Professional Documents

Culture Documents

ICAN B4 PM Mock Qs 2019

Uploaded by

Prof. OBESEOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ICAN B4 PM Mock Qs 2019

Uploaded by

Prof. OBESECopyright:

Available Formats

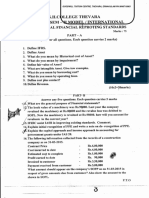

SKILLS LEVEL EXAMINATION

2019

Mock Exam

(3 hours)

Performance Management

1. This paper consists of SIX written test questions of which you must answer

FOUR questions in total.

Section A (40 marks) consists of one compulsory question

Section B (60 marks) consists of five 20-mark questions.

You must answer three questions only.

2. Ensure your candidate details are on the front of your answer booklet.

3. Answer each question in black ballpoint pen only.

4. Answers to each question must begin on a new page and must be clearly

numbered. Use both sides of the paper in your answer booklet.

5. The examiner will take account of the way in which answers are presented.

IMPORTANT Enter your candidate number in this box

Question papers contain confidential

information and must NOT be

removed from the examination hall.

DO NOT OPEN THE QUESTION

PAPER UNTIL INSTRUCTED

© Emile Woolf International The Institute of Chartered Accountants of Nigeria

Performance Management

< Blank Page >

© Emile Woolf International 1 The Institute of Chartered Accountants of Nigeria

Mock examination: Questions

Section A: 40 marks (compulsory)

Question 1

Tandem Corporation operates a delivery and passenger transporting service in

the metropolitan area. It has grown quickly since it was first established eight

years ago. It is now December 20X6.

Its main activities are the door-to-door delivery of parcels, a door-to-door

chauffeur driven taxi service and the transport of medical equipment between

clinics and other medical centres. Tandem uses the same cars for delivering

parcels and carrying people, but uses special vans for transporting medical

equipment.

The information in notes (1) to note (9) below relates to the activities of

Tandem Corporation in the year to 31 December 20X6, and planned

changes for 20X7.

(1) Tandem has a number of contract clients. These are charged a fixed rate of

₦250 for delivery of a parcel, ₦400 for carrying a passenger and ₦8,000 for

carrying medical equipment.

(2) Non-contract clients are also charged a fixed rate, but at higher rates than

for contract clients. For the year to 31 December, the prices charged to

non-contract clients were at the following premiums to the prices charged to

contract clients:

Operation Extra charge on top of contract

customer rates

Parcels 30%

People 20%

Medical equipment 40%

(3) On 1 January 20X5 Tandem negotiated a fixed price contract for the supply

of fuel for vehicles. The contract was for a three-year period ending 31

December 20X7. For the year ending 31 December 20X7, the costs of fuel

will be as follows:

(a) ₦20 per kilometre for parcels delivery and transporting people

(b) ₦30 per kilometre for the delivery of medical equipment.

(4) Each vehicle operated by Tandem operates for 330 days each year.

(5) All employees were paid an annual salary of ₦120,000 for the year to 31

December 20X6.

(6) Operating costs, excluding fuel and salaries were ₦5,000,000 in the year to

31 December 20X6.

(7) The finance director has estimated that salaries and operating costs, with

the exception of fuel costs, will increase by 3% in the year to 31 December

20X7.

(8) The directors have agreed that all fees and charges should be increased by

4% from 1 January 20X7. No increase in sales volumes is expected,

compared with 20X6.

(9) The board of directors has just completed the acquisition of Dorly

Deliveries, a partnership business that was established five years ago. The

purchase takes effect from 1 January 20X7. The main activities of Dorly

Deliveries are parcel delivery and a passenger taxi service, similar to the

activities of Tandem.

© Emile Woolf International 2 The Institute of Chartered Accountants of Nigeria

Performance Management

Other information

Table 1: Tandem

Medical

Parcels Passengers equipment

Number of deliveries 160,000 90,000 8,500

Contract customer deliveries 70% 60% 80%

Same-day deliveries 33,600 - 1,570

Next-day deliveries 126,400 - 6,930

Number of on-time deliveries 153,760 - 8,500

On-time deliveries target 98% - 98%

Number of lost items 1 - -

Table 2: Tandem vehicles and employees Tandem

Parcels and Medical

passengers equipment

Number of vehicles 35 10

Average kilometres per vehicle per day 250 200

Number of employees 40 15

No changes in these figures are planned for 20X7.

