Professional Documents

Culture Documents

Tax Information Interviewfg

Uploaded by

kailashCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax Information Interviewfg

Uploaded by

kailashCopyright:

Available Formats

Reference Id: A10153281SV7TL7JGC1SY

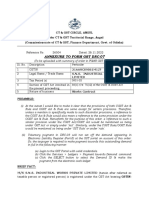

Certificate of Foreign Status of

Beneficial Owner for United

States Tax Withholding and

SUBSTITUTE

Form W-8BEN Reporting (Individuals) (Rev. October 2021)

Do NOT use this form if: Instead, use Form:

You are NOT an individual W-8BEN-E

You are a U.S. citizen or other U.S. person, including a resident alien individual W-9

You are a beneficial owner claiming that income is effectively connected with the W-8ECI

conduct of trade or business within the U.S.

(other than personal services)

You are a beneficial owner who is receiving compensation for personal services 8233 or W-4

performed in the United States

A person acting as an intermediary W-8IMY

Part I Identification of Beneficial Owner

1 Name of individual who is the beneficial owner

Kailash Chandra Sur

2 Country of citizenship

India

3 Permanent residence address (street, apt. or suite no., or rural route). Do not use a P.O. box or in-care-of

address.

Gopalpur

City or town, state or province. Include postal code where appropriate.

Jajpur Odisha 755008

Country

India

4 Mailing address (if different from above)

City or town, state or province. Include postal code where appropriate.

Country

5 U.S. taxpayer identification number (SSN or ITIN), if required (see

instructions)

6 Foreign tax identifying number (see instructions)

Part II Claim of Tax Treaty Benefits (for chapter 3 purposes only) (see instructions)

9 I certify that the beneficial owner is a resident of within the meaning of the income tax treaty between the

United States and that country.

10 Special rates and conditions (if applicable—see instructions): The beneficial owner is claiming the provisions

of

of the treaty identified on line 9 above to claim a

% rate of withholding on (specify type of income):

Explain the additional conditions in the Article and paragraph the beneficial owner meets to be eligible for the rate

of withholding:

Part III Certification

Under penalties of perjury, I declare that I have examined the information

on this form and to the best of my knowledge

and belief it is true,

correct, and complete. I further certify under penalties of perjury that:

1. I am the individual that is the beneficial owner (or am authorized to sign for the individual that is the

beneficial

owner) of all the income to which this form relates or am using this form to document myself

for chapter 4 purposes,

2. The person named on line 1 of this form is not a U.S. person,

3. This form relates to: (a) income not effectively connected with the conduct of a trade or business in the United

States;

(b) income effectively connected with the conduct of a trade or business in the United States but is not

subject to tax under an applicable income tax treaty;

(c) the partner's share of a partnership's effectively connected

taxable income; or

(d) the partner's amount realized from the transfer of a partnership interest subject to

withholding under section 1446(f);

4. The person named on line 1 of this form is a resident of the treaty country listed on line 9 of the form (if any) within

the meaning of the income tax treaty between the United States and that country, and

5. For broker transactions or barter exchanges, the beneficial owner is an exempt foreign person as defined in the

instructions.

Furthermore, I authorize this form to be provided to any withholding agent that has control, receipt, or custody of the

income of which I am the beneficial owner or any withholding agent that can disburse or make payments of the income

of which I am the beneficial owner. I agree that I will submit a new form within 30 days if any certification made on

this form becomes incorrect.

The Internal Revenue Service does not require your consent to any provisions of this document other than the

certifications required to establish your status as a non-U.S. individual and, if applicable, obtain a reduced rate of

withholding.

I certify that I have the capacity to sign for the person identified on line 1 of this form.

Sign Here

Kailash Chandra Sur

Signature of beneficial owner (or individual authorized to sign for beneficial owner)

02-04-2023

Date (MM-DD-YYYY)

Kailash Chandra Sur

Print name of signer

Above is preview of your tax form based on the information you have provided. Please review

and submit the form, or make changes if needed.

Make Changes Submit Form

You might also like

- Tax-Interview LandingDocument3 pagesTax-Interview LandingDeven GuptaNo ratings yet

- Us Foreigner Tax HolderDocument2 pagesUs Foreigner Tax Holderulissesfsilva07No ratings yet

- Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Document1 pageCertificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Study HelpNo ratings yet

- Amazon Tax Information InterviewDocument2 pagesAmazon Tax Information Interviewasad nNo ratings yet

- Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Document1 pageCertificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)perfora7orNo ratings yet

- Tax Interview PDFDocument1 pageTax Interview PDFSazidul IslamNo ratings yet

- Tax Information InterviewDocument4 pagesTax Information InterviewVera IwuchukwuNo ratings yet

- Tax InterviewDocument1 pageTax Interviewperfora7orNo ratings yet

- Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Document1 pageCertificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Bony PkNo ratings yet

- Tax InterviewDocument1 pageTax Interviewperfora7orNo ratings yet

- Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Document1 pageCertificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Syed Yousuf AliNo ratings yet

- W-8BEN: Do NOT Use This Form IfDocument1 pageW-8BEN: Do NOT Use This Form IfdoyokaNo ratings yet

- Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Document1 pageCertificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Gixxi FlangerNo ratings yet

- Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Document1 pageCertificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Chintu GaaduNo ratings yet

- Your IRS Form W-8 Has Been ReceivedDocument2 pagesYour IRS Form W-8 Has Been ReceivedManishDikshitNo ratings yet

- Formulario Amazon para EscritoresDocument1 pageFormulario Amazon para EscritoresAlberto AcevedoNo ratings yet

- Tax InterviewDocument1 pageTax Interviewfabico 77No ratings yet

- Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Document1 pageCertificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)halima halimaNo ratings yet

- Tax InterviewDocument1 pageTax InterviewEmilio Arreola VegaNo ratings yet

- Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Document1 pageCertificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Mackendy AsseusNo ratings yet

- Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Document1 pageCertificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)YLICH TARAZONANo ratings yet

- Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Document1 pageCertificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Yordani FabianiNo ratings yet

- Tax Information IntervieDocument2 pagesTax Information Intervieambet TayloNo ratings yet

- Tax InterviewDocument1 pageTax InterviewThiago HinojosaNo ratings yet

- Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Document1 pageCertificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)ayoub madaniNo ratings yet

- Tax InterviewDocument1 pageTax Interviewimma coverNo ratings yet

- Tax Information InterviewDocument2 pagesTax Information InterviewKIPA TV Pringsewu LampungNo ratings yet

- Tax Interview AmazonDocument1 pageTax Interview AmazonNuskyNo ratings yet

- Tax InterviewDocument1 pageTax InterviewZuko TvNo ratings yet

- W 8ben With AffidavitDocument1 pageW 8ben With AffidavitFelipeNo ratings yet

- Tax InterviewDocument1 pageTax InterviewgrigmihNo ratings yet

- Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Document1 pageCertificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)fernandoNo ratings yet

- Foreign Tax Status W8BENDocument9 pagesForeign Tax Status W8BENOctavio Alfredo Solano VillalazNo ratings yet

- Tax InterviewDocument1 pageTax InterviewMohamed HossamNo ratings yet

- Tax InterviewDocument1 pageTax Interviewsblackt74No ratings yet

- Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Document1 pageCertificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Cesar MoraNo ratings yet

- Tax Information InterviewDocument2 pagesTax Information InterviewKarthik RaoNo ratings yet

- Tax Information InterviewDocument2 pagesTax Information InterviewsedjNo ratings yet

- Cuestionario Fiscal Sobre Información TributariaDocument2 pagesCuestionario Fiscal Sobre Información TributariaCarlos Jose NuñezNo ratings yet

- W8Ben With US Mailing (FILLABLE)Document2 pagesW8Ben With US Mailing (FILLABLE)Veronica Mtz100% (1)

- Tax InterviewDocument1 pageTax InterviewrodrigoNo ratings yet

- Tax InterviewDocument1 pageTax InterviewENT erritorioNo ratings yet

- Amazon Tax Information InterviewDocument2 pagesAmazon Tax Information InterviewPrecious AdeboboyeNo ratings yet

- Cuestionario Fiscal Sobre Información TributariaDocument2 pagesCuestionario Fiscal Sobre Información TributariaLigia fernandezNo ratings yet

- Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Document1 pageCertificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Bifor PapuaNo ratings yet

- Tax InterviewDocument1 pageTax InterviewChristine Mae CapatoyNo ratings yet

- W-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax WithholdingDocument1 pageW-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax WithholdingImran BashaNo ratings yet

- Tax InterviewDocument1 pageTax Interviewtoxicruiz51No ratings yet

- Tax W8 BENsDocument3 pagesTax W8 BENsroman tamayo Jr.No ratings yet

- Tax InterviewDocument1 pageTax InterviewWilliams PereiraNo ratings yet

- W 8benDocument1 pageW 8benantonio tovarNo ratings yet

- Tax InterviewDocument1 pageTax InterviewMarcelo PeñaNo ratings yet

- Amazon KDPDocument2 pagesAmazon KDPyoussef elmoudenNo ratings yet

- Tax InterviewDocument1 pageTax InterviewMd Mehedi HasanNo ratings yet

- Tax InterviewDocument1 pageTax InterviewOwusu Agyapong StephenNo ratings yet

- Tax InterviewDocument1 pageTax InterviewAli RachidNo ratings yet

- Nur Hayati Indonesia: Identification of Beneficial Owner (See Instructions)Document1 pageNur Hayati Indonesia: Identification of Beneficial Owner (See Instructions)cahaya qolbuNo ratings yet

- Tax InterviewDocument1 pageTax Interviewsirdark66No ratings yet

- Tax InterviewDocument1 pageTax InterviewKofi SobersNo ratings yet

- Emoji DisruptionDocument10 pagesEmoji DisruptionkailashNo ratings yet

- Swagger Sharma Age, Biography, Wiki, Girlfriend & Many MoreDocument5 pagesSwagger Sharma Age, Biography, Wiki, Girlfriend & Many MorekailashNo ratings yet

- Tax InterviewDocument1 pageTax InterviewkailashNo ratings yet

- Swagger Sharma Biography, Age, Height, Girlfriend, Income, Net Worth, FamilyDocument8 pagesSwagger Sharma Biography, Age, Height, Girlfriend, Income, Net Worth, FamilykailashNo ratings yet

- 50-State Tax Sale Cheat Sheet: Deedgrabber PresentsDocument67 pages50-State Tax Sale Cheat Sheet: Deedgrabber Presentschill main100% (2)

- CIR Vs Primetown DigestDocument1 pageCIR Vs Primetown DigestChanyeol ParkNo ratings yet

- Ebook PDF Comparative Politics 2nd Edition by David J Samuels PDFDocument51 pagesEbook PDF Comparative Politics 2nd Edition by David J Samuels PDFrubin.smith411100% (33)

- Cost Sheet - Cost Accounting T. Y. B. Com. Sem V 1644476726Document42 pagesCost Sheet - Cost Accounting T. Y. B. Com. Sem V 1644476726Yugapreetha R100% (1)

- 16 - Discontinued OperationsDocument3 pages16 - Discontinued OperationsJessaNo ratings yet

- ASSIGNMENTDocument24 pagesASSIGNMENTKalpana BisenNo ratings yet

- Article - SarfaesiDocument32 pagesArticle - SarfaesiATUL100% (2)

- .Paper - V - Sec.I - Direct Taxes PDFDocument238 pages.Paper - V - Sec.I - Direct Taxes PDFMichelle MarkNo ratings yet

- E13.2 (LO 1) (Accounts and Notes Payable) The Following Are Selected 2022 Transactions ofDocument4 pagesE13.2 (LO 1) (Accounts and Notes Payable) The Following Are Selected 2022 Transactions ofChupa HesNo ratings yet

- ALİ, Jan, Sharif - 2015 - Effect of Dividend Policy On Stock PricesDocument32 pagesALİ, Jan, Sharif - 2015 - Effect of Dividend Policy On Stock Pricesmuhammad sami ullah khanNo ratings yet

- La Suerte v. CaDocument2 pagesLa Suerte v. CaLuna BaciNo ratings yet

- Chap 9: Present ValueDocument4 pagesChap 9: Present ValueDouglas M. DougyNo ratings yet

- List of Laws Effective DatesDocument36 pagesList of Laws Effective DatesLindsey BasyeNo ratings yet

- Philex Mining Corporation v. CIR, G.R. No. 125704, August 29, 1998Document8 pagesPhilex Mining Corporation v. CIR, G.R. No. 125704, August 29, 1998samaral bentesinkoNo ratings yet

- Tax 321 Prelim Quiz 1 Key PDFDocument13 pagesTax 321 Prelim Quiz 1 Key PDFJeda UsonNo ratings yet

- Annexure To Form GST Drc-07: 21AAVCS9861M1ZF S.N.S. Industrial Works Private LimitedDocument5 pagesAnnexure To Form GST Drc-07: 21AAVCS9861M1ZF S.N.S. Industrial Works Private LimitedBiswajit MishraNo ratings yet

- Business Plan WS-97 FormatDocument7 pagesBusiness Plan WS-97 FormatSanjay Vyas0% (1)

- 4.) Constitutional Provisions That Indirectly Affect Taxation UP TO Double TaxationDocument28 pages4.) Constitutional Provisions That Indirectly Affect Taxation UP TO Double Taxationlaw schoolNo ratings yet

- Bookkeeping Course Syllabus - SDPDFDocument0 pagesBookkeeping Course Syllabus - SDPDFjasonmendez2010No ratings yet

- Aprojectreportonequityevaluationoftop3itcompaniesatstockexchange 120808224509 Phpapp02Document106 pagesAprojectreportonequityevaluationoftop3itcompaniesatstockexchange 120808224509 Phpapp02surekha parasurNo ratings yet

- Initiating Coverage - United Spirits v2 300321Document16 pagesInitiating Coverage - United Spirits v2 300321Ranjith ChackoNo ratings yet

- 238-Cir v. NLRC G.R. No. 74965 November 9, 1994Document5 pages238-Cir v. NLRC G.R. No. 74965 November 9, 1994Jopan SJNo ratings yet

- Sales Quotation: Kind Attn:: TelDocument2 pagesSales Quotation: Kind Attn:: Telkiran rayan euNo ratings yet

- Fatca Form NewDocument1 pageFatca Form NewgaurdevNo ratings yet

- 2-Cost Plus Fixed Fee Sample InvoiceDocument4 pages2-Cost Plus Fixed Fee Sample Invoicekoyangi jagiyaNo ratings yet

- RR 11 2018 - Annex C - Withholding Agent Sworn DeclarationDocument1 pageRR 11 2018 - Annex C - Withholding Agent Sworn DeclarationJames Salviejo PinedaNo ratings yet

- Kunci Jawaban PT Alkindi Akuntansi Dagan PDFDocument15 pagesKunci Jawaban PT Alkindi Akuntansi Dagan PDFGunawan Wahyu FaqihNo ratings yet

- Arundeeps ICSE MCQ Chapterwise Mathematics Class 10 - SampleDocument22 pagesArundeeps ICSE MCQ Chapterwise Mathematics Class 10 - SampleArpit TiwariNo ratings yet

- S S T P S Wyoming: NtroductionDocument4 pagesS S T P S Wyoming: NtroductionManoj GNo ratings yet

- Business Services Destinations in Central Europe 2017 PDFDocument33 pagesBusiness Services Destinations in Central Europe 2017 PDFAravind GovindanNo ratings yet