Professional Documents

Culture Documents

AudChallanges PDF

Uploaded by

Arief HilmanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AudChallanges PDF

Uploaded by

Arief HilmanCopyright:

Available Formats

See discussions, stats, and author profiles for this publication at: https://www.researchgate.

net/publication/285482260

Audit challenges in Malaysia today

Article · January 2008

CITATIONS READS

21 12,233

2 authors, including:

Azham Md Ali

Universiti Pendidikan Sultan Idris (UPSI)

65 PUBLICATIONS 429 CITATIONS

SEE PROFILE

Some of the authors of this publication are also working on these related projects:

Audit Firms in Malaysia View project

CSR & Audit View project

All content following this page was uploaded by Azham Md Ali on 03 February 2020.

The user has requested enhancement of the downloaded file.

MANAGEMENT & ACCOUNTING

Audit Challenges

in Malaysia Today

Teck Heang Lee and Azham Md. Ali

Due to the outbreak of financial scandals involving Bursa Malaysia listed companies

Transmile and Megan Media, it may be argued that 2007 was a “challenging” year for

the auditing profession in Malaysia. The “ripple” effect of the scandals caused turbulence

in the auditing industry which spilled over to 2008 when the auditing profession was once

again in the limelight, in the case of Oilcorp Berhad.

T

he negative publicity connected

with these financial scandals

could very easily damage the

essence of the auditing profes-

sion i.e. “public trust.” Barker (2002)

claimed that society’s trust in a group of

professional persons is the “heartbeat of

that profession.” Hence, if such trust is

betrayed, the professional function, too, is

destroyed, since it would become useless.

Abdul Wahab Jaafar Sidek (The Star, 19

July 2008) of the Minority Shareholder

Watchdog Group (MSWG) opined that the

recent accounting scandals in Malaysia not

only adversely eroded trust of the sharehold-

ers and stakeholders in the affected compa-

nies but also affected the integrity of the capi-

tal market, the regulators and the auditing

profession. So, as far as the auditing profes-

sion is concerned, if that is indeed the case,

interested parties may need to be on the

highest alert for as mentioned by Railborn

and Schorg (2004), the presence of growing

distrust in the auditing profession may well

be “a cancer that is metastasising”.

All in all, there is little room for doubt

that the auditing profession in Malaysia is

currently experiencing a period of serious

turmoil. With fierce criticism against auditors,

it is only fair to hear the voices of the auditors

themselves. This may bring to light the prob-

lems faced by these professionals. Who

knows? Such enlightenment could one day

lead to amicable solutions sought by both au-

ditors and non-auditors.

24 ACCOUNTANTS TODAY • October 2008

Audit Challenges in Malaysia Today

Challenges Faced by Audit prominent value of auditing for the private the quality of one audit versus another. These

Practitioners In Malaysia companies is merely adding credibility to auditors argue that the public judgement of

10 interviews were conducted with au- the financial statements for the purpose of audit quality will only come out as a result of

dit practitioners working in audit firms of tax submission to the Inland Revenue subsequent events which more often than

various sizes in Malaysia from June to Au- Board (IRB) and that of loan applications not is demonstrated through negative report-

gust 2008. Overall, it was found that there to the financial institutions. ing by the media that an audit has not quite

are many problems faced by Malaysian au- On the other hand, many auditors agree been performed at an acceptable level! The

ditors. However, for the purpose of this pa- that an audit function has a more significant hindsight evaluation of auditors is deemed

per, the focus is on four issues. These are: role for public companies since it serves the to be unfair as the perceived quality of the

perceived value of audit function; hindsight purpose of reporting to their existing share- auditors has been judged using the benefit

evaluation of auditors’ performance; com- holders and attracting future investment. of knowledge after the event has taken place

petition for human capital; and audit fees When it concerns listed companies in par- to argue that auditors are not performing ad-

versus audit quality. ticular, apart from fulfilling the statutory equately.

