Professional Documents

Culture Documents

Ledgers & The Trial Balance: Topic Type

Uploaded by

Sharona jack0 ratings0% found this document useful (0 votes)

7 views4 pagesThe document outlines the topics and subtopics that will be covered for the 2021 Principles of Accounts P2 exam. It includes 9 main topics that cover concepts like ledgers, the accounting cycle, books of original entry, accounting adjustments, control systems, preparation of financial statements for sole traders, accounting for different business entities, accounting for entrepreneurs, and accounting for partnerships. Each topic contains several subtopics that will be covered at either a theoretical or practical level, and includes an indication of whether each subtopic has been completed.

Original Description:

Original Title

Untitled

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document outlines the topics and subtopics that will be covered for the 2021 Principles of Accounts P2 exam. It includes 9 main topics that cover concepts like ledgers, the accounting cycle, books of original entry, accounting adjustments, control systems, preparation of financial statements for sole traders, accounting for different business entities, accounting for entrepreneurs, and accounting for partnerships. Each topic contains several subtopics that will be covered at either a theoretical or practical level, and includes an indication of whether each subtopic has been completed.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views4 pagesLedgers & The Trial Balance: Topic Type

Uploaded by

Sharona jackThe document outlines the topics and subtopics that will be covered for the 2021 Principles of Accounts P2 exam. It includes 9 main topics that cover concepts like ledgers, the accounting cycle, books of original entry, accounting adjustments, control systems, preparation of financial statements for sole traders, accounting for different business entities, accounting for entrepreneurs, and accounting for partnerships. Each topic contains several subtopics that will be covered at either a theoretical or practical level, and includes an indication of whether each subtopic has been completed.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 4

2021 PRINCIPLES OF ACCOUNTS P2 TOPICS

Topic Type Completed

1. LEDGERS & THE TRIAL BALANCE

a. Describe the different classes of accounts Theory ☐

(nominal/real/personal)

b. Identify the different types of ledgers (GL/PL/SL) Theory ☐

c. Rules for double entry (categories of accounts and Theory ☐

whether they carry debit or credit entries and

whether they are increased/decreased with

debit/credit entry)

d. Post from journals to ledgers Practical ☐

e. Balance & close off accounts Practical ☐

f. Prepare a trial balance Practical ☐

g. Outline uses/limitations of a trial balance Theory ☐

2. ACCOUNTING AS A SYSTEM ☐

a. Accounting concepts & conventions Theory ☐

b. The Accounting Cycle Theory ☐

c. Accounting features of various legal structures Theory ☐

(sole trader, including manufacturing,

partnership, company, cooperatives, non-

profits)

d. Role/impact of technology in accounting Theory ☐

e. Discuss what a statement of financial position is, Theory ☐

what it shows etc

3. BOOKS OF ORIGINAL ENTRY

a. Identify and explain the uses of the books of original Theory ☐

entry

b. Distinguish between cash/credit transactions and Theory ☐

cash/trade discounts

c. Identify source documents and say which source Theory ☐

document is used for which book of original entry

d. Complete the books of original entry from a Practical ☐

source document(s) and transfer totals to the various

accounts in the relevant ledgers

e. Prepare various source documents (invoices, Practical ☐

petty cash voucher etc)

4. ACCOUNTING ADJUSTMENTS

a. Double-entry accounts for prepaid & accrued Practical ☐

expenses & prepaid & accrued revenue and

treatment of each in the Income Statement and

Statement of Financial Position

b. Bad debts & Provision for doubtful debts Theory/practical ☐

c. Calculation of depreciation under straight line and Theory/practical ☐

reducing balance method and completion of double

entry accounts for depreciation, including transfer

to the Income Statement at the end of a financial

period

d. Capital & Revenue Expenditure Theory ☐

e. Preparing adjusted financials (to take into Practical

account prepayments, accruals, depreciation & ☐

provision for bad debts)

5. CONTROL SYSTEMS

a. Uses of control systems (need for control/uses) Theory ☐

b. Identify 3 commonly used systems of control Theory ☐

(bank reconciliation statements, control

accounts & suspense accounts)

c. Error correction (those affecting & not affecting trial Theory/Practical ☐

balance agreement, includes suspense)

d. Calculation of revised net profit statements after Practical ☐

errors are corrected

e. Update cash book and prepare bank Practical ☐

reconciliation statements

f. Prepare control accounts and use control accounts Practical ☐

to find missing figures (for example, to calculate

purchases for a period)