The information in notes (10) to note (15) below relatesto the activities of

Dorly Deliveries for the year to 31 December 20X6, and planned changes for

20X7.

(10) Dorly Deliveries has established a market niche in providing delivery

services for security firms and has been very successful in winning

contracts with a number of client firms. Each contract is for a fixed term of

three years. The following contracts are in existence:

Number of Annual value per

contracts contract

5 ₦500,000

5 ₦350,000

8 ₦200,000

All these contracts were renewed for a new three-year period on 1 January

20X6.

(11) In the year to 31 December 20X6, fees charged by Dorly Deliveries were

on a similar fixed price structure to Tandem’s. It will not be possible to

increase these fees in 20X7.

(12) The volume of parcel deliveries and passenger taxi services is expected to

increase by 10% in 20X7.

(13) It will not be possible to obtain fuel for Dorly Deliveries at the same prices

that Tandem has negotiated for its own operations. It is estimated that fuel

costs for Dorly’s operations will be ₦25 per kilometre for the parcels and

passenger services, and ₦40 for security equipment transport. Dorly’s

vehicles are used for 330 days each year.

(14) All employees of Dorly Deliveries will be paid the same annual salaries as

employees of Tandem Corporation.

(15) The operating expenses of Dorly Deliveries, excluding fuel and salaries, will

be ₦650,000 in 20X7.

(16) Dory employees are paid the same as Tandem employees.

© Emile Woolf International 3 The Institute of Chartered Accountants of Nigeria

Mock examination: Questions

Other information

Security

Table 3: Dorly Parcels Passengers equipment

Number of deliveries 30,000 19,000 6,500

Contract customer deliveries 25% 25% 100%

Same-day deliveries 22,500 - 6,500

Next-day deliveries 7,500 - -

Number of on-time deliveries 23,700 - 6,305

On-time deliveries target 90% - 100%

Number of lost items 32 - -

Table 4: Dorly vehicles and employees

Parcels and Medical

passengers equipment

Number of vehicles 10 10

Average kilometres per vehicle per day 120 100

Number of employees 10 12

No changes in these figures are planned for 20X7.

(17) Tandem Corporation introduced a new customer call centre in January

20X5, with the intention of speeding up responses to customer calls.

Operational statistics for the call centre are as follows:

Table 5 Tandem Dorly

Number of calls received 895,000 302,000

Target time for answering 30 seconds 40 seconds

Number of calls answered in the target time 886,000 270,000

Number of abandoned calls - 6,100

Required

(a) Prepare the budgeted statements of profit or loss for the year to 31

December 20X7 for:

(i) Tandem Corporation

(ii) Dorly Deliveries

(iii) The two entities combined. (18 marks)

(b) Using relevant calculations where appropriate, comment on the

performance of the business operations of Tandem Corporation and Dorly

Deliveries for the year ended December 20X6 and for the year to 31

December 20X7. Your comments should include comments on the

following specific points:

(i) revenue per vehicle

(ii) vehicle utilisation

(iii) service quality. (17 marks)

(c) Suggest the main benefits that Tandem Corporation might gain from

undertaking a PEST analysis for the combined entity. (5 marks)

(Total: 40 marks)

© Emile Woolf International 4 The Institute of Chartered Accountants of Nigeria

Performance Management

Section B: 60 marks – answer three out of five questions

Question 2

Hall Sound Company manufactures digital radios. It produces two models of

radio. Model V and Model X. The two models are manufactured and assembled

in the same production facility.

The following information relates to the year ending 31 December 20X8.

(1) Unit selling prices and costs

Model V Model X

₦ per unit ₦ per unit

Sales price 40 32

Material cost 25 15

Variable production conversion costs 5 2

(2) Fixed production costs attributable to the manufacture of these two models

of radio will be ₦4,000,000 in 20X8.

(3) Expected demand for the two models:

Model V 240,000 units

Model X 300,000 units

(4) Each model is completed in the same finishing department, where there will

be 70,000 hours of available time during 20X8. Time in the finishing

department is restricted by a shortage of available equipment, which cannot

be resolved in 20X8.

The quantity of each model that can be completed in the finishing

department in one hour is as follows:

Model V 8 units

Model X 6 units

(5) Hall Sound operates a just-in-time (JIT) manufacturing system for the

manufacture of the radios, and its policy is to hold minimum quantities of

work-in-progress and finished goods. There are no inventories of finished

goods at the beginning of the year.