requirement of the Companies Act 1965, an The hindsight manner of evaluation is

Low perceived value of the audit audit is required by Bursa Malaysia and the likely to bring about a high level of criticism

function Securities Commission. Interestingly, this against the auditors given the significant

One of the challenges facing audit prac- has led an auditor to claim that even when amount of negative publicity they receive. In

titioners in Malaysia is the low perceived it concerns the public companies listed in actual fact, the blame should not be placed

value of the audit function. In short, for Bursa Malaysia, an audit function has to a on the auditors’ shoulder alone whenever a

many of the small audit clients of the audi- large extent continued to play a “conform- corporation is in trouble. This is simply be-

tors inter viewed, company auditing is ance” role of satisfying the statutory and cause there are many other reasons which

viewed as a waste of money and resources. regulatory requirements! may lead to the emergence of such a corpo-

From the theoretical perspective, the In the final analysis, some auditors are rate quagmire including mismanagement,

need of an audit function can be explained of the opinion that the practical usefulness bad strategic decisions, industry downturns,

by the agency theory, which denotes that of auditing may only be applicable to a lim- competition, poor oversight by the board of

due to a separation of ownership and con- ited group of users such as bankers, insti- directors and last but certainly not least fraud

trol, the principal (owner) will monitor the tutional investors and regulatory bodies by senior management.

activities of management through an audit such as the IRB and Bank Negara. They Since old habits die hard, notwithstanding

function. However, in Malaysia, an audit is have also argued that a large section of the the presence of these and other debilitating

mandatory for all companies despite their Malaysian public do not actually rely on the factors, the Malaysian public may continue

size and ownership structure (i.e. private audited financial statements for decision- to apply the hindsight manner of evaluation

or public companies). That is, according making. As a result, over the years, it can of auditors’ performance and accordingly

to Section 169(1), Section 174(1) and Sec- be witnessed that the practice of auditing blame the auditors after just about every dis-

tion 174(2) of the Companies Act 1965, has gained little perceived recognition closure of corporate debacle. In doing so, as

every single company in the country needs from a large section of the Malaysian pub- argued by an auditor, the public is in need to

to have its financial statements duly audited lic. be reminded with one important fact: the

by an independent auditor. number of alleged audit failures as compared

Notwithstanding the compulsory audit Hindsight evaluation of auditors’ to the number of audit cases conducted over

requirement, many auditors have pointed performance the years in the country is really quite small.

out that the actual contribution of auditing Another problem underlying the audit Hence, the terrible accusation thrown

towards its intended purposes is somehow practice in Malaysia is the inability of the against the audit profession in the country

limited. This is because a vast majority of public to make a fair evaluation of auditors’ as a result of a few bad apples does not seem

the companies in Malaysia are private com- performance. On the whole, audit practitio- to be reasonable at all.

panies as opposed to public companies. ners claim that the present deluge of accusa-

Furthermore, a majority of these private tions against auditors is largely associated Global competition for human capital

companies are owner-managed. Hence, an with the recent financial scandals at Human capital is the most important and

audit appears to be meaningless to most Transmile and Megan Media. They point out essential asset and sourcing for real talent

of the private companies because the di- that this is to be expected: it is the Malay- is posing to be a great challenge for the

rectors and the shareholders are basically sian habit to accuse the auditors of failing to auditing industry. Unlike other industries

the same people. perform their work diligently whenever a where technological advancement may

For this ver y reason, it explains why corporate financial scandal hits the news. In help to reduce human capital needed, the

most audit clients have found an audit func- their view, this is because the public do not auditing industry is similar to other ser-

tion as a non-value adding activity and per- have the necessary knowledge and ability to vice-based industries, which tend to be

ceive it to be a costly process. As pointed evaluate the quality of an audit leading to a labour intensive. An auditor has pointed

out by a number of auditors, the most situation of failing to differentiate between this out by saying that the forming of an

