Professional Documents

Culture Documents

Case Study: Programme Year Intake Total Marks

Uploaded by

Mina MooOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Case Study: Programme Year Intake Total Marks

Uploaded by

Mina MooCopyright:

Available Formats

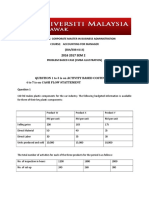

Case Study

PROGRAMME Bachelor of Commerce in Accounting

MODULE Management Accounting and Finance 2A

YEAR Two (2) Semester 1

INTAKE January 2023

TOTAL MARKS 30

SECTION A [30 Marks]

Answer ALL the questions in this section.

QUESTION 1

The information provided below represents the budgeted production and sales data of product X for the forthcoming

quarter at Alpha-Beta Inc.

INFORMATION

Planned sales volume 20 000 units

Sales R1 600 000

Direct materials cost R500 000

Direct labour cost R400 000

Variable manufacturing overhead cost R100 000

Fixed manufacturing overhead cost R200 000

Fixed administration and marketing cost R100 000

Variable administration and marketing cost R100 000

Use it to answer each of the following questions independently:

1.1 Calculate the contribution margin per unit. (3 marks)

1.2 Calculate the break-even quantity. (4 marks)

1.3 Calculate the margin of safety (as a percentage) and explain the value obtained. (4 marks)

1.4 Calculate the selling price per unit that will enable Alpha-Beta Inc. to break even if 16 000 units are (4 marks)

sold.

QUESTION 2

Study the information provided below and answer the following questions.

Stevmark Limited manufactures precision tools to its customers’ own specifications. The manufacturing operations are

divided into three cost centres: A, B and C. An extract from the company’s budget for the forthcoming period shows the

following data:

Cost centre Budgeted production overhead, R Basis of production overhead absorption, R

A 385 000 22 000 machine hours

B 750 880 19 760 machine hours

C 409 640 41 800 labour hours

Job AX1 was manufactured during the period and its job cost sheet reveals the following information relating to the job:

Direct material requisitioned R67 801

Direct material returned to store R396.00

Direct labour recorded against job AX1:

Cost centre A 146 hours at R48.00 per hour

Cost centre B 39 hours at R57.00 per hour

Cost centre C 279 hours at R61.00 per hour

A special machine was hired for job AX1 at a cost of R590.00.

Machine hours recorded against job AX1:

Cost centre A 411 hours

Cost centre B 657 hours

Price quoted and charged to customers, including delivery R172 000.

Stevmark Limited absorbs non-production overhead using the following pre-determined overhead absorption rates:

Administration and general overhead 10% of production costs

Selling and distribution overhead 12% of selling price

REQUIRED:

2.1 Calculate the predetermined overhead absorption rate for each of the cost centres, using the basis (3 marks)

indicated.

2.2 Present an analysis of the total cost and profit or loss attributable to job AX1. (12 marks)

You might also like

- Retail Branding and Store Loyalty - Analysis in The Context of Reciprocity, Store Accessibility, and Retail Formats (PDFDrive)Document197 pagesRetail Branding and Store Loyalty - Analysis in The Context of Reciprocity, Store Accessibility, and Retail Formats (PDFDrive)Refu Se ShitNo ratings yet

- 5 Ways To Foster A Global Mindset in Your CompanyDocument5 pages5 Ways To Foster A Global Mindset in Your CompanyGurmeet Singh KapoorNo ratings yet

- Investment Analysis and Portfolio Management: Frank K. Reilly & Keith C. BrownDocument113 pagesInvestment Analysis and Portfolio Management: Frank K. Reilly & Keith C. BrownWhy you want to knowNo ratings yet

- BSNL BillDocument3 pagesBSNL BillKaushik GurunathanNo ratings yet

- SCIENCE 11 WEEK 6c - Endogenic ProcessDocument57 pagesSCIENCE 11 WEEK 6c - Endogenic ProcessChristine CayosaNo ratings yet

- Marginal & Absorption CostingDocument6 pagesMarginal & Absorption CostingEman Mirza100% (4)

