Professional Documents

Culture Documents

AT 04 Practice - Regulation of The Profession

Uploaded by

PrincesOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AT 04 Practice - Regulation of The Profession

Uploaded by

PrincesCopyright:

Available Formats

ReSA - THE REVIEW SCHOOL OF ACCOUNTANCY

CPA Review Batch 43 May 2022 CPA Licensure Examination Week No. 4

AUDITING (Auditing Theory) J. IRENEO M. NGINA F. TUGAS

AT-04: PRACTICE & REGULATION OF THE PROFESSION

1. Why should CPAs in the Philippines adhere to the Statement of Membership Obligations (SMOs) of

the International Federation of Accountants (IFAC)?

A. because of globalization and ASEAN integration

B. because the Philippine Institute of Certified Public Accountants (PICPA) is a member-

professional organization of IFAC

C. because it is required by the Code of Ethics

D. because it is required by the CPD Act of 2016

2. Which of the following is/are included among the fundamental objectives of the Statement of

Membership Obligations (SMOs)?

A. to provide clear benchmarks to current IFAC member bodies only.

B. to support the adoption and implementation of international standards and other

pronouncements issued by the International Auditing and Assurance Standards Board

(IAASB), International Accounting Education Standards Board (IAESB), International

Ethics Standards Board for Accountants (IESBA), International Public Sector Accounting

Standards Board (IPSASB), and International Accounting Standards Board (IASB).

C. Both A and B

D. Neither A nor B

3. This SMO is issued by the IFAC Board and sets out requirements for IFAC member bodies with

respect to international standards issued by the International Accounting Education Standards

Board (IAESB), an independent standard-setting body supported by IFAC.

A. SMO 1 – Quality Assurance

B. SMO 2 – International Education Standards for Professional Accountants and Other

Pronouncements Issued by the IAESB

C. SMO 4 – IESBA Code of Ethics for Professional Accountants

D. SMO 6 – Investigation and Discipline

4. Emma Jean, a Filipino certified public accountant (CPA), is an accounting teacher in a higher

education institution in Davao City. She plans to become an ASEAN Chartered Professional

Accountant (ACPA). For this purpose, which of the following is/are among the requirements?

I. NBI clearance

II. Photocopies of CPD certificates of credit units earned

III. Certificate for ACPA Registration from nACPAE since she is a CPA in the education sector

IV. Registration Fee of ₱1,500

A. I only C. IV only

B. I, II, and IV only D. I, II, III and IV

5. Which of the following statements about the Philippine Accountancy Act of 2004 is LEAST LIKELY

CORRECT?

A. It shall provide for and govern the standardization and regulation of accounting education

and the examination for registration of certified public accountants.

B. It shall provide for and govern the supervision, control, and regulation of the practice of

Filipino professional accountants in the Philippines and abroad.

C. It is aligned with the policy of the State to recognize accountants in nation building and

development.

D. It aims to develop and nurture professional accountants whose standards of practice and

service shall be excellent, qualitative, world class, and globally competitive.

Page 1 of 6 0915-2303213/0908-6567516 resacpareview@gmail.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY AT-04

Week 4: PRACTICE & REGULATION of the PROFESSION

6. A person is deemed to be in practice of the accounting profession in commerce and industry when

he/she:

A. Holds, or is appointed to a position in an accounting professional group in government or

in a government-owned and/or controlled corporation, where decision-making requires

professional knowledge in the science of accounting.

B. Is involved in decision-making requiring professional knowledge in the science of

accounting, as well as the accounting aspects of finance and taxation, or is employed in a

position that requires a CPA.

C. Is in an educational institution which involves teaching of accounting, auditing,

management advisory services, accounting aspect of finance, business law, taxation, and

other technically-related subjects.

D. Holds out himself/herself as one skilled in the knowledge, science and practice of

accounting, and as someone qualified to render professional services as a CPA.

7. According to the IRR of RA 9298, the following can teach business law:

CPAs Members of the IBP

A. Yes Yes

B. Yes No

C. No Yes

D. No No

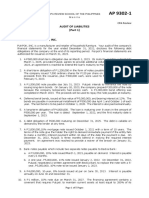

8. The following first-time candidates had these CPALE ratings:

Examinees CPALE Ratings

Subject Subject Subject Subject Subject Subject

1 2 3 4 5 6

Berlin 90 88 95 74 74 64

Manila 87 68 65 75 81 76

Nairobi 94 71 61 73 86 84

Rio 89 78 64 74 85 82

Tokyo 81 89 73 65 65 77

Statement 1: Only two candidates failed.

Statement 2: One candidate had to retake only one subject.

Statement 3: Two candidates would receive conditional credits.