Required

(a) Using marginal costing, calculate the quantities of each model of radio that

should be produced and sold in 20X8 in order to maximise profit, and state

the amount of that profit. (6 marks)

(b) Calculate the throughput accounting ratio for each model of radio. Explain

briefly how the throughput accounting ratio indicates whether it is worth

making a product, assuming that throughput accounting principles are

applied. You should assume that the variable production conversion costs

in your answer in part (a), amounting to ₦1,400,000, are fixed costs in the

short term. (5 marks)

(c) Using throughput accounting, calculate the quantities of each model of

radio that should be produced and sold in 20X8 in order to maximise profit,

and state the amount of that profit. (5 marks)

(d) Describe two aspects in which the concept of ‘contribution’ in marginal

costing differs from the concepts used in throughput accounting. (4 marks)

(Total: 20 marks)

© Emile Woolf International 5 The Institute of Chartered Accountants of Nigeria

Mock examination: Questions

Question 3

Slab Processes manufactures a single product. The product is manufactured in a

single process, by combining three raw materials, A, B and C.

For Year 6, the standard cost of a litre of the product was established in the

budget as follows:

Material Quantity Price per Standard cost

litre

litres ₦ ₦

A 0.4 2 0.8

B 0.5 4 2.0

C 0.2 8 1.6

–––– ––––

1.1 4.4

Loss in process (0.1) -

–––– ––––

Standard cost per litre of output 1.0 4.4

–––– ––––

The production management committee decided very early during the year that

the planned mix of materials was too expensive, and a decision was taken to

alter the mix. Although the formal standard cost per unit was not revised for cost

accounting purposes, it was established that a realistic cost per unit of output

should be as follows:

Material Quantity Price per Standard cost

litre

litres ₦ ₦

A 0.7 2 1.4

B 0.4 4 1.6

C 0.1 8 0.8

–––– ––––

1.2 3.8

Loss in process (0.2) -

–––– ––––

Standard cost per litre of output 1.0 3.8

–––– ––––

During one month in the year, 2,000 litres of finished product were output from

the process, and the actual direct material costs were as follows:

Material Quantity Cost

litres ₦

A 1,340 2,970

B 910 3,450

C 240 1,900

–––––

8,320

–––––

Required

(a) Calculate the material price variance and the material usage planning and

operational variances for the period. (7 marks)

(b) Analyse the operational usage variance into a materials mix and a

materials yield variance. (5 marks)

(c) Comment on the significance and usefulness of a materials mix and a

materials yield variance, for management control purposes. (4 marks)

(d) Explain the purpose of calculating planning and operational variances, and

the usefulness of this approach. (4 marks)

(Total: 20 marks)

© Emile Woolf International 6 The Institute of Chartered Accountants of Nigeria

Performance Management

Question 4

The finance director of Agbim plc is about to renegotiate the company’s overdraft

facility. The company currently has annual sales of:

Product A: 50,000 units at ₦4.50 per unit.

Product B: 60,000 units at ₦6.50 per unit.

Product C: 75,000 units at ₦3.50 per unit.

Other information is as follows:

Product A Product B Product C

Cost of sales 50% 60% 30%

Inventory conversion period (months) 1.5 2 1

Average receivables credit (months) 2.0 3 1.5

Average suppliers credit (months) 2.5 2.5 1.5

Forecast increase in sales volume 25% 20% 30%

The forecast increase in sales volume is expected to result from aggressive

marketing and not as a result of a price reduction. The costs associated with

marketing and other administrative activities are included in the average

suppliers (payables) conversion rates.

The finance director forecasts three possible scenarios. These are described

below. All variations are from the current position.

(i) The conversion rates of inventory, receivables and payables will remain

unchanged.

(ii) The conversion rates for receivables for all three products will deteriorate

by 25% because longer credit periods will have to be offered to customers

to gain the new business. The conversion rates for inventory and payables

will remain unchanged.

(iii) Much of the extra business will be gained by entering a new market of

cash-paying customers. As a result, the receivables conversion period for

all three products will improve by 25%. The conversion rate for inventory

will remain unchanged, but the rate for payables is likely to fall slightly to

2.4 months for Products A and B and to 1.2 months for Product C.

