Professional Documents

Culture Documents

Taxation 19-21

Uploaded by

AnuRaag SharmaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Taxation 19-21

Uploaded by

AnuRaag SharmaCopyright:

Available Formats

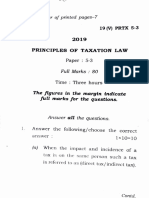

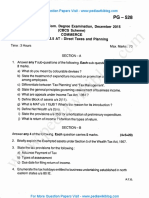

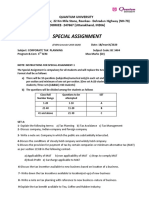

Total No.

of pages: 1

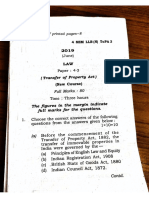

6 SEM LLB PTL 6.3 OP4

2021

(September)

LAW

Paper: 6.3 OP4

(Principles of Taxation Law)

Full Marks- 40

Time: 1 ½ Hrs

(The figures in the margin indicate the full marks for the questions)

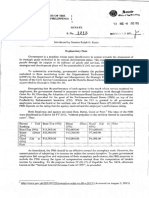

1. Answer any two from the following questions 13×2=26

a. Write an explanatory note on the Agricultural Income Tax in Assam. 13

b. Enumerate at least thirteen such incomes which do not form part of total income. 13

c. Define depreciation. Describe the rules for allowability of depreciation under various

block of assets as provided under the income Tax Act, 1961 3+10=13

d. For whom filing of income tax returns are mandatory? What is due date of return? Write in

short the assessment procedure enumerated under the Income Tax Act, 1961. 5+3+5=13

e. What are the various penal provisions under GST Act for non-payment of tax & interest

and also for non-furnishing of prescribed returns under the Act? 13

2. Answer any one from the following questions. 14×1=14

a. Critically examine the necessity of tax in the modern economy of a country. What are the

prerequisites of a good tax system? Distinguish between tax planning and tax evasion.

5+4+5 = 14

b. Explain the followings:- 7 × 2 = 14

(i) Capital receipts v. Revenue receipts

(ii) Special provisions relating to newly established industrial units in SEZ

c. Discuss the provisions relating to the computation of ‘Salary income’ under the Income Tax

Act, 1961. 14

d. Discuss the rules regarding the followings:- 7 ×2=14

(i) Clubbing of income of one person with the income of other,

(ii) Set off of losses within various sources or heads of income.

e. Write in detail the procedure for registration of dealer under the Goods and Services Act.

Describe the procedure for claiming input tax credit and TDS by a registered dealer under the

Act. 7+7=14

Page 1 of 1

You might also like

- Principles of Taxation Law Paper 5.3Document22 pagesPrinciples of Taxation Law Paper 5.3mg9433822No ratings yet

- OSMS/M-20 Taxation Laws IMS-601: Roll No. .......................... Total Pages: 05Document5 pagesOSMS/M-20 Taxation Laws IMS-601: Roll No. .......................... Total Pages: 05mehaik patwa , 20No ratings yet

- Principles of Taxation - 2019Document2 pagesPrinciples of Taxation - 2019Anushka SinghNo ratings yet

- Labour Law-Ii-19-22Document11 pagesLabour Law-Ii-19-22AnuRaag SharmaNo ratings yet

- Basic Tax QuestionDocument7 pagesBasic Tax QuestionMonirul Islam MoniirrNo ratings yet

- Law LLB 6.3Document2 pagesLaw LLB 6.3bijay.desunNo ratings yet

- Sixteenth Congress of The) Republic of The Philippines) : First Regular SessionDocument4 pagesSixteenth Congress of The) Republic of The Philippines) : First Regular Sessionfrank japosNo ratings yet

- Assignment - TaxationDocument2 pagesAssignment - TaxationMuskan MittalNo ratings yet

- Form 16 Part A: WWW - Taxguru.inDocument10 pagesForm 16 Part A: WWW - Taxguru.inAjit KhurdiaNo ratings yet

- CS Executive Direct Tax Revision For Dec 19 PDFDocument224 pagesCS Executive Direct Tax Revision For Dec 19 PDFPreeti Ray100% (1)

