Professional Documents

Culture Documents

Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)

Uploaded by

Study HelpOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)

Uploaded by

Study HelpCopyright:

Available Formats

Reference Id: A03622653HV0JO783BUQF

Certificate of Foreign Status of Beneficial

Owner for United

SUBSTITUTE

States Tax Withholding and Reporting

Form W-8BEN (July 2017)

(Individuals)

Do NOT use this form if: Instead, use Form:

. You are NOT an individual W-8BEN-E

. You are a U.S. citizen or other U.S. person, including a resident alien individual W-9

. You are a beneficial owner claiming that income is effectively connected with the conduct of trade or business W-8ECI

within the U.S. (other than personal services)

. You are a beneficial owner who is receiving compensation for personal services performed in the United States 8233 or W-4

. A person acting as an intermediary W-8IMY

Part I Identification of Beneficial Owner

1 Name of individual who is the beneficial owner 2 Country of citizenship

Vinay Hirawat India

3 Permanent residence address (street, apt. or suite no., or rural route). Do not use a P.O. box or in-care-of address.

A-3, Vishwambhar apartment , Bapunagar , AmberCinema

City or town, state or province. Include postal code where appropriate.

AHMEDABAD Gujarat 380024

Country

India

4 Mailing address (if different from above)

City or town, state or province. Include postal code where appropriate.

Country

5 U.S. taxpayer identification number (SSN or ITIN), if required (see instructions) 6 Foreign tax identifying number (see instructions)

Part II Claim of Tax Treaty Benefits

9 I certify that the beneficial owner is a resident of within the meaning of the income tax

treaty between the United States and that country.

10 Special rates and conditions (if applicable--see instructions):

The beneficial owner is claiming the provisions of of the treaty identified on line 9 above to claim a

% rate of withholding on (specify type of income): .

Explain the additional conditions in the Article and paragraph the beneficial owner meets to be eligible for the rate of withholding:

Part III Certification

Under penalties of perjury, I declare that I have examined the information on this form and to the best of my knowledge and belief it is true, correct,

and complete. I further certify under penalties of perjury that:

.

1. I am the individual that is the beneficial owner (or am authorized to sign for the individual that is the beneficial owner) of all the income to

which this form relates or am using this form to document myself for chapter 4 purposes,

2. The person named on line 1 of this form is not a U.S. person,

3. The income to which this form relates is:

(a) not effectively connected with the conduct of a trade or business in the United States,

(b) effectively connected but is not subject to tax under an applicable income tax treaty, or

(c) the partner's share of a partnership's effectively connected income,

4. The person named on line 1 of this form is a resident of the treaty country listed on line 9 of the form (if any) within the meaning of the income

tax treaty between the United States and that country, and

5. For broker transactions or barter exchanges, the beneficial owner is an exempt foreign person as defined in the instructions.

Furthermore, I authorize this form to be provided to any withholding agent that has control, receipt, or custody of the income of which I am the

beneficial owner or any withholding agent that can disburse or make payments of the income of which I am the beneficial owner. I agree that I will

submit a new form within 30 days if any certification made on this form becomes incorrect.

The Internal Revenue Service does not require your consent to any provisions of this document other than the certifications required to

establish your status as a non-U.S. individual and, if applicable, obtain a reduced rate of withholding.

Sign Vinay Hirawat 06-08-2021

Here Signature of beneficial owner (or individual authorized to sign for beneficial owner) Date (MM-DD-YYYY) Capacity in which acting

You might also like

- Foreign Tax Status W8BENDocument9 pagesForeign Tax Status W8BENOctavio Alfredo Solano VillalazNo ratings yet

- Form W-8BEN Certificate Foreign StatusDocument1 pageForm W-8BEN Certificate Foreign Statusantonio tovarNo ratings yet

- W-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Document1 pageW-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)MatNo ratings yet

- W8Ben With US Mailing (FILLABLE)Document2 pagesW8Ben With US Mailing (FILLABLE)Veronica Mtz100% (1)

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- W 8ben With AffidavitDocument1 pageW 8ben With AffidavitFelipeNo ratings yet

