Professional Documents

Culture Documents

Question 7

Question 7

Uploaded by

Edwin Otieno0 ratings0% found this document useful (0 votes)

8 views1 pageThe document calculates the net present worth (NPW) of an investment in equipment that costs $625,000 to purchase and $125,000 to install. It factors in an annual cash inflow of $150,000 over 10 years discounted at 5% per year, as well as the full $875,000 cost discounted at 5% over 10 years. Performing the calculations, it determines the NPW is -$4,387.25, indicating the investment is not financially feasible.

Original Description:

Original Title

Question 7.docx

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document calculates the net present worth (NPW) of an investment in equipment that costs $625,000 to purchase and $125,000 to install. It factors in an annual cash inflow of $150,000 over 10 years discounted at 5% per year, as well as the full $875,000 cost discounted at 5% over 10 years. Performing the calculations, it determines the NPW is -$4,387.25, indicating the investment is not financially feasible.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views1 pageQuestion 7

Question 7

Uploaded by

Edwin OtienoThe document calculates the net present worth (NPW) of an investment in equipment that costs $625,000 to purchase and $125,000 to install. It factors in an annual cash inflow of $150,000 over 10 years discounted at 5% per year, as well as the full $875,000 cost discounted at 5% over 10 years. Performing the calculations, it determines the NPW is -$4,387.25, indicating the investment is not financially feasible.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

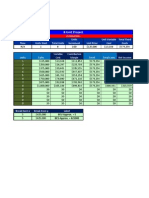

Question 7:

NPW = -$625,000 + $150,000(P/A,5%,10) - $875,000(P/F,5%,10)

Cost of the equipment = $500,000+$125,000

$150,000(P/A,5%,10) = $150,000 * 7.7217 = $1,158,255

$875,000(P/F,5%,10) = $875,000 * 0.61391 = $537,643.25

Substituting these values in the equation, we get:

NPW = -$625,000 + $1,158,255 - $537,643.25

Simplifying, we get:

NPW = $-4,387.25

Therefore, the net present worth of this investment is -$4,387.25, indicating that the

investment is not financially feasible.

You might also like

- Solved Problems in Engineering Economics: CLSU-AE Board Exam Review Materials 1Document49 pagesSolved Problems in Engineering Economics: CLSU-AE Board Exam Review Materials 1Abas Acmad67% (3)

- The Basics of Capital Budgeting: Evaluating Cash Flows: Solutions To End-Of-Chapter ProblemsDocument22 pagesThe Basics of Capital Budgeting: Evaluating Cash Flows: Solutions To End-Of-Chapter ProblemsGhina ShaikhNo ratings yet

- Practice Problems - SolutionsDocument29 pagesPractice Problems - SolutionsTabassumAkhterNo ratings yet

- Solution - Chapter 5Document16 pagesSolution - Chapter 5Diva Tertia AlmiraNo ratings yet

- The Basics of Capital Budgeting: Evaluating Cash Flows: Solutions To End-Of-Chapter ProblemsDocument5 pagesThe Basics of Capital Budgeting: Evaluating Cash Flows: Solutions To End-Of-Chapter ProblemsRichi MatheuNo ratings yet

- BSOP 209 Week 3 Assignment AnswerDocument2 pagesBSOP 209 Week 3 Assignment AnswerEslam SabryNo ratings yet

- Module 7 Incremental Method - RevDocument18 pagesModule 7 Incremental Method - RevYun TelNo ratings yet

- Module 7 Incremental Method - RevDocument18 pagesModule 7 Incremental Method - RevReza PahleviNo ratings yet

- Chapter 2 Review ExerciseDocument1 pageChapter 2 Review ExerciseKenisha ManicksinghNo ratings yet

- Module 7 Incremental Method PDFDocument14 pagesModule 7 Incremental Method PDFRizki AnggraeniNo ratings yet

- Module 7 Incremental MethodDocument14 pagesModule 7 Incremental MethodRizki AnggraeniNo ratings yet

- Rounding Off Income Matrix Example MJT Washing House Has The Following Transaction For ItsDocument3 pagesRounding Off Income Matrix Example MJT Washing House Has The Following Transaction For ItsPaul Assie RosarioNo ratings yet

- Chapter 9 AssignmentDocument4 pagesChapter 9 AssignmentabraamNo ratings yet

- Chapter 7 - Engineering Economic Analysis, 2nd Canadian EditionDocument46 pagesChapter 7 - Engineering Economic Analysis, 2nd Canadian EditionSamNo ratings yet

- Chapter 8 Solutions Corporate FinanceDocument5 pagesChapter 8 Solutions Corporate FinanceWill GarciaNo ratings yet

- FFM 11ce SM Chapter09Document42 pagesFFM 11ce SM Chapter09Manish SadhuNo ratings yet

- Nguyen Thi Thanh TrangDocument12 pagesNguyen Thi Thanh TrangNguyễn Thanh TrangNo ratings yet

- CH 7 AnswersDocument5 pagesCH 7 Answersthenikkitr0% (1)

- CH 10Document23 pagesCH 10Nguyễn Hữu HoàngNo ratings yet

- 35 Practice MCQ Solutions For Website - UPDATEDDocument7 pages35 Practice MCQ Solutions For Website - UPDATEDBaher WilliamNo ratings yet

