Professional Documents

Culture Documents

Cost Accounting System Essentials

Uploaded by

Papia SenOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cost Accounting System Essentials

Uploaded by

Papia SenCopyright:

Available Formats

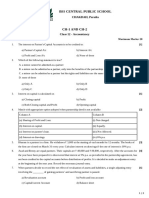

Manoj K Jain

Cost Sheet

By

CA M K Jain

Cost Sheet Page 1

Manoj K Jain

COST SHEET

Theory Questions with Answers

Question.1

(2002) (1994-Nov)

Write short notes on Chargeable Expenses.

Answer

These are the expenses which can be charged directly to jobs, products, processes, cost center or cost units. These are also

known direct expenses. Depending on the situation, the same item of expenses may be treated as chargeable expenses or an

indirect cost. The following may also be treated as chargeable expenses in relation to a product or job.

(1) Cost of patents.

(2) Hire charge in respect of special machinery or plant.

(3) Architects, surveyors and other consultant’s fees.

(4) Travelling, expenses to site.

(5) Freight inward on special materials.

Question.2

(1997, 2002) (1995-May)

Write short notes on Cost Center

Answer

Cost Center

It is defined as a location, person or an item of equipment or a group of these for which costs are ascertained and used for cost

control. Cost center are two types viz., impersonal and personal.

A cost center which consists of a location or an item of equipment or a group of these is called an impersonal cost center. A cost

center which consists of a person or a group of persons is Known as personal cost center.

In a manufacturing concern there are two types of cost center viz., production and service. Production cost centers are those were

production activity is actually carried out whereas services cost center are those sections which are ancillary to and render service

to production cost center.

Question.3

(1994, 1997, 2002, 2003) (2001 - May)

(1) Cost control and Cost reduction.

(2) Cost allocation and Cost Absorption.

(3) Controllable costs and uncontrollable costs (B. Com. (H) - 1999)

Answer

(I) Cost Control:

(1) cost control represents efforts made towards achieving a target or goal.

(2) The process of cost control is to set up a target, investments the variances variations and taking remedial measures to

correct them.

(3) Cost control assumes existence of standard of norms which are not challenged.

(4) Cost control is a preventive function Cost are optimized before they are incurred.

Cost Sheet Page 2

Manoj K Jain

(5) cost control sometime lack dynamics approach.

Cost Reduction:

(1) Cost reduction represents achievements in reduction or cost.

(2) Cost reduction is not contended merely with maintenance of performance according to the standards.

(3) It assumes the existence of concealed potential savings in the standards or norms which are therefore subject to constant

challenge or improvement.

(4) cost reduction is a corrective function. It operates even when efficient cost control system exists. There is a room for

reduction in the achieved costs.

(5) It is continuous process of analysis by various methods of all the factors affecting costs, efforts and functions in an

organization. The main aim is to have continuous economy in costs.

Part (II)

Cost allocation and cost absorption:-

Cost allocation is the allotment of whole item of costs to a cost center or cost unit. In other words, it is process of identifying,

assigning or allowing cost to a cost center or a cost unit.

Cost absorption is the process of absorbing all indirect costs or overhead costs allocated to or apportioned over particular cost

center or production departments by the units produced.

Part (III)

Controllable cost and Uncontrollable cost:-

Controllable cost are the costs which can be influenced by the action of specified member of an undertaking. Controllable costs

incurred in a particular responsibility center can be influenced by the action of the executive heading that responsibility center.

Uncontrollable costs are the cost which cannot be influenced by the action of a specified member of an undertaking.

The distinction between controllable and uncontrollable costs in not very sharp and is sometimes left to individual judgement. In

fact, no cost is controllable; it is only in relation to a particular individual that we may specify a particular cost to be either

controllable or uncontrollable.

Question.4

(a) What are the essentials of a goods Cost accounting system?

(b) Narrate the essential factors to be considered while designing and installing a cost accounting system. (1996 - May)

Answer

Essentials of a good cost accounting system:

The essential features of a good system cost accounting system are as follows:-

(1) The cost accounting system should be tailor made, practical, simple and capable of meeting the requirements of business

concern.

(2) The method of costing should be suitable to the industry and serve its objectives.

(3) The costing system should receive cooperation and participation of executives from various departments.

(4) The cost of installing and operating the system should justify the results.

(5) The system of costing should not sacrifice the utility by introducing meticulous and unnecessary details.

(6) The system should consider the organisation structure of the business and it should be designed and a sub - system of the

overall organisation.

(7) There should be a harmonious relationship between costing system and financial accounts. Unnecessary duplication should

be avoided. A single integrated accounting system would be ideal.

Cost Sheet Page 3

Manoj K Jain

Essential factors for designing a cost accounting system.

The essential factors installing a cost accounting system are listed as below:-

(1) A through understanding of - Organisational structure, manufacturing procedure and process; selling and distribution

procedure; and type of cost information required.

(2) Selection of a suitable costing technique (standard or actual, marginal or absorption).

(3) Pricing method suitable, for the material, to be issued to production.

(4) Method suitable for booking labour cost on jobs.

(5) A sound plan should be devised for the collection, allocation, apportionment and absorption of overheads.

(6) Deciding on ways of treating waste, scrap and idle time.

(7) Designing of suitable forms to be used for collecting and dissemination of cost data/information.

(8) Introduction of budgetary control technique so that actual performance may be compared with budgetary figures, for

measuring efficiency of performance.

Essential factors for installing a cost accounting system.

(1) The objectives of installing a costing system and the expectations of the management from the system should be identified

first. The system will be a simple one in the case of a single objectives but will be an elaborate one in the case of multiple

objectives.

(2) It is important to ascertain the significant variables of the manufacturing unit which are amenable to control and affect the

concern.

(3) A through study of the nature of business, its technical aspects, products, methods and stages of production should be

made. This will help in selecting a proper method of costing.

(4) A study for the organization structure, its size and layout etc. is also necessary this is useful to management to determine to

the scope of responsibilities of various managers.

(5) The costing system should be evolved in consultation with the staff and should be introduced only after meeting their

objections and doubts, if any. The cooperation of staff is essential for the successful operation of the system.

(6) Details of the records to be maintained by the costing system should be carefully worked out. The degree of accuracy of the

data to be supplied by the system should be determined.

(7) The forms to be used by foreman, workers etc. should b standardized. These forms be suitably designed and must ensure

minimum clerical work at all stages.

Question.5

(1996 - Nov)

A factory manufacturing only one product in one quality and size. The owner of the factory states that he has a sound system of

financial accounting which can provide him with unit cost information and as such he does not need a cost accounting system.

State your arguments to convince him the need to introduce a cost accounting system?

Answer

Arguments in favour of installing a cost accounting system

In a single product manufacturing factory

1. Management for a manufacturing units need information to draw plans for the future, to control the working of the unit and for

making day to day decisions, such information are not available from financial accounts. Financial accounting generates two

documents viz., profit and loss account and Balance Sheet at the end of the financial year. These two documents take

roughly about 13 to 14 months to reach to the hands of executives. Even on their receipts these executives cannot set right

anything that has gone wrong in the past. There fore in order to facilities executives to perform well the function of planning,

control and decision making the use of cost accounting system.

2. In financial accounting system no attempt is generally made to record data by jobs, processes, products, departments etc. It

only provides information in terms of income expenses, asset and liabilities for the company as a whole that Thus the

available information is not quite useful for the ascertainment of price, control of costs, ascertainment of product profitability

etc. Cost accounting records data in the manner that helps the ascertainment of price and profitability and also the control of

costs by using variances.

Cost Sheet Page 4

Manoj K Jain

3. Government in its efforts to protect consumers, often resorts to statutory price control. Cost accounting can help by providing

enough cost information which could be utilized to press upon the government to convince the price and to arrive at a

suitable price before their arbitrary fixation.

4. A sound system of cost accounting will highlight the capacity utilization and efficiency which will be beneficial in taking

suitable decisions for the improvement of operational results.

