Professional Documents

Culture Documents

Audit 2-Of-Ppe PDF

Audit 2-Of-Ppe PDF

Uploaded by

Shaz Naga0 ratings0% found this document useful (0 votes)

24 views6 pagesOriginal Title

AUDIT 2-OF-PPE.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

24 views6 pagesAudit 2-Of-Ppe PDF

Audit 2-Of-Ppe PDF

Uploaded by

Shaz NagaCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 6

AUDIT OF PROPERTY, PLANT, AND EQUIPMENT PAS 16 AUDIT OBJECTIVES IN AUDITING PPE

INTRODUCTION ASSERTIONS AUDIT OBJECTIVES

Existence All recorded PPE on the statement

Property, plant, equipment (PPE) of financial position (including

- one of the most significant portions of an entity’s noncurrent asset assets leased under finance lease)

exist.

- tangible assets with a service life of more than one year and are used in Completeness All PPE owned and leased under

the operation of business finance lease by the entity at the

reporting date are included on the

- usually is the biggest portion in the asset statement of financial position.

Valuation and Allocation PPE is carried at the appropriate

- issue is more on its existence amount taking into account the

Initial Measurement: Cost or the amount of cash/cash equivalent paid or requirements of PAS 16, PPE and

PAS 36 Impairment of Assets.

the fair value of the other consideration given. It is measured at the cash

Rights and Obligations The entity owns, or has a legal

price equivalent at the acquisition date.

right to all PPE reported on the

Cost compromises of: statement of financial position at

the reporting date.

1. Purchase price including import duties, insurance, nonrefundable Presentation and Disclosure PPE and related income accounts

taxes, less trade disc. And rebates are properly classified, described

2. Direct cost including freight, professional fees, cost of site and disclosed in the FS, including

preparation notes, in accordance with the

3. Initial measurement of dismantlement, removal, and site applicable PFRS.

restoration costs

Liens, pledges, security interest

When planning the audit of PPE, the auditor should consider that the and restrictions to PPE are

amounts for this PPE is material to the statement if financial position and identified and properly disclosed.

expect that the account balance do not necessarily change significantly

from year to year.

PRIMARY SUBSTANTIVE TEST/ AUDIT PROCEDURES FOR PPE

The auditor normally assess control risk at the maximum level and performs

1. Obtaining a summary analysis of changes in property owned and

extensive substantive tests which emphasize the review of significant

reconcile with ledgers;

additions and disposal, and analytical procedures to test the provisions for

2. Vouching for additions and disposals (including retirements) of PPE

depreciation (estimate) and depletion.

during the year;

In conjunction with the audit of PPE, the auditors also obtain evidence about 3. Physical inspection of major acquisition of PPE during the year;

the related accounts of depreciation expense, accumulated depreciation, 4. Examining proof of ownership of PPE;

lease (rent) expense, impairment loss (if any) and repairs and maintenance 5. Analyzing lease, repair and maintenance expense accounts;

expense. Implication is on taxation purposes. 6. Testing for the accuracy and reasonableness for provision for

depreciation and depletion;

7. Investigating current and potential impairments of PPE; - After GL/SL reconciliation, vouching of additions and disposals

8. Performing analytical procedures for reasonableness of PPE and including retirements should be performed.

related expense reported in the FS; and - Vouching is one of the important substantive tests for PPE/

9. Evaluating FS presentation and disclosures for item of PPE Investment Property.

including its related revenue and expense. - Extent of vouching is dependent upon the auditor’s assessment of

control risk for the existence and valuation of PPE.

Additions : How to perform vouching for additions?

RECONCILING OF SL AND GL (Valuation & Allocation, Completeness)

1. Check any additions (by purchase)

- Make sure total of SL and GL are the same/equal, including the trial

2. Check for any construction of assets and its related costs that

balance and control account.

should be capitalized (PAS 16 -PPE and PAS 23 – Borrowing Cost)

- Before doing the detailed analysis of additions, disposals,

3. Addition from Donation

retirement or any reclassification and depreciation of PPE including

4. Generally, vouching is 100% (since this is not a voluminous

capitalized leases, ensure to tie up/ agree the general ledger transaction)

balances from subsidiary ledger balance.

