Professional Documents

Culture Documents

3rd Quarter Tax

Uploaded by

miguel tinsayCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

3rd Quarter Tax

Uploaded by

miguel tinsayCopyright:

Available Formats

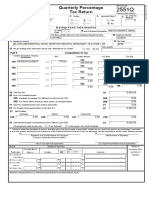

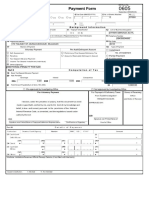

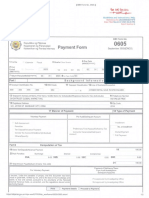

BIR Form No.

2551Q Page 1 of 1

BIR Form No.

Quarterly Percentage

2551Q

Republika ng Pilipinas

Kagawaran ng Pananalapi

Kawanihan ng Rentas Internas

Tax Return February 2002 (ENCS)

1 For the Calendar Fiscal 3 Quarter 4 Amended Return? No. of Sheets

5 Attached

2

Year Ended

(MM/YYYY) 12 - December 2021 1st

1st 2nd

2nd Yes 0

3rd

3rd 4th

4th No

Part I Background Information

6 TIN 476 486 321 000 7 RDO 033 8 Line of Business/Occupation ONLINE%2520SHOP

Code

9 Taxpayer's Name (For Individual) Last Name, First Name, Middle Name/ (For Non-individual) Registered Name 10 Telephone Number

CANILLO, RUDY ENCARNACION 09495624964

11 Registered Address 12 Zip Code

UNIT 1607 16TH FLOOR BERGUNDY WESTBAY TOWER 82 P OCAMPO ST BARANGAY 719 1004

ZONE 76 MALATE MANILA

If yes, specify

13 Are you availing of tax relief under Special Law / International Tax Treaty? Yes No

Part II Computation of Tax

Taxable Transaction / Industry

ATC Taxable Amount Tax Rate Tax Due

Classification

14C 14D

14A PERSON EXEMPT FROM14B

VAT UNDER

14B PT010

SEC. 109(BB) (SEC. 116)

20,000.00 3.0 14E 600.00

15C 15D

15A 15B

15B 15E 0.00

0.00 0.00

16C 16D

16A 16B

16B 16E 0.00

0.00 0.00

17C 17D

17A 17B

17B 17E 0.00

0.00 0.00

18C 18D

18A 18B

18B 18E 0.00

0.00 0.00

19 Total Tax Due 19 600.00

20 Less: Tax Credits/Payments

20A Creditable Percentage Tax Withheld Per BIR Form No. 2307 20A 0.00

20B Tax Paid in Return Previously Filed, if this is an Amended Return 20B 0.00

21 Total Tax Credit/Payments (Sum of Items 20A & 20B) 21 0.00

22 Tax Payable (Overpayment) (Item 19 less Item 21) 22 600.00

23 Add Penalties

Surcharge Interest Compromise

23A 0.00 23B 0.00 23C 0.00 23D 0.00

24 Total Amount Payable / (Overpayment) (Sum of Items 22 and 23D) 24 600.00

If Overpayment, mark one box only To be Refunded To be issued a Tax Credit Certificate

I declare, under the penalties of perjury, that this return has been made in good faith, verified by me, and to the best of my knowledge, and belief,

is true and correct, pursuant to the provisions of the National Internal Revenue Code, as amended, and the regulations issued under authority thereof.

25____________________________________________________ 26_____________________________________

Signature over Printed Name of Taxpayer/ Title/Position of Signatory

Taxpayer Authorized Representative

______________________________________________________ _______________________________________

TIN of Tax Agent (if applicable) Tax Agent Accreditation No.(if applicable)

Machine Validation/Revenue Official Receipt Details (If not filed with the bank)

file:///C:/Users/Admin/AppData/Local/Temp/%7BACA73A24-12E9-4142-92EC-41DEA... 10/21/2021

You might also like

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesFrom EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo ratings yet

- Quarterly Percentage Tax Return - 1st QuarterDocument2 pagesQuarterly Percentage Tax Return - 1st QuarterJo HernandezNo ratings yet

- BIR Form 2551 - PDFDocument1 pageBIR Form 2551 - PDFMichael LaquianNo ratings yet

