Professional Documents

Culture Documents

Written Report Psa

Uploaded by

Lynne Peters0 ratings0% found this document useful (0 votes)

4 views2 pagesOriginal Title

WRITTEN-REPORT-PSA

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views2 pagesWritten Report Psa

Uploaded by

Lynne PetersCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

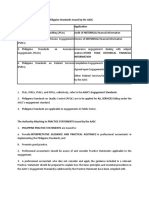

Auditing and Assurance Standards Council (AASC)

Ruling body ensuring the excellence and uniformity of auditing and assurance

related services in the country.

Main objective: Attain uniformity of the local GAAS with the IAASB

pronouncement.

Philippine Standards on Auditing

Philippine Auditing Practice Statements (PAPS)

The purpose of this Philippine Auditing Practice Statement (PAPS) is to provide

practical guidance in addition to that contained in PSA 500, “Audit Evidence,”

with respect to certain specific financial statement amounts and other

disclosures.

Its purpose is to assist auditors, and to develop good practice, by providing

guidance on the application of the PSAs when conducting an audit of financial

statements.

Philippine Standards in Review Engagements (PSREs)

It is to establish standards and provide guidance on the auditor’s professional

responsibilities when the auditor undertakes an engagement to review interim

financial information of an audit client, and on the form and content of the

report.

Are to be applied in the review of historical financial information.

Philippine Standards on Assurance Engagements (PSAE)

It is to establish standards and provide guidance on engagements to examine

and report on prospective financial information including examination

procedures for best-estimate and hypothetical assumptions.

Are to be applied in assurance engagements dealing with subject matters other

than historical information.

Philippine Standards on Related Services (PSRS)

Are to be applied to compilation engagements, engagements to apply agreed

upon procedures to information and other related services engagements as

specified by the AASC.

Philippine Standards on Quality Control (PSQC)

Deals with a firm's responsibilities for its system of quality control for audits

and reviews of FS, and other assurance and related services engagements

Applies to all firms of professional accountants. The nature and extent of the

policies and procedures will depend on various factors such as such and

operating characteristics of the firm.

Intended to assist the firm in:

Understanding what needs to be accomplished.

Deciding whether more needs to be done to achieve the objective.

a.) The firm and its personnel comply with professional standards and

regulatory and legal requirements.

b.) Reports issued by the firm or the engagement partners are appropriate in

the circumstances.

The firm’s system of quality control:

Shall understand this PSQC.

Shall comply with each requirement of this PSQC.

Quality Control for an audit of Financial Information (PSA 220)

PSA 220 deals with the specific responsibilities of the auditor regarding quality

control procedures for an audit of financial statements.

Under PSQC – a firm or engagement team should implement quality control

procedures that are applicable to the individual audit engagement.

You might also like

- Motion To Recuse A Judge TemplateDocument4 pagesMotion To Recuse A Judge TemplateTyler100% (12)

- FDCPA and State Law Claims Against Debt CollectorDocument7 pagesFDCPA and State Law Claims Against Debt CollectorIdont Haveaface100% (10)

- Skrill PEP Self-Declaration FormDocument2 pagesSkrill PEP Self-Declaration FormMuhammad Hasnain71% (7)

- AC3101 PresentationsDocument21 pagesAC3101 PresentationsAngie Koh Ann Ping100% (1)

- Paper Merge CubeDocument1 pagePaper Merge Cubeefren hazaar herrera isaac100% (2)

- Accounting 16aDocument93 pagesAccounting 16aLelouch BritanianNo ratings yet

- PSQC 1Document22 pagesPSQC 1Hazel EspinosaNo ratings yet

- Unit II Professioinal StandardsDocument14 pagesUnit II Professioinal StandardsMark GerwinNo ratings yet

- PSQC Quality ControlDocument36 pagesPSQC Quality ControlMichael Vincent Buan SuicoNo ratings yet

- Introduction to Audit and Assurance PrinciplesDocument4 pagesIntroduction to Audit and Assurance Principleshazel alvarezNo ratings yet

