Professional Documents

Culture Documents

BIR Form 1600 Monthly Remittance Return

Uploaded by

Analyn DomingoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BIR Form 1600 Monthly Remittance Return

Uploaded by

Analyn DomingoCopyright:

Available Formats

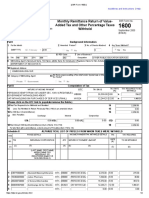

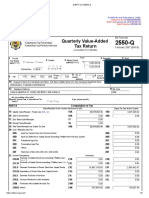

BIR Form No.

1600 Page 1 of 1

Monthly Remittance Return of BIR Form No.

1600

Republika ng Pilipinas

Kagawaran ng Pananalapi

Kawanihan ng Rentas Internas

Value-Added Tax and Other

Percentage Taxes Withheld September 2005 (ENCS)

Under RAs 1051, 7649, 8241, 8424 and 9337

1 For the Month (MM/YYYY) 2 Amended Return? 3 No. of Sheets Attached? 4 Any Taxes Withheld?

02 - February 2023 Yes No

0

Yes No

Part I Background Information

5 TIN 449 876 374 049 6 RDO 108 7 Line of Business/Occupation NONE

Code

8 Withholding Agent's Name (Last Name, First Name, Middle Name for Individuals) /(Registered Name for Non-Individuals) 9 Telephone Number

BACOLOD ELEMENTARY SCHOOL 09101063785

10 Registered Address 11 Zip Code

UPPER MINGADING, ALEOSAN, COTABATO 9415

12 Category of Withholding Agent 13 Are there payees availing of tax relief under Special Law or International Tax

Treaty?

Private Government

Yes No

If yes, specify -

Part II Computation of Tax ATC

TAX REQUIRED TO

NATURE OF INCOME PAYMENT ATC TAX BASE TAX RATE

BE WITHHELD

PERSONS EXEMPT FROM VAT UNDER SEC. 109V (CREDITABLE)-GOVERNMENT WITHHOLDING AGENT WB080 63,423.47 1.0 634.23

14 Total Tax Required to be Withheld and Remitted 14 634.23

15 Less: Tax Remitted in Return Previously Filed, if this is an amended return 15 0.00

16 Tax Still Due / (Overremittance) 16 634.23

17 Add: Penalties

Surcharge Interest Compromise

17A 0.00 17B 0.00 17C 0.00 17D 0.00

18 Total Amount Still Due/(Overremittance) (Sum of items 16 & 17D) 18 634.23

For late filers with overremittance, extend amount of Penalties (Item 17D to 18)

ALPHABETICAL LIST OF PAYEES FROM WHOM TAXES WERE WITHHELD

Schedule II

(Attach additional sheet/s if necessary)

PAYEE DETAILS INCOME PAYMENT/TAX WITHHELD DETAILS

(1) (2) TIN (3) INDIVIDUAL/ CORPORATION (4) ATC (5) NATURE OF PAYMENT (6) AMOUNT (7) TAX (8) TAX REQUIRED TO BE

SEQ (LAST NAME, FIRST NAME, RATE(%) WITHHELD

NO. MIDDLE NAME FOR INDIVIDUALS

OR REGISTERED NAME FOR

NON-INDIVIDUALS)

1 000000000000 PJH ENTERPRISES ATC WB080 PERSONS EXEMPT FROM VAT UNDER

34,213.31

SEC. 109V

1.0(CREDITABLE) 342.13

2 000000000000 LAKAY CONSTRUCTION SUPPLIES

ATC WB080 PERSONS EXEMPT FROM VAT UNDER

29,210.16

SEC. 109V

1.0(CREDITABLE) 292.10

3 ATC 0.00

4 ATC 0.00

5 ATC 0.00

6 ATC 0.00

7 ATC 0.00

8 ATC 0.00

9 ATC 0.00

10 ATC 0.00

Total 634.23

I declare, under the penalties of perjury, that this return has been made in good faith, verified by me, and to the best of my knowledge, and belief,

is true and correct, pursuant to the provisions of the National Internal Revenue Code, as amended, and the regulations issued under authority thereof.

