Professional Documents

Culture Documents

Output Page110 PDF

Uploaded by

aaaa bbbOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Output Page110 PDF

Uploaded by

aaaa bbbCopyright:

Available Formats

Anirban Ghatak,

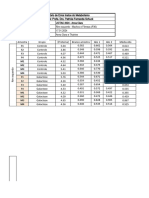

shown graphically below. The cut off correlation value is 0.78. For further

analysis the pairs with correlation above 0.78 are only considered as they follow

conventional risk-return relationship. 49 such pairs are found in this segment.

For these 49 pairs individual sample 2-tail t-test is done for each

trading signal to check the statistical significance of the obtained returns. The

test result includes mean return for each signal, standard deviation of each signal

set, and t statistics. The test result is shown below:

One-Sample Statistics

Trade Signal N Mean Std. Deviation Std. Error Mean

0.7/0.5 49 7.657 15.660 2.237

0.7/0.4 49 8.798 25.224 3.603

0.6/0.4 49 4.247 6.465 0.924

0.6/0.3 49 3.423 2.907 0.415

0.5/0.3 49 2.378 1.878 0.268

0.5/0.2 49 2.460 1.783 0.255

0.4/0.2 49 1.961 2.071 0.296

0.4/0.1 49 2.369 3.464 0.495

0.3/0.1 49 1.410 1.163 0.166

Table .4: mean stat for natural pairs

One-Sample Test

Test Value = 0

Trade T Df Sig. Mean 95% Confidence

Signal Difference Interval of the

(2-tailed)

Difference

Lower Upper

0.7/0.5 3.423 48 0.001 7.657 3.159 12.155

0.7/0.4 2.442 48 0.018 8.798 1.553 16.044

0.6/0.4 4.598 48 0.000 4.247 2.390 6.104

0.6/0.3 8.243 48 0.000 3.423 2.588 4.258

19

You might also like

- Output Page215Document1 pageOutput Page215aaaa bbbNo ratings yet

- Asme b18.2.1 Hvy Hex BDocument1 pageAsme b18.2.1 Hvy Hex BPhú PhạmNo ratings yet

- Bolts 354 BDDocument2 pagesBolts 354 BDfernandoarias100% (1)

- Supplementary Information For Machine Learning Derived Disease Risk Prediction For Anorexia NervosaDocument16 pagesSupplementary Information For Machine Learning Derived Disease Risk Prediction For Anorexia NervosaAntonio EleuteriNo ratings yet

- Rajat Kapoor Assignment No. 5 8102Document7 pagesRajat Kapoor Assignment No. 5 8102kapoorrajat859500No ratings yet

- Critical ValueDocument12 pagesCritical ValueZAIRUL AMIN BIN RABIDIN (FRIM)No ratings yet

- Ampacities and Mechanical Properties of Rectangular Copper Busbars: Table 1. Ampacities of Copper No. 110Document4 pagesAmpacities and Mechanical Properties of Rectangular Copper Busbars: Table 1. Ampacities of Copper No. 110Kiran KarthikNo ratings yet

- MU06 Rosca Americana Grossa Unc TecemDocument1 pageMU06 Rosca Americana Grossa Unc TecemnevesgoNo ratings yet

- MU06 Rosca Americana Grossa Unc Tecem PDFDocument1 pageMU06 Rosca Americana Grossa Unc Tecem PDFJnr SktNo ratings yet

- MU06 Rosca Americana Grossa Unc Tecem PDFDocument1 pageMU06 Rosca Americana Grossa Unc Tecem PDFromuloacNo ratings yet

- Keyway in Hub - BS 46 Part 1Document3 pagesKeyway in Hub - BS 46 Part 1Anatta RahardjoNo ratings yet

- Case 1Document23 pagesCase 1Emad RashidNo ratings yet

- Arnco Wire Usage ChartDocument1 pageArnco Wire Usage ChartRodrigo FernándezNo ratings yet

- We Can See The Cases From Cluster Membership Table Which Cases Belongs To Which ClustersDocument4 pagesWe Can See The Cases From Cluster Membership Table Which Cases Belongs To Which ClustersAman SankrityayanNo ratings yet

- Basic Stats Assignment 1Document22 pagesBasic Stats Assignment 1Snimy StephenNo ratings yet

- A Note On Optimal Capital AllocationDocument2 pagesA Note On Optimal Capital AllocationAmbuj GargNo ratings yet

- Thompson and Fearn (Ref 3) - Example Data N in Fish Food: 8.6% 6.9% 0.005 JAR A BDocument25 pagesThompson and Fearn (Ref 3) - Example Data N in Fish Food: 8.6% 6.9% 0.005 JAR A BPing NoppamasNo ratings yet

- Steel Pipe Pile Unit Weights - Marine - Pile - FoundationsDocument1 pageSteel Pipe Pile Unit Weights - Marine - Pile - FoundationsjuliancajiaoNo ratings yet

- HW5 2023Document5 pagesHW5 2023writersleedNo ratings yet

- Test 1Document10 pagesTest 1Brandeice BarrettNo ratings yet

- Biochem EnzymeDocument7 pagesBiochem EnzymePeter Hong Leong Cheah100% (5)

- TelemedicineDocument3 pagesTelemedicineSWAGATA RANA GIRINo ratings yet

- Vlookup (B13,$G$2:$H$7,2)Document3 pagesVlookup (B13,$G$2:$H$7,2)api-25888404No ratings yet

