Professional Documents

Culture Documents

606B Cif 2022

Uploaded by

gurpOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

606B Cif 2022

Uploaded by

gurpCopyright:

Available Formats

SE Society’s

SNBP College of Arts Commerce Science & Management Studies

Morwadi, Pimpri, Pune-18

Department of BBA

Academic Year – 2022-23

Assignment Questions

Class TYBBA (Term – VI)

Specialization in Finance

Subject – Cases in Finance + Projects (606 B)

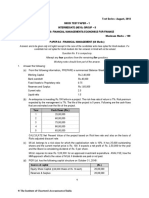

Q.1) SKS Pvt. Ltd. Company is considering a new project to increase its production

capacity of machine. Two alternative projects have been suggested each costing Rs.

1,00,000. Earning After Tax is expected to be as follows-

Year Project 1 Project 2

1 30,000 10,000

2 40,000 30,000

3 50,000 40,000

4 30,000 60,000

5 20,000 40,000

Company has target return on capital of 10% and present value of Rs. 1 @ 10% as

follows-

1st year 2nd year 3rd year 4th year 5th year

0.91 0.83 0.75 0.68 0.62

Calculate-

a) Payback Period

b) Discounted Payback Period

c) NPV

d) Profitability Index and give your opinion to the management about the option

which is financially more preferable.

Q.2) A firm’s after-tax cost of capital of the specific sources is as follows:

Cst of Debt 8%

Cost of Preference shares (including Dividend Tax) 14%

Cost of Euity funds 17%

The Following is the capital Structure:

Source Amount (Rs.)

Debt 3,00,000

Preference Capital 2,00,000

Equity Capital 5,00,000

Total 10,00,000

Calculate the weighted average cost of capital, (k0), using book value weights.

*******

You might also like

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsFrom EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNo ratings yet

- Ii Semester Endterm Examination March 2016Document2 pagesIi Semester Endterm Examination March 2016Nithyananda PatelNo ratings yet

- Bangalore University Previous Year Question Paper AFM 2020Document3 pagesBangalore University Previous Year Question Paper AFM 2020Ramakrishna NagarajaNo ratings yet

- Capital Budgeting-ProblemsDocument5 pagesCapital Budgeting-ProblemsUday Gowda0% (1)

- HW3MGT517Document3 pagesHW3MGT517Jaya PaudwalNo ratings yet

- 8) FM EcoDocument19 pages8) FM EcoKrushna MateNo ratings yet

- Bfi 4301 Financial Management Paper 1Document10 pagesBfi 4301 Financial Management Paper 1Paul AtariNo ratings yet

- Corporate Finance I mA6Q2VgQxb PDFDocument4 pagesCorporate Finance I mA6Q2VgQxb PDFvikas4433No ratings yet

- FMECO M.test EM 30.03.2021 QuestionDocument6 pagesFMECO M.test EM 30.03.2021 Questionsujalrathi04No ratings yet

- CA Intermediate Mock Test Eco FM 16.10.2018 EM Only QuestionDocument6 pagesCA Intermediate Mock Test Eco FM 16.10.2018 EM Only QuestionTanmayNo ratings yet

- Use of Statistical Tables PermittedDocument2 pagesUse of Statistical Tables PermittedPAVAN KUMARNo ratings yet

- 6th Sem-FM - Model QP by Srijita Datta and Arunangsu Das Sarma-26Apr2020Document15 pages6th Sem-FM - Model QP by Srijita Datta and Arunangsu Das Sarma-26Apr2020Kashish GroverNo ratings yet

- 4a. Capital BudgetingDocument6 pages4a. Capital BudgetingShubhrant ShuklaNo ratings yet

- Capital Budgeting Sums - 16-17 (2018 - 05 - 19 12 - 01 - 33 UTC) (2019 - 01 - 22 04 - 17 - 23 UTC) (2019 - 07 - 02 05 - 43 - 05 UTC) PDFDocument7 pagesCapital Budgeting Sums - 16-17 (2018 - 05 - 19 12 - 01 - 33 UTC) (2019 - 01 - 22 04 - 17 - 23 UTC) (2019 - 07 - 02 05 - 43 - 05 UTC) PDFutsavNo ratings yet

