Professional Documents

Culture Documents

Project Work Accountancy 20

Project Work Accountancy 20

Uploaded by

Nikunj0 ratings0% found this document useful (0 votes)

27 views1 pageSDFGFG

Original Title

437570166 Project Work Accountancy 20

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentSDFGFG

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

27 views1 pageProject Work Accountancy 20

Project Work Accountancy 20

Uploaded by

NikunjSDFGFG

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 1

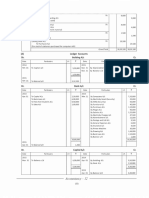

The transactions during the financial year 2014-15 were

z

Purchases of Computers 7,50,000

Security Deposited for electric connection with electricity board 20,000

Security Deposited with VSNL for telephone and Internet connection, 30,000

Purchased Furniture 40,000

Fees received from students 6,50,000

Bought computer stationery 1,10,000

Sale of computer stationery 1,60,000

Wages paid 90,000

Salaries paid 41,25,000

Electricity charges 47,500

Advertisement 2,000

Postage and Call 9,500

General Expenses 6,000

Insurance Premium 4,600

Bought Printer Machine 30,000

He withdrew & 12,000 per month as drawing and repaid the annual instalment of bank loan along with interest

ddue on 34st March, 2015, Assume al ransactions took place through HOFC Bank.

You are required to:

(1) Journalise these transactions after considering the following information :

(i) Depreciate building by 5% and computer and Furniture @ 10% p.2.

(ii) Salary unpaid 7 9,000

(ii) Advertisement include unissued material worth & 4,000.

(iv) Insurance prepaid € 1,500.

(v) Stock of computer stationery % 19,500.

(2) Post them into Ledger and prepare Trial Balance.

(3) Prepare financial statements for the year ended 31st March, 2015.

(4) Mr. Roop Narain wishes to expand his business further so he approached his banker for further loan. What ratios

shouldhisbanker considerbefore providingloan considering that similar firms earn 60%as Gross Profitand25%asNet

Profit?

Sol. The Project work is (Planning)

()) To prepare accounting record of Mr. Roop Narain for the accounting year 2014-15.

(i) To prepate Trial Balance and his Trading and Profit and Loss Account and Balance Sheet.

(ii) To calculate profitability ratios.

(iv) To know whether he will get further bank loan or not

Necessary data glven to complete the Project Work

Execution of Project Work

(1) Preparation of Journal, Ledger and Trial Balance.

(2) Preparation of financial statements for the year ending 34st March, 2015,

(3) Computation of gross profit ratio, net profit ratio and operating ratio to assess profitability

(4) Computation of short term and long term solvency ratios to know whether loan be given by bank or not

Accountancy ~ 12

2)

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (843)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5808)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (346)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Project Work Accountancy 47Document1 pageProject Work Accountancy 47NikunjNo ratings yet

- Project Work Accountancy 38Document1 pageProject Work Accountancy 38NikunjNo ratings yet

- Project Work Accountancy 22Document1 pageProject Work Accountancy 22NikunjNo ratings yet

- Project Work Accountancy 8Document1 pageProject Work Accountancy 8NikunjNo ratings yet

- Project Work Accountancy 33Document1 pageProject Work Accountancy 33NikunjNo ratings yet

- Project Work Accountancy 51Document1 pageProject Work Accountancy 51NikunjNo ratings yet

- Project Work Accountancy 3Document1 pageProject Work Accountancy 3NikunjNo ratings yet

- Project Work Accountancy 25Document1 pageProject Work Accountancy 25NikunjNo ratings yet

- Project Work Accountancy 52Document1 pageProject Work Accountancy 52NikunjNo ratings yet

- Project Work Accountancy 7Document1 pageProject Work Accountancy 7NikunjNo ratings yet

- Project Work Accountancy 14Document1 pageProject Work Accountancy 14NikunjNo ratings yet

- Project Work Accountancy 24Document1 pageProject Work Accountancy 24NikunjNo ratings yet

- Project Work Accountancy 44Document1 pageProject Work Accountancy 44NikunjNo ratings yet

- Project Work Accountancy 37Document1 pageProject Work Accountancy 37NikunjNo ratings yet

- Project Work Accountancy 2Document1 pageProject Work Accountancy 2NikunjNo ratings yet

- Project Work Accountancy 53Document1 pageProject Work Accountancy 53NikunjNo ratings yet

- Project Work Accountancy 6Document1 pageProject Work Accountancy 6NikunjNo ratings yet

- Project Work Accountancy 46Document1 pageProject Work Accountancy 46NikunjNo ratings yet

- Rich Dad Poor Dad 188Document1 pageRich Dad Poor Dad 188NikunjNo ratings yet

- Rich Dad Poor Dad 186Document1 pageRich Dad Poor Dad 186NikunjNo ratings yet