Professional Documents

Culture Documents

Unit 1 Auditing

Uploaded by

Aditi SinghOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Unit 1 Auditing

Uploaded by

Aditi SinghCopyright:

Available Formats

1

UNIT – 1

CONTEMPRARY AUDIT

B.COM (H) 6 SEM

INTRODUCTION OF AUDITING

Auditing Origin and Evolution – History of Auditing

In the early stages of civilization, the methods of maintaining accounts were very

unrefined. The person used to listen to the accounts read over by an accountant to check

them, he was known as the auditor.

HISTORY OF AUDITING

Auditing is as old as accounting, and there are signs of its existence in all ancient cultures

such as Mesopotamia, Greece, Egypt, Rome, UK, and India.

Arthashastra by Kautilya detailed rules for accounting and auditing of public finances.

In olden days the key purpose of audits was to gain information about the financial system

and records of the business.

However, recently auditing has begun to include non-financial subject areas such as safety,

security, information system performance and environmental concerns.

With the non-profit organization and government agencies, there has been an increasing

need for performing an audit, examining their success in satisfying mission objectives of the

business.

AUDITING ORIGIN AND EVOLUTION

The auditing origin can be traced back to the 18th century, when the practice of large scale

production developed as a result of the Industrial Revolution.

Systems of checks and counter checks were implemented to maintain public accounts as

early as the days of ancient Egyptians, Greeks and Romans.

The last decade of the 15th century was a crucial period during which a great impetus was

given to trade and commerce by Renaissance in Italy, and the principles of double entry

bookkeeping were evolved and published in 1494 at Venice in Italy by Luca Paciolo.

Auditing Notes by Manish Srivastava

2

This system of accounts was quite capable of recording all types of mercantile transactions.

The Industrial Revolution of England was another landmark in the history of trade and

commerce.

The industrial revolution led to a significant expansion in the volume of trading transactions

which compelled the use of more money, and the ordinary trader was enforced to combine

with the partnership with others.

Consequently, a big enterprise was framed in the form of partnership firms and joint-stock

companies.

This growth of business enterprises before and after the revolution accompanied an

improved accounting system.

Besides British Companies made stockholders realize that an independent and impartial

audit could well protect their interest.

Such developments had a direct effect on the evolution of the practice of auditing, but the

audit of business accounts could not be standard until the 19th century.

A Royal Charter incorporated the Institute of Chartered Accountants in England and Wales

on May 11, 1880. The key purpose of this incorporation was to prepare Auditors.

In January 1923, the British Association of Accountants and Auditors got established, and a

person could be fully competent to work as a professional auditor after clearing this exam.

MEANING OF AUDITING

Auditing is a systematic examination of the books and records of a business or other

organization to ascertain or verify and report upon the facts regarding its financial

operations and the results thereof.

Auditing is concerned with verifying accounting data by determining the accuracy and

reliability of accounting statements and reports.

The Report of the Committee on Basic Auditing Concepts of the American Accounting

Association (AAA) defines,

Auditing is a systematic process of objectively obtaining and evaluating evidence regarding

assertions about economic actions and events to ascertain the degree of correspondence

between those assertions and established criteria and communicate the results to

interested users.

Auditing Notes by Manish Srivastava

3

The audit is one of the most dynamic areas of the accounting sciences.

The word “audit” has Latin origins (audire, means listening). This word has known many

definitions and classifications during this time. Generally, it is a synonym to control, check,

inspect, and revise.

While accounting has suffered a little change in time, the audit has permanently evolved,

answering to the environmental changes and modifying its objectives starting the middle

age, passing through the industrial revolution up to the 21st century.

Companies prepare financial statements of their activities, which represent their overall

performance. These financial statements are examined and evaluated by independent

persons, who assess them according to the industry’s generally accepted standards.

DEFINITION OF AUDITING

1. According to general guidelines on internal Auditing issued by ICAI, auditing is

defined as a

Systematic and independent examination of data, statements, records, operations and

performances (financial or otherwise) of an enterprise for a stated purpose. In any auditing

situation, the auditor receives and recognizes the propositions before him for examination,

collects evidence, evaluates the same and on this basis, formulates his judgement which is

communicated through his Audit Report.

ICAI

The above definitions of auditing have certain important elements. They are:

1. Independence: The auditor has to express an opinion on the financial statements

examined by him. Therefore, the auditor should be free from any interest which

might detract his objectivity.

2. Auditor’s opinion: The auditor has to express an opinion on the financial

statements examined in the form of an audit report. The audit report is an

expression of opinion rather than a statement of verified facts.

3. Financial statements: The financial statements comprise of Balance Sheet, Profit

and Loss Account, notes and other statements, which collectively are intended to

give a proper understanding of the financial position. The auditor has to express

an opinion on the financial statements.

These three elements are contained in any kind of audit, whether profit-oriented or not and

irrespective of its size or legal form.

2. Montgomery defines the term as “Auditing is a systematic examination of books and

records of a business or other organization in order to ascertain or verify and to

report upon the facts regarding its financial operations and the result thereof”.

Auditing Notes by Manish Srivastava

4

3. Spicer and Pegler defines auditing as, “such an examination of books of accounts

and vouchers of a business as will enable the auditor to satisfy the Balance Sheet is

properly drawn up so as to give a true and fair view of the state of affairs of the

business, whether the Profit and Loss account gives a true and fair view of the profit

and loss for the financial period, according to the best of his information and

explanation given to him as shown by the books, and if not, in what respect he is not

satisfied.”

SCOPE OF AUDIT

Scope: An auditor will be determined the scope of an audit of financial

statements with regards to –

a) The terms of the engagements

b) The pronouncements of ICAI

c) The requirements of relevant legislation

Coverage of work: The auditor should be organized to cover all operational

aspects relevant to the financial statements. He has to make study & evaluate the

accounting system & internal controls on which auditor wishes to rely.

Disclosure: Auditor should ensure whether all relevant information is properly

disclosed in financial statements & as per statutory requirement. The disclosure

requirement can be verified by performing-

– Financial statement analysis

– Evaluation of accounting policies

Judgment: Absolute certainty is not attainable in auditing because of the need to

exercise judgment. The auditor is also required to examine the reasonableness of

judgment.