- Tabela de PesosDocument20 pagesTabela de PesosRafael MeciasNo ratings yet

- PsychologyDocument516 pagesPsychologyShakeela ShanmuganathanNo ratings yet

- Tutorial 1Document5 pagesTutorial 1Aayush RandeepNo ratings yet

- Tutorial 1Document6 pagesTutorial 1Aayush RandeepNo ratings yet

- Hoja Tecnica ASTM A449Document2 pagesHoja Tecnica ASTM A449fernandoraiasaNo ratings yet

- Bnad 276 Case Assignment 1 1Document6 pagesBnad 276 Case Assignment 1 1api-709819015No ratings yet

- 014 - (Abs) Pipe Class 9Document1 page014 - (Abs) Pipe Class 9hentai savemeNo ratings yet

- WPS02 01 Que 20190116 PDFDocument32 pagesWPS02 01 Que 20190116 PDFNour AbouzeidNo ratings yet

- Area Dimensions, In. Weight Per Foot, LB DC Resistance at 20° C, Microhms Per FT Circular Mils, ThousandsDocument4 pagesArea Dimensions, In. Weight Per Foot, LB DC Resistance at 20° C, Microhms Per FT Circular Mils, Thousandsrafabustamante7651No ratings yet

- MM Chart For SystemDocument7 pagesMM Chart For SystemMahendra JaganiNo ratings yet

- Conexion de Acero Al Carbono Lap Joint Stub EndsDocument3 pagesConexion de Acero Al Carbono Lap Joint Stub EndsVictor MuñozNo ratings yet

- Variables You Can Change: Press F9 Key To Update SimulationDocument1 pageVariables You Can Change: Press F9 Key To Update Simulationapi-19921807No ratings yet

- Week 7 8Document22 pagesWeek 7 8Koko Yanne'No ratings yet

- 48x16 rEDUCER TeeDocument4 pages48x16 rEDUCER TeejohnloopsNo ratings yet

- TableDocument2 pagesTableMuntaha MuntahaNo ratings yet

- Busbar Sizing Us StandardsDocument16 pagesBusbar Sizing Us StandardsZaferullah KhanNo ratings yet

- Tabela de PesosDocument20 pagesTabela de PesosIrisSalesNo ratings yet

- Tugas One WayDocument5 pagesTugas One WaymirantiNo ratings yet

- Discriminant Validity - Hypothesis TestingDocument9 pagesDiscriminant Validity - Hypothesis TestingPhạm Đào Thanh TâmNo ratings yet

- Pressure Tank Drawndown FactorDocument1 pagePressure Tank Drawndown FactorJerry TomNo ratings yet

- Pearson R XXXXDocument9 pagesPearson R XXXXRendon StephenNo ratings yet

- Heat Exchanger Tube - Principal BWG Sizes: Outside Diameter Birmingham Wire Gauge (BWG)Document1 pageHeat Exchanger Tube - Principal BWG Sizes: Outside Diameter Birmingham Wire Gauge (BWG)amr kouranyNo ratings yet

- Unit 6. Work and Kinetic EnergyDocument2 pagesUnit 6. Work and Kinetic EnergyRussel Jane BaccayNo ratings yet

- TINH KC BE NUOC OkDocument35 pagesTINH KC BE NUOC OkTuấn Anh TrầnNo ratings yet

- Distillation Report Group1 - 4DDocument8 pagesDistillation Report Group1 - 4D2023471822No ratings yet

- WPS01 01 Que 20190111 PDFDocument24 pagesWPS01 01 Que 20190111 PDFNour AbouzeidNo ratings yet

- A Level Psychology Paper 2 QPDocument52 pagesA Level Psychology Paper 2 QPM.A. HassanNo ratings yet

- 2024 - 17.01 Cálculo Do Conteúdo de Grupos Sulfidrila - JICTAC 2024 (Anna Clara)Document6 pages2024 - 17.01 Cálculo Do Conteúdo de Grupos Sulfidrila - JICTAC 2024 (Anna Clara)MilenaNo ratings yet

- Using Statistics in Validation - Small Molecule Case Study: Jane WeitzelDocument78 pagesUsing Statistics in Validation - Small Molecule Case Study: Jane WeitzelLuis CárdenasNo ratings yet

- Basic Data Extraction and Organizing: Inomial Ption RicingDocument4 pagesBasic Data Extraction and Organizing: Inomial Ption RicingHakobNo ratings yet

- Univariate Analysis of Variance: NotesDocument23 pagesUnivariate Analysis of Variance: NotesHizkia SebayangNo ratings yet

- Su AlbuDocument7 pagesSu AlbuLama SalahatNo ratings yet

- Soal UTS Statistik MultivariatDocument23 pagesSoal UTS Statistik MultivariatAndrioNo ratings yet

- MU07 Rosca Americana Fina Unf Tecem PDFDocument1 pageMU07 Rosca Americana Fina Unf Tecem PDFmarcosNo ratings yet

- Rosca Americana Fina Unf TecemDocument1 pageRosca Americana Fina Unf TecemPauloPaixãoNo ratings yet

- Study Material Hypothesis Testing PDFDocument19 pagesStudy Material Hypothesis Testing PDFMajji ToshithaNo ratings yet

- Math Practice Simplified: Decimals & Percents (Book H): Practicing the Concepts of Decimals and PercentagesFrom EverandMath Practice Simplified: Decimals & Percents (Book H): Practicing the Concepts of Decimals and PercentagesRating: 5 out of 5 stars5/5 (3)