Statement 4: Only two candidates passed.

a. Only one statement is correct. c. Only three statements are correct.

b. Only two statements are correct. d. All statements are correct.

9. Any candidate who fails in two (2) complete CPA Board Examinations shall be disqualified from

taking another set of examinations unless he/she submits certificate of completion of refresher

course to the satisfaction of the PRBOA that he/she enrolled in and completed at least twenty-four

(24) units of subjects given in the licensure examination. Such a certificate shall be valid for ___

years from the date of completion.

A. One C. Three

B. Two D. Four

10. The PRBOA, subject to the approval of the PRC, may revise or exclude any of the subjects and

their syllabi, and add new ones as the need arises, provided that the change shall not be more

often than:

A. Every two years. C. Every four years.

B. Every three years. D. Every five years.

11. Evaluate the following statements:

I. In a year, the Professional Regulatory Board of Accountancy (PRBOA) ordinarily administers

three (3) CPA licensure examinations in the Philippines.

II. As of the most recent update, a professional identification card has a validity of five (5)

years.

A. True, True C. False, True

B. True, False D. False, False

Page 2 of 6 0915-2303213/0908-6567516 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY AT-04

Week 4: PRACTICE & REGULATION of the PROFESSION

12. A certificate under seal, bearing a registration number, issued to an individual, by the PRC, upon

recommendation by the Board of Accountancy, signifying that the individual has complied with all

the legal and procedural requirements for such issuance, including, in appropriate cases, having

successfully passed the CPA licensure examinations.

A. Certificate of registration. C. Certificate of identification.

B. Certificate of accreditation. D. Certificate of quality review.

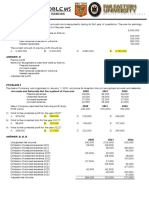

13. Continuing Professional Development (CPD) programs for accountancy shall have these objectives:

A B C D

• To raise and maintain the professional’s capability for

delivering professional services Yes Yes No Yes

• To attain and maintain the minimum standards and

quality in the practice of the profession No Yes Yes No

• To make the profession financially rewarding Yes No Yes No

14. CPD competence areas include:

A. technical skills. C. professional values, ethics, and attitudes.

B. professional competence. D. All of the above.

15. With reference to membership to IFAC, aspiring professional accountants are required to complete

practical experience by the end of initial professional development as compliance to:

A. International Education Standard (IES) 3

B. International Education Standard (IES) 5

C. International Education Standard (IES) 6

D. International Education Standard (IES) 7

16. Per PRBOA Resolution 254 Series of 2017, which of the following statements is INCORRECT?

A. The following can be a CPD provider: sole proprietor, partnership, corporation, government

institutions, and foreign entities.

B. Members of PRBOA are disqualified to be a CPD provider during their incumbency.

C. Application for CPD program accreditation should be filed 60 days before the offering of

the program.

D. The CPD monitor should submit the monitoring report to PRC within 15 working days after

the conduct of the program.

17. With respect to the most recent IRR (PRC Resolution 1146 Series of 2019) for CPD Law, which of

the following statements is INCORRECT?

A. The new provisions would take effect by March 1, 2019.

B. It would refer to CPD Law of 2016.

C. 15 CPD credit units would be required for the renewal of the PRC ID.

D. 120 CPD credit units would be required for the accreditation of CPAs in government.

18. What is the minimum number of CPD credit units that a registered professional accountant in public

practice should accumulate for accreditation within the three-year period starting 2019?

A. 15 credit units C. 100 credit units

B. 45 credit units D. 120 credit units

19. Which of the following is NOT a ground for the suspension or revocation of certificate of registration

and professional identification card?

A. Possession of an unsound mind

B. Practice in more than one field of accountancy

C. Conviction of a criminal offense involving moral turpitude

D. Unprofessional or unethical conduct, malpractice, or violation of RA 9298.

20. The punishment, upon conviction, for any person who has violated any of the provisions of the

Accountancy Act of 2004, or any of its Implementing Rules and Regulations as promulgated by the

Board of Accountancy:

A. A fine of not less than fifty thousand pesos (₱50,000.00) and imprisonment for a period

not exceeding two (2) years.

B. A fine of not less than fifty thousand pesos (₱50,000.00) but not an imprisonment.

C. No fine but an imprisonment for a period not exceeding two (2) years.

D. A fine of not less than fifty thousand pesos (₱50,000.00) or imprisonment for a period not

exceeding two (2) years, or both.