Materiality: Material items are those, which might influence the decision of the

users of financial statements. The auditor should exercise his professional

experience & judgment with material items.

Technical aspects: Auditor is not expected to perform duties, which fall outside

the scope of his competence. The auditor is not an expert in all fields. So, an

auditor can take the advice of an expert for technical work.

OBJECTIVES OF AUDITING

The objective of an audit is to express an opinion on financial statements.

The auditor has to verify the financial statements and books of accounts to certify

the truth and fairness of the financial position and operating results of the business.

Therefore, the objectives of audit are categorized as primary or main objectives and

secondary objectives.

Auditing Notes by Manish Srivastava

5

PRIMARY OBJECTIVES

The primary or main objective of audit is as follows:

1. To Examine the Accuracy of the Books of Accounts

An auditor has to examine the accuracy of the books of accounts, vouchers and other

records to certify that Profit and Loss Account discloses a true and fair view of profit or loss

for the financial period and the Balance Sheet on a given date is properly drawn up to exhibit

a true and fair view of the state of affairs of the business. Therefore the auditor should

undertake the following steps:

· Verify the arithmetical accuracy of the books of accounts.

· Verify the existence and value of assets and liabilities of the companies.

· Verify whether all the statutory requirements on maintaining the book of accounts has

been complied with.

Meaning of Books of Accounts

· Books of Accounts mean the financial records maintained by a business concern for a

period of one year. The period of one year can be either calendar year i.e., from 1st January

to 31st December or financial year i.e., from 1st April to 31st March. Usually, business

concerns adopt financial year for accounting all business transactions.

· Books of accounts include the following: ledgers, subsidary books, cash and other

account books either in the written form or through print outs or through electronic storage

devices.

Auditing Notes by Manish Srivastava

6

2. To Express Opinion on Financial Statements

After verifying the accuracy of the books of accounts, the auditor should express his expert

opinion on the truthfulness and fairness of the financial statements. Finally, the auditor

should certify that the Profit and Loss Account and Balance Sheet represent a true and fair

view of the state of affairs of the company for a particular period.

Meaning of Financial Statement

Financial Statement means the statements prepared at the end of the year

taking into account the business activities that took place for a year, for example,

transactions that takes place in a business concern from 1st April to 31st March.

Components of Financial Statement

Financial Statement includes the following:

· Trading and Profit and Loss Account, and

· Balance Sheet.

Elements of Financial Statements include the following:

· Assets: Assets include cash and bank balance, value of closing stock, debtors, bills

receivable, investments, fixed assets, prepaid expenses and accrued income.

· Liabilities: Liabilities include capital, profit and loss balance, creditors, bills payable,

outstanding expenses and income received in advance.

· Revenue: Revenue includes sales, collection from debtors, rent received, dividend,

interest received and other incomes received.

· Expenditure: Expenditure includes purchases, payment to creditors, manufacturing

and trade expenses, office expenses, selling and distribution expenses, interest and dividend

paid.

SECONDARY OBJECTIVES

The secondary objectives of audit are: (1) Detection and Prevention of Errors, and (2)

Detection and Prevention of Frauds.

Detection And Prevention of Errors

The Institute of Chartered Accountants of India defines an error as, “an unintentional

mistake in the books of accounts.” Errors are the carelessness on the part of the person

preparing the books of accounts or committing mistakes in the process of keeping accounting

records. Errors which take place in the books of accounts and the duty of an auditor to locate

such errors are discussed below:

Auditing Notes by Manish Srivastava

7

1. CLERICAL ERROR

Errors that are committed in posting, totalling and balancing of accounts are called as Clerical

Errors. These errors may or may not affect the agreement of the Trial Balance.

Types of Clerical Errors:

(A) Errors of Omission:

When a transaction is not recorded or partially recorded in the books of account is known as

Errors of Omission. Usually, it arises due to the mistake of clerks. Error of omission can occur

due to complete omission or partial omission.

(1) Error of Complete Omission: When a transaction is totally or completely omitted to be

recorded in the books it is called as “Error of Complete Omission”. It will not affect the

agreement of the Trial Balance and hence it is difficult to detect such errors.

Example – 1: Goods purchased on credit from Mr. X on 10.5.2016 for Rs. 20,500, not recorded

in Purchases Book.

Example – 2: Goods sold for cash to Ram for Rs. 10,000 on 1.7.2016, not recorded in Cash

Book.

(2) Errors of Partial Omission: When a transaction is partly recorded, it is called as “Error of

Partial Omission”. Such kind of errors can be detected easily as it will affect the agreement of

the Trial Balance.

Example – 1: Credit purchase from Mr.C for Rs. 45,000 on 10.12.2016, is entered in the

Purchases Book but not posted in Mr.C’s account.

Example – 2: Cash book total of Rs. 1,10,100 in Page 5 is not carried forward to next page.

(B) Errors of Commission:

Errors which are not supposed to be committed or done by carelessness is called as

Error of Commission. Such errors arise in the following ways:

Auditing Notes by Manish Srivastava

8

(1) Error of Recording

(2) Error of Posting

(3) Error of casting, or Error of Carry-forward.

(1) Error of Recording: The error arises when any transaction is incorrectly recorded in the

books of original entry. This error does not affect the Trial Balance.

Example – 1: Goods purchased from Shyam for Rs. 1000 wrongly recorded in Purchases Day

Book as Rs. 100.

Example – 2: Goods purchased from Ram for Rs. 1,000, instead of entering in Purchase Day

Book wrongly entered in Sales Day Book.

(2) Error of Posting: The error arises when a transaction is correctly journalised but wrongly

posted in ledger account.

Example – 1: Rent paid to landlord for Rs. 10,000 on 1.5.2016 is wrongly posted to debit side

of Repairs account instead of debit side of Rent account.

Example – 2: Rent paid to landlord for Rs. 10,000 on 1.5.2016 is wrongly posted to credit side

of Rent account instead of debit side of Rent account.