- Mba Executive - I Year 2 Semester / January 2021Document2 pagesMba Executive - I Year 2 Semester / January 2021gaurav jainNo ratings yet

- Accountancy and Business Statistics Second Paper: Management AccountingDocument10 pagesAccountancy and Business Statistics Second Paper: Management AccountingGuruKPONo ratings yet

- Capital Budgeting Techniques-For StudentsDocument4 pagesCapital Budgeting Techniques-For StudentsIshika HimatsinghkaNo ratings yet

- CF - PWS - 5Document3 pagesCF - PWS - 5cyclo tronNo ratings yet

- Managerial FinanceDocument2 pagesManagerial FinanceWasim Bin ArshadNo ratings yet

- UntitledDocument5 pagesUntitledbetty KemNo ratings yet

- SFM - 1Document3 pagesSFM - 1ketulNo ratings yet

- Question PaperDocument3 pagesQuestion PaperAmbrishNo ratings yet

- Financial Management: Assignment MB0029 (3 Credits) Set 1 Marks 60Document3 pagesFinancial Management: Assignment MB0029 (3 Credits) Set 1 Marks 60JhorapaataNo ratings yet

- PRM41 - FM - End Term Question PaperDocument2 pagesPRM41 - FM - End Term Question PapershravaniNo ratings yet

- Financial-Planning-and-Budgeting-S-22 PaperDocument3 pagesFinancial-Planning-and-Budgeting-S-22 Paperrjyasir1985No ratings yet

- Assignment DMBA202 MBA 2 Set-1 and 2 Nov 2022Document2 pagesAssignment DMBA202 MBA 2 Set-1 and 2 Nov 2022Solve AssignmentNo ratings yet

- Paper14 Strategic Financial ManagementDocument34 pagesPaper14 Strategic Financial ManagementKumar SAPNo ratings yet

- Bba - 17ubn05 - 01.02.2022 - FN PDFDocument3 pagesBba - 17ubn05 - 01.02.2022 - FN PDFBdhs HdhdNo ratings yet

- Capital Budgeting Problems 1Document5 pagesCapital Budgeting Problems 1Juber AhamadNo ratings yet

- Financial Management (MBOF 912 D) 1Document5 pagesFinancial Management (MBOF 912 D) 1Siva KumarNo ratings yet

- Loyola College (Autonomous), Chennai - 600 034: APRIL 2016 Co 6608 - Financial ManagementDocument34 pagesLoyola College (Autonomous), Chennai - 600 034: APRIL 2016 Co 6608 - Financial ManagementSimon JosephNo ratings yet

- Rajdhani College FM Assignment FinalDocument6 pagesRajdhani College FM Assignment Finalayushkorea52629No ratings yet

- Financial Management - II CA QPDocument4 pagesFinancial Management - II CA QPSivaramkrishna KasilingamNo ratings yet

- Finance For ProcurementDocument3 pagesFinance For ProcurementAlex MuhweziNo ratings yet

- FM Revision 3rd YearDocument39 pagesFM Revision 3rd YearBharat Satyajit100% (1)

- Mbac 2001Document6 pagesMbac 2001sujithNo ratings yet

- 01 LeveragesDocument11 pages01 LeveragesZerefNo ratings yet

- Capital Budgeting Exercise1Document14 pagesCapital Budgeting Exercise1rohini jha0% (1)

- Investment Decisions Problems 2Document5 pagesInvestment Decisions Problems 2MussaNo ratings yet

- Capital Budgeting Questions - UE - FMDocument3 pagesCapital Budgeting Questions - UE - FMVimoli MehtaNo ratings yet

- Financial ManagementDocument3 pagesFinancial Managementakshaymatey007No ratings yet

- sFikv8tLO3DuTOB3I8bY 4762Document2 pagessFikv8tLO3DuTOB3I8bY 4762dipusharma4200No ratings yet

- FM-Cap. Budgeting LeverageDocument31 pagesFM-Cap. Budgeting Leverageshagun.2224mba1003No ratings yet

- Sessional Examination: Master of Business Administration (MBA) Semester: IIIDocument4 pagesSessional Examination: Master of Business Administration (MBA) Semester: IIINishaTripathiNo ratings yet