- MarioeFPS Home - EFiling and Payment SystemDocument2 pagesMarioeFPS Home - EFiling and Payment SystemEdward Roy “Ying” AyingNo ratings yet

- Quarterly Value-Added Tax ReturnDocument2 pagesQuarterly Value-Added Tax ReturnFrancis M. TabajondaNo ratings yet

- Quarterly Percentage Tax Return: 12 - DecemberDocument1 pageQuarterly Percentage Tax Return: 12 - DecemberralphalonzoNo ratings yet

- EFPS Home - EFiling and Payment SystemDocument2 pagesEFPS Home - EFiling and Payment Systemmelanie venturaNo ratings yet

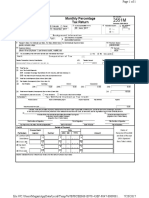

- Monthly Percentage Tax Return: 12 - December 04 - AprilDocument1 pageMonthly Percentage Tax Return: 12 - December 04 - AprilTamara HamiltonNo ratings yet

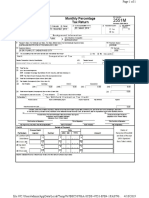

- Monthly Percentage Tax Return: 12 - December 06 - JuneDocument1 pageMonthly Percentage Tax Return: 12 - December 06 - JuneDana PardeNo ratings yet

- Bir GinaDocument1 pageBir GinaApril ManjaresNo ratings yet

- Quarterly Value-Added Tax ReturnDocument2 pagesQuarterly Value-Added Tax ReturnjoshuaNo ratings yet

- Accounting Information System: Section B6Document20 pagesAccounting Information System: Section B6Claire Mae AniñonNo ratings yet

- Gts 1stDocument2 pagesGts 1stGOLDEN TOPSTEEL CONSTRUCTION SUPPLYNo ratings yet

- BIR Form 2550M Monthly VAT SummaryDocument2 pagesBIR Form 2550M Monthly VAT SummaryLulu Adaro VillanuevaNo ratings yet

- Nilda 1Document1 pageNilda 1Mary Lynn Sta PriscaNo ratings yet

- Quarterly Remittance Return: of Creditable Income Taxes Withheld (Expanded)Document2 pagesQuarterly Remittance Return: of Creditable Income Taxes Withheld (Expanded)Francis M. TabajondaNo ratings yet

- EFPS Home - EFiling and Payment SystemDocument2 pagesEFPS Home - EFiling and Payment SystemJinkieNo ratings yet

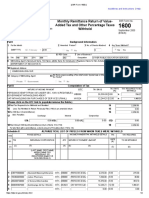

- BIR Form 1600 Monthly Remittance ReturnDocument1 pageBIR Form 1600 Monthly Remittance ReturnAnalyn DomingoNo ratings yet

- ZetkjretkjzrtkrzDocument2 pagesZetkjretkjzrtkrzHyacinth BalmacedaNo ratings yet

- 1701qjuly2008 (ENCS) q22019Document5 pages1701qjuly2008 (ENCS) q22019Andrew AndalNo ratings yet

- 0605 - Dasma Bir Registration - Year 2022 - Draft For Filing - 01.12.2022Document1 page0605 - Dasma Bir Registration - Year 2022 - Draft For Filing - 01.12.2022graceNo ratings yet

- 2550-M August-2022Document2 pages2550-M August-2022Jing ReyesNo ratings yet

- 2550-M October-2022Document2 pages2550-M October-2022Jing ReyesNo ratings yet

- 2550-M February-2022Document2 pages2550-M February-2022Jing ReyesNo ratings yet

- Monthly Remittance Return of Income Taxes Withheld On CompensationDocument4 pagesMonthly Remittance Return of Income Taxes Withheld On CompensationHanabishi RekkaNo ratings yet

- Annual Income Tax Return: A B C A B C A B C B C A B C A B C A B ADocument9 pagesAnnual Income Tax Return: A B C A B C A B C B C A B C A B C A B ArootspacificNo ratings yet

- 1701Q BIR Form PDFDocument3 pages1701Q BIR Form PDFJihani A. SalicNo ratings yet

- Monthly Remittance ReturnDocument1 pageMonthly Remittance ReturnAnalyn DomingoNo ratings yet

