Professional Documents

Culture Documents

Dividend Policy Question

Uploaded by

raju kumar0 ratings0% found this document useful (0 votes)

28 views3 pagesOriginal Title

dividend policy question

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

28 views3 pagesDividend Policy Question

Uploaded by

raju kumarCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

ustration 11.

1 CALCULATION OF DIVIDEND PER SHARE AT 50% PAYOUT

nZ company expects with some degree of certainty to Year Proflit Dividends DPS Investment Ext. Fnancing

senerate the following profits and to have the following ? 50,00,000 25,00,000 72.50 ? 20,00,000

canital investment during the next five years. 2 40,00,000 20,00,000 2.00 25,00,000 5,00,000

12,50,000 1.25 32,00,000 19,50,000

3 25,00,000

(Figures in '000) 4 20,00,000 10,00,000 1.00 40,00,000 30,00,000

1 2 7,50,000 0.75 50,00,000 42,50,000

lear 3 4 5 5 15,00,000|

Net Income 5,000 4,000 2,500 2,000 1,500

Investment 2,000 2,500 3,200 4,000 5,000 Mustration 11.2

The company currently has 10,00,000 shares of equity and Two companies - A Ltd. and B Ltd. are in the same industry

pavs dividends of 5 per share. with identical earnings per share for the last five years. ALtd.

(9) Determine dividends per share if dividend policy is treated has a policy of paying 40% of earnings as dividends, while the

as a residual decision. BLtd. pays a constant amount of dividend per share. There is

disparity between the market prices of the shares of the two

() Determine dividends per share and the amounts of the companies. The price of the A's share is generally lower than

external financing that will be necessary if a dividend that of the B, even through in some years ALtd. paid more

payout ratio of 50% is maintained. dividends than B. The data on earnings, dividends and market

Solution : price for the two companies are as under :

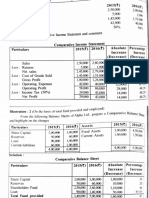

CALCULATION OF DIVIDEND PER SHARE A LTD.

Year EPS DPS Market price

Year Profit Investment Balance DPS Ext. Financing

30,00,000 73.00 2012 4.00 1.60 ? 12.00

50,00,000 20,00,000

2 40,00,000 25,00,000 15,00,000 1.50 0 2013 1.50 0.60 8.50

3 25,00,000 32,00,000 7,00,000 2014 5.00 2.00 13.50

4 20,00,000 40,00,000 20,00,000 2015 4.00 1.60 11.50

5 15,00,000 50,00,000 0 35,00,000 2016 8.00 3.20 14.50

230 PART IV DIVIDEND DECISION

is

The Profit after ax for the year 2016 6,00,000.

BLTD. dividendcn t. Thene

(ompany is contemplating the payment of

Year Ers DPs Market prlce Share for the year 2016. You are required to find ut

(a) EPS and maximum DPSif 10% of the current year profits

2012 t400 tI80 IR50

12.50

2013 L50

$00

180

1.80 1250 are required to be retained.

2014

2015 4.00 180 12.50 (b) Residual DPS if 10% of current year profits to be retaix- .

and fresh investment proposals hefore the

2016 8.00 L80 15.00

requires 2,50,000 for which no horrowing is Company

() Calulate (a) pavout ratio, (b) dividend vield, and

proprsed

Solutlon:

() earning vield for both the companies.

() What are the reasons for the differences in the market EPS of the company :

prices of the two companies share?

Profit After Tax

Less Preference Share Dividend

6,00,000

(in What can be done by the A Ltd. to increase the market 1,30,000

Profit for Equity Shareholders

price of its shares ?

EPS (4,50,000 2,20,000)

450,000

Solution: 2.045

Maximum DPS:

The Payout ratio is DPS ÷ EPS

The Dividend yield is DPS MP

Profit After Tax 6,00,000

The Earnings yield is EPS MP

Less Retained earnings 60,000

Profit available for distribution

The following table shows payout, dividend yield and earn Pref. Share dividend

5,40,000

ings yield for ALtd. and B Ltd. 1,50,000

Profit for Equity shareholders 3,90,000

Year Payout Dividend yield Earnings yield

Cash and Bank balance 3,50,000

A Ltd. B. Ltd. ALtd. B. Ltd. ALtd. B. Ltd.

