Professional Documents

Culture Documents

Format YA 2022

Uploaded by

sharifah nurshahira sakinaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Format YA 2022

Uploaded by

sharifah nurshahira sakinaCopyright:

Available Formats

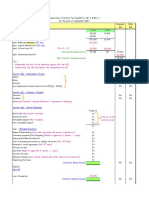

ABC Sdn Bhd

Computation of Income Tax Payable for YA 2022

Add (+) Less (-) Amount

RM RM RM

Net profit/(loss) before tax XX / (XX)

Adjustment: COGS

a) Provision for stock losses XX

b) Gift Nil

c) Compensation – Restrictive covenant XX

d) Drawings – Market value [PR3/2020] XX

1)Gain/non-business income

Dividend XX

Interest* - Refer PR3/2016 XX

Discount XX

Rental income - PR12/2018 & E.O 2 2019 XX

Gain/profit on sale of fixed asset (not allowed) XX

Compensation received XX

2) Double deduction for expenses

a) Salary – Disable: PR3/2019 XX

b) Promotion for export XX

c) Approved R&D XX

3)Non-Deductible Expenses

a. Expenses that are not wholly & exclusively XX

incurred to generate gross income

XX

b. Capital expenditure

c. Expenses related to investment income XX

d. Section 39 prohibited expenses XX

e. Capital expenditure expensed off to P&L XX

XX (XX) (XX)

ADJUSTED BUSINESS INCOME / (LOSS) XX

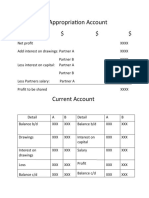

Amount

RM RM RM

ADJUSTED BUSINESS INCOME / (LOSS) XX

Add/(Less): Balancing charge X

(Balancing allowance) (X)

Less: Capital allowance b/f (X)

Capital allowance – current (X)

IBA / AA (X)

STATUTORY BUSINESS INCOME XXX

Less: Unabsorbed loss b/f (X)

Add: Other income (non-business income)

a) S.4(c) Investment Income X

b) S.4(d) Rental, Royalty, Premium X

c) S.4(f) Other Income X

AGGREGATE INCOME (AI) XXX

Less: Current year business loss (X)

Less: Zakat (2.5% of AI or Actual -WIL) (X)

Less: Donation to Government (x)

Less: Approved donation – Section 44

(10% of AI or Actual – WIL) (X)

CHARGEABLE INCOME (CI) XXX

Tax Rate # 24%

INCOME TAX PAYABLE XX

# For SME

First RM600,000 @ 17%

Remaining amount @ 24%

You might also like

- Chapter 9 Ptx1033/Personal TaxDocument10 pagesChapter 9 Ptx1033/Personal TaxNUR ALEEYA MAISARAH BINTI MOHD NASIR (AS)No ratings yet

- Computation Format For Individual Tax Liability For The Year of Assessment 20XXDocument4 pagesComputation Format For Individual Tax Liability For The Year of Assessment 20XXMiera FrnhNo ratings yet

- Computation Format For Individual Tax Liability For The Year of Assessment 20XXDocument4 pagesComputation Format For Individual Tax Liability For The Year of Assessment 20XXannastasia luyah100% (1)

- Ya2022 - Format Tax Computation Trust BodyDocument4 pagesYa2022 - Format Tax Computation Trust BodyDaniel HaziqNo ratings yet

- Computation Format - Company's Income TaxDocument2 pagesComputation Format - Company's Income TaxNik Fatehah NajwaNo ratings yet

- Mock Answers Far-1 Autumn 2022Document13 pagesMock Answers Far-1 Autumn 2022rana m harisNo ratings yet

- SOPL and SOFP FormatDocument3 pagesSOPL and SOFP Formatnurizzatul syazwaniNo ratings yet

- IAS 7 - Cashflow StatementsDocument64 pagesIAS 7 - Cashflow StatementsDawar Hussain (WT)No ratings yet

- Format Relief Rebate Ya 2021 - LatestDocument4 pagesFormat Relief Rebate Ya 2021 - LatestJasne OczyNo ratings yet

- Name of Business: Format of Final Accounts (Vertical Format)Document2 pagesName of Business: Format of Final Accounts (Vertical Format)adamyasmin825No ratings yet

- Chapter 23 - Personal Taxation - January 2024Document23 pagesChapter 23 - Personal Taxation - January 2024Aikal HakimNo ratings yet

