Professional Documents

Culture Documents

010a - Annexure 10a - SOP For Fixed Assets - 311018

Uploaded by

MahabubnubOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

010a - Annexure 10a - SOP For Fixed Assets - 311018

Uploaded by

MahabubnubCopyright:

Available Formats

ANNEXURE-10a

SOP FOR FIXED ASSETS MANAGEMENT:

Version …..: ……/…………/…..

Proposed by

Approved by:

OBJECTIVE:

This Policy document establishes best policy & procedures for acquisition,

accounting, use, & disposal of Fixed Assets. These procedures provide reasonable

standards of compliance with Accounting Standards.

It standardizes the procurement of Fixed Assets in accordance with the Capital

Purchase Budget.

It emphasizes on the identification of Fixed Assets and its recording in Fixed Assets

Register & its periodical physical verification. Adherence to these procedures will

facilitate accurate record keeping related to the acquisition, control, and disposition

of Fixed Assets.

The combination of accurate accounting records and strong internal controls must

be in place to protect against misappropriation & wrong valuation of the Fixed

Assets.

1. SCOPE:

This policy document applies to the assets managed by the company at all its units.

Additions and deletions made to the fixed assets.

Proper documentation Physical Verification of these assets.

2. FIXED ASSETS DEFINITION:

Fixed Assets can be defined as those assets which are acquired by the COMOS with the

intention of use in the process of production of goods & provision of services and not

with the intention of sale in the normal course of business.

COMOS-Standard operating procedures & guidelines Annexure-10a

3. FIXED ASSETS CLASSIFICATION :

Fixed Assets can be broadly classified as follows:

a) Land,

b) Building,

c) Plant & Machinery,

d) Furniture & Fixtures,

e) Office Equipment,

f) Vehicles,

g) Intangibles &

h) Others.

4. ACQUISITION OF ASSETS:

4.1 Purchased Fixed Assets: The purchasing and procurement of COMOS fixed assets shall

be carried out in strict compliance with the COMOS’s policy on same outlined at the

Procurement to Payment section on the COMOS website. The principles of openness,

transparency, and value for money shall be applied by way of seeking quotations and

tenders as appropriate in accordance with COMOS Policy. For.

4.2 Donated Fixed Assets: Where COMOS receives an asset as a gift or donation, the same

should be accepted vide a formal acceptance agreement and this should simultaneously

be informed to the Accounting section of COMOS for valuation of asset acquired as well

as for making necessary entries in records and registers.. These Valuations are generally

based on a market value (i.e. a building would be recorded at its current market value,

other items based on whether new or used etc.)

4.3 Recording of Fixed Assets (Fixed Asset Register) : COMOS has developed a centrally

maintained consolidated Fixed Asset Register (FAR) format., that will meet its custodial

obligations and insurance needs, as well as funding bodies’ requirements.. Under the

FAR, there will be common criteria for the recognition of fixed assets that will be

reconciled to the COMOSs’ financial statements. The FAR will make it easier to account

for depreciation and ensure accuracy in tracking and accounting for fully written off

assets and disposals.

COMOS-Standard operating procedures & guidelines Annexure-10a

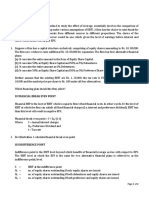

4.4 What gets capitalised in the Fixed Asset Register? All COMOS fixed assets with an

individual item cost of Rs. 10,000 (inclusive of taxes) and above will be captured on the

Fixed Asset Register. This process within the Fixed Asset Register module will be

managed and maintained centrally by the Accounting section. For definitions of a fixed

asset please see above clause 2 & 3. The fixed asset register to be maintained as per the

format prescribed under the applicable laws, if any with respect to the same. It will be

mandatory to include the following details in relation to each fixed asset, Fixed Asset

No./ Serial No. , Item Description, Location (Building, floor and room number), Purchase

Date, Purchase Cost, Depreciation, Depreciated Value, Current Depreciation, Total

Depreciation, Supplier Value in Rs, Month Purchased, Invoice No. /Reference.