(3) Error of casting, or Error of Carry-forward: The error arises when a mistake is committed

in carrying forward a total of one page on the next page. This error affects the Trial Balace.

Example – 1: Purchases Book is totalled as Rs. 10,000 instead of 1,000.

Example – 2: Total of Purchases Book is carried forward as Rs. 1,000 instead of Rs. 100.

2. ERROR OF DUPLICATION

Errors of duplication arise when an entry in a book of original entry has been made twice and

has also been posted twice. These errors do not affect the agreement of trial balance, hence

it can’t located easily.

Example: Amount paid to Anbu, a creditor on 1.10.2016 for Rs. 75,000 wrongly accounted

twice to Anbu’s account.

3. ERROR OF COMPENSATION (or) COMPENSATING ERRORS

When one error on debit side is compensated by another entry on credit side to the same

extent is called as Compensating Error. They are also called as Off-setting Errors. These errors

do not affect the agreement of trial balance and hence it cannot be located.

Example: A’s account which was to be debited for Rs. 5,000 was credited as Rs. 5,000 and

similarly B’s account which was to be credited for Rs. 5,000 was debited for Rs. 5,000.

4. ERROR OF PRINCIPLES

An error of principle occurs when the generally accepted principles of accounting are not

followed while recording the transactions in the books of account. These errors may be due

Auditing Notes by Manish Srivastava

9

to lack of knowledge on accounting principles and concepts. Errors of principle do not affect

the trial balance and hence it is very difficult for an auditor to locate such type of errors.

Example – 1: Repairs to Office Building for Rs. 32,000, instead of debiting to repairs account

is wrongly debited to building account.

Example – 2: Freight charges of Rs. 3,000 paid for a new machinery, instead of debiting to

Machinery account wrongly debited to Freight account.

Detection and Prevention of Frauds

Fraud is the intentional or wilful misrepresentation of transactions in the books of accounts

by the dishonest employees to deceive somebody. Thus, detection and prevention of fraud is

of great importance and constituents an important duty of an auditor. Fraud can be classified

as:

MISAPPROPRIATION OF CASH

This is a very common method of misappropriation of cash by the dishonest employees by

giving false representation in the books of accounts intentionally. In order to detect and

prevent misappropriation, the auditor should verify the system of internal check in operation

and by making a detailed examination of records and documents. Cash may be

misappropriated in the following ways:

(1) By omitting to enter cash which has been received.

Example: Cash received on account of cash sales for Rs. 35,000 is not accounted in the debit

side of the cash book.

(2) By accounting less amount on the receipt side of cash book than the actual amount

received.

Example: Cash received on account of cash sales for Rs. 35,000 is accounted in the debit side

of the cash book as Rs. 25,000. The difference of Rs. 10,000 may be defrauded by the cashier.

Auditing Notes by Manish Srivastava

10

(3) By recording fictitious entries on the payment side of cash book.

Example: Cash book is credited for Rs. 44,000 as amount paid to Mr X for goods purchased

on credit but actually no amount is paid. Hence, cashier misappropriates Rs. 44,000 of cash

as paid to Mr X.

(4) By accounting more amount on payments side of cash book than the actual amount paid.

Example: Amount paid to Gopal for Rs. 5,000 is accounted on the credit side of cash book

as Rs. 15,000. The difference of Rs. 10,000 may be defrauded by the cashier.

(5) Teeming and Lading of Fraud which means cash received from one customer is

misappropriated and remittance received from another debtor is posted to the first debtor’s

account.

2. MISAPPROPRIATION OF GOODS

Fraud which takes places in respect of goods is Misappropriation of Goods. Such a type

of fraud is difficult to detect and usually takes place where the goods are less bulky and are

of high value.

· By showing less amount of purchase than actual purchase in the books of accounts.

· By showing issue of material more than actual issue made.

· By showing good materials as obsolete or poor line of goods.

· By showing fictitious entries in the books of accounts.

Example – 1: Goods purchased amounting to Rs. 58,000 is wrongly accounted in Purchases

Book as Rs. 50,000. Hence, showing a smaller number of purchases than the actual and

misappropriating goods worth Rs. 8,000.

Example – 2: Goods issued from stores for 1000 units is wrongly accounted in the Ledger

accounts as 3000 units issued. The difference of 2000 units may be misappropriated by the

storeskeeper.

Example – 3: Entries in the Purchases Book may be suppressed or inflated to show more or

less profit.

Detection of Misappropriation of goods is a difficult task for an Auditor. Only through efficient

system of inventory control, periodical stock verification, internal check system and adequate

security arrangement the scope for such frauds can be eliminated or minimized.

Auditor has to thoroughly scrutinize the inward and outward registers, invoices, sales memos,

audit notes, etc., to detect the goods-related frauds.

3. MANIPULATION OF ACCOUNTS

There is a very common practice almost in every organization, some dishonest employees

have intention to commit this type of fraud. Manipulation of accounts is the procedure to

Auditing Notes by Manish Srivastava

11

alter books of accounts in such a way that there will be an increase or decrease in the amount

of profit to achieve some personal objectives of the high officials. It is very difficult for the

auditors to identify such frauds which may be due to manipulation of accounts.

Causes of Manipulation of Accounts

· There are different reasons for manipulation of accounts. The reasons are:

· To get more commission calculated on profit

· For evasion of income tax and sales tax

· To get huge loan from financial institutions by showing more profit in the books of

accounts.

· To declare more dividend to the shareholders.

· By showing more profit than actual to get confidence of the shareholders.

· To make secret reserves by showing less income or by showing more expenses in the

books of accounts.

Ways of Manipulation of Accounts

Manipulation of accounts may be made in the following ways:

· By showing more or less amount on fixed assets,

· By showing over valuation or under valuation of stock,

· Over or under valuation of liabilities,

· Creation of over or under provision for depreciation,

· Charging capital expenditure as revenue expenditure or vice versa,

· By making more or less provision for bad debts and for outstanding liabilities,

· By showing advance income or expenditure in the current year accounts.

Objectives of Manipulation of Accounts

The objectives of Manipulation may be window dressing or creation of secret reserves.

