Professional Documents

Culture Documents

BIR Ruling DA-460-07 (PAGCOR)

Uploaded by

JonCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BIR Ruling DA-460-07 (PAGCOR)

Uploaded by

JonCopyright:

Available Formats

August 21, 2007

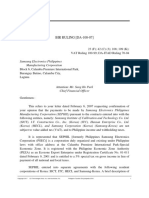

BIR RULING [DA-460-07]

DA-045-2004 Sec. 1 (C) RA 9337; RA 7716;

Sec. 13 (2) (b) PD 1869; Sec. 27, NIRC

Cayañga, Zuñiga and Angel

2nd Flr. One Corporate Plaza

845 Arnaiz Ave. Legaspi Village

Makati City

Attention : Atty. Aureen Soriano

Gentlemen :

This refers to your letter dated September 9, 2005 requesting for a ruling on

whether the tax exemption being enjoyed by the Philippine Amusement and Gaming

Corporation (PAGCOR) under Section 13 (2) (b) of Presidential Decree (PD) No.

1869 may be extended to your client by virtue of its Contract of Lease with the

former.

It is represented that your client, Pacific Digital Amusement Systems,

Incorporated ("Pacific Amusements", for brevity) is a corporation duly organized

under Philippine laws and has exclusive proprietary rights to a gaming system

software and owns the hardware, equipment and accessories to operate electronic

games.

It is further represented that Pacific Amusements and PAGCOR executed a

Contract of Lease on August 8, 2005 whereby the former leased its electronic gaming

system, including gaming kiosks/terminals and a fully equipped electronic amusement

station in Miramar Hotel for a period of one year. The said contract also provided that

PAGCOR shall pay Pacific Amusements a monthly variable rent amounting to forty

percent (40%) of the gross revenues of the gaming system's operation at the station

after deducting the players' winnings/prizes and all applicable taxes due to the Bureau

Copyright 1994-2009 CD Technologies Asia, Inc. Philippine Taxation 2008 1

of Internal Revenue. EcHAaS

In reply, please be informed that Section 13 (2) (b) of PD 1869 is no longer

applicable to your client as PAGCOR, starting November 1, 2005, no longer enjoys

exemption from income taxes with the implementation of Republic Act (RA) No.

9337. Section 1 (C) of RA 9337 states that:

Section 1. Section 27 of the National Internal Revenue Code of 1997, as

amended, is hereby further amended to read as follows:

"(C) Government-Owned or Controlled Corporations, Agencies or

Instrumentalities. — The provisions of existing special or general laws to the

contrary notwithstanding, all corporations, agencies, or instrumentalities

owned or controlled by the Government, except the Government Service

Insurance System (GSIS), the Social Security System (SSS), the Philippine

Health Insurance Corporation (PHIC), and the Philippine Charity Sweepstakes

(PCSO), shall pay such rate of tax upon their taxable income as are imposed

by this Section upon corporations or associations engaged in a similar

business, industry, or activity."

It can be seen here that RA 9337 omitted PAGCOR from the list of

government corporations that are exempt from income taxation under Section 27 of

the Tax Code of 1997. As a result, PAGCOR is now regarded as liable for income

taxes imposed on domestic corporations along with its 10% (now 12% starting

February 1, 2006) VAT liability under RA 7716. And since there is no longer any

income tax exemption to speak of, it follows that PAGCOR has no exemption

privileges to extend to Pacific Amusements under Section 13 (2) (b) of P.D. 1869.

Accordingly, this office is of the opinion that since there is no longer any basis

on PAGCOR's part to claim exemption from income taxes, it follows that Pacific

Amusements is taxable on income gained from its Contract of Lease with the former

starting November 1, 2005. In addition, all transactions entered into by your client as a

seller of goods and services or lessor of properties are subject to VAT.

This ruling is being issued on the basis of the foregoing facts as represented.

