Professional Documents

Culture Documents

Country Bankers Insurance v. Llanga Bay and Community Multi-Purpose Cooperative 374 SCRA 653 2002

Uploaded by

Pepper PottsOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Country Bankers Insurance v. Llanga Bay and Community Multi-Purpose Cooperative 374 SCRA 653 2002

Uploaded by

Pepper PottsCopyright:

Available Formats

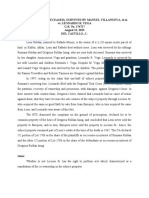

G.R. No.

136914 January 25, 2002

COUNTRY BANKERS INSURANCE CORPORATION, petitioner,

vs.

LIANGA BAY AND COMMUNITY MULTI-PURPOSE COOPERATIVE, INC., respondent.

Facts:

The petitioner is a domestic corporation principally engaged in the insurance business wherein it

undertakes, for a consideration, to indemnify another against loss, damage or liability from an

unknown or contingent event including fire while the respondent is a duly registered

cooperative judicially declared insolvent and represented by the elected assignee, Cornelio

Jamero.

It appears that sometime in 1989, the petitioner and the respondent entered into a contract of

fire insurance. The petitioner insured the respondent’s stocks-in-trade against fire loss, damage

or liability during the period starting from June 20, 1989 at 4:00 p.m. to June 20, 1990 at 4:00

p.m., for the sum of Two Hundred Thousand Pesos (₱200,000.00).

On July 1, 1989, at or about 12:40 a.m., the respondent’s building located at Barangay Diatagon,

Lianga, Surigao del Sur was gutted by fire and reduced to ashes, resulting in the total loss of the

respondent’s stocks-in-trade, pieces of furnitures and fixtures, equipments and records.

Due to the loss, the respondent filed an insurance claim with the petitioner under its Fire

Insurance Policy No. F-1397, submitting: (a) the Spot Report of Pfc. Arturo V. Juarbal, INP

Investigator, dated July 1, 1989; (b) the Sworn Statement of Jose Lomocso; and (c) the Sworn

Statement of Ernesto Urbiztondo.

The petitioner, however, denied the insurance claim on the ground that, based on the submitted

documents, the building was set on fire by two (2) NPA rebels who wanted to obtain canned

goods, rice and medicines as provisions for their comrades in the forest, and that such loss was

an excepted risk under paragraph No. 6 of the policy conditions of Fire Insurance, which

provides:

This insurance does not cover any loss or damage occasioned by or through or in consequence,

directly or indirectly, of any of the following occurrences, namely:

xxx xxx xxx

(d) Mutiny, riot, military or popular uprising, insurrection, rebellion, revolution, military or

usurped power.

Any loss or damage happening during the existence of abnormal conditions (whether physical or

otherwise) which are occasioned by or through or in consequence, directly or indirectly, of any

of said occurrences shall be deemed to be loss or damage which is not covered by this

insurance, except to the extent that the Insured shall prove that such loss or damage happened

independently of the existence of such abnormal conditions.

Issue: WON the cause of the fire was an excepted risk

Held: NO, Where a risk is excepted by the terms of a policy which insures against other perils or hazards,

loss from such a risk constitutes a defense which the insurer may urge, since it has not assumed that

risk, and from this it follows that an insurer seeking to defeat a claim because of an exception or

limitation in the policy has the burden of proving that the loss comes within the purview of the

exception or limitation set up. If a proof is made of a loss apparently within a contract of insurance, the

burden is upon the insurer to prove that the loss arose from a cause of loss which is excepted or for

which it is not liable, or from a cause which limits its liability. Stated else wise, since the petitioner in this

case is defending on the ground of non-coverage and relying upon an exemption or exception clause in

the fire insurance policy, it has the burden of proving the facts upon which such excepted risk is based,

by a preponderance of evidence. But petitioner failed to do so.

The petitioner relies on the Sworn Statements of Jose Lomocso and Ernesto Urbiztondo as well as on the

Spot Report of Pfc. Arturo V. Juarbal.