Page 3 of 6 0915-2303213/0908-6567516 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY AT-04

Week 4: PRACTICE & REGULATION of the PROFESSION

21. A CPA whose certificate has been revoked:

A. Is required to take the CPA Board Licensure examinations before reinstatement

B. May be reinstated by the PRBOA after the expiration of two (2) years from the date of

revocation

C. Can no longer be reinstated as a Certified Public Accountant

D. Has committed a crime involving moral turpitude

22. Evaluate the following statements:

I. A BSA graduate is NOT allowed to practice public accountancy under his or her own name

immediately upon passing the CPA Board Exams.

II. The certificate of accreditation for CPAs in education is granted only once and remains in

effect until withdrawn, suspended, or revoked in accordance with RA 9298.

A. True, True C. False, True

B. True, False D. False, False

23. Evaluate the following statements:

I. Single practitioners and partnerships for the practice of public accountancy shall be

registered certified public accountants in the Philippines.

II. A certificate of accreditation shall be issued to certified public accountants in public practice

only upon showing, that such registrant has acquired a minimum of three (3) years

meaningful experience in any of the areas of public practice including taxation.

A. True, True C. False, True

B. True, False D. False, False

24. Which of the following functions would usually be performed by a senior (experienced) associate?

A. Signs the audit report.

B. Performs detailed audit procedures.

C. Prepares the audit program and performs more complex audit procedures

D. Tasked with liaison work between partners and other team members

25. The amount of professional fees depend largely on the:

A. Size and capitalization of the company under audit.

B. Amount of profit for the year.

C. Availability of cash.

D. Volume of audit work and degree of competence and responsibilities involved.

26. Under this method of billing a client, billing is done on the basis of actual time spent by the staff

multiplied by the hourly rates agreed upon.

A. Per diem basis C. Flat or fixed fee basis

B. Retainer fee basis D. Maximum fee basis

27. Which of the following cannot be mentioned by an author in publicizing a book in accounting?

A. Name C. Membership in professional organization

B. Qualifications D. Services that the author’s firm provides

28. May a CPA give a brochure to a non-client?

A. No, because this is a violation of the revised rules on advertising

B. Yes, since this is acceptable under the revised rules on advertising

C. No, unless the non-client becomes a client within ten (10) days from receipt of the brochure

D. Yes, if the non-client has made an unsolicited request

29. Subjects or citizens of foreign countries:

A. May be allowed to practice accountancy in the Philippines, regardless of the provisions of

existing laws and international treaty obligations, including mutual recognition agreements

entered into by the Philippine government with other countries.

B. Are not allowed to practice accountancy in the Philippines, unless they take, and pass, the

certified public accountant licensure examination given by the Board of Accountancy

C. May be allowed to practice accountancy in the Philippines, subject to the provisions of

existing laws and international treaty obligations, including mutual recognition agreements

entered into by the Philippine government with other countries.

D. Are never allowed to practice accountancy in the Philippines because they will jeopardize

the interests of Filipino certified public accountants.

Page 4 of 6 0915-2303213/0908-6567516 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY AT-04

Week 4: PRACTICE & REGULATION of the PROFESSION

30. RA 9298 provides that temporary or special permits may be issued to Foreign CPAs in the following

situations:

A. A foreign CPA was called for consultation which, in the judgment of the Board of

Accountancy, is essential for the development of the Philippines. The permit restricts the

foreign CPA’s practice to the particular consultation work being performed. No Filipino CPA

was qualified for such consultation.

B. A foreign CPA was engaged to lecture on fields essential to accountancy education in the

Philippines. The permit restricts the CPA to teaching only, and limited public practice

provided such practice is conducted outside class hours.

C. A foreign CPA, an IFRS expert, is engaged for services essential for the advancement of

accountancy in the Philippines which can also be performed by Filipino CPAs

D. All of the above situations do not justify the issuance of a temporary or special permit.

31. Violations of the IRR shall subject the CPA to fines and penalties as provided for in RA 9298,

including its IRR. Such violations include:

I. Engaging in public accounting practice without first registering with the PRBOA & the SEC

II. Continuing to engage in the practice of public accountancy after the expiration of the

registration/accreditation

III. Continuing to engage in the practice of public accountancy after suspension, revocation

or withdrawal of registration

IV. Giving any false information, data, statistics, reports or other statement which tend to

mislead, obstruct, or obscure the registration of an Individual CPA, Firm or Partnership of

CPAs under the IRR.

V. Giving any misrepresentation to the effect that registration was secured in truth when in

fact, it was not secured

VI. Failure or refusal to undergo quality review

A. I, II, III, IV, V, and VI C. I, II, III, IV, and VI

B. I, II, III, IV, and V D. I, II, IV, V, and VI

32. Fill out the table below to summarize pointers on the PRBOA:

Composition

7 members

Nominations APO- 5 nominees, PRC chooses 3, President

One (1) complete term 12 years

Maximum no. of years

Vice Chairman (term) 1year

Two (2) consecutive complete terms 6 years

33. The following are qualifications of the members of the Board of Accountancy, EXCEPT:

A. Natural-born citizen and resident of the Philippines.

B. Duly registered CPA with at least five (5) years of work experience in any scope of practice

of accountancy.

