Professional Documents

Culture Documents

University of Liberal Arts Bangladesh

University of Liberal Arts Bangladesh

Uploaded by

Mahafuz Rahman (173011064)Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

University of Liberal Arts Bangladesh

University of Liberal Arts Bangladesh

Uploaded by

Mahafuz Rahman (173011064)Copyright:

Available Formats

UNIVERSITY OF LIBERAL ARTS BANGLADESH

School of Business

BBA PROGRAM

BUS 422 (Security Analysis and Portfolio Management)

Mid Term Exam, Fall 2021

Section: 1 TIME: 1.5 hour Full Marks: 30

Answer all the questions.

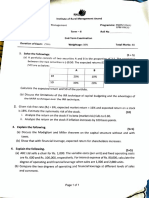

1.a Discuss how financial market and assets help in developing the economy of a country. 4

b Top managers of corporations are provided with different types of incentives (stock option) to 4

match shareholder-management goal. Still, reports of corporate scandals by top management

dampens the image and trust of the governance system. Explain the reasons and suggest

solutions to this problem.

2.a Explain the concept of indifference curve and Capital Allocation line (CAL) with appropriate 5

diagram.

Assume you sold short 300 shares of common stock at Tk45 per share. The initial margin is 2

b.

60%. What would be the maintenance margin if a margin call is made at a stock price of Tk55?

3.a You purchase a share of CBX stock for Tk 80. One year later, after receiving a dividend of Tk. 5, 2

you sell the stock for Tk. 92. What was your holding-period return?

You have Tk. 20,000 to invest in a portfolio. There is 80% probability to earn Tk 12,000 and 2

b. 20% probability to earn Tk. 2000. If risk free investment can earn Tk. 7000 then calculate the

risk premium in Taka.

c. Calculate the Expected return and Standard deviations of the following stocks 4

Recession Normal Boom

Probability 0.25 0.4 .35

Stock A -15% 20% 30%

Stock B -12% 25% 40%

4.a You invest Tk2,000 in a risky asset with an expected rate of return of 0.16 and a standard 2

deviation of 0.30 and a T-bill with a rate of return of 0.05. What percentages of your money must

be invested in the risky asset and the risk-free asset, respectively, to form a portfolio with an

expected return of 0.11?

What percentages of your money must be invested in the risk-free asset and the risky asset, 2

b. respectively, to form a portfolio with a standard deviation of 0.20?

c. Calculate the slope of CAL. 1

d. If the degree of risk aversion A=3, what proportion of the money should be invested in risky 2

asset.

You might also like

- CUSIP IdentifierDocument4 pagesCUSIP IdentifierFreeman Lawyer97% (34)

- Paper - 2: Strategic Financial Management Questions Security ValuationDocument21 pagesPaper - 2: Strategic Financial Management Questions Security ValuationRITZ BROWNNo ratings yet

- Portfolio Management Handout 1 - Questions PDFDocument6 pagesPortfolio Management Handout 1 - Questions PDFPriyankaNo ratings yet

- Credit Derivatives and Structured Credit: A Guide for InvestorsFrom EverandCredit Derivatives and Structured Credit: A Guide for InvestorsNo ratings yet

- 4 Audit of InvestmentsDocument11 pages4 Audit of InvestmentsMarcus MonocayNo ratings yet

- Exercises On Accounting RatiosDocument7 pagesExercises On Accounting RatiosDiannaNo ratings yet

- January Batch MasterclassDocument16 pagesJanuary Batch MasterclassSaransh GuptaNo ratings yet

- Asset Swaps: Not For Onward DistributionDocument23 pagesAsset Swaps: Not For Onward Distributionjohan oldmanNo ratings yet

- FIN42040 Tutorial 2Document1 pageFIN42040 Tutorial 2Duoqi WangNo ratings yet

- Reliance Petroleum Project ReportDocument52 pagesReliance Petroleum Project ReportDNYANKUMAR SHENDE71% (7)

- SMM148 Theory of Finance Questions Jan 2020Document5 pagesSMM148 Theory of Finance Questions Jan 2020minh daoNo ratings yet