- If not equal, inquire and ask client entity’s management to What documents to check?

reconcile.

1. For acquisition of property, examine the capital expenditure

The reconciliation schedule should normally include: authorization and purchase agreement, contract deeds, cancelled

checks, and other important documentation. The auditor should

1. Asset description/ asset classification

ensure all costs of acquisition are included in the PPE accounts.

2. Cost for each asset or asset classification, including the opening

2. Other additions – check the purchase orders, capital expenditure

balances at the beg. Of the year, any additions and disposals, authorization, contracts, architect’s certificates, legal

retirement and the balance at the end of the year (LAPSING

correspondence, supplier’s invoices, cancelled checks, etc.

SCHEDULE)

3. For cost incurred related to PPE (Land improvements, bldg..

3. Accumulated depreciation, showing:

improvement, major repairs), the auditor should examine the

• Beginning balance of the year; supporting invoices and check whether the acquisition represents

• Debts to acc. Dep. Due to transfers, derecognition and capital expenditures based on the capitalization policy of the entity.

reversals; 4. When it comes to land titles, make sure it is the original copy.

• Depreciated book value before the CY depreciation, if the Implications: when only photocopy is given, possibility is that the

provision is based on the declining balance; original copy is up as security or collateral.

• Depreciation or depletion rate for each asset classification 5. For PPE under construction:

• Depreciation or depletion expense for the year; and • Check that additions are properly approved and

• Balance at the end of the year authorized

• Verify the change in construction in progress (CIP)

account by examining contractor’s progress billings labor

EXAMINATION OF ADDITIONS/DISPOSALS (INCLUDING RETIREMENTS) changes, and other important documents.

(Existence/Occurrence (Income Statement account), Valuation and Rights)

• Check that all costs incurred up to the reporting date and 2. For new additions, determine the status of old asset whether this

any withholding payments have been properly recorded represent a replacement of old asset.

(ex. Amount withheld from payments to contractors 3. When verifying PPE acquisitions, check for any trade-in-credits

pending satisfactory complerion of construction). received and then check that the related assets trade-ins are

• Test calculation of capitalized borrowing cost (interest, recorded in the disposals for the year.

appropriate rate, amounts and capitalization periods have 4. Analyze miscellaneous revenue account for cash proceeds from

been used, and whether these are in accordance with the sale of PPE.

entity’s capitalization policy). 5. If company’s product lines are discontinued, investigate disposition

• Review and calculate the allocation of overhead charges of plant facilities.

attributable to construction. 6. Consider whether property exists for all property taxes paid, and, if

• Compare the total cost of self-constructed equipment not, determine whether the property was sold and included in the

with bids or estimated purchase prices for similar disposals for the year;

equipment from outside supplier, savings on construction 7. Examine retirement work orders or other source documents for

should not be recognized; and proper authorization; and

• Trace transfer from the CIP account to the PPE observing 8. Investigate any reduction in insurance coverage as this may

propriety of classification indicate retirement if PPE.

6. For assets leased under finance lease, the auditor should ensure

the capitalized amount is in accordance with PFRS 16. Leases by

performing the following: PHYSICAL INSPECTION OF MAJOR ADDITIONS OF PPE (Existence and

• Obtain a copy of the lease contract and examine the terms Completeness)

to verify that the lease meets the criteria of finance lease;

- Ocular inspection

• Recompute the PV of the minimum lease payments;

- The # of PPE that needs to be inspected will depend on a. risk of

• Review the FV of the assets leased; and

material misstatement b. number of PPE in consideration

• Check whether the capitalized value is the lower of the FV

- How to perform? (same as inventory)

of the leased asset and the PV of the minimum lease

a. Floor-to-list procedure (completeness)

payments.

b. List-to-floor procedure (existence and condition of property if

Disposal/ Retirement Examination nonfunctioning or fully depreciated)

The main purpose of checking any disposal/retirement of PPE is to

determine whether any PPE has been replaced, sold, dismantled,

EXAMINE EVIDENCE OF LEGAL OWNERSHIP OF PPE (Rights and Obligations)

abandoned without such being reflected in the accounting records.