C. Good moral character, not convicted of crimes involving moral turpitude.

D. No direct, or indirect pecuniary interest in any school, college, university or institution

conferring the B.S. Accountancy degree or providing CPA Review classes.

34. These qualifications are common to members of the PRBOA and the CPALE applicants, EXCEPT:

A. good moral character. C. Both A and B.

B. natural-born Filipino citizen. D. Neither A nor B.

35. The Accredited Integrated Professional Organization (AIPO) shall submit its nominations for the

PRBOA, with complete documentation, to the Commission

A. Not later than sixty (60) days prior to the expiry of the term of an incumbent chairman or

member.

B. On the date of expiry of the term of an incumbent chairman or member.

C. After the 60th day from the expiry of the term of an incumbent chairman or member.

D. Upon request by the Commission for the submission of nominations.

36. The following are among the powers and functions of the PRBOA, EXCEPT:

A. To prescribe and/or adopt a Code of Ethics for the practice of accountancy

B. To ensure, in coordination with DepEd and CHED that all senior high schools and higher

education institutions offering accountancy-related programs and strand comply with

prescribed policies, standards and requirements

C. To conduct an oversight into the quality of audits of financial statements

D. None of the choices

Page 5 of 6 0915-2303213/0908-6567516 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY AT-04

Week 4: PRACTICE & REGULATION of the PROFESSION

37. The following are grounds for suspension or removal of members of the PRBOA, EXCEPT:

A. Neglect of duty or incompetence.

B. Violation or tolerance of any violation of RA 9298 and its IRR, or the Code of Ethics and

technical and professional standards of practice for CPAs.

C. Pending case on a crime involving moral turpitude.

D. Manipulation or rigging of the CPA licensure examination results.

38. According to the IRR of RA 9298, this group is tasked to assist the PRC in accepting, evaluating,

and approving applications for accreditation of CPE programs, activities or sources as to their

relevance to the profession and determine the number of CPE credit units to be earned on the

basis of the contents of the programs, activity or source submitted by the CPE providers.

A. PRC Quality Review Committee C. PRC CPE Council

B. PRC Education Technical Council D. PRC CPD Committee

39. The Quality Review Committee (QRC) shall have the following functions:

A. Conduct quality control review on applicants for registration to practice public accountancy

and render a report on such quality review

B. Revoke the certificate of registration and professional ID of an individual CPA, firm, or

partnership of CPAs who have not observed quality control measures.

C. Both A and B

D. Neither A nor B

40. Evaluate the following statements:

I. The Philippine Institute of Certified Public Accountants is registered with the SEC as a stock

corporation and recognized by the PRBOA, subject to the approval by the PRC.

II. Membership in PICPA shall be a bar to membership in any other association of certified

public accountants.

A. True, True C. False, True

B. True, False D. False, False

41. Sectoral organizations have been established to promote the interests of groups of professional

accountants. Which of the following is the sectoral organization for CPAs employed under oil and

gas companies?

A. GACPA B. ACPAPP C. ACPACI D. nACPAE

42. In compliance with the SEC, auditors accredited under this/these group/s are allowed to perform

FS audit services to pre-need companies.

A. Group A only C. Groups A, B, and C only

B. Groups A and B only D. All groups (A to D)

43. Which of the following is a CORRECT qualification of the Chairman and two Commissioners of COA?

A. A naturalized citizen of the Philippines

B. At least forty (40) years of age upon appointment

C. CPAs with no less than five (5) years of auditing experience or members of the Philippine

bar who have been engaged in law practice for at least five (5) years

D. Must not have been candidates for any elective position preceding appointment

44. In the COA logo, the ___ silver stars on the blue background represent the national scope of

jurisdiction of the Commission and the ___ gold coins on red base represent the functions of the

Commission.

A. 3; 6 C. 4; 6

B. 3; 7 D. 4: 7

45. Evaluate the following statements:

Statement 1: The vision of COA is to ensure accountability for public resources, promote

transparency, and help improve government operations, in partnership with

stakeholders, for the benefit of the Filipino people.

Statement 2: The Commission on Audit can conduct special audits on NGOs upon request by

proper authorities or as determined by the Chairman.

a. Only statement 1 is correct. c. Only statement 2 is correct.

b. Both statements are correct. d. Both statements are incorrect.