Required

(a) Calculate the net current operating assets (inventory, receivables and

payables) and the likely future requirements based on the three scenarios

presented above; (14 marks)

(b) Comment on other information which the Finance Director might require

before he renegotiates the company’s overdraft requirements. (6 marks)

(Total: 20 marks)

© Emile Woolf International 7 The Institute of Chartered Accountants of Nigeria

Mock examination: Questions

Question 5

KMP began trading three years ago, on 1 January 20X4. It specialises in the

provision of expert advice to clients, in accountancy, taxation and regulatory

compliance. It has a team of professional advisers, each specialising in one of

these three areas of advice.

KMP has a target for delivering its services to clients promptly. From the time the

client asks for advice, KMP undertakes to provide a formal report to the client

within 10 working days.

The following information relates to the financial year ended 31 December 20X6.

(1) The professional advisers are budgeted to work 220 days each year. They

charge ₦1,400 per day to new clients and ₦1,200 to established clients.

(2) As a marketing measure intended to win new business, the advisers also

give consultations to potential clients on a ‘no fee’ basis. These

consultations, which are budgeted to take one day each, are accounted for

as business development costs in the marketing budget.

(3) The professional advisers are also required to attend some ‘workshops’

with new clients who are having difficulties with implementing the advice

that they have been given by KMP. These workshops, which are also given

on a ‘no fee’ basis, are budgeted to last two days.

(4) KMP also has a help desk to provide client support. It responds to

telephone and e-mail enquiries from all new and established clients.

(5) The team of professional advisers is exactly 50. It is a policy of KMP to limit

the team to 50, regardless of the volume of demand for its services.

(6) All professional advisers are paid a salary of ₦100,000 per year. In

addition, they are entitled to share equally in an annual bonus. The bonus

is 50% of the amount by which fee income generated exceeds budget

minus the revenue foregone as a result of having to give workshops for

clients. This revenue foregone is assessed at a notional daily rate of

₦1,200 per adviser/day.

(7) Operating expenses of the business, excluding salaries of the advisers,

were ₦3,100,000 in 20X6. The budget for these expenses was ₦2,800,000.

Other information

Budget 20X6 Actual 20X6

Professional advisers, by category

Accounting 15 10

Tax 20 20

Compliance 15 20

Enquiries about seeking new advice

New clients 2,600 2,200

Established clients 4,000 3,700

Number of chargeable client days

New clients 2,600 2,750

Established clients 5,100 5,500

Average client days per job 4 4

Mix of chargeable client days

Accounting 1,155 1,650

Tax 1,540 3,300

Compliance 1,155 3,300

© Emile Woolf International 8 The Institute of Chartered Accountants of Nigeria

Performance Management

The following are actual results for each of the three years 20X4-20X6

20X4 20X5 20X6

Number of clients 160 248 347

Number of complaints from clients 50 75 95

Number of accounts in dispute 10 7 5

Support desk: % of calls resolved 86% 94% 97%

% of jobs completed within 10 days 90% 95% 98%

Average time to complete a job (days) 12.6 10.7 9.5

Chargeable client days 7,200 7,750 8,250

Number of consultations (business development) 50 100 150

Number of workshops given 110 135 165

Revenue (₦000) 8,920 9,740 ?

Net profit (₦000) 1,740 1,940 ?

Required

Using the information provided, analyse and discuss the performance of KMP for

the year to 31 December 20X6, under the following headings:

(a) financial performance and competitiveness

(b) internal efficiency

(c) external effectiveness. (Total: 20 marks)

© Emile Woolf International 9 The Institute of Chartered Accountants of Nigeria

Mock examination: Questions

Question 6

Tee Company makes and sells a product, the Green, which is nearing the end of

its life. A replacement product, Brace, has been designed and test marketed and

the company is trying to decide when to replace Green with Brace. Tee Company

only has the capability to produce one of the two products at a time.

Sales of Green are expected to be 100,000 units in the first quarter of Year 7 and

are forecast to fall after that so that each quarter’s sales will be 10% less than

those of the previous quarter. Green has a selling price of ₦14 per unit and its

contribution to sales ratio (C/S ratio) is 40%. The fixed costs of making Green in

Year 7 will be ₦200,000 per quarter.

