Professional Documents

Culture Documents

Test Bank Questions Chapter 3 2019 2022

Uploaded by

Ngọc DungCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Test Bank Questions Chapter 3 2019 2022

Uploaded by

Ngọc DungCopyright:

Available Formats

lOMoARcPSD|14067412

Test bank questions Chapter 3 2019-2022

Econometrics (Trường Đại học Kinh tế Thành phố Hồ Chí Minh)

Studocu is not sponsored or endorsed by any college or university

Downloaded by Ng?c Dung (ngdung0910@gmail.com)

lOMoARcPSD|14067412

Multiple Choice Test Bank Questions No Feedback – Chapter 3

Correct answers denoted by an asterisk.

1. Regression is concerned with describing and evaluating the relationship between

(a) A dependent variable and regressands

(b) An independent variable and regressors

(c)* A dependent variable and regressors

(d) An effect variable and explained variables.

2. What does a positive linear relationship between x and y in a simple regression

imply?

(a) Increases in the independent variable are usually accompanied by increases in the

regressor

(b) The relationship between x and y cannot be explained by a straight line

(c) Decreases in the independent variable is usually accompanied by increases in the

regressors

(d)* Increases in the regressor are usually accompanied by increases in the dependent

variable.

3. Which of these is NOT a reason for adding a disturbance term to a regression

model yt xt ut ?

(a) Some determinants of the effect variable may be omitted from the model

(b) Some determinants of the effect variable may be unobservable

(c)* Some determinants of the independent variable may be omitted from the model

(d) There may be errors in the way that the dependent variable is measured which

cannot be modelled.

4. Which of these is not a standard method for estimating econometric models?

(a) Ordinary least squares

(b) The method of moments

(c)* Method of generalised squared moments

(d) Maximum likelihood.

5. The method of estimating econometric models which involves fitting a line to the

data by minimising the sum of squared residuals is the

(a)* Method of ordinary least squares

(b) Method of moments

(c) Method of generalised squared moments

(d) Method of maximum likelihood.

Downloaded by Ng?c Dung (ngdung0910@gmail.com)

lOMoARcPSD|14067412

6. Suppose you have 5-year annual data on the excess returns on a fund manager’s

portfolio (‘fund ABC’) and the excess returns on a market index (where rABC is the

return on fund ABC, rf is the risk-free rate and rM is the return on the market index):

Year t Excess return on fund ABC Excess return on market index

rABC ,t rf ,t rM ,t rf ,t

1 14.0 16.0

2 32.0 21.7

3 11.6 6.0

4 21.2 16.2

5 17.4 11.0

What is the estimated alpha ( ̂ ) for Fund ABC?

(a) 2.3

(b)* 3.3

(c) 4.3

(d) 5.3.

7. Given the data in Question 6, what is the estimated beta ( ̂ ) of Fund ABC?

(a) 3.1

(b) 2.1

(c)* 1.1

(d) None of the above.

8. Suppose that the unbiased estimator of the standard deviation of the disturbance (s)

is 5.1. What is the nearest value to the standard errors of the estimated CAPM alpha (

̂ ) of Fund ABC from Question 6?

(a) 3.5

(b) 4.5

(c) 5.5

(d)* 6.5.

9. The estimated alpha ( ̂ ) and beta ( ̂ ) of a rival fund, Fund DEF, are 2.3 and 3.1,

respectively. If the expected market risk premium is 12%, what would we expect the

excess return of Fund DEF to be?

(a)* 39.5%

(b) 30.7%

(c) 5.4%

(d) 64.8%.

10. What is the most appropriate interpretation of the assumption cov ui , u j 0

concerning the regression disturbance terms?

(a) The errors are nonlinearly independent of one another

(b) The errors are linearly dependent of one another

(c) The covariance of the errors is constant and finite over all its values

(d)* The errors are linearly independent of one another.

Downloaded by Ng?c Dung (ngdung0910@gmail.com)

lOMoARcPSD|14067412

11. The estimators ̂ and ̂ determined by OLS will be the Best Linear Unbiased

Estimators (BLUE) if which of the following assumptions hold?

(I) The errors have zero mean

(II) The variance of the errors is constant and finite over all values of the independent

variable(s)

(III) The errors are linearly independent of one another

(IV)There is no relationship between the error and corresponding independent

variables

(a) I and II only

(b) I, II and III only

(c) II, III and IV only

(d)* I, II, III, and IV.

12. Standard errors

(a) Give us an idea of the deviation of the errors from their mean

(b) Measure the reliability of the independent variables

(c)* Give us an idea of the precision of estimates of and

(d) Measure the reliability of the dependent variables.

Suppose you have calculated the following regression results:

yˆ t 1.25 0.64 xt . The standard errors of ̂ and ˆ are 1.22 and 0.58, respectively.

13. Using the test of significance approach, what is the test statistic value of a

hypothesis to test whether the true value of statistically different from zero?

(a)* 1.10

(b) 0.91

(c) –0.62

(d) Cannot say without more information.

14. Assuming there are 1000 observations in your sample, what are the test statistic

and critical value of a two-sided hypothesis test of whether the true value of

statistically different from zero be given a 5% significance level?

(a)* 1.10 and 1.96, respectively

(b) 0.91 and 1.65, respectively

(c) –0.62 and 1.96, respectively

(d) Cannot say without more information.

15. Consider a bivariate regression model with coefficient standard errors calculated

using the usual formulae. Which of the following statements is/are correct regarding

the standard error estimator for the slope coefficient?

(i) It varies positively with the square root of the residual variance (s)

(ii) It varies positively with the spread of X about its mean value

(iii) It varies positively with the spread of X about zero

(iv) It varies positively with the sample size T

(a) * (i) only

(b) (i) and (iv) only

(c) (i), (ii) and (iv) only

(d) (i), (ii), (iii) and (iv).

Downloaded by Ng?c Dung (ngdung0910@gmail.com)

lOMoARcPSD|14067412

16. In a time-series regression of the excess return of a mutual fund on a constant and

the excess return on a market index, which of the following statements should be true

for the fund manager to be considered to have ‘beaten the market’ in a statistical

sense?

(a) * The estimate for should be positive and statistically significant

(b) The estimate for should be positive and statistically significantly greater than

the risk-free rate of return

(c) The estimate for should be positive and statistically significant

(d) The estimate for should be negative and statistically significant.

17. What result is proved by the Gauss–Markov theorem?

(a) That OLS gives unbiased coefficient estimates

(b) That OLS gives minimum variance coefficient estimates

(c) * That OLS gives minimum variance coefficient estimates only among the class of

linear unbiased estimators

(d) That OLS ensures that the errors are distributed normally.

18. The type I error associated with testing a hypothesis is equal to

(a) One minus the type II error

(b) The confidence level

(c) * The size of the test

(d) The size of the sample.

19. Which of the following is a correct interpretation of a ‘95% confidence interval’

for a regression parameter?

(a) * We are 95% sure that the interval contains the true value of the parameter

(b) We are 95% sure that our estimate of the coefficient is correct

(c) We are 95% sure that the interval contains our estimate of the coefficient

(d) In repeated samples, we would derive the same estimate for the coefficient 95% of

the time.

20. Which of the following statements is correct concerning the conditions required

for OLS to be a usable estimation technique?

(a) * The model must be linear in the parameters

(b) The model must be linear in the variables

(c) The model must be linear in the variables and the parameters

(d) The model must be linear in the residuals.

21. Which of the following is NOT a good reason for including a disturbance term in

a regression equation?

(a) It captures omitted determinants of the dependent variable

(b) * To allow for the non-zero mean of the dependent variable

(c) To allow for errors in the measurement of the dependent variable

(d) To allow for random influences on the dependent variable.

Downloaded by Ng?c Dung (ngdung0910@gmail.com)

lOMoARcPSD|14067412

22. Which of the following is NOT correct with regard to the p-value attached to a test

statistic?

(a) * p-values can only be used for two-sided tests

(b) It is the marginal significance level where we would be indifferent between

rejecting and not rejecting the null hypothesis

(c) It is the exact significance level for the test

(d) Given the p-value, we can make inferences without referring to statistical tables.

23. Which one of the following is NOT an assumption of the classical linear

regression model?

(a) The explanatory variables are uncorrelated with the error terms.

(b) The disturbance terms have zero mean

(c) * The dependent variable is not correlated with the disturbance terms

(d) The disturbance terms are independent of one another.

24. Which of the following is the most accurate definition of the term ‘the OLS

estimator’?

(a) It comprises the numerical values obtained from OLS estimation

(b) * It is a formula that, when applied to the data, will yield the parameter estimates

(c) It is equivalent to the term ‘the OLS estimate’

(d) It is a collection of all of the data used to estimate a linear regression model.

25. Two researchers have identical models, data, coefficients and standard error

estimates. They test the same hypothesis using a two-sided alternative, but researcher

1 uses a 5% size of test while researcher 2 uses a 10% test. Which one of the

following statements is correct?

(a) Researcher 2 will use a larger critical value from the t-tables

(b) * Researcher 2 will have a higher probability of type I error

(c) Researcher 1 will be more likely to reject the null hypothesis

(d) Both researchers will always reach the same conclusion.

26. Consider an increase in the size of the test used to examine a hypothesis from 5%

to 10%. Which one of the following would be an implication?

(a) * The probability of a Type I error is increased

(b) The probability of a Type II error is increased

(c) The rejection criterion has become more strict

(d) The null hypothesis will be rejected less often.

27. What is the relationship, if any, between the normal and t-distributions?

(a) A t-distribution with zero degrees of freedom is a normal

(b) A t-distribution with one degree of freedom is a normal

(c) * A t-distribution with infinite degrees of freedom is a normal

(d) There is no relationship between the two distributions.

Downloaded by Ng?c Dung (ngdung0910@gmail.com)

You might also like

- Multiple Choice Test Bank Questions No Feedback - Chapter 3Document5 pagesMultiple Choice Test Bank Questions No Feedback - Chapter 3Đức Nghĩa100% (1)

- Multiple Choice Test Bank Questions No Feedback – Chapters 1 and 2 StatisticsDocument3 pagesMultiple Choice Test Bank Questions No Feedback – Chapters 1 and 2 StatisticsAnonymous 8ooQmMoNs150% (2)

- Test Bank Questions Chapters 1 and 2Document3 pagesTest Bank Questions Chapters 1 and 2Khánh HuyềnNo ratings yet

- Multiple Choice - Chow Test Parameter StabilityDocument9 pagesMultiple Choice - Chow Test Parameter StabilityΛένια ΙωσηφίδηNo ratings yet

- MCQ's on Introductory EconometricsDocument74 pagesMCQ's on Introductory EconometricsSimran Simie100% (1)

- Answers Are Highlighted in Yellow Color: MCQ's Subject:Introductory EconometricsDocument16 pagesAnswers Are Highlighted in Yellow Color: MCQ's Subject:Introductory EconometricsMajid AbNo ratings yet

- Exam AFF700 211210 - SolutionsDocument11 pagesExam AFF700 211210 - Solutionsnnajichinedu20No ratings yet

- Multiple Choice Sample QuestionsDocument3 pagesMultiple Choice Sample QuestionsthuyvuNo ratings yet

- Multiple Choice Test Bank Questions No Feedback - Chapter 5Document7 pagesMultiple Choice Test Bank Questions No Feedback - Chapter 5Đức NghĩaNo ratings yet

- Multiple choice Sample questionsDocument3 pagesMultiple choice Sample questionsNguyn Lại QuengNo ratings yet

- Aff700 1000 220401Document8 pagesAff700 1000 220401nnajichinedu20No ratings yet

- Data Smoothing and Forecasting Techniques ComparedDocument9 pagesData Smoothing and Forecasting Techniques ComparedGagandeep SinghNo ratings yet

- State Level Statistics Revision TestDocument15 pagesState Level Statistics Revision TesttafcentralstudentsNo ratings yet

- NSE BA Sample Paper With SolutionDocument18 pagesNSE BA Sample Paper With SolutionSanjay Singh100% (1)

- Midterm PrinciplesDocument8 pagesMidterm Principlesarshad_pmadNo ratings yet

- 12Document16 pages12Vishal kaushikNo ratings yet

- Itae006 Test 1 and 2Document18 pagesItae006 Test 1 and 2Nageshwar SinghNo ratings yet

- Business Forecasting Example QuestionsDocument7 pagesBusiness Forecasting Example QuestionsRavi Arjun KumarNo ratings yet

- Exam FinalDocument21 pagesExam FinalAnugrah Stanley100% (1)

- Managerial Economics 7th Edition Keat Test Bank 1Document18 pagesManagerial Economics 7th Edition Keat Test Bank 1barbara100% (45)

- Managerial Economics 7Th Edition Keat Test Bank Full Chapter PDFDocument36 pagesManagerial Economics 7Th Edition Keat Test Bank Full Chapter PDFrichard.jennings889100% (12)

- R04 Introduction To Linear RegressionDocument12 pagesR04 Introduction To Linear RegressionIndonesian ProNo ratings yet

- TRUE/FALSE. Write 'T' If The Statement Is True and 'F' If The Statement Is FalseDocument20 pagesTRUE/FALSE. Write 'T' If The Statement Is True and 'F' If The Statement Is FalseJane LuNo ratings yet

- Take Home Quiz 1Document4 pagesTake Home Quiz 1HealthyYOUNo ratings yet

- Final Exam 1Document4 pagesFinal Exam 1HealthyYOU50% (2)

- ICO 2023 Important Questions Class 11 - International Commerce OlympiadDocument13 pagesICO 2023 Important Questions Class 11 - International Commerce OlympiadNitya AggarwalNo ratings yet

- 商情預測期中考 2018Document3 pages商情預測期中考 2018Jane LuNo ratings yet

- Week 7 Assignment SCADocument2 pagesWeek 7 Assignment SCAdhruvNo ratings yet

- CT 2Document4 pagesCT 2Anisha AuladNo ratings yet

- University of Mauritius Quantitative Finance II ExamDocument8 pagesUniversity of Mauritius Quantitative Finance II ExamRevatee HurilNo ratings yet

- 613 PDocument2 pages613 PAman ChhedaNo ratings yet

- Business Statistics Practice FinalDocument10 pagesBusiness Statistics Practice FinalJason ChanNo ratings yet

- Aff700 1000 230109Document9 pagesAff700 1000 230109nnajichinedu20No ratings yet

- Last Assignment September 2021Document231 pagesLast Assignment September 2021pubg loverNo ratings yet

- Chapter 5 - GeDocument17 pagesChapter 5 - Gewcm007No ratings yet

- Test Bank Questions Chapter 6Document3 pagesTest Bank Questions Chapter 6Anonymous 8ooQmMoNs1No ratings yet

- STA 3024 Practice Problems Exam 2 Multiple RegressionDocument13 pagesSTA 3024 Practice Problems Exam 2 Multiple Regressiondungnt0406100% (2)

- 2023 Mock TestDocument3 pages2023 Mock TestMoyinoluwa AdesiyanNo ratings yet

- Mcqs EconometricDocument25 pagesMcqs Econometricsajad ahmad78% (18)

- Qcm1 February 2015 424 CorrigeDocument10 pagesQcm1 February 2015 424 CorrigeFlorian DupuyNo ratings yet

- Caiib Financialmgt A MCQDocument15 pagesCaiib Financialmgt A MCQsilyyjay121No ratings yet

- Understanding Types of Numbers and Data in ResearchDocument50 pagesUnderstanding Types of Numbers and Data in ResearchTÂM NGÔ NHƯNo ratings yet

- Quantative Analysis-1 Sample PaperDocument4 pagesQuantative Analysis-1 Sample PaperghogharivipulNo ratings yet

- Full Download Test Bank For Business Forecasting 6th Edition Wilson PDF Full ChapterDocument36 pagesFull Download Test Bank For Business Forecasting 6th Edition Wilson PDF Full Chapterbranlinsuspectnm8l100% (18)

- MCQ StatisticsDocument15 pagesMCQ StatisticsArslan ArslanNo ratings yet

- Test Bank For Business Forecasting 6th Edition WilsonDocument8 pagesTest Bank For Business Forecasting 6th Edition WilsonOdell Brown100% (31)

- Exit Exam Practice QuestionsDocument31 pagesExit Exam Practice Questionsdilbinaji4No ratings yet

- Forecasting Demand and Inventory LevelsDocument36 pagesForecasting Demand and Inventory LevelsJinky P. RefurzadoNo ratings yet

- Class-Xi ECONOMICS (030) ANNUAL EXAM (2020-21) : General InstructionsDocument8 pagesClass-Xi ECONOMICS (030) ANNUAL EXAM (2020-21) : General Instructionsadarsh krishnaNo ratings yet

- CHW 4Document7 pagesCHW 4Anonymous 7CxwuBUJz3No ratings yet

- Sample Exam With Solutions. Econometrics II 2015.Document15 pagesSample Exam With Solutions. Econometrics II 2015.Nuria CivitNo ratings yet

- Mas 766: Linear Models: Regression: SPRING 2020 Team Assignment #1 Due: Feb 3, 2020Document4 pagesMas 766: Linear Models: Regression: SPRING 2020 Team Assignment #1 Due: Feb 3, 2020Aashna MehtaNo ratings yet

- Test Bank For Business Forecasting 6th Edition WilsonDocument36 pagesTest Bank For Business Forecasting 6th Edition Wilsonsporting.pintle.75ba100% (50)