- END -

Page 6 of 6 0915-2303213/0908-6567516 www.resacpareview.com

You might also like

- Udd - Pre01 - Auditing and Assurance Principle - Midterm ExaminationDocument9 pagesUdd - Pre01 - Auditing and Assurance Principle - Midterm ExaminationMicah ErguizaNo ratings yet

- The Professional CPA Review School - Auditing Problems First Preboard ExamDocument18 pagesThe Professional CPA Review School - Auditing Problems First Preboard ExamRodmae VersonNo ratings yet

- Farap 4502Document9 pagesFarap 4502Marya NvlzNo ratings yet

- CHAPTER 7 Auditing-Theory-MCQs-by-Salosagcol-with-answersDocument2 pagesCHAPTER 7 Auditing-Theory-MCQs-by-Salosagcol-with-answersMichNo ratings yet

- CPA ethics and principlesDocument2 pagesCPA ethics and principlesMichNo ratings yet

- Ap-1403 ReceivablesDocument18 pagesAp-1403 Receivableschowchow123No ratings yet

- Aud2 CashDocument6 pagesAud2 CashMaryJoyBernalesNo ratings yet

- Aud ThEORY - 2nd PreboardDocument11 pagesAud ThEORY - 2nd PreboardKim Cristian MaañoNo ratings yet

- Total Bills = P 800Coins 10.00 x 50 pieces = P 500 5.00 x 15 pieces = 75 0.25 x 32 pieces = 8Document8 pagesTotal Bills = P 800Coins 10.00 x 50 pieces = P 500 5.00 x 15 pieces = 75 0.25 x 32 pieces = 8Anonymous LC5kFdtcNo ratings yet

- CPA Review School Philippines First Preboard ExamDocument17 pagesCPA Review School Philippines First Preboard ExamJane DizonNo ratings yet

- 91 - Final Preaboard Afar (Weekends)Document18 pages91 - Final Preaboard Afar (Weekends)Joris YapNo ratings yet

- Quiz For 3rd ExamDocument2 pagesQuiz For 3rd ExamSantiago BuladacoNo ratings yet

- Auditing Chapter 1 Quiz: Key Terms and ConceptsDocument24 pagesAuditing Chapter 1 Quiz: Key Terms and ConceptsSophia JunelleNo ratings yet

- Understanding Internal ControlsDocument4 pagesUnderstanding Internal ControlsGlaizzaNo ratings yet

- Ass 2 in AuditingDocument5 pagesAss 2 in Auditingarnel gallarteNo ratings yet

- ICARE Preweek MASDocument16 pagesICARE Preweek MASjohn paulNo ratings yet

- Audit of Shareholders' Equity: Auditing ProblemsDocument4 pagesAudit of Shareholders' Equity: Auditing ProblemsKenneth Adrian AlabadoNo ratings yet

- ACCO 30043: Quiz Number 1 (Introduction To Assurance and Audit Services)Document16 pagesACCO 30043: Quiz Number 1 (Introduction To Assurance and Audit Services)pat lanceNo ratings yet

- CHAPTER 1 Auditing-Theory-MCQs-by-Salosagcol-with-answers 1Document2 pagesCHAPTER 1 Auditing-Theory-MCQs-by-Salosagcol-with-answers 1MichNo ratings yet

- PRTC - AT3 - The Professional Practice of Public AccountingDocument4 pagesPRTC - AT3 - The Professional Practice of Public Accountingelle868No ratings yet

- Applied Auditing Quiz #1 (Diagnostic Exam)Document15 pagesApplied Auditing Quiz #1 (Diagnostic Exam)xjammerNo ratings yet

- ReSA B45 AUD First PB Exam - Questions, Answers - SolutionsDocument21 pagesReSA B45 AUD First PB Exam - Questions, Answers - SolutionsDhainne Enriquez100% (1)

- Auditing Theory Test BankDocument9 pagesAuditing Theory Test BankTricia Mae FernandezNo ratings yet

- Dayag Notes Partnership DissolutionDocument3 pagesDayag Notes Partnership DissolutionGirl Lang AkoNo ratings yet

- Accountancy Law (Q&A)Document8 pagesAccountancy Law (Q&A)Rosario Garcia CatugasNo ratings yet

- MASTERY CLASS IN AUDITING PROBLEMS Part 1 Prob 1 9Document35 pagesMASTERY CLASS IN AUDITING PROBLEMS Part 1 Prob 1 9Mark Gelo WinchesterNo ratings yet

- Aud Theo Compilation1Document97 pagesAud Theo Compilation1AiahNo ratings yet

- Audit of Receivables: Cebu Cpar Center, IncDocument10 pagesAudit of Receivables: Cebu Cpar Center, IncEvita Ayne TapitNo ratings yet