- Understanding Named, Automatic and Additional Insureds in the CGL PolicyFrom EverandUnderstanding Named, Automatic and Additional Insureds in the CGL PolicyNo ratings yet

- RTC Batangas Civil Case Collection MoneyDocument3 pagesRTC Batangas Civil Case Collection MoneyÝel Äcedillo100% (2)

- 7 - TaxFormForeign PDFDocument1 page7 - TaxFormForeign PDFDiego MartínNo ratings yet

- Mou For SamirDocument6 pagesMou For SamirJohn HudsonNo ratings yet

- IRRBAM Vol2Document100 pagesIRRBAM Vol2GwenNo ratings yet

- W-8BEN: Do NOT Use This Form IfDocument1 pageW-8BEN: Do NOT Use This Form IfdoyokaNo ratings yet

- 14 A Study On Women Empowerment Through Self Help Groups in IndiaDocument6 pages14 A Study On Women Empowerment Through Self Help Groups in IndiaPARAMASIVAN CHELLIAH100% (1)

- Expo 2020Document4 pagesExpo 2020Saher SeherNo ratings yet

- Dallas Police and Fire Pension BriefingDocument85 pagesDallas Police and Fire Pension BriefingTristan HallmanNo ratings yet

- Basic MicroeconomicsDocument8 pagesBasic MicroeconomicsJanzen Mark GuetaNo ratings yet

- Tax Interview PDFDocument1 pageTax Interview PDFSazidul IslamNo ratings yet

- Foreign Tax CertificateDocument1 pageForeign Tax CertificateChintu GaaduNo ratings yet

- Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Document1 pageCertificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)halima halimaNo ratings yet

- Tax InterviewDocument1 pageTax InterviewThiago HinojosaNo ratings yet

- Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Document1 pageCertificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)ayoub madaniNo ratings yet

- Tax InterviewDocument1 pageTax Interviewsblackt74No ratings yet

- Foreign Status CertificateDocument1 pageForeign Status CertificateBony PkNo ratings yet

- Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Document1 pageCertificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)fernandoNo ratings yet

- Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Document1 pageCertificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Syed Yousuf AliNo ratings yet

- Formulario Amazon para EscritoresDocument1 pageFormulario Amazon para EscritoresAlberto AcevedoNo ratings yet

- Tax InterviewDocument1 pageTax Interviewperfora7orNo ratings yet

- Foreign Status CertificateDocument1 pageForeign Status CertificateGixxi FlangerNo ratings yet

- Tax InterviewDocument1 pageTax Interviewperfora7orNo ratings yet

- Tax Interview AmazonDocument1 pageTax Interview AmazonNuskyNo ratings yet

- Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Document1 pageCertificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Mackendy AsseusNo ratings yet

- Foreign Status CertificateDocument1 pageForeign Status Certificateperfora7orNo ratings yet

- Tax InterviewDocument1 pageTax InterviewEmilio Arreola VegaNo ratings yet

- Amazon Tax Information InterviewDocument2 pagesAmazon Tax Information Interviewasad nNo ratings yet

- Tax InterviewDocument1 pageTax InterviewMohamed HossamNo ratings yet

- Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Document1 pageCertificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Yordani FabianiNo ratings yet

- Tax InterviewDocument1 pageTax Interviewimma coverNo ratings yet

- Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Document1 pageCertificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)YLICH TARAZONANo ratings yet

- Foreign Tax CertificateDocument1 pageForeign Tax Certificatefabico 77No ratings yet

- Tax InterviewDocument1 pageTax InterviewENT erritorioNo ratings yet

- Foreign Tax FormDocument2 pagesForeign Tax FormkailashNo ratings yet

- Tax Interview SummaryDocument2 pagesTax Interview SummaryJoudar Youssef100% (1)

- Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Document1 pageCertificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Bifor PapuaNo ratings yet

- Tax InterviewDocument1 pageTax InterviewZuko TvNo ratings yet

- Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Document1 pageCertificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Cesar MoraNo ratings yet

- Tax Information IntervieDocument2 pagesTax Information Intervieambet TayloNo ratings yet