The company can distribute dividends of ? 3,90,000 but the

2012 40 45 .13 .13 33 3

2013 40 1.20 .07 .14 .18 .12 cash available is only 3,50,000. So, maximum DPS is

2014 40 36 .15 .14 37 40 1.59 (ie, 3,50,000 -+ 2,20,000).

2015 40 45 14 .44 35 32 If the company has investment plans of 2,50,000, then the

2016 40 23 .22 .12 55 53 cash available isonly 1,00,000 and the maximum DPS would

It seems that investors evaluate the shares of these two be0.45 (ie, 100,000-+ 2,20,000).

companies in terms of dividend payments. The average divi llustration 11.4

dend per share overa period of five years for both the firms

is 1.80. But the average market price for the B Ltd. Import Replacement Ltd. specialises in producing goods to

R13.20) has been 10% higher than the average market price substitute imports from the USA. The managing director of

for the ALtd. (R 12). The market has used ahigher capitaliza the company, Ajay, is seriously concerned about the dividend

tion rate to discount the fluctuating dividend per share of the payout policy of the company. He has asked you as acompany

ALtd., thus valuing the shares of the ALtd. at a lower price secretary-cum-finance director to suggest dividend payout

than that of the B Ltd. under each of the following alternative policies :

It is obvious that the market evaluates these firms in terms of Policy I:Adividend payout of ? 2.00 per share, increasing by

dividends. Ahigher market price might be obtained for the <0.20per share over the previous year whenever the dividend

shares of the ALtd., if it increases its dividend payout ratio. payout falls below 50% for the two consecutive years.

The company should evaluate this option in light of funds Policy II:A dividend payout of? 1.00per share for each period

requirements.

except when earnings per share exceed ? 6.00when an extra

dividend equal to 80% of earnings beyond 6.00 would be

llustration 11.3 paid.

Following information is available in respect of Eriksson Ltd.

as on Dec. 31, 2016: The earnings per share of the company over the last 10 years

is shown in the following table:

15% Pref. Share Capital ? 10,00,000

Year Earnings per Share

Equity Share Capital (FV? 10) 22,00,000

Securities Premium A/c 2016 78.00

8,00,000 2015 7.60

Reserves 7,00,000

Cash and Bank Balance (after paymernt of 2014 6.40

2013

Preference Dividend) 3,50,000 2012

5.60

6.40

2011 4.80

CH. 11:DIVIDEND POLICY:DETERMINANTS AND CONSTRAINTS 231

Year

Earnings per Share Year

Earning per share Polley I Polley I

2010 2.40

2000 2008 L.00 200 100

3.60

2007 0.50 2.00

2008 1.00

2007 0.50 The above calculations are based on the assurnptionthat the

ouarealso requiredto discuss the pros and cons of each of company has adequate reserves to pay dividends when prof-

its are low. Under Policy I, the cornpany pays a constant

dhidendIpolicies mentioned above. amount of dividend of ? 2per share and enhanced armount of

dividend of ? 0.20 per share over the previous years when

CALCULATION OF DIVIDEND PAYOUT UNDER dividend-payout ratio falls below 50% for two consecutive

ALTERNATIVE POLICIES years. This policy provides the owners with information

Earning per share

indicating that the firm is okay. Under this Policy, the firm

Policy I Policy II

Year pays dividend even when earning is inadequate and thus

7 8.00 73.00 1.00 + (2 X0.80) = 2.60

2016 provide stability in the dividend payment.

7.60 2.80 1.00 × (1.60 X 0.80) = 2.28 Under Policy II, the company pays dividend at ?lper share

and extra dividend when earning exceeds 6. This policy is in

6.40 2.60 1.32

2014

2013

5.60 2.40 1.00

nature of low regular plus extra dividend policy. By establish

2012 6.40 2.20 1.00 + (0.40 X 0.80) =1.32 ing a low regular dividend that is paid each period, the firm

2011 4.80 2.00 1.00 gives investors the stable income necessary to build conti

2010 2.40 2.00 1.00 dence in the company and the extra dividend permits them to

2009 3.60 2.00 1.00 share in the earnings from an especially good period.