The following items are optional fields but, in the case of certain equipment items, may

assist in easier identification and verification of said assets:

Serial Number, Model Number, Manufacturer Purchase Order Number. All movable

fixed assets, which have been included in the FAR, should be appropriately tagged with

the Asset Tag Number, to clearly identify it as being COMOS property. Tags will be

provided by the Finance/Accounts Office once the asset has been appropriately set-up

and recorded in the FAR. What are Asset Tags and how will they is generated? Tagging

is the process of numbering fixed assets and allows the tracking of the movement of

fixed assets from location to location. Tagging allows the positive identification of assets.

It can provide an accurate method of identifying individual assets,

Aid in the taking of physical inventory,

Control the location of all physical assets,

Act as theft deterrence,

Aid in preventive maintenance of fixed assets, and

Provide a common ground of communication for the Finance Office and theassets'

users.

The tag number is entered in the asset master record on the FAR at the point of

tagging by the Finance/ Accounts Office. The asset tag itself will be issued by the

Finance/Accounts Office to the asset assignee (with responsibility for the asset) for

attachment to the asset.

Asset tags should be consistently placed in the same location on each similar asset type.

The tags should be placed, if possible, where they can be easily accessible for viewing

and easily identifiable without disturbing the operation of the asset. This will assist in

the audit inventory process, if at any time required.

COMOS-Standard operating procedures & guidelines Annexure-10a

You might also like

- Internal Control of Fixed Assets: A Controller and Auditor's GuideFrom EverandInternal Control of Fixed Assets: A Controller and Auditor's GuideRating: 4 out of 5 stars4/5 (1)

- Fixed Asset PolicyDocument20 pagesFixed Asset PolicyMandar Jayesh Patel100% (4)

- Unit: Subject: Sarbanes-Oxley Act Review - Fixed Assets Cycle Title: Risk and Control Identification Year EndDocument5 pagesUnit: Subject: Sarbanes-Oxley Act Review - Fixed Assets Cycle Title: Risk and Control Identification Year EndOrxan JavadovNo ratings yet

- Operating Equipment Policy & ProcedureDocument5 pagesOperating Equipment Policy & ProcedureRex UrciaNo ratings yet

- Fixed Assets - RevisedDocument6 pagesFixed Assets - RevisedPiyush MundadaNo ratings yet

- Asset AccountingDocument36 pagesAsset AccountinganfalsNo ratings yet

- Chapter FourDocument18 pagesChapter Fourmubarek oumerNo ratings yet

- Fixxed Asset PolicyDocument6 pagesFixxed Asset Policyfarry aliNo ratings yet

- ASKs 2008Document42 pagesASKs 2008rishijain4No ratings yet

- Policy AssetManagementDocument6 pagesPolicy AssetManagementPascal MbongoNo ratings yet

- Fixed Asset Management & Control: April 2012Document8 pagesFixed Asset Management & Control: April 2012kathNo ratings yet

- Chapter 33 Caro-2020Document45 pagesChapter 33 Caro-2020ganesh PALNo ratings yet

- 1 Aston Manor Academy - Fixed Asset & Depreciation Adopted April 2012Document7 pages1 Aston Manor Academy - Fixed Asset & Depreciation Adopted April 2012william chandraNo ratings yet

- Chapter 5 & 6Document20 pagesChapter 5 & 6Tesfahun tegegnNo ratings yet

- Class Notes - Fix Asset AccountingDocument2 pagesClass Notes - Fix Asset AccountinglaolagnesiaNo ratings yet

- Standard No. 03 Tangible Fixed AssetsDocument7 pagesStandard No. 03 Tangible Fixed AssetsVy NguyenNo ratings yet

- Answer On Understanding The EntityDocument3 pagesAnswer On Understanding The EntityNusrat JahanNo ratings yet