October 2008 • ACCOUNTANTS TODAY 25

Audit Challenges in Malaysia Today

independent opinion whether the financial vides better services may not be the right Failure to make the necessary move would

statements give a true and fair view is a one considering the fact that companies in- only mean that audit quality in Malaysia

process that requires much subjective volved in the recent financial debacles have will continue to be the case of unfulfilled

judgement. Such a task needs to be per- auditors coming from among the Big 4. For expectations.

formed by professional audit personnel. example, Transmile and Megan Media were

Therefore, “people” are always important audited by Deloitte KassimChan and Conclusions and Outlook

for the success of an audit firm. KPMG, respectively. In response to the recent financial scan-

In recent years, globalisation has gained Apart from the issue of Big 4 vs non-Big dals in the last few years, the regulatory

widespread impact on the financial sector 4 in regard to audit quality, the issue of low and legislative authorities have imple-

in Malaysia. As far as the audit profession audit fees resulting from “lowballing” has mented a number of reforms as far as the

in Malaysia is concerned, it has now had been a major concern of the auditing pro- audit function in Malaysia is concerned.

to face global competition for human capi- fession in Malaysia for many years. Even These reforms include amending related

tal. One of the auditors pointed out that though the Malaysian Institute of Accoun- legislation and enforcing a higher degree

local audit firms are now facing a tough tants (MIA) has provided guidelines for of regulation. In particular, with the imple-

time in recruiting qualified auditing per- audit pricing in Malaysia, such guidelines mentation of the practice review and finan-

sonnel as they are paid much better in have not been adopted by most audit firms. cial statement review by the MIA, the au-

countries like Singapore, China and the As a result, audit fees in Malaysia have dit profession may now be considered to

Middle East. According to him a qualified been considered by some auditors to be be highly regulated. The audit regulation

audit personnel is paid double in Singapore quite low when comparison is made across in Malaysia is likely to be more stringent

and four to five times in China and the countries in the region. Some auditors once the so-called Public Companies Ac-

Middle East. This in his view can only have the opinion that the price war among counting Oversight Board (PCAOB) (an-

mean more headache for audit proprietors audit firms will have negative implications nounced over a year ago in the Prime

and partners who for many years now have on audit quality. This is because to ensure Minister’s 2008 Budget Speech) is finally

already had to confront the view held by the necessary profit margin and to stay established in the near future.

fresh accounting graduates that auditing competitive in the auditing industry, audi- Nevertheless, it should be noted that

is a less attractive profession due to its long tors are likely to reduce audit procedures stronger regulation may not be the only

working hours and less lucrative remu- in order to cut down the cost of perform- solution in promoting better audit practice

neration. ing the audit assignment. An auditor men- in Malaysia. Perhaps, stressing on a higher

Another auditor claims that the shortage tions that it is possible for auditors to do moral value in audit lessons and training

of auditing staff has caused an unhealthy so because: (i) the audit clients may not could be the accompanying path worthy of

competition among audit firms in Malay- be interested to demand for higher audit involvement of various interested parties.

sia particularly for young graduates. He quality; and, (ii) audit clients may not be Finally, educating society on the nature and

explained, audit firms are supposed to be able to judge the audit quality. All in all, purpose of an audit may actually help the

training providers for novices to gain the audit quality is likely to be sacrificed as a public recognise the value of auditing and

necessar y knowledge and experience; result of low audit fees while maintaining the contribution of auditors.

however, the switching of jobs rapidly by a lucrative profit margin. All in all, given the challenges faced by

the so-called new accountants across a The evidence of low audit fees can be auditors in Malaysia, one should have sec-

number of audit firms will cer tainly found in the case of Transmile. A review ond thoughts before pointing fingers at au-

jeopardise their learning process. of the audit fees of Transmile for a two- ditors when another financial scandal hits

year period showed that the fees were low the news. AT

Audit fees versus audit quality when the audit assignment was per-

Audit ser vices for public companies for med by Deloitte KassimChan: References

in Malaysia have been dominated by RM150,000 in 2006 and RM73,000 in 2005 Barker, P. (2002). Audit committees: solution to

the four international audit firms (Big when revenue was RM655,831,000 and a crisis of trust? Accountancy Ireland. June. Vol-

ume 34. No. 3.