Test market results for Brace were very good and demand for similar products is

growing rapidly. Tee Company believes that sales of Brace can be predicted by

the following equation:

Y = 80,000 + 6,000 T

Where:

Y = sales of Brace in units per quarter

T = time, measured in quarters. For the first quarter of Year 7 (that is, January

to March Year 7), T = 1; for the second quarter of Year 7, T = 2; etc

The selling price of the Brace will be ₦16 and its contribution per unit will be ₦6.

Fixed costs will increase to ₦240,000 per quarter if Green is replaced by Brace.

To avoid disruption of the production of Tee’s other products the changeover

between Green and Brace must take place on either 1 January Year 7 or 1 July

Year 7. The costs of changeover will differ depending upon which date is chosen

and the following information is available.

1 Some of the machinery used to make the Green will no longer be required

for the Brace. The written down value of this machinery will be ₦250,000 at

1 January Year 7, and ₦220,000 by 1 July Year 7. Its net realisable value

at 1 January Year 7 will be ₦140,000, but by 1 July Year 7 it will be

₦30,000.

2 Some redundancies will result from the change of products. Redundancy

payments of ₦40,000 will be made if the changeover occurs on 1 January,

but these will rise to ₦50,000 by 1 July. The five administration workers

concerned are each paid ₦20,000 per annum and will not be replaced.

Their wages are not included in the costs given in part (a).

Required

(a) Determine whether the company should continue to sell Green in Year 7 or

introduce Brace in Year 7. (7 marks)

(b) If the company were to replace Green with Brace in Year 7 recommend

whether this should be with effect from 1 January or 1 July. (Include a

schedule of relevant costs and revenues and provide explanations of your

figures). (7 marks)

© Emile Woolf International 10 The Institute of Chartered Accountants of Nigeria

Performance Management

The CEO of Tee is a non-executive director of Easy Ltd, a long-established

company which manufactures a large range of computers on a single site. Its

revenue is about ₦850 million per annum. The company has recently undergone

a major information systems change involving the following:

capital expenditure of ₦70 million over three years (the NPV will be ₦8

million)

workforce change from 900 to 650 employees

radical changes to work practices, both in the manufacturing systems (use

of CAD/CAM) and reorganisation of managerial and administrative

functions.

The CEO needs to identify and understand some indicators which can be used to

evaluate the success or otherwise of this change.

Required

Identify and explain briefly two key indicators that could be used to evaluate the

success (or otherwise) of this change. (6 marks)

(Total: 20 marks)

< End of exam paper >

© Emile Woolf International 11 The Institute of Chartered Accountants of Nigeria

You might also like

- ISO 9000 Internal Audit Checklist Clause WiseDocument26 pagesISO 9000 Internal Audit Checklist Clause Wisesajid waqas100% (1)

- ICAEW Professional Level Audit & Assurance Question & Answer Bank March 2016 To March 2020Document409 pagesICAEW Professional Level Audit & Assurance Question & Answer Bank March 2016 To March 2020Optimal Management Solution100% (2)

- Share Based Compensation Share Based Compensation: Accounting (Mapua University) Accounting (Mapua University)Document6 pagesShare Based Compensation Share Based Compensation: Accounting (Mapua University) Accounting (Mapua University)Peri Babs100% (1)

- Solution Manual For Advanced Accounting 14th Edition Joe Ben Hoyle Thomas Schaefer Timothy DoupnikDocument39 pagesSolution Manual For Advanced Accounting 14th Edition Joe Ben Hoyle Thomas Schaefer Timothy DoupnikMariaPetersonewjkf100% (79)

- Chapter Seven: Supply Chain ManagementDocument42 pagesChapter Seven: Supply Chain ManagementYaredNo ratings yet

- Nike LawsuitDocument24 pagesNike LawsuitJ RohrlichNo ratings yet

- Solution Manual For Small Business Management Launching and Growing Entrepreneurial Ventures 19th Edition Justin G LongeneckerDocument10 pagesSolution Manual For Small Business Management Launching and Growing Entrepreneurial Ventures 19th Edition Justin G LongeneckerMichelleLeoniafg100% (38)

- GAAP Graded Questions 2022Document377 pagesGAAP Graded Questions 2022Mika-eel100% (4)

- Quarter 4 Entrep Handout 2 With WW PTDocument5 pagesQuarter 4 Entrep Handout 2 With WW PTRodalyn Pang-ot100% (1)