- IDT Past Exam CA Saumil Manglani For CS Exe Jun 22 & Dec 22Document38 pagesIDT Past Exam CA Saumil Manglani For CS Exe Jun 22 & Dec 22RahulNo ratings yet

- Cma DT Revision For June and Dec 21Document205 pagesCma DT Revision For June and Dec 21Manikant ReddiNo ratings yet

- TaxLaw 12marks PYDocument2 pagesTaxLaw 12marks PYCoimbatore IndustryNo ratings yet

- Kanga & Palkhivala IT Act 10th Ed Vol I CH 4 Part IDocument119 pagesKanga & Palkhivala IT Act 10th Ed Vol I CH 4 Part IlokeshNo ratings yet

- DownloadDocument6 pagesDownloadpankhewalegNo ratings yet

- DBA7107Document21 pagesDBA7107Bhat MerajNo ratings yet

- Ch-1 To 4 - FY 22-23Document56 pagesCh-1 To 4 - FY 22-23SaNo ratings yet

- Form 16 Part A Name and Address of The Employer Name and Designation of The EmployeeDocument3 pagesForm 16 Part A Name and Address of The Employer Name and Designation of The EmployeeishaqmdNo ratings yet

- Introduction and DefinitionsDocument7 pagesIntroduction and DefinitionsmandeepNo ratings yet

- Bcoc 136Document2 pagesBcoc 136Suraj JaiswalNo ratings yet

- GST Returns: BackgroundDocument3 pagesGST Returns: BackgroundPrakash PalanisamyNo ratings yet

- Advanced Tax Laws and Practice: PP-ATLP-June 2011 20Document18 pagesAdvanced Tax Laws and Practice: PP-ATLP-June 2011 20Murugesh Kasivel EnjoyNo ratings yet

- GST Annual ReturnsDocument2 pagesGST Annual ReturnsKumariNo ratings yet

- Tax TallyDocument5 pagesTax TallySakshi JainNo ratings yet

- Income Tax AssignmentDocument7 pagesIncome Tax AssignmentDisha MohantyNo ratings yet

- Payment of Bonus Rules (Pt.-4)Document9 pagesPayment of Bonus Rules (Pt.-4)Anonymous QyYvWj1No ratings yet

- Upto salary-JKSC Inter DT MAy 22 (Prof - Aagam Dalal)Document59 pagesUpto salary-JKSC Inter DT MAy 22 (Prof - Aagam Dalal)pritika mishraNo ratings yet

- Income Tax Charts by CA Pooja Kamdar DateDocument67 pagesIncome Tax Charts by CA Pooja Kamdar Datejjhjjgg hfhgf100% (1)

- Tax LawDocument535 pagesTax LawPrem MahalaNo ratings yet

- NEW DT Bullet (MCQ'S) by CA Saumil Manglani - CS Exec June 22 & Dec 22 ExamsDocument168 pagesNEW DT Bullet (MCQ'S) by CA Saumil Manglani - CS Exec June 22 & Dec 22 ExamsAkash MalikNo ratings yet

- Nov 06Document24 pagesNov 06Vascilly TerentievNo ratings yet

- Tax Audit ReportDocument18 pagesTax Audit ReportNeha DenglaNo ratings yet

- Statecircular 291022Document6 pagesStatecircular 291022King KiteNo ratings yet

- ShowfileDocument4 pagesShowfileMkNo ratings yet

- Payment of Bonus Act FormsDocument5 pagesPayment of Bonus Act Formspratik06No ratings yet

- ICAB Certificate Level Taxation Nov 17Document9 pagesICAB Certificate Level Taxation Nov 17Prithvi PrasadNo ratings yet

- CS Executive Direct TaxDocument477 pagesCS Executive Direct TaxJanhaviNo ratings yet

- Q&A, November 2023Document9 pagesQ&A, November 2023Cerealis FelicianNo ratings yet

- Tax Law BookDocument582 pagesTax Law BookSasmit PatilNo ratings yet

- AC2101 SemGrp4 Team6Document34 pagesAC2101 SemGrp4 Team6Kwang Yi JuinNo ratings yet