Window Dressing: In window dressing, accounts are manipulated in such a manner to reveal

a much better and sound financial position of the business than what actually it is, in order to

mislead the outsiders by inflating the profit.

Secret Reserves: Accounts are prepared in such a manner that they disclose a worse financial

position than the real. The real picture of the business is concealed and a distorted one is

revealed.

Auditing Notes by Manish Srivastava

12

BOOK-KEEPING, ACCOUNTANCY AND AUDITING

Book-Keeping is the art of recording the business transactions in the books of original

entry. It involves the process of recording all the transactions, journalising, posting to the

relevant ledger accounts and balancing.

Accountancy involves the process of recording, classifying, summarising and interpreting all

the financial transactions that take place during a particular period in a concern. It is the work

of an accountant in maintaining financial books, checking of numerical accuracy of the books

of accounts, preparation of trial balance, trading account, profit and loss account and balance

sheet. Hence, it is commonly said “Accountancy begins where Book-keeping ends”.

Auditing involves a detailed and critical examination and verification of accounts by an

independent and qualified person to ascertain the true and fair view of the financial position

of the concern. For example, after verification the auditor has to submit a report to the

management that the financial statement represents a true and fair view of the statement of

affairs of the business. Hence, it is said “Auditing begins where Accountancy ends”.

Auditing Notes by Manish Srivastava

13

The duty of an auditor with regard to the detection and prevention of fraud and error has

been a matter of discussion for a long time. It has been laid down by several legal decisions

and has been considered in many professional pronouncements. In this blog, we are going

to throw light on some of these decisions and discuss the meaning of the famous quote

“Auditor is a watchdog, not a bloodhound”.

THE LEGAL PERSPECTIVE ON “AUDITOR IS A WATCHDOG, NOT A BLOODHOUND”

In the last century, the way an auditor’s duty is perceived with regard to the detection and

prevention of fraud and error has undergone many changes. Initially, it was more to do with

the decision given in the Kingston Cotton Mills Co. case (1896). In that case, the learned

Judge Lopes categorically defined an auditor’s duty by stating that an auditor is a watchdog,

but not a bloodhound. Unless doubtful situations are there, the auditor is totally justified in

relying upon the management/employees of his client.

An auditor is not expected to act as a detective or approach his or her work with undue

suspicion or having preconceived notions in mind. He is not a bloodhound, but he is a

watchdog. This statement means the following:

In the case of a limited company, an auditor is appointed by the company’s

shareholders. He is expected to work on their behalf in the role of a watchdog and

should look after their best interests.

Unlike a bloodhound, the auditor’s main duty is towards verification of the client’s

books rather than detection. During the course of his audit, if he finds something

suspicious, he should extend his audit procedures to examine the matter in detail

and should communicate the same to the shareholders. However, in the absence of

any such suspicious circumstances, he is completely justified in relying upon the

representations made by the client’s staff and management. When it comes to fraud

and error, he has to exercise reasonable care only.

Auditing Notes by Manish Srivastava

14

Later, in the case of Westminster Road Construction and Engineering Co. (1932), it was

pointed out that an auditor should adopt necessary audit procedures to confirm the facts

stated through management representations. Hence, it broadened the scope of an auditor’s

duty with regard to the detection and prevention of fraud and error and provided stricter

norms to be followed while exercising reasonable care.

Further, in some other cases, this scope was all the more extended to include the auditor’s

accountability not only towards shareholders but also towards third parties provided that

his negligence is proved. This means that in case an auditor is found negligible and fails to

detect misstatements that he could have easily found had he exercised due care, he shall be

held accountable. Since auditors play a major role in enhancing the creditability of financial

statements, they are under societal pressure to take more responsibility for fraud detection.

Hence, for the first time in the case of Hedley Byrne & Co Ltd v Heller & Partners Ltd (1963),

the liability of auditors towards third parties was recognized. Also, a similar decision was

taken in Caparo’s case (1990) wherein the principle of the auditor’s duty towards third

parties was acknowledged in case he is found negligent to detect and prevent fraud and

error.

PROFESSIONAL PERSPECTIVE

SA 240 entitled “The Auditor’s Responsibility to Consider Fraud and Error in an Audit of

Financial Statements” gives guidance on what ought to be the responsibility of an auditor

for identifying fraud and error and reporting on them.

According to SA 240, an auditor conducts a financial audit of an entity in order to obtain a

reasonable assurance (and not absolute assurance) that its financials are free from any

fraud/error and material misstatements.

In addition, the auditor must approach the work with a certain degree of professional

skepticism. He must always be alert to any signs of misstatement. If there are any doubtful

situations, the auditor should extend his procedures to confirm or dispel that doubt.

When a misstatement is identified, the auditor has to evaluate whether such misstatement

is indicative of fraud or not. He has to also consider whether the representations given by

management in this regard are satisfactory or not. He should look for situations that may

indicate fraud involving management, employees, or third parties. The possibility of such

fraud and its implications for the audit must be evaluated well. However, it should be noted

that he is not responsible for the subsequent discovery of frauds as long as he undertakes

adequate audit procedures.

The auditor is liable for failure to detect fraud only when such failure is substantially due

to a lack of reasonable care and skill being exercised on his part.

Status of the auditor: “Auditor is a watchdog, not a bloodhound”

The point now arises as to what an auditor’s true status in a corporation is. Clearly, an

auditor has legal standing. To put it another way, a company auditor is a statutory auditor

Auditing Notes by Manish Srivastava

15

since he is appointed strictly according to the law’s regulations. The following principles

determine the status of an auditor in a company:

An agent: The auditor is an agent of the company’s members assigned to execute tasks

outlined in (a) the Companies Act, (b) the company’s Articles of Association, and (c) the

audit engagement between the auditor and the client.

Not an advisor: An auditor is not a company advisor. It is not his responsibility to advise the

board of directors or the shareholders.

Not a detective: An auditor is neither a detective nor a company employee. He (the auditor)

is a watchdog, not a bloodhound. He does not need to be overly suspicious in his work.

Not to discover frauds: It is not the auditor’s responsibility to uncover scams that have been

carefully planned and committed. He can rely on the honesty of the company’s employees,

who have a high level of trust in the organization.