- Tax Information InterviewDocument2 pagesTax Information InterviewKIPA TV Pringsewu LampungNo ratings yet

- Tax-Interview LandingDocument3 pagesTax-Interview LandingDeven GuptaNo ratings yet

- Tax Information InterviewDocument4 pagesTax Information InterviewVera IwuchukwuNo ratings yet

- IRS Form W-8 ReceivedDocument2 pagesIRS Form W-8 ReceivedManishDikshitNo ratings yet

- Tax Information Interview With An AppDocument2 pagesTax Information Interview With An AppMahnoor TalpurNo ratings yet

- Tax Information InterviewDocument2 pagesTax Information InterviewsedjNo ratings yet

- Tax InterviewDocument1 pageTax InterviewgrigmihNo ratings yet

- Tax InterviewDocument1 pageTax InterviewAli RachidNo ratings yet

- Tax InterviewDocument1 pageTax InterviewrodrigoNo ratings yet

- Form W-8BEN-E Certificate Status Beneficial OwnerDocument2 pagesForm W-8BEN-E Certificate Status Beneficial OwnerApoyo A La Cultura PicoteraNo ratings yet

- Cuestionario Fiscal Sobre Información TributariaDocument2 pagesCuestionario Fiscal Sobre Información TributariaCarlos Jose NuñezNo ratings yet

- Cuestionario Fiscal Sobre Información TributariaDocument2 pagesCuestionario Fiscal Sobre Información TributariaLigia fernandezNo ratings yet

- Us Foreigner Tax HolderDocument2 pagesUs Foreigner Tax Holderulissesfsilva07No ratings yet

- W-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Document1 pageW-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)H PNo ratings yet

- Tax W8 BENsDocument3 pagesTax W8 BENsroman tamayo Jr.No ratings yet

- Form W-8BEN GuideDocument1 pageForm W-8BEN GuideChristine Mae CapatoyNo ratings yet

- Tax Information InterviewDocument2 pagesTax Information InterviewKarthik RaoNo ratings yet

- W8 FormDocument2 pagesW8 FormAwais HassanNo ratings yet

- Tax FormDocument1 pageTax FormitflyiljulwhzthzxfNo ratings yet

- Amazon KDPDocument2 pagesAmazon KDPyoussef elmoudenNo ratings yet

- ISC Commerce Exam Question PaperDocument17 pagesISC Commerce Exam Question PaperStudy HelpNo ratings yet

- Revision Test - I STD - Xii (Accountancy) : Seventh Day Adventist Higher Secondary SchoolDocument3 pagesRevision Test - I STD - Xii (Accountancy) : Seventh Day Adventist Higher Secondary SchoolStudy HelpNo ratings yet

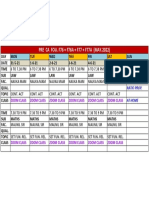

- PRE CA FOU. F76 + F76A + F77 + F77A (MAY.2022) : Zoom Class Zoom Class Zoom Class Zoom Class Zoom Class Zoom ClassDocument1 pagePRE CA FOU. F76 + F76A + F77 + F77A (MAY.2022) : Zoom Class Zoom Class Zoom Class Zoom Class Zoom Class Zoom ClassStudy HelpNo ratings yet

- F76f76af77f77aDocument1 pageF76f76af77f77aStudy HelpNo ratings yet

- 5-9-21 f76 cf-2240 Law QueDocument1 page5-9-21 f76 cf-2240 Law QueStudy HelpNo ratings yet

- Scanned With CamscannerDocument18 pagesScanned With CamscannerStudy HelpNo ratings yet

- Commerce Test (MCQ) CH 1,2 (Responses)Document7 pagesCommerce Test (MCQ) CH 1,2 (Responses)Study HelpNo ratings yet

- Foundation May2022Document6 pagesFoundation May2022Study HelpNo ratings yet

- Elasticity of Demand SumsDocument11 pagesElasticity of Demand SumsStudy HelpNo ratings yet

- Full Course of XII and CA FoundationDocument5 pagesFull Course of XII and CA FoundationStudy HelpNo ratings yet