However, if upon investigation, it will be disclosed that the facts are different, then

this ruling shall be considered null and void. DacTEH

Very truly yours,

Copyright 1994-2009 CD Technologies Asia, Inc. Philippine Taxation 2008 2

Commissioner of Internal Revenue

By:

(SGD.) JAMES H. ROLDAN

Assistant Commissioner

Legal Service

Copyright 1994-2009 CD Technologies Asia, Inc. Philippine Taxation 2008 3

You might also like

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

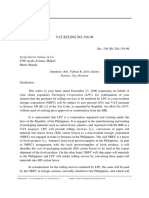

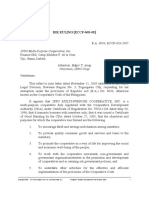

- BIR Ruling DA-229-06 (PAGCOR) PDFDocument4 pagesBIR Ruling DA-229-06 (PAGCOR) PDFJonNo ratings yet

- BIR Ruling No. 750-18Document4 pagesBIR Ruling No. 750-18SGNo ratings yet

- BIR RULING NO. 1102-18: Tata Consultancy Services (Philippines), IncDocument3 pagesBIR RULING NO. 1102-18: Tata Consultancy Services (Philippines), IncKathleen Leynes100% (1)

- Bir Ruling Da 108 07Document9 pagesBir Ruling Da 108 07Ylmir_1989No ratings yet

- VAT Ruling No. 16-09Document4 pagesVAT Ruling No. 16-09Rieland CuevasNo ratings yet

- 1999 ITAD RulingsDocument97 pages1999 ITAD RulingsJerwin DaveNo ratings yet

- 2012 ITAD - BIR - Ruling - No. - 092 1220210505 11 1ig3ujmDocument4 pages2012 ITAD - BIR - Ruling - No. - 092 1220210505 11 1ig3ujmrian.lee.b.tiangcoNo ratings yet

- RMC 33-2013Document4 pagesRMC 33-2013Ephraim TuganoNo ratings yet

- BIR Ruling ECCP 068-08Document4 pagesBIR Ruling ECCP 068-08Kendra Miranda LorinNo ratings yet

- 2006 ITAD Rulings - Delegated AuthorityDocument537 pages2006 ITAD Rulings - Delegated AuthorityJerwin DaveNo ratings yet

- Bir Ruling Da Il 046 797 09Document3 pagesBir Ruling Da Il 046 797 09JianSadakoNo ratings yet

- BIR Ruling on Donor's Tax Exemption for Religious OrganizationDocument69 pagesBIR Ruling on Donor's Tax Exemption for Religious OrganizationDaisy Ducepec100% (1)

- BIR Ruling (DA - (IL-045) 516-08)Document7 pagesBIR Ruling (DA - (IL-045) 516-08)Jerwin DaveNo ratings yet

- C25. Bloomberry Resort v. BIR, G.R. 212530, Aug 10, 2016 PDFDocument19 pagesC25. Bloomberry Resort v. BIR, G.R. 212530, Aug 10, 2016 PDFMaria Jeminah TurarayNo ratings yet

- BIR Ruling DA - C-018 075-10Document2 pagesBIR Ruling DA - C-018 075-10Mark Lord Morales BumagatNo ratings yet

- SG ITAD Ruling No. 019-03Document4 pagesSG ITAD Ruling No. 019-03Paul Angelo TombocNo ratings yet

- Itad Bir Ruling No. 065-05Document4 pagesItad Bir Ruling No. 065-05msdivergentNo ratings yet

- Bir Ruling 418-03 PDFDocument2 pagesBir Ruling 418-03 PDFSor Elle100% (1)

- Bloomberry Resort vs. BIRDocument6 pagesBloomberry Resort vs. BIRCyruss Xavier Maronilla NepomucenoNo ratings yet

- Bloomberry Resorts and Hotels, Inc. vs. Bureau of Internal RevenueDocument13 pagesBloomberry Resorts and Hotels, Inc. vs. Bureau of Internal Revenuevince005No ratings yet