Not to guarantee: The opinion of an auditor on the financial statements of the company

does not imply an inherent assurance of correctness of books of accounts.

An officer: Although an auditor is not an employee of a company, he is treated as an official

of the company under many provisions of the Companies Act.

Final thoughts

By combining the above legal and professional perspectives, it can be seen that the auditor’s

roles and responsibilities have been extended and made stricter over time. He is required to

maintain an attitude of professional skepticism at all times, should confirm the

representations made by management, and remain alert to any signs of misstatement.

Also, even though he is not needed to provide absolute assurance, it is his duty to exercise

all reasonable care to ensure that the financial statements are free from fraud. But unless

he has been negligent in his approach, he can’t be held liable for non-detection of

misstatements.

AUDIT PROCESS

INTRODUCTION

Audit process usually starts from the appointment of auditors until the issuance of the audit

report as shown in the audit process flowchart. As auditors, we usually need to follow many

audit steps before we can issue the audit report.

However, those audit steps can be categorized into the main stages of audit, including the

planning stage, audit evidence-gathering stage, and completion stage which is the final

stage of audit where we can issue the report.

Auditing Notes by Manish Srivastava

16

Audit Process Flowchart

Below is the audit process flowchart that shows an overview of auditing and the

main stages of audit.

Auditing Notes by Manish Srivastava

17

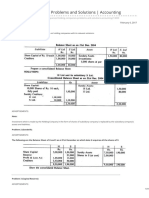

To make it easy we can make a summary which follows the audit process flowchart

above as in the table below:

Auditing Notes by Manish Srivastava

18

Summary of Audit Process

This is the first step in the audit process flowchart above where we, as

1. Appointment auditors, are appointed to perform the audit work on the client’s financial

statements.

After being appointed as auditors, we can start the initial planning of the

2. Plan the audit audit. This may include evaluating compliance and ethical matters as well as

forming appropriate audit team members.

This is where we obtain an understanding of the client’s business and

3. Understand controls environment. While obtaining an understanding of the client in this

client stage of audit process, we also need to identify any risks that the client’s

accounts expose to.

In this step of audit process flowchart, we assess the risk of material

misstatement that can occur on the client’s financial statements. This step

4. Risk

also includes how we respond to the assessed risk, e.g. we will perform the

assessment

test of controls or go directly to substantive audit procedures by ticking the

control risk as high.

This where we perform the test of controls to support our assessment of

internal controls. However, we only perform this type of test if we believe the

client’s internal controls can reduce the risk of material misstatement; and

5. Test of

we intend to rely on internal controls to reduce our substantive procedures.

controls

If we assess that the internal controls are ineffective, we will go directly to

substantive procedures.

This step of audit process flowchart is where we gather audit evidence by

6. Substantive

testing various audit assertions of the client’s accounts. Substantive audit

audit procedures

procedures include substantive analytical procedures and tests of details.

After we have obtained sufficient appropriate audit evidence, we will

7. Overall review perform an overall review of financial statements before we express our

of financial opinion. This is to see if the financial statement as a whole looks reasonable

statements and is in conjunction with the conclusion drawn from other audit evidence

obtained.

Auditing Notes by Manish Srivastava

19

This is the final audit process where we issue the audit report by giving our

opinion on financial statements. Usually, we give an unqualified or clean

opinion as most of the time the audit adjustment is usually made if there’s

8. Audit report

any material misstatement.

However, sometimes other audit opinions such as qualified opinion, adverse

opinion, or disclaimer of opinion may be given instead.

For the report of internal control weaknesses which shows in the audit process

flowchart, we do not include in this summary of audit process. This is due to this type

of report is not the audit report and it’s not the main objective of our audit.

Though, we will issue this report when we found that internal controls are ineffective

to prevent or detect material misstatement, either during the risk assessment or

after the test of controls. This way, it can add more value to the client as they can

make more improvements in the internal control to prevent or detect the risk of

error or fraud.

AUDIT PROGRAMME

MEANING

An audit programme is a detailed, written statement designed by the auditor

indicating the work to be performed by the audit assistants, specifying the time

limit for completion of work, instructions and guidance to the audit staff. In

short, it is a tool for planning, directing and controlling the audit work.

An audit programme is a detailed plan of the auditing work to be performed. It

specifies the procedures to be followed in the conduct of audit more efficiently.

The auditor outlines the whole procedure of audit from beginning till the

finalization of audit report. Audit programme is generally contained in the audit

notebook.

Definition

Prof. Meigs defines an audit programme as, “an audit programme is a detailed

plan of the auditing work to be performed, specifying the procedures to be

followed in verification of each item and the financial statements and giving the

estimated time required.”

Auditing Notes by Manish Srivastava

20

Features (or) Characteristics of an Audit Programme

The features of an audit programme may be of the following:

1. It is a set of procedures to be adopted to conduct the audit more

efficiently.

2. It is a written scheme designed by the auditor.

3. It is a blue print of the audit work.

4. It facilitates delegation of work, based on the capabilities of audit staff.

5. It acts as evidence in future for the audit work being performed.

6. It specifies the work to be done by the audit staff, the manner and time

limit for completion of the work.

Objectives of Audit Programme

The following are the objectives of audit programme:

1. To provide clear instructions to the audit assistants specifying the nature of

work to be performed and fixing the time span for completion of each work.

2. To facilitate coordination among various parts of audit work.

3. To ensure uniformity in the performance of audit work and to avoid

duplication and repetition of work.

4. To attain a fair allocation of work among audit team.

5. To fix responsibility and accountability of each audit assistant.

6. To serve as a guide for planning the audit work in future.

7. To serve as evidence in future showing the date of completion of audit work,

methods or procedures undertaken, persons involved in completion of audit work

etc.

Contents of an Audit Programme

The following are the details of an audit programme:

1. Name of the client.

2. Nature of operations and business of client.

3. Review of system of internal check.

4. Date of commencement of audit work.

5. Duration of audit work.

6. Accounting system followed in client organization.

7. Review the report of the previous auditor.

Auditing Notes by Manish Srivastava

21

8. Review the remarks, instructions or objections raised in the previous audit

report.

