Professional Documents

Culture Documents

Sectioemily Valley Is A Licensed Dentist. During The First Month of The Operation of Her Business, The Following Events and Transactions Occurredn4

Uploaded by

Bassam Alyeser0 ratings0% found this document useful (0 votes)

84 views14 pagesOriginal Title

sectioEmily Valley is a licensed dentist. During the first month of the operation of her business, the following events and transactions occurredn4

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

84 views14 pagesSectioemily Valley Is A Licensed Dentist. During The First Month of The Operation of Her Business, The Following Events and Transactions Occurredn4

Uploaded by

Bassam AlyeserCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 14

The Accounts that increase

the owner’s equity (Credit)

Debit Credit The Accounts that

Accounts Accounts decrease the owner’s

equity (Debit)

Increase the owner’s equity so its

nature is credit Account

Increase in credit – decrease in debit

Decrease the owner’s equity so its

nature is Debit Account

Increase in debit– decrease in credit

Increase the owner’s equity so its

nature is credit Account

Increase in credit – decrease in debit

Decrease the owner’s equity so its

nature is debit Account

Increase in debit– decrease in credit

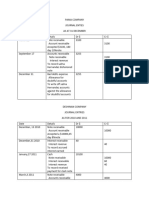

P2-2A Emily Valley is a licensed dentist. During

the first month of the operation of her business,

the following events and transactions occurred:

• Instructions

(a) Journalize the transactions.

(b) Post to the ledger accounts.

(c) Prepare a trial balance on April 30, 2017

April 1 Invested $20,000 cash in her business.

Cash Increased Owner’s Capital Increased

Debit Credit

date Explanation Debit Credit

April 1 cash 20000

Owner’s Capital 20000

date debit credit Balance date debit credit Balance

April1 20000 20000 April1 20000 20000

April1 Hired a secretary-receptionist at a salary of $700

per week payable monthly.

April2 Paid office rent for the month $1,100.

Cash Decreased(Credit) Rent Expense. increased (Debit)

date Explanation Debit Credit

April 2 Rent Expense 1100

Cash 1100

date debit credit Balance date debit credit Balance

April1 20000 20000 April3 1100 1100

April2 1100 18900

April 3 Purchased dental supplies on account from Dazzle

Company $4,000.

Supplies increased(Debit) Accounts payable increased (Credit)

date Explanation Debit Credit

April 3 Supplies 4000

Accounts Payable 4000

date debit credit Balance date debit credit Balance

April3 4000 4000

April3 4000 4000

April 10 Performed dental services and billed insurance

companies $5,100.

Service Revenues Increased (Credit)

Accounts Receivable increased (debit)

date Explanation Debit Credit

April 10 Accounts Receivable 5100

Service Revenues 5100

date debit credit Balance date debit credit Balance

April10 5100 5100 April10 5100 5100

April 11 Received $1,000 cash advance from Leah Mataruka for

an implant.

Cash increased ( Debit)

Unearned Service Revenues increased (Credit)

date Explanation Debit Credit

April 10 Cash 1000

Unearned Service Revenue 1000

date debit credit Balance date debit credit Balance

April1 20000 20000 April11 1000 1000

April2 1100 18900

April11 1000 19900

April 20 Received $2,100 cash for services performed

from Michael Santos.

Cash increased (Debit)

Service Revenue increased (Credit)

date Explanation Debit Credit

April20 Cash 2100

Service Revenue 2100

date debit credit Balance

date debit credit Balance

April1 20000 20000

April10 5100 5100

April2 1100 18900

April20 2100 7200

April11 1000 19900

April20 2100 22000

April 30 Paid secretary-receptionist for the month $2,800.

Cash decreased (Credit)

Salaries Expense increased (Debit)

date Explanation Debit Credit

April 30 Salaries Expense 2800

Cash 2800

date debit credit Balance date debit credit Balance

April1 20000 20000 April30 2800 2800

April2 1100 18900

April11 1000 19900

April20 2100 22000

April30 2800 19200

April 30 Paid $2,400 to Dazzle for accounts payable due.