- Assets Management Policy: by Girra Walter EmailDocument23 pagesAssets Management Policy: by Girra Walter EmailSAMDNo ratings yet

- Audit Program-Fixed AssetsDocument7 pagesAudit Program-Fixed AssetsNaomiNo ratings yet

- Guidance Note AuditDocument7 pagesGuidance Note AuditAndrewNo ratings yet

- Fixed Assets - SOPsDocument9 pagesFixed Assets - SOPsAlif KhanNo ratings yet

- Audit Program: Property Plant and EquipmentDocument8 pagesAudit Program: Property Plant and EquipmentAqib Sheikh100% (3)

- IMS Proschool IFRS EbookDocument143 pagesIMS Proschool IFRS EbookhariinshrNo ratings yet

- Auditing Fixed Assets and Capital Work in ProgressDocument23 pagesAuditing Fixed Assets and Capital Work in ProgressMM_AKSI87% (15)

- Chapter 5 Audit of FADocument6 pagesChapter 5 Audit of FAminichelNo ratings yet

- Unit 5: Audit of Fixed AssetsDocument4 pagesUnit 5: Audit of Fixed AssetsTilahun S. KuraNo ratings yet

- Asfaw, Audit II Chapter 5Document3 pagesAsfaw, Audit II Chapter 5alemayehu100% (1)

- Fixed Asset AuditsDocument8 pagesFixed Asset AuditsnabihaNo ratings yet

- Unit I: Audit of Investment PropertyDocument11 pagesUnit I: Audit of Investment PropertyMarj ManlagnitNo ratings yet

- Unit I: Audit of Investment PropertyDocument11 pagesUnit I: Audit of Investment PropertyAnn SarmientoNo ratings yet

- Accounting StandardsDocument98 pagesAccounting Standardsbudsy.lambaNo ratings yet

- Valuation Part2Document52 pagesValuation Part2Ar Neelesh Kant SaxenaNo ratings yet

- Accounting SystemDocument14 pagesAccounting SystemPooja MaldeNo ratings yet

- Asset Specifications: For Each Asset, Kindly Provide Detailed Specifications, Such As MakeDocument3 pagesAsset Specifications: For Each Asset, Kindly Provide Detailed Specifications, Such As MakeAJAY K & ASSOCIATESNo ratings yet

- Caroline Samuel M.Document7 pagesCaroline Samuel M.Sunday OcheNo ratings yet

- Exam 2Document8 pagesExam 2saif nazirNo ratings yet

- Audit of Property, Plant, and Equipment - Hahu Zone - 1622367787308Document8 pagesAudit of Property, Plant, and Equipment - Hahu Zone - 1622367787308Iam AbdiwaliNo ratings yet

- 5-Auditing 2 - Chapter FiveDocument10 pages5-Auditing 2 - Chapter Fivesamuel debebeNo ratings yet

- 338.SMSF Working Group: Issues Paper On Amendments To SIS Provisions March 2011Document7 pages338.SMSF Working Group: Issues Paper On Amendments To SIS Provisions March 2011Flinders TrusteesNo ratings yet

- Auditing AssingmentsDocument6 pagesAuditing AssingmentsTumaini EdwardNo ratings yet

- Accounting StandardDocument9 pagesAccounting StandardVanshika GaneriwalNo ratings yet

- Test Bank For Intermediate Accounting Volume 1-2-12th Canadian Edition Donald e Kieso Isbn 1119496330 Isbn 9781119496335 Full DownloadDocument66 pagesTest Bank For Intermediate Accounting Volume 1-2-12th Canadian Edition Donald e Kieso Isbn 1119496330 Isbn 9781119496335 Full Downloadkellidunnobpqjdixan100% (24)

- CAPEX Accounting PolicyDocument14 pagesCAPEX Accounting PolicyArchie Lazaro100% (1)