- Format of Computation For Income Tax PayableDocument2 pagesFormat of Computation For Income Tax PayableMiera FrnhNo ratings yet

- Format ComputationDocument2 pagesFormat Computationathirah jamaludinNo ratings yet

- MFRS101 Presentation of Financial StatemntsDocument8 pagesMFRS101 Presentation of Financial StatemntsIsmahani HaniNo ratings yet

- Format of FS-1Document4 pagesFormat of FS-1Happy PillsNo ratings yet

- Tax317 Topic 2 Company TaxationDocument14 pagesTax317 Topic 2 Company Taxationhizzat firdausNo ratings yet

- Lecture 5 - Corporate Tax 2022Document23 pagesLecture 5 - Corporate Tax 2022Jasne OczyNo ratings yet

- Chapter 5: Corporate Tax Learning ObjectivesDocument19 pagesChapter 5: Corporate Tax Learning ObjectivesLogaa UthyasuriyanNo ratings yet

- Power Point Chapter - 12Document42 pagesPower Point Chapter - 12tara.tzaferisNo ratings yet

- Accounting-Formats For Cambridge IGCSEDocument11 pagesAccounting-Formats For Cambridge IGCSEmuhtasim kabir100% (9)

- TXZAF 2019 Dec ADocument8 pagesTXZAF 2019 Dec AKAH MENG KAMNo ratings yet

- Vertical Balance SheetDocument3 pagesVertical Balance Sheetamit2201No ratings yet

- Consolidated Statement of Financial PositionDocument29 pagesConsolidated Statement of Financial PositionTinashe ZhouNo ratings yet

- Week 9, CT Losses, 2022-23 - TutorDocument32 pagesWeek 9, CT Losses, 2022-23 - Tutorarpita aroraNo ratings yet

- Chapter 11Document5 pagesChapter 11abinaNo ratings yet

- Module 4 - Specific Inclusions Lecture Notes-3Document31 pagesModule 4 - Specific Inclusions Lecture Notes-3Sphephelo MbhamalyNo ratings yet

- Divisible Income/ (Loss) : Computation of Tax Payable For Each PartnerDocument1 pageDivisible Income/ (Loss) : Computation of Tax Payable For Each PartnerNURAISHA AIDA ATANNo ratings yet

- 5.consolidated SOCI - AAFRDocument11 pages5.consolidated SOCI - AAFRAli OptimisticNo ratings yet

- Chapter 5 - Computation of Statutory Business Income LatestDocument3 pagesChapter 5 - Computation of Statutory Business Income LatestAnonymous iQuwAQTH60% (5)

- FR 2019 Marjun Sample A PDFDocument10 pagesFR 2019 Marjun Sample A PDFJenifer KlintonNo ratings yet

- T8 Tutorial SolutionsDocument4 pagesT8 Tutorial SolutionsAnathi AnathiNo ratings yet

- 05 Current Taxation 05 Current TaxationDocument28 pages05 Current Taxation 05 Current TaxationShehrozSTNo ratings yet

- PSA ACCOUNTS - MR Desmond AboagyeDocument17 pagesPSA ACCOUNTS - MR Desmond AboagyeGen AbulkhairNo ratings yet

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document6 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)Neeraj JoshiNo ratings yet

- Chapter 3 Ascertainment of Chargeable IncomeDocument9 pagesChapter 3 Ascertainment of Chargeable IncomeLOO YU HUANGNo ratings yet

- Less: Trading Losses Brought Forward Under CTA 2010, S. 45Document2 pagesLess: Trading Losses Brought Forward Under CTA 2010, S. 45Dime PierrowNo ratings yet

- Entity Y: Problem 4: Activity 2Document11 pagesEntity Y: Problem 4: Activity 2Christine Eunice RaymondeNo ratings yet

- Consolidated Statement of Profit or Losses and Other Comprehensive IncomeDocument10 pagesConsolidated Statement of Profit or Losses and Other Comprehensive IncomeTinashe ZhouNo ratings yet

- FA2 - Sem04 ImpairmentDocument5 pagesFA2 - Sem04 Impairmenttitu patriciuNo ratings yet

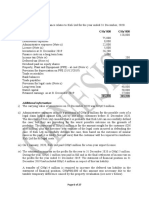

- Format PartnershipDocument1 pageFormat PartnershipAyu IbrahimNo ratings yet

- Ir 957 eDocument4 pagesIr 957 eVintonius Raffaele PRIMUSNo ratings yet

- Power Point Chapter - 13Document24 pagesPower Point Chapter - 13tara.tzaferisNo ratings yet

