Professional Documents

Culture Documents

Case 1 Journal Book

Uploaded by

EL ZamberianoOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Case 1 Journal Book

Uploaded by

EL ZamberianoCopyright:

Available Formats

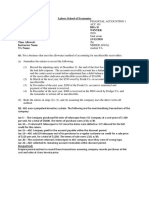

UNIVERSIDAD TECNOLÓGICA DE PANAMÁ

FACULTY OF INDUSTRIAL ENGINEERING

CASE 1

“CARGA, S.A.”

Register the following transactions of Carga S.A. in the Journal and Legder book.

Carga S.A. started a ITBM taxable merchandise sales business in October 31, 2017,

and the company requires you to register the following transactions.

1. Opening of a checking account in Banistmo for US10,000.00, and register 10

common shares with a nominal value of US$ 1,000.00 each in favour of Edith

Rodríguez.

2. The total purchases of Merchandise during the month of October was

US150,000.00 plus ITBM on credit.

3. Sales for the month of october were US275,000.00 plus 19,250.00 ITBM. Out of

the total sale, 60% was in cash, and deposited in the bank account, 20% as an

account receivable, and 20% as a promissory note.

4. a. Acquisition of furniture and equipment, 75% paid in cash and 25% as an

account payable

b. Computers valued at US $ 10,500.00 plus ITBMS.

c. Office furniture for US $ 5,000.00 plus ITBMS.

d. Delivery car for US $ 15,000.00 plus ITBMS

5. During the month of october, the company paid its payroll. The gross salary of

the employees was US$ 5,000.00, the risk of a company accident is medium

(2.10%). Employee social contributions correspond to:

Descripción SS SE RP

Employee 9.75% 1.25%

Employer 12.25% 1.50% 2.10%

Other checks drawn during the months were:

a. Local rent for U$ 1,000.00 plus ITBMS.

b. Other Suppliers credit for purchases made, 60% of credit purchases.

c. Payment of electric service for US $ 375.00

d. Telephone bill payment for US $ 500.00.

Note: Once you prepare the transaction journal entries in the Journal

and Ledger, prepare the Trial Balance.

You might also like

- NAU Accounting Skills Assessment Practice Exam Revised 0416Document11 pagesNAU Accounting Skills Assessment Practice Exam Revised 0416Danica VetuzNo ratings yet

- Test (BBA)Document5 pagesTest (BBA)Ab Wahab100% (4)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Jesse Taylor Comprehensive Accounting ProblemDocument9 pagesJesse Taylor Comprehensive Accounting Problemapi-311367219No ratings yet

- Wiley - Practice Exam 3 With SolutionsDocument15 pagesWiley - Practice Exam 3 With SolutionsIvan BliminseNo ratings yet

- Receivables ProblemsDocument13 pagesReceivables ProblemsIris Mnemosyne0% (1)

- Acc 112 RevisionDocument16 pagesAcc 112 RevisionhamzaNo ratings yet

- Intermidate AssignmentDocument6 pagesIntermidate AssignmentTahir DestaNo ratings yet

- Acc SampleexamDocument12 pagesAcc SampleexamAmber AJNo ratings yet

- Leonardo Wagster Decided To Open Wagster's Window Washing On September 1, 2020. in September, The Following Transactions Took PlaceDocument12 pagesLeonardo Wagster Decided To Open Wagster's Window Washing On September 1, 2020. in September, The Following Transactions Took PlaceJohnMurray111100% (1)

- Tutorial Before UTS Peng Akun 1Document11 pagesTutorial Before UTS Peng Akun 1Fanji AriefNo ratings yet

- Quiz ch1 2Document5 pagesQuiz ch1 2loveshareNo ratings yet

- F 2019092615474369290942Document12 pagesF 2019092615474369290942Deta BenedictaNo ratings yet

- Soal UTS SMT 1 AkP (12-10-21)Document22 pagesSoal UTS SMT 1 AkP (12-10-21)Bayu PrasetyoNo ratings yet

- Module 3 Practice ProblemsDocument25 pagesModule 3 Practice Problemsmaxz0% (1)

- Individual Category Part 2 PDFDocument25 pagesIndividual Category Part 2 PDFDina DulatreNo ratings yet

- TN Cô Cho ThêmDocument3 pagesTN Cô Cho ThêmDĩm MiNo ratings yet

- Chapter 2 Practice ExercisesDocument2 pagesChapter 2 Practice ExercisesSokrit SoeurNo ratings yet

- Midterm 2022 - v1Document6 pagesMidterm 2022 - v1JF FNo ratings yet

- Midterm 2022 - v2Document6 pagesMidterm 2022 - v2JF FNo ratings yet

- Accounting For ReceivableDocument2 pagesAccounting For ReceivableHeliani sajaNo ratings yet