- DTI DAO No. 10-10Document4 pagesDTI DAO No. 10-10Peggy SalazarNo ratings yet

- BIR Ruling - DA-200-04Document3 pagesBIR Ruling - DA-200-04foxofthedesert2001No ratings yet

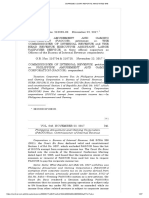

- Philippine Amusement and Gaming Corporation (PAGCOR) vs. Commissioner of Internal Revenue, 846 SCRA 340, November 22, 2017Document27 pagesPhilippine Amusement and Gaming Corporation (PAGCOR) vs. Commissioner of Internal Revenue, 846 SCRA 340, November 22, 2017Christopher IgnacioNo ratings yet

- Bir Ruling (Da - (C-104) 328-08)Document3 pagesBir Ruling (Da - (C-104) 328-08)E ENo ratings yet

- CIR V PALDocument28 pagesCIR V PALReg AnasNo ratings yet

- Peza Erd Form No. 03-01 2018Document2 pagesPeza Erd Form No. 03-01 2018John LuNo ratings yet

- 2006 BIR - Ruling - DA 432 06 - 20210505 13 1t6tcx6Document3 pages2006 BIR - Ruling - DA 432 06 - 20210505 13 1t6tcx6Boss NikNo ratings yet

- 2000 ITAD RulingsDocument409 pages2000 ITAD RulingsJerwin DaveNo ratings yet

- BIR Rulings (2017 - 2018)Document2,631 pagesBIR Rulings (2017 - 2018)Jerwin DaveNo ratings yet

- BIR Ruling No. DA-181-06 Dated Mar. 27, 2006Document3 pagesBIR Ruling No. DA-181-06 Dated Mar. 27, 2006KriszanFrancoManiponNo ratings yet

- XII. CIR vs. Secretary of Justice & PAGCORDocument17 pagesXII. CIR vs. Secretary of Justice & PAGCORStef OcsalevNo ratings yet

- Yu, Jr. vs. Mupas, 870 SCRA 391, July 04, 2018Document27 pagesYu, Jr. vs. Mupas, 870 SCRA 391, July 04, 2018Vida MarieNo ratings yet

- Commissioner of Internal Revenue vs. Philippine Airlines, Inc.Document22 pagesCommissioner of Internal Revenue vs. Philippine Airlines, Inc.jillian vinluanNo ratings yet

- BIR Ruling on Exemption from IAET for PEZA-Registered FirmDocument3 pagesBIR Ruling on Exemption from IAET for PEZA-Registered FirmStacy Liong BloggerAccountNo ratings yet

- CIR vs. American Express InternationalDocument30 pagesCIR vs. American Express InternationalMonikkaNo ratings yet

- Bir Ruling (Da-560-99) : LexlibDocument3 pagesBir Ruling (Da-560-99) : LexlibRichardNo ratings yet

- Commissioner of Internal Revenue vs. Philippine Airlines, IncDocument13 pagesCommissioner of Internal Revenue vs. Philippine Airlines, IncNash LedesmaNo ratings yet

- 240 Supreme Court Reports AnnotatedDocument8 pages240 Supreme Court Reports AnnotatedKenmar NoganNo ratings yet

- Taxation Case Digest (Batch 2) Case #1Document7 pagesTaxation Case Digest (Batch 2) Case #1Na AbdurahimNo ratings yet

- Bloomberry Resorts V Bir (Exemption-It)Document13 pagesBloomberry Resorts V Bir (Exemption-It)Christopher Ronn PagcoNo ratings yet

- Pagcor Vs BirDocument2 pagesPagcor Vs BirMarie ChieloNo ratings yet

- Tax Alert - 2007 - MarDocument10 pagesTax Alert - 2007 - MarKeats QuindozaNo ratings yet

- Bir Ruling Da C 296 727 09Document3 pagesBir Ruling Da C 296 727 09doraemoanNo ratings yet

- 7333-1998-Bir Ruling No. 029-98 PDFDocument3 pages7333-1998-Bir Ruling No. 029-98 PDFjeffreyNo ratings yet