- EXERCISE MEETING 1 - MAF603 Oct 2020Document3 pagesEXERCISE MEETING 1 - MAF603 Oct 2020nurul syakirinNo ratings yet

- Mid 1 Questions (Except 405)Document4 pagesMid 1 Questions (Except 405)Raisha LionelNo ratings yet

- Allama Iqbal Open University, Islamabad: (Department of Commerce)Document4 pagesAllama Iqbal Open University, Islamabad: (Department of Commerce)ilyas muhammadNo ratings yet

- IU - Fm.lecture5 Handouts 2021NCTDocument5 pagesIU - Fm.lecture5 Handouts 2021NCTmai anh NguyễnNo ratings yet

- BEA3008 Tutorial 3 Corporate FinanceDocument3 pagesBEA3008 Tutorial 3 Corporate FinanceinesNo ratings yet

- Investment Planning and Portfolio ManagementDocument3 pagesInvestment Planning and Portfolio ManagementTark Raj BhattNo ratings yet

- ACFrOgAtXyswolRjfYdCDxU7EzrL942lyhhOv1UYBiNSkeQa 3vz3jl5VFzUf0wESBUlUJe28mOMagbjYh yF0RQC5gK8q8FkTmJoBSOlx-lvQmx0duR-r6HjbFap2CtAEg-cTmrBISHQppmN f5Document1 pageACFrOgAtXyswolRjfYdCDxU7EzrL942lyhhOv1UYBiNSkeQa 3vz3jl5VFzUf0wESBUlUJe28mOMagbjYh yF0RQC5gK8q8FkTmJoBSOlx-lvQmx0duR-r6HjbFap2CtAEg-cTmrBISHQppmN f5Mahafuz Rahman (173011064)No ratings yet

- Paper - 8: Financial Management and Economics For Finance Section - A: Financial ManagementDocument29 pagesPaper - 8: Financial Management and Economics For Finance Section - A: Financial ManagementPhein ArtNo ratings yet

- Financial Markets and Institutions248 ut9g7tDEPEDocument2 pagesFinancial Markets and Institutions248 ut9g7tDEPEKhushi SangoiNo ratings yet

- Alternate Investment Markets765 NGb2azffmxDocument4 pagesAlternate Investment Markets765 NGb2azffmxKanishka GuptaNo ratings yet

- Question Paper SAPMDocument8 pagesQuestion Paper SAPMBala VigneshNo ratings yet

- Financial-Planning-and-Budgeting-S-22 PaperDocument3 pagesFinancial-Planning-and-Budgeting-S-22 Paperrjyasir1985No ratings yet

- IM41032 Financial Risk Modelling MS 2013 PDFDocument2 pagesIM41032 Financial Risk Modelling MS 2013 PDFPooja ReddyNo ratings yet

- Fourth Semester 5 Year B.B.A. LL.B. Examination, June/July 2014 Financial ManagementDocument4 pagesFourth Semester 5 Year B.B.A. LL.B. Examination, June/July 2014 Financial ManagementsimranNo ratings yet

- Assignment 2Document3 pagesAssignment 2Gabriel PodolskyNo ratings yet

- F1 FIOO - L-December-2020Document8 pagesF1 FIOO - L-December-2020Laskar REAZNo ratings yet

- Training ExercisesDocument4 pagesTraining ExercisesnyNo ratings yet

- FNCE 10002 Sample FINAL EXAM 2 For Students - Sem 2 2019 PDFDocument3 pagesFNCE 10002 Sample FINAL EXAM 2 For Students - Sem 2 2019 PDFC A.No ratings yet

- Af 212 - Review Questions 2022 2Document3 pagesAf 212 - Review Questions 2022 2Mwamba HarunaNo ratings yet

- Assignment1 2020 PDFDocument8 pagesAssignment1 2020 PDFmonalNo ratings yet

- Investement AssDocument2 pagesInvestement Assbona birra0% (1)

- FM Assignment - 01Document3 pagesFM Assignment - 01usafreefire078No ratings yet

- Cma January-2022 Examination Operational Level Subject: F1. Financial OperationsDocument9 pagesCma January-2022 Examination Operational Level Subject: F1. Financial Operationsnatsu broNo ratings yet