Cash decreased (Credit) Accounts Payable Decreased (Debit)

date Explanation Debit Credit

April30 Accounts payable 2400

Cash 2400

date debit credit Balance date debit credit Balance

April1 20000 20000 April3 4000 4000

April2 1100 18900 April30 2400 1600

April11 1000 19900

April20 2100 22000

April30 2800 19200

April30 2400 16800

Cash Accounts Payable

date debit credit Balance date debit credit Balance

April1 20000 20000 April3 4000 4000

April2 1100 18900 April30 2400 1600

April11 1000 19900

Unarned Service Revenue

April20 2100 22000

date debit credit Balance

April30 2800 19200

April11 1000 1000

April30 2400 16800

Owner’s Capital

Supplies

date debit credit Balance

date debit credit Balance

April1 20000 20000

April3 4000 4000

Rent Expense

Accounts Receivable

date debit credit Balance

date debit credit Balance

April3 1100 1100

April10 5100 5100

Salaries Expense

Service Revenue

date debit credit Balance

date debit credit Balance

April30 2800 2800

April10 5100 5100

April20 2100 7200

BRIDGETTE KEYES, DENTIST

Trial Balance

April 30, 2014

Explanation Debit Credit

Cash 16800

Accounts receivable 5100

Supplies 4000

Accounts Payable 1600

Unearned Service Revenue 1000

Owner’s Capital 20000

Service Revenue 7200

Salaries & Wages Expense 2800

Rent Expense 1100

29800 29800

You might also like

- Computerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionNo ratings yet

- Wells Fargo Wiring InstructionsDocument2 pagesWells Fargo Wiring InstructionsHosein Kerdar100% (2)

- Month Sales (Credit) Purchase (Credit) Wages Manufacturing Expenses Administrative Expenses Selling ExpensesDocument3 pagesMonth Sales (Credit) Purchase (Credit) Wages Manufacturing Expenses Administrative Expenses Selling Expensesaishwarya raikar100% (2)

- A Project Report On Bharti-AXA Life Insurance Co.Document66 pagesA Project Report On Bharti-AXA Life Insurance Co.sushobhanbirtia85% (20)

- Heidi Jara Opened Jara's Cleaning Service On July 1, 2014. During July, The Following Transactions Were CompletedDocument6 pagesHeidi Jara Opened Jara's Cleaning Service On July 1, 2014. During July, The Following Transactions Were Completedlaale dijaan100% (1)

- 1 Kyc PDFDocument70 pages1 Kyc PDFMallikaNo ratings yet

- Tugas P2-1A Dan P2-2A Peng - AkuntansiDocument5 pagesTugas P2-1A Dan P2-2A Peng - AkuntansiAlche MistNo ratings yet

- Maisie Consulting Financial RecordsDocument18 pagesMaisie Consulting Financial RecordsAli Sami Ahmad Faqeeh 160021176No ratings yet

- Accounting Lecture 2Document11 pagesAccounting Lecture 2Asma SaddiqueNo ratings yet

- Assignment 2Document5 pagesAssignment 2MD. AREFIN ISLAMNo ratings yet

- ACT 201 Chapter 2 (Journal, Ledger & Trial Balance - Practice Problem Solution)Document7 pagesACT 201 Chapter 2 (Journal, Ledger & Trial Balance - Practice Problem Solution)MD SHAFIN AHMED0% (1)

- IX Accounting MidDocument9 pagesIX Accounting MidArkar.myanmar 20180% (1)

- Tugas III Irensyah PayungbuaDocument4 pagesTugas III Irensyah PayungbuaWilliam MangumbanNo ratings yet

- Trial Balance SolutionDocument4 pagesTrial Balance SolutionUppertuition FridayNo ratings yet

- AccountDocument4 pagesAccountCarlos AlphonceNo ratings yet

- ACC101 Su20 HuyenDTT GroupAssignment Group3Document40 pagesACC101 Su20 HuyenDTT GroupAssignment Group3An Hoài ThuNo ratings yet

- Tugas III Siti Ananda MaisyahDocument8 pagesTugas III Siti Ananda MaisyahSiti Ananda MaisyahNo ratings yet

- Jurnal 1Document8 pagesJurnal 1William MangumbanNo ratings yet

- Journal To Trial BalanceDocument19 pagesJournal To Trial BalanceIrfan Ul HaqNo ratings yet

- Pembahasan Contoh Soal Matrikulasi Day 2Document5 pagesPembahasan Contoh Soal Matrikulasi Day 2valdaNo ratings yet

- Accounting Assignment P4-5A: Anya's Cleaning ServiceDocument10 pagesAccounting Assignment P4-5A: Anya's Cleaning ServiceTamzid Islam0% (1)

- HW CH2Document3 pagesHW CH2Hà HoàngNo ratings yet

- assignmentDocument7 pagesassignmentangelnayera7No ratings yet

- BASIC ACCOUNTING PRINCIPLESDocument28 pagesBASIC ACCOUNTING PRINCIPLEStanvir ahmedNo ratings yet

- (Financial Accounting) : Assignment TitleDocument11 pages(Financial Accounting) : Assignment TitleRandy KyawNo ratings yet

- Major Assignment - Act 201 - Sec 20Document15 pagesMajor Assignment - Act 201 - Sec 20Nishat FarhatNo ratings yet