You might also like

- MRA Project Milesone-1: BY-Shorya Goel PGP Dsba Oct - 20 BDocument35 pagesMRA Project Milesone-1: BY-Shorya Goel PGP Dsba Oct - 20 Bshorya90% (21)

- Business Plan Concept Design StudioDocument26 pagesBusiness Plan Concept Design StudioMichael Kagube100% (2)

- Business Plan 1Document19 pagesBusiness Plan 1nurul nabillah natasha80% (5)

- MINIMALPLAN Project Launch Workbook ENG V3Document21 pagesMINIMALPLAN Project Launch Workbook ENG V30177986100% (2)

- Birdie Golf-Hybrid Golf Merger AnalysisDocument8 pagesBirdie Golf-Hybrid Golf Merger AnalysisSiska Kurniawan0% (1)

- Unit 1 - QuestionsDocument4 pagesUnit 1 - QuestionsMohanNo ratings yet

- Acctg122 Chapter 2 ExercisesDocument5 pagesAcctg122 Chapter 2 ExercisesIce James Pachano100% (1)

- Attempt Any Four Case Study Case 1: Zip Zap Zoom Car CompanyDocument23 pagesAttempt Any Four Case Study Case 1: Zip Zap Zoom Car CompanyDiabolic Colt100% (1)

- Capital Budgeting-2Document48 pagesCapital Budgeting-2Adarsh Singh RathoreNo ratings yet

- Capital Structure Debt Equity - ProblemsDocument5 pagesCapital Structure Debt Equity - ProblemsSaumya SinghNo ratings yet

- Maximizing Market Value Through Equity FinancingDocument5 pagesMaximizing Market Value Through Equity FinancingNeelNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument24 pages© The Institute of Chartered Accountants of IndiaAniketNo ratings yet

- ABCDDocument4 pagesABCDYaseen Nazir MallaNo ratings yet

- Simsr2 Mba B III FM Quep 1Document4 pagesSimsr2 Mba B III FM Quep 1Priyanka ReddyNo ratings yet

- CAPITAL STRUCTURE Sums OnlinePGDMDocument6 pagesCAPITAL STRUCTURE Sums OnlinePGDMSoumendra RoyNo ratings yet

- Numericals On Financial ManagementDocument4 pagesNumericals On Financial ManagementDhruv100% (1)

- District Resource Centre Mahbubnagar:, Pre-Final Examinations - Jan / Feb - 2011 Management AccountingDocument5 pagesDistrict Resource Centre Mahbubnagar:, Pre-Final Examinations - Jan / Feb - 2011 Management Accountingtadepalli patanjaliNo ratings yet

- Ratio Analysis Numericals Including Reverse RatiosDocument6 pagesRatio Analysis Numericals Including Reverse RatiosFunny ManNo ratings yet

- Fund Flow Statement WorksheetDocument3 pagesFund Flow Statement WorksheetAnish AroraNo ratings yet

- Tax Guide for Manufacturing CompanyDocument10 pagesTax Guide for Manufacturing CompanynikhilramaneNo ratings yet

- MANAGEMENT ACCOUNTING & CONTROL 306 Ele Paper IIIDocument5 pagesMANAGEMENT ACCOUNTING & CONTROL 306 Ele Paper IIItadepalli patanjaliNo ratings yet

- 7680 PEIIPaper 4 Financial Managementyearmay 2005 Section BDocument15 pages7680 PEIIPaper 4 Financial Managementyearmay 2005 Section BManish MishraNo ratings yet

- MCQS On Financial ManagementDocument3 pagesMCQS On Financial ManagementAnonymous kwi5IqtWJNo ratings yet

- ms4 2017 IIDocument4 pagesms4 2017 IIsachin gehlawatNo ratings yet

- Ipm Question SDocument7 pagesIpm Question SAamir AwanNo ratings yet

- LEVERAGESDocument4 pagesLEVERAGESdonadisamanta9No ratings yet

- Baf 422 Continous Assessment Test Class Assignment 20240328Document5 pagesBaf 422 Continous Assessment Test Class Assignment 20240328briankuria21No ratings yet

- Notes CA Int GMDocument51 pagesNotes CA Int GMDharmateja ChakriNo ratings yet

- Alindip Datta FA 2Document9 pagesAlindip Datta FA 2Vishwak SubramaniamNo ratings yet

- Universny: TshwaneDocument5 pagesUniversny: TshwaneAnonymous 1Ew0UPNo ratings yet

- LEVERAGE - hons.Document7 pagesLEVERAGE - hons.BISHAL ROYNo ratings yet

- Traditional Theory Approach: Illustrations 1Document7 pagesTraditional Theory Approach: Illustrations 1PRAMOD VNo ratings yet