A witness can testify only to those facts which he knows of his personal knowledge, which means those

facts which are derived from his perception. Consequently, a witness may not testify as to what he

merely learned from others either because he was told or read or heard the same. Such testimony is

considered hearsay and may not be received as proof of the truth of what he has learned. Such is the

hearsay rule which applies not only to oral testimony or statements but also to written evidence as well.

Thus, the Sworn Statements of Jose Lomocso and Ernesto Urbiztondo are inadmissible in evidence, for

being hearsay, inasmuch as they did not take the witness stand and could not therefore be cross-

examined.

There are exceptions to the hearsay rule, among which are entries in official records. To be admissible in

evidence, however, three (3) requisites must concur, to wit:

(a) that the entry was made by a public officer, or by another person specially enjoined by law to do so;

(b) that it was made by the public officer in the performance of his duties, or by such other person in the

performance of a duty specially enjoined by law; and

(c) that the public officer or other person had sufficient knowledge of the facts by him stated, which

must have been acquired by him personally or through official information.

The third requisite was not met in this case since no investigation, independent of the statements

gathered from Jose Lomocso, was conducted by Pfc. Arturo V. Juarbal. In fact, as the petitioner itself

pointed out, citing the testimony of Pfc. Arturo Juarbal, the latter’s Spot Report "was based on the

personal knowledge of the caretaker Jose Lomocso who witnessed every single incident surrounding the

facts and circumstances of the case."

You might also like

- Polirev 2 - Case Digests (Procedural Due Process)Document14 pagesPolirev 2 - Case Digests (Procedural Due Process)Carla Virtucio100% (2)

- Answering Questions in Criminal LawDocument33 pagesAnswering Questions in Criminal LawShajana ShahulNo ratings yet

- Suntay v. Suntay - 95 PHIL 500Document5 pagesSuntay v. Suntay - 95 PHIL 500Eryl YuNo ratings yet

- Civpro Partv SummonsDocument62 pagesCivpro Partv SummonsAngela ConejeroNo ratings yet

- INSURANCE CONTRACT CONSTRUCTIONDocument71 pagesINSURANCE CONTRACT CONSTRUCTIONGreta Almina Costales GarciaNo ratings yet

- Digest Insurance Law 1Document15 pagesDigest Insurance Law 1Limberge Paul CorpuzNo ratings yet

- 62 - DBP Pool of Accredited Insurance Companies v. Radio Mindanao Network, Inc.Document3 pages62 - DBP Pool of Accredited Insurance Companies v. Radio Mindanao Network, Inc.Katrina Janine Cabanos-ArceloNo ratings yet

- Case DigestDocument7 pagesCase DigestStephen HumiwatNo ratings yet

- Insurance case digest covers construction of contracts, accidental death benefitsDocument70 pagesInsurance case digest covers construction of contracts, accidental death benefitsGF Sotto100% (2)

- Pacific Banking Corporation V CADocument2 pagesPacific Banking Corporation V CAArtemisTzy100% (1)

- Ang Yu Asuncion v. CADocument4 pagesAng Yu Asuncion v. CAPepper PottsNo ratings yet

- 2 Pacific Banking Corporation V CA and Oriental AssuranceDocument3 pages2 Pacific Banking Corporation V CA and Oriental AssuranceKokoNo ratings yet

- Country Bankers Insurance CorpDocument2 pagesCountry Bankers Insurance CorpGerard MGNo ratings yet

- Insured Can Directly Sue Insurer for CompensationDocument2 pagesInsured Can Directly Sue Insurer for CompensationJazem AnsamaNo ratings yet

- Borromeo V. DescalarDocument3 pagesBorromeo V. DescalarPepper Potts100% (1)

- Finman General Assurance Corporation VsDocument4 pagesFinman General Assurance Corporation VsYulo Vincent Bucayu PanuncioNo ratings yet