- Caro ChecklistDocument26 pagesCaro ChecklistKushalKaleNo ratings yet

- Chapter 4Document10 pagesChapter 4Jarra AbdurahmanNo ratings yet

- Final Revesion 2016 Essay Q & A CMA Part 1 by ArabwebsoftDocument48 pagesFinal Revesion 2016 Essay Q & A CMA Part 1 by ArabwebsoftAslam SiddiqNo ratings yet

- Accounting For Property Classification Is KeyDocument6 pagesAccounting For Property Classification Is KeyAmanda7No ratings yet

- Property Management Procedure ManualDocument6 pagesProperty Management Procedure ManualHaroonNo ratings yet

- Fixed AssetsDocument46 pagesFixed AssetsSprancenatu Lavinia0% (1)

- CO5123 Assignment - FinalDocument23 pagesCO5123 Assignment - Finalchenxinyu821No ratings yet

- Process Manual - Finalr1Document22 pagesProcess Manual - Finalr1drrocsNo ratings yet

- Audit of PPEDocument7 pagesAudit of PPEGille Rosa AbajarNo ratings yet

- James Hall Chap 6Document2 pagesJames Hall Chap 6ryan angelica allanicNo ratings yet

- Week 10 - 01 - Module 22 - Property, Plant & Equipment (Part 1)Document17 pagesWeek 10 - 01 - Module 22 - Property, Plant & Equipment (Part 1)지마리No ratings yet

- Asset Management Policy 2019 20 PDFDocument49 pagesAsset Management Policy 2019 20 PDFTrevor Mathabatha100% (1)

- 2 Guidelines FARDocument9 pages2 Guidelines FARPragati BeheraNo ratings yet

- The Use of Assertions in Obtaining Audit EvidenceDocument7 pagesThe Use of Assertions in Obtaining Audit EvidenceJesebel AmbalesNo ratings yet

- Intangible Assets: International Accounting Standard 38Document19 pagesIntangible Assets: International Accounting Standard 38ZayaNo ratings yet

- As-28 (Impairment of Assets)Document11 pagesAs-28 (Impairment of Assets)api-3828505100% (1)

- Mushak-17 Sales RegisterDocument3 pagesMushak-17 Sales RegisterMahabubnubNo ratings yet

- Cash Handling ProceduresDocument15 pagesCash Handling ProceduresMahabubnubNo ratings yet

- Cash & Cash EquivalentDocument2 pagesCash & Cash EquivalentMahabubnubNo ratings yet

- Standard Operating Procedure For Procurement Personell PDFDocument24 pagesStandard Operating Procedure For Procurement Personell PDFMahabubnubNo ratings yet

- Elundini LM - SCM Standard Operating Procedures - Version 1 00 - Final 002 PDFDocument114 pagesElundini LM - SCM Standard Operating Procedures - Version 1 00 - Final 002 PDFMahabubnubNo ratings yet

- Fixed Asset Accounting SOP PDFDocument5 pagesFixed Asset Accounting SOP PDFMahabubnubNo ratings yet

- Right To Information Ordinance, 2008 ENDocument17 pagesRight To Information Ordinance, 2008 ENMahabubnubNo ratings yet

- Audit CompletionDocument37 pagesAudit CompletionMahabubnubNo ratings yet

- ICT Policy Bangladesh 2009Document60 pagesICT Policy Bangladesh 2009Mahfoz KazolNo ratings yet

- B. Law - Din Islam Miah, FCADocument27 pagesB. Law - Din Islam Miah, FCAMahabubnub0% (1)

- B. Law - Din Islam Miah, FCADocument27 pagesB. Law - Din Islam Miah, FCAMahabubnub0% (1)

- Gobs Fa CapsuleDocument118 pagesGobs Fa CapsuleAbhishek Choudhary100% (1)

- Blend Corporate Deck 2023Document39 pagesBlend Corporate Deck 2023Kamlesh SamaliyaNo ratings yet