Completed

6. PREPARATION AND ANALYSIS OF

FINANCIAL STATEMENTS OF A SOLE

TRADER

a. Say why financial statements are prepared Theory ☐

b. Prepare an Income Statement and Statement of Practical ☐

Financial Position for a Sole Trader

c. Say what is working capital, why it is important and be Theory/practical ☐

able to identify it on a SOFP & calculate it if given

figures

d. Ratio analysis & interpretation & recommendations Practical ☐

e. Show the effect of net profit/loss on capital Practical ☐

7. ACCOUNTING FOR LIMITED

LIABILITIY COMPANIES,

COOPERATIVES & NON-PROFITS

a. Features/types of each of the above Theory ☐

b. Advantages & disadvantages of each of the above Theory ☐

c. Ways in which each of the above raises capital Theory ☐

(including shares & debentures)

d. Types of shares Theory ☐

e. Preparation of journal entries/double entry accounts to Practical ☐

issue shares & debentures

f. Calculation of dividends for ordinary and Practical ☐

preference shareholders

g. Appropriate profits based on instructions given Practical ☐

h. Prepare the final accounts of limited liability Practical ☐

companies & cooperatives (exclude non-profit final

accounts – ie no I&E / Balance Sheet but must

include Receipts & Payments account for a non-

profit)

i. Ratio analysis & interpretation & recommendations ☐

for these types of businesses/entities

8. ACCOUNTING FOR THE ENTREPRENEUR

a. List methods of payments to employees, supplies and Theory Completed

purchases of goods/services

b. Payroll – timecard, timebooks, employee earnings record Theory/practical

c. Calculate gross & net wages Practical

d. Prepare cash flow projections for a six month period Practical

e. Budgets Theory/practical

f. Business plan Theory

9. ACCOUNTING FOR PARTNERSHIPS

a. Define partnerships & state features Theory

b. Advantages & disadvantages of partnerships Theory

c. Partnership agreements Theory

d. Journal/double entry to record capital Practical

e. Prepare financial statements of a partnership, including Practical

appropriation accounts

f. Prepare current accounts of partners (columnar format Practical

preferred)

g. Interpret balances on current accounts Theory

You might also like

- Financial and Managerial Accounting The Basis For Business Decisions 18th Edition Williams Solutions ManualDocument87 pagesFinancial and Managerial Accounting The Basis For Business Decisions 18th Edition Williams Solutions ManualEmilyJonesizjgp100% (17)

- 3rd Quarter - BUS4 BlankDocument7 pages3rd Quarter - BUS4 BlankKian Barredo0% (1)

- Advanced Financial Accounting IDocument3 pagesAdvanced Financial Accounting IMaryam umarNo ratings yet

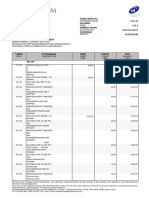

- UzAuto Motors IFRS Report FY2022Document41 pagesUzAuto Motors IFRS Report FY2022id00001875No ratings yet

- ABC CompanyDocument7 pagesABC CompanyLouise Kyla CabreraNo ratings yet

- Fin Acctg - Sample With Answers USEDDocument5 pagesFin Acctg - Sample With Answers USEDMara Shaira SiegaNo ratings yet

- Chapter 4. Accounting and Financial StatementsDocument6 pagesChapter 4. Accounting and Financial StatementsPolina Nalistia IrawanNo ratings yet

- Solution Manual For Financial and Managerial Accounting The Basis For Business Decisions 18Th Edition by Williams Haka Bettner and Carcello Isbn 125969240X 9781259692406 Full Chapter PDFDocument36 pagesSolution Manual For Financial and Managerial Accounting The Basis For Business Decisions 18Th Edition by Williams Haka Bettner and Carcello Isbn 125969240X 9781259692406 Full Chapter PDFfrances.langley893100% (12)

- Financial and Managerial Accounting The Basis For Business Decisions 18th Edition by Williams Haka Bettner and Carcello ISBN 125969240X Solution ManualDocument91 pagesFinancial and Managerial Accounting The Basis For Business Decisions 18th Edition by Williams Haka Bettner and Carcello ISBN 125969240X Solution Manuallaurel100% (28)

- Financial Accounting 17th Edition by Williams ISBN Solution ManualDocument90 pagesFinancial Accounting 17th Edition by Williams ISBN Solution Manualjames100% (25)

- Exam 1 Learning ObjectivesDocument4 pagesExam 1 Learning ObjectivesYingfanNo ratings yet