- Quality Is Everything - Not Profit! Profit Should Only Be The By-Product of Quality ServiceDocument27 pagesQuality Is Everything - Not Profit! Profit Should Only Be The By-Product of Quality ServicetrishaNo ratings yet

- Chapter 1Document17 pagesChapter 1RahulNo ratings yet

- AT Lecture 1 Overview of AuditingDocument15 pagesAT Lecture 1 Overview of AuditingmoNo ratings yet

- AuditingDocument19 pagesAuditingEliza BethNo ratings yet

- Auditing Standards and Quality ControlDocument47 pagesAuditing Standards and Quality ControlLaezelie PalajeNo ratings yet

- PSBA - AT Lecture 1 Overview of Auditing (2SAY2021)Document13 pagesPSBA - AT Lecture 1 Overview of Auditing (2SAY2021)Abdulmajed Unda MimbantasNo ratings yet

- Chapter 2 THE PROFESSIONAL STANDARDSDocument5 pagesChapter 2 THE PROFESSIONAL STANDARDSNicole Anne M. ManansalaNo ratings yet

- Auditing Standards and Quality ControlsDocument9 pagesAuditing Standards and Quality ControlsJoe P PokaranNo ratings yet

- Isqc 1Document35 pagesIsqc 1JecNo ratings yet

- 1718 01 Fundamentals of Auditng and Assurance EngagementsDocument5 pages1718 01 Fundamentals of Auditng and Assurance EngagementsBryan TerceroNo ratings yet

- 6.standards On Quality ControlDocument2 pages6.standards On Quality ControlmercatuzNo ratings yet

- Isqc 1Document27 pagesIsqc 1baabasaamNo ratings yet

- Module 3 The Professional StandardsDocument24 pagesModule 3 The Professional StandardsGONZALES, MICA ANGEL A.No ratings yet

- Overview of Auditing and AssuranceDocument15 pagesOverview of Auditing and AssuranceJadeFerrer50% (2)

- Auditing Theory: CPA ReviewDocument12 pagesAuditing Theory: CPA ReviewThan TanNo ratings yet

- 01 - Fundamentals of Auditng and Assurance EngagementsDocument5 pages01 - Fundamentals of Auditng and Assurance EngagementsMaybelle BernalNo ratings yet

- (Notes) MET 1 ACAUD 2247 Fundamentals of Auditing and Assurance ServicesDocument29 pages(Notes) MET 1 ACAUD 2247 Fundamentals of Auditing and Assurance ServicesMa. Helena Angela SerranoNo ratings yet

- Quality Control For Firms That Perform Audits and Reviews of Financial Statements, and Other Assurance and Related Services Engagements)Document40 pagesQuality Control For Firms That Perform Audits and Reviews of Financial Statements, and Other Assurance and Related Services Engagements)nikNo ratings yet

- Topic 3 - The Professional StandardsDocument19 pagesTopic 3 - The Professional StandardsLorein ArchambeaultNo ratings yet

- (Notes) ACAUD 2247 Fundamentals of Auditing and Assurance ServicesDocument29 pages(Notes) ACAUD 2247 Fundamentals of Auditing and Assurance ServicesMa. Helena Angela SerranoNo ratings yet

- Isa 220Document19 pagesIsa 220Monjurul HassanNo ratings yet

- H3 Quality ControlDocument7 pagesH3 Quality ControlTrek ApostolNo ratings yet

- Acctg 14.1Document13 pagesAcctg 14.1arman dela cruzNo ratings yet

- Module 001 Overview of The Risk-Based AuditDocument12 pagesModule 001 Overview of The Risk-Based AuditCherwin bentulan100% (1)

- At 9401Document12 pagesAt 9401Luzviminda SaspaNo ratings yet

- CSQC-1 (2014)Document16 pagesCSQC-1 (2014)zelcomeiaukNo ratings yet

- Philippine Standards On Auditing 220 RedraftedDocument20 pagesPhilippine Standards On Auditing 220 RedraftedJayNo ratings yet

- Developing an Audit Strategy for Financial Statement AuditsDocument14 pagesDeveloping an Audit Strategy for Financial Statement AuditssammycoombsNo ratings yet

- PSA 220 Quality Control AuditsDocument11 pagesPSA 220 Quality Control AuditsZach RiversNo ratings yet

- Psa 210 & 220Document1 pagePsa 210 & 220anna rodriguezNo ratings yet

- Philippine Standard On Auditing 200Document4 pagesPhilippine Standard On Auditing 200Zach RiversNo ratings yet

- Preface To Philippine StandardsSEFSDFASDFASSDFDocument7 pagesPreface To Philippine StandardsSEFSDFASDFASSDFTEph AppNo ratings yet

- AASC establishes auditing standards in the PhilippinesDocument41 pagesAASC establishes auditing standards in the PhilippinesAltessa Lyn ContigaNo ratings yet

- Auditing StandardsDocument6 pagesAuditing StandardsVienne MaceNo ratings yet

- Philippine Standards Authority and Assurance EngagementsDocument26 pagesPhilippine Standards Authority and Assurance EngagementsLana sereneNo ratings yet

- Auditing and Assurance ServicesDocument9 pagesAuditing and Assurance Servicessky wayNo ratings yet

- PSQC 1Document35 pagesPSQC 1Airah Abcede FajardoNo ratings yet

- Auditing Auditing Report Cabral and de JesusDocument43 pagesAuditing Auditing Report Cabral and de JesusLalaine De JesusNo ratings yet

- Edited Lesson 3 - Overview of AuditingDocument30 pagesEdited Lesson 3 - Overview of AuditingS RNo ratings yet

- Psa 200 PDFDocument7 pagesPsa 200 PDFDanzen Bueno ImusNo ratings yet

- PSA 120: Framework of Philippine Standards of AuditingDocument4 pagesPSA 120: Framework of Philippine Standards of AuditingSkye LeeNo ratings yet

- 1911 PDFDocument31 pages1911 PDFSrikanthNo ratings yet

- Psa 120-200Document2 pagesPsa 120-200Hannah FigueroaNo ratings yet

- ISQC 1 Implementation Guide PDFDocument107 pagesISQC 1 Implementation Guide PDFKashif KamranNo ratings yet

- PSA 220 Quality ControlDocument19 pagesPSA 220 Quality ControlSheena Belleza FernanNo ratings yet

- 910-Psa 910Document26 pages910-Psa 910Gwenneth BachusNo ratings yet

- Engagement Essentials: Preparation, Compilation, and Review of Financial StatementsFrom EverandEngagement Essentials: Preparation, Compilation, and Review of Financial StatementsNo ratings yet

- Annual Update and Practice Issues for Preparation, Compilation, and Review EngagementsFrom EverandAnnual Update and Practice Issues for Preparation, Compilation, and Review EngagementsNo ratings yet

- Audit Risk Alert: General Accounting and Auditing Developments, 2017/18From EverandAudit Risk Alert: General Accounting and Auditing Developments, 2017/18No ratings yet

- Audit and Accounting Guide - Depository and Lending Institutions: Banks and Savings Institutions, Credit Unions, Finance Companies, and Mortgage CompaniesFrom EverandAudit and Accounting Guide - Depository and Lending Institutions: Banks and Savings Institutions, Credit Unions, Finance Companies, and Mortgage CompaniesNo ratings yet

- Audit Risk Alert: Government Auditing Standards and Single Audit Developments: Strengthening Audit Integrity 2018/19From EverandAudit Risk Alert: Government Auditing Standards and Single Audit Developments: Strengthening Audit Integrity 2018/19No ratings yet

- Agreement: at - Along With Fixtures and Fittings (HereinafterDocument5 pagesAgreement: at - Along With Fixtures and Fittings (HereinafterNikhil PomalNo ratings yet