- Check the proof of ownership such as:

The auditor typically includes the following procedures to discover

1. Deeds or property, land/lot title (real estate)

unrecorded retirements or disposals: (Completeness)

2. Vehicle registration documents

1. Inquire of executives and supervisors of PPE retirements of - The auditor should also inquire with the management of any

disposals during the year; restriction on this item of PPE as they may be used as collateral for

a loan.

ANALYZE LEASE, REPAIR & MAINTENANCE EXPENSE ACCOUNTS (Valuation c. Perform independent recalculation

& Allocation, Completeness and Classification) d. Compare credits to accumulated depreciation for the year with

the debits to depreciation expense.

- This procedure is to ensure that all capital expenditure should have

4. Trace deductions from accumulated depreciation for assets retired.

not been included in the expense accounts. a. Trace deductions to the working paper analyzing retirements

- Lease expense: check the terms of the lease contract (operating

of assets during the year; and

lease)

b. Test accuracy of accumulated depreciation to date of

- Repairs & Maintenance expense: check the written policy

retirement.

regarding capitalization of capital expenditures.

5. Perform analytical procedures

a. Compute the ratio of depreciation expense to total cost of PPE

compare with prior years;

TEST THE PROVISION FOR DEPRECIATION OR DEPLETION (Valuation & b. Compare the % relationships between accumulated

Allocation, Accuracy) depreciation and the related property accounts with those in

prior years.

- Depreciation/depletion re examples of accounting estimate and

c. Inquire with management any significant variations from the

PSA 540 (revised and redrafted) requires that in evaluating

normal depreciation.

accounting estimates, auditors first obtain an understanding of

client’s process and controls in developing accounting estimates. EXAMINE IMPAIRMENTS OF PPE (Valuation & Allocation)

- In auditing depreciation/depletion, the auditor’s objective is to

obtain sufficient appropriate audit evidence about whether: - PAS 36 requires that an entity should review assets for

1. Depreciation/depletion are reasonable impairment whenever events or changes in circumstances indicate

2. Related disclosures are adequate that carrying amount may not be recoverable.

How to audit? - Management should recognize impairment loss if the CA of PPE is

more than its recoverable amount.

1. Review the company manuals discussing the depreciation policy.

2. Obtain or prepare a summary of analysis of accumulated How to perform?

depreciation.

1. Evaluate the appropriateness of the valuation model and

a. Compare the beginning balances with the audited amounts in

assumptions used;

last year’s working papers; and

2. Assess the reasonableness of management’s estimates; and

b. Determine the totals of accumulated depreciation recorded in

3. Evaluate the accuracy, completeness and the relevance of the

the SL of PPE agrees with the GL recorded. important data on which the estimates or measurements are based.

3. Test the provision for depreciation

a. Assess the reasonableness of the depreciation methods and

rates by comparing it from last year and investigate any

PERFORM ANALYTICAL PROCEDURES (Existence/Occurrence, Rights &

material difference.

Obligations, Completeness, Valuation and Allocation)

b. For assets acquired or disposed during the year, check whether

depreciation was provided based on the accounting policy of

the company.

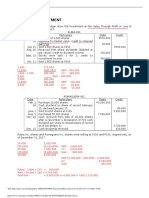

How to perform? SUMMARY OF AUDIT PROCEDURES CALSSIFIES PER ASSERTION

1. Ratio Analysis ASSERTION CATEGORY PRIMARY AUDIT PROCEDURES

a. Total cost of PPE divided by annual output in pesos, pounds or Existence or Occurrence • Reconciling of general ledger with

other units; subledger

b. Total cost of PPE divided by cost of goods sols; • Examination of additions and

c. Total depreciation expense divided by total cost of PPE disposals

2. Trend Analysis • Physical inspection of major

a. Comparison of repairs and maintenance expense on a monthly additions of PPE

basis and from year to year; • Perform analytical procedures for

b. Comparison of acquisition for the CY with PY PPE and its related accounts (lease

expense, depreciation expense,

c. Comparison of retirements for the CY with PY

accumulated depreciation, repairs

and maintenance, property taxes

and property insurance.)