- (Approved) Ugb163 Ia Mdist Ay2021-22Document4 pages(Approved) Ugb163 Ia Mdist Ay2021-22CannoniehNo ratings yet

- All Amounts Include VAT and Are in Zimbabwean Dollars (ZWL) Unless Otherwise StatedDocument6 pagesAll Amounts Include VAT and Are in Zimbabwean Dollars (ZWL) Unless Otherwise StatedMoses Nhlanhla MasekoNo ratings yet

- IFRS B.com SH College Model Question Paper 2017 March 2Document2 pagesIFRS B.com SH College Model Question Paper 2017 March 2Rainy GoodwillNo ratings yet

- SL - No. Annexure Page No. Annexure NoDocument7 pagesSL - No. Annexure Page No. Annexure NoNyunyu DariNo ratings yet

- Audit and Assurance: Professional Level Examination Monday 5 December 2016 (2 Hours)Document8 pagesAudit and Assurance: Professional Level Examination Monday 5 December 2016 (2 Hours)JusefNo ratings yet

- Af QP - CFSDocument4 pagesAf QP - CFSaman KumarNo ratings yet

- Tutorial AccountingDocument5 pagesTutorial AccountingMevika MerchantNo ratings yet

- Paper - 3: Cost and Management Accounting Questions Material CostDocument32 pagesPaper - 3: Cost and Management Accounting Questions Material CostNiyi SeiduNo ratings yet

- COSTINGDocument6 pagesCOSTINGriyaNo ratings yet

- Finance Inter MTP Oct 2023Document7 pagesFinance Inter MTP Oct 2023Bijay AgrawalNo ratings yet

- Fac511s - Financial Accounting 101 2nd Opp. July 2018Document6 pagesFac511s - Financial Accounting 101 2nd Opp. July 2018Anonymous 1AdS3uS5ANo ratings yet

- Final May 2019 C4Document22 pagesFinal May 2019 C4sweya juliusNo ratings yet

- ExercisesDocument11 pagesExercisesGayathri PrasathNo ratings yet

- Assignment On Analysis of Annual Report ofDocument12 pagesAssignment On Analysis of Annual Report ofdevbreezeNo ratings yet

- Case Study 1 - Fac4862 - 2022Document7 pagesCase Study 1 - Fac4862 - 2022THABO CLARENCE MohleleNo ratings yet

- Solution DEc-19 CMADocument20 pagesSolution DEc-19 CMAvertikaNo ratings yet

- Revisionary Test Paper - Intermediate - Syllabus 2012 - Jun2014: Answer CDocument62 pagesRevisionary Test Paper - Intermediate - Syllabus 2012 - Jun2014: Answer CSon DonNo ratings yet

- Costing - QuestionsDocument7 pagesCosting - Questionssinglatanmay84No ratings yet

- CA IPCC Advance Accounts Paper May 2015Document11 pagesCA IPCC Advance Accounts Paper May 2015Abhay AnandNo ratings yet

- Scmpe RTP M23Document36 pagesScmpe RTP M23govarthan1976No ratings yet

- MAF603-QUESTION TEST 2 - Dec 2018Document4 pagesMAF603-QUESTION TEST 2 - Dec 2018fareen faridNo ratings yet

- MBAP - AF101-Accounting and Finance - 10 Nov 23Document6 pagesMBAP - AF101-Accounting and Finance - 10 Nov 23aqueelahadam786No ratings yet

- Franchise and ConstructionDocument4 pagesFranchise and Constructiondiane camansagNo ratings yet

- Sraw 2013 QuestionsDocument15 pagesSraw 2013 QuestionsGuillermo Anjo NeilNo ratings yet

- Assignment - Financial ManagementDocument18 pagesAssignment - Financial ManagementSando VincentNo ratings yet

- Cama PDFDocument15 pagesCama PDFChandrikaprasdNo ratings yet

- Bcom 2 Sem Financial Accounting 2 20101139 Nov 2020Document5 pagesBcom 2 Sem Financial Accounting 2 20101139 Nov 2020Akhil AbrahamNo ratings yet

- TRUCK TRANSPOR1 - RemixDocument4 pagesTRUCK TRANSPOR1 - RemixAdvait MalvankarNo ratings yet