- 2.ed - Eng6 - q1 - Mod3 - Make Connections Between Information Viewed and Personal ExpiriencesDocument32 pages2.ed - Eng6 - q1 - Mod3 - Make Connections Between Information Viewed and Personal ExpiriencesToni Marie Atienza Besa100% (3)

- P1 Question Bank - CH 1 and 2Document29 pagesP1 Question Bank - CH 1 and 2prudencemaake120No ratings yet

- T7Q Absorption Costing and Marginal Costing 20170213Document4 pagesT7Q Absorption Costing and Marginal Costing 20170213janice0% (1)

- Problem-42: RequiredDocument7 pagesProblem-42: RequiredRADHIKA V HNo ratings yet

- OSA Question - Cost AccountingDocument9 pagesOSA Question - Cost AccountingMohola Tebello GriffithNo ratings yet

- Management Accounting Final OSADocument9 pagesManagement Accounting Final OSAAthiNo ratings yet

- Assignment 1Document2 pagesAssignment 1Betheemae R. MatarloNo ratings yet

- 4 2 Sma 2017Document5 pages4 2 Sma 2017Nawoda SamarasingheNo ratings yet

- Tutorial OverheadDocument6 pagesTutorial OverheadImran FarhanNo ratings yet

- Exercise 1Document2 pagesExercise 1TAETAE50% (2)

- Introduction To Financial Management Main ProjectDocument5 pagesIntroduction To Financial Management Main ProjectMelissa KleinNo ratings yet

- Exc 1Document2 pagesExc 1Anonymous OxCDfW1CFVNo ratings yet

- Tutorial Overhead StudentsDocument8 pagesTutorial Overhead Studentsnatasha thaiNo ratings yet

- Marginal Costing .. Feb 2020: Q. 1 Denton Company (Rupees in '000') 20x4 20x5Document5 pagesMarginal Costing .. Feb 2020: Q. 1 Denton Company (Rupees in '000') 20x4 20x5신두No ratings yet

- BBS 2nd Year QuestionDocument1 pageBBS 2nd Year Questionsatya25% (4)

- Revision Week 1. Questions. Question 1. Cost of Goods Manufactured, Cost of Goods Sold, Income Statement. (A)Document5 pagesRevision Week 1. Questions. Question 1. Cost of Goods Manufactured, Cost of Goods Sold, Income Statement. (A)Sujib BarmanNo ratings yet

- Semester Paper CostDocument4 pagesSemester Paper CostMd HussainNo ratings yet

- Cost Accounting 3Document3 pagesCost Accounting 3sharu SKNo ratings yet

- Tutorial 1 - Topic 4 - OAR - QDocument6 pagesTutorial 1 - Topic 4 - OAR - QJong HannahNo ratings yet

- Grand Test - Question PaperDocument3 pagesGrand Test - Question PaperWaseim khan Barik zaiNo ratings yet

- Manufacturing Account (With Answers) : Advanced LevelDocument15 pagesManufacturing Account (With Answers) : Advanced LevelMomoh Kebiru0% (1)

- JobDocument4 pagesJobNeha SmritiNo ratings yet

- Mba104 - Cost and Management Accounting PDFDocument3 pagesMba104 - Cost and Management Accounting PDFAnurag VarmaNo ratings yet

- Institute of Cost and Management Accountants of PakistanDocument11 pagesInstitute of Cost and Management Accountants of PakistanAsad RiazNo ratings yet

- Business Accounting and Finance: QUESTION 1 (P17-2A)Document9 pagesBusiness Accounting and Finance: QUESTION 1 (P17-2A)sang_ratu_1No ratings yet

- Marginal CostingDocument4 pagesMarginal CostingFareha Riaz100% (3)

- Master Budget Sample ProblemsDocument14 pagesMaster Budget Sample ProblemscykablyatNo ratings yet

- Cost Accounting Question BankDocument28 pagesCost Accounting Question BankdeepakgokuldasNo ratings yet