- First Boot LogDocument14 pagesFirst Boot Logcristoferalegre48No ratings yet

- Engg Economics (Topic 8) Rate of ReturnDocument15 pagesEngg Economics (Topic 8) Rate of ReturnmhammadsarganaNo ratings yet

- Break Even 2Document2 pagesBreak Even 2DavidNo ratings yet

- AEFMANDocument3 pagesAEFMANJohn Domenic LuceroNo ratings yet

- Immanuel Uugwanga Cost and Procuremt PDFDocument5 pagesImmanuel Uugwanga Cost and Procuremt PDFElisha WoyoNo ratings yet

- NPV of Purchasing Delta Calculation of Tax 0 1Document2 pagesNPV of Purchasing Delta Calculation of Tax 0 1ASAD ULLAHNo ratings yet

- Exercises, BondsDocument1 pageExercises, BondsbecerranfNo ratings yet

- Sv351 F09 PS2 SolutionsDocument20 pagesSv351 F09 PS2 SolutionsSeptiVeri Andriono0% (1)

- MTK LanjutanDocument1 pageMTK LanjutanDela Agussetiawati AlamNo ratings yet

- Standard Costing and Variance Analysis: 22. A. Total Purchases AP × AQDocument7 pagesStandard Costing and Variance Analysis: 22. A. Total Purchases AP × AQShaira UnggadNo ratings yet

- P10-7 Net Present Value - Independent Projects Project ADocument2 pagesP10-7 Net Present Value - Independent Projects Project AIntan N TNo ratings yet

- Premiums TableDocument7 pagesPremiums TableJhorine Mae ChavezNo ratings yet

- Solutions To Practice Problem Set #8: Capital Budgeting Practice ProblemsDocument16 pagesSolutions To Practice Problem Set #8: Capital Budgeting Practice ProblemsraymondNo ratings yet

- Capital Budgeting - SolutionsDocument7 pagesCapital Budgeting - SolutionsraymondNo ratings yet

- CH 5 Solutions FinalDocument14 pagesCH 5 Solutions FinalAbner MolinaNo ratings yet

- Arab American University Faculty of Graduate Studies Accounting DepartmentDocument3 pagesArab American University Faculty of Graduate Studies Accounting DepartmentHasan NajiNo ratings yet

- Streamlined Expense Estimates4Document5 pagesStreamlined Expense Estimates4Baljeet SinghNo ratings yet

- Week 10&11 Assignment-HernandezDocument3 pagesWeek 10&11 Assignment-HernandezDigna HernandezNo ratings yet

- Streamlined Expense Estimates1Document5 pagesStreamlined Expense Estimates1dhineshNo ratings yet

- Asignment Chapter 10Document6 pagesAsignment Chapter 10Thi Khanh Linh PhamNo ratings yet

- Brief Exercises: Jesica Islas Intermediate Accounting 1 February 12, 2007 Professor A. WuDocument11 pagesBrief Exercises: Jesica Islas Intermediate Accounting 1 February 12, 2007 Professor A. Wugeenah111No ratings yet

- Scientific Notation 2Document2 pagesScientific Notation 2api-277628628No ratings yet

- Chapter 12 SolutionsDocument11 pagesChapter 12 SolutionswieNo ratings yet

- Module 7 Incremental MethodDocument14 pagesModule 7 Incremental MethodRhonita Dea AndariniNo ratings yet

- ACC2101 Midterm ReviewDocument3 pagesACC2101 Midterm Reviewalbert100% (1)

- Multiage Proposed BudgetDocument1 pageMultiage Proposed Budgetapi-321107718No ratings yet

- Fee StructureDocument4 pagesFee Structureapi-523244805No ratings yet

- Passignment4 Nagumhannahkeil 6219 A116Document4 pagesPassignment4 Nagumhannahkeil 6219 A116Vonreev OntoyNo ratings yet

- Pag 199 4. Pag 199: Unitat 10. ActivitatsDocument5 pagesPag 199 4. Pag 199: Unitat 10. ActivitatsAlèxia SalvadorNo ratings yet

- Earned Value ManagementsDocument43 pagesEarned Value Managementsadityavicky1No ratings yet

- I. Time Value of Money: PortfolioDocument7 pagesI. Time Value of Money: PortfoliocarlaNo ratings yet

- Module 9 Replacement AnalysisDocument17 pagesModule 9 Replacement AnalysisRizki AnggraeniNo ratings yet

- Module 3 ActivityDocument3 pagesModule 3 ActivityLezi WooNo ratings yet

- Chapter 6 - Answer KeyDocument8 pagesChapter 6 - Answer KeyĐặng Thanh ThuỷNo ratings yet

- Assignment 3 - Calculating Turnover CostDocument14 pagesAssignment 3 - Calculating Turnover CostShweta SharmaNo ratings yet

- Case 12Document2 pagesCase 12Edwin OtienoNo ratings yet

- EqualityDocument1 pageEqualityEdwin OtienoNo ratings yet

- Question 4Document1 pageQuestion 4Edwin OtienoNo ratings yet

- CEE 300 AssignmentDocument2 pagesCEE 300 AssignmentEdwin OtienoNo ratings yet

- Assignment - CEE 300Document3 pagesAssignment - CEE 300Edwin OtienoNo ratings yet