Professional Documents

Culture Documents

A7 Bela

Uploaded by

Trishia Mae Bela0 ratings0% found this document useful (0 votes)

18 views4 pagesCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

18 views4 pagesA7 Bela

Uploaded by

Trishia Mae BelaCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 4

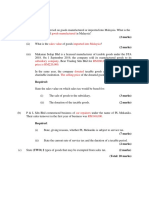

NAME: Bela, Trishia Mae Q.

SECTION: BSA-B126

Activity 7

ABC Company’s financial information is presented below:

Cash on hand 100,000.00 Unearned service revenue 105,000.00

Cash in bank 280,000.00 Short-term BDO payable 60,000.00

Petty cash fund 40,000.00 Notes payable due 8 months 50,000.00

Travel fund 35,000.00 Current portion of BPI long-term payable 60,000.00

Building 400,000.00 Income tax payable 30,000.00

Short-term investment 125,000.00 Notes payable due 18 months 100,000.00

Accounts receivable 325,000.00 Noncurrent portion of BPI long-term payable 540,000.00

Trade notes receivable 100,000.00 Mortgage payable 400,000.00

Short-term notes receivable 150,000.00 Deferred tax payable 65,000.00

Interest receivable 15,000.00 Capital ?

Commission receivable 35,000.00 Service Revenue 2,340,000.00

Office supplies 10,000.00 Commission income 345,000.00

Prepaid rent 60,000.00 investment income 130,000.00

Prepaid insurance 48,000.00 interest income 45,000.00

Land 200,000.00 Advertising expense 100,000.00

Cash equivalents 150,000.00 Traveling expense 85,000.00

Interest fund 20,000.00 Office supplies expense 30,000.00

Office equipment 245,000.00 Office depreciation expense 60,000.00

Office furniture and fixtures 145,000.00 Office utilities expense 216,000.00

Motor vehicle 600,000.00 Office rent expense 720,000.00

Trade mark 20,000.00 Contribution to charity 100,000.00

Computer software 105,000.00 Accounting fees 105,000.00

Long-term investment 400,000.00 Legal fees 235,000.00

Cash surrender value 220,000.00 Loss due to theft 55,000.00

Long-term notes receivable 400,000.00 Loss on sale of investment 230,000.00

Accounts payable 146,200.00 Income tax expense 277,200.00

Trade notes payable 125,000.00 Interest payable 10,000.00

Requirement: Compute the following

1. Cash and Cash equivalents

2. Trade and other receivables

3. Prepaid expense

4. Total current assets

5. Property and equipment

6. Intangible assets

7. Long-term investment

8. Total noncurrent assets

9. Total assets

10. Trade and other payables

11. Total current liabilities

12. Total noncurrent liabilities

13. Total liabilities

14. Income from operating activity

15. Income from non-operating activity

16. Total income

17. Selling expense

18. Administrative expense

19. Other expenses

20. Total expenses

21. Total Equity

22. Capital

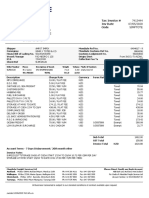

ANSWERS: 6. Intangible Assets

1. Cash and Cash equivalents Trademark 20,000

Cash on hand 100,000.00 Computer software 105,000

Cash in bank 280,000.00 Total 125,000

Petty cash 40,000.00 7. Long term Investments

fund

Travel fund 35,000.00 Long term 400,000

Cash 150,000.00 Investments

Equivalents Cash Surrender value 220,000

TOTAL 605,000.00 Total 660,000

2. Trade and other receivable 8. Total Noncurrent assets

Property & equip. 1,600,000

Accounts Intangible assets 125,000

receivable 325,000.00 Long term 660,000

Trade notes investments

receivable 100,000.00 Long term 400,000

Short-term notes receivable

receivable 150,000.00 Total 2,785,000

Interest 9. Total assets

receivable 15,000.00

Commission Current Assets 1,263,000

receivable 35,000.00 Noncurrent assets 2,875,000

Unearned service 105,000.00 Total 4,138,000

Revenue 10. Trade and Other Payables

TOTAL 405,000.00

3. Prepaid Expense Accounts payable 146,200.00

Prepaid rent 60,000.00 trade notes payable 125, 000

Prepaid insurance 48,000.00 Notes payable due 50,000.00

8 months

Interest fund 20, 000.00

TOTAL 128, 000.00 Unearned service 105,000.00

4. Total Current assets revenue

Cash 605,000

total 426,200

Trade and other 405,000

receivable 11. Total Current Liabilities