- LTD Grey Alba Vs Dela CruzDocument2 pagesLTD Grey Alba Vs Dela CruzPepper PottsNo ratings yet

- Insurance Cases 1Document4 pagesInsurance Cases 1JVLNo ratings yet

- FILIPINAS COMPAÑÍA A DE SEGUROS Vs .TAN CHAUCODocument3 pagesFILIPINAS COMPAÑÍA A DE SEGUROS Vs .TAN CHAUCORenz Aimeriza AlonzoNo ratings yet

- Capin-Cadiz Vs Brent Hospital and Colleges Inc. GR No. 187417. DigestDocument3 pagesCapin-Cadiz Vs Brent Hospital and Colleges Inc. GR No. 187417. DigestMichelle Cosico100% (2)

- Perez, Hilado v. CADocument9 pagesPerez, Hilado v. CAPepper PottsNo ratings yet

- Stay Application On Case ProceedingsDocument4 pagesStay Application On Case ProceedingsThe Divorce Lawyer100% (1)

- Country Bankers V Lianga BayDocument1 pageCountry Bankers V Lianga BayHency TanbengcoNo ratings yet

- Blue Cross V Olivares GDocument12 pagesBlue Cross V Olivares Gwilliam091090No ratings yet

- People Vs CADocument1 pagePeople Vs CAAlvin Earl NuydaNo ratings yet

- Insurance Country Bankers Vs LiangaDocument2 pagesInsurance Country Bankers Vs LiangaKaye de Leon0% (1)

- Property - Villarico v. Sarmiento, Et. AlDocument2 pagesProperty - Villarico v. Sarmiento, Et. AlPepper PottsNo ratings yet

- Insurance Case Digests Case 1 70Document70 pagesInsurance Case Digests Case 1 70Hazel Martinii PanganibanNo ratings yet

- Insurance Case Digest Construction PrescDocument39 pagesInsurance Case Digest Construction PrescDebson Martinet Pahanguin100% (1)

- 9 Traders Insurance & Surety Co. V. Golangco PDFDocument5 pages9 Traders Insurance & Surety Co. V. Golangco PDFKrisleen AbrenicaNo ratings yet

- Bagatsing vs. RamirezDocument2 pagesBagatsing vs. RamirezManuel Luis100% (1)

- Ining VS VegaDocument2 pagesIning VS VegaANSAI CLAUDINE CALUGANNo ratings yet

- Calanoc Vs CA GR NoDocument6 pagesCalanoc Vs CA GR NolazylawstudentNo ratings yet

- Finman General Assurance Corp. vs. Court of AppealsDocument5 pagesFinman General Assurance Corp. vs. Court of AppealsNullus cumunisNo ratings yet

- Digest LTD - RP v. EspinosaDocument2 pagesDigest LTD - RP v. EspinosaPepper Potts100% (1)

- Losses Cases in InsuranceDocument8 pagesLosses Cases in InsurancePrincess MelodyNo ratings yet

- Country Bankers Insurance CorpDocument2 pagesCountry Bankers Insurance CorprengieNo ratings yet

- 73-Country Bankers Insurance Corporation vs. Lianga Bay and Community Multi-Purpose Cooperative, 374 SCRA 653 (2002)Document6 pages73-Country Bankers Insurance Corporation vs. Lianga Bay and Community Multi-Purpose Cooperative, 374 SCRA 653 (2002)Jopan SJNo ratings yet

- Loss and Notice of LossDocument32 pagesLoss and Notice of LossFrank FernandezNo ratings yet

- 15 - Country Bankers Insurance Corp Vs Lianga BayDocument8 pages15 - Country Bankers Insurance Corp Vs Lianga BayVincent OngNo ratings yet

- Case Digests3Document3 pagesCase Digests3Stephen MagallonNo ratings yet

- Malayan Insurance Co., Inc., Petitioner, vs. Rodelio ALBERTO and ENRICO ALBERTO REYES, RespondentsDocument15 pagesMalayan Insurance Co., Inc., Petitioner, vs. Rodelio ALBERTO and ENRICO ALBERTO REYES, RespondentsJulius AnthonyNo ratings yet