- Less: Interest On Debt (10% × ' 2,00,000) : © The Institute of Chartered Accountants of IndiaDocument16 pagesLess: Interest On Debt (10% × ' 2,00,000) : © The Institute of Chartered Accountants of IndiaGao YungNo ratings yet

- CE On Operating SegmentsDocument3 pagesCE On Operating SegmentsalyssaNo ratings yet

- The Following Financial Data Have Been Furnished by A Ltd. and B LTDDocument10 pagesThe Following Financial Data Have Been Furnished by A Ltd. and B LTDNaveen SatiNo ratings yet

- Capital Structure Leverage Drill: EBIT Analysis Plans A-CDocument2 pagesCapital Structure Leverage Drill: EBIT Analysis Plans A-CTineNo ratings yet

- Segment ReportingDocument7 pagesSegment ReportingNamita GoburdhanNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument7 pages© The Institute of Chartered Accountants of IndiaSarvesh JoshiNo ratings yet

- FMC 2019Document3 pagesFMC 2019Shweta ShrivastavaNo ratings yet

- Case Study On LeveragesDocument5 pagesCase Study On LeveragesSantosh Kumar Roul100% (2)

- GOVERNMENT COLLEGE MANAGEMENT ACCOUNTING EXAMDocument5 pagesGOVERNMENT COLLEGE MANAGEMENT ACCOUNTING EXAMJayaprakash JayathNo ratings yet

- Module 4 - Consolidation Subsequent to the Date of Acquisition (Hand - Outs 1)Document3 pagesModule 4 - Consolidation Subsequent to the Date of Acquisition (Hand - Outs 1)ariannealcaraz6No ratings yet

- Management Accounitng - 104 (I)Document4 pagesManagement Accounitng - 104 (I)Rudraksh PareyNo ratings yet

- Corporate Finance JUNE 2022Document7 pagesCorporate Finance JUNE 2022Rajni KumariNo ratings yet

- Cafes Richard Bangladesh financial analysisDocument9 pagesCafes Richard Bangladesh financial analysiscsolution0% (2)

- FM&EconomicsQUESTIONPAPER MAY21Document6 pagesFM&EconomicsQUESTIONPAPER MAY21Harish Palani PalaniNo ratings yet

- Leverages and Profits Analysis for Various CompaniesDocument7 pagesLeverages and Profits Analysis for Various CompaniesVaishnavi ShigvanNo ratings yet

- Financial Management Project AnalysisDocument10 pagesFinancial Management Project AnalysisAlisha Shaw0% (1)

- Mid Term FIN 514Document4 pagesMid Term FIN 514Showkatul IslamNo ratings yet

- Paper - 8: Financial Management and Economics For Finance Part A: Financial Management Questions Ratio AnalysisDocument29 pagesPaper - 8: Financial Management and Economics For Finance Part A: Financial Management Questions Ratio AnalysisEFRETNo ratings yet

- Book Value Per Ordinary Share Computation for Preference and Ordinary SharesDocument4 pagesBook Value Per Ordinary Share Computation for Preference and Ordinary SharesNica CezarNo ratings yet

- Mas M 1404 Financial Statements AnalysisDocument22 pagesMas M 1404 Financial Statements Analysisxxx101xxxNo ratings yet

- Finace TestDocument6 pagesFinace TestMichael AzerNo ratings yet

- TEST Paper 2Document10 pagesTEST Paper 2Pools KingNo ratings yet

- Unilever Pakistan Foods LimitedDocument22 pagesUnilever Pakistan Foods Limiteddanyalkamal69No ratings yet

- Test, FMDocument61 pagesTest, FMNeeraj GuptaNo ratings yet

- 5.ratio Analysis SumsDocument9 pages5.ratio Analysis Sumsvinay kumar nuwalNo ratings yet

- Management Accounting - 1Document4 pagesManagement Accounting - 1amaljacobjogilinkedinNo ratings yet

- IIBMS Finance Case Study on Zip Zap Zoom Car CompanyDocument18 pagesIIBMS Finance Case Study on Zip Zap Zoom Car Companysainath mistryNo ratings yet

- Capital Budgeting MathDocument3 pagesCapital Budgeting MathMD.TARIQUL ISLAM CHOWDHURYNo ratings yet

- Unit-2 SUM Comparative, Commonsize, Trend examplesDocument14 pagesUnit-2 SUM Comparative, Commonsize, Trend examplesbhargav.bhut112007No ratings yet