4) i.e. KPMG, Deloitte KassimChan, RM356,379,000 respectively. However, in

The Star (2008).The auditing profession – way

PricewaterhouseCoopers and Ernst & 2007 when the audit assignment was for ward. The Star. 19 July 2008. Available at

Young. Generally, public companies pay a taken over by KPMG, the audit fees shot h t t p : / / b i z . t h e s t a r. c o m . m y / b i z w e e k /

“premium” for audit services obtained from s t o r y. a s p ? f i l e = / 2 0 0 8 / 7 / 1 9 / b i z w e e k /

up to RM280,000 while the revenue 1622049&sec=bizweek 19 July. Accessed on 1

the Big 4. This is perhaps to be expected. dropped to RM616,227,000 . August 2008.

An auditor claims that the reason for public Generally, auditors agree that the prob- Railborn, C & Schorg, C. (2004). The Sarbanes-

companies to engage a Big 4 firm is to pro- lem of low audit fees is brought on by the Oxley Act of 2002: An analysis of comments on

the accounting-related provisions. Journal of Busi-

vide stronger assurance to their stakehold- practice of “lowballing” among audit firms. ness and Management. Vol. 10. No.1. pp.1-13.

ers over the trustworthiness of their finan- To overcome this problem, they believe

cial statements. However, another auditor that audit firms should soon come to an The writers can be contacted at

has argued that the view that the Big 4 pro- agreement for a standardised audit pricing. leeth@mail.utar.edu.my (Teck Heang Lee)

26 ACCOUNTANTS TODAY • October 2008

View publication stats

You might also like

- Future of Wealth Management Revisited Winter 2020Document20 pagesFuture of Wealth Management Revisited Winter 2020anujNo ratings yet

- The Joint Venture (JV) HandbookDocument24 pagesThe Joint Venture (JV) HandbookDjamel BenNo ratings yet

- PWC Ir Practical GuideDocument32 pagesPWC Ir Practical GuideAleksandra KowalikNo ratings yet

- THESIS Measures Taken by SMEs in Bacolod City For Financial Audit Quality EnhancementDocument46 pagesTHESIS Measures Taken by SMEs in Bacolod City For Financial Audit Quality EnhancementVon Ianelle AguilaNo ratings yet

- Insurtech Rising: A Profile of The Insurtech Landscape: Jackson MuellerDocument52 pagesInsurtech Rising: A Profile of The Insurtech Landscape: Jackson MuellerSRAVANECE11_68643439No ratings yet

- 10 Auditing SA 2009 The Audit Expectation Gap in Malaysia Lee Ali Gloeck - 1Document5 pages10 Auditing SA 2009 The Audit Expectation Gap in Malaysia Lee Ali Gloeck - 1T.a. TemesgenNo ratings yet

- Farmer ReviewDocument80 pagesFarmer ReviewRui GavinaNo ratings yet

- Deloitte Au Audit Transparency Report 2022Document27 pagesDeloitte Au Audit Transparency Report 2022Gurkirat Singh OberoiNo ratings yet

- External Audit Quality and Firms' Credit Score: Cogent Business & ManagementDocument17 pagesExternal Audit Quality and Firms' Credit Score: Cogent Business & Managementnovie endi nugrohoNo ratings yet

- AldhamariDocument26 pagesAldhamariEkawati 1910247720No ratings yet

- COVID-19: Ethics and Independence Considerations: Staff Questions & Answers - May 2020Document9 pagesCOVID-19: Ethics and Independence Considerations: Staff Questions & Answers - May 2020Karinha NathalieNo ratings yet

- The Audit Expectation Gap: An Empirical Study in MalaysiaDocument15 pagesThe Audit Expectation Gap: An Empirical Study in Malaysiaak shNo ratings yet