- UnderstandabilityDocument2 pagesUnderstandabilityJasmine LeeNo ratings yet

- 4.3.2.5 Elaborate - Determining AdjustmentsDocument4 pages4.3.2.5 Elaborate - Determining AdjustmentsMa Fe Tabasa0% (1)

- Alanis Parks Department: Analyze and Chart Financial DataDocument7 pagesAlanis Parks Department: Analyze and Chart Financial DataJacob SheridanNo ratings yet

- Axis Bank - Final.Document55 pagesAxis Bank - Final.TEJASHVINI PATELNo ratings yet

- Unit 1 - IS-LM-PCDocument27 pagesUnit 1 - IS-LM-PCGunjan ChoudharyNo ratings yet

- PGBPDocument189 pagesPGBPumakantNo ratings yet

- Fabm2 - Statement of Comprehensive Income (Practice Problems) - Answer KeyDocument3 pagesFabm2 - Statement of Comprehensive Income (Practice Problems) - Answer KeyMounicha Ambayec100% (4)

- IJIBM Vol9No4 Nov2017Document310 pagesIJIBM Vol9No4 Nov2017فوزان علیNo ratings yet

- Banking RatiosDocument7 pagesBanking Ratioszhalak04No ratings yet

- Final Project Report of Summer Internship (VK)Document56 pagesFinal Project Report of Summer Internship (VK)Vikas Kumar PatelNo ratings yet

- Chapter No. 2Document46 pagesChapter No. 2Muhammad SalmanNo ratings yet

- Part 5555Document2 pagesPart 5555RhoizNo ratings yet

- Capital Structure Policy I Ebit-Eps Analysis: Page 1 of 2Document2 pagesCapital Structure Policy I Ebit-Eps Analysis: Page 1 of 2Danzo ShahNo ratings yet

- Invty EstimationDocument6 pagesInvty EstimationdmiahalNo ratings yet

- WFP Cash and Vouchers ManualDocument92 pagesWFP Cash and Vouchers ManualSoroush AsifNo ratings yet

- Borrowing Costs - Assignment - For PostingDocument1 pageBorrowing Costs - Assignment - For Postingemman neriNo ratings yet

- Divine Word College of BanguedDocument3 pagesDivine Word College of BanguedAeRis Blancaflor BalsitaNo ratings yet

- Econ 101 Cheat Sheet (FInal)Document1 pageEcon 101 Cheat Sheet (FInal)Alex MadarangNo ratings yet

- QUIZ - PPE PART 1 Answer KeyDocument4 pagesQUIZ - PPE PART 1 Answer KeyRena Rose MalunesNo ratings yet

- BSBCRT611 BriefDocument2 pagesBSBCRT611 BriefJohnNo ratings yet

- W1 Partnership AccountingDocument11 pagesW1 Partnership AccountingChristine Joy MondaNo ratings yet

- Project of Merger Acquisition SANJAYDocument65 pagesProject of Merger Acquisition SANJAYmangundesanju77% (74)

- Audit of CashDocument9 pagesAudit of CashEmma Mariz Garcia25% (8)

- Overview of Wave Money: Leading Fintech in MyanmarDocument20 pagesOverview of Wave Money: Leading Fintech in MyanmarCoco100% (1)

- The Bankers Own The EarthDocument51 pagesThe Bankers Own The EarthIanSmith777100% (3)

- Viacom18 Gears Up For IPL Ex-Star Head Uday Shankar To Likely Drive Digital Initiatives?Document3 pagesViacom18 Gears Up For IPL Ex-Star Head Uday Shankar To Likely Drive Digital Initiatives?bdacNo ratings yet

- Application For Shifting Branch - Sharekhan LTD & SBPFSL - FinalDocument1 pageApplication For Shifting Branch - Sharekhan LTD & SBPFSL - Finalchethan0% (1)

- Cost of Capital ChapterDocument25 pagesCost of Capital ChapterHossain Belal100% (1)