5. It also helps the management for the periodic assessment of performance of its executives. This can be done by establishing

standards, and presenting reports to appropriate authority.

Question.6

1997 Nov

What is meant by ‘Profit center’ ?

Answe r

It is define as an activity center of a business organization. Chief of such a center is fully responsible for all costs, revenues and

profitability of its operation. The main objective of profit center is to maximize the centers profit. Creation of profit centers facilities

management control and implementation of the objectives of responsibility accounting . A profit center may have a number of cost

center.

Question.7

1998 - Nov

Specify the methods of costing and cost units applicable to the following industries:

(1) Toy making

(2) Cement

(3) Radio

(4) Bicycle

(5) Ship building

(6) Hospital

Answer

Industry Method of costing Unit of cost

Toy making Batch Per batch

Cement Unit Per tonne or per bag

Radio Multiple per radio or per batch

Bicycle Multiple per bicycle

Ship Building contract per ship

Hospital operating per bad per day or per patient per day

Question.8

1999 - Nov

Discuss the four different methods of costing along with their applicability to concerned industry?

Answer

Four different methods of costing along with their applicability to concerned industry have been discussed as below:-

Job Costing:-

It is a method of costing which is used when the work is undertaken as per the customer’s special requirements. When an enquiry

is received form the customer, costs expected to be incurred on the job are estimated and on the basis of the estimate, a price is

quoted to the customer. Actual cost of materials, labour and overheads are accumulated and on the completion of job, these actual

costs are compared with the quoted price and thus the profit or loss on it is determined.

Batch Costing:-

Cost Sheet Page 5

Manoj K Jain

It is variant of Job costing. Under batch costing, a lot of similar units which comprises the batch may be used as a unit for

ascertaining cost. In the case of batch costing separate cost sheets are maintained for each batch of products by assigning a batch

number. Cost per unit in a batch is ascertained by dividing the total cost of batch by the number of units produced in that batch.

Contract Costing:-

If a job is very big and takes a long time for its completion, then method used for costing is known as contract costing. Here the cost

of each contract is ascertained separately. It is suitable for firms engaged in the construction of bridges, roads, building etc.

Operating Costing:-

It is define as the refinement of process costing. It is concerned with the determination of the cost of each operation rather than the

process. In those industries where a process consists of distinct operations, the method of costing applied or used is called

operation costing. Operation costing offers scope for control. It facilitates the computation of units operation cost at the end of each

operation by dividing the total operation cost by total output units. It is the category of the basic costing method, applicable, where

standardized goods or services result from a sequences of repetitive and more or less continuous operations, or processes to

which costs are charged before being averaged over the units produced during the period. The two costing methods included under

this head are process costing and service costing.

Question.9

1999 - Nov

Enumerate the factors which are to be considered before installing a system of cost accounting in a manufacturing organization.

Answer

Factors which are to be considered before installing a system of cost accounting in a manufacturing organization are:

(1) The objectives of installing a system of cost accounting should be defined, that is whether the system is meant for control of

cost or for price fixation.

(2) The organization of the company should be studied to understand the authority and responsibilities of the managers.

(3) The technical aspects and flow process should be taken into consideration.

(4) The products to be manufactured should be studied.

(5) The marketing set up to be looked into for devising suitable control reports.

(6) The possibility of integrating cost accounting system with financial accounting system should be examined.

(7) The procedure for collection and verification of reliability of the information should be studied.

(8) The degree of details of information required at each level of management should be examined

Question.10

2000 - May

Define cost objects and give three examples.

Answer

Cost Object:-

Cost object is defined as anything for which a separate measurements of costs is desired, Examples of cost object include a

product, service, project, customer, brand category, activity, departments or programme.

Question.11

2000 - May

Give three examples of cost drives of the following business functions in the value chain.

(i) Research and development

(ii) Design of products, Services and processes.

(iii) Marketing

(iv) Distribution

(v) Customer service.

Cost Sheet Page 6

Manoj K Jain

Answer

A cost driver is any factor whose change causes a change in the total cost of a related cost object. In other words, a change in the

level of cost driver will cause a change in the level of the total cost of a related cost object.

The cost drivers for business functions viz., Research and development; design of products services and process; marketing;

distribution and customer services are as below:-

Business functions Cost drivers

(1) Research and development --- No of research projects

--- personal hours on a project

--- Technical complexities of the projects

(2) Design of products, Services and --- Number of products in design

Processes --- Number of parts per product

(3) Marketing --- Number of engineering hours

--- Number of advertising run

--- Sales revenue

--- Number of products and volume of sales (in quantitative terms)

(4) Distribution --- Number of items distributed

--- Weight of items distributed

--- Number of customer

(5) Customer service --- Number of services calls

--- Number of products serviced

--- Hours spent in servicing of products.

Question.12

2000 - Nov

Explain Sunk costs and pre-production costs

Answer

Sunk Costs:-

These are historical cost which are incurred in the past. These costs were incurred for a decision made in the past and cannot be

changed by any decision that will be made in future. In other words, these costs plays no role in decision making in the current

period. While considering the replacement of a plant, the depreciated book value for the old plant is irrelevant, as the amount is a

sunk cost which is to be written off at the time of replacement.

Pre-Production Costs:-

These costs forms the part of development cost, incurred in making a trial production run, preliminary to formal production. These

costs are incurred when a new factory in the process of establishment or a new project is undertaken or a new product line or

product is taken up, but there is no established or formal production to which such costs may be charged. These costs are normally

treated as deferred revenue expenditure (except the portion which has been capitalized and charged to the costs of future

production.

Question.13

(2002) 2001 - May

What are the main objective of cost accounting?

Answer

Main objectives of cost accounting are as follows:-

(1) Ascertainment of cost

Cost Sheet Page 7

Manoj K Jain

(2) Determination of selling price

(3) Cost control and cost reduction.

(4) Ascertainment of profit of each activity.

(5) Assisting management in decision making.

Part C

Define Explicit costs. How it different from implicit costs?

Answer

Explicit cost:-

These costs are also known as out of pocket costs. They refer to those costs which invoice immediate payment of cash, Salaries,

Wages, postage and telegram, interest on loan etc. are some examples of explicit costs Because they involve immediate cash

payment. These payment are recorded in the books of accounts and can be measured.

Main points of difference

The following are the main points of difference between explicit and implicit costs.

(i) Implicit costs do not involve any immediate each payments. As such they are also known as imputed costs are economics

costs.

(ii) Implicit costs are not involve in the books of accounts but yet, they are important for certain types of managerial decision

such as equipment replacement and relative profitability of two alternative course of action.

Question.14

2002 - May

You have been asked to install a costing system in a manufacturing company. What practical difficulties:

Will you expect and how will you propose to overcome and the same?

Answer

The practical difficulties with which a cost accountant is usually confronted with while installing a costing system in a manufacturing

company are as follows:-

Lack of top management support:-

(1) Installation of a costing system do not receive the support of top management. They consider it as an interference in their

work. They believe that such, a system.

Resistance from cost accounting departmental staff:-

(2) the staff resists because of their fear of loosing their jobs and importance after the implementation for the new system.

Non cooperation from user departments:-

(3) The foreman, supervisors and other staff members may not cooperate in providing requisite data, as this would not only add

to their responsibilities but will also increase paper work of the entire team as well.

Shortage of trained staff:-

(4) Since cost accounting system’s installation involves specialized work, there may be a shortage of trained staff.

To overcome these practical difficulties necessary steps required are.

--- To sell idea to top management to convince them of the utility of the system.

--- Resistance and non - cooperation can be overcome by behavioral approach. To deal with the staff concerned effectively.

--- Proper training should be given to the staff at each level.

--- Regular meetings should be held with the cost accounting staff, user departments, staff and top management to clarify their

doubts/ points.

Question.15

Cost Sheet Page 8

Manoj K Jain

2002 - May

Select a suitable unit of cost to be used in the following.