19_____________________________________________________________________ 20_____________________________

President/Vice President/Principal Officer/Accredited Tax Agent/ Treasurer/Assistant Treasurer

Authorized Representative/Taxpayer (Signature Over Printed Name)

(Signature Over Printed Name)

______________________________ ______________________________ ______________________________

Title/Position of Signatory TIN of Signatory Title/Position of Signatory

______________________________________ ______________ ______________ ______________________________

Tax Agent Acc. No./ Atty's Roll No. (If Applicable) Date of Issuance Date of Expiry TIN of Signatory

Machine Validation/Revenue Official Receipt Details (If not filed with an Authorized Agent Bank)

file:///C:/Users/Admin/AppData/Local/Temp/%7B6ED7A950-92DF-425E-A5D7-C339507... 3/6/2023

You might also like

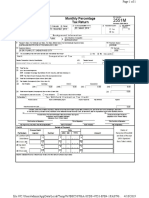

- Monthly Remittance ReturnDocument1 pageMonthly Remittance ReturnAnalyn DomingoNo ratings yet

- EFPS Home - EFiling and Payment SystemDocument2 pagesEFPS Home - EFiling and Payment SystemJinkieNo ratings yet

- Bir1600 July52019 - 2 PDFDocument2 pagesBir1600 July52019 - 2 PDFMaureen AlapaapNo ratings yet

- BIR Form No. 1600Document2 pagesBIR Form No. 1600Lorraine Steffany BanguisNo ratings yet

- Fill in All Applicable Spaces. Mark All Appropriate Boxes With An "X"Document5 pagesFill in All Applicable Spaces. Mark All Appropriate Boxes With An "X"May Joy DepalomaNo ratings yet

- Fill in All Applicable Spaces. Mark All Appropriate Boxes With An "X"Document4 pagesFill in All Applicable Spaces. Mark All Appropriate Boxes With An "X"Emelyn Ventura SantosNo ratings yet

- BIR Form 1601-EDocument2 pagesBIR Form 1601-ELovella Phi Go100% (1)

- 1 0 2 0 1 0 8 0 0 National Agency Deped - Division of Las Piñas City Gabaldon BLDG Diego Cera Avenue E. Aldana, Las Piñas CityDocument3 pages1 0 2 0 1 0 8 0 0 National Agency Deped - Division of Las Piñas City Gabaldon BLDG Diego Cera Avenue E. Aldana, Las Piñas CityReese QuinesNo ratings yet

- Monthly Remittance Return of Income Taxes Withheld On CompensationDocument4 pagesMonthly Remittance Return of Income Taxes Withheld On CompensationHanabishi RekkaNo ratings yet

- eFPS Home - Efiling and Payment System AprilDocument2 pageseFPS Home - Efiling and Payment System AprilRenalynNo ratings yet

- Quarterly Remittance Return of Final Income Taxes Withheld: Background InformationDocument2 pagesQuarterly Remittance Return of Final Income Taxes Withheld: Background InformationVincent John RigorNo ratings yet

- Certificate of Creditable Tax Withheld at Source: Marfrancisco, Pinamalayan, Oriental MindoroDocument5 pagesCertificate of Creditable Tax Withheld at Source: Marfrancisco, Pinamalayan, Oriental MindoroChristcelda lozadaNo ratings yet

- Dimensional Service Corporation 2307Document3 pagesDimensional Service Corporation 2307Randy RosasNo ratings yet

- 2550-M October-2022Document2 pages2550-M October-2022Jing ReyesNo ratings yet

- Monthly Remittance Return of SK BarangayDocument2 pagesMonthly Remittance Return of SK BarangayJEREMY WILLIAM COZENS-HARDYNo ratings yet

- Bir Form 1600 FinalDocument4 pagesBir Form 1600 Finaljhonnamaemaygue08No ratings yet

- Bir GinaDocument1 pageBir GinaApril ManjaresNo ratings yet

- Bir Form 1603Document3 pagesBir Form 1603Nava NavarreteNo ratings yet

- Certificate of Creditable Tax Withheld at Source: (MM/DD/YYYY) (MM/DD/YYYY)Document32 pagesCertificate of Creditable Tax Withheld at Source: (MM/DD/YYYY) (MM/DD/YYYY)Sakura AvhrynNo ratings yet

- 2550-M August-2022Document2 pages2550-M August-2022Jing ReyesNo ratings yet

- 2307 FormDocument3 pages2307 FormK and F Construction Dev't CorpNo ratings yet

- e Efps Bir Form PDFDocument2 pagese Efps Bir Form PDF沈华仁No ratings yet

- MarioeFPS Home - EFiling and Payment SystemDocument2 pagesMarioeFPS Home - EFiling and Payment SystemEdward Roy “Ying” AyingNo ratings yet