- Problems Inter Acc1Document10 pagesProblems Inter Acc1Chau NguyenNo ratings yet

- Quiz On RizalDocument14 pagesQuiz On RizalYorinNo ratings yet

- Chapt 1,2,3,5,6 MCQDocument24 pagesChapt 1,2,3,5,6 MCQbritzNo ratings yet

- F3 Final Mock 2Document8 pagesF3 Final Mock 2Nicat IsmayıloffNo ratings yet

- Fundamentals of Accounting IDocument7 pagesFundamentals of Accounting IDawit TilahunNo ratings yet

- Fundamentals of Accounting-I WorksheetDocument7 pagesFundamentals of Accounting-I WorksheetLee HailuNo ratings yet

- Assessment Part 1Document5 pagesAssessment Part 1RoNnie RonNieNo ratings yet

- Ajd 2023 PR Materi Sesi 1 Akuntansi Dan Persamaan AkuntansiDocument2 pagesAjd 2023 PR Materi Sesi 1 Akuntansi Dan Persamaan AkuntansiX IPS 3/01 Ade Isna MaulidaNo ratings yet

- ACC 205 Complete Class HomeworkDocument41 pagesACC 205 Complete Class HomeworkAvicciNo ratings yet

- Revision - Gacc102Document13 pagesRevision - Gacc102Khang VũNo ratings yet

- BA3 Special Revision MockDocument17 pagesBA3 Special Revision MockSanjeev JayaratnaNo ratings yet

- Assignment IIDocument4 pagesAssignment IIAfifa TonniNo ratings yet

- Association of Chartered Certified Accountants Multiple Choice Questions - Paper 1.1Document24 pagesAssociation of Chartered Certified Accountants Multiple Choice Questions - Paper 1.1tahahameed55No ratings yet

- Chapter One Assignment On ReceivablesDocument3 pagesChapter One Assignment On ReceivablesBee TadeleNo ratings yet

- Far IDocument9 pagesFar IPamela Bugarso0% (1)

- CHAPTER-9-Principles of AccountingDocument39 pagesCHAPTER-9-Principles of AccountingNguyễn Ngọc AnhNo ratings yet

- Conta FinancieraDocument21 pagesConta FinancieraAdrian TajmaniNo ratings yet

- Exam 3 AnsDocument4 pagesExam 3 AnsMahediNo ratings yet

- 123Document18 pages123Andrin LlemosNo ratings yet

- Level III NewDocument5 pagesLevel III NewElias TesfayeNo ratings yet

- Multiple ChoiceDocument18 pagesMultiple ChoiceJonnel Samaniego100% (1)

- Unit 1 Exam Review - Chapters 1-3Document5 pagesUnit 1 Exam Review - Chapters 1-3Jullian LimNo ratings yet

- ACC 205 Complete Class AssignmentsDocument39 pagesACC 205 Complete Class AssignmentsDecemberjaan0% (1)

- Soal Cash ArDocument10 pagesSoal Cash ArmfreakthingNo ratings yet

- Section A Multiple Choice Questions 25 Marks (Answer in Multiple Choice Answer Sheet Provided) (Suggested Time: 36 Minutes)Document11 pagesSection A Multiple Choice Questions 25 Marks (Answer in Multiple Choice Answer Sheet Provided) (Suggested Time: 36 Minutes)wainikitiraculeNo ratings yet

- 84 164046 5994Document3 pages84 164046 5994Afaq ZaimNo ratings yet

- Midterm PDFDocument7 pagesMidterm PDFsubash1111@gmail.comNo ratings yet

- Fsa Questions FBNDocument34 pagesFsa Questions FBNsprykizyNo ratings yet

- Asset To LiabDocument25 pagesAsset To LiabHavanaNo ratings yet

- Module 05-06-07 ProblemsDocument14 pagesModule 05-06-07 ProblemsmaxzNo ratings yet

- ACT 2100 Worksheet IIIDocument4 pagesACT 2100 Worksheet IIIAshmini PershadNo ratings yet

- Reviewer (Cash-Accounts Receivable)Document5 pagesReviewer (Cash-Accounts Receivable)Camila Mae AlduezaNo ratings yet

- Principle CH 8 Ed.23 Oxley Internal Control, and Cash)Document8 pagesPrinciple CH 8 Ed.23 Oxley Internal Control, and Cash)Heri SiringoringoNo ratings yet

- Recitation #8Document3 pagesRecitation #8wtfNo ratings yet

- F3 - Mock B - QuestionsDocument15 pagesF3 - Mock B - QuestionsabasNo ratings yet

- Accounting For Hospitality AssingmentDocument2 pagesAccounting For Hospitality Assingmenthabtamu tadesseNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet