Professional Documents

Culture Documents

Calculate key financial ratios from 2016-2020

Uploaded by

Qasim SaleemOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Calculate key financial ratios from 2016-2020

Uploaded by

Qasim SaleemCopyright:

Available Formats

Name : ……………………………………….. Roll No …………………………………….

Class Activity

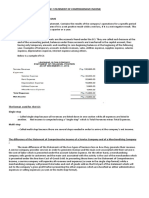

Calculate Ratios from your one Company From 2016 to 2020

1- Net Margin Formula = Net Income / Sales

Net Margin is basically the net effect of operating as well as financing decisions taken by the company. It is

called a Net Margin because, in the numerator, we have Net Income (Net of all the operating expenses, interest

expenses as well as taxes)

2- Operating Profit Margin = EBIT / Sales

Operating profit or Earnings Before Interest and Taxes (EBIT) margin measures the rate of profit on sales after

operating expenses. Operating income can be thought of as the “bottom line” from operations.

3- Receivables Turnover Formula = Credit Sales / Accounts Receivables

Accounts Receivables Turnover Ratio can be calculated by dividing Credit Sales by Accounts Receivables.

Intuitively. It provides us the number of times Accounts Receivables (Credit Sales) is converted into Cash

Sales.

4- Accounts Receivables Days Formula = Number of Days in Year / Accounts Receivables Turnover

Days receivables are directly linked with the Accounts Receivables Turnover. Days receivables express the

same information but in terms of the number of days in a year. This provides an intuitive measure of

Receivables Collection Days.

5- Inventory Turnover Formula = Cost of Goods Sold / Inventory

The Inventory Ratio means how many times the inventories are restored during the year. It can be calculated by

taking the Cost of Goods Sold and dividing it by Inventory.

6- Inventory Days Formula = Number of days in a year / Inventory Turnover.

Think of Inventory Days as the approximate number of days it takes for inventory to convert into a finished

product.

You might also like

- Understanding Financial Statements (Review and Analysis of Straub's Book)From EverandUnderstanding Financial Statements (Review and Analysis of Straub's Book)Rating: 5 out of 5 stars5/5 (5)

- Types of Financial Ratios: Their Analysis and Interpretation - Penpoin.Document17 pagesTypes of Financial Ratios: Their Analysis and Interpretation - Penpoin.John CollinsNo ratings yet

- Financial Analysis FundamentalsDocument12 pagesFinancial Analysis FundamentalsAni Dwi Rahmanti RNo ratings yet

- Financial Statement Analysis RatiosDocument3 pagesFinancial Statement Analysis RatiosshahbazsiddikieNo ratings yet

- D196 Study Guide Answers & NotesDocument21 pagesD196 Study Guide Answers & NotesAsril DoankNo ratings yet

- Multi Step Income Statement For Merchadising BusinessDocument10 pagesMulti Step Income Statement For Merchadising Businessjesi zamoraNo ratings yet

- Inventory, Efficiency, and Asset RatiosDocument5 pagesInventory, Efficiency, and Asset RatiosEzekiel MalazzabNo ratings yet

- Chapter 03 IM 10th EdDocument32 pagesChapter 03 IM 10th EdahelmyNo ratings yet

- Financial Ratio AnalysisDocument4 pagesFinancial Ratio Analysisapi-299265916No ratings yet

- List of Financial RatiosDocument9 pagesList of Financial RatiosPrinces Aliesa BulanadiNo ratings yet

- Financial Ratio HANDOUTSDocument3 pagesFinancial Ratio HANDOUTSMichelle GoNo ratings yet

- Lecture 2728 Prospective Analysis Process of Projecting Income Statement Balance SheetDocument36 pagesLecture 2728 Prospective Analysis Process of Projecting Income Statement Balance SheetRahul GautamNo ratings yet

- Projected Cash Flow StatementDocument6 pagesProjected Cash Flow StatementIqtadar AliNo ratings yet

- Statement of Comprehensive Income - FABM 2 Grade 12Document36 pagesStatement of Comprehensive Income - FABM 2 Grade 12Abegail BoqueNo ratings yet

- Profitability, Liquidity, Efficiency & Leverage Ratios ExplainedDocument2 pagesProfitability, Liquidity, Efficiency & Leverage Ratios Explainedrachel anne belangelNo ratings yet

- Chapter 7Document26 pagesChapter 7EricKHLeawNo ratings yet

- Chapter 1 - FS AnalysisDocument40 pagesChapter 1 - FS AnalysisKenneth Bryan Tegerero Tegio100% (2)

- Ratio AnalysisDocument8 pagesRatio AnalysisRenz Abad0% (1)

- The Formula To Calculate Days in Inventory Is The Number of Days in The Period Divided by The Inventory Turnover RatioDocument5 pagesThe Formula To Calculate Days in Inventory Is The Number of Days in The Period Divided by The Inventory Turnover RatioEmba MadrasNo ratings yet

- Financial Feasibility Report of Content CreationDocument7 pagesFinancial Feasibility Report of Content CreationSamyak KalaskarNo ratings yet

- Lecture Three Chapter FiveDocument4 pagesLecture Three Chapter Fivebouchra bouchraNo ratings yet

- CashflowDocument6 pagesCashflowAizia Sarceda Guzman71% (7)

- Stock Analysis Week 4: Quantitative Analysis: Balance SheetDocument7 pagesStock Analysis Week 4: Quantitative Analysis: Balance SheetSushil1998No ratings yet

- Lo 4Document11 pagesLo 4Omar El-TalNo ratings yet

- Ratio Analysis GuideDocument5 pagesRatio Analysis GuideZeshan MustafaNo ratings yet