- Jurnal Dirvi Surya Abbas 4Document21 pagesJurnal Dirvi Surya Abbas 4Lionnel AkisNo ratings yet

- ICSI MLB CGRatingSystems Jan.09Document9 pagesICSI MLB CGRatingSystems Jan.09404 Error foundNo ratings yet

- Credit Rating ArticleDocument2 pagesCredit Rating ArticleLaweesh KumarNo ratings yet

- Does Enterprise Risk Management Enhance Operating Performance?Document19 pagesDoes Enterprise Risk Management Enhance Operating Performance?Maen BarakatNo ratings yet

- Namo General Mangement ProjectDocument46 pagesNamo General Mangement ProjectvadansukhvindersinghNo ratings yet

- Review of Related Studies..Document4 pagesReview of Related Studies..Mary Joy CapinpinNo ratings yet

- Corporate Governanceand Firm ValueDocument19 pagesCorporate Governanceand Firm ValueAbinash MNo ratings yet

- Does Ownership Characteristics Have Any Impact On Audit Report Lag? Evidence of Malaysian Listed CompaniesDocument13 pagesDoes Ownership Characteristics Have Any Impact On Audit Report Lag? Evidence of Malaysian Listed CompaniesahmadhidrNo ratings yet

- Theoretical Interpretation of Business Processes in Insurance Activity: Generality and SpecificityDocument9 pagesTheoretical Interpretation of Business Processes in Insurance Activity: Generality and SpecificityResearch ParkNo ratings yet

- Accounting, Organizations and Society: Christopher Humphrey, Anne Loft, Margaret WoodsDocument16 pagesAccounting, Organizations and Society: Christopher Humphrey, Anne Loft, Margaret Woodskoro bucleNo ratings yet

- Todays-Interdisciplinary-Auditors Joa Eng 0919Document5 pagesTodays-Interdisciplinary-Auditors Joa Eng 0919Koyel BanerjeeNo ratings yet

- EDPACS The EDP Audit Control and SecuritDocument11 pagesEDPACS The EDP Audit Control and SecuritBeemnet MellonaNo ratings yet

- (Solved) QUESTION ONE JJ & Co Associates Are The Auditors Of... - Course HeroDocument4 pages(Solved) QUESTION ONE JJ & Co Associates Are The Auditors Of... - Course HeroCharles UnlocksNo ratings yet

- Ado 2020Document7 pagesAdo 2020arielNo ratings yet

- 43926-Acc 260 CH 4Document108 pages43926-Acc 260 CH 4Roi Ting0% (1)

- 1 s2.0 S2199853123001531 MainDocument16 pages1 s2.0 S2199853123001531 Main170602032No ratings yet

- 90 Ijar-19560Document14 pages90 Ijar-19560Hamza ChNo ratings yet

- 3 "Implementing Robust Risk Appetite Frameworks To Strengthen Financial Institutions," Institute of International Finance, June 2011Document80 pages3 "Implementing Robust Risk Appetite Frameworks To Strengthen Financial Institutions," Institute of International Finance, June 2011ThanhNo ratings yet

- Checkpoint 1Document5 pagesCheckpoint 1Weidza CommunityNo ratings yet

- Risk and Investment Conference 2013: Brighton, 17 - 19 JuneDocument6 pagesRisk and Investment Conference 2013: Brighton, 17 - 19 JuneKathGuNo ratings yet

- Building Trusted Customer Experiences in The Metaverse 1687717439Document22 pagesBuilding Trusted Customer Experiences in The Metaverse 1687717439architsomani.tradingNo ratings yet

- Benefits To SocietyDocument15 pagesBenefits To SocietyAuliatur RohmahNo ratings yet

- Critical Factors Influencing Voluntary Disclosure: The Palestine Exchange "PEX"Document9 pagesCritical Factors Influencing Voluntary Disclosure: The Palestine Exchange "PEX"It's NovNo ratings yet