Financial asset 125, 000

Prepaid rent 128,000 Property and equip 426,200

Total 1,263,000 Short-term BDO 60,000.00

5. Property and equipment payable

Notes payable due 50,000.00

Land 200,000.00 8 months

Building 400,000.00 Interest payable 10,000

Office supplies 10,000.00 Total 546,200

Office equipment 245,000.00 12. Total Noncurrent Liabilities

furniture and 145,000.00

fixtures Notes payable due 100,000.00

Motor vehicle 600,000.00 18 months

TOTAL 1,600,000

Noncurrent portion 540,000.00 Office utilities 216,000.00

of BPI long-term expense

payable Office rent expense 720,000.00

Total 640,000 Total 1,026,000

13. Total Liabilities 19. Other expense

Property and equip 426,200 Contribution to 100,000.00

Short-term BDO 60,000.00 charity

payable Accounting fees 105,000.00

Notes payable due 50,000.00 Legal fees 235,000.00

8 months Loss due to theft 55,000.00

Interest payable 10,000 Loss on sale of 230,000.00

Notes payable due 100,000.00 investment

18 months Total 725,000

Noncurrent portion 540,000.00 20. Total Expenses

of BPI long-term

payable Selling expense 462,200

Total 1,186,000 Administrative 1,026,000

14. Income From Operating Expense expense

Other expense 725,000

Service Revenue 2,340,000.00 Total 2,213,200

Commission 345,000.00 21. Total Equity

income

Total 2,685,000 Equity= Assets + Liability

15. Income from non-operating expense

E= 4,138,000 + 1,186,000

investment income 130,000.00 E = 5,324,000

interest income 45,000.00

total 175,000 22. Capital

16. Total income

Capital= Equity – income + expense

Income from 2,685,000

operating expense C= 5,324,000 -2,860,000 + 2,213,200

Income from non- 175,000 C= 4,677,000

operating expense

Total 2,860,000

17. Selling expense

Traveling expense 85,000.00

Advertising 100,000.00

expense

Income tax 277, 200

Expense

Total 462,200

18. Administrative Expense

Office supplies 30,000.00

expense

Office depreciation 60,000.00

expense

You might also like

- Freight Trucking Business Plan ExampleDocument35 pagesFreight Trucking Business Plan Exampleanang WahjudiNo ratings yet

- Project ReportDocument23 pagesProject ReportAndrew PottsNo ratings yet

- Your Bofa Core Checking: Account SummaryDocument8 pagesYour Bofa Core Checking: Account SummaryArgenis Del Jesus VillalbaNo ratings yet

- UAE Imports and Exports Guide PDFDocument55 pagesUAE Imports and Exports Guide PDFImpex BookNo ratings yet

- Detailed Investment PlanDocument6 pagesDetailed Investment Planabubakr zulfiqar57% (7)

- Myanmar Link invoice for 15 Mbps internet planDocument1 pageMyanmar Link invoice for 15 Mbps internet planAye Min TunNo ratings yet

- Sales Contract: The Seller: Shanghai Prema International Trade Co.,LtdDocument4 pagesSales Contract: The Seller: Shanghai Prema International Trade Co.,LtdThúy NguyễnNo ratings yet

- L4 05 Purchasing ContextsDocument166 pagesL4 05 Purchasing ContextsukalNo ratings yet

- ABC Company Financial AnalysisDocument5 pagesABC Company Financial AnalysisRenzyl NolascoNo ratings yet

- UntitledDocument3 pagesUntitledClay MaaliwNo ratings yet

- Module 2 - Financial StatementsDocument6 pagesModule 2 - Financial Statementskemifawole13No ratings yet

- Bhieee Company Statement of Financial Position 31-Dec-19Document6 pagesBhieee Company Statement of Financial Position 31-Dec-19Ace ClarkNo ratings yet

- Buscom SeatworkDocument3 pagesBuscom SeatworkTintin AquinoNo ratings yet

- Financial Ratio QuizDocument1 pageFinancial Ratio QuizMylene SantiagoNo ratings yet

- I Can Make It Corp financial performance 2020 vs 2019Document3 pagesI Can Make It Corp financial performance 2020 vs 2019Evan MiñozaNo ratings yet

- Case StudyDocument2 pagesCase Studyの変化 ナザレNo ratings yet

- Financial StatementDocument18 pagesFinancial StatementhamdanNo ratings yet

- Activity6 1Document3 pagesActivity6 1Prince ArañasNo ratings yet

- Problem 1Document4 pagesProblem 1Rio De LeonNo ratings yet

- Net Cash Flows From Operating ActivitiesDocument7 pagesNet Cash Flows From Operating ActivitiesShaneNiñaQuiñonezNo ratings yet