(i) Hospital

(ii) City Bus Transport

(iii) Hotels providing lodging facilities

Answer

Industry or product Unit of cost

(i) Hospital Patient bed/day

(ii) City Bus Transport Passenger - km

(iii) Hotels providing lodging facilities Room / day

Question.16

1997

Explain the nature of product and period cost. How to they affect net income of a business enterprise?

Answer

Product costs:

Product costs are those which are included in the cost of product. These consist of direct material, direct labour and some of the

factory overheads. These costs change if there is a change in the level of output.

Period Costs:

Period costs are those which change with time and have no relation with the volume of production. These costs are not included in

the cost of product and are charged to Profit & Loss Account of the period. For example, under Marginal costing, all fixed costs are

period costs and are not included in the cost of production but transferred to costing Profit and Loss Account. Classification into

Period cost and Product Cost does affect income determination of a business. That is why there may be a difference in profit under

marginal costing and absorption costing.

Question.17

1997

Explain the important objective of cost accounting? What is cost accounting? Discuss briefly is important functions in a business

firm.

Answer

Meaning of Cost Accounting:-

Cost Accounting is the com used to describe the principles, conventions, techniques and systems which are employed I in detail,

the utilisation of its resources. The terminology in a business to plan and control in detail, the utilization of its resources. The

terminology of Cost Accountancy published by Chartered Institute of Management Accountants of England gives the following

definition of Cost Accountancy. The application of costing and accounting principles, methods and techniques to the science, art

and practice of cost control and the ascertainment of profitability. It includes the presentation of information derived therefrom the

purpose of managerial decision making.

The same terminology defines costing as ‘The techniques and process of ascertaining costs’.

Wheldon has expanded the ideas contained in these definitions and according to him ‘ Costing is the classifying, recording and

appropriate allocation of expenditure for the determination of the cost of products or services, the relation of these costs to sales;

values and the ascertainment of profitability.’

Role of Cost Accounting:-

Cost Sheet Page 9

Manoj K Jain

Cost Accounting has grown out of the needs of businessmen to known in detail the costs involved in producing goods and services.

A good cost accounting system, as such, generates lots of cost information’s which serve may aims, objectives or purposes of cost

accounting such as :

Cost Ascertainment:-

(1) Cost Accounting helps in arriving at cost of production of each individual unit of production or job or operation or process or

department or service. Cost accounting lays down the principles which help in evolving method by which expenses are

analyzed and related to the unit production or job. Thus, one very important function of a cost accountants is the cost

ascertainment of each unit of production or job process.

Fixation of selling Price:-

(2) Through there are several Other factors determining the price of a product, yet one very important basis of fixing the selling

price is the because of this that many a time the pricing of the product is done cost of production. It is in this area where cost

accounting plays an important role. Techniques like break -even analysis help in this regard.

Helps in estimating:-

(3) In types of business where jobs or contract are to be for which tenders or quotations am to be given, cost accounting is very

helpful carried out to which the desired Cost Accounting records helps in such cases in estimating the costs profit margins

are added to arrive at the prices to be quoted in the tenders for the jobs or contracts.

Cost Control:-

(4) ‘Control’ means that plans and actions should confirm each on available from Cost Accounting, the managers at various level

in the organisation are able to control cost as well. In modern times, controlling costs is rather than the main objective of Cost

Accounting where as cost ascertainment is only a secondary objective. This purpose of cost control is ought to be achieved

through costing techniques such as Budgeting Standard Costing etc.

Providing data or information:-

(5) Which are the basis of management accounting thereby helping the management in taking long-term as well as short term

decisions. Decision-making actually involves comparison of the profitability of the various alternatives and in this area, Cost

Accounting serves a great purpose.

Part B

Methods of costing:-

Usually, two types of business concerns are found. One, which manufacture goods for stock and then ultimate sell to the

consumers. These concerns generally involved in non-standards products. Examples of these industries are printer, engineers,

builders, shoes and ready made garments manufacturers etc. In industries where continuous or successive processes are

involved, Process Costing method is employed, whereas in industries where jobs are undertaken and executed against specific

orders, it is job costing method which is employed.

Job Costing and Process Costing are the two main methods of costing. There are many more methods of costing which are based

on these two methods. A list of all the methods of costing is given below:-

--- Job costing

--- Contract costing

--- Batch costing

--- Process costing

--- Unit costing

--- operating costing

--- Multiple costing

Question.18

(B Com.-1999) 1998

“Product cost is a general term denotes different costs allocated to products for different purpose”. Describe three purpose. Explain

the composition of ‘Product cost, for the purpose of external financial reporting along with its rationale.

Answer

Period costs are those which change with time and have no relation with the volume of production. These costs are not included in

the cost of product and are charged to Profit and Loss Account of the period.

Cost Sheet Page 10

Manoj K Jain

The concept of period cost and product cost means differently for marginal costing and absorption costing. For marginal costing

purpose, period cost is fixed cost i.e. fixed factory overheads, fixed administration and selling and distribution overheads. In

marginal costing product cost is all variable cost i.e., direct material cost, direct labour cost and variable factory overheads.

For the purpose of absorption costing, period cost includes all selling distribution and administration overheads and product cost is

direct labour cost and factory overheads (both fixed and variable).

Question.19

(B.Com (H)- 1998,2000)

Distinguish between any three of the following:

(a) Expired cost and unexpired cost

(b) Direct and Indirect cost

Answer

Expired cost and unexpired cost.

Expired cost is that part of the cost , the benefit of which is already received. For example wages paid for the work done is an

expired cost.

Unexpired cost is that part of the cost, the benefit of which is yet to be received. For example, when insurance is paid in advance,

the extent of prepaid insurance is unexpired cost. Expired cost is called an expense and is debited to Profit and Loss account of the

period. Unexpired cost is an asset and is shown on the Assets side of the Balance Sheet of the company.

Part B

Direct and Indirect costs.

Direct Materials or Direct Labour or Direct Expenses (Direct Costs). Direct costs may be defined as the costs which can be easily

and directly identified with a particular costs unit. For example, cost of cloth in a ready made shirt or wages paid or payable to the

tailor for its stitching charges etc. are part of direct costs.

Indirect Materials/Indirect Labour/Indirect Expenses (Indirect Costs.) Indirect costs as opposed to direct costs, are those which can

not be easily or conveniently associated with particular cost units of cost centers. These costs are of general natured and are not

incurred for a specific cost unit. Examples are salaries of general staff, insurance charges depreciation of machinery, rent or

depreciation of the building etc.

The distinction between direct and indirect costs (be it materials or labour or other expenses) is done only on the basis of

convenience. In some cases, even some direct materials (such as gum, buttons, thread, nails etc.) used in production may be

treated as indirect materials simply because of the time and labour involved in ascertaining their costs for the particular cost units. It

is the some total of all indirect expenses, which is called ‘overheads’ which may further be classified as:

--- Factory overheads

--- Office and administrative overheads

--- Selling and Distribution overheads.

Question.19 A

1999

Distinguish between Fixed Cost and Variable Costs.

Answer

Fixed costs and variable costs.

On the basis, costs may be classified as fixed, variable and semi-variable. Fixed costs are those which remain fixed or constant

over a certain output limit. Even these costs may vary beyond that limit. So within this output limit at least, these cost remains

constant in total while the cost per unit varies with the change in output level. These costs vary with time. However, variable costs

are those which change in total amount . With the change in volume of output. But amount of these costs per unit of output remains

constant. As against these two, the semi-variable costs contain both fixed and variable costs. These costs are neither fully fixed nor

fully variable. These are also known as ‘ Fixed Costs’.

Cost Sheet Page 11

Manoj K Jain

In the following figure, a fixed cost line has been shown. This line is parallel to X -Axis which shows that fixed cost remains fixed

irrespective of the volume of output.

Variable costs are those which vary in total in direct proportion to the volume of output. These costs per unit remain relatively

constant with changes in production. Thus, variable costs fluctuate in total amount but tend to remain constant per unit as

production activity changes. Examples are direct material costs, direct labour cost, power repairs etc.

Question.20

1999

Explain the significance of ‘Decision - Making cost.