- BAC1624 - Tutorial 1Document4 pagesBAC1624 - Tutorial 1Amiee Laa PulokNo ratings yet

- Cost Accounting: T I C A PDocument4 pagesCost Accounting: T I C A PShehrozSTNo ratings yet

- Variable and Absorption CostingDocument52 pagesVariable and Absorption CostingcruzchristophertangaNo ratings yet

- Group AssignmentDocument7 pagesGroup Assignmentsaidkhatib368No ratings yet

- TutorialActivity 3Document7 pagesTutorialActivity 3Adarsh AchoyburNo ratings yet

- Class Question Cost SheetDocument3 pagesClass Question Cost SheetRachit SrivastavaNo ratings yet

- Tutorial 6 AcmcDocument4 pagesTutorial 6 Acmcsarahayeesha1No ratings yet

- Management Information June-2012Document2 pagesManagement Information June-2012Laskar REAZNo ratings yet

- Cma Final 2018 19Document3 pagesCma Final 2018 19BrijmohanNo ratings yet

- Me2612 Business Planning WorksheetDocument6 pagesMe2612 Business Planning Worksheetrizwanwakil999No ratings yet

- 11-11-21... 4060 GR I... Ni-3124... Costing... QueDocument4 pages11-11-21... 4060 GR I... Ni-3124... Costing... QueVimal Shroff55No ratings yet

- Cost Accounting: T I C A PDocument5 pagesCost Accounting: T I C A PShehrozSTNo ratings yet

- Zegu Cac 414 Practice QuestionsDocument9 pagesZegu Cac 414 Practice Questionsloise zvizvaiNo ratings yet

- 5) May 2007 Cost ManagementDocument32 pages5) May 2007 Cost Managementshyammy foruNo ratings yet

- International BusinessDocument10 pagesInternational BusinessTerryDemetrioCesarNo ratings yet

- Handout - CHAPTER 2Document15 pagesHandout - CHAPTER 2Merveille SadyNo ratings yet

- Tutorial 4 - Costing For OverheadDocument5 pagesTutorial 4 - Costing For OverheadMuhammad Alif100% (1)

- Problem Unit 4Document7 pagesProblem Unit 4meenasaratha100% (1)

- Unit 2 - Question BankDocument34 pagesUnit 2 - Question BankTamaraNo ratings yet

- Job and Batch CostingDocument3 pagesJob and Batch CostingbhngbjNo ratings yet

- DAC503 ILLUSTRATIVE QUESTION - Cost Accumulation & PricingDocument3 pagesDAC503 ILLUSTRATIVE QUESTION - Cost Accumulation & PricingDavidNo ratings yet

- Manufacturing A LevelDocument21 pagesManufacturing A LevelSheraz AhmadNo ratings yet

- Accountancy & Auditing-I 2021Document2 pagesAccountancy & Auditing-I 2021Zeeshan Ashraf MalikNo ratings yet

- ABC and CashFlow QuestionDocument11 pagesABC and CashFlow QuestionTerryDemetrioCesarNo ratings yet

- Manac 3 Sem 1 Test 1 2023Document6 pagesManac 3 Sem 1 Test 1 2023LuciaNo ratings yet

- U Win Bo Myint Cost and Management Overhead Homework - 2Document3 pagesU Win Bo Myint Cost and Management Overhead Homework - 2Theint Myat KyalsinNo ratings yet

- Sesi 5&6 PraktikDocument6 pagesSesi 5&6 PraktikDian Permata SariNo ratings yet

- AccountsDocument14 pagesAccountsgokulamaromal2001No ratings yet

- Costing QN PaperDocument5 pagesCosting QN PaperAJNo ratings yet

- ABC AssignmentDocument3 pagesABC AssignmentSunil ThapaNo ratings yet

- E-Beauty: A Successful Model For B2C Business: Rong Chen Feng HeDocument3 pagesE-Beauty: A Successful Model For B2C Business: Rong Chen Feng HeMina MooNo ratings yet