- CA Inter FM SM Q MTP 2 May 2024 Castudynotes ComDocument12 pagesCA Inter FM SM Q MTP 2 May 2024 Castudynotes ComsaurabhNo ratings yet

- Simsr2 Mba B III FM Quep 1Document4 pagesSimsr2 Mba B III FM Quep 1Priyanka ReddyNo ratings yet

- MTP 19 53 Questions 1713430127Document12 pagesMTP 19 53 Questions 1713430127Murugesh MuruNo ratings yet

- Loyola College (Autonomous), Chennai - 600 034: APRIL 2016 Co 6608 - Financial ManagementDocument3 pagesLoyola College (Autonomous), Chennai - 600 034: APRIL 2016 Co 6608 - Financial ManagementvivekNo ratings yet

- Question No. 1 Is Compulsory. Attempt Any Five Questions From The Remaining Six Questions. Working Notes Should Form Part of The AnswerDocument17 pagesQuestion No. 1 Is Compulsory. Attempt Any Five Questions From The Remaining Six Questions. Working Notes Should Form Part of The AnswerMajidNo ratings yet

- Sri Sairam Institute of Management Studies Chennai - 44Document4 pagesSri Sairam Institute of Management Studies Chennai - 44Anbarasu KrishnanNo ratings yet

- Assignment2 FMDocument2 pagesAssignment2 FMSiva Kumar0% (1)

- Capital Budgeting ProblemsDocument2 pagesCapital Budgeting Problemsvijayadarshini vNo ratings yet

- Cash Flow Probability Cash Flow Probability Proj A Proj B Proj A Year Project A Project B Expected Value Discount Rate PV (Encf)Document10 pagesCash Flow Probability Cash Flow Probability Proj A Proj B Proj A Year Project A Project B Expected Value Discount Rate PV (Encf)hardik100No ratings yet

- Og FMDocument5 pagesOg FMSiva KumarNo ratings yet

- Fundamentals of Financial Management All Questions Are Compulsory Students Have To Upload The Scanned Solution On TEAMSDocument3 pagesFundamentals of Financial Management All Questions Are Compulsory Students Have To Upload The Scanned Solution On TEAMSlolik soli100% (1)

- 820003Document2 pages820003komalbhadani77No ratings yet

- MML 5202Document6 pagesMML 5202MAKUENI PIGSNo ratings yet

- Financial Management 201Document4 pagesFinancial Management 201Avijit DindaNo ratings yet

- MBA 2nd-4th Sem Internal TestDocument3 pagesMBA 2nd-4th Sem Internal TestNritya khoundNo ratings yet

- Facacor03T-B.C - (CC3) C M A - I: West Bengal State UniversityDocument4 pagesFacacor03T-B.C - (CC3) C M A - I: West Bengal State UniversityAbhayNo ratings yet

- Assignment No: 1Document2 pagesAssignment No: 1gurpNo ratings yet

- UntitledDocument1 pageUntitledgurpNo ratings yet

- 401 - E&sbmDocument1 page401 - E&sbmgurpNo ratings yet

- S.E.Society'S SNBP College of Acs and Management Studies Morwadi Pimpri Subject: Subject Code:403Document1 pageS.E.Society'S SNBP College of Acs and Management Studies Morwadi Pimpri Subject: Subject Code:403gurpNo ratings yet

- UntitledDocument1 pageUntitledgurpNo ratings yet

- Assignment No. 01 Q1.: What Are Long Term Sources of Finance. Explain in Detail. Q2. Factors Affecting Capital StructureDocument1 pageAssignment No. 01 Q1.: What Are Long Term Sources of Finance. Explain in Detail. Q2. Factors Affecting Capital StructuregurpNo ratings yet

- 601 Assignment 2022 23Document1 page601 Assignment 2022 23gurpNo ratings yet

- Assignment Questions MOISDocument2 pagesAssignment Questions MOISgurpNo ratings yet

- Assignment 01 BPMDocument1 pageAssignment 01 BPMgurpNo ratings yet

- Assignment MIS TYDocument1 pageAssignment MIS TYgurpNo ratings yet

- Walunj 2424Document10 pagesWalunj 2424gurpNo ratings yet

- 505B New Aditya2242Document17 pages505B New Aditya2242gurpNo ratings yet