- CA Foundation Syllabus and Revision PlanDocument10 pagesCA Foundation Syllabus and Revision PlanStudy HelpNo ratings yet

- ACCOUNTS Specimen For ISCDocument15 pagesACCOUNTS Specimen For ISCStudy HelpNo ratings yet

- Stakeholders Icse 2020 PDFDocument6 pagesStakeholders Icse 2020 PDFStudy HelpNo ratings yet

- Foundation May2022Document6 pagesFoundation May2022Study HelpNo ratings yet

- Commercial Studies Sample Paper ICSE 2020Document10 pagesCommercial Studies Sample Paper ICSE 2020Study HelpNo ratings yet

- Stakeholders Icse 2020 PDFDocument6 pagesStakeholders Icse 2020 PDFStudy HelpNo ratings yet

- The Neoliberal State and The Depoliticization of Poverty. Activist Anthropology and Ethnography From Below - Lyon-CalloDocument30 pagesThe Neoliberal State and The Depoliticization of Poverty. Activist Anthropology and Ethnography From Below - Lyon-CalloJozch EstebanNo ratings yet

- Cib ExamDocument3 pagesCib ExamAhmed HakimNo ratings yet

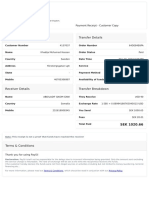

- Sender Details Transfer Details: Payment Receipt - CustomerDocument1 pageSender Details Transfer Details: Payment Receipt - CustomerAbshira Abdi AliNo ratings yet

- Japan Customs InformationDocument6 pagesJapan Customs InformationJawad HussainNo ratings yet

- Jatf - Seed: S E E DDocument6 pagesJatf - Seed: S E E DDivyam ShahNo ratings yet

- Document PDFDocument5 pagesDocument PDFHassan RabihNo ratings yet

- Verma Committee ReportDocument170 pagesVerma Committee Reportaeroa1No ratings yet

- Finance Projection 1Document20 pagesFinance Projection 1api-3741610100% (2)

- Chapter-12 Intermediate AccountingDocument4 pagesChapter-12 Intermediate AccountingDanica Mae GenaviaNo ratings yet

- Ffiffitrffi'': Karnataka Gramin BankDocument2 pagesFfiffitrffi'': Karnataka Gramin BankRøhíth Kumar CNo ratings yet

- Touchstone 4 - Analyzing Your Personal Finances - InstructionsDocument2 pagesTouchstone 4 - Analyzing Your Personal Finances - InstructionsConnex Killen0% (2)

- The Accounting Equation and The Rules of Debit and CreditDocument9 pagesThe Accounting Equation and The Rules of Debit and CreditJoseph LimbongNo ratings yet

- CAP Timetable 2016-2017Document2 pagesCAP Timetable 2016-2017Trung NguyenNo ratings yet

- Mohammed Meraj Ul Haq TaquiDocument60 pagesMohammed Meraj Ul Haq TaquiAmit KapoorNo ratings yet

- UnpublishedDocument25 pagesUnpublishedScribd Government DocsNo ratings yet

- Exercises on Utility Functions, Risk Aversion, and Portfolio ChoiceDocument22 pagesExercises on Utility Functions, Risk Aversion, and Portfolio ChoicemattNo ratings yet

- 30-Dec-2020-Memorandum To Sebi and Justice BN AgrawalDocument17 pages30-Dec-2020-Memorandum To Sebi and Justice BN AgrawalMoneylife FoundationNo ratings yet

- Basel I I I Presentation 1Document32 pagesBasel I I I Presentation 1madhusudhananNo ratings yet

- Mcqs Report Writing: The Purpose of ValuationDocument2 pagesMcqs Report Writing: The Purpose of Valuationask1379808No ratings yet

- EFM2e, CH 04, SlidesDocument16 pagesEFM2e, CH 04, SlidesMaria DevinaNo ratings yet

- FIC77LIFE - Bene ChangeDocument6 pagesFIC77LIFE - Bene ChangeMary GeorgeNo ratings yet

- Vinamilk'SCMDocument63 pagesVinamilk'SCMTrinh Hai AnhNo ratings yet