Professional Documents

Culture Documents

Assignment 2

Uploaded by

Rajesh KrishnanOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assignment 2

Uploaded by

Rajesh KrishnanCopyright:

Available Formats

Rajesh Krishnan

Name: Rajesh kRishnan Batch: XMBA 37 Centre: Matunga, MuMbai Subject: MIS Structured and unstructured RepoRt Lecturer: capt. Haridas

Rajesh Krishnan

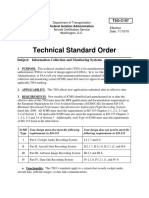

Structured Report-1

Example 1: Standard operating Procedure for the processing billing Input: Offer letter duly signed and accepted by the client. Process: Deal recognition report Approval Routing Acceptance at accounts department. Output: Invoice created in MS Navision Axapta Maintenance of records in excel Passing of accounting entries Systems Used: MS-Excel MS Navision Axapta SAP Process flow is given in the next page.

Rajesh Krishnan

Process flow for Billing

Start Sales / RM sends offer letter to client Client signs the offer letter

RM raises DRR referring the offer letter

DRR is approved by the Business development head and accounts dept.

Accounts dept passes accounting entries and raises the invoice in triplet. The invoices are sent to client via courier and the RM needs to follow up for the fees. Client wise ageing files are sent to RM for timely follow up of fees and other charges.

Receives Fees from Client and accounted

STOP

Rajesh Krishnan

Structured Report-2

Example 2: Standard operating Procedure for the Securitization transaction Setting Up: Vetting of legal documentation deed of assignment, Trust Deed, Securitisation & Servicing agreement, power of attorney by assignor in favour of assignee etc, Inputs on structure, Banking relationships - Opening of accounts for payout related activities and placing of FD's for credit enhancement., Negotiating with the bankers for getting a better rate on the FD's, Demating of PTC's. Monitoring: Examine performance report (servicer report) versus the scheduled cash flow received from assignor on a monthly basis, Monitoring of Collection and Payment Account for periodical and timely receipt of funds and making payouts, In the event of shortfall, utilise Credit Enhancement mechanisms as per the terms in the structure, Ensure compliance with rating rationale / conditions precedent. Servicing: Servicing Making payouts periodically as mandated, Interface with Assignor, if necessary, especially on defaults/shortfall/overdues, etc. Facilitate / coordinate between Assignor and Assignee, etc. Utilization of Credit Enhancement: Ensuring lien, strict adherence to waterfall mechanism, Monitoring credit enhancement levels as stipulated, Utilisation & top up of credit enhancement on account of shortfall and excess. Back Office: Payout computation, Payouts / Dispatch of cheques Pool Performance Reviews: Quarterly qualitative analysis, Specific queries Initiate subsequent reviews of the pool.

Process flow is given in the next page.

Rajesh Krishnan

Process flow for Securitization transaction

Rajesh Krishnan

Unstructured Report-1& 2

Example 1: Standard operating Procedure for the processing billing In case if the client is not able sign the offer letter an e mail confirmation is taken and on basis of that invoices are raised, which is an unstructured decision taken by the company.

Example 2: Standard operating Procedure for the Securitization transaction While servicing the pool, if the collection files are not received by the trustee on timely basis, then the trustee has to just pass on the entire collection amount to the investor on the payment date. Thereafter, when the collection files are received, they will prepare the final monitoring report and make necessary adjustment in the payment. This is an unstructured process of making the investor payout.

You might also like

- Cash Management: by Prasad PVLNDocument19 pagesCash Management: by Prasad PVLNSaakshi HarshNo ratings yet

- Cash NarrativeDocument4 pagesCash NarrativeCaterina De LucaNo ratings yet

- Debt ManagementDocument38 pagesDebt ManagementhemaguruNo ratings yet

- FSCM WFDocument2 pagesFSCM WFGoutam MahatoNo ratings yet

- WIP IA Manual - Audit Program - Sales and ReceivablesDocument10 pagesWIP IA Manual - Audit Program - Sales and ReceivablesMuhammad Faris Ammar Bin ZainuddinNo ratings yet

- Blueprint For Service Design of A Credit Card DivisionDocument3 pagesBlueprint For Service Design of A Credit Card Divisionanaghmahajan100% (1)

- Acconts Payable PDFDocument17 pagesAcconts Payable PDFN Tarun ManjunathNo ratings yet