- Free Version of Growthinks Beauty Supply Store Business Plan TemplateDocument15 pagesFree Version of Growthinks Beauty Supply Store Business Plan TemplateMina MooNo ratings yet

- Case Study: Programme Year Intake Total MarksDocument2 pagesCase Study: Programme Year Intake Total MarksMina MooNo ratings yet

- Business Ethics Case Study: Ethical Issues at Coca ColaDocument4 pagesBusiness Ethics Case Study: Ethical Issues at Coca ColaMina MooNo ratings yet

- Working Capital Management: Problem Solving 3 QuestionsDocument4 pagesWorking Capital Management: Problem Solving 3 QuestionsMina MooNo ratings yet

- Heading 1Document1 pageHeading 1Mina MooNo ratings yet

- Subtitle: TitleDocument1 pageSubtitle: TitleMina MooNo ratings yet

- PCM Cables: What Is PCM Cable? Why PCM Cables? Application?Document14 pagesPCM Cables: What Is PCM Cable? Why PCM Cables? Application?sidd_mgrNo ratings yet

- Celula de CargaDocument2 pagesCelula de CargaDavid PaezNo ratings yet

- Stratum CorneumDocument4 pagesStratum CorneumMuh Firdaus Ar-RappanyNo ratings yet

- Cln4u Task Prisons RubricsDocument2 pagesCln4u Task Prisons RubricsJordiBdMNo ratings yet

- An Enhanced Radio Network Planning Methodology For GSM-R CommunicationsDocument4 pagesAn Enhanced Radio Network Planning Methodology For GSM-R CommunicationsNuno CotaNo ratings yet

- Porter's 5-Force Analysis of ToyotaDocument9 pagesPorter's 5-Force Analysis of ToyotaBiju MathewsNo ratings yet

- DHA - Jebel Ali Emergency Centre + RevisedDocument5 pagesDHA - Jebel Ali Emergency Centre + RevisedJam EsNo ratings yet

- 5045.CHUYÊN ĐỀDocument8 pages5045.CHUYÊN ĐỀThanh HuyềnNo ratings yet

- CandyDocument24 pagesCandySjdb FjfbNo ratings yet

- Previews 1633186 PreDocument11 pagesPreviews 1633186 PreDavid MorenoNo ratings yet

- Outlook of PonDocument12 pagesOutlook of Ponty nguyenNo ratings yet

- Guidelines For Doing Business in Grenada & OECSDocument14 pagesGuidelines For Doing Business in Grenada & OECSCharcoals Caribbean GrillNo ratings yet

- 95-03097 Ballvlv300350 WCB PDFDocument26 pages95-03097 Ballvlv300350 WCB PDFasitdeyNo ratings yet

- Air Blower ManualDocument16 pagesAir Blower ManualshaiknayeemabbasNo ratings yet

- Kiraan Supply Mesin AutomotifDocument6 pagesKiraan Supply Mesin Automotifjamali sadatNo ratings yet

- JIMMA Electrical&ComputerEngDocument219 pagesJIMMA Electrical&ComputerEngTewodros71% (7)

- City Limits Magazine, December 1981 IssueDocument28 pagesCity Limits Magazine, December 1981 IssueCity Limits (New York)No ratings yet

- HDO OpeationsDocument28 pagesHDO OpeationsAtif NadeemNo ratings yet

- TransistorsDocument21 pagesTransistorsAhmad AzriNo ratings yet

- 1Document2 pages1TrầnLanNo ratings yet

- Punches and Kicks Are Tools To Kill The Ego.Document1 pagePunches and Kicks Are Tools To Kill The Ego.arunpandey1686No ratings yet

- NCP - Impaired Urinary EliminationDocument3 pagesNCP - Impaired Urinary EliminationFretzgine Lou ManuelNo ratings yet

- Ultimate Trading Guide - Flash FUT 2023Document33 pagesUltimate Trading Guide - Flash FUT 2023marciwnw INo ratings yet

- MegaMacho Drums BT READ MEDocument14 pagesMegaMacho Drums BT READ MEMirkoSashaGoggoNo ratings yet