Professional Documents

Culture Documents

Q1B Memo Without Marks PDF

Uploaded by

FolaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Q1B Memo Without Marks PDF

Uploaded by

FolaCopyright:

Available Formats

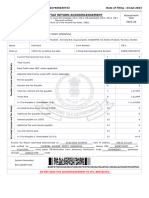

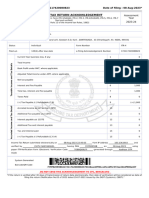

Reminder: Please note that the e-filing system “look and feel” of the VAT201return is

different from the final printed version. The print version of the VAT201 return is used for

purposes of integration of practical application with theoretical knowledge in the

simulation.

Diesel

On Land Off shore Rail and Harbour Services

Vendor Details

Trading Name EVOQUE GROUP VAT Reg No 4220325658

or Other Name Customs Code

Tax Period 202104

Contact Details

First Name HARRIS

Surname SMITH

Capacity ACCOUNTANT

Bus Tel No 011 456 58956 Fax No Cell Nr

Email harris@evoque.co.za

Voluntary Disclosure Programme Declaration

Is this declaration made in respect of a VDP Yes VDP Application No I declare that the information given on this

agreement with SARS form is complete and correct

No X

Tax Practitioner details Date

CCYYMMDD

Tax Practitioner No Tax Practitioner Tel No

A. Calculation of Output Tax and Imported Services

Supply of Goods and/or Services by you

Standard rate (excluding capital goods and/or services and accommodation) 1 R 24 084 x r/(100+r) 4 R 3 141.39

Standard rate (only capital goods and/or services) 1A R 32 000 x r/(100+r) 4A R 4 173.91

Zero rate (excluding goods exported) 2 R

Zero rate (only exported goods) 2A R

Exempt and non-supplies 3 R 2 797

Supply of accommodation:

Exceeding 28 days 5 R 632 775 x 60 % 6 R 379 665

Value Not exceeding 28 days 7 R 1 138 057

Total: (6 + 7) 8 R 1 517 722 x r/100 9 R 227 658.25

Adjustments:

Change in use and export of second-hand goods 10 R x r/(100+r) 11 R

Other and imported services 12 R

Total A: TOTAL OUTPUT TAX (4+4A+9+11+12) 13 R 234 973.55

B. Calculation of Input Tax

Capital goods and/or services supplied to you 14 R 1 942.17

Capital goods imported by you 14A R

Other goods and/or services supplied to you (not capital goods) 15 R 51 963.91

Other goods imported by you (not capital goods) 15A R

Adjustments:

Change in use 16 R

Bad debts 17 R 423.91

Other 18 R

Total B: TOTAL INPUT TAX (14+14A+15+15A+16+17+18) 19 R 54 329.99

VAT PAYABLE/REFUNDABLE (Total A - Total B) 20 R 180 643.56

You might also like

- Profit Or: Loss From BusinessDocument2 pagesProfit Or: Loss From BusinessBryan Pasqueci100% (2)

- U.S. Real Estate Mortgage Investment Conduit (REMIC) Income Tax ReturnDocument4 pagesU.S. Real Estate Mortgage Investment Conduit (REMIC) Income Tax ReturnIRSNo ratings yet

- 1040C Leslie and Althea Windsor 2021 ClientDocument3 pages1040C Leslie and Althea Windsor 2021 ClientpayfallusdNo ratings yet

- US Internal Revenue Service: f8830 - 2000Document2 pagesUS Internal Revenue Service: f8830 - 2000IRSNo ratings yet

- US Internal Revenue Service: f8830 - 1994Document2 pagesUS Internal Revenue Service: f8830 - 1994IRSNo ratings yet

- US Internal Revenue Service: f8845 - 1996Document3 pagesUS Internal Revenue Service: f8845 - 1996IRSNo ratings yet

- US Internal Revenue Service: f8830 - 1992Document2 pagesUS Internal Revenue Service: f8830 - 1992IRSNo ratings yet

- US Internal Revenue Service: f8845 - 1995Document2 pagesUS Internal Revenue Service: f8845 - 1995IRSNo ratings yet