- ICARE - MAS - PreWeek - Batch 4Document18 pagesICARE - MAS - PreWeek - Batch 4john paulNo ratings yet

- SAMPLEDocument3 pagesSAMPLEkrizzmaaaayNo ratings yet

- Module 1 Exercises - AT Answers To Chap 1 To 3Document6 pagesModule 1 Exercises - AT Answers To Chap 1 To 3Kim IgnacioNo ratings yet

- PDF Cebu Cpar Audit of Inventory DLDocument32 pagesPDF Cebu Cpar Audit of Inventory DLJune KooNo ratings yet

- AFAR Q1 Pre-Week SolMan - MAY 2019Document13 pagesAFAR Q1 Pre-Week SolMan - MAY 2019Aj PacaldoNo ratings yet

- Audit of Inventory PDFDocument7 pagesAudit of Inventory PDFMae-shane SagayoNo ratings yet

- Practice Problems Corporate LiquidationDocument2 pagesPractice Problems Corporate LiquidationAllira OrcajadaNo ratings yet

- Audit of CashDocument14 pagesAudit of CashEll VNo ratings yet

- Team PRTC FPB May 2023 TaxDocument8 pagesTeam PRTC FPB May 2023 TaxAra ara KawaiiNo ratings yet

- ACCY 303 Midterm Exam ReviewDocument12 pagesACCY 303 Midterm Exam ReviewCORNADO, MERIJOY G.No ratings yet

- Far - Pre BoardDocument17 pagesFar - Pre BoardClene DoconteNo ratings yet

- Assurance Principles MT Quiz 1 and 2 FinalDocument13 pagesAssurance Principles MT Quiz 1 and 2 FinalSunshineNo ratings yet

- CHAPTER 8 Auditing-Theory-MCQs-by-Salosagcol-with-answersDocument1 pageCHAPTER 8 Auditing-Theory-MCQs-by-Salosagcol-with-answersMichNo ratings yet

- CW6 - MaterialityDocument3 pagesCW6 - MaterialityBeybi JayNo ratings yet

- Auditing Theory Review Course Pre-Board Exam - FinalDocument11 pagesAuditing Theory Review Course Pre-Board Exam - FinalROMAR A. PIGANo ratings yet

- Solving Construction Problems Step-by-StepDocument6 pagesSolving Construction Problems Step-by-StepAlexNo ratings yet

- AT08 Audit Sampling (PSA 530)Document6 pagesAT08 Audit Sampling (PSA 530)John Paul SiodacalNo ratings yet

- Chapter 10: Cash and Financial InvestmentsDocument13 pagesChapter 10: Cash and Financial Investmentsdes arellanoNo ratings yet

- Auditing Problems Test Banks - LIABILITIES Part 1Document5 pagesAuditing Problems Test Banks - LIABILITIES Part 1Alliah Mae Arbasto0% (1)

- ApatDocument10 pagesApatWilliam Leo GasconNo ratings yet

- Emilio Aguinaldo College - Cavite Campus School of Business AdministrationDocument8 pagesEmilio Aguinaldo College - Cavite Campus School of Business AdministrationKarlayaanNo ratings yet

- Since 1977: Preliminary Audit ActivitiesDocument7 pagesSince 1977: Preliminary Audit ActivitiesYukiNo ratings yet

- AUDITINGDocument2 pagesAUDITINGAlexander ConcepcionNo ratings yet

- Module 2 - Major Specialized IndustriesDocument10 pagesModule 2 - Major Specialized IndustriesKalven Perry AgustinNo ratings yet

- Which Situation Most Likely Violates The IIA's Code of Ethics and The Standards?Document5 pagesWhich Situation Most Likely Violates The IIA's Code of Ethics and The Standards?ruslaurittaNo ratings yet

- Assertions Audit Objectives Audit Procedures: Audit of Intangible AssetsDocument12 pagesAssertions Audit Objectives Audit Procedures: Audit of Intangible AssetsUn knownNo ratings yet

- Ira Shalini M. YbañezDocument5 pagesIra Shalini M. YbañezIra YbanezNo ratings yet

- AT 04 Practice and Regulation of The ProfessionDocument6 pagesAT 04 Practice and Regulation of The ProfessionEira ShaneNo ratings yet

- At Reviewer PT 2Document42 pagesAt Reviewer PT 2lender kent alicanteNo ratings yet

- c3 ReviewerDocument42 pagesc3 Reviewerrandomlungs121223No ratings yet

- 04 Practice & Regulation of The ProfessionDocument7 pages04 Practice & Regulation of The Professionrandomlungs121223No ratings yet

- At-04 (Practice and Regulation of The Profession)Document6 pagesAt-04 (Practice and Regulation of The Profession)Angela Laine HiponiaNo ratings yet

