Professional Documents

Culture Documents

OLFU For Simplified Accounting For Sole Proprietorship in Preparation of Financial Statements Practice Problems Worksheet

Uploaded by

JANNA RAZONOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

OLFU For Simplified Accounting For Sole Proprietorship in Preparation of Financial Statements Practice Problems Worksheet

Uploaded by

JANNA RAZONCopyright:

Available Formats

ACTG121 Simplified Accounting for Sole Proprietorship:

Sample Problem for Statement of Changes in Owner’s Equity, Income Statement and Balance

Sheet.

OUR LADY OF FATIMA UNIVERSITY

Practice Set Worksheet

PROBLEMS

A. Shown below is the preliminary trial balance of MAGINHAWA SERVICE CENTER for the calendar

year 200A. Prepare its Statement of Changes in Owner’s Equity, Income Statement and Balance

Sheet.

E. Liwanag Capital P85,000 Notes Receivable P1,200

Office Equipment 12,000 Notes Payable 8,000

Accounts Payable 16,600 Interest Income 360

Cash 18,540 Tel. & Telegrams Expense 1,250

Tools 21,500 Interest Expense 220

E. Liwanag Drawing 10,000 Postage & Stamps Expense 50

Accounts Receivable 21,460 Insurance Expense 4,100

Mortgage Payable 30,000 Car 84,700

Loan Payable (Short-term) 20,000 Utilities Expense 160

Service Income 8,560 Supplies Expense 3,150

Furniture & Fixtures 8,900 Massage Equipment 36,290

Salaries Expense 21,000 Rental Income 6,000

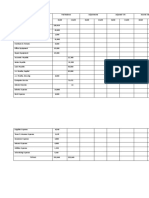

A. The following is the adjusted trial balance of LENMAR Service Company for the fiscal year ending

May 31 200B. Prepare its Statement of Changes in Owner’s Equity, Income Statement and

Balance Sheet.

Cash P40,860 Mortgage Payable P120,000

Notes Receivable 4,000 M. Lanza Capital 75,000

Accounts Receivable 57,880 M. Lanza Drawing 20,000

Allow. For Impairment Loss 3,280 Service Income 204,000

Prepaid Advertising 10,000 Rental Income 22,000

Unexpired Insurance 6,000 Interest Income 40

Supplies Inventory 1,260 Salaries Expense 114,600

Interest Receivable 40 Rent Expense 30,000

Furniture & Fixtures 36,800 Utilities Expense 8,250

Accum. Dep’n – Furn. & fixt. 1,840 Supplies Expense 4,160

Office Equipment 50,000 Advertising Expense 40,000

Accum. Dep’n – Office Eqpmt. 2,500 Insurance Expense 24,000

Note Payable (short-term) 2,000 Taxes & Licenses 12,000

Accounts Payable 24,250 Interest Expense 200

Utilities Payable 4,250 Impairment Loss 280

Interest Payable 10 Depreciation – Furn. & Fixt. 840

Unearned Rental 2,000 Depreciation – Office Eqpmt. 500

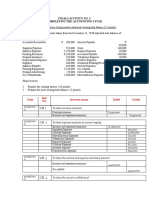

SOLUTION AND ANSWER SHEET:

Maginhawa Service Center

Unadjusted Trial Balance

As of ended December 31, 200A

ACCOUNT TITLES DEBIT CREDIT

Cash ₱18,540

Account Receivable 21,460

Notes Receivable 1,200

Tools 21,500

Furniture & Fixture 8,900

Office Equipment 12,000

Massage Equipmnet 36,290

Car 84,700

Account Payable ₱16,600

Note Payable 8,000

Loan Payable (Short Term) 20,000

Mortgage Payable 30,000

E. Liwanag, Capital 85,000

E. Liwanag, Drawing 10,000

Service Income 78,560

Interest Income 360

Rental Income 6,000

Salaries Expense 21,000

Utilities Expense 160

Supplies Expense 3,150

Interest Expense 220

Insurance Expense 4,100

Tel. & Telegram Expense 1,250

Postage & Stamp Expense 50

TOTAL: ₱244,520 ₱244,520

Maginhawa Service Center

Statement of Changes in Owner's Equity

As of ended December 31, 200A

E. Liwanag, Capital (Beginning) 85,000

Less: E. Liwanag, Drawings -10,000

TOTAL: 75,000

Add: NET INCOME 54,990

E. LIWANAG, CAPITAL (ENDING) 129,990

Maginhawa Service Center

Income Statement

As of ended December 31, 200A

INCOME

Service Income 78,560

Interest Income 360

Rental Income 6,000

TOTAL INCOME 84,920

LESS: EXPENSE

Salaries Expense 21,000

Utilities Expense 160

Supplies Expense 3,150

Interest Expense 220

Insurance Expense 4,100

Tel. & Telegram Expense 1,250

Postage & Stamp Expense 50

TOTAL EXPENSES 29,930

NET INCOME 54,990

Maginhawa Service Center

Balance Sheet

As of ended December 31, 200A

ASSETS

CURRENT ASSETS

Cash 18,540

Accounts Receivable 21,460

Notes Receivable 1,200

TOTAL CURRENT ASSETS 41,200

NON-CURRENT ASSETS

Tools 21,500

Furnitures & Fixture 8,900

Office Equipment 12,000

Massage Equipment 36,290

Car 84,700

TOTAL NON-CURRENT ASSETS 163,390

TOTAL ASSETS 204,590

LIABILITIES

CURRENT LIABILITIES

Accounts Payable 16,600

Notes Payable 8,000

Loan Payable (short - term) 20,000

TOTAL CURRENT LIABLITIES 44,600

NON-CURRENT LIABILITIES

Mortgage Payable 30,000

TOTAL NON-CURRENT LIABILITIES 30,000

TOTAL LIABILITIES 74,600

TOTAL OWNER'S EQUITY 129,990

TOTAL LIABILITIES AND OWNER'S EQUITY 204,590

You might also like

- Weddings R Us Worksheet AdjustmentsDocument13 pagesWeddings R Us Worksheet AdjustmentsAlyanne Patrice Medrana100% (1)

- Bohol Pension House 1Document7 pagesBohol Pension House 1Chloe Cataluna86% (7)

- Rey's Internet Cafe Trial Balance AnalysisDocument19 pagesRey's Internet Cafe Trial Balance AnalysisPAU VLOGSNo ratings yet

- Nerissa Mae L. Santos Activity On Completing The Accounting Cycle 1Document3 pagesNerissa Mae L. Santos Activity On Completing The Accounting Cycle 1Mica Mae Correa100% (1)

- May Accounting Journal Entries and Trial BalanceDocument12 pagesMay Accounting Journal Entries and Trial BalanceJASTINENo ratings yet

- Problems & Solutions - RNSDocument28 pagesProblems & Solutions - RNSAyushi0% (1)

- 605701b41234414fbf70f2a0d6734ae1Document3 pages605701b41234414fbf70f2a0d6734ae1BabaNo ratings yet

- Ross Rica Sales Center, Inc. v. Spouses Ong DigestDocument4 pagesRoss Rica Sales Center, Inc. v. Spouses Ong DigestRobyn Bangsil100% (2)

- Financial ReportsDocument6 pagesFinancial ReportsCatherine KimNo ratings yet

- Adjusted Trial Balance To Financial StatementsDocument16 pagesAdjusted Trial Balance To Financial StatementsABM ST.MATTHEW Misa john carloNo ratings yet

- Finals Activity No .2 Completing THE Accounting Cycle: Palad, Nica C. Mr. Alfred BautistaDocument6 pagesFinals Activity No .2 Completing THE Accounting Cycle: Palad, Nica C. Mr. Alfred BautistaMica Mae CorreaNo ratings yet

- Servicing Financial MDocument15 pagesServicing Financial Mjoy fabNo ratings yet

- Quiz Financial StatementDocument3 pagesQuiz Financial StatementJasmine ManingoNo ratings yet

- Auditing Practice Problem 5Document2 pagesAuditing Practice Problem 5Maria Fe FerrarizNo ratings yet

- Assignment 9 FARDocument23 pagesAssignment 9 FARcha618717No ratings yet

- Problems & Solutions - RNSDocument27 pagesProblems & Solutions - RNSSiddhant AggarwalNo ratings yet