Answer

Decision - making cost. There are certain costs which are specially used for decision making by the management. Such decision -

making costs may be relevant costs or irrelevant costs. Various types of costs used by the management in decision making are

briefly described below:

Out of pocket costs:-

(1) Out of pocket costs are those which involve cash outlay as against those costs which do not require cash payment. For

example, material costs is an out of pocket cost while depreciation is not an out of pocket cost.

Sunk costs:-

(2) Sunk costs represent those cots which were incurred in the past, cannot be recovered. These costs are not relevant for

decision making.

Differential costs:-

(3) Different in the costs of two alternatives is called differential costs. For example, two alternatives may be two levels of activity

and the different in the costs of two level of activity is differential costs. Such differential costs may be either increase in total

cost or decrease in total cost in which case this may be known as incremental cost or decrement cost.

Conversion Cost:-

(4) Conversion cost is the aggregate of direct wages and factory overheads. In other words, total production cost minus cost of

raw materials is known as conversion cost.

Replacement Cost:-

(5) This is the cost of replacing the asset which is being used. For example, the replacement cost of material is the present

market price of material on the date of issue to the production department. Similarly, replacement cost of an asset is the price

at which a particular asset will be replaced i.e., its market price on the date of its purchase.

Opportunity Cost:-

(6) This is the cost of an alternative. This mean opportunity cost is the advantage foregone as a result of an alternative course of

action. This concept is used in problems of alternative choice.

Imputed Costs:-

(7) These are notional costs, which are not actually incurred. For example, when a building is owned and rent is paid. Then

notional rent or the rental value of such a building is an imputed cost.

Question.21

1999

Explain any two of the following:

(i) Notional salary for properties supervision.

(ii) Packing Expense

(iii) Sunk Costs

Answer

(i) Notional salary for proprietors’ supervision is that salary which is not actually payable but charged in the cost. It is the type of

imputed cost which may be specially computed for certain decision making. It is an item which is similar to notional rent of a

building owned by the company on which no rent is actually payable.

Cost Sheet Page 12

Manoj K Jain

(ii) Packing Expenses may be treated in cost as follows:

(1) Primary packing is a part of the production cost. For example, packing of chemicals and medicines etc. is primary packing

and should be included in the production cost of the product.

(2) Secondary packing is a part of the selling and distribution cost. Secondary packing is that which is required while

Selling/transferring the product and for its safe delivery to the customer. For example television set is sold in a especial kind

os packing. Such expenses are charged to selling and distribution overheads.

(iii) Sunk cost. Sunk cost is a past or historical cost which cannot be changed. Such costs are not relevant for decision making .

For example, if a company purchased a plant about 10 years ago, its purchase cost is not relevant for any decision that will

be taken at the time of purchase of a new plant. But sunk costs are analyzed before taking decisions because these may

affect future tax payments.

Question.22

2000

‘Cost Accounting has come to be an essential tool of the management’.

Answer

Advantages of costing.

A concern derives many advantages from the installation of a Costing system. Some of the important advantages are given below:

1. Cost accounting provides reliable cost data with regard to different elements of cost., i.e., material, labour and expenses.

This helps management in accurately determining the value of inventory and cost of goods sold.

2. A cost system reveals unprofitable activities, losses or inefficiencies occurring in any form such as inadequate utilisation of

plant, machinery, wastage of manpower etc.

3. Introduction of a cost reduction programme combined with operational research and value analysis techniques lead to

economy.

4. As costs are accumulated by jobs, processes, products and departments, the management can distinguish between

profitable and unprofitable activities. Effective measures may be taken to remove or reduce the unprofitable activities.

5. Availability of accurate cost data helps in the fixation of prices and price changes to be effected with greater reliance on the

outcome.

6. Costing furnishes suitable data and informations to the management to serve as guides in taking decisions involving financial

considerations. Information is provided on a number of problems such as whether to make or buy whether to, accept orders

below cost etc.

7. Standard costing and budgetary control methods help in the fixation of optimum level of efficiency. Variance analysis helps in

pointing out the deviations from this level so that suitable measures can be taken for plugging weak points.

8. A cost system provides ready figures for use by the Government for application to problems like price fixation, price control,

wage-level fixation, payment of dividends or settlement of disputes etc.

9. Cost Accounting provides the management with valuable data for the control of costs. Comparisons may be made from

period to period, of several units in the industry by employing uniform costing. Comparisons may also be made in respect of

cost of jobs, processes or cost centres.

10. When a concern is not working in full capacity due to some reason, the cost of idle capacity can be easily worked out and

revealed to the management.

11. The operation cost audit system in the Organisation prevents frauds and assists in furnishing correct cost data to the

management as well as outside parties.

12. Perpetual inventory system helps in exercising inventory control and preparation of periodical Profit & Loss Account.

Question.23

2001

Explain in brief the following concepts.

Product Costs.

Answer

Product Costs:-

Cost Sheet Page 13

Manoj K Jain

These are those costs which are necessary for production and which are included in the cost of production. Examples are direct

materials, direct wages and those factory overheads which are to be included in cost depending on the method of costing i.e.,

marginal costing or absorption costing.

Question.24

2001

Describes briefly the principle aims of classifying the costs.

Answer

Main aims of classifying the cost:

1. Classification of cots into fixed and variable helps in break-even analysis.

2. It also helps in preparation of flexible budgets.

3. This classification also helps the management in decision making.

4. Classification of costs into controllable and uncontrollable helps in controlling costs.

5. Classification of cots into product cost and period cost helps in computing product cost.

Question.25

2002

What purpose do cost centers serve? Are cost centers and cost units related to each other? If Yes, how?

Answer

‘Cost Center and Cost Unit’ are two very important terms used in connection with the ‘Costing’ which itself is defined are the

process and technique of ascertaining cost’. A Cost Center is defined as ‘A location person or item of equipment (or groups of

these) for which costs may be ascertained and used for the purposes of cost control’.

But a cost unit means ‘A unit of quantity of product, service or time (or a combination of these) in relation to which costs may be

ascertained or expressed’.

Ascertaining costs is the key activity in cost accounting. So it also becomes necessary to determine ‘unit’ in terms of which costs

are to be ascertained. Hence, a particular unit or measure of the product or service so selected or taken as the unit for costing

purposes is called ‘Cost unit’. A few examples of Cost Units usually are:

Product/Industry Cost Unit

Radio/T.V. Per radio or T.V.

Car Per Car

Coal Per tonne

Bricks Per thousand

Hospital Per bed or per patient per day

Transport Per k.m. Per bus/truck

0r

Per k.m. Per tonne

Building Construction Per building.

Similarly, the concept of ‘Cost Center’ is as well equally important in costing. Each identified portion of the factory for which costs

are first accumulated forms a cost center.

These costs are then charged to different cost units passing through the part of the factory or cost center.

Question.26

2002

Cost Sheet Page 14

Manoj K Jain

“The term cost must be qualified according to its context.” Comment.

Answer

There are many definitions of the concept of Cost. The most acceptable definition of cost is the amount of expenditure (actual or

notional) incurred on, or attributable to a giving thing’ However, the term Cost cannot be easily defined. Its interpretation depends

upon the nature of the business or industry and the context in which it is used. The term Cost must be qualified according to its

context. For example, Fixed Cost, Sunk Cost, Labour Cost, period Cost etc.

The term ‘Cost’ should be distinguished from ‘expense’ though these two terms are sometimes interchangeably used. The term

‘Expense’ refers to sacrifice, the renouncing aspect of a revenue transaction. Expenses are matched with revenue to determine

income. Loss, on the other hand, is a term which is used to mean excess of cost over revenue. In other words, when revenue falls

short of cost, the difference between the two is termed as ‘Loss’.

Question.27

1999

Distinguish between Prime Cost & Conversion Cost

Answer

Prime Cost is the total of all direct costs i.e., direct materials, direct labour and direct expenses. Conversion Cost may be defined as

the sum of direct wages and overheads cost of converting raw material to the finished state or converting a material from one

stage of production to the next. In brief conversion cost is the total of direct wages and overheads.

Cost Sheet Page 15

Manoj K Jain

Numericals

Question.1

Prepare a cost sheet from the following data to find out profit and cost per unit.

Rs.

Raw materials consumed 1,60,000

Direct wages 80,000

Factory overheads 16,000

Office overheads 10% of factory cost

Selling overheads 12,000

Units produced 4,000

units sold 3,600

Selling price 100 per unit

Answer Prime cost Rs. 2,40,000: Factory cost Rs. 2,56,000: Cost of production Rs. 2,81600: Cost of goods sold Rs.

2,53,440; Total cost Rs. 2,65,440; Profit Rs. 94,560; Sales Rs. 3,60,000

QUESTION 2

Find out the cost of Raw materials purchased from the data given below:

Rs.

Prime Cost 2,00,000

Closing stock of raw materials 20,000

Direct labour 1,00,000

Expenses on purchases 10,000

Answer: Rs. 1,10,000

QUESTION 3

Prepare a cost sheet showing the cost per each item of expenses and the total cost per quintal when quintals

manufactured are 17,200.

Rs.

Raw materials 28,000

Fuel 6,900

Electric power 1,340

Process and general wages 63,500

Repairs 2,400

Haulage 1,060

Light and power 400

Rent 2,000

Rates and insurance 300

Office salaries and general expenses 7,000

Administration 5,000

Depreciation on Machinery 2,500

Answer Prime cost Rs. 91,500; Works cost Rs. 1,08,400; Total cost Rs. 1,20,400

QUESTION 4

Compute manufacturing expenses from the data given below

Rs.

Opening stock of raw material 5,000

Purchases 25,000

Cost Sheet Page 16

Manoj K Jain

Expenses on purchases 1,000

Direct wages 20,000

Direct expenses 1,000

Closing stock of raw materials 7,000

Manufacturing cost 80,000

Answer Rs. 35,000

QUESTION 5

Prepare a cost sheet from the following

Rs.

Opening stock of Raw materials 5,000

Raw materials purchased 50,000

Sale of wastage of materials 200

Productive wages 20,000

Direct expenses 2,000

Unproductive wages 10,500

Estimating 800

Worker's canteen and welfare expenses 1,500

Bank interest 1,200

Expenses of capital issues 10,000

Godown expenses 1,000

Expenses of Branch establishments 500

Depreciation 2,000

Carriage inward on materials purchased

(not included in the cost of materials) 1,250

Carriage outwards 750

Consumable stores 2,000

Audit fees 250

Expenses of sales office 1,100

Wages of delivery vans 2,000

Municipal taxes in respect of factory

buildings 500

Printing and stationery sales 225

Cost of training new workers 2,300

Motive power 4,500

Bad debts 100

Advertising 300

Legal expenses 500

Rent of warehouse 300]

Bank charges 50

Commission on sales 1,500

Loose tools written off 600

Water supply 1,200

Discount on sales 200

Income tax paid 600

Works manager salary 1,000

Loss on sale of a part of plant 400

Insurance of stock of raw materials 300

Contribution to provident fund of

factory employees 1,000

Cost of samples 300

Shortage in stocks of finished goods 20

Experimental expenses 200

Wages of fireman 1,000

Telephone expenses 500

Market research expenses 500

Cost Sheet Page 17

Manoj K Jain

Travelling expenses 300

QUESTION 6

Prepare the cost sheet to show the total cost of production and cost per unit of goods manufactured by a co. for the

month of July 1999. Also find out the cost of sales

Rs.

Stock of raw materials 1-7-99 3,000

Raw materials purchased 28,000

Stock of raw materials 31-7-99 4,500

Manufacturing wages 7,000

Depreciation on plant 1,500

Loss on sale of a part of plant 300

Factory rent and rates 3,000

Office rent 500

General expenses 400

Discount on sales 300

Advertisement expenses to be charged fully 600

Income tax paid 2,000

The number of units produced during July 1999 was 3,000

The stock of finished goods was 200 and 400 units on 1-7-99 and 31-7-99 respectively. The total cost of units on hand

on 1-7-99 was Rs. 2,800. All these had been sold during the month.

Answer Prime cost Rs. 33,500; Factory cost Rs. 38,000; Cost of production Rs. 38,900; Cost of sales Rs. 37413

Question 7

From the following particulars, prepare a statement in such form as you consider most suitable for showing clearly all elements of

cost:-

Rs.

Opening stock of Raw Materials 25,000

Purchase of Raw Materials 70,000

Raw material returned to suppliers 2,000

Closing stock of raw materials 18,800

Wages paid to :-

Productive workers 18,000

Non productive workers 2,000

Salary paid to office staff 5,000

Carriage on raw material purchased 500

Carriage on goods sold 1,500

Rent and rates of workshop 2,500

Fuel, gas, water etc. 1,000

Repair to plant 600

Depreciation on machinery 1,400

Office Expenses 1,500

Direct chargeable expense 800

Advertising 1,200

Answer Prime cost Rs. 73,500, Net factory cost Rs. 1,01,000, Cost of production of goods sold Rs. 1,07,500, Cost of sales Rs.

1,10,200

Question.8

The following data relate to the manufacture of a standard product during the following week period to June 30th 1991.

Rs.

Raw Materials consumed 4,000

Cost Sheet Page 18

Manoj K Jain

Wages 6,000

Machine hours worked 1,000

Machine hours rate 50 paise

Office overhead 20% on works Cost

Selling Overhead 6 paise per unit

Units produced 20,000

Units sold 18,000

@ Rs. 1/ per unit.

You are required to prepare a cost sheet showing the cost per unit and profit for the period.

Answer

Profit Rs. 5580.00 per unit profit - Rs. 0.310

Question.9

The following particulars relating to the year 1994 have been taken from the books of a chemical works manufacturing and selling a

manufacturing mixture.

Kg. Rs.

Stock on 1st Jan,. 1994

Raw materials 2,000 2,000

Finished mixture 500 1,750

Factory stores 7,250

Purchases

Raw materials 1,60,000 1,80,000

Factory stores 24,250

Sales

Finished mixture 1,53,050 9,18,000

Factory scrap 8,170

Factory wages 1,78,650

Power 30,400

Depreciation of machinery 18,000

Salaries:

Factory 72,220

Office 37,220

Selling 41,500

Expenses:

Direct 18,500

Office 18,200

Selling 18,000

Stock on 31st December, 1994

Raw material 1,200 --

Finished mixture 450

Factory stores 5,550

The stock of finished mixture at the end of 1994 is to be valued at the factory cost of the mixture for that year. The purchase price of

raw materials remained unchanged throughout 1994.

Prepare a statement giving the maximum possible information about cost and its break up for the year 1994.

Answer

Prime cost Rs. 3,77,800, factory cost Rs. 5,16,200, Cost of production of finished mixture sold Rs. 5,71,852, Cost of sales Rs.

6,31,352.

Question.10

Cost Sheet Page 19

Manoj K Jain

The following information has been obtained from the records of ABC Corporation for the period from June 1 to June 30th, 1991.

On June 1, 1991 On June 30th, 1991

Rs. Rs.

Cost of raw materials 60,000 50,000

Cost of work-in-progress 12,000 15,000

Cost of stock of finished goods 90,000 1,10,000

Rs.

Purchase of raw materials during June 91 4,80,000

Wages paid 2,40,000

Factory Overheads 1,00,000

Administration overheads 50,000

Selling & Distribution Overheads 25,000

Sales 10,00,000

Prepare a statement giving the following information:

(a) Materials consumed

(b) Prime cost

(c) Factory cost

(d) Cost of goods sold and

(e) Net profit

Answer

(a) 4,90,000

(b) 7,30,000

(c) 8,27,000

(d) 8,57,000

(e) 1,18,000

Question.11

The following figures are extracted from the trial balance of GoGetter Co. On 30th September1986:-

Rs. Rs.