- 0605 2023 Bulatao FloridaDocument1 page0605 2023 Bulatao FloridaPiei CornerNo ratings yet

- 0605 PDFDocument2 pages0605 PDFeugene badere50% (2)

- 0605 PDFDocument2 pages0605 PDFRob Villanueva100% (1)

- BIR Payment Form ExplainedDocument2 pagesBIR Payment Form ExplainedElbert Natal100% (1)

- 0605Document2 pages0605Kath Rivera60% (42)

- BIR Payment Form TitleDocument2 pagesBIR Payment Form Titleeugene badere50% (2)

- Form 0605 PDFDocument2 pagesForm 0605 PDFeugene badereNo ratings yet

- 2020 With PenaltiesDocument1 page2020 With PenaltiesKashato BabyNo ratings yet

- Quarterly Income Tax Return: 12 - December 056Document2 pagesQuarterly Income Tax Return: 12 - December 056Cha GomezNo ratings yet

- BIR Form 1702-RTDocument4 pagesBIR Form 1702-RTAljohn Sechico BacolodNo ratings yet

- Mci REGDocument3 pagesMci REGPAULA TVNo ratings yet

- BIR Form 1604cfDocument3 pagesBIR Form 1604cfMaryjean PoquizNo ratings yet

- Monthly Percentage Tax ReturnDocument4 pagesMonthly Percentage Tax ReturnromarcambriNo ratings yet

- Mail To LornaDocument27 pagesMail To Lornaapi-3740993No ratings yet

- Registration FeeDocument1 pageRegistration FeeanakinNo ratings yet

- 2550-M November-2022Document2 pages2550-M November-2022Jing ReyesNo ratings yet

- BIR Form No. 0605 Payment FormDocument1 pageBIR Form No. 0605 Payment FormPAULA TVNo ratings yet

- BIR Form No. 0605 (2021)Document1 pageBIR Form No. 0605 (2021)Nathan Veracruz100% (1)

- Sample Bir Form - CorporationsDocument4 pagesSample Bir Form - CorporationsChristine ViernesNo ratings yet

- CSSM 0605 2023Document1 pageCSSM 0605 2023PAULA TVNo ratings yet

- 1702Q FhcsiDocument2 pages1702Q FhcsiRaffy Enix DavisNo ratings yet

- 0605 2018 - MP PDFDocument1 page0605 2018 - MP PDFAnonymous DohqBW7g0% (1)

- CARELIFT - BIR Form No. 1604E 2021Document1 pageCARELIFT - BIR Form No. 1604E 2021Jay Mark DimaanoNo ratings yet

- Payment FormDocument4 pagesPayment FormRodel Rivera VelascoNo ratings yet

- BIR Form 0605 Payment FormDocument1 pageBIR Form 0605 Payment FormbertlaxinaNo ratings yet

- Drafted BIR Form No. 2000Document2 pagesDrafted BIR Form No. 2000Kevin BesaNo ratings yet

- MiggMatugas 1701Q 1st Quarter 2023P1Document2 pagesMiggMatugas 1701Q 1st Quarter 2023P1stillwinmsNo ratings yet

- 6J Store - WPDocument99 pages6J Store - WPAngelo LabiosNo ratings yet

- e Efps Bir Form PDFDocument2 pagese Efps Bir Form PDF沈华仁No ratings yet

- Monthly Percentage Tax Return: Fill in All Applicable Spaces. Mark All Appropriate Boxes With An "X". X X 12Document2 pagesMonthly Percentage Tax Return: Fill in All Applicable Spaces. Mark All Appropriate Boxes With An "X". X X 12PingLomaadEdulanNo ratings yet

- Extrajudicial Settlement of EstateDocument2 pagesExtrajudicial Settlement of Estatemiguel tinsayNo ratings yet

- Aug Bir NewDocument1 pageAug Bir Newmiguel tinsayNo ratings yet

- Aug Bir NewDocument1 pageAug Bir Newmiguel tinsayNo ratings yet

- Aug Bir NewDocument1 pageAug Bir Newmiguel tinsayNo ratings yet

- ESPIRITUMICOH PPDVariable-LoadingDocument80 pagesESPIRITUMICOH PPDVariable-Loadingmiguel tinsayNo ratings yet