Professional Documents

Culture Documents

Homework 1 (Due - Jan 28)

Homework 1 (Due - Jan 28)

Uploaded by

Jamila Nussip0 ratings0% found this document useful (0 votes)

5 views1 pageThis document contains homework assignments for a financial risk management class, including tasks to calculate the expected return and standard deviation of a combined portfolio from given weights and statistics of individual portfolios, define what a credit default swap is, and analyze the expected return and standard deviation of Apple stock prices from 2022 using daily closing data downloaded from Yahoo Finance.

Original Description:

Financial Risk Management

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains homework assignments for a financial risk management class, including tasks to calculate the expected return and standard deviation of a combined portfolio from given weights and statistics of individual portfolios, define what a credit default swap is, and analyze the expected return and standard deviation of Apple stock prices from 2022 using daily closing data downloaded from Yahoo Finance.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views1 pageHomework 1 (Due - Jan 28)

Homework 1 (Due - Jan 28)

Uploaded by

Jamila NussipThis document contains homework assignments for a financial risk management class, including tasks to calculate the expected return and standard deviation of a combined portfolio from given weights and statistics of individual portfolios, define what a credit default swap is, and analyze the expected return and standard deviation of Apple stock prices from 2022 using daily closing data downloaded from Yahoo Finance.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

Kazakh-British Technical University | Business School

Discipline: “Financial Risk Management”

Semester: Spring 2023

Homework 1

Student name:_________________________________

ID:______________________________________________

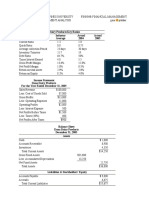

Task 1: You have two portfolios: Portfolio A and Portfolio B:

Weights Return Standard Correlation

deviation

Portfolio A 0.65 11% 0.12

Portfolio B 0.35 25% 0.15

Correlation -0.2

1. Calculate expected return of the combined portfolio.

2. Calculate standard deviation of the combined portfolio.

Task 2: What is Credit Default Swap? (use your own language)

Task 3: From yahoo finance dowload daily prices of apple from January 1 2022 to December

31 2022. Using closing day prices, calculate expected return and standard deviation. (Use excel)

You might also like

- Assignment #1 (With Answers)Document9 pagesAssignment #1 (With Answers)南玖No ratings yet

- Management Accounting-1 08.03.2022 MBSDocument16 pagesManagement Accounting-1 08.03.2022 MBSMani Bhushan SinghNo ratings yet

- CH 5Document11 pagesCH 5johndoe3535No ratings yet

- Accounting Level II - Third Term Assignement IDocument3 pagesAccounting Level II - Third Term Assignement IEdomNo ratings yet

- Resource Leveling Vs Resource AllocationDocument7 pagesResource Leveling Vs Resource AllocationmawandeNo ratings yet

- Cambridge International AS & A Level: Business 9609/23 October/November 2020Document16 pagesCambridge International AS & A Level: Business 9609/23 October/November 2020Kwadwo AsareNo ratings yet

- Expected & Unexpected LossDocument5 pagesExpected & Unexpected LossAdil AnwarNo ratings yet

- Notes For Business Analytics Part IIDocument66 pagesNotes For Business Analytics Part IISakshi ShardaNo ratings yet

- Attachment 1Document5 pagesAttachment 1Sylvester WafulaNo ratings yet

- Problem Set 8Document4 pagesProblem Set 8joannamanngoNo ratings yet

- Assignment Brief MAPE 6AG523 Jan 2024Document16 pagesAssignment Brief MAPE 6AG523 Jan 2024tabonemoira88No ratings yet

- IM41032 Financial Risk Modelling MS 2013 PDFDocument2 pagesIM41032 Financial Risk Modelling MS 2013 PDFPooja ReddyNo ratings yet

- Tutorial Solutions7Document8 pagesTutorial Solutions7Yilin YANGNo ratings yet

- Quiz # 4-Solution-Egineering Economics MS291Document3 pagesQuiz # 4-Solution-Egineering Economics MS291samadNo ratings yet

- Exam 3 TestbankDocument76 pagesExam 3 Testbankpauline leNo ratings yet

- 5 Answerfsanalysisquiz04122023Document10 pages5 Answerfsanalysisquiz04122023Ralphjersy AlmendrasNo ratings yet

- Sample Paper IBPDocument4 pagesSample Paper IBPMuhammad RamzanNo ratings yet

- NPTEL Assign 4 Jan23 Behavioral and Personal FinanceDocument6 pagesNPTEL Assign 4 Jan23 Behavioral and Personal FinanceNitin Mehta - 18-BEC-030No ratings yet

- Management of Commercial Banking Assignment-Week 2Document15 pagesManagement of Commercial Banking Assignment-Week 2Yogesh KumarNo ratings yet

- Cambridge International AS & A Level: Business 9609/23 May/June 2020Document11 pagesCambridge International AS & A Level: Business 9609/23 May/June 2020VinayakNo ratings yet

- Cambridge International AS & A Level: Business 9609/22 October/November 2020Document20 pagesCambridge International AS & A Level: Business 9609/22 October/November 2020Kwadwo AsareNo ratings yet

- Fin 2Document16 pagesFin 2Chinmoy0% (1)