- Auditing Problems: Ap - 01: Correction of ErrorsDocument15 pagesAuditing Problems: Ap - 01: Correction of ErrorsPrinces100% (2)

- Bp. 22 Quizzer With AnswersDocument2 pagesBp. 22 Quizzer With AnswersPrincesNo ratings yet

- UntitledDocument10 pagesUntitledPrincesNo ratings yet

- AT Code of EthicsDocument10 pagesAT Code of EthicsPrincesNo ratings yet

- Auditing ProblemsDocument29 pagesAuditing ProblemsPrincesNo ratings yet

- The Odyssey Describes The Action and Aftermath of TheDocument4 pagesThe Odyssey Describes The Action and Aftermath of ThePrincesNo ratings yet

- ACCY121MidtermExamStudyGuidePPTSlidesonchs2 3 4 5 7 8 PDFDocument218 pagesACCY121MidtermExamStudyGuidePPTSlidesonchs2 3 4 5 7 8 PDFShareyld De GuiaNo ratings yet

- Science CG - With Tagged Sci Equipment - Revised PDFDocument203 pagesScience CG - With Tagged Sci Equipment - Revised PDFRonnelMananganCorpuzNo ratings yet

- Intermediate Acctg 3 Finals With Answers PDFDocument6 pagesIntermediate Acctg 3 Finals With Answers PDFPrincesNo ratings yet

- The Iliad Is An Epic That Tells About Only A Few Weeks During The Trojan War. It BeganDocument3 pagesThe Iliad Is An Epic That Tells About Only A Few Weeks During The Trojan War. It BeganPrincesNo ratings yet

- ABM - Organization and Management CG - 4 PDFDocument5 pagesABM - Organization and Management CG - 4 PDFHaj Heloise75% (20)

- Reyes Princes - MidtermAct1Document4 pagesReyes Princes - MidtermAct1PrincesNo ratings yet

- QUIZ - CHAPTER 1 - STATEMENT OF FINANCIAL POSITION With SolutionsDocument9 pagesQUIZ - CHAPTER 1 - STATEMENT OF FINANCIAL POSITION With Solutionsfinn mertens100% (1)

- P.E. 03 (First Aid and Water Safety)Document4 pagesP.E. 03 (First Aid and Water Safety)PrincesNo ratings yet

- Classification of Individual Taxpayers and Income TaxesDocument95 pagesClassification of Individual Taxpayers and Income TaxesPrincesNo ratings yet

- Mathematics: Quarter 1 - Module 3: Arithmetic Means and Term of An Arithmetic SequenceDocument27 pagesMathematics: Quarter 1 - Module 3: Arithmetic Means and Term of An Arithmetic SequenceDaveNo ratings yet

- PDF 01 Introduction To Financial Management Keypdf DDDocument4 pagesPDF 01 Introduction To Financial Management Keypdf DDPrincesNo ratings yet

- Ielts Usa Practice Speaking Test PDFDocument2 pagesIelts Usa Practice Speaking Test PDFAsfandNo ratings yet

- PAS 1 Presentation of Financial Statements: Quiz 1: Multiple ChoiceDocument3 pagesPAS 1 Presentation of Financial Statements: Quiz 1: Multiple Choicetrixie mae88% (8)

- Chapter 2-Value Added Tax On Importation Multiple Choice: Theory - Agricultural or Marine Food Products: Part 1Document20 pagesChapter 2-Value Added Tax On Importation Multiple Choice: Theory - Agricultural or Marine Food Products: Part 1Carlo Baculo0% (2)

- Strategic PositioningDocument21 pagesStrategic PositioningPrincesNo ratings yet

- Maximizing Jewelry Store ProfitsDocument14 pagesMaximizing Jewelry Store ProfitsPrincesNo ratings yet

- Audit Risk and Materiality Multiple Choice QuestionsDocument18 pagesAudit Risk and Materiality Multiple Choice QuestionsSamit Tandukar100% (1)

- Capital Budgeting TechniquesDocument37 pagesCapital Budgeting TechniquesPrincesNo ratings yet

- Auditing Problem - Correl 2 Exercise 1: Name: Date: Professor: Section: ScoreDocument17 pagesAuditing Problem - Correl 2 Exercise 1: Name: Date: Professor: Section: ScorePrincesNo ratings yet

- RA 9298 - KEY POINTS ON PHILIPPINE ACCOUNTANCY ACTDocument10 pagesRA 9298 - KEY POINTS ON PHILIPPINE ACCOUNTANCY ACTJyznareth TapiaNo ratings yet

- Working Capital FinanceDocument12 pagesWorking Capital FinanceYeoh Mae100% (4)