9. Examine the various ledger accounts and subsidiary books.

10. Examine the statutory books and registers, profit and loss account, and

balance sheet.

Advantages of an Audit Programme

An audit programme can give the following advantages:

1. Helps in Estimation and Division of Work: Audit Programme helps

in estimating the quantum of audit work in advance and also helps in dividing the

work among the audit assistants based on their capabilities.

2. Helps in Fixation of Responsibility: It enables to fix responsibility on the

audit assistants by clearly defining the scope of work.

3. Helps in Future Planning: Audit programme serves as a basis for planning

the audit work for subsequent year.

4. Serves as a Guide: It serves as a valuable guide for the audit staff in

execution of the audit work for succeeding years.

5. Valuable Evidence: It serves as evidence for the work done as initials of

those who have done the particular work are appended to it. The auditor can

produce the audit programme as a proof when a charge of negligence being

brought upon him.

6. Uniformity: It provides for uniformity in audit work as the same work will

be done every year.

7. Continuity: When an audit staff goes on leave others can continue the work

by referring to the audit programme, hence, audit programme provides for

continuity of work.

Auditing Notes by Manish Srivastava

22

8. Coordination: If facilitates coordination and helps in supervising the work

of the audit staff.

Disadvantages of an Audit Programme

The disadvantages that may be experienced by conducting audit as per

predetermined audit programme are -

1. Mechancial: When audit work is conducted mechanically every year based on

the audit programme, it causes monotony and boredom to the auditor and audit

staffs.

2. No Quality in Work: The audit staff will be more interested to complete the

work in time rather than to maintain any standard in the work.

3. Loss of Initiative: Audit staff cannot take their own decisions and they are

compelled to comply with the audit programme. Hence, an efficient audit clerk

loses his initiative and interest as he cannot make any suggestions.

4. Rigidity: A rigid and inflexible audit programme cannot be laid for all types

of business. During the course of audit, new areas to be verified may come to the

notice of the audit staff. Unless the audit programme is revised, such areas may

escape from auditing.

5. Shelter for Inefficient Staff: Inefficient audit staffs conceal their mistakes or

weakness on the basis of audit programme. Hence, it provides shelter for

inefficient audit staff.

6. Unsuitable: Pre-determined audit programme is not suitable for small

business organizations.

Auditing Notes by Manish Srivastava

23

Auditing Notes by Manish Srivastava

24

Auditing Notes by Manish Srivastava

25

Auditing Notes by Manish Srivastava

You might also like

- Unit 1 Auditing 6-1-1Document23 pagesUnit 1 Auditing 6-1-1Aditi SinghNo ratings yet

- 5th Sem I Unit Auditing PPT 1.pdf334Document26 pages5th Sem I Unit Auditing PPT 1.pdf334Asad RNo ratings yet

- CHAPTER 1 Audit IDocument18 pagesCHAPTER 1 Audit IEyuel SintayehuNo ratings yet

- BCOM 411 & Bcop 341 & BPLM 422 AUDITING NOTES (Verification)Document35 pagesBCOM 411 & Bcop 341 & BPLM 422 AUDITING NOTES (Verification)anzenzenelson7No ratings yet

- Chapter One AuditingDocument10 pagesChapter One AuditingMulugeta BerihunNo ratings yet

- Chapter 1Document10 pagesChapter 1vikings12345678900No ratings yet

- AuditDocument90 pagesAuditSailesh GoenkkaNo ratings yet

- Ipcc Auditing 4 Chapters PDFDocument56 pagesIpcc Auditing 4 Chapters PDFmounika100% (1)

- Introduction To AuditingDocument21 pagesIntroduction To AuditingKul ShresthaNo ratings yet

- Audit ch1 NotesDocument10 pagesAudit ch1 NotesAkash KamathNo ratings yet

- CH 1Document20 pagesCH 1lijeNo ratings yet

- Chapter No:-1 1.1: Introduction of Audit: Stakeholders Material Legal PersonDocument31 pagesChapter No:-1 1.1: Introduction of Audit: Stakeholders Material Legal PersonmadhuriNo ratings yet

- Auditing I-Chapter 1 MLCDocument13 pagesAuditing I-Chapter 1 MLCHilew TSegayeNo ratings yet

- Unit One Audit IDocument17 pagesUnit One Audit IAkkamaNo ratings yet

- Auditing BasicsDocument12 pagesAuditing BasicsBasappaSarkarNo ratings yet

- Advanced Accountancy: Shivaji University, KolhapurDocument99 pagesAdvanced Accountancy: Shivaji University, KolhapurEswari GkNo ratings yet

- Auditing PresentationDocument54 pagesAuditing PresentationMuzaFarNo ratings yet

- Nature of AuditingDocument21 pagesNature of AuditingSachin ChourasiyaNo ratings yet

- Auditing and Assurance by Ca Nitin Gupta PDFDocument25 pagesAuditing and Assurance by Ca Nitin Gupta PDFVijaya LaxmiNo ratings yet

- Chapter 1 Introduction To AuditingDocument64 pagesChapter 1 Introduction To Auditingshafiullah.omar2021No ratings yet

- Principles and Practice of Auditing IDocument14 pagesPrinciples and Practice of Auditing Iyebegashet100% (1)

- Unit 1 Overview of Audit FunctionDocument33 pagesUnit 1 Overview of Audit FunctionKaycia HyltonNo ratings yet

- An overview of auditing origins, types and objectivesDocument34 pagesAn overview of auditing origins, types and objectivesoliifan HundeNo ratings yet

- Auditing Teaching Material Edited OneDocument64 pagesAuditing Teaching Material Edited OneGetachew JoriyeNo ratings yet

- Study TYBCom Accountancy Auditing-IIDocument396 pagesStudy TYBCom Accountancy Auditing-IIRani Naik Dhuri100% (2)

- Project On Audit Committee: Origin and Evoluation of AuditingDocument20 pagesProject On Audit Committee: Origin and Evoluation of AuditingMukesh ManwaniNo ratings yet