- Coaf 4106 Risk Analysis Mock Exam Dec 2021Document5 pagesCoaf 4106 Risk Analysis Mock Exam Dec 2021Lasborn DubeNo ratings yet

- Corporate FinanceDocument2 pagesCorporate FinanceMuhammad Atif SheikhNo ratings yet

- IPMDocument6 pagesIPMPOOJAN DANIDHARIYANo ratings yet

- Ac.f215 Exam 2018-2019 PDFDocument6 pagesAc.f215 Exam 2018-2019 PDFWilliam NogueraNo ratings yet

- Semester - IV End Semester Examination, 2021 FIN203-02: Business FinanceDocument4 pagesSemester - IV End Semester Examination, 2021 FIN203-02: Business FinanceDeval DesaiNo ratings yet

- Risk & Return: Page 1 of 5Document5 pagesRisk & Return: Page 1 of 5Saqib AliNo ratings yet

- Tutorial Chapter 4Document13 pagesTutorial Chapter 4Amirul ZikrieyNo ratings yet

- Paper - 8: Financial Management and Economics For Finance Section - A: Financial ManagementDocument23 pagesPaper - 8: Financial Management and Economics For Finance Section - A: Financial ManagementZrake 24No ratings yet

- PP Invt&sec 2018Document5 pagesPP Invt&sec 2018Revatee HurilNo ratings yet

- Baf2104 Financial Management I, School BasedDocument4 pagesBaf2104 Financial Management I, School BasedLemaronNo ratings yet

- Indian Institute of Management R: Post-Graduate Programme in ManagementDocument3 pagesIndian Institute of Management R: Post-Graduate Programme in ManagementNavya AgrawalNo ratings yet

- 313 Practice Exam III 2015 Solution 2Document9 pages313 Practice Exam III 2015 Solution 2Johan JanssonNo ratings yet

- Paper - 2: Strategic Financial Management Questions Security ValuationDocument120 pagesPaper - 2: Strategic Financial Management Questions Security ValuationKeshav SethiNo ratings yet

- Paper - 2: Strategic Financial Management Questions Security ValuationDocument21 pagesPaper - 2: Strategic Financial Management Questions Security ValuationItikaa TiwariNo ratings yet

- P8 FM ECO Q MTP 1 Nov 23Document5 pagesP8 FM ECO Q MTP 1 Nov 23spyverse01No ratings yet

- 71487bos57500 p8Document29 pages71487bos57500 p8OPULENCENo ratings yet

- Assignment # 2 MBA 1306: QuestionsDocument3 pagesAssignment # 2 MBA 1306: QuestionsZ KhanNo ratings yet

- PST Fundamentals of Finance 2015 2022Document58 pagesPST Fundamentals of Finance 2015 2022benard owinoNo ratings yet

- BSF 4234 - Advanced Portfolio Management - December 2022Document6 pagesBSF 4234 - Advanced Portfolio Management - December 2022faithwambui2001No ratings yet

- Investment Analysis and Portfolio Management: ERASMUS Assignment 2009-2010Document3 pagesInvestment Analysis and Portfolio Management: ERASMUS Assignment 2009-2010farrukhazeemNo ratings yet

- MTH222R: Foundations of Asset Pricing ModelsDocument7 pagesMTH222R: Foundations of Asset Pricing ModelsSuwandi LieNo ratings yet

- InvestmentTheory&PracticeExamJune, 2022FDocument9 pagesInvestmentTheory&PracticeExamJune, 2022Fbabie naaNo ratings yet

- Prob Set#4-Risk - Return - ProblemsDocument4 pagesProb Set#4-Risk - Return - ProblemsKenya Levy0% (1)

- 1ST Ass QuestionsDocument6 pages1ST Ass QuestionsAbbas WazeerNo ratings yet

- SMM148 Theory of Finance QuestionsDocument5 pagesSMM148 Theory of Finance Questionsminh daoNo ratings yet

- FM End Term 42Document1 pageFM End Term 42ParasNo ratings yet

- ICAI - Question BankDocument6 pagesICAI - Question Bankkunal mittalNo ratings yet