- ProjectDocument28 pagesProjectanam khanNo ratings yet

- Natural Cosmetics Company Applies Overhead Costs On The Basis of MachineDocument1 pageNatural Cosmetics Company Applies Overhead Costs On The Basis of MachineAmit PandeyNo ratings yet

- 8508Document10 pages8508Danyal ChaudharyNo ratings yet

- PL FM D17 ExamDocument8 pagesPL FM D17 ExamIQBAL MAHMUDNo ratings yet

- 76922bos61942 3Document9 pages76922bos61942 3nerises364No ratings yet

- Direct Tax Laws & International Taxation Mock Test Paper SeriesDocument11 pagesDirect Tax Laws & International Taxation Mock Test Paper SeriesDeepsikha maitiNo ratings yet

- Intermediate Cost Management em RTP Nov 19Document26 pagesIntermediate Cost Management em RTP Nov 19Akash TiwariNo ratings yet

- Suggested Answer - Syl12 - Jun2014 - Paper - 19 Final Examination: Suggested Answers To QuestionsDocument15 pagesSuggested Answer - Syl12 - Jun2014 - Paper - 19 Final Examination: Suggested Answers To QuestionsMdAnjum1991No ratings yet

- Bcom 5 Sem Cost Accounting 1 20100106 Feb 2020Document4 pagesBcom 5 Sem Cost Accounting 1 20100106 Feb 2020sandrabiju7510No ratings yet

- Great Zimbabwe University Faculty of CommerceDocument9 pagesGreat Zimbabwe University Faculty of CommerceTawanda Tatenda HerbertNo ratings yet

- Bcom 5 Sem Cost Accounting 1 21100106 Feb 2021Document4 pagesBcom 5 Sem Cost Accounting 1 21100106 Feb 2021sandrabiju7510No ratings yet

- TISBmpaRev1 3Document6 pagesTISBmpaRev1 3azizul mat aripNo ratings yet

- Specific Financial Reporting Ac413 May19bDocument5 pagesSpecific Financial Reporting Ac413 May19bAnishahNo ratings yet

- 55910bosintermay20 p3 cp12Document50 pages55910bosintermay20 p3 cp12Anand PandeyNo ratings yet

- Capital and Revenue ExpendituresDocument5 pagesCapital and Revenue ExpendituresALI KHANNo ratings yet

- Tutorial Solution Week 06Document4 pagesTutorial Solution Week 06itmansaigonNo ratings yet

- 73256bos559103 Inter p3Document26 pages73256bos559103 Inter p3Ajith SMNo ratings yet

- Accounting 108Document2 pagesAccounting 108Ghie RodriguezNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument0 pages© The Institute of Chartered Accountants of IndiaamitmdeshpandeNo ratings yet

- Bos 45818 P 3Document25 pagesBos 45818 P 3Sourav ChamoliNo ratings yet

- Quiz KeysDocument11 pagesQuiz KeyspragadeeshwaranNo ratings yet

- Latest SeviceDocument60 pagesLatest SeviceNaga ChandraNo ratings yet

- 4.service & Operating CostingDocument60 pages4.service & Operating CostingNaga ChandraNo ratings yet

- Service CostingDocument60 pagesService Costingpranoti tardeNo ratings yet

- Group Project On Cost Accounting: Institute of Commerce, Nirma University SEM-2Document24 pagesGroup Project On Cost Accounting: Institute of Commerce, Nirma University SEM-2Harsh PatwaNo ratings yet

- TCI ExpressDocument6 pagesTCI ExpressYash NyatiNo ratings yet

- AFW2020 S1 2011 Final ExamDocument8 pagesAFW2020 S1 2011 Final ExamVenessa YongNo ratings yet

- Doing Business With UNDP Sept 2016 FINALDocument16 pagesDoing Business With UNDP Sept 2016 FINALErrol KausimaeNo ratings yet

- Cost Accounting - 2 2020Document5 pagesCost Accounting - 2 2020Shone Philips ThomasNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Ias 36 2Document4 pagesIas 36 2Prof. OBESENo ratings yet

- Ecobank Transnational IncorporatedDocument15 pagesEcobank Transnational IncorporatedProf. OBESENo ratings yet

- Part4.pdf Nov 2013Document76 pagesPart4.pdf Nov 2013Prof. OBESENo ratings yet

- Corporate Reporting Paper 3.1 July 2023Document32 pagesCorporate Reporting Paper 3.1 July 2023Prof. OBESENo ratings yet