- US Internal Revenue Service: f8830 - 1993Document2 pagesUS Internal Revenue Service: f8830 - 1993IRSNo ratings yet

- US Internal Revenue Service: f8834 - 1994Document2 pagesUS Internal Revenue Service: f8834 - 1994IRSNo ratings yet

- US Internal Revenue Service: f8830 - 1996Document2 pagesUS Internal Revenue Service: f8830 - 1996IRSNo ratings yet

- Form16 (2020-2021)Document2 pagesForm16 (2020-2021)P v v RaoNo ratings yet

- US Internal Revenue Service: f8830 - 1995Document2 pagesUS Internal Revenue Service: f8830 - 1995IRSNo ratings yet

- US Internal Revenue Service: f1120h - 1994Document4 pagesUS Internal Revenue Service: f1120h - 1994IRSNo ratings yet

- US Internal Revenue Service: f8844 - 1994Document3 pagesUS Internal Revenue Service: f8844 - 1994IRSNo ratings yet

- Tax Card 2017Document26 pagesTax Card 2017Mohsin EhsanNo ratings yet

- Idt Compiler 2.0 CA Final New by CA Ravi AgarwalDocument402 pagesIdt Compiler 2.0 CA Final New by CA Ravi AgarwalAnisha PujNo ratings yet

- US Internal Revenue Service: f8844Document4 pagesUS Internal Revenue Service: f8844IRSNo ratings yet

- Bir1600 July52019 - 2 PDFDocument2 pagesBir1600 July52019 - 2 PDFMaureen AlapaapNo ratings yet

- Billing Statement: Address ToDocument4 pagesBilling Statement: Address Tomqhy9b622hNo ratings yet

- VATReturn All Annexs 6402227Document6 pagesVATReturn All Annexs 6402227muhammad saadNo ratings yet

- Indian Income Tax Return Acknowledgement: Acknowledgement Number:438523430120723 Date of Filing: 12-Jul-2023Document1 pageIndian Income Tax Return Acknowledgement: Acknowledgement Number:438523430120723 Date of Filing: 12-Jul-2023kambojnaresh693No ratings yet

- Rajesh Bora Itr PLBS 2022Document5 pagesRajesh Bora Itr PLBS 2022ABDUL KHALIKNo ratings yet

- US Internal Revenue Service: f8844 - 2004Document4 pagesUS Internal Revenue Service: f8844 - 2004IRSNo ratings yet

- US Internal Revenue Service: f8830 - 1998Document2 pagesUS Internal Revenue Service: f8830 - 1998IRSNo ratings yet

- US Internal Revenue Service: f8844 - 1995Document4 pagesUS Internal Revenue Service: f8844 - 1995IRSNo ratings yet

- Billing Statement: Address ToDocument5 pagesBilling Statement: Address ToElla CalinoNo ratings yet

- Management PrinciplesDocument2 pagesManagement Principlesamon zuluNo ratings yet

- US Internal Revenue Service: f8896 - 2004Document2 pagesUS Internal Revenue Service: f8896 - 2004IRSNo ratings yet

- US Internal Revenue Service: f8844 - 2005Document4 pagesUS Internal Revenue Service: f8844 - 2005IRSNo ratings yet

- Tax_Invoice_-_IN12720_-_17_04_2024Document1 pageTax_Invoice_-_IN12720_-_17_04_2024Tatiana DeehNo ratings yet

- US Internal Revenue Service: f5884 - 2001Document3 pagesUS Internal Revenue Service: f5884 - 2001IRSNo ratings yet

- Indian Income Tax Return Acknowledgement: Acknowledgement Number:380069251021023 Date of Filing: 02-Oct-2023Document78 pagesIndian Income Tax Return Acknowledgement: Acknowledgement Number:380069251021023 Date of Filing: 02-Oct-2023Mohit DuhanNo ratings yet

- New ChangeDocument68 pagesNew ChangeAnoop Kamla PandeyNo ratings yet

- US Internal Revenue Service: F1120rei - 1992Document4 pagesUS Internal Revenue Service: F1120rei - 1992IRSNo ratings yet