- Part II Insight Sept 2017Document108 pagesPart II Insight Sept 2017rowan betNo ratings yet

- Acctg 111 - TPDocument4 pagesAcctg 111 - TPElizabeth Espinosa ManilagNo ratings yet

- Chapter 1 Introduction To AccountingDocument4 pagesChapter 1 Introduction To AccountingErica mae BodosoNo ratings yet

- Diagnostic Test FAR (No Answers)Document4 pagesDiagnostic Test FAR (No Answers)David GonzalesNo ratings yet

- ABMFABM1 q3 Mod2 Accounting-Guidelines v2Document15 pagesABMFABM1 q3 Mod2 Accounting-Guidelines v2Eduardo john DolosoNo ratings yet

- Accounting What The Numbers Mean 10th Edition Marshall Solutions ManualDocument25 pagesAccounting What The Numbers Mean 10th Edition Marshall Solutions ManualEricHowardftzs100% (54)

- Principlesof Accounts Curriculum Guide Grade 10Document8 pagesPrinciplesof Accounts Curriculum Guide Grade 10Talliah shenejvaNo ratings yet

- Dwnload Full Financial Accounting 17th Edition Williams Solutions Manual PDFDocument35 pagesDwnload Full Financial Accounting 17th Edition Williams Solutions Manual PDFmargrave.mackinaw.2121r100% (13)

- Audit Program For EquityDocument12 pagesAudit Program For EquityIra Jean DaganzoNo ratings yet

- FMAALearningOutcomeStatements DewDocument9 pagesFMAALearningOutcomeStatements Dewbahaasaffarino9No ratings yet

- Review For Final - Comprehensive and CHPT 11-1Document4 pagesReview For Final - Comprehensive and CHPT 11-1ARHistoryHubNo ratings yet

- Review of The Accounting ProcessDocument5 pagesReview of The Accounting Processrufamaegarcia07No ratings yet

- Qualifying Reviewer Questions CFASDocument9 pagesQualifying Reviewer Questions CFASReinalyn Larisma MendozaNo ratings yet

- Solution Manual For Financial and Managerial Accounting The Basis For Business Decisions 18Th Edition by Williams Haka Bettner A Full Chapter PDFDocument36 pagesSolution Manual For Financial and Managerial Accounting The Basis For Business Decisions 18Th Edition by Williams Haka Bettner A Full Chapter PDFfrances.langley893100% (11)

- Website PCPA LandingPage 8.0 LowDocument1 pageWebsite PCPA LandingPage 8.0 LowMaxwell JohnNo ratings yet

- CFAS - Prelims Exam With AnsDocument12 pagesCFAS - Prelims Exam With AnsAbarilles, Sherinah Mae P.No ratings yet

- Accounting ExamDocument31 pagesAccounting ExamPrincess Kaye PitogoNo ratings yet

- Accounting Cycle Part I TheoriesDocument3 pagesAccounting Cycle Part I TheoriesHeeseung Lee100% (1)

- Midterm - Financial Acctg & Reporting First Sem (Sy2021 2022) BDocument6 pagesMidterm - Financial Acctg & Reporting First Sem (Sy2021 2022) BLENNETH MONESNo ratings yet

- Exam NoDocument17 pagesExam NoAzzia Morante LopezNo ratings yet

- Acc 101 PDFDocument6 pagesAcc 101 PDFalizaNo ratings yet

- Philippine School of Business Administration: Cpa ReviewDocument9 pagesPhilippine School of Business Administration: Cpa ReviewLeisleiRagoNo ratings yet

- Business Standards: Committee MembersDocument17 pagesBusiness Standards: Committee MembersBhavesh AgrawalNo ratings yet

- Chapter 4 - PUTERI AMALIA - 2010313320025Document6 pagesChapter 4 - PUTERI AMALIA - 2010313320025putri amaliaNo ratings yet

- Final Exam Enhanced 1 1Document8 pagesFinal Exam Enhanced 1 1Villanueva Rosemarie100% (1)

- Financial Accounting and Reporting-Preliminary ExamDocument7 pagesFinancial Accounting and Reporting-Preliminary Examromark lopezNo ratings yet

- 02 Accounting Process (Student)Document31 pages02 Accounting Process (Student)Christina DulayNo ratings yet

- Financial ManagementDocument3 pagesFinancial ManagementJullie Anne LlagasNo ratings yet

- 1) Match The Type of Accounting With The Skills RequiredDocument3 pages1) Match The Type of Accounting With The Skills RequiredThảo NhiNo ratings yet

