Professional Documents

Culture Documents

Class Exercise

Uploaded by

Christina KaukareOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Class Exercise

Uploaded by

Christina KaukareCopyright:

Available Formats

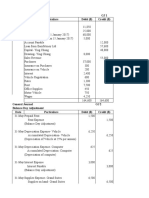

EXERCISE 2–3

Erick Hardware and Computing Service provide computing service to its client while also selling

computing, electronic and some hardware to its customers. The business is register for VAT and deposit

cash received on daily basis. Given below are list of transactions for month of April:

CASH RECEIPTS

Date Transaction Details Receipt # Amount VIP

1–Apr Cash Services R50 $926.50

5–Apr Cash Sales CSD25 $1,090.00

6-–Apr Cash Received from Mark Brian for Commission R51 $610.40

10–Apr Cash Sales CSD26 $2,725.00

Cash Sales CSD27 $817.50

15–Apr Cash Services R52 $697.60

Cash Sales CSD58 $2,060.10

20–Apr Cash Received from R. Prasad For Rent Services R53 $654.00

25–Apr Cash Sales CSD29 $872.00

30–Apr Interest Received (VAT Not Applicable) B/S $150.00

CASH PAYMENT

Date Transaction Details Cheque # Amount VIP

2–Apr Purchased Inventory for Cash 601 $981.00

6–Apr Paid for Advertising 602 $218.00

8–Apr Brought Goods for Cash 603 $1,111.80

12–Apr Paid Wages 604 $2,020.00

Paid Utility Bills 605 $545.00

18–Apr Owner withdraw cash from business 606 $1,500.00

Paid Accounting fees 607 $327.00

20–Apr Bought equipment for cash 608 $13,080.00

25–Apr Paid for repairs and maintenance 609 $250.70

30–Apr Loan Repayment B/S $2,800.00

Account Keeping Fees B/S $30.00

Required:

1. Prepare Cash Receipts and Cash Payments Books for Month of April and Cross Balance.

You might also like

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Class Exercise SolutionDocument10 pagesClass Exercise SolutionChristina KaukareNo ratings yet

- Heidi Jara Opened Jara's Cleaning Service On July 1, 2014. During July, The Following Transactions Were CompletedDocument6 pagesHeidi Jara Opened Jara's Cleaning Service On July 1, 2014. During July, The Following Transactions Were Completedlaale dijaan100% (1)

- P 1548 2Document7 pagesP 1548 2Jalaj GuptaNo ratings yet

- No. Debits NoDocument11 pagesNo. Debits Nomohitgaba19100% (1)

- Rose Trial BalanceDocument29 pagesRose Trial BalanceWenna BaeNo ratings yet

- Tugas Pertemuan 4Document6 pagesTugas Pertemuan 4Muhammad Musaid Rafii MaradityaNo ratings yet

- General JournalDocument5 pagesGeneral Journal૨εƒ XianNo ratings yet

- General JournalDocument5 pagesGeneral Journal૨εƒ XianNo ratings yet

- General JournalDocument5 pagesGeneral Journalmonicaaa melianaaaNo ratings yet

- Problem Set 1Document6 pagesProblem Set 1Arvin Operania TolentinoNo ratings yet

- Kirby Company Financial AnalysisDocument6 pagesKirby Company Financial AnalysisvanessaNo ratings yet

- Final Exam - ACCT 5001P - Fall 2022Document23 pagesFinal Exam - ACCT 5001P - Fall 2022shuvorajbhattaNo ratings yet

- Eco & Actg for Engineers Assignment SolutionsDocument6 pagesEco & Actg for Engineers Assignment SolutionsNayeem HossainNo ratings yet

- Jeneral JournalDocument12 pagesJeneral Journalaterefemelaku29No ratings yet

- Date Particulars Dr. CR.: Answer 01Document7 pagesDate Particulars Dr. CR.: Answer 01Mursalin RabbiNo ratings yet

- Simulation 9 - Nikita SaxenaDocument9 pagesSimulation 9 - Nikita Saxenaapi-663766273No ratings yet