- Additional Vat MSQ PDFDocument14 pagesAdditional Vat MSQ PDFPrincesNo ratings yet

- 40 Financial Statements TheoryDocument9 pages40 Financial Statements TheoryPrincesNo ratings yet

- DLP Answer SheetDocument13 pagesDLP Answer Sheetarman delos santosNo ratings yet

- Resolution Drainage CanalDocument1 pageResolution Drainage CanalNENITA TRAVILLA100% (1)

- Important info legal referralDocument3 pagesImportant info legal referralAlyssa Newsome NixonNo ratings yet

- Preamble: Read Republic Act 8491Document3 pagesPreamble: Read Republic Act 8491Junjie FuentesNo ratings yet

- Confirm ASCP Exam Appointment Dec 27Document2 pagesConfirm ASCP Exam Appointment Dec 27Gerald HernandezNo ratings yet

- GOMsNo30 DT - 15-02-2007 2 PagesDocument2 pagesGOMsNo30 DT - 15-02-2007 2 PagesSurya Prakash AatlaNo ratings yet

- Consumer Dispute ResolutionDocument23 pagesConsumer Dispute ResolutionEric PottsNo ratings yet

- اتفاقية بيع مخزون و أسهم في شركةDocument3 pagesاتفاقية بيع مخزون و أسهم في شركةMohamad ZaarourNo ratings yet

- CA 1 Module 5Document6 pagesCA 1 Module 5Ce —nNo ratings yet

- Department of Education: Republic of The PhilippinesDocument3 pagesDepartment of Education: Republic of The PhilippinesAlbin John A. LalagunaNo ratings yet

- 1st National Maritime Conference PapersDocument18 pages1st National Maritime Conference PapersainasafiaNo ratings yet

- IBC Knowledge Capsule on Framework for Personal GuarantorsDocument8 pagesIBC Knowledge Capsule on Framework for Personal GuarantorsprdyumnNo ratings yet

- Declaration of Secrecy & Independence: DTTL Member FirmDocument2 pagesDeclaration of Secrecy & Independence: DTTL Member FirmJOhnNo ratings yet

- 130 UDocument2 pages130 UNoelleNo ratings yet

- Financial Rehabilitation and Insolvency ActDocument38 pagesFinancial Rehabilitation and Insolvency ActBevz23No ratings yet

- Pestel AnalysisDocument2 pagesPestel AnalysisIsmail Mia Alif 1612031630No ratings yet

- Rotc Midterm ReviewerDocument12 pagesRotc Midterm ReviewerAnthony SalameraNo ratings yet

- Philippine National Police, Police Regional Office Calabarzon Cavite Police Provincial Office Imus City Police StationDocument3 pagesPhilippine National Police, Police Regional Office Calabarzon Cavite Police Provincial Office Imus City Police StationJam JamNo ratings yet

- 1 10 3rd DigestDocument57 pages1 10 3rd DigestKirsten Rose Boque ConconNo ratings yet

- 2023 Animo Tips Civil LawDocument34 pages2023 Animo Tips Civil LawEileen Dela Cruz-ducusinNo ratings yet

- Fundamentas of Criminal Investigation Long QuizDocument8 pagesFundamentas of Criminal Investigation Long QuizEdward MorbiusNo ratings yet

- Thomas HobbesDocument4 pagesThomas HobbesRowena Pulido AntonioNo ratings yet

- Ivan Kodeh..appli VS Sardinius..respo Civil Appli No.1 of 2015 Hon - Mziray, J.ADocument21 pagesIvan Kodeh..appli VS Sardinius..respo Civil Appli No.1 of 2015 Hon - Mziray, J.AOmar SaidNo ratings yet

- KDU Degree Certificate RequestDocument3 pagesKDU Degree Certificate RequestNatasha de SilvaNo ratings yet

- City Skylines Mechanic SOPDocument7 pagesCity Skylines Mechanic SOPEco MaasinNo ratings yet

- Volvo Clutch Wear CheckDocument3 pagesVolvo Clutch Wear ChecksengottaiyanNo ratings yet

- 2020 11 03 - Distressed and Illiqquid BondsDocument1 page2020 11 03 - Distressed and Illiqquid BondsSouthey CapitalNo ratings yet

- Final Exam Criminal Law Book 1Document9 pagesFinal Exam Criminal Law Book 1Rey Lagunzad Flores Fernandez100% (1)

- Corona Vs United Harbor Pilots Assoc of The Phil - GR No. 111953Document11 pagesCorona Vs United Harbor Pilots Assoc of The Phil - GR No. 111953Jobi BryantNo ratings yet

- Simple Interest Qa PresentationDocument63 pagesSimple Interest Qa PresentationCyril Grace Alburo BoocNo ratings yet