- JSF Winter 2009 RosnerDocument17 pagesJSF Winter 2009 RosnerJoshua RosnerNo ratings yet

- Corporate Governance Dilemma - Evidence From MalaysiaDocument16 pagesCorporate Governance Dilemma - Evidence From MalaysiaFouad KaakiNo ratings yet

- 2008 Global Private Equity ReportDocument60 pages2008 Global Private Equity Reportbrokencircle13No ratings yet

- Qualitative Characteristics of Financial Reporting: An Evaluation of Users' Perception in BangladeshDocument9 pagesQualitative Characteristics of Financial Reporting: An Evaluation of Users' Perception in BangladeshJillian LaluanNo ratings yet

- Corporate Governance in Indian Banking SectorDocument11 pagesCorporate Governance in Indian Banking SectorFàrhàt HossainNo ratings yet

- Transmile Berhad Report - Group ProjectDocument18 pagesTransmile Berhad Report - Group ProjectWrite ReadNo ratings yet

- Risk Based Internal Audit Persepctives Offered ToDocument8 pagesRisk Based Internal Audit Persepctives Offered ToAtika AminuddinNo ratings yet

- Ethics in Finance and Accounting Editorial IntroductionDocument5 pagesEthics in Finance and Accounting Editorial IntroductionKmiloNo ratings yet

- Corporate Governance Dilemma - Evidence From Malaysia: SSRN Electronic Journal January 2010Document17 pagesCorporate Governance Dilemma - Evidence From Malaysia: SSRN Electronic Journal January 2010Wong Yong Sheng WongNo ratings yet

- SimCorp Journal Credit+Ratings Apr09Document2 pagesSimCorp Journal Credit+Ratings Apr09richardwillsherNo ratings yet

- Lindganis,+A3 DETERMINING Special+EditionDocument8 pagesLindganis,+A3 DETERMINING Special+EditionHanny MusramNo ratings yet

- The World's Largest 500 Asset Managers - Joint Study With Pensions & Investments - October 2020Document56 pagesThe World's Largest 500 Asset Managers - Joint Study With Pensions & Investments - October 2020alexNo ratings yet

- 1.impact of CorporateDocument8 pages1.impact of CorporateshovonNo ratings yet

- Deepak KR Jha (STPR)Document90 pagesDeepak KR Jha (STPR)rakeshkumarjha874No ratings yet

- Gallagher Re Insurtech Report q4 2022Document88 pagesGallagher Re Insurtech Report q4 2022Aparna DineshNo ratings yet

- Artificial Neural Network Model For Business Failure Prediction of Distressed Firms in Colombo Stock Exchanged - Sujeewa - 2014 PDFDocument18 pagesArtificial Neural Network Model For Business Failure Prediction of Distressed Firms in Colombo Stock Exchanged - Sujeewa - 2014 PDFMd AzimNo ratings yet

- Job Satisfaction of Insurance Employees in BangladeshDocument18 pagesJob Satisfaction of Insurance Employees in BangladeshDr. Nazrul IslamNo ratings yet

- Saputri & Asrori (2019)Document7 pagesSaputri & Asrori (2019)Ilham DavantonioNo ratings yet

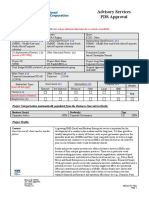

- Advisory Services PDS Approval: Project InformationDocument15 pagesAdvisory Services PDS Approval: Project InformationMohamed Ali AtigNo ratings yet

- BussinessDocument7 pagesBussinessroh beckNo ratings yet

- Jurnal Manajemen KeuanganDocument7 pagesJurnal Manajemen Keuanganla ode muhamad nurrakhmadNo ratings yet

- Narrative Reporting: Give Yourself A Head StartDocument22 pagesNarrative Reporting: Give Yourself A Head StartBaiq AuliaNo ratings yet

- The Need of AssuranceDocument2 pagesThe Need of AssuranceValentin BurcaNo ratings yet