- 3 - Finman Vs CADocument5 pages3 - Finman Vs CAVincent OngNo ratings yet

- Insurance CaseDocument11 pagesInsurance CaseWEa MaTrizNo ratings yet

- First Integrated Bonding vs. HernandoDocument10 pagesFirst Integrated Bonding vs. HernandojieNo ratings yet

- Garland P. Stout v. Grain Dealers Mutual Insurance Company, 307 F.2d 521, 4th Cir. (1962)Document6 pagesGarland P. Stout v. Grain Dealers Mutual Insurance Company, 307 F.2d 521, 4th Cir. (1962)Scribd Government DocsNo ratings yet

- Insurance dispute CA ruling upheldDocument6 pagesInsurance dispute CA ruling upheldXaviera MarieNo ratings yet

- Geogonia Vs CADocument4 pagesGeogonia Vs CAJasper PelayoNo ratings yet

- Essential Elements of Insurance ContractsDocument90 pagesEssential Elements of Insurance ContractsKaisser John Pura AcuñaNo ratings yet

- Insurance Proceeds Belong to Designated BeneficiariesDocument6 pagesInsurance Proceeds Belong to Designated BeneficiariesStephen MagallonNo ratings yet

- Court Rules on Personal Accident Insurance PolicyDocument3 pagesCourt Rules on Personal Accident Insurance PolicyRache BaodNo ratings yet

- 8 Finman General Assurance Corp v. CADocument7 pages8 Finman General Assurance Corp v. CAcool_peachNo ratings yet

- Finman Gen. Assur. Corp. vs. CA and Julia Surposa, Gr. No. 100970, Sep 2, 1992Document8 pagesFinman Gen. Assur. Corp. vs. CA and Julia Surposa, Gr. No. 100970, Sep 2, 1992Beltran KathNo ratings yet

- Insurance NotesDocument11 pagesInsurance NotesBay Ariel Sto TomasNo ratings yet

- DBP Pool of Accredited Insurance Companies vs. RMN, 480 Scra 314, January 27Document15 pagesDBP Pool of Accredited Insurance Companies vs. RMN, 480 Scra 314, January 27Dennis VelasquezNo ratings yet

- Del Rosario vs. EquitableDocument7 pagesDel Rosario vs. EquitableJappy AranasNo ratings yet

- Case Briefs 071418Document19 pagesCase Briefs 071418Irish FloresNo ratings yet

- Finman General Assurance Corp Vs CADocument3 pagesFinman General Assurance Corp Vs CAPearl Ponce de LeonNo ratings yet

- 14 Geagonia vs. CA G.R. No. 114427 February 6 1995Document5 pages14 Geagonia vs. CA G.R. No. 114427 February 6 1995JNo ratings yet

- InsuranceDocument4 pagesInsuranceYsa SumayaNo ratings yet

- Zenith Insurance vs CA: Ruling on unreasonable delay in paying car insurance claimDocument3 pagesZenith Insurance vs CA: Ruling on unreasonable delay in paying car insurance claimAleks OpsNo ratings yet

- Diget BTCH 3Document5 pagesDiget BTCH 3Don SumiogNo ratings yet

- Docshare - Tips Evid HearsayDocument45 pagesDocshare - Tips Evid HearsayKevin AmanteNo ratings yet

- 37-DBP Pool Accredited Insurance Company vs. Radio Mindanao Network, Inc., 480 SCRA 314 (2006)Document6 pages37-DBP Pool Accredited Insurance Company vs. Radio Mindanao Network, Inc., 480 SCRA 314 (2006)Jopan SJNo ratings yet

- G.R. No. 100970 September 2, 1992 Finman General Assurance Corporation, Petitioner, The Honorable Court of Appeals and Julia SURPOSA, RespondentsDocument3 pagesG.R. No. 100970 September 2, 1992 Finman General Assurance Corporation, Petitioner, The Honorable Court of Appeals and Julia SURPOSA, RespondentsalyssaNo ratings yet