- ACC136_MODULE_GUIDE_-_CopyDocument36 pagesACC136_MODULE_GUIDE_-_Copymcskelta8No ratings yet

- Fabm1 Q2 PPT W2Document24 pagesFabm1 Q2 PPT W2esmeraylunaaaNo ratings yet

- Accounting Books - Journal and LedgerDocument10 pagesAccounting Books - Journal and LedgerPerlas Flordeliza100% (1)

- BT kế toán quốc tếDocument58 pagesBT kế toán quốc tếUyên Nguyễn Hoàng ThanhNo ratings yet

- Accounting Process T-AccountsDocument115 pagesAccounting Process T-AccountsLê NaNo ratings yet

- Ke Toan Quoc Te Excel Bai TapDocument111 pagesKe Toan Quoc Te Excel Bai TapLê NaNo ratings yet

- AccountingDocument21 pagesAccountingReana ReyesNo ratings yet

- Chapter 2 Practice KEYDocument17 pagesChapter 2 Practice KEYmartinmuebejayiNo ratings yet

- Pengantar Akuntansi I - Jurnal Umum dan Buku BesarDocument5 pagesPengantar Akuntansi I - Jurnal Umum dan Buku Besarsinta agnesNo ratings yet

- Revenues Journal: Date 2020 Invoice No. Service Revenues Credit Accounts Receivable DebitDocument10 pagesRevenues Journal: Date 2020 Invoice No. Service Revenues Credit Accounts Receivable DebitEzekiel LapitanNo ratings yet

- Principles of Accounting1Document5 pagesPrinciples of Accounting1johnny80% (5)

- FAR Assignment 4Document10 pagesFAR Assignment 4Rumani ChakrabortyNo ratings yet

- JURNAL AM TARIKH Urus NiagaDocument16 pagesJURNAL AM TARIKH Urus Niagasiti maisarah bt razaliNo ratings yet

- Exercise 3-1Document4 pagesExercise 3-1Soo Tong JiangNo ratings yet

- Form Latihan Bab 2 Dan 3Document10 pagesForm Latihan Bab 2 Dan 3Gogo LinaNo ratings yet

- Example - From The Following Forecasts of Income and Expenditure, Prepare A Cash Budget For The Months Jan. To April 2011Document1 pageExample - From The Following Forecasts of Income and Expenditure, Prepare A Cash Budget For The Months Jan. To April 2011narunsankarNo ratings yet

- ACT Assignment FullDocument16 pagesACT Assignment Fullsadif sayeed100% (3)

- Technology Consultants Adjusted Trial BalanceDocument13 pagesTechnology Consultants Adjusted Trial BalanceNguyen Huong Huyen (K15 HL)100% (1)

- Accounting principles trial balanceDocument28 pagesAccounting principles trial balanceqasimtenNo ratings yet

- Balancing of Accounts SolutionDocument3 pagesBalancing of Accounts SolutionRoshan RamkhalawonNo ratings yet

- Problem P2 2ADocument2 pagesProblem P2 2ASHAMSUN NAHARNo ratings yet

- AIDocument13 pagesAIAi TanahashiNo ratings yet

- Name Roll No Program: Hamza Iqbal 2021-25-0001 Financial ManagementDocument9 pagesName Roll No Program: Hamza Iqbal 2021-25-0001 Financial ManagementHamza IqbalNo ratings yet

- MockDocument2 pagesMockfa6613323No ratings yet

- Cover Page: Name: ID: SubjectDocument6 pagesCover Page: Name: ID: SubjectMuhammad Yaseen LakhaNo ratings yet

- ACCN04B Module 1 - Review of The Accounting Cycle 1Document5 pagesACCN04B Module 1 - Review of The Accounting Cycle 1dumpwey1No ratings yet

- Tutorial 1. FA2Document11 pagesTutorial 1. FA2bolaemil20No ratings yet

- ABC Supermarket Accounting DataDocument7 pagesABC Supermarket Accounting Datawaweru karanjaNo ratings yet

- Requirement 1 2 3: ACCT500: Course ProjectDocument18 pagesRequirement 1 2 3: ACCT500: Course Projectsuruth242No ratings yet

- Anna Car Repair Shop Trial BalanceDocument16 pagesAnna Car Repair Shop Trial BalanceSurmaNo ratings yet

- Abdulla YounisDocument4 pagesAbdulla Younisashwani singhaniaNo ratings yet

- Revision ch1&2 1thDocument23 pagesRevision ch1&2 1thYousefNo ratings yet

- Accounting P2 TR2 2021Document12 pagesAccounting P2 TR2 2021Jinan MahmudNo ratings yet

- Tugas FA 1 (Lee Chang)Document16 pagesTugas FA 1 (Lee Chang)Handy Nugraha100% (4)