- Paper12 SolutionDocument21 pagesPaper12 SolutionAnkit PandeyNo ratings yet

- HWK2Document3 pagesHWK2inder3999No ratings yet

- East Delta University (EDU) : School of Business AdministrationDocument2 pagesEast Delta University (EDU) : School of Business AdministrationYeasir KaderNo ratings yet

- Allama Iqbal Open University, Islamabad Warning: (Department of Commerce)Document9 pagesAllama Iqbal Open University, Islamabad Warning: (Department of Commerce)AR KhanNo ratings yet

- FINA110 SyllabusDocument3 pagesFINA110 Syllabuswinwin2302No ratings yet

- Cost Acc Q1Document4 pagesCost Acc Q1Lica CiprianoNo ratings yet

- Chapter One - Intermediate Fa IDocument64 pagesChapter One - Intermediate Fa Icherinetbirhanu8No ratings yet

- 08-MMDA2022 Part1-Notes To FSDocument74 pages08-MMDA2022 Part1-Notes To FSRonna FererNo ratings yet

- Problem 26 (12) - 2A: InstructionsDocument6 pagesProblem 26 (12) - 2A: InstructionsAhmed MahmoudNo ratings yet

- Invoice 197Document2 pagesInvoice 197miroljubNo ratings yet

- Financial Management: FINA 6212Document81 pagesFinancial Management: FINA 6212Yuhan KENo ratings yet

- Account For MaterialDocument25 pagesAccount For Materialshrestha.aryxnNo ratings yet

- Tutorial 5 Investment Appraisal Tutorial QuestionsDocument3 pagesTutorial 5 Investment Appraisal Tutorial QuestionsNicholas LowNo ratings yet

- FIN4001 Assessment Questions 1Document14 pagesFIN4001 Assessment Questions 1Kreach411100% (1)

- Liabilities Exercises SolutionsDocument8 pagesLiabilities Exercises Solutionsthanh subNo ratings yet

- Avp Wacc InitailDocument3 pagesAvp Wacc InitailYasir AamirNo ratings yet

- Jollibee Foods Corporation: Consolidated Statements of IncomeDocument9 pagesJollibee Foods Corporation: Consolidated Statements of Incomearvin cleinNo ratings yet

- Advanced Accounting 6th Edition Jeter Solutions ManualDocument25 pagesAdvanced Accounting 6th Edition Jeter Solutions Manualjasonbarberkeiogymztd100% (51)

- Exam3 Fin370 B KeyDocument22 pagesExam3 Fin370 B KeyNick GuidryNo ratings yet

- Assertions On The Financial StatementsDocument1 pageAssertions On The Financial StatementsRenato AlferesNo ratings yet

- INVESTMENT ANALYSIS & PORTFOLIO MANAGEMENT 17th Dec, 2020 PDFDocument4 pagesINVESTMENT ANALYSIS & PORTFOLIO MANAGEMENT 17th Dec, 2020 PDFVidushi ThapliyalNo ratings yet

- Auditing and Assurance Services 14Th Edition Arens Test Bank Full Chapter PDFDocument56 pagesAuditing and Assurance Services 14Th Edition Arens Test Bank Full Chapter PDFstephenthanh1huo100% (10)

- Activist Investing in Asia Sept 2017Document20 pagesActivist Investing in Asia Sept 2017qpmoerzhNo ratings yet

- Financial Accounting and Reporting I: Additional Practice QuestionsDocument34 pagesFinancial Accounting and Reporting I: Additional Practice Questionsalia khanNo ratings yet

- Learn FaDocument6 pagesLearn Fagacon87No ratings yet

- Home Office, Branch, & Agency AccountingDocument13 pagesHome Office, Branch, & Agency AccountingGround ZeroNo ratings yet

- 5CHAPTER 5 LTI (Capital Budgeting)Document10 pages5CHAPTER 5 LTI (Capital Budgeting)TIZITAW MASRESHANo ratings yet

- TGS Kelompok PPEDocument3 pagesTGS Kelompok PPESHYAILA ANISHA DE LAVANDANo ratings yet