- Assignment - Aduit of CashDocument5 pagesAssignment - Aduit of CashEdemson NavalesNo ratings yet

- Nama: Melvina Puhut Siregar Nim: 1932150049 E7-23 (Petty Cash) Mcmann, Inc. Decided To Establish A Petty Cash Fund To Help Ensure InternalDocument6 pagesNama: Melvina Puhut Siregar Nim: 1932150049 E7-23 (Petty Cash) Mcmann, Inc. Decided To Establish A Petty Cash Fund To Help Ensure Internalmelvina siregarNo ratings yet

- Date Account Names Debit CreditDocument2 pagesDate Account Names Debit Creditfarhann JattNo ratings yet

- Muhammad Zidan Akbar - Morgan Company - 1EB09Document12 pagesMuhammad Zidan Akbar - Morgan Company - 1EB09rully.movizarNo ratings yet

- General Journal GJ1 Date Particulars Debit ($) Credit ($)Document25 pagesGeneral Journal GJ1 Date Particulars Debit ($) Credit ($)Jennifer ChandraNo ratings yet

- 3 Slide Đầu RevisionDocument5 pages3 Slide Đầu RevisionLương Mỹ DungNo ratings yet

- Exercise: Partnership (Q & A)Document5 pagesExercise: Partnership (Q & A)Far-east faizahNo ratings yet

- Practice SetDocument100 pagesPractice SetZamantha Oliveros100% (1)

- Ink Books SuppliesDocument63 pagesInk Books SuppliesZamantha Oliveros100% (1)

- Ink Books SuppliesDocument81 pagesInk Books SuppliesZamantha Oliveros100% (1)

- Morelli Equipment Repair Journal EntriesDocument10 pagesMorelli Equipment Repair Journal EntriesMARCELLINO MARCELLINONo ratings yet

- FS SaplanDocument16 pagesFS SaplanMarilyn Cercado FernandezNo ratings yet

- BUS 142 - Exercises CH 8Document22 pagesBUS 142 - Exercises CH 8Jess IcaNo ratings yet

- Chapter 7Document4 pagesChapter 7Rani OktaviaNo ratings yet

- Key accounts for caravan servicing and law office problemsDocument21 pagesKey accounts for caravan servicing and law office problemsJoseph LimbongNo ratings yet

- Amaliya Quiz Tutor Finacc 1 Week 2Document8 pagesAmaliya Quiz Tutor Finacc 1 Week 2Amaliya MalikovaNo ratings yet

- Minhaj University Group 2nd Presentation on Accounting CycleDocument30 pagesMinhaj University Group 2nd Presentation on Accounting CycleAmmad Ud Din SabirNo ratings yet

- Ink Books Supplies 2Document94 pagesInk Books Supplies 2Zamantha Oliveros100% (1)

- Cash Additional ProblemsDocument2 pagesCash Additional ProblemsRed TigerNo ratings yet

- 718 MP111 Individual Assignment S2 2022 Part 1Document23 pages718 MP111 Individual Assignment S2 2022 Part 1Rosalie BachillerNo ratings yet

- 5.Cash-Bank Book (Three Column)Document6 pages5.Cash-Bank Book (Three Column)jangirvihan2No ratings yet

- M. Firman Ardiyansyah - Morgan Company - 1EB09Document6 pagesM. Firman Ardiyansyah - Morgan Company - 1EB09rully.movizarNo ratings yet

- Book 1Document45 pagesBook 1ZULFA SYAMNo ratings yet

- Jurnal 1Document8 pagesJurnal 1William MangumbanNo ratings yet

- Cash Flow Indirect MethodDocument3 pagesCash Flow Indirect MethodLusianaaNo ratings yet

- Revision ch1&2 1thDocument23 pagesRevision ch1&2 1thYousefNo ratings yet

- Chapter 2 Practice KEYDocument17 pagesChapter 2 Practice KEYmartinmuebejayiNo ratings yet