- Cost of debtDocument2 pagesCost of debtbekalgagan29No ratings yet

- FM. Final Exam (December 2019)Document12 pagesFM. Final Exam (December 2019)elodie Helme GuizonNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- RFBT ExamsDocument42 pagesRFBT ExamsJoyce LunaNo ratings yet

- Medina Foundation College: Sapang Dalaga, Misamis OccidentalDocument18 pagesMedina Foundation College: Sapang Dalaga, Misamis OccidentalDELPGENMAR FRAYNANo ratings yet

- FISIP UNJANI Gambar Arsitektur Pengembangan Desain Bagian 2Document18 pagesFISIP UNJANI Gambar Arsitektur Pengembangan Desain Bagian 2Harlanrizki PraoktaNo ratings yet

- Indian Film Manufacturers Adding Capacities To Meet Growing Demand For Bopp and BopetDocument8 pagesIndian Film Manufacturers Adding Capacities To Meet Growing Demand For Bopp and BopetSanjay Kumar ShahiNo ratings yet

- 22-Civis Mathimata Scholis Ope 1Document5 pages22-Civis Mathimata Scholis Ope 1MargaritaNo ratings yet

- Grade 8 Term 1 NotesDocument26 pagesGrade 8 Term 1 NotesShadow WalkerNo ratings yet

- Lorelle CarenderiaDocument22 pagesLorelle CarenderiaShiela may AdlawonNo ratings yet

- Zudio Marketing PlanDocument2 pagesZudio Marketing PlanAmir KhanNo ratings yet

- Topic 50 To 54 QuestionDocument12 pagesTopic 50 To 54 QuestionNaveen SaiNo ratings yet

- Selling Groceries Through The Cloud in A Tier II City in IndiaDocument12 pagesSelling Groceries Through The Cloud in A Tier II City in IndiaFathima HeeraNo ratings yet

- LRT Transit PrioritiesDocument6 pagesLRT Transit PrioritiesAnonymous NbMQ9YmqNo ratings yet

- 5 Key Financial Ratios and How To Use ThemDocument10 pages5 Key Financial Ratios and How To Use ThemdiahNo ratings yet

- Mba FT 2024-26Document27 pagesMba FT 2024-26Khushi BerryNo ratings yet

- Chapter 9 Assigned Question SOLUTIONSDocument31 pagesChapter 9 Assigned Question SOLUTIONSDang ThanhNo ratings yet

- Jayesh Gogri 170618 Records Payment PDFDocument72 pagesJayesh Gogri 170618 Records Payment PDFMadhur BihaniNo ratings yet

- NH - Cardiac Care of The PoorDocument11 pagesNH - Cardiac Care of The PoorJordan ScottNo ratings yet

- Questionnaire SummaryDocument7 pagesQuestionnaire Summaryinfo -ADDMASNo ratings yet

- Chap 123 AAADocument10 pagesChap 123 AAAHà Phương TrầnNo ratings yet

- MPU3222 - Course Introduction Briefing For Student (Sem 1 - 2022-2023) (I)Document24 pagesMPU3222 - Course Introduction Briefing For Student (Sem 1 - 2022-2023) (I)trickyhunter9999No ratings yet

- Summary of Checks Issued: Sampaguita, Solana, CagayanDocument1 pageSummary of Checks Issued: Sampaguita, Solana, CagayanXian Ase MiguelNo ratings yet

- Commercial Law Case Digest: List of CasesDocument57 pagesCommercial Law Case Digest: List of CasesJean Mary AutoNo ratings yet

- Submitted by - Madhav Khaneja (9130) Section-C Subject - Strategy Submitted To-Mrs. Garima WadhwaDocument26 pagesSubmitted by - Madhav Khaneja (9130) Section-C Subject - Strategy Submitted To-Mrs. Garima Wadhwamadhav khanejaNo ratings yet

- Sample Copy - Mphasis &finsource PDFDocument2 pagesSample Copy - Mphasis &finsource PDFSameer ShaikhNo ratings yet

- South Est BankDocument78 pagesSouth Est BankGolpo MahmudNo ratings yet

- Comprehensive Exam Case Analysis Lester Limheya FinalDocument36 pagesComprehensive Exam Case Analysis Lester Limheya FinalXXXXXXXXXXXXXXXXXXNo ratings yet

- Group 9 Eabdm s13Document3 pagesGroup 9 Eabdm s13DIOUF SHAJAHAN K TNo ratings yet