- Introduction To AuditingDocument24 pagesIntroduction To AuditingVinayak SaxenaNo ratings yet

- Auditing Teaching MaterialDocument49 pagesAuditing Teaching MaterialGetachew JoriyeNo ratings yet

- Module IDocument22 pagesModule ImathewosNo ratings yet

- Practical AuditingDocument77 pagesPractical AuditingVijay KumarNo ratings yet

- Chapter - 1 Introduction of 1) Meaning of AuditingDocument31 pagesChapter - 1 Introduction of 1) Meaning of AuditingRajesh GuptaNo ratings yet

- Chapter-One: 1 Introduction - An Overview of Auditing 1.1 Historical Background of Auditing PracticesDocument76 pagesChapter-One: 1 Introduction - An Overview of Auditing 1.1 Historical Background of Auditing PracticesYohannes TesfayeNo ratings yet

- Public Sector Auditing ExplainedDocument17 pagesPublic Sector Auditing ExplainedhezronNo ratings yet

- Chapter 1 Overview of AuditingDocument28 pagesChapter 1 Overview of AuditingTesfaye DesalegnNo ratings yet

- Audit and Other Assurance ServicesDocument13 pagesAudit and Other Assurance ServicesRhn Habib RehmanNo ratings yet

- Jahangirnagar University (IBA-JU) : Institute of Business AdministrationDocument9 pagesJahangirnagar University (IBA-JU) : Institute of Business Administrationtabassum tasnim SinthyNo ratings yet

- Submitted To: Institute of Chartered Accountant of India: Submitted By: Sumit Arora REG. NO - NRO0210695Document23 pagesSubmitted To: Institute of Chartered Accountant of India: Submitted By: Sumit Arora REG. NO - NRO0210695Anshu LalitNo ratings yet

- ICA SUBMITTED PROJECT ON AUDITING FUNDAMENTALSDocument23 pagesICA SUBMITTED PROJECT ON AUDITING FUNDAMENTALSAnshu LalitNo ratings yet

- Simple Project On Audit of BankDocument31 pagesSimple Project On Audit of BankRonak SinghNo ratings yet

- Advanced Audit Course OverviewDocument66 pagesAdvanced Audit Course OverviewAgatNo ratings yet

- Year Unit I Introduction To Auditing Meaning and Definition of AuditingDocument53 pagesYear Unit I Introduction To Auditing Meaning and Definition of AuditingTimothy KambuniNo ratings yet

- Final Project On Audit of BankDocument39 pagesFinal Project On Audit of BankVaibhav MohiteNo ratings yet

- Audit Techniques and ProceduresDocument119 pagesAudit Techniques and Procedures04beingsammyNo ratings yet

- UntitledDocument25 pagesUntitledSakshi YadavNo ratings yet

- Audit of BankDocument37 pagesAudit of BankDaniel ShettyNo ratings yet

- Rohit Yadav 55Document7 pagesRohit Yadav 55Sameer ChoudharyNo ratings yet

- Auditing Notes-Merged-CompressedDocument69 pagesAuditing Notes-Merged-CompressedComeNo ratings yet

- Index: Audit of BankDocument63 pagesIndex: Audit of Bankritesh shrinewarNo ratings yet

- Cma Inter Audit - Marathon Notes Relevant For June and Dec 23Document64 pagesCma Inter Audit - Marathon Notes Relevant For June and Dec 23Sarfaraz ShaikhNo ratings yet

- Infolink College Auditing Course OverviewDocument85 pagesInfolink College Auditing Course OverviewSamuel DebebeNo ratings yet

- Advanced Accountancy: Shivaji University, KolhapurDocument101 pagesAdvanced Accountancy: Shivaji University, KolhapurptgoNo ratings yet

- Dividend PDFDocument101 pagesDividend PDFneeraj goyalNo ratings yet

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"From Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"No ratings yet

- Annual Update and Practice Issues for Preparation, Compilation, and Review EngagementsFrom EverandAnnual Update and Practice Issues for Preparation, Compilation, and Review EngagementsNo ratings yet

- Engagement Essentials: Preparation, Compilation, and Review of Financial StatementsFrom EverandEngagement Essentials: Preparation, Compilation, and Review of Financial StatementsNo ratings yet

- Audit Risk Alert: General Accounting and Auditing Developments, 2017/18From EverandAudit Risk Alert: General Accounting and Auditing Developments, 2017/18No ratings yet

- Assignment Nishtha Ent 2Document1 pageAssignment Nishtha Ent 2Aditi SinghNo ratings yet

- Unit 3 AuditingDocument17 pagesUnit 3 AuditingAditi SinghNo ratings yet

- Adobe Scan 01 Apr 2023Document1 pageAdobe Scan 01 Apr 2023Aditi SinghNo ratings yet

- Assignment Nishtha Ent 2Document1 pageAssignment Nishtha Ent 2Aditi SinghNo ratings yet

- Itm School of ManagementDocument110 pagesItm School of ManagementAditi SinghNo ratings yet

- Admit CardDocument2 pagesAdmit CardAditi SinghNo ratings yet

- Assignment Nishtha EthicsDocument1 pageAssignment Nishtha EthicsAditi SinghNo ratings yet

- CertiDocument2 pagesCertiAditi SinghNo ratings yet

- Assignment Nishtha EthicsDocument1 pageAssignment Nishtha EthicsAditi SinghNo ratings yet

- Itm School of ManagementDocument110 pagesItm School of ManagementAditi SinghNo ratings yet

- CertiDocument2 pagesCertiAditi SinghNo ratings yet

- Book 1Document1 pageBook 1Aditi SinghNo ratings yet

- Chapter - 5 (Book Work)Document3 pagesChapter - 5 (Book Work)Aditi SinghNo ratings yet

- CH 6 2836.p65Document2 pagesCH 6 2836.p65Aditi SinghNo ratings yet

- Emerging Tech Transforming BankingDocument44 pagesEmerging Tech Transforming BankingAditi SinghNo ratings yet

- Adobe Scan 17 Aug 2022Document1 pageAdobe Scan 17 Aug 2022Aditi SinghNo ratings yet