- Exercise Chap 2 NLKTDocument10 pagesExercise Chap 2 NLKTalexnguyen21007No ratings yet

- CORRECTIONS Ledger ProperDocument37 pagesCORRECTIONS Ledger ProperPatrick ArazoNo ratings yet

- Activity Sheet 6 10Document9 pagesActivity Sheet 6 10Yaxi AxhiaNo ratings yet

- Acc. - Assignment - 1 - TonushreeDocument9 pagesAcc. - Assignment - 1 - TonushreeTanvir RohanNo ratings yet

- Journal, T Accounts, TrialDocument14 pagesJournal, T Accounts, TrialJasmine ActaNo ratings yet

- Assignment 1 G10 - ACCT9700Document8 pagesAssignment 1 G10 - ACCT9700Senior BrosNo ratings yet

- FM SpreadsheetDocument6 pagesFM SpreadsheetMihiret GirmaNo ratings yet

- AccountingDocument7 pagesAccountingCarla Jane Maitom TagoyNo ratings yet

- Accounting10 (Reviewer)Document5 pagesAccounting10 (Reviewer)Erika Panit ReyesNo ratings yet

- Assignment-4 and 8Document15 pagesAssignment-4 and 8Carla Sader0% (1)

- Answer - Tutorial - Record Business TransactionDocument10 pagesAnswer - Tutorial - Record Business TransactiondenixngNo ratings yet

- Saplan - Danilyn - Final OutputDocument16 pagesSaplan - Danilyn - Final OutputMarilyn Cercado FernandezNo ratings yet

- Unit 1 TestDocument10 pagesUnit 1 TestLoic Lim-YookNo ratings yet

- Milestone 1Document22 pagesMilestone 1Luis MelendezSilvaNo ratings yet

- Accounting Cycle WorksheetDocument11 pagesAccounting Cycle Worksheettarikuabdisa0No ratings yet

- Question No 1: Cash Capital StockDocument6 pagesQuestion No 1: Cash Capital StockBushra NazNo ratings yet

- Certainty and Incomplete Agreements in Contract LawDocument1 pageCertainty and Incomplete Agreements in Contract LawChristina KaukareNo ratings yet

- Social and Domestic AgreementsDocument1 pageSocial and Domestic AgreementsChristina KaukareNo ratings yet

- Week 3 Tutorials Forum 2023Document3 pagesWeek 3 Tutorials Forum 2023Christina KaukareNo ratings yet

- Tutorial 1 AnsDocument2 pagesTutorial 1 AnsChristina KaukareNo ratings yet

- Privity of Contract Limits Major Lazer's RightsDocument2 pagesPrivity of Contract Limits Major Lazer's RightsChristina KaukareNo ratings yet

- lw201 Answers Tutorial 5Document3 pageslw201 Answers Tutorial 5Christina KaukareNo ratings yet

- LW201Document3 pagesLW201Christina KaukareNo ratings yet

- LW201: Enforcing Promises in a Marital AgreementDocument8 pagesLW201: Enforcing Promises in a Marital AgreementChristina KaukareNo ratings yet

- LW201 - Contract Law Assignment 1 AnalysisDocument6 pagesLW201 - Contract Law Assignment 1 AnalysisChristina KaukareNo ratings yet

- LW201: Enforcing Promises in a Marital AgreementDocument8 pagesLW201: Enforcing Promises in a Marital AgreementChristina KaukareNo ratings yet

- 4 PDFDocument4 pages4 PDFChristina KaukareNo ratings yet

- Contract Law Quiz QuestionsDocument4 pagesContract Law Quiz QuestionsChristina KaukareNo ratings yet

- LW201Document3 pagesLW201Christina KaukareNo ratings yet

- Sample RRL AND RRSDocument9 pagesSample RRL AND RRSGlory Nicol OrapaNo ratings yet

- Plastic Money PDFDocument6 pagesPlastic Money PDFJosé BurgeiroNo ratings yet

- 6 - Examdays - Monthly CA Capsule - February 2021Document92 pages6 - Examdays - Monthly CA Capsule - February 2021Sandeep NegiNo ratings yet