- Shanchay Patra BB ReceiptDocument5 pagesShanchay Patra BB Receiptkhan_sadiNo ratings yet

- Accounts Payable ProcedureDocument6 pagesAccounts Payable ProcedurerameshNo ratings yet

- Refunds - FinalDocument7 pagesRefunds - FinalSergio ArtinanoNo ratings yet

- New Microsoft Excel WorksheetDocument2 pagesNew Microsoft Excel WorksheetTajammal HussainNo ratings yet

- Audit and Internal ReviewDocument3 pagesAudit and Internal ReviewemeraldNo ratings yet

- Cta - Cash Advance Policy 1Document3 pagesCta - Cash Advance Policy 1Leizza Ni Gui DulaNo ratings yet

- Cash PolicyDocument6 pagesCash PolicyMazhar Ali JoyoNo ratings yet

- Analytical ReportDocument7 pagesAnalytical ReportDương Quang VinhNo ratings yet

- Weekly Report 2: Comsats Institute of Information Technology, M. A. Jinnah Campus, LahoreDocument5 pagesWeekly Report 2: Comsats Institute of Information Technology, M. A. Jinnah Campus, LahoreUmair RiazNo ratings yet

- Cash Management ServicesDocument3 pagesCash Management ServicesSumegha KanojiaNo ratings yet

- Sample JDA - Accounts Payable StaffDocument3 pagesSample JDA - Accounts Payable StaffAyana Mae BaetiongNo ratings yet

- Credit Monitoring and Follow-Up: MeaningDocument23 pagesCredit Monitoring and Follow-Up: Meaningpuran1234567890100% (2)

- Allowance For Doubtful Accounts Policy - Sample 2Document2 pagesAllowance For Doubtful Accounts Policy - Sample 2Muri EmJayNo ratings yet

- APDocument6 pagesAPprasana devi babu raoNo ratings yet

- Credit ManagementDocument7 pagesCredit Managementprabhatrc4235100% (1)

- Chapter 2 Audit of Receivables and SalesDocument19 pagesChapter 2 Audit of Receivables and SalesKez MaxNo ratings yet

- Process IndicatorsDocument2 pagesProcess IndicatorsSeneca GonzalesNo ratings yet

- 1 PNPM Peduli - Significant Issue Audit Laporan Keuangan - Kemitraan - 2013 - English (Rev Bung)Document8 pages1 PNPM Peduli - Significant Issue Audit Laporan Keuangan - Kemitraan - 2013 - English (Rev Bung)Bungaran HasiholanNo ratings yet

- Process Confirmation - Accounts Receivable R-010 Thru R-060: Project XYZ Initiative April 22nd 2008Document28 pagesProcess Confirmation - Accounts Receivable R-010 Thru R-060: Project XYZ Initiative April 22nd 2008barbarabolognesiNo ratings yet

- Credit Procedures and ControlsDocument5 pagesCredit Procedures and ControlsJR DevienteNo ratings yet

- C. Process DescriptionDocument5 pagesC. Process Descriptionkhan_sadiNo ratings yet

- Credit MonitoringDocument97 pagesCredit MonitoringManish AroraNo ratings yet

- Appendix 7 Example Handover Checklist Aug 13Document4 pagesAppendix 7 Example Handover Checklist Aug 13waqarjunejo120% (5)

- Chapter 3 Accounts Receivable May 2010Document48 pagesChapter 3 Accounts Receivable May 2010Berbagi UsahaNo ratings yet

- Bank Reconciliation Best PracticesDocument3 pagesBank Reconciliation Best Practiceshossainmz100% (1)

- Chapter-6 DisbursementDocument161 pagesChapter-6 DisbursementMyca Orticio100% (2)

- Resume-Sharma Prajakta.Document3 pagesResume-Sharma Prajakta.Prajakta SharmaNo ratings yet

- All Are Proper Segregation of Functions Except DDocument3 pagesAll Are Proper Segregation of Functions Except DSai AlviorNo ratings yet

- FICAAADocument4 pagesFICAAAYash GuptaNo ratings yet

- Compensation PolicyDocument17 pagesCompensation PolicySwetha BuridiNo ratings yet

- Process Confirmation - Accounts Receivable R-010 Thru R-060: Project XYZ Initiative April 22nd 2008Document28 pagesProcess Confirmation - Accounts Receivable R-010 Thru R-060: Project XYZ Initiative April 22nd 2008barbarabolognesiNo ratings yet