- Journal Entries Trial BalanceDocument3 pagesJournal Entries Trial BalanceLiu CellNo ratings yet

- Jayakody Hardware Stores Trial Balance and Financial StatementsDocument4 pagesJayakody Hardware Stores Trial Balance and Financial StatementsmonteNo ratings yet

- Closing entries for printing businessDocument3 pagesClosing entries for printing businessNicole FidelsonNo ratings yet

- Directions: Write Your Answer On A Separate Paper. Problem 1Document1 pageDirections: Write Your Answer On A Separate Paper. Problem 1Gio SantosNo ratings yet

- BBB - Assignment FARDocument23 pagesBBB - Assignment FARcha618717No ratings yet

- Account Title Unadjusted Trial Balance Adjustments Adjusted Trial Balance Debit Credit Debit Credit DebitDocument15 pagesAccount Title Unadjusted Trial Balance Adjustments Adjusted Trial Balance Debit Credit Debit Credit DebitTwins VinesNo ratings yet

- ACCT 2105 Tutorial Exercises - Topic 4 - Income StatementDocument8 pagesACCT 2105 Tutorial Exercises - Topic 4 - Income StatementHoàng Trọng HiếuNo ratings yet

- 4 5Document7 pages4 5Jyan GayNo ratings yet

- Class ExerciseDocument14 pagesClass ExerciseAbdul Basit MalikNo ratings yet

- Adjustment journal entries explainedDocument4 pagesAdjustment journal entries explainedchristian ferryNo ratings yet

- Problem 6 1 Answer KeyDocument7 pagesProblem 6 1 Answer Keyanika.delalunaNo ratings yet

- Preparation of FSDocument1 pagePreparation of FSmarkjuan301993No ratings yet

- Trial Balance, Adjustments, Income Statement for Peralta AccountsDocument2 pagesTrial Balance, Adjustments, Income Statement for Peralta AccountsMinjin lesner ManalansanNo ratings yet

- Finacre Assignment3 M4Document2 pagesFinacre Assignment3 M4dexter gentrolesNo ratings yet

- BTNS Services Income Statement for Year Ending Dec 31, 201ADocument2 pagesBTNS Services Income Statement for Year Ending Dec 31, 201AIvan CutiamNo ratings yet

- Class Exercise Session 5 and 6Document8 pagesClass Exercise Session 5 and 6Sumeet KumarNo ratings yet

- Financial Statement Analysis of Tie Beauty EnterpriseDocument15 pagesFinancial Statement Analysis of Tie Beauty Enterprisenur anisNo ratings yet

- Q3 Navin PackagingDocument3 pagesQ3 Navin PackagingRishabh ChawlaNo ratings yet

- Problem #3: Teresita Nacion Publishers Trial BalanceDocument4 pagesProblem #3: Teresita Nacion Publishers Trial BalanceRhea Sismo-anNo ratings yet

- Quiz - 2 - BAAB1014 - (Sept2022) AnswerDocument8 pagesQuiz - 2 - BAAB1014 - (Sept2022) AnswerTheresa AnneNo ratings yet

- PT BaDocument18 pagesPT BaJasmine Merthel Masmila ObstaculoNo ratings yet

- Trial Balance and Financial StatementsDocument18 pagesTrial Balance and Financial StatementsJasmine Merthel Masmila ObstaculoNo ratings yet

- Dr Wan Cosmetic ChartDocument11 pagesDr Wan Cosmetic ChartCherryll MancenidoNo ratings yet

- Financial Accounting and ReportingDocument2 pagesFinancial Accounting and ReportingAj LontocNo ratings yet

- Accounting TestDocument4 pagesAccounting Testdinda ardiyaniNo ratings yet

- Trial - Intro To Accounting Ch. 2 (12th Ed)Document5 pagesTrial - Intro To Accounting Ch. 2 (12th Ed)Bambang HasmaraningtyasNo ratings yet

- Trial - Intro To Accounting Ch. 2 (12th Ed)Document5 pagesTrial - Intro To Accounting Ch. 2 (12th Ed)Bambang HasmaraningtyasNo ratings yet