- 5769 - Toa Test Bank 74Document12 pages5769 - Toa Test Bank 74Rod Lester de GuzmanNo ratings yet

- Bookkeeping and Basic Accounting For Non AccountantsDocument2 pagesBookkeeping and Basic Accounting For Non Accountantsmelanie sorianoNo ratings yet

- ISC AccountsDocument17 pagesISC AccountsAneek KumarNo ratings yet

- 1.1 Conceptual Framework (Student Guide)Document19 pages1.1 Conceptual Framework (Student Guide)Nikka Hazel MendozaNo ratings yet

- EntrepreneurshipDocument12 pagesEntrepreneurshipjhonnyNo ratings yet

- Learning Outcome StatementsDocument24 pagesLearning Outcome Statementsestihdaf استهدافNo ratings yet

- Jose Maria College College of Business Education: Name: - Date: - Instructor: John Paul S. Tan, Cpa, MDM, CatpDocument7 pagesJose Maria College College of Business Education: Name: - Date: - Instructor: John Paul S. Tan, Cpa, MDM, CatpAngelica CastilloNo ratings yet

- Ta WP CebuDocument48 pagesTa WP CebuPatricia ByunNo ratings yet

- Theory of Accounts With AnswersDocument14 pagesTheory of Accounts With Answersralphalonzo100% (1)

- Fabm Summative 2Document3 pagesFabm Summative 2jelay agresorNo ratings yet

- Accounting Theories ReviewerDocument2 pagesAccounting Theories ReviewerAkemiNo ratings yet

- Exercises/Assignments: 1. A. B. C. D. 2. A. B. C. D. 3. B. C. D. 4. A. B. C. D. 5. A. B. C. DDocument6 pagesExercises/Assignments: 1. A. B. C. D. 2. A. B. C. D. 3. B. C. D. 4. A. B. C. D. 5. A. B. C. DBryantNo ratings yet

- Business Math 9: Department of Education SPTVEDocument10 pagesBusiness Math 9: Department of Education SPTVESunday MochicanaNo ratings yet

- Principles of Financial Accounting PDFDocument5 pagesPrinciples of Financial Accounting PDFJia SNo ratings yet

- Test Bank Financial Accounting and Reporting TheoryDocument58 pagesTest Bank Financial Accounting and Reporting TheoryAngelie De LeonNo ratings yet

- Fabm1 Completing The Accounting CycleDocument16 pagesFabm1 Completing The Accounting CycleVenice100% (1)

- Module For Fundamentals of AccountingDocument9 pagesModule For Fundamentals of AccountingJohn Rey Bantay Rodriguez50% (2)

- DocxDocument7 pagesDocxPearl Jade YecyecNo ratings yet

- A Level Paper 1 TheoryDocument4 pagesA Level Paper 1 TheoryMinhaz AhmedNo ratings yet

- The Entrepreneur’S Dictionary of Business and Financial TermsFrom EverandThe Entrepreneur’S Dictionary of Business and Financial TermsNo ratings yet

- Bookkeeping And Accountancy Made Simple: For Owner Managed Businesses, Students And Young EntrepreneursFrom EverandBookkeeping And Accountancy Made Simple: For Owner Managed Businesses, Students And Young EntrepreneursNo ratings yet

- UntitledDocument1 pageUntitledSharona jackNo ratings yet

- 5B1 - Principles of Accounts Assignment (To Be Done in Class) Assignment Date: 14 September 2020Document1 page5B1 - Principles of Accounts Assignment (To Be Done in Class) Assignment Date: 14 September 2020Sharona jackNo ratings yet

- Data Collection SourcesDocument2 pagesData Collection SourcesSharona jackNo ratings yet

- New 2Document32 pagesNew 2Sharona jackNo ratings yet

- WeB GWUDocument11 pagesWeB GWUSharona jackNo ratings yet

- Letter To The EditorDocument1 pageLetter To The EditorSharona jackNo ratings yet

- Mob HomeworkDocument3 pagesMob HomeworkSharona jackNo ratings yet

- Names For It DatabaseDocument3 pagesNames For It DatabaseSharona jackNo ratings yet

- Web Source For Website On WixDocument13 pagesWeb Source For Website On WixSharona jackNo ratings yet

