations (“non-compliance”) comprises acts of omission or commission,

tentional or unintentional, which are contrary to the prevailing laws or regulations committed by the ff parties:

= The Professional Accountant's employing organization

= TCWG of the employing organization

= Management of the employing organization

Other individuals working for or under the direction of the employing organization

> Responsibilities of the employing organization's management and TCWG.

> Responsibilities of all Professional Accountants

> Responsibilities of Senior PAIBs (Directors, Officers or Senior Employees able to exert

significant influence over, and make decisions regarding the acquisition, deployment and

control of the organization's resources)

Responsibilities of Professional Accountants other than Senior PAIBS

> Requirements

Vv

270. Pressure to breach fundamental principles

> AProfessional Accountant Shall not

= Allow pressure from others to result in a breach of compliance with the fundamental principles; or

= Place pressure on others that the accountant knows, or has reason to believe, would result in the other

individuals breaching the fundamental principles

v

Intent of the individual

Laws, regulations, and professional standards

Culture and leadership of employing organization

Policies and procedures of the employing organization

> Considerations

Individual exerting pressure

‘Superior

> Discuss the Higher levels of management

matter w/ > HR, ethics committee

> Regulatory Bodies

> Legal Counsel

> Requirements

vev|vye

Part 3: Professional Accountants in Public Practice (PAPPs)

Main Fundamental

see, Creumstances Main Treats Createa | _Maln Fundamental

310 | Confit of merest Satrneest Objectivity

320 Professional Appointments All All

321 Second Opinions Self-Interest yjrckeselonal Compevstica and

Bue Care

Fees and Other pes of : Professional Competence ard

330 | Remunerations Se Due Care, and Objectivity

340 Inducements, including gifts and Self-Interest, Familiarity, Integrity, Objectivity,

hospitality Intimidation Professional Behavior

350 | custody of cient Assets Setinerest Objectivity, Profesional

360 | Responding to NOCLAR Self-Interest, Intimidation Integrity, Professional

Behavior

310, Conflict of Interest

> Professional Accountant undertakes a professional activity related to a particular matter for 2 or more clients

whose interests with respect to the matter are in conflict; or

> Interest of a Professional Accountant with respect to a particular matter and the interests of a client for whom the

accountant undertakes a professional activity related to the matter are in conflict,

> Conflict identification

> Safeguards to threats created (restructuring, segregation of duties, oversight, ete.)

> Requirements | > Disclose the relevant parties affected

> Obtain consent from relevant parties

> Confidentiality (when conflict of interest involves 2 or more

nts)

320. Professional Appointments

> Acceptance of a new client relationship or changes in an existing engagement might create a threat to compliance

w/ one more of the fundamental principles (Primarily, Self-Interest Threat)

Client and Engagement Acceptance (competencies needed)

Changes in a Professional Appointment (ex. Replacement of existing PA)

Changes in Audit/Review Appointment (ex. Communication w/ Predecessor Auditor)

Client and Engagement Continuance (recurring engagements)

Using the work of an expert (determine the necessity of expert and reliability of work done)

> Requirements

VvvvY

321. Second Opinions

> AProfessional Accountant might be asked to provide a second opinion on the application of accounting, auditing,

reporting or other standards or principles to:

= Specific Circumstances; or

= Transactions by or on behalf of a company or an entity that is not an existing client

lot same set of facts, or insufficient evidence

> Obtain information from the existing or predecessor accountant (w/ client permission)

> Describing the limitations surrounding second opinion

> Providing the existing or predecessor accountant w/a copy of opinion (may also include

basis)

> Requirements

330. Fees and Other types of Remunerations

> AProfessional Accountant might quote whatever fee is considered appropriate, Quoting a fee lower than another

accountant is not in itself unethical

Issue: Fees are so low that Professional Accountants can no longer comply with the applicable technical and

professional standards

> Adjustment of fees to reasonable level (law or regulation, benchmarking, costs necessary to

perform engagement, etc.)