- International Tax and Technology - IiDocument2 pagesInternational Tax and Technology - IiShravan Subramanian BNo ratings yet

- Minimum Alternative TaxDocument27 pagesMinimum Alternative TaxYash TiwariNo ratings yet

- 1mba FM 042mbaDocument3 pages1mba FM 042mbaAtindra ShahiNo ratings yet

- IT FormDocument8 pagesIT Formapi-3829020No ratings yet

- DT Revision Cum Marathon Dec 22Document164 pagesDT Revision Cum Marathon Dec 22Suraj PawarNo ratings yet

- Saaransh Income Tax Chart Book For AY 22-23Document70 pagesSaaransh Income Tax Chart Book For AY 22-23JobhaNo ratings yet

- 3rd Sem MCom Direct Taxes Dec 2015Document4 pages3rd Sem MCom Direct Taxes Dec 2015ravi nNo ratings yet

- Module 3 Dec 20Document132 pagesModule 3 Dec 20Dinesh GadkariNo ratings yet

- Income Tax Law & Practice: The Figures in The Right-Hand Margin Indicate MarksDocument3 pagesIncome Tax Law & Practice: The Figures in The Right-Hand Margin Indicate Markstusar dasNo ratings yet

- Technical Guide On GST Reconciliation Statement (Form GSTR 9C) - (05.12.2023)Document2 pagesTechnical Guide On GST Reconciliation Statement (Form GSTR 9C) - (05.12.2023)thiliphanstar24No ratings yet

- Common ItrDocument169 pagesCommon ItrJITENDRA AGARWALNo ratings yet

- Cma RTP Dec 18Document34 pagesCma RTP Dec 18amit jangraNo ratings yet

- Question BankDocument2 pagesQuestion BankSandeep YadavNo ratings yet

- Income Tax - IntroductionDocument2 pagesIncome Tax - Introductiondubeyshibu743No ratings yet

- Basic Concept: (3 To 6 Marks)Document168 pagesBasic Concept: (3 To 6 Marks)netrathakur72No ratings yet

- Corporate Tax Planning - 2Document3 pagesCorporate Tax Planning - 2sarthak guptaNo ratings yet

- Public Sector Accounting and Administrative Practices in Nigeria Volume 1From EverandPublic Sector Accounting and Administrative Practices in Nigeria Volume 1No ratings yet

- Pil 19-22Document11 pagesPil 19-22AnuRaag SharmaNo ratings yet

- TP 19-22Document23 pagesTP 19-22AnuRaag SharmaNo ratings yet

- LabourLaw II 2018Document4 pagesLabourLaw II 2018AnuRaag SharmaNo ratings yet

- Ipr 2018Document5 pagesIpr 2018AnuRaag SharmaNo ratings yet

- 2nd Semester PDFDocument8 pages2nd Semester PDFAnuRaag SharmaNo ratings yet

- The Insurance Act, 1938Document5 pagesThe Insurance Act, 1938AnuRaag SharmaNo ratings yet

- Plantations Labour Act PDFDocument18 pagesPlantations Labour Act PDFAnuRaag SharmaNo ratings yet

- Meyerhold & GrotowskiDocument2 pagesMeyerhold & Grotowskiohay2691No ratings yet

- British American Tobacco Bangladesh Company LTD Vs Begum Shamsun NaharDocument5 pagesBritish American Tobacco Bangladesh Company LTD Vs Begum Shamsun NaharFahim Shahriar MozumderNo ratings yet

- Lesson 1 Powerpoint On NetworksDocument17 pagesLesson 1 Powerpoint On NetworksInma CDNo ratings yet

- რორტიDocument24 pagesრორტიTamta ZakarashviliNo ratings yet

- BNIS Macroeconomic Outlook 2023 Threading The Global Slowdown NeedleDocument36 pagesBNIS Macroeconomic Outlook 2023 Threading The Global Slowdown NeedleBrainNo ratings yet

- Eye WitnessDocument3 pagesEye WitnessValeria ZarvaNo ratings yet

- Important Stanzas For ComprehensionDocument39 pagesImportant Stanzas For ComprehensionCybernet BroadbandNo ratings yet