- Intro To Accounting Ch. 2Document5 pagesIntro To Accounting Ch. 2Bambang HasmaraningtyasNo ratings yet

- 03 Activity 1Document1 page03 Activity 1bea santiagoNo ratings yet

- Ashlee Yvon Degumbis - Activity 10.1Document5 pagesAshlee Yvon Degumbis - Activity 10.1Ashlee DegumbisNo ratings yet

- Nicanor Comptech Service Year End WorksheetDocument5 pagesNicanor Comptech Service Year End WorksheetAshlee DegumbisNo ratings yet

- Profit and Loss Statement For The Y.E. 31.1.20XX Balance Sheet As On 31.1.20XX Income: AssetsDocument4 pagesProfit and Loss Statement For The Y.E. 31.1.20XX Balance Sheet As On 31.1.20XX Income: AssetsSmriti singhNo ratings yet

- Tugas CompletingDocument6 pagesTugas CompletingWidad NadiaNo ratings yet

- Navin Packaging LimitedDocument1 pageNavin Packaging LimitedSoumyaNo ratings yet

- Trial BalanceDocument4 pagesTrial BalanceRonnie Lloyd JavierNo ratings yet

- Banking Company Final Accounts QuestionsDocument8 pagesBanking Company Final Accounts QuestionsPradeepaa BalajiNo ratings yet

- 05 Completing The Accounting Cycle PROBLEMSDocument5 pages05 Completing The Accounting Cycle PROBLEMSbetlogNo ratings yet

- Form Jurnal PT CahayaDocument93 pagesForm Jurnal PT CahayaEka Matriyani06No ratings yet

- Financial Statement - Without AdjustmentDocument29 pagesFinancial Statement - Without AdjustmentAnmol SinghNo ratings yet

- Financial Statement HandoutDocument5 pagesFinancial Statement Handoutmuzamilarshad31No ratings yet

- WS MerchDocument5 pagesWS Merchjeonlei02No ratings yet

- Journalizing T-Accounts Account Title PR Debit CreditDocument29 pagesJournalizing T-Accounts Account Title PR Debit CreditIza Valdez100% (1)

- WorksheetDocument5 pagesWorksheethgiang2308No ratings yet

- Total: Nancy Mulles Data Encoders May 15 2018Document6 pagesTotal: Nancy Mulles Data Encoders May 15 2018Tashnim AreejNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Our Lady of Fatima University For Accounting For Sole Proprietorship For BS Accountancy DiscussionDocument8 pagesOur Lady of Fatima University For Accounting For Sole Proprietorship For BS Accountancy DiscussionJANNA RAZONNo ratings yet

- Our Lady of Fatima University For Accounting For Sole Proprietorship ACTG121 Practice Set ExamplesDocument2 pagesOur Lady of Fatima University For Accounting For Sole Proprietorship ACTG121 Practice Set ExamplesJANNA RAZONNo ratings yet

- OLFU RIZAL111 Jose Rizals First Homecoming 2nd Travel Abroad Study Guide Discussion PaperDocument9 pagesOLFU RIZAL111 Jose Rizals First Homecoming 2nd Travel Abroad Study Guide Discussion PaperJANNA RAZONNo ratings yet

- Accounting for Sole Proprietorship IntroductionDocument12 pagesAccounting for Sole Proprietorship IntroductionJANNA RAZONNo ratings yet

- OLFU For Rizals First Homecoming 2nd Travel Abroad Japan Interlude Sidetrip To The USA DiscussionDocument48 pagesOLFU For Rizals First Homecoming 2nd Travel Abroad Japan Interlude Sidetrip To The USA DiscussionJANNA RAZONNo ratings yet

- GMO Golden Rice Debate For Vitamin A Deficiency Research EssayDocument4 pagesGMO Golden Rice Debate For Vitamin A Deficiency Research EssayJANNA RAZONNo ratings yet

- SENATE BILL 1101 Rank Reclassification of The BFP and BJMPDocument10 pagesSENATE BILL 1101 Rank Reclassification of The BFP and BJMPRoyce Christian EbitNo ratings yet