- Describe Merchandising Operations and Inventory SystemsDocument4 pagesDescribe Merchandising Operations and Inventory SystemsSadia RahmanNo ratings yet

- Entrepreneurship Quarter 2 - Module 9: Senior High SchoolDocument11 pagesEntrepreneurship Quarter 2 - Module 9: Senior High SchoolFelipe Balinas100% (1)

- Fabm 2 - Lesson 2 - SCIDocument20 pagesFabm 2 - Lesson 2 - SCIwendell john medianaNo ratings yet

- Business Finance FormulaDocument9 pagesBusiness Finance FormulaGeorge Nicole BaybayanNo ratings yet

- Business Finance FormulaDocument9 pagesBusiness Finance FormulaGeorge Nicole BaybayanNo ratings yet

- ABM 12 - Accounting-Module 2 SCIDocument6 pagesABM 12 - Accounting-Module 2 SCIWella LozadaNo ratings yet

- ASF Assignment by Kainat KumariDocument12 pagesASF Assignment by Kainat KumariNoorNo ratings yet

- Key 3 The Hidden Power of Your Financial ForecastDocument10 pagesKey 3 The Hidden Power of Your Financial ForecastIcecream-y JaclynNo ratings yet

- Fs Analysis Quizzer PDF FreeDocument22 pagesFs Analysis Quizzer PDF FreeXela Mae BigorniaNo ratings yet

- Retail Book Chap06Document21 pagesRetail Book Chap06Harman Gill100% (1)

- Q2 WK4 Las Entrep Graciel Ann C. SolatorioDocument8 pagesQ2 WK4 Las Entrep Graciel Ann C. SolatorioMalouiesa ManalastasNo ratings yet

- Financial Statement Analysis RatiosDocument9 pagesFinancial Statement Analysis RatiosKean Brean GallosNo ratings yet

- Week 6 Learning Summary Financial RatiosDocument10 pagesWeek 6 Learning Summary Financial RatiosRajeev ShahdadpuriNo ratings yet

- SALES MANAGEMENT: DETERMINING SALESFORCE SIZE AND BUDGETINGDocument18 pagesSALES MANAGEMENT: DETERMINING SALESFORCE SIZE AND BUDGETINGKENMOGNE TAMO MARTIALNo ratings yet

- Far 1-5Document32 pagesFar 1-5Lisel SalibioNo ratings yet

- How Do You Calculate The Operating Cycle Ratio of A Business - A Knol by Nowmaster AccountingDocument2 pagesHow Do You Calculate The Operating Cycle Ratio of A Business - A Knol by Nowmaster Accounting113322No ratings yet

- Ratio Analyisi of Financial StatementDocument11 pagesRatio Analyisi of Financial StatementdarraNo ratings yet

- ACCT 101 Chapter 4 HandoutDocument5 pagesACCT 101 Chapter 4 Handoutchienna.mercadoNo ratings yet

- Evaluating A Firms Financial Performance by Keown3Document36 pagesEvaluating A Firms Financial Performance by Keown3talupurum100% (1)

- FinanceDocument5 pagesFinanceDHRUV SONAGARANo ratings yet

- Financial RatiosDocument16 pagesFinancial Ratiosparidhi.b22No ratings yet

- Monetrix Combined - FinDocument266 pagesMonetrix Combined - Fin21P028Naman Kumar GargNo ratings yet

- Working Capital Operating CycleDocument3 pagesWorking Capital Operating CycleRatish NairNo ratings yet

- Acctg FormulasDocument7 pagesAcctg FormulasAira Santos VibarNo ratings yet

- Income Statement & Capital Statement GuideDocument7 pagesIncome Statement & Capital Statement GuideIsabelleDynahE.GuillenaNo ratings yet

- 02.financial Analysis IDocument8 pages02.financial Analysis ISVS ShanthaNo ratings yet

- Chapter 3 Financial RatiosDocument2 pagesChapter 3 Financial RatiosSidny HerreraNo ratings yet

- Ratios FormulasDocument4 pagesRatios FormulasTutii FarutiNo ratings yet

- Retail Financial Strategy: ROA AnalysisDocument19 pagesRetail Financial Strategy: ROA AnalysisSanjini GautamNo ratings yet

- All AccountingDocument122 pagesAll AccountingHassen ReshidNo ratings yet

- AssesmentDocument14 pagesAssesmentbhumi shuklaNo ratings yet

- Financial RatiosDocument16 pagesFinancial Ratiospraveen bishnoiNo ratings yet

- Analysis of Key Financial RatiosDocument31 pagesAnalysis of Key Financial RatiosMaxhar AbbaxNo ratings yet

- Financial Metrics 1671597940Document9 pagesFinancial Metrics 1671597940gaurav SinghNo ratings yet

- DemoDocument3 pagesDemoJayesh KukretiNo ratings yet

- Ratio Analysis Before and After ProvisionDocument2 pagesRatio Analysis Before and After ProvisionQasim SaleemNo ratings yet

- Time Value of Money FormulasDocument1 pageTime Value of Money FormulasQasim SaleemNo ratings yet

- Difference Between Capitalism Socialism CommunismDocument5 pagesDifference Between Capitalism Socialism CommunismQasim SaleemNo ratings yet

- Local and World History Both Important for StudentsDocument20 pagesLocal and World History Both Important for StudentsQasim SaleemNo ratings yet

- The Impact of Intellectual Capital On Firms' Market Value and Financial PerformanceDocument21 pagesThe Impact of Intellectual Capital On Firms' Market Value and Financial PerformanceQasim SaleemNo ratings yet

- Corporate SustainabilityDocument13 pagesCorporate SustainabilityQasim SaleemNo ratings yet