- Chapter - 6 Divisional Performance Measurement and ControlDocument17 pagesChapter - 6 Divisional Performance Measurement and ControlProf. OBESENo ratings yet

- ADVANCED AUDIT ASSURANCE PAPER 3 2 May2018-1Document22 pagesADVANCED AUDIT ASSURANCE PAPER 3 2 May2018-1Prof. OBESENo ratings yet

- Capitalism, Power and Innovation. Intellectual Monopoly Capitalism Uncovered by Cecilia RikapDocument56 pagesCapitalism, Power and Innovation. Intellectual Monopoly Capitalism Uncovered by Cecilia RikapLeandro Módolo PaschoalotteNo ratings yet

- A Comparative Study On Customer Satisfaction at Airtel Digital TV and Dish TV DTH Service ProvidersDocument7 pagesA Comparative Study On Customer Satisfaction at Airtel Digital TV and Dish TV DTH Service ProvidersEditor IJTSRDNo ratings yet

- Class 12 Accountancy CBSE Cash Flow StatementDocument7 pagesClass 12 Accountancy CBSE Cash Flow StatementSarvesh SreedharNo ratings yet

- Business Cycles (Economics) : Did You Understand The Text?Document2 pagesBusiness Cycles (Economics) : Did You Understand The Text?Moussa CoulibalyNo ratings yet

- Financial Inclusion FinalDocument54 pagesFinancial Inclusion FinalSOHAM DESAINo ratings yet

- Main Uddin Report IIUCDocument9 pagesMain Uddin Report IIUCgawsia computerNo ratings yet

- Horizontal and Vertical IntegrationDocument12 pagesHorizontal and Vertical Integrationsujitbhadoriya100% (3)

- Entrepreneurship: By: Elias Gerodemos, Nicholas Brandt, & Kameron HarrisDocument7 pagesEntrepreneurship: By: Elias Gerodemos, Nicholas Brandt, & Kameron Harrisapi-510211690No ratings yet

- General Mills' PaperDocument9 pagesGeneral Mills' PaperSarah McDermottNo ratings yet

- Will These '20s Roar?: Global Asset Management 2019Document28 pagesWill These '20s Roar?: Global Asset Management 2019Nicole sadjoliNo ratings yet

- 3 International Standard AuditDocument10 pages3 International Standard AuditDwi Puji AstutiNo ratings yet

- Company Analysis of Apple Inc. and Capital Budgeting TechniquesDocument19 pagesCompany Analysis of Apple Inc. and Capital Budgeting TechniquesDellNo ratings yet

- 2017-2018 B Com Hons in Accounting CBCS New Curriculum PDFDocument4 pages2017-2018 B Com Hons in Accounting CBCS New Curriculum PDFShekhar MondalNo ratings yet

- BOOKKEEPING Module (For Printing)Document73 pagesBOOKKEEPING Module (For Printing)Tesda TesdaNo ratings yet

- Environmental Sustainability and Financial Performance of SmesDocument47 pagesEnvironmental Sustainability and Financial Performance of SmesMuhammadUmarNazirChishtiNo ratings yet

- The Anz Smart Atm GuideDocument8 pagesThe Anz Smart Atm GuidepronesssNo ratings yet

- Top Stories:: THU 05 MAR 2020Document12 pagesTop Stories:: THU 05 MAR 2020JajahinaNo ratings yet

- Chapter 16Document30 pagesChapter 16Jieun LeeNo ratings yet

- Lecture 1 - Intro To Strategic ManagementDocument34 pagesLecture 1 - Intro To Strategic ManagementQiu yiiNo ratings yet

- Kazi Farm Kitchen in The Bakery IndustryDocument20 pagesKazi Farm Kitchen in The Bakery Industryshariar MasudNo ratings yet

- Strategic Management & Business Policy: Thomas L. Wheelen J. David HungerDocument42 pagesStrategic Management & Business Policy: Thomas L. Wheelen J. David Hungerm saNo ratings yet

- Sugar Factory ModelDocument32 pagesSugar Factory ModelAKANSH ARORANo ratings yet

- How To Lead in The Stakeholder EraDocument9 pagesHow To Lead in The Stakeholder EraHuicai MaiNo ratings yet