- Credit Risk Pricing Models - Theory and PracticeDocument387 pagesCredit Risk Pricing Models - Theory and PracticeRishi RaiNo ratings yet

- GS III Booster Mainstorming 2023 WWW - Iasparliament.com1Document117 pagesGS III Booster Mainstorming 2023 WWW - Iasparliament.com1sayednishattanaum99No ratings yet

- RBI Official's Guide to Current Account Forex TransactionsDocument50 pagesRBI Official's Guide to Current Account Forex Transactionsrebalap15No ratings yet

- UMB Mobile Banking: SMS/Text Message CommandsDocument3 pagesUMB Mobile Banking: SMS/Text Message CommandsMenk JnrNo ratings yet

- Internship Report of SEBL Feni BranchDocument27 pagesInternship Report of SEBL Feni BranchShah Mohammad ImtiyazNo ratings yet

- Bni PT Bangun Jun22Document3 pagesBni PT Bangun Jun22Yehezkiel AdhiNo ratings yet

- Role of SBCO in CBSDocument11 pagesRole of SBCO in CBSBaskar ANgadeNo ratings yet

- Unit 4: by Ankita UpadhyayDocument65 pagesUnit 4: by Ankita UpadhyayAarushi CharurvediNo ratings yet

- Breaking Free From Broke - George KamelDocument289 pagesBreaking Free From Broke - George KamelAlonso RodriguezNo ratings yet

- Bank Statement Nov-DecDocument7 pagesBank Statement Nov-DecUS BANK ONLINE TRANSFERS100% (6)

- Core Banking and Financial Operations at Punjab and Sind BankDocument74 pagesCore Banking and Financial Operations at Punjab and Sind BankJoshua LoyalNo ratings yet

- Thames Water Bill (PDF Original)Document5 pagesThames Water Bill (PDF Original)robin sajid67% (3)

- L7 Financial ManagementDocument42 pagesL7 Financial Managementfairylucas708No ratings yet

- Cash MemoDocument3 pagesCash MemoHimanshu SinghNo ratings yet

- Banking and Finance Project Topics and MaterialsDocument3 pagesBanking and Finance Project Topics and MaterialsAlo Peter taiwoNo ratings yet

- Working of State Bank of IndiaDocument9 pagesWorking of State Bank of Indiakamblepoonam96No ratings yet

- Notes-N-Unit-2-Starting To Cash Book (ALL) - .Document93 pagesNotes-N-Unit-2-Starting To Cash Book (ALL) - .happy lifeNo ratings yet

- Equity Analysis With Reference To Automobile IndustryDocument79 pagesEquity Analysis With Reference To Automobile Industrysmartway projectsNo ratings yet

- HKDL Group 4Document16 pagesHKDL Group 4RAHUL DASNo ratings yet

- Unit 2 - Sbaa7001 Banking Products and ServicesDocument38 pagesUnit 2 - Sbaa7001 Banking Products and ServicesGracyNo ratings yet

- FM 415 Money MarketsDocument50 pagesFM 415 Money MarketsMarc Charles UsonNo ratings yet

- Mcqs LedgerDocument10 pagesMcqs LedgerUsama SaadNo ratings yet

- Credit and Collection: Methods of Establishing The CreditDocument8 pagesCredit and Collection: Methods of Establishing The CreditArnold BelangoyNo ratings yet

- SFF AgendaDocument43 pagesSFF Agendadelmal1234No ratings yet

- IAS-23 Borrowing Costs CapitalisationDocument19 pagesIAS-23 Borrowing Costs CapitalisationAbdul SamiNo ratings yet

- 2023 07 q1-2024 Investor PresentationDocument73 pages2023 07 q1-2024 Investor PresentationtsasidharNo ratings yet

- Proposal by Afize JemalDocument54 pagesProposal by Afize Jemaloumer muktarNo ratings yet