- CH 4 2832.p65Document2 pagesCH 4 2832.p65Aditi SinghNo ratings yet

- Assignment Nishtha Industrial LawDocument2 pagesAssignment Nishtha Industrial LawAditi SinghNo ratings yet

- CalcDocument35 pagesCalcAditi SinghNo ratings yet

- CH 6 2838.p65Document2 pagesCH 6 2838.p65Aditi SinghNo ratings yet

- CH 6 2834.p65Document2 pagesCH 6 2834.p65Aditi SinghNo ratings yet

- Tally ERP9Document45 pagesTally ERP9Aditi SinghNo ratings yet

- Examination Session 2020-21: Exam Form # Verification #Document2 pagesExamination Session 2020-21: Exam Form # Verification #Aditi SinghNo ratings yet

- CH 4 2831.p65Document2 pagesCH 4 2831.p65Aditi SinghNo ratings yet

- Aditi Singh's Digital Unlocke CourseDocument1 pageAditi Singh's Digital Unlocke CourseAditi SinghNo ratings yet

- Career Edge - Knockdown The LockdownDocument1 pageCareer Edge - Knockdown The LockdownSourav SahuNo ratings yet

- PD 1752-Amending The Act Creating The HDMF PDFDocument6 pagesPD 1752-Amending The Act Creating The HDMF PDFMousy GamalloNo ratings yet

- AICPA Released Questions AUD 2015 DifficultDocument26 pagesAICPA Released Questions AUD 2015 DifficultTavan ShethNo ratings yet

- Q&A - Exit Test For Cost ManagementDocument4 pagesQ&A - Exit Test For Cost Managementapi-3738465No ratings yet

- Finance Student Resume Highlighting Education, Experience, SkillsDocument1 pageFinance Student Resume Highlighting Education, Experience, SkillsNguyễn SinhNo ratings yet

- Bab 14 15 Manajemen ProyekDocument18 pagesBab 14 15 Manajemen ProyekWening WilantariNo ratings yet

- NCE - Specimen Audit Report March 2020Document4 pagesNCE - Specimen Audit Report March 2020damancaNo ratings yet

- AOM No. 1 Derecognized PPEDocument4 pagesAOM No. 1 Derecognized PPEKean Fernand BocaboNo ratings yet

- 2019 June 23 ACT 701 Chapter 3 Problems and SolutionDocument21 pages2019 June 23 ACT 701 Chapter 3 Problems and SolutionZisanNo ratings yet

- Case Study of Satyam Fiasco Causes, Lessons and Actions To Be TakenDocument6 pagesCase Study of Satyam Fiasco Causes, Lessons and Actions To Be Takenpentium447No ratings yet

- Auditing and Assurance Services: Seventeenth Edition, Global EditionDocument37 pagesAuditing and Assurance Services: Seventeenth Edition, Global Edition賴宥禎100% (1)

- Debtors SystemDocument4 pagesDebtors SystemRohit ShrivastavNo ratings yet

- Task List: Pay Roll AdministrationDocument2 pagesTask List: Pay Roll AdministrationNipun ChathurangaNo ratings yet

- Nidhish Raju Resume New UpdateDocument3 pagesNidhish Raju Resume New UpdateCma Nidhish RajuNo ratings yet

- IATF - International Automotive Task Force: Rules For Achieving and Maintaining IATF Recognition IATF Rules 5 EditionDocument22 pagesIATF - International Automotive Task Force: Rules For Achieving and Maintaining IATF Recognition IATF Rules 5 Editionviveknarula295382No ratings yet

- 2009 Revised Rules of Procedure of The CoaDocument21 pages2009 Revised Rules of Procedure of The Coaedzn55100% (3)

- Wilderness Travel Service financial statementsDocument1 pageWilderness Travel Service financial statementscons theNo ratings yet

- Union Cement Holdings Corp. v. Commissioner of Internal Revenue, C.T.A. Case No. 6799, (July 12, 2010)Document11 pagesUnion Cement Holdings Corp. v. Commissioner of Internal Revenue, C.T.A. Case No. 6799, (July 12, 2010)Kriszan ManiponNo ratings yet

- Basic Elements of The Auditor's ReportDocument5 pagesBasic Elements of The Auditor's ReportRichie BoomaNo ratings yet

- Session 1 - Ms Hansha MishraDocument31 pagesSession 1 - Ms Hansha MishrafreddyNo ratings yet

- ACCA Marking Insight Mock Exam 2018 - Annotated Example Answer CDocument10 pagesACCA Marking Insight Mock Exam 2018 - Annotated Example Answer CQasim RaoNo ratings yet

- Audit Case StudiesDocument18 pagesAudit Case StudiesAanand ALNo ratings yet

- Holding Companies Problems and Solutions AccountingDocument11 pagesHolding Companies Problems and Solutions AccountingGenarul IslamNo ratings yet

- Budget process key to local government control and coordinationDocument5 pagesBudget process key to local government control and coordinationanthonyNo ratings yet

- University of Economics Faculty of Accounting AUD2001 Principles of AuditingDocument34 pagesUniversity of Economics Faculty of Accounting AUD2001 Principles of AuditingThị Hải Yến TrầnNo ratings yet

- SLM-Unit 04Document27 pagesSLM-Unit 04Margabandhu NarasimhanNo ratings yet

- IP Due Diligence: Assessing Value and RisksDocument2 pagesIP Due Diligence: Assessing Value and RisksRenu GothwalNo ratings yet

- CVDocument3 pagesCVShallainee Marie CasilNo ratings yet

- The Role of Internal Control in Ghana's Public Healthcare SectorDocument55 pagesThe Role of Internal Control in Ghana's Public Healthcare SectorAKINWUMI JOHNNo ratings yet

- BIR Provides "Rich Broth" For CorruptionDocument4 pagesBIR Provides "Rich Broth" For Corruptionrico mangawiliNo ratings yet

- Materi Lab 6 - Audit of The Inventory and Warehousing CycleDocument30 pagesMateri Lab 6 - Audit of The Inventory and Warehousing CycleMuflikh ZenithNo ratings yet