- Abb HandlesDocument8 pagesAbb HandlesOcklen SetiadilagaNo ratings yet

- Lyons D. The Correlativity of Rights and DutiesDocument12 pagesLyons D. The Correlativity of Rights and DutiesccoamamaniNo ratings yet

- Aseambankers Malaysia BHD & Ors V Shen CourtDocument44 pagesAseambankers Malaysia BHD & Ors V Shen CourtwedyinganywaysNo ratings yet

- Philippines Labor Dispute NoticeDocument4 pagesPhilippines Labor Dispute NoticeshariabordoNo ratings yet

- VA Disability and Divorce: Myths and RealitiesDocument6 pagesVA Disability and Divorce: Myths and RealitiesLouise MucciNo ratings yet

- Oath of AllegianceDocument2 pagesOath of AllegianceRoma Jean D. MonteroNo ratings yet

- Coscouella V Sandiganbayan GR 191411Document3 pagesCoscouella V Sandiganbayan GR 191411Dominic Loren AgatepNo ratings yet

- People vs. Nonoy Ebet CrimDocument2 pagesPeople vs. Nonoy Ebet CrimKayee KatNo ratings yet

- Memorial (Appellant)Document14 pagesMemorial (Appellant)Yukta SoniNo ratings yet

- Offenses Against Masonic LawDocument40 pagesOffenses Against Masonic LawjpesNo ratings yet

- General Powers, Theory of General CapacityDocument5 pagesGeneral Powers, Theory of General CapacityMitchi BarrancoNo ratings yet

- 50 GMCR V Bell Telecom GR 126496 043097 271 Scra 790Document5 pages50 GMCR V Bell Telecom GR 126496 043097 271 Scra 790Winfred TanNo ratings yet

- Court Reprimands Judge and Clerk for Unprofessional ConductDocument5 pagesCourt Reprimands Judge and Clerk for Unprofessional ConductChristie Joy BuctonNo ratings yet

- Spec Pro-Pros. CentenoDocument24 pagesSpec Pro-Pros. CentenoNoel RemolacioNo ratings yet

- Fehrenbacher V National Attorney Collection Services Inc Archie R Donovan NACS National Attorneys Service Debt Collection ComplaintDocument6 pagesFehrenbacher V National Attorney Collection Services Inc Archie R Donovan NACS National Attorneys Service Debt Collection ComplaintghostgripNo ratings yet

- Judgment Tothpal Et Szabo v. Romania - Violation of Freedom of ReligionDocument3 pagesJudgment Tothpal Et Szabo v. Romania - Violation of Freedom of ReligionAnonymous HiNeTxLMNo ratings yet

- Volterra Semiconductor v. Primarion Patent MSJDocument147 pagesVolterra Semiconductor v. Primarion Patent MSJNorthern District of California BlogNo ratings yet

- The Lawyer and Society ReviewerDocument15 pagesThe Lawyer and Society ReviewerJeg GonzalesNo ratings yet

- Chapter 5. Interpretation of ContractsDocument5 pagesChapter 5. Interpretation of ContractsRose Anne CaringalNo ratings yet

- Evidence Notes by Erika Rule 128 129Document19 pagesEvidence Notes by Erika Rule 128 129AllynNo ratings yet

- 2024 Remedial Law Bar SyllabusDocument12 pages2024 Remedial Law Bar SyllabusJohnny Castillo SerapionNo ratings yet

- Pastor Bravo's libel case against Bibiano ViñaDocument10 pagesPastor Bravo's libel case against Bibiano ViñaAngela Kristine PinedaNo ratings yet

- Universal Robina vs. AciboDocument2 pagesUniversal Robina vs. AciboSherwinBriesNo ratings yet

- TM Morality and Professional EthicsDocument126 pagesTM Morality and Professional EthicsKiya Abdi100% (2)

- 8 Calang Vs WilliamsDocument2 pages8 Calang Vs WilliamsRexNo ratings yet