- Chapter 02: Credit and Collection Operations: Lesson 02Document10 pagesChapter 02: Credit and Collection Operations: Lesson 02Llyod Daniel PauloNo ratings yet

- Extaud3 NotesDocument5 pagesExtaud3 NotesAngelie SaavedraNo ratings yet

- Accounts Payable ProcedureDocument5 pagesAccounts Payable ProceduremohamedNo ratings yet

- Fabm Week 7Document6 pagesFabm Week 7Dyerald PalimaNo ratings yet

- Strategic Credit Management - IntroductionDocument14 pagesStrategic Credit Management - IntroductionDr VIRUPAKSHA GOUD G50% (2)

- AccountsPayablePolicy 201511191421224864 PDFDocument4 pagesAccountsPayablePolicy 201511191421224864 PDFSer Yev NuguidNo ratings yet

- FRD DraftDocument104 pagesFRD DraftFahad FarishNo ratings yet

- Balaji Resume (4 Yrs Exp)Document5 pagesBalaji Resume (4 Yrs Exp)Vishu DcpNo ratings yet

- Sudhakar C Gour Sde (L), RTTC, MysoreDocument50 pagesSudhakar C Gour Sde (L), RTTC, MysoreSri NidhiNo ratings yet

- NMIMS MUMBAI NAVI MUMBAI Student Activity Sponsorship and Exp - POLICYDocument5 pagesNMIMS MUMBAI NAVI MUMBAI Student Activity Sponsorship and Exp - POLICYRushil ShahNo ratings yet

- Accounting EntriesDocument5 pagesAccounting Entriesjavedaa444No ratings yet

- The Revenue Cycle: Gwyneth L. Beriña Maria Jhanelle B. Cancejo Trixie Anne H. IlaoDocument59 pagesThe Revenue Cycle: Gwyneth L. Beriña Maria Jhanelle B. Cancejo Trixie Anne H. IlaoJessica GonzalesNo ratings yet

- Finance Policy and ProceduresDocument6 pagesFinance Policy and ProceduresNgọc Vân0% (1)

- Mega Project Assurance: Volume One - The Terminological DictionaryFrom EverandMega Project Assurance: Volume One - The Terminological DictionaryNo ratings yet

- Universal Teller - Hyderabad, Sukkur & GujranwalaDocument2 pagesUniversal Teller - Hyderabad, Sukkur & GujranwalaBilalTariqNo ratings yet

- Monthly Report (WRITE-UP - 26-06-19) Title - Branch Operations and Process ImprovementDocument5 pagesMonthly Report (WRITE-UP - 26-06-19) Title - Branch Operations and Process ImprovementvisvanathanNo ratings yet

- Pre-Sanction Credit ProcessDocument67 pagesPre-Sanction Credit Processsiddharthzala0% (2)

- Accruals Vs ReversalsDocument31 pagesAccruals Vs ReversalsChhavibhasinNo ratings yet

- Changes To Credit ManualDocument9 pagesChanges To Credit ManualSusan BoylNo ratings yet

- Cash ManagementDocument4 pagesCash Managementzaira caraosNo ratings yet

- Textbook of Urgent Care Management: Chapter 13, Financial ManagementFrom EverandTextbook of Urgent Care Management: Chapter 13, Financial ManagementNo ratings yet

- Name: Rajesh Krishnan Batch: Xmba - 37 Centre: Matunga, Mumbai Subject: Mis - Government To Citizen (G2C) Site Information. Lecturer: Capt. HaridasDocument6 pagesName: Rajesh Krishnan Batch: Xmba - 37 Centre: Matunga, Mumbai Subject: Mis - Government To Citizen (G2C) Site Information. Lecturer: Capt. HaridasRajesh KrishnanNo ratings yet

- CIS Presentation 3aug11Document3 pagesCIS Presentation 3aug11Rajesh KrishnanNo ratings yet

- CCCC CC: CCCDocument3 pagesCCCC CC: CCCRajesh KrishnanNo ratings yet

- Swot Is Final HotelsDocument11 pagesSwot Is Final HotelsRajesh KrishnanNo ratings yet

- Marketing Functions of Fortis Mar11 - NewDocument17 pagesMarketing Functions of Fortis Mar11 - NewRajesh KrishnanNo ratings yet

- The Consulting Industry and Its Transformations in WordDocument23 pagesThe Consulting Industry and Its Transformations in Wordlei ann magnayeNo ratings yet