Contingent Assets (for non-assurance engagements)

= Have an appropriate reviewer who is not involved in the non-assurance work

> Requirements * Obtain written agreement from client on basis of renumeration,

> Referral Fees and Commissions

* Obtain written agreement as to basis of fees or commissions

* Disclose such arrangements to relevant parties

Purchase or Sale of Firm — not considered referral fees or commissions

v

a

‘340, Inducement, including Gifts and Hospitality

> An inducement is an object, situation, or action that is used as a means to influence another individual's behavior,

but not necessarily with the intent to improperiy influence that individual's behavior

Prohibited by laws and regulations — comply w/ requirement

Not prohibited by law, with intent (based on judgment) to improperly influence behavior

= do not accept

> Not prohibited by law, no intent (based on judgment) to improperly influence behavior —

Accept only if trivial and inconsequential

» Transparency and reporting

> Requirements | > An inducement is considered as improperly influencing an individual's behavior if it causes

the individual to act in an unethical manner

Difference: PAIBs: PA and relevant business parties (superior, customer, supplier, etc.)

VY

350. Custody of Glient Assets

Holding client assets creates a self-interest or other threat to compliance wi the principles of professional

behavior and objectivity

> Do not assume custody unless permitted to do so by law

» Make inquiries about the source of the assets

> Consider legal and regulatory obligations

Before taking

Custody

> Comply with laws and regulations relevant to holding and

> Rego accounting for the assets

oe > Keep the assets separately from personal or firm assets

2 > Use the assets only for the purpose for which they are intended

Custody

> Be ready at all times to account for the assets. and any income,

dividends, or gains generated, to any individuals entitled to that

accounting

‘360. Responding to NOCLAR

> Non-compliance w/ laws and regulations ("non-compliance") comprises acts of omission or commission,

intentional or unintentional, which are contrary to the prevailing laws or regulations committed by the ff parties:

* Client

+ TCWG of a Client

‘= Management of a Client

= Other individuals working for or under the direction of the Client

Responsibilities of the Client's management and TCWG

Responsibilities of all Professional Accountants

Obtaining an understanding of the matter

Addressing the matter

‘Communication w/ respect to audit of components

‘Communication w/ entity's external auditor (for non-audit engagements)

Determine whether further action is needed (client's corrective actions)

Disclosure to appropriate authority (consider confidentiality)

Groen ee ced

> Requirements

VvVVVVNY

__ Periods during which an

independence is required:

> Engagement Period ‘Audit and Review Engagement | A network firm shall be independent of the

> Period covered by FS (4A) audit clients of its member firms

When a firm has reason to believe that

Other than Auditand Review interests and relationships create a threat,

(48) these must be addressed.

Doeamentaton

Compliance Threats Safeguards

See 0 FEES

ceuretances Teas Factors FionsTSaeguarde

Operating stucure, | maease cent basen he

Relative size(tottal | serimerestnimiaion | _coubishmentatt, | tm toteduce dependerer

simnfeane ofauatcent | "” “onavat cent

Tatease por or

reer te | ener || omsseannen

revenue of partner parhereconporcaion | — Have an appropiate

Relative Size (client is a If > 15% of total fees, Disclose such fact to

Punic interest Ent for | oreret tmidaion | cote wether pose Tews

2 years andes > 19% iruanesrevion eet | Consider pre‘suence and

atta sation post uance fee

Aaa totaannawa Ott paral payment

Overdue Fees Settinerest Mave on apropte

Guarantee

rodent

Contngart Fee Ttalowod for Aue Engagement

‘Sec, 411 — Compensation and Evaluation Policies

Circumstances Threats Factors Actions/Safeguards

‘Audit Team Member is

evaluated or Study of Compensation Revise the Policy.

compensated for selling Self-interest policies, role inthe | Remove the Individual from

non-assurance services engagement team, etc. the Audit Team.

toa client

‘Sec. 420 — Gifts and Hospitality

Circumstances Threats Factors ‘Actions/Safeguards

Gifts and Hospitality

Not allowed, unless value is trivial and inconsequential

I (Inducements — Part 3)

‘Sec. 430 — Actual or Threatened Litigation

Circumstances Threats Factors Actions/Safeguards

rape Have an appropriate

Actual or Threatened Beene clea reviewer.