- General Journal: Date Account Titles and Explanation CreditDocument4 pagesGeneral Journal: Date Account Titles and Explanation CreditHarriane Mae GonzalesNo ratings yet

- General journal entriesDocument12 pagesGeneral journal entriesFerris126GTNo ratings yet

- Homework 1 and Its SolutionsDocument5 pagesHomework 1 and Its SolutionsBassam AlyeserNo ratings yet

- Ch2 - Exercises PDFDocument54 pagesCh2 - Exercises PDFBassam AlyeserNo ratings yet

- Prepared by Coby Harmon University of California, Santa Barbara Westmont CollegeDocument39 pagesPrepared by Coby Harmon University of California, Santa Barbara Westmont CollegeMahdi MohammedNo ratings yet

- CH 01Document50 pagesCH 01api-282719837No ratings yet

- Vodafone Payment ReceiptDocument1 pageVodafone Payment ReceiptRahul ManwatkarNo ratings yet

- Chapter One 1.1 Background To The StudyDocument50 pagesChapter One 1.1 Background To The StudyMahamood OlaideNo ratings yet

- A Study On The Performance of Meghalaya Cooperative Apex BankDocument4 pagesA Study On The Performance of Meghalaya Cooperative Apex Bankhunrisha nongdharNo ratings yet

- Legal Opinion on 14.85 Acre PropertyDocument9 pagesLegal Opinion on 14.85 Acre PropertyBRINDANo ratings yet

- Arima Kousei QuizDocument2 pagesArima Kousei QuizKen Alob100% (1)

- McGuire Vs Province of Samar, GR L-8155, Oct. 23, 1956 CaseDocument2 pagesMcGuire Vs Province of Samar, GR L-8155, Oct. 23, 1956 Casejolly verbatimNo ratings yet

- CH 10 Vocab Money and BankinggDocument3 pagesCH 10 Vocab Money and BankinggNelson OkunlolaNo ratings yet

- Key-Man InsuranceDocument3 pagesKey-Man InsuranceLee Sai KeatNo ratings yet

- P&P Planning ManagementDocument50 pagesP&P Planning ManagementAnand DubeyNo ratings yet

- N26 Mobile Bank Facts: 2.5M Customers, 800 Employees, 24 CountriesDocument1 pageN26 Mobile Bank Facts: 2.5M Customers, 800 Employees, 24 CountriesLala AmirovaNo ratings yet

- Project Report On Quality Online Banking ServicesDocument60 pagesProject Report On Quality Online Banking ServicesMrinal KalitaNo ratings yet

- Does IT Pay Off HSBC and Citi Case StudyDocument8 pagesDoes IT Pay Off HSBC and Citi Case StudyIIMnotesNo ratings yet

- Financial Innovation ProjectDocument4 pagesFinancial Innovation Projectibra100% (1)

- Kotak Multi Currency World Travel Card Application FormDocument2 pagesKotak Multi Currency World Travel Card Application FormVivek ShuklaNo ratings yet

- PF Withdrawal Form Process ChartDocument6 pagesPF Withdrawal Form Process ChartmynksharmaNo ratings yet

- Indemnity Bond With Surety - 2Document5 pagesIndemnity Bond With Surety - 2Siva Prasad Thulabandula0% (1)

- International Taxation Law: - Shaista NeeluDocument25 pagesInternational Taxation Law: - Shaista NeeluShaista KhanNo ratings yet

- ListDocument6 pagesListrafifobaid17No ratings yet

- Audit cash bank cutoff statementDocument2 pagesAudit cash bank cutoff statementPopeye AlexNo ratings yet

- CSR Arm of Metrobank GroupDocument11 pagesCSR Arm of Metrobank GroupAbigail LeronNo ratings yet

- Motor Claim Form TheftDocument2 pagesMotor Claim Form TheftSai PrasanthNo ratings yet

- Work Experience Verification TemplateDocument17 pagesWork Experience Verification TemplateUSHA RANINo ratings yet

- List of Accredited Collection Agency As of October 2021Document3 pagesList of Accredited Collection Agency As of October 2021DODJIE DIMACULANGANNo ratings yet

- Special Resolution Requirements Listed Companies PakistanDocument32 pagesSpecial Resolution Requirements Listed Companies PakistanRam IyerNo ratings yet

- Agreement for Bank Locker RentalDocument2 pagesAgreement for Bank Locker RentaldemiNo ratings yet

- ApgvbnoDocument10 pagesApgvbnoJeshiNo ratings yet

- Knowing The Score:: New Data, Underwriting, and Marketing in The Consumer Credit MarketplaceDocument34 pagesKnowing The Score:: New Data, Underwriting, and Marketing in The Consumer Credit MarketplaceSonia LópezNo ratings yet