- Client/shipper Visit (New Shipper & Twice A Year For Regular Client) (Commercial Team)Document2 pagesClient/shipper Visit (New Shipper & Twice A Year For Regular Client) (Commercial Team)PT. Estupedo Agri MakmurNo ratings yet

- About Strand PDFDocument2 pagesAbout Strand PDFErnesto CaguayNo ratings yet

- KissingerDocument4 pagesKissingerAlperUluğNo ratings yet

- The Relationship Between Work-Family Con Ict, Correctional Officer Job Stress, and Job SatisfactionDocument18 pagesThe Relationship Between Work-Family Con Ict, Correctional Officer Job Stress, and Job SatisfactionSilvester SimanjuntakNo ratings yet

- Classical and Human Relations Approaches To ManagementDocument10 pagesClassical and Human Relations Approaches To ManagementDhanpaul OodithNo ratings yet

- Impact of Urbanisation and Encroachment in Wetlands, A Case Study of Ganga Riparian Wetlands, Patna Impacts of Urbanization and Encroachment in Urban Wetlands, A Case Study of Gang..Document8 pagesImpact of Urbanisation and Encroachment in Wetlands, A Case Study of Ganga Riparian Wetlands, Patna Impacts of Urbanization and Encroachment in Urban Wetlands, A Case Study of Gang..Abdul QuadirNo ratings yet

- Solution Manual For Global Marketing Plus 2014 Mymarketinglab With Pearson Etext Package 8 e Warren J Keegan Mark C Green Full DownloadDocument24 pagesSolution Manual For Global Marketing Plus 2014 Mymarketinglab With Pearson Etext Package 8 e Warren J Keegan Mark C Green Full Downloadcarlyterrysnycxdekbz100% (42)

- AAD Thevaram EnglishDocument44 pagesAAD Thevaram EnglishSashe NadaNo ratings yet

- Principles of Freedom by MacSwiney, Terence J. (Terence Joseph), 1879-1920Document72 pagesPrinciples of Freedom by MacSwiney, Terence J. (Terence Joseph), 1879-1920Gutenberg.orgNo ratings yet

- 上海证券交易所股票上市规则(英文版)Document145 pages上海证券交易所股票上市规则(英文版)monicakuoNo ratings yet

- Worship SongDocument1 pageWorship SongAngeline AbaiNo ratings yet

- Ideal Company:bossDocument1 pageIdeal Company:bossSkoro EducationNo ratings yet

- Hi-Tea Menu PackageDocument32 pagesHi-Tea Menu PackageRupesh GuravNo ratings yet

- YM Website - User Manual: BookingDocument19 pagesYM Website - User Manual: Bookingwinda hervianaNo ratings yet

- Case 4 Big Data at GapDocument8 pagesCase 4 Big Data at GapThảo NguyênNo ratings yet

- Education-Watch-Report - 2002Document84 pagesEducation-Watch-Report - 2002api-19623971No ratings yet

- AP US History Cram Chart 2021Document1 pageAP US History Cram Chart 2021Aubrey BalesNo ratings yet

- Exam 2019 Questions and AnswersDocument19 pagesExam 2019 Questions and AnswersĐạt NguyễnNo ratings yet

- Practice Test 9 - 1Document9 pagesPractice Test 9 - 1Phuong DaoNo ratings yet

- 2016 Financial Industry Cybersecurity Report: SecurityscorecardDocument22 pages2016 Financial Industry Cybersecurity Report: SecurityscorecardHiba AfanehNo ratings yet

- Dr. Jose Protacio Mercado Rizal Alonso Y RealondaDocument22 pagesDr. Jose Protacio Mercado Rizal Alonso Y RealondaKathrene Angel GumilaoNo ratings yet

- What Are The Important Stipulations in Magna Carta For Teachers and The Code of Ethics For Professional Teachers?Document1 pageWhat Are The Important Stipulations in Magna Carta For Teachers and The Code of Ethics For Professional Teachers?Junnel CasanovaNo ratings yet

- Practice Final ExamDocument9 pagesPractice Final ExamAcir ElbidercniNo ratings yet