- Case Digests-InsuranceDocument13 pagesCase Digests-InsuranceKasurog CopsNo ratings yet

- Del Rosario v. Equitable InsuranceDocument2 pagesDel Rosario v. Equitable InsuranceDeyna MaiNo ratings yet

- Finman General Assurance Corporation V UsiphilDocument2 pagesFinman General Assurance Corporation V UsiphilJVMNo ratings yet

- Duty of Care CasesDocument84 pagesDuty of Care CasesKomuntale CatherinaNo ratings yet

- Tuazon vs. North China Ins. Co. G.R. No. 22498, December 16, 1924, 47 Phil. 14Document4 pagesTuazon vs. North China Ins. Co. G.R. No. 22498, December 16, 1924, 47 Phil. 14Rochelle Othin Odsinada MarquesesNo ratings yet

- 4 Tort Law 2017.2018Document22 pages4 Tort Law 2017.2018Constantin LazarNo ratings yet

- Roy III Vs Chairperson Teresita Herbosa Et. Al. G.R. No. 207246 November 22 2016Document96 pagesRoy III Vs Chairperson Teresita Herbosa Et. Al. G.R. No. 207246 November 22 2016Pepper PottsNo ratings yet

- Distinction between venue and jurisdictionDocument3 pagesDistinction between venue and jurisdictionPepper PottsNo ratings yet

- Joselito Musni Puno vs. Puno Enterprise, Inc, Et AlDocument6 pagesJoselito Musni Puno vs. Puno Enterprise, Inc, Et AlPepper PottsNo ratings yet

- Canilang Vs CA & Great Pacific LifeDocument1 pageCanilang Vs CA & Great Pacific LifewuplawschoolNo ratings yet

- MARC II Marketing, Inc vs. Alfred JosonDocument22 pagesMARC II Marketing, Inc vs. Alfred JosonPepper PottsNo ratings yet

- Mirant Phils. Corp Et - Ql. v. Joselito CaroDocument22 pagesMirant Phils. Corp Et - Ql. v. Joselito CaroPepper PottsNo ratings yet

- Perez, Mari v. BonillaDocument2 pagesPerez, Mari v. BonillaPepper PottsNo ratings yet

- Queensland Tokyo Commodoties Inc., Et. Al., Vs Thomas GeorgeDocument10 pagesQueensland Tokyo Commodoties Inc., Et. Al., Vs Thomas GeorgePepper PottsNo ratings yet

- People Vs FloresDocument11 pagesPeople Vs FloresPepper PottsNo ratings yet

- Perez, Aranas v. Mercado, Et. Al.Document18 pagesPerez, Aranas v. Mercado, Et. Al.Pepper PottsNo ratings yet

- Harpoon Marine Services Inc, Et - Al v. Fernan FranciscoDocument12 pagesHarpoon Marine Services Inc, Et - Al v. Fernan FranciscoPepper PottsNo ratings yet

- Perez, San Luis v. SagalongosDocument17 pagesPerez, San Luis v. SagalongosPepper PottsNo ratings yet

- Lumanlaw Vs PeraltaDocument15 pagesLumanlaw Vs PeraltaPepper PottsNo ratings yet

- People Vs AysonDocument8 pagesPeople Vs AysonPepper PottsNo ratings yet

- Perez, Nuguid v. NuguidDocument6 pagesPerez, Nuguid v. NuguidPepper PottsNo ratings yet

- Pascual v. Angeles, Et. Al. G.R. No. L-4957Document1 pagePascual v. Angeles, Et. Al. G.R. No. L-4957Pepper PottsNo ratings yet

- Amion Vs ChiongsonDocument8 pagesAmion Vs ChiongsonPepper PottsNo ratings yet

- People Vs AmacaDocument11 pagesPeople Vs AmacaPepper PottsNo ratings yet

- Joint Affidavit of ConsentDocument2 pagesJoint Affidavit of ConsentPepper PottsNo ratings yet