- US Internal Revenue Service: f5884 - 1995Document2 pagesUS Internal Revenue Service: f5884 - 1995IRSNo ratings yet

- US Internal Revenue Service: f3800 - 1992Document2 pagesUS Internal Revenue Service: f3800 - 1992IRSNo ratings yet

- US Internal Revenue Service: F1120rei - 1993Document4 pagesUS Internal Revenue Service: F1120rei - 1993IRSNo ratings yet

- US Internal Revenue Service: f1066 - 1991Document4 pagesUS Internal Revenue Service: f1066 - 1991IRSNo ratings yet

- With Holding Tax ASTDocument10 pagesWith Holding Tax ASTAnonymous ZRWdF8h3No ratings yet

- EFPS Home - EFiling and Payment SystemDocument2 pagesEFPS Home - EFiling and Payment SystemJinkieNo ratings yet

- US Internal Revenue Service: f1120s - 1992Document4 pagesUS Internal Revenue Service: f1120s - 1992IRSNo ratings yet

- 1201 Rental Tax Books of AcctDocument3 pages1201 Rental Tax Books of AcctMaddahayota College100% (1)

- US Internal Revenue Service: f1120pc - 1993Document8 pagesUS Internal Revenue Service: f1120pc - 1993IRSNo ratings yet

- Completed 1040-FormDocument6 pagesCompleted 1040-Formapi-464285260No ratings yet

- US Internal Revenue Service: f5884 - 1999Document3 pagesUS Internal Revenue Service: f5884 - 1999IRSNo ratings yet

- US Internal Revenue Service: f1120h - 2004Document6 pagesUS Internal Revenue Service: f1120h - 2004IRSNo ratings yet

- US Internal Revenue Service: f8844 - 1998Document3 pagesUS Internal Revenue Service: f8844 - 1998IRSNo ratings yet

- Inv No.074Document5 pagesInv No.074Rajiv DubeyNo ratings yet

- US Internal Revenue Service: f1120h - 1993Document4 pagesUS Internal Revenue Service: f1120h - 1993IRSNo ratings yet

- Ack 638167400230723Document1 pageAck 638167400230723gamers SatisfactionNo ratings yet

- US Internal Revenue Service: F1120icd - 2000Document6 pagesUS Internal Revenue Service: F1120icd - 2000IRSNo ratings yet

- US Internal Revenue Service: f8845 - 2000Document3 pagesUS Internal Revenue Service: f8845 - 2000IRSNo ratings yet

- ACK172117420080823Document1 pageACK172117420080823thakurravindra197071No ratings yet

- US Internal Revenue Service: f8844 - 2000Document4 pagesUS Internal Revenue Service: f8844 - 2000IRSNo ratings yet

- Monthly Percentage Tax Return: Fill in All Applicable Spaces. Mark All Appropriate Boxes With An "X". X X 12Document2 pagesMonthly Percentage Tax Return: Fill in All Applicable Spaces. Mark All Appropriate Boxes With An "X". X X 12PingLomaadEdulanNo ratings yet

- Tax Card 2021 2022Document26 pagesTax Card 2021 2022AqeelAhmadNo ratings yet

- IAS 12 TaxationDocument158 pagesIAS 12 TaxationAphelele GqadaNo ratings yet

- Wa0015.Document1 pageWa0015.Dhanush BalajiNo ratings yet

- ITL152 2024 01 SGDocument118 pagesITL152 2024 01 SGFolaNo ratings yet

- ITL152 2024 01 SGDocument118 pagesITL152 2024 01 SGFolaNo ratings yet

- SARS Notice of Assessment for 2020Document1 pageSARS Notice of Assessment for 2020FolaNo ratings yet

- SARS Notice of Assessment for 2020Document1 pageSARS Notice of Assessment for 2020FolaNo ratings yet

- Q1C Memo Without MarksDocument1 pageQ1C Memo Without MarksFolaNo ratings yet

- Q1A Memo Without MarksDocument2 pagesQ1A Memo Without MarksFolaNo ratings yet

- Q1A Student TemplateDocument1 pageQ1A Student TemplateFolaNo ratings yet