- SME Financial StatementsDocument15 pagesSME Financial StatementsJatha JamolodNo ratings yet

- Financial Statement Analysis AssignmentDocument48 pagesFinancial Statement Analysis Assignmentabhishek.rp997No ratings yet

- Presentation of Properly Classified FSDocument9 pagesPresentation of Properly Classified FSpapa1No ratings yet

- Sample Problems Cash Flow AnalysisDocument2 pagesSample Problems Cash Flow AnalysisTeresa AlbertoNo ratings yet

- HO#2 Aug14 SFPDocument8 pagesHO#2 Aug14 SFPMakoy BixenmanNo ratings yet

- Prepare Profit & Loss Account and Balance Sheet With The Help of Information Given in The Trial BalanceDocument4 pagesPrepare Profit & Loss Account and Balance Sheet With The Help of Information Given in The Trial BalanceEntertainment StatusNo ratings yet

- Problem 1: True or FalseDocument8 pagesProblem 1: True or Falsenatalie clyde matesNo ratings yet

- FAR1 SolutionsDocument8 pagesFAR1 SolutionsJoebin Corporal LopezNo ratings yet

- Financial StatementsDocument5 pagesFinancial StatementsCA AlmazanNo ratings yet

- Financial Position PretestDocument4 pagesFinancial Position PretestGina DiwagNo ratings yet

- 5.2. Unit 5 AAB AP A2 Report SunDocument5 pages5.2. Unit 5 AAB AP A2 Report SunHằng Nguyễn ThuNo ratings yet

- Course Folder Fall 2022Document26 pagesCourse Folder Fall 2022Areeba QureshiNo ratings yet

- Lobrigas - Week6 Ia3Document18 pagesLobrigas - Week6 Ia3Hensel SevillaNo ratings yet

- Cash Flow QuestionsDocument6 pagesCash Flow QuestionsBhakti GhodkeNo ratings yet

- Ce Quiz II (A+b+c)Document3 pagesCe Quiz II (A+b+c)Mohaiminur ArponNo ratings yet

- CONFRA2Document5 pagesCONFRA2Pia ChanNo ratings yet

- 8447809Document11 pages8447809blackghostNo ratings yet

- TF 00000053Document2 pagesTF 00000053api-355983822No ratings yet

- Camille ManufacturingDocument4 pagesCamille ManufacturingChristina StephensonNo ratings yet

- Total Project Cost Fixed Assets/ Capital InvestmentsDocument8 pagesTotal Project Cost Fixed Assets/ Capital InvestmentsLorna BacligNo ratings yet

- Budget CotchieDocument17 pagesBudget CotchieDuaaaaNo ratings yet

- Business Finance SamplesDocument2 pagesBusiness Finance SamplesjoeromesantosNo ratings yet

- FlyByU AG Balance Sheet and Profit and Loss StatementDocument1 pageFlyByU AG Balance Sheet and Profit and Loss StatementChiara AnindaNo ratings yet

- Case StudyDocument22 pagesCase StudyM Zain Ul AbedeenNo ratings yet

- Peoria COperation - Cash Flow StatementDocument8 pagesPeoria COperation - Cash Flow StatementcbarajNo ratings yet

- CFAB - Accounting - QB - Chapter 13Document14 pagesCFAB - Accounting - QB - Chapter 13Huy NguyenNo ratings yet

- Entity ADocument4 pagesEntity Ataeyung kimNo ratings yet

- Copia de Economatica Apple 2Document12 pagesCopia de Economatica Apple 2Juan o Ortiz aNo ratings yet

- Cash Flow Statement-ExampleDocument18 pagesCash Flow Statement-ExampleAnakha RadhakrishnanNo ratings yet

- Amount REVENUE From Sales (-) COGS Total Revenue Expenses Direct CostsDocument6 pagesAmount REVENUE From Sales (-) COGS Total Revenue Expenses Direct CostsGurucharan BhatNo ratings yet

- Act 1 Simple Company (SFP)Document3 pagesAct 1 Simple Company (SFP)Reginald MundoNo ratings yet

- Far (Semestral Project)Document5 pagesFar (Semestral Project)Diana Rose RioNo ratings yet

- Far01 - The Financial Statements PresentationDocument10 pagesFar01 - The Financial Statements PresentationRNo ratings yet

- Illustrative Full Set of IFRS For SME Financial StatementsDocument16 pagesIllustrative Full Set of IFRS For SME Financial StatementsGirma NegashNo ratings yet

- Income Statement of Apple IncDocument6 pagesIncome Statement of Apple IncBharat PanthiNo ratings yet