- Possession 3 Lasam V DIRDocument2 pagesPossession 3 Lasam V DIRPepper PottsNo ratings yet

- Affidavit of Loss AgsaludDocument1 pageAffidavit of Loss AgsaludPepper PottsNo ratings yet

- 01 Felices v. Colegado G.R. No. L 23374 1970 09 30Document2 pages01 Felices v. Colegado G.R. No. L 23374 1970 09 30Pepper PottsNo ratings yet

- Victoria Pumps Submissions - EditedDocument6 pagesVictoria Pumps Submissions - EditedMORRIS ANUNDANo ratings yet

- Rocio Sanchez Ponce Versus Baran California LitigationDocument15 pagesRocio Sanchez Ponce Versus Baran California LitigationlanashadwickNo ratings yet

- 7 PArtnershipDocument12 pages7 PArtnershipnatsu lolNo ratings yet

- Villafuerte vs. RobredoDocument2 pagesVillafuerte vs. RobredoJanaBabyShizukaRC100% (1)

- VJ Thomas V Pathrose Abraham OthersDocument4 pagesVJ Thomas V Pathrose Abraham OthersPlay With NoobsNo ratings yet

- Fixtures and Ownership of FixturesDocument8 pagesFixtures and Ownership of FixturesEdgar OkitoiNo ratings yet

- Bhaktivedanta Academy For CultureDocument5 pagesBhaktivedanta Academy For CulturebaceindrapuramNo ratings yet

- Meneja Mkuu Zanzi Resort Hotel vs Ali Said Paramana (Civil Appeal 296 of 2019) 2020 TZCA 1920 (18 December 2020)Document30 pagesMeneja Mkuu Zanzi Resort Hotel vs Ali Said Paramana (Civil Appeal 296 of 2019) 2020 TZCA 1920 (18 December 2020)TeknoNo ratings yet

- Act 387 Attestation of Registrable Instruments Mining Act 1960Document14 pagesAct 387 Attestation of Registrable Instruments Mining Act 1960Adam Haida & CoNo ratings yet

- Empress Trucking-MOA - Revised PDFDocument5 pagesEmpress Trucking-MOA - Revised PDFJoviNo ratings yet

- PALE Cases B-DDocument40 pagesPALE Cases B-DaverellabrasaldoNo ratings yet

- Deed of Transfer of Rights Alvin JoseDocument1 pageDeed of Transfer of Rights Alvin JoseDead WolfNo ratings yet

- Peoria County Booking Sheet 09/07/13Document9 pagesPeoria County Booking Sheet 09/07/13Journal Star police documentsNo ratings yet

- Everything about Geographical IndicationsDocument2 pagesEverything about Geographical IndicationsPrabhpreet kaurNo ratings yet

- 17 Lutap vs. PeopleDocument15 pages17 Lutap vs. PeopleFrench TemplonuevoNo ratings yet

- Offences and Penalties Under Cooperative Societies ActDocument8 pagesOffences and Penalties Under Cooperative Societies ActPious MudgilNo ratings yet

- Court upholds dismissal of collection caseDocument2 pagesCourt upholds dismissal of collection casePaul Joshua SubaNo ratings yet

- Consumers Act On TortsDocument1 pageConsumers Act On TortsVINCENTREY BERNARDONo ratings yet

- The Death Penalty Debate in IndiaDocument6 pagesThe Death Penalty Debate in IndiagambitsaNo ratings yet

- Elements of Cyber LibelDocument2 pagesElements of Cyber LibelMike MarquezNo ratings yet

- Beradio v. CA, 103 SCRA 567Document7 pagesBeradio v. CA, 103 SCRA 567PRINCESS MAGPATOCNo ratings yet

- Saint Louis University: Parent'S ConsentDocument2 pagesSaint Louis University: Parent'S ConsentRecson BangibangNo ratings yet