- Internship Diary Format - 2023Document48 pagesInternship Diary Format - 2023Amolak SinghNo ratings yet

- Montesquieu's Separation of PowersDocument33 pagesMontesquieu's Separation of PowersCeline SinghNo ratings yet

- Covid Grand Jury DispositionDocument4 pagesCovid Grand Jury DispositionDeanna GugelNo ratings yet

- Constitutional TortsDocument68 pagesConstitutional TortsMihaela HristodorNo ratings yet

- Quiao vs. Quiao G.R. No 176556 July 4, 2012Document2 pagesQuiao vs. Quiao G.R. No 176556 July 4, 2012Lei Jeus TaligatosNo ratings yet

- TSPI Corporation vs. TSPI Employees UnionDocument2 pagesTSPI Corporation vs. TSPI Employees UnionD. RamNo ratings yet

- Garcia V LlamasDocument2 pagesGarcia V LlamasAllen Windel BernabeNo ratings yet

- Choice of Law Determines Validity of Divorce and WillDocument2 pagesChoice of Law Determines Validity of Divorce and WillJustice PajarilloNo ratings yet

- SOP - NorthumbriaDocument2 pagesSOP - NorthumbriaMuhammad Bilal AshrafNo ratings yet

- Section B-B Section A-A: Joe Mills ArchitectsDocument1 pageSection B-B Section A-A: Joe Mills ArchitectsPrashashtiNo ratings yet

- Department of Education: Republic of The PhilippinesDocument3 pagesDepartment of Education: Republic of The PhilippinesRames Ely GJNo ratings yet

- Chapter - Viii Conclusion and SuggestionsDocument33 pagesChapter - Viii Conclusion and SuggestionsShubham TanwarNo ratings yet

- Born - CH 1 - Intro To Int ArbitrationDocument38 pagesBorn - CH 1 - Intro To Int ArbitrationFrancoNo ratings yet

- Request For NOC For Excavation Within The Coastal Zone: Environment DepartmentDocument4 pagesRequest For NOC For Excavation Within The Coastal Zone: Environment DepartmentMohammed NajathNo ratings yet

- Negotiable InstrumentDocument9 pagesNegotiable Instrumentvishal bagariaNo ratings yet

- Cymbol ComplaintDocument52 pagesCymbol Complaintkc wildmoonNo ratings yet

- DIGETED & FULL TEXT - Turquesa vs. Valera, 322SCRA 573Document7 pagesDIGETED & FULL TEXT - Turquesa vs. Valera, 322SCRA 573KidMonkey2299No ratings yet

- Code of Professional Conduct 2019Document64 pagesCode of Professional Conduct 2019Nor Afzan Mohd TahirNo ratings yet

- Tendernotice 7Document34 pagesTendernotice 7Neil AgshikarNo ratings yet

- DAO1704 Assignment 2: Due DateDocument2 pagesDAO1704 Assignment 2: Due DateHuang ZhanyiNo ratings yet

- Report On Absences Tardiness and UndertimeDocument3 pagesReport On Absences Tardiness and UndertimeerichjustineNo ratings yet

- HNP-B-T'CN Ae - PDW Pnãm-) - ©M-B V 1Document40 pagesHNP-B-T'CN Ae - PDW Pnãm-) - ©M-B V 1sreehari dineshNo ratings yet

- Done Big Data Security - SyllabusDocument2 pagesDone Big Data Security - SyllabusArun SharmaNo ratings yet

- 1.3 Ra 11058Document52 pages1.3 Ra 11058Fritz MayordomoNo ratings yet

- MOM ReferenceDocument2 pagesMOM ReferenceEjay EmpleoNo ratings yet

- Legal Framework Governing Foreign Arbitral Awards 1683001170Document3 pagesLegal Framework Governing Foreign Arbitral Awards 1683001170SAHIBZADA MUHAMMAD MUBEENNo ratings yet

- PBC Laxmi Chand & Sons-1Document1 pagePBC Laxmi Chand & Sons-1amitkv7No ratings yet

- Expropriation case determines just compensation for expropriated landDocument13 pagesExpropriation case determines just compensation for expropriated landKatNo ratings yet