- COMSATS University Islamabad, Lahore CampusDocument2 pagesCOMSATS University Islamabad, Lahore CampusALEEM MANSOORNo ratings yet

- 2022 ZBDocument10 pages2022 ZBChandani FernandoNo ratings yet

- Finance Case 3Document3 pagesFinance Case 3jessevanderendeNo ratings yet

- BAP11 A T2 2021 Individual AssignmentDocument7 pagesBAP11 A T2 2021 Individual AssignmentsadiaNo ratings yet

- Tutorials 6 - Risk ReturnDocument2 pagesTutorials 6 - Risk ReturnDEVINA GURRIAHNo ratings yet

- 02 Activity 119Document4 pages02 Activity 119Harvi PunoNo ratings yet

- Benos - SME Risk RatingDocument18 pagesBenos - SME Risk Ratingvishwanath180689No ratings yet

- Goal ProgrammingDocument9 pagesGoal ProgrammingCheslyn EspadaNo ratings yet

- B F (ACC501) : Semester Spring 2022Document3 pagesB F (ACC501) : Semester Spring 2022Mubeen RazaNo ratings yet

- ACC Final Exam S1 2022 Examiner's ReportDocument3 pagesACC Final Exam S1 2022 Examiner's ReportVikash PatelNo ratings yet

- Chapter 2 - Capital StructureDocument19 pagesChapter 2 - Capital StructureNguyễn Ngàn NgânNo ratings yet

- University of Liberal Arts BangladeshDocument1 pageUniversity of Liberal Arts BangladeshMahafuz Rahman (173011064)No ratings yet

- ps3 2010Document6 pagesps3 2010Ives LeeNo ratings yet

- Management Accounting-2 08.03.2022 MBSDocument16 pagesManagement Accounting-2 08.03.2022 MBSMani Bhushan SinghNo ratings yet

- Exercises w1Document6 pagesExercises w1hqfNo ratings yet

- Risk and Return - Capital Marketing TheoryDocument19 pagesRisk and Return - Capital Marketing TheoryKEZIAH REVE B. RODRIGUEZNo ratings yet

- BuisinessDocument13 pagesBuisinessralph ghazziNo ratings yet

- Lecture 6 FinalDocument30 pagesLecture 6 FinalLIAW ANN YINo ratings yet

- Assignment - 2 - Accounting - DeepaliDocument16 pagesAssignment - 2 - Accounting - DeepaliChinmoyNo ratings yet

- Financial Reporting (FR) Mar / June 2021 Examiner's ReportDocument24 pagesFinancial Reporting (FR) Mar / June 2021 Examiner's ReportKeong ShengNo ratings yet

- BAC 3684 Tutorial Chapter 7 & 8 QDocument6 pagesBAC 3684 Tutorial Chapter 7 & 8 Q1191103342No ratings yet

- IU - Fm.lecture5 Handouts 2021NCTDocument5 pagesIU - Fm.lecture5 Handouts 2021NCTmai anh NguyễnNo ratings yet

- Paper 1 2023Document16 pagesPaper 1 2023Salman ArshadNo ratings yet

- Test Bank Ch6 ACCTDocument89 pagesTest Bank Ch6 ACCTMajed100% (1)

- Acc 2NDDocument3 pagesAcc 2NDAhmed YusufNo ratings yet

- Marketing Management-2 08.03.2022 MBSDocument16 pagesMarketing Management-2 08.03.2022 MBSMani Bhushan SinghNo ratings yet

- Financial Management (8513) STEDocument7 pagesFinancial Management (8513) STEmuhammad yousafNo ratings yet

- Finc361 - Lecture - 10 - Project Cost of Capital PDFDocument36 pagesFinc361 - Lecture - 10 - Project Cost of Capital PDFLondonFencer2012No ratings yet

- MBE AssignmentDocument4 pagesMBE AssignmentDeepanshu Arora100% (1)

- L'oreal ProjetDocument11 pagesL'oreal Projetkfcsh5cbrcNo ratings yet

- PM SD21 Examiner's ReportDocument22 pagesPM SD21 Examiner's ReportSalu SalusNo ratings yet

- Exam SamplesDocument5 pagesExam SamplesQuỳnh TrangNo ratings yet

- Problem Set #1 Solution: Part 1 (Cost of Capital)Document4 pagesProblem Set #1 Solution: Part 1 (Cost of Capital)Shirley YeungNo ratings yet

- FM - 1 To 3Document169 pagesFM - 1 To 3FCA Zaid Travel VlogsNo ratings yet

- 2021 Corporate Finance M1 Final Exam Correction For Students Final VersionDocument9 pages2021 Corporate Finance M1 Final Exam Correction For Students Final Versionadrien.graffNo ratings yet

- The Basel Ii "Use Test" - a Retail Credit Approach: Developing and Implementing Effective Retail Credit Risk Strategies Using Basel IiFrom EverandThe Basel Ii "Use Test" - a Retail Credit Approach: Developing and Implementing Effective Retail Credit Risk Strategies Using Basel IiNo ratings yet

- The Social Protection Indicator: Assessing Results for AsiaFrom EverandThe Social Protection Indicator: Assessing Results for AsiaNo ratings yet