Litigation

Self-interest, Intimidation

whether litigation relates to

prior audit engagement

Removing the individual

from the audit team,

Sec, 510 — Financ

Interests

Circumstances

Threats

Factors

Actions/Safeguards

Held by firm, a network

firm, audit team

members and immediate

family

Not allowed to have Direct Financial Interest or a Material I

indirect Financial Interest

In an entity controlling

an audit client

Not allowed to have Direct Financial Interest or a Material I

indirect Financial Interest

Held as Trustee

Selt-Interest

Beneficiary, Materiality,

Significant Influence over

the Audit Client or the Trust

Consider the factors, Not

allowed to have Direct

Financial interest or a

Material Indirect Financial

Interest over Audit Client

In Common w! the Audit

Client

Self-nterest

Materiality, significant

influence over the entity

Consider the factors, Not

allowed to have Direct

Financial Interest or a

Material Indirect Financial

Interest over Audit Client

Received

unintentionally

Selt-Interest

Materiality

Not allowed to have Direct

Financial Interest or a

Material Indirect Financial

Interest over Audit Client

Sec. 511 — Loan:

iS and Guarantees:

Circumstances

Threats

Factors

‘Actions/Safeguards

With an Audit Client

(general)

Not permitted unless immaterial

With an Audit Client that

is a bank or similar

institutions.

Not permitted unless the loan or guarantee is made under normal lending procedures,

terms and conditions

‘Sec. 520 — Business Relationships

Circumstances

Threats

Factors

‘Actions/Safeguards

Between a Firm and an

Audit Client

Not allowed unless financial interest is immaterial and business relationship is.

insignificant to the client and

the firm

‘Common Interest in

closely-held entities

Not allowed unless the immaterial and no investor has the ability to control the closely-

held entity

Buying Goods or

Services

‘Allowed ifin the normal course of business and at arm's length (no preferential terms or

pricing)

‘Sec, 521 — Family and Personal Relationships

Circumstances Threats Factors Actions/Safeguards

Responsibilities on the

‘Audi Team. Role ofthe | Removing the individual

Family and Personal Self-interest, Familiarity, family member wiin the from the Audit Team

Relationships intimidation family memberwin the | pestuctrng the Aud

; ‘eam

relationship

‘Sec. 522 - Recent Service wi Audit Client

Circumstances Threats Factors Actions/Safeguards

> Service during period

covered by Audit Report | Removing the individual

Recent Service wi Audit | Sel-interest, Self-review, | —not allowed from the Audit Team

Client Familiarity, > Service before period Restructuring the Audit

covered by Audit Report Team

~ may be allowed

‘Sec. 523 — Serving as a Director or Officer of an Audit Client

Circumstances Threats Factors Actions/Safeguards

‘Asa Director or Officer_[ Not allowed

Not allowed unless permitted by law, no managerial decisions involved, and limited only

‘As Company Secretary Tio routine and administrative functions

Sec. 524 — Employment w/ an Audit Client

Circumstances Threats Factors Actions/Safeguards

Previously a member of

the Audit Team

Director or Officer, or any employee in a position to exert

Familia, Intimidation significant influence over the preparation of the FS

‘Sec. 525 — Temporary Personnel Assignments

Circumstances Threats Factors Actions/Safeguards

‘Additional review of work

vi Performed

Teorey Selfreview, Advocacy, | Nature and Scope of work | Excluding loaned staff from

Assignments Familiarity a

Restructuring Audit Team

‘Sec. 540 — Long Association Provisions

Client Rules on Rotation

Not a Publicly Listed

Entity Firm's discretion

7-year “time-on" period (cumulative) for Key Audit Partner roles

Cooling-off Period:

Publicly Listed Entity > 5 years — Engagement Partner

3 years — EQCR Partner

2 years ~ Other Key Audit Partner role (subsidiaries, division, etc.)