- Cad32gd - Contactor ManualDocument28 pagesCad32gd - Contactor Manualhassan karimiNo ratings yet

- API IND DS2 en Excel v2 10081834Document462 pagesAPI IND DS2 en Excel v2 10081834Suvam PatelNo ratings yet

- Abacus 1 PDFDocument13 pagesAbacus 1 PDFAli ChababNo ratings yet

- Portfolio Write-UpDocument4 pagesPortfolio Write-UpJonFromingsNo ratings yet

- Harley Davidson U S Reportedly Uses Risk Sharing Agreements With Its Foreign SubsidiariesDocument1 pageHarley Davidson U S Reportedly Uses Risk Sharing Agreements With Its Foreign Subsidiariestrilocksp SinghNo ratings yet

- Tso C197Document6 pagesTso C197rdpereirNo ratings yet

- Haymne Uka@yahoo - Co.ukDocument1 pageHaymne Uka@yahoo - Co.ukhaymne ukaNo ratings yet

- Chemical Safety ChecklistDocument3 pagesChemical Safety ChecklistPillai Sreejith100% (10)

- Written Report in Instructional PlanningDocument6 pagesWritten Report in Instructional PlanningRose Aura HerialesNo ratings yet

- Altura Architect & Interior Design BriefDocument56 pagesAltura Architect & Interior Design BriefDave WongNo ratings yet

- Npad PGP2017-19Document3 pagesNpad PGP2017-19Nikhil BhattNo ratings yet

- Your Bentley Bentayga V8: PresentingDocument9 pagesYour Bentley Bentayga V8: PresentingThomas SeiferthNo ratings yet

- Image Hosting SitesDocument16 pagesImage Hosting SitesstudentNo ratings yet

- A Sample Script For Public SpeakingDocument2 pagesA Sample Script For Public Speakingalmasodi100% (2)

- Wind Turbines - I. Al-BahadlyDocument664 pagesWind Turbines - I. Al-Bahadlykevin_leigh_1No ratings yet

- Sco 8th Class Paper - B Jee-Main Wtm-15 Key&Solutions Exam DT 17-12-2022Document4 pagesSco 8th Class Paper - B Jee-Main Wtm-15 Key&Solutions Exam DT 17-12-2022Udaya PrathimaNo ratings yet

- 762id - Development of Cluster-7 Marginal Field Paper To PetrotechDocument2 pages762id - Development of Cluster-7 Marginal Field Paper To PetrotechSATRIONo ratings yet

- GSM Radio ConceptsDocument3 pagesGSM Radio ConceptsMD SahidNo ratings yet

- Letter Writing: An Informative Powerpoint About LetterDocument11 pagesLetter Writing: An Informative Powerpoint About LetterMalik KamranNo ratings yet

- Gothic ArchitectureDocument6 pagesGothic ArchitectureleeNo ratings yet

- Mang-May-Tinh - 03a.-Dns1 - (Cuuduongthancong - Com)Document52 pagesMang-May-Tinh - 03a.-Dns1 - (Cuuduongthancong - Com)Anh Quân TrầnNo ratings yet

- Comparison of Sic Mosfet and Si IgbtDocument10 pagesComparison of Sic Mosfet and Si IgbtYassir ButtNo ratings yet

- Makerere University Is Inviting Applications For Undergraduate Admissions On Private Sponsorship For Academic Year 2015/2016Document9 pagesMakerere University Is Inviting Applications For Undergraduate Admissions On Private Sponsorship For Academic Year 2015/2016The Campus TimesNo ratings yet

- Practical Applications of Electrical ConductorsDocument12 pagesPractical Applications of Electrical ConductorsHans De Keulenaer100% (5)

- March 2023 (v2) INDocument8 pagesMarch 2023 (v2) INmarwahamedabdallahNo ratings yet

- Elerick Ron Cynthia 1983 SouthAfricaDocument4 pagesElerick Ron Cynthia 1983 SouthAfricathe missions networkNo ratings yet

- The Dust Bunnies COL FKBDocument36 pagesThe Dust Bunnies COL FKBPradeep ManralNo ratings yet

- Final Notice To Global Girls Degree CollgeDocument2 pagesFinal Notice To Global Girls Degree CollgeIbn E AdamNo ratings yet

- Wits Appraisalnof Jaw Disharmony by JOHNSONDocument20 pagesWits Appraisalnof Jaw Disharmony by JOHNSONDrKamran MominNo ratings yet