- Remittance Return of Percentage Tax On Winnings and Prizes Withheld by Race Track OperatorsDocument1 pageRemittance Return of Percentage Tax On Winnings and Prizes Withheld by Race Track OperatorsShaira Patricia Angelyn NiloNo ratings yet

- BIR Form 1604cfDocument3 pagesBIR Form 1604cfMaryjean PoquizNo ratings yet

- Monthly Percentage Tax Return: 12 - December 04 - AprilDocument1 pageMonthly Percentage Tax Return: 12 - December 04 - AprilTamara HamiltonNo ratings yet

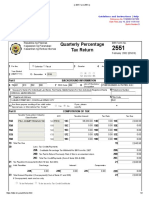

- Quarterly Percentage Tax Return: 12 - December 059Document2 pagesQuarterly Percentage Tax Return: 12 - December 059Abby UmipigNo ratings yet

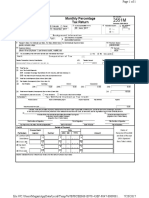

- 2550-M February-2022Document2 pages2550-M February-2022Jing ReyesNo ratings yet

- Monthly Percentage Tax Return: 12 - December 06 - JuneDocument1 pageMonthly Percentage Tax Return: 12 - December 06 - JuneDana PardeNo ratings yet

- Registration FeeDocument1 pageRegistration FeeanakinNo ratings yet

- PC Square2307Document3 pagesPC Square2307SirManny ReyesNo ratings yet

- BIR Form 2550M Monthly VAT SummaryDocument2 pagesBIR Form 2550M Monthly VAT SummaryLulu Adaro VillanuevaNo ratings yet

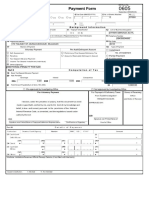

- BIR Form No. 0605 (2021)Document1 pageBIR Form No. 0605 (2021)Nathan Veracruz100% (1)

- BIR Form 1601-EDocument2 pagesBIR Form 1601-EJerel John Calanao67% (3)

- BIR Form 0605 Payment FormDocument1 pageBIR Form 0605 Payment FormbertlaxinaNo ratings yet

- 2550-M November-2022Document2 pages2550-M November-2022Jing ReyesNo ratings yet

- Nilda 1Document1 pageNilda 1Mary Lynn Sta PriscaNo ratings yet

- 3rd Quarter TaxDocument1 page3rd Quarter Taxmiguel tinsayNo ratings yet

- FBT Form 1603Document2 pagesFBT Form 1603Cb SingsonNo ratings yet

- 0605 - Dasma Bir Registration - Year 2022 - Draft For Filing - 01.12.2022Document1 page0605 - Dasma Bir Registration - Year 2022 - Draft For Filing - 01.12.2022graceNo ratings yet

- Monthly Remittance Return of Creditable Income Taxes Withheld (Expanded)Document2 pagesMonthly Remittance Return of Creditable Income Taxes Withheld (Expanded)Games NathanNo ratings yet

- BIR Form Certificate of Final Tax Withheld At SourceDocument5 pagesBIR Form Certificate of Final Tax Withheld At SourceHa HakdogNo ratings yet

- Certificate of Final Tax Withheld at Source: 004 053 294 000 Barangay CentroDocument5 pagesCertificate of Final Tax Withheld at Source: 004 053 294 000 Barangay CentroHa HakdogNo ratings yet

- BIR Form 1600WPDocument1 pageBIR Form 1600WPCharmaine MejiaNo ratings yet

- Form 2306 Witn Computation Electric BillDocument3 pagesForm 2306 Witn Computation Electric BillJanus Salinas100% (2)

- 2020 0605 Return MspaduaDocument1 page2020 0605 Return MspaduaEljoe VinluanNo ratings yet

- 2020 With PenaltiesDocument1 page2020 With PenaltiesKashato BabyNo ratings yet

- Mci REGDocument3 pagesMci REGPAULA TVNo ratings yet

- BIR Form No. 0605 (2022)Document1 pageBIR Form No. 0605 (2022)Nathan VeracruzNo ratings yet

- Illustration 1 SampleDocument2 pagesIllustration 1 SampleGwen ClarinNo ratings yet

- Group 8 Project 3 - Preparation of Estate Tax ReturnDocument3 pagesGroup 8 Project 3 - Preparation of Estate Tax ReturnVan Joshua NunezNo ratings yet