EVALUATE THE FS PRESENTATION AND DISCLOSURE (Presentation and Completeness • Reconciliation of GL w SL

Disclosure) • Physical inspection of major

acquisition of PPE

- Under PAS 16, the following each class of PPE should disclose the following:

• Analysis of lease, repair and

1. Basis for measuring carrying amount; maintenance account

• Perform analytical procedures for

2. Depreciation method used; reasonableness of PPE and related

expense reported in the FS

3. Useful lives or depreciation rates used; Valuation and Allocation • Examination of additions and

4. Gross carrying amount and accumulated depreciation and disposals including retirements

• Analysis of lease, repair and

impairment losses at the beginning and end of the period

maintenance account

5. restrictions on title • Test of provision for depreciation or

depletion

- The auditor should also be satisfied that any revaluation surplus should be • Examination of PPE

properly presented as part of “Other Comprehensive Income” in the • Perform analytical procedures for

statement of comprehensive income. reasonableness of PPE and related

expense reported in the FS

- Items of PPE are presented as non-current asset in a line item in the SFP as Rights and Obligations • Examination of additions and

“Property, Plant, and Equipment.” disposals including retirements

• Examination of proof of ownership

of PPE

Presentation and • Evaluate FS presentation and

Disclosure disclosures for PPE and relates

revenue and expense account.

Classification • Analysis of lease, repair and

maintenance account

Accuracy • Test of provision for depreciation or

depletion

You might also like

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5807)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (346)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Audit 2, AEC-64 AUDIT PPEDocument5 pagesAudit 2, AEC-64 AUDIT PPEShaz NagaNo ratings yet

- Audit 2, PENSION-EQUITY-INVESTMENT-LONG-QUIZDocument3 pagesAudit 2, PENSION-EQUITY-INVESTMENT-LONG-QUIZShaz NagaNo ratings yet

- Audit 2, Copy of CHAPTER 7Document36 pagesAudit 2, Copy of CHAPTER 7Shaz NagaNo ratings yet

- Audit 2, Investment Property RoqueDocument56 pagesAudit 2, Investment Property RoqueShaz NagaNo ratings yet

- Audit 2, AUDIT - OF - INVESTMENT - Problem - 2Document2 pagesAudit 2, AUDIT - OF - INVESTMENT - Problem - 2Shaz NagaNo ratings yet

- Conso FS Sdoa - DiscussionDocument10 pagesConso FS Sdoa - DiscussionShaz NagaNo ratings yet

- WP LQDocument5 pagesWP LQShaz NagaNo ratings yet

- Dissolution and LiquidationDocument4 pagesDissolution and LiquidationShaz NagaNo ratings yet

- Construction Contracts ExercisesDocument4 pagesConstruction Contracts ExercisesShaz NagaNo ratings yet

- NCM 111 Rle Bliock e Surgical Group Adherence To Measles Vaccine Chapter 1Document36 pagesNCM 111 Rle Bliock e Surgical Group Adherence To Measles Vaccine Chapter 1Shaz NagaNo ratings yet

- Quiz Chapter-2 Partnership-Operations 2020-EditionDocument7 pagesQuiz Chapter-2 Partnership-Operations 2020-EditionShaz NagaNo ratings yet

- PartnershipDocument10 pagesPartnershipShaz NagaNo ratings yet

- BusCom Practice SetsDocument20 pagesBusCom Practice SetsShaz NagaNo ratings yet

- Assignment 1 FluidDocument3 pagesAssignment 1 FluidShaz NagaNo ratings yet

- Accounting For Corporate LiquidationDocument8 pagesAccounting For Corporate LiquidationShaz NagaNo ratings yet

- AEC12 - Lazarte Learning LogDocument61 pagesAEC12 - Lazarte Learning LogShaz NagaNo ratings yet

- Dissolution and Liquidation Sample ProblemsDocument5 pagesDissolution and Liquidation Sample ProblemsShaz NagaNo ratings yet