V

‘Combination of Key Audit | > Key Audit Partner roles and engagement partner for 4 or more cumulative years

Partner roles > 5 years colling off period

‘SRC Rule 68 — Rotation of External Auditors

Client Rules on Rotation

Time-on Period Rotation after every 5 years of engagement

Cooling-off Period 2 years

‘Sec. 600 - Provision of Non-Assurance Services to an Audit Client (for Publicly Listed Entity)

Prohibited Prohibited if material to the FS

> Management Responsibility ® Valuation services

> General Counsel > Tax calculation

» Accounting and Bookkeeping Services* » Tax advisory or corporate finance advisory

» Promoting, dealing in, or underwriting client shares | > Resolution of tax matters

> Negotiating for the client as part of a recruiting > Intemal Audit Services

service > Designing/implementing financial reporting IT systems

> Recrulting directors/officers, or senior management | > Estimating damages or other amounts as part of

‘who will have significant influence over the FS litigation support services

» Evaluating of compensating a Key Audit Partner > Acting as an advocate to resolve a dispute or litigation

based on selling non-assurance services

Mi ee a

Similar Provisions

Section Content

905 Fees:

906 Gifis and Hospitality

‘907 Actual or Threatened Litigation

1 Loans and Guarantees

920 Business Relationships

924 Family and Personal Relationships

922 Recent Service w/ Assurance Client

923 ‘Serving as Director or Officer of an Assurance Client

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- UntitledDocument10 pagesUntitledPrincesNo ratings yet

- Bp. 22 Quizzer With AnswersDocument2 pagesBp. 22 Quizzer With AnswersPrincesNo ratings yet

- AT 04 Practice - Regulation of The ProfessionDocument6 pagesAT 04 Practice - Regulation of The ProfessionPrincesNo ratings yet

- Auditing ProblemsDocument29 pagesAuditing ProblemsPrincesNo ratings yet

- Intermediate Acctg 3 Finals With Answers PDFDocument6 pagesIntermediate Acctg 3 Finals With Answers PDFPrincesNo ratings yet

- 02 IndividualsDocument95 pages02 IndividualsPrincesNo ratings yet

- Auditing Problems: Ap - 01: Correction of ErrorsDocument15 pagesAuditing Problems: Ap - 01: Correction of ErrorsPrinces100% (2)

- PAS 1 Presentation of Financial Statements: Quiz 1: Multiple ChoiceDocument3 pagesPAS 1 Presentation of Financial Statements: Quiz 1: Multiple Choicetrixie mae88% (8)

- Strategic PositioningDocument21 pagesStrategic PositioningPrincesNo ratings yet

- The Odyssey Describes The Action and Aftermath of TheDocument4 pagesThe Odyssey Describes The Action and Aftermath of ThePrincesNo ratings yet

- PDF 01 Introduction To Financial Management Keypdf DDDocument4 pagesPDF 01 Introduction To Financial Management Keypdf DDPrincesNo ratings yet

- Capital Budgeting Theories: Basic ConceptsDocument37 pagesCapital Budgeting Theories: Basic ConceptsPrincesNo ratings yet

- UniFAST - Press ReleaseDocument3 pagesUniFAST - Press ReleasePrincesNo ratings yet

- 40 Financial Statements TheoryDocument9 pages40 Financial Statements TheoryPrincesNo ratings yet

- ADMS 3330 Final ExamDocument14 pagesADMS 3330 Final ExamPrincesNo ratings yet

- Additional Vat MSQ PDFDocument14 pagesAdditional Vat MSQ PDFPrincesNo ratings yet

- Auditing Problem - Correl 2 Exercise 1: Name: Date: Professor: Section: ScoreDocument17 pagesAuditing Problem - Correl 2 Exercise 1: Name: Date: Professor: Section: ScorePrincesNo ratings yet

- World Literature: Colegio de Dagupan Arellano St. Dagupan CityDocument1 pageWorld Literature: Colegio de Dagupan Arellano St. Dagupan CityPrincesNo ratings yet

- Net Present Value: Mod. 4.3 VCMDocument27 pagesNet Present Value: Mod. 4.3 VCMPrincesNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)