- FS Group 2Document5 pagesFS Group 2Ge-Ann BonuanNo ratings yet

- Financial Management July 18, 2021Document7 pagesFinancial Management July 18, 2021Bhie JaneeNo ratings yet

- Sample of Business Plan For Automotive (A Navalta)Document5 pagesSample of Business Plan For Automotive (A Navalta)Alliver SapitulaNo ratings yet

- ABC FOOD CO., LTD Income Statement: Adjustment EntriesDocument11 pagesABC FOOD CO., LTD Income Statement: Adjustment EntriesPham Huyen MyNo ratings yet

- Intl Business Machines Corp ComDocument6 pagesIntl Business Machines Corp Comluisa Fernanda PeñaNo ratings yet

- Intl Business Machines Corp ComDocument6 pagesIntl Business Machines Corp Comluisa Fernanda PeñaNo ratings yet

- ABE Company 2021 Year-End Financial BalancesDocument4 pagesABE Company 2021 Year-End Financial Balancesangeline bulacanNo ratings yet

- A1 FS PreparationDocument1 pageA1 FS PreparationJudith DurensNo ratings yet

- ARM Corp Statement of Cash FlowsDocument2 pagesARM Corp Statement of Cash FlowsJeasmine Andrea Diane PayumoNo ratings yet

- Cash Flow AnalysisDocument4 pagesCash Flow AnalysisMargin Pason RanjoNo ratings yet

- Cash Flow Statement QuestionDocument5 pagesCash Flow Statement QuestionsatyaNo ratings yet

- DRACARYS INC. Statement of Financial PositionDocument8 pagesDRACARYS INC. Statement of Financial PositionCaryl Joyce OmboyNo ratings yet

- International Business Law 6th Edition August Test BankDocument21 pagesInternational Business Law 6th Edition August Test Bankchristabeldienj30da100% (33)

- Two Column Cash BookDocument24 pagesTwo Column Cash BookDarshans dadNo ratings yet

- Singapore's Vulnerability to External Economic ShocksDocument11 pagesSingapore's Vulnerability to External Economic ShocksMax KewNo ratings yet

- Dissolution Changes in OwnershipDocument29 pagesDissolution Changes in OwnershipKenaniah SanchezNo ratings yet

- Global Business Environment Unit 1Document18 pagesGlobal Business Environment Unit 1deep gargNo ratings yet

- 03 Module ABM502Document9 pages03 Module ABM502Leodian Diadem MercurioNo ratings yet

- Brief On Basics of International TradeDocument22 pagesBrief On Basics of International Tradeapi-37270900% (1)

- Import Export DivisionDocument5 pagesImport Export DivisionSanskar TiwariNo ratings yet

- MCQs On Taxation LawDocument18 pagesMCQs On Taxation LawAli Asghar RindNo ratings yet

- Microeconomics AeroDocument4 pagesMicroeconomics AeroDiestro Lyka Mae L.No ratings yet

- Tutorial Question - Sales - Service Tax 1Document5 pagesTutorial Question - Sales - Service Tax 1Braham Rahul Ram JamnadasNo ratings yet

- Eou FTZ EpzDocument18 pagesEou FTZ EpzNaveen Kumar0% (1)

- EconomicsDocument157 pagesEconomicsportableawesomeNo ratings yet

- Gbe A1.1Document23 pagesGbe A1.1Đại NghĩaNo ratings yet

- Commercial History of DhakaDocument664 pagesCommercial History of DhakaNausheen Ahmed Noba100% (1)

- Is GMA 7 UnderleveragedDocument7 pagesIs GMA 7 UnderleveragedRalph Julius VillanuevaNo ratings yet

- Characteristics of monetary standardsDocument8 pagesCharacteristics of monetary standardsMarlyn T. EscabarteNo ratings yet

- Down With DumpingDocument2 pagesDown With DumpingRAY NICOLE MALINGINo ratings yet

- Capital Investment Ashok Sahakari Sakhar KarkhanaDocument59 pagesCapital Investment Ashok Sahakari Sakhar Karkhanaakshaykhade9834No ratings yet

- Government Budget NotesDocument25 pagesGovernment Budget NotesShivam MutkuleNo ratings yet

- AQS - Accounting Questions For StudentsDocument325 pagesAQS - Accounting Questions For StudentsMasego phologoloNo ratings yet

- Simply Totes & Co 11 Blaenavon Lane Halswell Christchurch: Inv Date Code Tax Invoice #Document1 pageSimply Totes & Co 11 Blaenavon Lane Halswell Christchurch: Inv Date Code Tax Invoice #Mary Anne JamisolaNo ratings yet