- 04 - Bloomberry Resorts Vs BIRDocument12 pages04 - Bloomberry Resorts Vs BIRthelawanditscomplexitiesNo ratings yet

- BIR Ruling No. 123-2018Document3 pagesBIR Ruling No. 123-2018AizaNo ratings yet

- TaxDocument4 pagesTaxKathlene JaoNo ratings yet

- PAGCOR V CIRDocument27 pagesPAGCOR V CIRChin T. OndongNo ratings yet

- Bir Ruling (Da 533 07)Document2 pagesBir Ruling (Da 533 07)Jeffrey JosolNo ratings yet

- CIR v. Seceretary of JusticeDocument20 pagesCIR v. Seceretary of Justiceevelyn b t.No ratings yet

- Pagcor Vs BirDocument5 pagesPagcor Vs BirClarisse Ann MirandaNo ratings yet

- G.R. No. 215705-07 Commissioner of Internal Revenue and Commissioner of Customs, Petitioners vs. Philippine Airlines, Inc., RespondentDocument4 pagesG.R. No. 215705-07 Commissioner of Internal Revenue and Commissioner of Customs, Petitioners vs. Philippine Airlines, Inc., RespondentJed Takoy ParachaNo ratings yet

- 36 PAGCOR Vs BIR, GR No. 172087, March 15, 2011Document17 pages36 PAGCOR Vs BIR, GR No. 172087, March 15, 2011Sarah Jean SiloterioNo ratings yet

- PAGCOR VAT EXEMPTIONDocument20 pagesPAGCOR VAT EXEMPTIONDarrel John SombilonNo ratings yet

- IV. CIR vs. PALDocument14 pagesIV. CIR vs. PALStef OcsalevNo ratings yet

- 10 Da-596-06Document3 pages10 Da-596-06Cheska VergaraNo ratings yet

- PAGCOR vs. BIRDocument1 pagePAGCOR vs. BIRDette de LaraNo ratings yet

- Constitution Statutes Executive Issuances Judicial Issuances Other Issuances Jurisprudence International Legal Resources AUSL ExclusiveDocument9 pagesConstitution Statutes Executive Issuances Judicial Issuances Other Issuances Jurisprudence International Legal Resources AUSL Exclusivesbce14No ratings yet

- Digest (1986 To 2016)Document151 pagesDigest (1986 To 2016)Jerwin DaveNo ratings yet

- Monthly Remittance Return of Income Taxes Withheld On CompensationDocument3 pagesMonthly Remittance Return of Income Taxes Withheld On CompensationJonNo ratings yet

- 0605Document4 pages0605Ck Bongalos AdolfoNo ratings yet

- Schedules of Alphanumeric Tax CodesDocument2 pagesSchedules of Alphanumeric Tax CodesJon0% (1)

- Ra 7641Document2 pagesRa 7641JonNo ratings yet

- RR 1-83Document5 pagesRR 1-83Crnc NavidadNo ratings yet

- RR 11-01 (Fees) PDFDocument1 pageRR 11-01 (Fees) PDFJonNo ratings yet

- BIR Bank Bulletin Tax Amnesty Payment Deadline May 5 2008Document2 pagesBIR Bank Bulletin Tax Amnesty Payment Deadline May 5 2008JonNo ratings yet

- RMC 10-83Document2 pagesRMC 10-83JonNo ratings yet

- E-Library - Used Vehicle Import Ban Ruled UnconstitutionalDocument18 pagesE-Library - Used Vehicle Import Ban Ruled UnconstitutionalJonNo ratings yet

- E-Library - Information At Your Fingertips: Printer FriendlyDocument15 pagesE-Library - Information At Your Fingertips: Printer FriendlyJonNo ratings yet

- CIR V Estate of Benigno Toda (GR No 147188, Sept 2004)Document10 pagesCIR V Estate of Benigno Toda (GR No 147188, Sept 2004)JonNo ratings yet