Inventories:

Finished stock 80,000

Raw materials 1,40,000

Work-in-progress 2,00,000

Office appliances 17,400

Plant & Machinery 4,60,500

Buildings 2,00,000

Sales 7,68,000

Sales returns and rebates 14,000

Material Purchased 3,20,000

Freight incurred on material 16,000

Purchase returns 4,800

Direct labour 1,60,000

Indirect labour 18,000

Factory Supervision 10,000

Repairs and Upkeep-factory 14,000

Heat, Light & Power 65,000

Rates and Taxes 6,300

Miscellaneous factory expenses 18,700

Sales commission 33,600

Sales promotion 22,500

Sales travelling 11,000

Distribution Deptt- Salaries and Expenses 18,000

Office Salaries and Expenses 8,600

Cost Sheet Page 20

Manoj K Jain

Interest on Borrowed funds 2,000

Further details are available as follows

Closing Inventories:

Finished goods 1,15,000

Raw materials 1,80,000

Work-in-progress 1,92,000

Accrued expenses on:

Direct labour 8,000

Indirect labour 1,200

Interest on Borrowed funds 2,000

Depreciation to be provided on:

Office appliances 5%

Plant and Machinery 10%

Building 4%

Distribution of the following costs:

Heat, Light and power to Factory, Office and Distribution in the ratio 8:1:1 Rates and Taxes two-thirds to factory and one-third to

office. Depreciation on building to Factory, Office and selling in the ratio 8:1:1. With the help of the above information you are

required to prepare a condensed Profit and Loss statement of Gogetee Co. for the year ended 30th September 1986 along with

supporting schedules of :

(1) Cost of Sales

(2) Selling and Distribution Expenses

(3) Administration Expenses

Answer

Net profit Rs. 39,980

(1) Cost of Sales Rs. 7,14,020;

(2) Selling and Distribution Expenses Rs. 92,400;

(3) Administration Expenses Rs. 18,870

Question.12

The books of Adarsh Manufacturing Company present the following data for month of April 1992. Direct labour cost is Rs. 17,500

being 175% of works overhead. Cost of goods sold 56,000 excluding administration overhead.

April 1 April 2

Rs. Rs.

Raw materials 8,000 10,600

Work-in-progress 10,500 14,500

Finished goods 17,600 19,000

Other data are:

Selling Expenses 3,500

General and administration expenses 2,500

Sales for the month 75,000

You are required to:

(1) Compute the value of materials purchased.

(2) Prepare a cost statement showing the various elements of costs and also the profit earned.

Answer

(1) Rs. 36,500

(2) Prime cost Rs. 51,400; Works cost Rs. 61,400; Cost of Goods sold Rs. 56,000; Cost of Sales Rs. 62,000; Profit Rs. 13,000.

Question.13

The following figures for the month of April, 1991 were extracted from the records of a factory:-

Cost Sheet Page 21

Manoj K Jain

Rs.

Opening stock of finished goods (5,000 units) 45,000

Purchase of raw materials 2,57,100

Direct wages 1,05,000

Factory overheads 100% of Direct Wages

Administration on Overheads Rs. 1/- per unit

Selling and Distribution Overheads 10% of sales

Closing Stock of finished goods (10,000 units) ?

Sales (45,000 units) 6,60,000

Prepare a cost sheet for the month of April 1991, assuming that sales are made on the basis of “first-in first-out” principle.

Answer

Profit Rs. 1,35,320

Question.14

Bharat Electronics Ltd. furnishes the following information for 10,000 TV Valves manufactured during the year 1991:

Material 90,000

Direct wages 60,000

Selling Expenses 5,500

Power & Consumable stores 12,000

Factory Indirect Wages 15,000

Lighting of factory 5,500

Defective work (Cost of rectification) 3,000

Clerical Salaries and Management Expenses 33,500

Sale proceeds of scraps 2,000

Plant repairs & Maintenance and Depreciation 11,500

The net selling price was Rs. 31.60 per unit sold and all the units were sold.

As from 1st January, 1992 the selling price was reduced to Rs. 31.00 per unit. It was estimated that production could be increased

in 1992 by 50% utilizing spare capacity. Rates for materials and direct wages will increase by 10%.

You are required to prepare:-

(a) Cost sheet for the year 1991, showing various element of cost per unit and

(b) Estimated cost and profit for the 1992 assuming that 15000 units will be produced and sold during the year and factory

overheads will be recovered as a percentage of direct wages and office and selling expenses as a percentage of work cost.

Answer

(a) Profit total 82,000 & per unit 8.20

(b) Rs. 78,900

Question.15

A critical study of past expenses incurred on the manufacture of two kinds of acid containers (drums) shows:-

Nature of Expenses Expenses incurred on the

Manufacture of acid containers

Type “X” (Rs.) Type “Y” (Rs.)

Direct Material 3.50 6.50

Direct wages 1.00 1.50

Plant and Machine usage

allocated as hourly basis 2.00 3.00

General overhead apportioned

at 200% of direct wages 2.00 3.00

------------ ------------

8.50 14.00

======= =======

Cost Sheet Page 22

Manoj K Jain

Cost records for month of August 1991 show:

Direct materials utilised 26,500

Direct wages 5,850

Plant and Machine Usage 16,250

General Overheads 11,700

------------

Total 60,300

=======

Containers produced: Type ‘X’ 2000 units and Type ‘Y’ 3,000 units.

Prepare a consolidated cost sheet distributing the total production cost between the two types of containers according to the

different elements of cost and also showing cost per container of each type.

Answer

Type X 8.70

Type Y 14.30

Type X 17,400

Type Y 42,900

--------------

60,300

========

Question.16

Sreelekha Mfg. Co. Manufacturing two types of pens P & Q. The cost for the year ended 30th June 1991 is as follows:-

Rs.

Direct Material 4,00,000

Direct Wages 2,24,000

Production Overheads 96,000

-------------

7,20,000

Its further ascertained that:

(a) Direct Materials in Type P cost twice as much direct materials as in type Q.

(b) Direct Wages for type Q were 60% of those for type P.

(c) Production overheads was of the same rate of both types.

(d) Administration overheads for each was 200% of direct labour.

(e) Selling cost were 50 paise per pen for both types.

(f) Production during the year:

Type P 40,000

Type Q 1,20,000

(g) Sales during the year:

Type P 36,000 pens and

Type Q 1,00,000 pens.

(h) Selling prices were Rs. 14 per pen for type P and Rs. 10 per pen for type Q.

Prepare statement showing per unit cost of production, total cost, profit and also total sales value and profit Separately for the two

types of Pen P & Q.

Answer Profit per unit P Rs. 2.90, Q Rs. 3.30, Material cost per unit P rs. 4, Q Rs. 2., Cost of sales per unit P =

Rs. 11.10, Q Rs. 6.7

Question.17

The books and records of the Anand Manufacturing Co. present the following data for the month of August 1988.

Direct labour cost Rs. 16,000 (160% of factory overheads)

Cost Sheet Page 23

Manoj K Jain

Cost of goods sold Rs. 56,000

Inventory accounts showed these opening and closing balances:-

August 1 August 31

Raw Materials 8,000 8,600

Work-in-progress 8,000 12,000

Finished goods 14,000 18,000

Other data

Selling expenses 3,400

General and administration expenses 2,600

Sales for the month 75,000

You are required to prepare a statement showing cost of goods manufactured and sold and profit earned.

Answer

15,600 - profit.

Question.18

A Ltd. Co. has capacity to produce 1,00,000 units of a product every month. Its works cost at varying levels of production is as

under:

Level Works cost per unit

Rs.

10% 400

20% 390

30% 380

40% 370

50% 360

60% 350

70% 340

80% 330

90% 320

100% 310

Its fixed administration expenses amount to Rs. 1,50,000 and fixed marketing expenses amount to Rs. 2,50,000 per month

respectively. The variable distribution cost amount to Rs. 30 per unit.

It can market 100% of its output at Rs. 500 per unit provided it incurs the following further expenditure:

(a) It gives gift items costing Rs. 30 per unit of sale;

(b) It has lucky draws every month giving the first prize of Rs. 50,000; 2nd prize of Rs. 25,000; , 3rd prize of Rs. 10,000 and

three consolation prizes of Rs. 5,000 each to customers buying the products.

(c) It spends Rs. 1,00,000 on refreshments served every month to its customers;

(d) It sponsors a television programmed every week at a cost of Rs. 20,00,000 per month.

It can market 30% of its output at Rs. 550 per unit without incurring any of expenses referred to in (a) to (d) above.

Advise the company on its course of action. Show the supporting cost sheets.

Answer

38,00,000, 104,00,000

Question.19

The cost structure of an article the selling of which is Rs. 45,000 is as follows:

Direct material 50%

Direct Labour 20%

Overheads 30%

An increase of 15% in the cost of materials and of 25% in the cost of labour is anticipated. These increased costs in relation to the

present selling price would cause a 25% decrease in the amount of present profit and article.

Cost Sheet Page 24

Manoj K Jain

You are required:

(1) To prepare a statement of profit per article at present

(2) The revised selling price to produce the same percentage of profit to sales as above before.

Answer

(1) Profit Rs. 15,000 and

(2) Selling prize Rs. 50,625.

Question.20

On June 30th, 1996 a flash flood damaged the ware house and factory of ABC corporation completely destroying the work in

progress Inventory. There was no damage to either the raw materials of finished goods inventories. A physical verification taken

after the flood revealed the following valuations:

Raw material Rs. 62,000

work in progress ?

Finished Goods Rs. 1,19,000

The Inventory on Jan. 1, 1996 consisted of the following:

Raw Materials Rs. 30,000

Work in progress Rs. 1,00,000

Finished goods Rs. 1,40,000

-------------- 2,70,000

A review of the books and records disclosed that the gross profits margin historically approximated 25% of sales. The sales for the

first six months of 1996 were Rs. 3,40,000. Raw material purchase were Rs. 1,15,000. Direct labour costs for this period were Rs.

80,000 and manufactures overhead has historically been 50% of direct labour.

Compute the cost of work in progress inventory lost at June 30, 1996 by preparing a Statement of cost and profit.

Question.21

The following inventory data relate to XYZ Ltd.

Opening Closing

Finished goods Rs. 1,10,000 95,000

Work in progress Rs. 70,000 80,000

Raw material Rs. 90,000 95,000

Additional information:

Cost of goods available for sale Rs. 6,84,000

Total goods processed during the period 6,54,000

Factory overheads Rs. 1,67,000

Direct material used Rs. 1,93,000

Requirements:

(1) Determine raw material purchases

(ii) Determine the direct labour cost incurred.

(iii) Determine the cost of goods sold.

Answer i. Rs. 1,98,000, ii. Rs. 2,24,000, iii. Rs. 5,89,000

Question.22

A fire occurred in the factory premises on October 31, 2003. The accounting records have been destroyed certain accounting

records were kept in another building. They reveal the following for the period September, 1, 2003 to October 31, 2003:-

(i) Direct materials purchased Rs. 2,50,000

(ii) Work in process inventory, 1.9.2003 Rs. 40,000

(iii) Direct materials inventory, 1.9.2003 Rs. 20,000

(iv) Finished goods inventory, 1.9.2003 Rs. 37,750

Cost Sheet Page 25

Manoj K Jain

(v) Indirect manufacturing cost 40% of conversion cost

(vi) Sales revenues Rs. 7,50,000

(vii) Direct manufacturing labour Rs. 2,22,250

(viii) Prime cost Rs. 3,97,750

(ix) Gross margin percentage based on revenues 30%

(x) Cost of goods available for sale Rs. 5,55,775

The loss is fully covered by insurance. The insurance company wants to know the historical cost of the inventories as a basis for

negotiating a settlement, although the settlement is actually to be based on replacement cost and not historical cost.

Required:-

(i) Finished goods inventory, 31.10.2003

(ii) Work in progress inventory, 31.10.2003

(iii) Direct material inventory, 31.10.2003

Answer i) Rs. 30,775, ii) Rs. 67,892, iii) Rs. 94,500

Question.23

The following data pertains to a company for the month of March, 2003

(1) Direct material used Rs. 847

(2) Opening stock of finished goods.

(3) Closing stock of finished goods Rs. 94

(4) Direct labour cost Rs. 389.

(5) Manufacturing overheads?

(6) Cost of goods produced Rs. 1,878

(7) Cost of goods sold?

(8) Cost of goods available for sale Rs. 1,949.

Answer

[Manufacturing overheads Rs. 642; opening stock of finished goods Rs. 71; cost of good sold Rs. 1,855]

Question.24

The following information for the year ended 31st March, 1999, is obtained form the book and records of a factory:

Completed Jobs Work in progress

Rs. Rs.

Raw material supplied from stores 1,80,000 60,000

Wages 2,00,000 80,000

Chargeable expenses 20,000 8,000

Material transferred to work in progress 4,000 4,000

Material returned to stores 2,000 ---

Factory overhead is 80% of wages and administrative overhead is 25% of factory cost.

The value of executed jobs during 1999 was Rs. 8,20,000.

Prepare:

(1) Consolidated completed jobs account showing the profit made or loss incurred on Jobs, and also

(2) Consolidated work in progress account.

Question 25

The cost sale of production ‘A’ is made up as follows:

rs.

Material used in :

manufacturing 5,500

Cost Sheet Page 26

Manoj K Jain

selling the product 150

packing materials 1,000

factory :75

the office 125

Labour required in production 1,000

Labour required for supervision of the management for factory 200

Expenses:

Direct factory 500

indirect factory 100

office 125

Depreciation:

office building and equipment 75

factory 175

Selling expenses 350

Freight on materials 500

Advertising 125

Assuming that all products manufactured are sold, what should be the selling price to obtain a profit of 25% on selling price?

Answer prime cost Rs. 8,500, factory cost Rs. 9,050, cost of production rs. 9,375, cost of sales rs.

10,000, sales rs. 13,333

Question.26

Prepare Cost Sheet for month of March 1991 from the following particulars:

Inventories 1.3.91 (Rs.) 31.3.91 (Rs.)

Raw Material 10,000 12,000

WIP 25,000 20,000

Finished Goods 30,000 35,000

Raw Material Purchased Rs. 1,00,000

Productive Wages Rs. 62,000

Chargeable Expenses Rs. 40,000

Factory Overheads 50% of Wages

Administration Overheads 20% of Works Cost

Selling & Distribution Overheads Rs. 21,800

Sales Rs. 2,50,000

Answer Loss Rs. 50,000

Question.27

Using following information prepare Cost Sheet by FIFO Method and determine profit for March 2000:

Raw Materials on 1-3-2000 2,000 Kgs Rs. 2,000

Raw Material Purchased 1,00,000 Kgs Rs. 1,10,000

Raw Materials Stock on 31-3-2000 5,000 Kgs

Productive Wages Rs. 73,500

Chargeable Expenses Rs. 50,000

Factory Overheads 40% of chargeable expenses

Administration Overheads 20% of Works Cost

Opening Stock of finished goods 5,000 units Rs. 55,000

Sales 32,000 units

Closing Stock finished goods 3,000 units

Selling and Distribution Overheads Rs. 2 per unit

Profit margin 50% on Sales.

Also rework your answer if:

Cost Sheet Page 27

Manoj K Jain

(i) Stock valuation on Weighted average method.

(ii) Stock Valuation on LIFO method.

(iii) Attempt the question if stock valuation at factory Costs.

Question.28

Raw Material Consumed Rs. 2,00,000

Productive Wages Rs. 1,00,000

Factory Overheads Rs. 2/- unit

Opening Stock finished goods 5,000 units Rs. 50,000

Sales 25,000 units @Rs. 20/-

Closing Stock finished goods 10,000 units

Opening WIP NIL

Closing WIP Rs. 10,000

It consists of

Material Rs. 5,000

Labour Rs. 3,000

Factory Overheads Rs. 2,000

Administration Overheads Rs. 38,000

Selling & Distribution Overheads Rs. 2/- unit

Prepare Cost Sheet:

Answer Profit Rs. 1,41,333

Question.29

A factory has received an order for three different types of casting weighting respectively 18,45 and 27 tonnes. 10% of the raw

materials used are wasted in manufacturing and are sold as scrap for 20% of the cost of raw materials .