- HTML Need To KnowDocument3 pagesHTML Need To KnowSharona jackNo ratings yet

- Sample SBADocument8 pagesSample SBASharona jackNo ratings yet

- Robyn Rihanna Fenty: (Rhianna)Document3 pagesRobyn Rihanna Fenty: (Rhianna)Sharona jackNo ratings yet

- Auditing MCQs Multiple Choice Questions and Answers 2023 - Auditing MCQs For B.Com, CA, CS and CMA ExamsDocument38 pagesAuditing MCQs Multiple Choice Questions and Answers 2023 - Auditing MCQs For B.Com, CA, CS and CMA Examsvenakata3722No ratings yet

- Annual Report 2022: Credit Suisse Group AGDocument452 pagesAnnual Report 2022: Credit Suisse Group AGSubash NehruNo ratings yet

- Bank Veteran AR 2014Document60 pagesBank Veteran AR 2014Adhiyanto Puji LaksonoNo ratings yet

- Quiz 5 Problems Second Semester AY2223 With AnswersDocument4 pagesQuiz 5 Problems Second Semester AY2223 With AnswersManzano, Carl Clinton Neil D.No ratings yet

- Ifrs Unit 3Document15 pagesIfrs Unit 3Deven LadNo ratings yet

- Quiz 1 CDocument6 pagesQuiz 1 Crana ahmedNo ratings yet

- PRC-04 (ITA) Last Assignment January 2024-1Document132 pagesPRC-04 (ITA) Last Assignment January 2024-1contact.samamaNo ratings yet

- Finance ReviewerDocument4 pagesFinance ReviewerAngelo SibuloNo ratings yet

- Accounting For Non-ABM - Adjusting Entries - Module 4 AsynchronousDocument57 pagesAccounting For Non-ABM - Adjusting Entries - Module 4 AsynchronousPamela PerezNo ratings yet

- A Project Report On Study of Mutual Fund With Respect To Systematic Investment PlanDocument84 pagesA Project Report On Study of Mutual Fund With Respect To Systematic Investment PlanNeeraj BaghelNo ratings yet

- RTP Nov 2022Document139 pagesRTP Nov 2022abhichavan7722No ratings yet

- Practice For Quiz #3 Solutions For StudentsDocument10 pagesPractice For Quiz #3 Solutions For Studentssylstria.mcNo ratings yet

- Estatement-202301 20230427045057Document3 pagesEstatement-202301 20230427045057Abu SaiNo ratings yet

- AE108 FinMan C1 IntroductionDocument27 pagesAE108 FinMan C1 Introduction4qfg4pctbpNo ratings yet

- RFBT - FriaDocument2 pagesRFBT - FriaglcpaNo ratings yet

- 2023 Tutorial 1 FMADocument4 pages2023 Tutorial 1 FMAĐỗ Ngọc ÁnhNo ratings yet

- Interloop Financials 2023Document31 pagesInterloop Financials 2023Ghulam MustafaNo ratings yet

- Dragos Revnic Financial AccountingDocument17 pagesDragos Revnic Financial AccountingDragosNo ratings yet

- Corporate Law II - Course Outline 2023Document9 pagesCorporate Law II - Course Outline 2023Lalbee SNo ratings yet

- IntAcc-1 Accounting For ReceivablesDocument13 pagesIntAcc-1 Accounting For ReceivablesShekainah BNo ratings yet

- Topic 2 Bonds Price YieldDocument52 pagesTopic 2 Bonds Price Yieldjason leeNo ratings yet

- TAN410 Quiz 1. Review Chapter 1 Chapter 2 Questions PDFDocument14 pagesTAN410 Quiz 1. Review Chapter 1 Chapter 2 Questions PDFChúc TrầnNo ratings yet

- GRP 1 Series 1 MTP CompiledDocument72 pagesGRP 1 Series 1 MTP CompiledSairamNo ratings yet

- Chapter 5 Thesis ExampleDocument12 pagesChapter 5 Thesis ExampleAure MengoNo ratings yet

- Prysor Co ExcelDocument4 pagesPrysor Co Excelsanjay gautamNo ratings yet

- Organizational Health IndexDocument21 pagesOrganizational Health IndexSukamto PrasetyoNo ratings yet

- Capital Structure Theory1Document9 pagesCapital Structure Theory1Kamba RumbidzaiNo ratings yet

- South Western Federal Taxation 2019 Corporations Partnerships Estates and Trusts 42nd Edition Raabe Test BankDocument38 pagesSouth Western Federal Taxation 2019 Corporations Partnerships Estates and Trusts 42nd Edition Raabe Test Bankmateosowhite100% (16)