- One and Done 2307Document2 pagesOne and Done 2307Maricris LegaspiNo ratings yet

- EFPS Home - EFiling and Payment SystemDocument2 pagesEFPS Home - EFiling and Payment Systemmelanie venturaNo ratings yet

- Bir Form 1600Document44 pagesBir Form 1600Jerel John CalanaoNo ratings yet

- 0605Document2 pages0605Kath Rivera60% (42)

- BIR Payment Form TitleDocument2 pagesBIR Payment Form Titleeugene badere50% (2)

- 0605 PDFDocument2 pages0605 PDFRob Villanueva100% (1)

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNo ratings yet

- Green Gold Elegant CertificateDocument1 pageGreen Gold Elegant CertificateAnalyn DomingoNo ratings yet

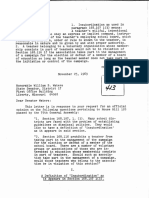

- INSUBORDINATIONDocument8 pagesINSUBORDINATIONAnalyn DomingoNo ratings yet

- Statistical Analysis Using PythonDocument3 pagesStatistical Analysis Using PythonAnalyn DomingoNo ratings yet

- Red Beige Wedding Invitation Card Floral Watercolor ArrangementDocument1 pageRed Beige Wedding Invitation Card Floral Watercolor ArrangementAnalyn DomingoNo ratings yet

- 2306 Jan 2018 ENCS v4Document2 pages2306 Jan 2018 ENCS v4Analyn DomingoNo ratings yet

- 108 Request For InclusionDocument1 page108 Request For InclusionAnalyn DomingoNo ratings yet

- Data Analysis With PythonDocument24 pagesData Analysis With PythonAnalyn Domingo0% (1)

- AttendanceDocument18 pagesAttendanceAnalyn DomingoNo ratings yet

- 0619e August 2022Document1 page0619e August 2022Analyn DomingoNo ratings yet

- Annual Implementation PlanDocument11 pagesAnnual Implementation PlanAnalyn DomingoNo ratings yet

- Brown White Abstract Freelancer Instagram Bio LinkDocument1 pageBrown White Abstract Freelancer Instagram Bio LinkAnalyn DomingoNo ratings yet

- General Percentile AverageDocument1 pageGeneral Percentile AverageAnalyn DomingoNo ratings yet

- 2307 Jan 2018 ENCS v3Document2 pages2307 Jan 2018 ENCS v3Analyn DomingoNo ratings yet

- Face To Face Implementation Plan 2022-2023Document1 pageFace To Face Implementation Plan 2022-2023Analyn DomingoNo ratings yet

- Monday Tuesday Wednesday Thursday Friday: GRADES 1 To 12 Daily Lesson LogDocument7 pagesMonday Tuesday Wednesday Thursday Friday: GRADES 1 To 12 Daily Lesson LogAnalyn DomingoNo ratings yet

- EARLY GRADES READING ASSESSMENT RESULTSDocument21 pagesEARLY GRADES READING ASSESSMENT RESULTSAnalyn DomingoNo ratings yet

- Back To School Social MediaDocument48 pagesBack To School Social MediaAnalyn DomingoNo ratings yet

- May 2022 School Partnerships Report for ALEOSAN CENTRAL ELEMENTARY SCHOOLDocument23 pagesMay 2022 School Partnerships Report for ALEOSAN CENTRAL ELEMENTARY SCHOOLAnalyn DomingoNo ratings yet

- Department of Education: Direction: Please Fill-Out The Needed DataDocument6 pagesDepartment of Education: Direction: Please Fill-Out The Needed DataAnalyn DomingoNo ratings yet

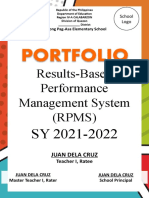

- E-Rpms Portfolio (Design One) - DepedclickDocument71 pagesE-Rpms Portfolio (Design One) - Depedclickrenia pimentelNo ratings yet

- E-Rpms Portfolio (Design One) - DepedclickDocument71 pagesE-Rpms Portfolio (Design One) - Depedclickrenia pimentelNo ratings yet

- Koronadal Certificate of Non-Availability of Stocks: Product Code Product Description UOM PriceDocument6 pagesKoronadal Certificate of Non-Availability of Stocks: Product Code Product Description UOM PriceAnalyn DomingoNo ratings yet