- FR SD20 Sample - Suggested Solutions and Marking Schemes v1.0Document9 pagesFR SD20 Sample - Suggested Solutions and Marking Schemes v1.0anh anhNo ratings yet

- Final Account of Insurance Company (Introduction)Document5 pagesFinal Account of Insurance Company (Introduction)Praveen JoeNo ratings yet

- BiyaniSir-Amendments For CAInter Tax - Nov20Document51 pagesBiyaniSir-Amendments For CAInter Tax - Nov20shri jeetNo ratings yet

- Sample Chapter 1Document15 pagesSample Chapter 1Miera FrnhNo ratings yet

- Format BZ IncomeDocument1 pageFormat BZ IncomezulfikriNo ratings yet

- Accounting For Income TaxDocument6 pagesAccounting For Income TaxKakay EspirituNo ratings yet

- Atxuk Sample Marjun 2019 ADocument10 pagesAtxuk Sample Marjun 2019 AAdam KhanNo ratings yet

- Acca F6 Uk Taxation FA 2017: Course Notes For Exams From June 2018 To March 2019Document100 pagesAcca F6 Uk Taxation FA 2017: Course Notes For Exams From June 2018 To March 2019AliRazaSattarNo ratings yet

- Ias 1-Presentation of Financial StatementsDocument21 pagesIas 1-Presentation of Financial StatementsChumani GqadaNo ratings yet

- FCFF Calculation 16.05.2022Document5 pagesFCFF Calculation 16.05.2022রাফিউল রিয়াজ অমিNo ratings yet

- Vertical Format: Format of Income Statement ParticularsDocument4 pagesVertical Format: Format of Income Statement ParticularsAnjali Betala Kothari100% (1)

- QUESTION 6 Financial Reporting May 2021 KOLIDocument6 pagesQUESTION 6 Financial Reporting May 2021 KOLILaud ListowellNo ratings yet

- Cash Flow - Format 2021Document3 pagesCash Flow - Format 2021Roy YadavNo ratings yet

- Format of Final Accounts (Vertical Format)Document3 pagesFormat of Final Accounts (Vertical Format)ummieulfahNo ratings yet

- Individual Chargeable Income (Section 4a To 4d) Tax Computation FormatDocument1 pageIndividual Chargeable Income (Section 4a To 4d) Tax Computation FormatHaananth SubramaniamNo ratings yet

- Business & ProfessionDocument10 pagesBusiness & ProfessionGaurav vaidyaNo ratings yet

- Schedule C (Form 1040)Document2 pagesSchedule C (Form 1040)Vita Volunteers WebmasterNo ratings yet

- Private Debt: Yield, Safety and the Emergence of Alternative LendingFrom EverandPrivate Debt: Yield, Safety and the Emergence of Alternative LendingNo ratings yet

- Activity 2 Basis PeriodDocument1 pageActivity 2 Basis Periodsharifah nurshahira sakinaNo ratings yet

- SS - TEST FAR270 - NOV 2022 Set 2 StudentDocument5 pagesSS - TEST FAR270 - NOV 2022 Set 2 Studentsharifah nurshahira sakinaNo ratings yet

- SS CT 1 FAR270 Sem MAC2022 StudentDocument4 pagesSS CT 1 FAR270 Sem MAC2022 Studentsharifah nurshahira sakinaNo ratings yet

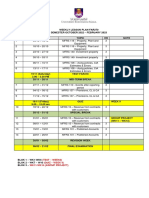

- 0 - Far270 - Weekly Lesson Plan - Oct 2022 PDFDocument2 pages0 - Far270 - Weekly Lesson Plan - Oct 2022 PDFsharifah nurshahira sakinaNo ratings yet

- REVISED SS CT FAR270 May 2021 With ExplanationDocument4 pagesREVISED SS CT FAR270 May 2021 With Explanationsharifah nurshahira sakinaNo ratings yet

- SS Illustrative Example ItaDocument1 pageSS Illustrative Example Itasharifah nurshahira sakinaNo ratings yet

- Solution Illustrative Example PSDocument1 pageSolution Illustrative Example PSsharifah nurshahira sakinaNo ratings yet

- TAX317 TEST Q Dec2021Document10 pagesTAX317 TEST Q Dec2021sharifah nurshahira sakinaNo ratings yet

- Tax317 Ctmay2022Document10 pagesTax317 Ctmay2022sharifah nurshahira sakinaNo ratings yet