The cost of raw materials is Rs. 250 per tonne, the wages for three types of casting are respectively Rs. 4,000 Rs. 10,500 and Rs.

5,500. The cost of the moulds for the three different types of casting are respectively Rs. 400, Rs. 500 and Rs. 300.

If the factory overhead charges are 40% of the wages in each case, find the cost of production per tonne of each type of casting.

Answer I Rs. 605.56, II Rs. 610, III Rs. 568.52

Question.30

The following figures are collected from the books of an iron foundry after the close of the year:

Raw Materials: Rs.

Opening Stock at the beginning of the year 7,000

Purchases during the year 50,000

Closing stock at the end of the year 5,000

Direct Wages 10,000

Works overhead: 50% of direct wages

Stores overhead on material: 10% on the cost of materials.

10% of the finished castings were found to be defective in manufacturing and were rectified by expenditure of additional works

overhead charges to the extent of 20% on the proportionate direct wages.

10% of the castings were rejected being not upto specification and a sum of Rs. 400 was realised on sale as scrap.

The total gross output of casting during the year was 1,000 tonnes.

Find out the manufacturing cost of the saleable castings per tonne

Answer Quantity 900, Value rs. 71,980

Question.31

Cost Sheet Page 28

Manoj K Jain

Pleasant Cold Limited manufactured and sold 1,000 refrigerators in the year ending 31st March, 1995. The summarized Trading &

Profit and Loss A/c is set out below:

Rs. Rs.

To Cost of Materials 80,000 By Sales 4,00,000

To Direct Wages 1,20,000

To Manufacturing expenses 50,000

To Gross Profit c/d 1,50,000

-------------- ------------

4,00,000 4,00,000

======== =======

To Management and Staff

Salaries 60,000 By Gross profit b/d 1,50,000

To Rent, Rates, Insurance 10,000

To Selling expenses 30,000

To General expenses 20,000

To Net Profit 30,000

------------ ------------

1,50,000 1,50,000

======= =======

For the year ending 31st March, 1996 it is estimate that-

1. Output and sales will be 1,200 refrigerators.

2. Prices of new materials will rise by 20% of the previous years level.

3. Wages rates will rise by 5%.

4. Manufacturing cost will rise in proportion to the combined cost of materials and wages.

5. Selling cost per unit will remain unchanged.

6. Other expenses will remain unaffected by the rise in output.

You are required to submit a statement for the Board of Directors showing the price at which the refrigerators should be marketed

so a to show a profit of 10% on selling price. (Hint : Calculate cost per unit )

Answer Prime cost Rs. 222, Works cost Rs 277.5, Cost of production Rs. 352.5, Cost of

sales Rs. 382.5 , Sale price Rs. 425.

Question.32

The cost structure of an article the selling price of which is Rs. 500 is as follows:

Direct Materials : 50% of the total cost

Direct Labour: 30% of the total cost.

Overhead : Balance

Due to anticipated increase in existing materials price by 20% and in the existing labour rate by 10% the existing profit would come

down by 30 % if the selling price remains unchanged.

Prepare a comparative statement showing the cost, profit and sale price under the present conditions and with the increase

expected for the future. Assuming the same percentage of profit on cost as under present conditions. (Calculations may be made to

the nearest rupee) has to be earned.

Question.33

Find profit by drawing a cost sheet with the following information for the month of June, 2001:

Rs.

Opening stock: Raw - materials 1350

Finished goods 2500

Closing Stock : Raw - Materials 750

Finished goods 1500

Raw - Materials purchased 20,000

Cost Sheet Page 29

Manoj K Jain

Wages paid to labourers 8000

Direct expenses 1250

Experimental expenses 450

Factory printing and stationery 350

Rent : Factory 250

Office 120

------- 370

Wages for supervisor 1000

Interest paid 1200

Dividend received 300

Lighting - office 125

Audit fees 150

Bank charges 500

Cost of samples 100

Income tax 1000

Telephone expenses 600

Advertising 1250

Cash discount 800

Market research expenses 550

Salary of godown - keepers 175

Travelling expenses 750

Commission of travelling agents 500

Sales 50000

Answer Profit Rs. 12,280

Question.34

The Margos company has just completed operations for the year 1983. The company’s Assistant Accountant (who is very

inexperienced) prepared the following Profit and Loss Account for the years activities:

Rs. Rs.

Sales 32,00,000

Operating Expenses:

Insurance 40,000

Gas, electricity and water 1,00,000

Direct Labour Cost 6,00,000

Depreciation on factory equipment 1,60,000

Raw Materials purchased during the year 12,00,000

Rent 4,00,000

Selling & Administration Overheads 3,20,000

Indirect labour 1,20,000

----------- 29,40,000

---------------

Net Profit 2,60,000

You have been asked to assist the company in preparing a correct cost sheet for the year 1983. The following additional

information is available.

(i) The company is a manufacturing firm that produces a product for sale to outside customers.

(ii) 80 percent of the rent paid applies to factory operations and the remainder to Selling and Administration activities.

(iii) No raw materials were on hand on 1st January . However, raw materials of the value of Rs. 1,50,000 purchased during 1983

were still on hand on 31st December. The remainder was used in production during the year.

(iv) 70 percent of the Insurance and 90% of the Gas, Electricity and water paid apply to factory operations the remainder applies

to Selling and Administration activities.

(v) Work - in - Progress and finished goods inventories were:

1st January 31st December

Work-in-Progress Rs. 4,20,000 Rs. 4,80,000

Finished goods Rs. 5,40,000 Rs. 4,00,000

Cost Sheet Page 30

Manoj K Jain

You are required to prepare:

(a) A statement of cost of goods manufactured in 1983, and

(b) A corrected Cost Sheet for the year ended 31st December, 1983.

Question 35

A manufacturer of metal chairs of several types follows a simple costing system. Records are kept of the materials consumed in the

manufacture of each type of chair and of the number of chairs of each type Produced. Wages and overheads are allocated in

Proportion to the cost of raw materials. Accounts are made up to 30th June every year. During the year ending June 30th, 2000 the

output of type ‘A’ chairs was 40,000. The cost of raw materials used as Rs. 2,75,000. The following is the summarised statement of

the Manufacturing and Profit and Loss Account for the year.

Rs. Rs.

To Raw Material 13,75,000 By Sales 48,55,000

To Factory Wages 11,50,000 By Stock of finished goods 80,000

To Factory Expenses 11,12,500

To Opening Stock of Finished Goods 50,000

To Gross Profit 12,47,500

----------------- ----------------

49,35,000 49,35,000

========== =========

To Office and Administration Expenses 3,05,000 By Gross Profit 12,47,500

To Net Profit 9,42,500

----------------- ----------------

12,47,500 12,47,500

========== =========

In August 2000, the business was offered a Government Contract to manufacture and supply of 10,000 ‘A’ type chairs at a Price to

allow a net profit equal to 10% of cost. All expenses charged in the above account are admissible with the exception of the

following under ‘Administration expenses’.

Advertisement Rs. 18,500; Bad debts Rs. 11,000;

Directors fees Rs. 1,20,000 to be restricted to Rs. 1,15,000.

It was ascertained that in August, 2000 the cost of Raw Materials is 10% above last year and the wage rate has increased by 20%.

Factory Expenses Per unit of output are estimated not to have changed. Owing to increase in output the Proportion of office and

administrative expenses have been reduced by 10 Per cent. Calculate on the basis of these estimates, total contract price for

10,000 chairs.

Question 36

A Company Produces a fan and sells it for Rs. 300. An increase of 15 Per cent in cost of material and 10 Per cent in cost of labour