- Financial Reporting Volume-IDocument860 pagesFinancial Reporting Volume-IMayank Parekh100% (3)

- The Future Starts Today, Not Tomorrow.: Chapter 8: Overview of Working Capital ManagementDocument29 pagesThe Future Starts Today, Not Tomorrow.: Chapter 8: Overview of Working Capital ManagementIni IchiiiNo ratings yet

- Cost 2023-MayDocument6 pagesCost 2023-MayDAVID I MUSHINo ratings yet

- Mergers and AcquisitionsDocument20 pagesMergers and Acquisitionsfirman prabowoNo ratings yet

- Solutions - Chapter 2Document29 pagesSolutions - Chapter 2Dre ThathipNo ratings yet

- Musa Moshref and Shaniqua Hollins Have Operated A Successful FirmDocument2 pagesMusa Moshref and Shaniqua Hollins Have Operated A Successful FirmMuhammad ShahidNo ratings yet

- ING Group 2Document4 pagesING Group 2Puneet JainNo ratings yet

- Corporate Valuation - Study GuideDocument18 pagesCorporate Valuation - Study GuideJohn Mathias100% (1)

- Tutorial Question (New) - Sem1, 2024Document20 pagesTutorial Question (New) - Sem1, 202422070825No ratings yet

- MBG Corporation Business and Financial Analysis: I. Company BackgroundDocument21 pagesMBG Corporation Business and Financial Analysis: I. Company BackgroundAnggoro PutroNo ratings yet

- Bookkeeping FinalDocument67 pagesBookkeeping FinalKatlene JoyNo ratings yet

- Sample Trading LogDocument10 pagesSample Trading LogVilas ParabNo ratings yet

- Mark Twain Once Divided The World Into Two Kinds of PeopleDocument6 pagesMark Twain Once Divided The World Into Two Kinds of PeopleSunil Bathakaran KanagarajNo ratings yet

- Business ApplicationDocument1 pageBusiness ApplicationBảo Châu VươngNo ratings yet

- Ultimate Guide To Trading Binary OptionsDocument20 pagesUltimate Guide To Trading Binary OptionsBigOption100% (3)

- MCQ On Security Analysis and Portfolio ManagementDocument4 pagesMCQ On Security Analysis and Portfolio ManagementKrithi SelvaNo ratings yet

- Chapter 09Document24 pagesChapter 09Mohamed MadyNo ratings yet

- Wheeliy - Haque - PitchDeck - InvestorsDocument14 pagesWheeliy - Haque - PitchDeck - InvestorsGideon DassNo ratings yet

- Discuss Whether The Dividend Growth Model or The Capital Asset Pricing Model Offers The Better Estimate of Cost of Equity of A Company3Document24 pagesDiscuss Whether The Dividend Growth Model or The Capital Asset Pricing Model Offers The Better Estimate of Cost of Equity of A Company3Henry PanNo ratings yet

- From BMC To Financial Projection 1 Dan 2 FileDocument34 pagesFrom BMC To Financial Projection 1 Dan 2 FileJEREMIA GUNAWANNo ratings yet

- Accounting For Manufacturing ConcernDocument2 pagesAccounting For Manufacturing ConcernAhmed MemonNo ratings yet

- PR - Order in The Matter of M/s. Phenix Properties LimitedDocument2 pagesPR - Order in The Matter of M/s. Phenix Properties LimitedShyam SunderNo ratings yet

- Activist's Latest Short - The Death Industry, StoneMor, LumaDocument2 pagesActivist's Latest Short - The Death Industry, StoneMor, Lumadajeca7No ratings yet

- DFHIDocument4 pagesDFHIJignesh TogadiyaNo ratings yet

- Sources of FinanceDocument25 pagesSources of FinanceAnand Kumar MishraNo ratings yet

- 澳亚 CPA 21S1 FR week2 M2&3Document89 pages澳亚 CPA 21S1 FR week2 M2&3Sijia TaoNo ratings yet

- Brealey. Myers. Allen Chapter 20 TestDocument11 pagesBrealey. Myers. Allen Chapter 20 TestSaleh Kattarwala100% (5)

- BookkeepingDocument14 pagesBookkeepingCristel TannaganNo ratings yet

- Sec D CMA Part 2.Document2 pagesSec D CMA Part 2.shreemant muniNo ratings yet

- Practice TestDocument17 pagesPractice Testgurukant desiNo ratings yet