- AP Computer Science Principles: Student-Crafted Practice Tests For ExcellenceFrom EverandAP Computer Science Principles: Student-Crafted Practice Tests For ExcellenceNo ratings yet

- Classification, Parameter Estimation and State Estimation: An Engineering Approach Using MATLABFrom EverandClassification, Parameter Estimation and State Estimation: An Engineering Approach Using MATLABRating: 3 out of 5 stars3/5 (1)

- Additional QuestionDocument4 pagesAdditional QuestionNgọc DungNo ratings yet

- Test Bank Questions Chapters 11 14Document4 pagesTest Bank Questions Chapters 11 14Ngọc DungNo ratings yet

- Chuong 3 - Phan Tich BCTC & Cac MHTC - Gui SVDocument32 pagesChuong 3 - Phan Tich BCTC & Cac MHTC - Gui SVNgọc DungNo ratings yet

- Chuong 16 - CTV - Gui SVDocument37 pagesChuong 16 - CTV - Gui SVNgọc DungNo ratings yet

- Document SummaryDocument10 pagesDocument SummaryNgọc DungNo ratings yet

- En Eco-Drive Panel ConnectionDocument4 pagesEn Eco-Drive Panel ConnectionElectroventica ElectroventicaNo ratings yet

- Ael Coal To PVCDocument2 pagesAel Coal To PVCdeepak saxenaNo ratings yet

- Basic Sciences: Home MCQ's DiscussionsDocument10 pagesBasic Sciences: Home MCQ's Discussionsdileep9002392No ratings yet

- International Journal of Infectious DiseasesDocument3 pagesInternational Journal of Infectious DiseasesDetti FahmiasyariNo ratings yet

- Coding and Decoding Practice TestDocument13 pagesCoding and Decoding Practice TestRaja SubramanianNo ratings yet

- DTMF Relay and Interworking On CUBE PDFDocument18 pagesDTMF Relay and Interworking On CUBE PDFEngin KartalNo ratings yet

- Acoustic EmissionDocument11 pagesAcoustic Emissionuyenowen@yahoo.comNo ratings yet

- Public Health Risks of Inadequate Prison HealthcareDocument3 pagesPublic Health Risks of Inadequate Prison HealthcarerickahrensNo ratings yet

- Module #5 Formal Post-Lab ReportDocument10 pagesModule #5 Formal Post-Lab Reportaiden dunnNo ratings yet

- Solar Power PlantDocument100 pagesSolar Power Plantbaaziz2015100% (3)

- Mechanik Lammert ContentDocument3 pagesMechanik Lammert Contentapi-129423309No ratings yet

- Bachelor Thesis MaritimeDocument43 pagesBachelor Thesis MaritimeMiriam PedersenNo ratings yet

- Aci 306.1Document5 pagesAci 306.1safak kahramanNo ratings yet

- Jerome KaganDocument5 pagesJerome KaganMandeep morNo ratings yet

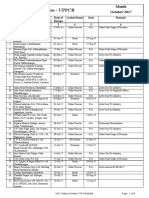

- NOC Status for UPPCB in October 2017Document6 pagesNOC Status for UPPCB in October 2017Jeevan jyoti vnsNo ratings yet

- Montageanleitung sf25 35 enDocument20 pagesMontageanleitung sf25 35 enPaulo santosNo ratings yet

- Appendix A. Second QuantizationDocument24 pagesAppendix A. Second QuantizationAgtc TandayNo ratings yet

- The Law of DemandDocument13 pagesThe Law of DemandAngelique MancillaNo ratings yet

- Operation ManualDocument83 pagesOperation ManualAn Son100% (1)

- FNCP Family Nursing Care Plan 1 Poor Environmental Sanitation Health ThreatDocument2 pagesFNCP Family Nursing Care Plan 1 Poor Environmental Sanitation Health Threatbraceceeem03No ratings yet

- azezew(1)Document48 pagesazezew(1)temesgen AsmamawNo ratings yet

- Media ExercisesDocument24 pagesMedia ExercisesMary SyvakNo ratings yet

- American Cows in Antarctica R. ByrdDocument28 pagesAmerican Cows in Antarctica R. ByrdBlaze CNo ratings yet

- Early Daoist Dietary Practices: Examining Ways To Health and Longevity. by Shawn ArthurDocument6 pagesEarly Daoist Dietary Practices: Examining Ways To Health and Longevity. by Shawn ArthurlsdkNo ratings yet

- Yu Gi Oh Card DetailDocument112 pagesYu Gi Oh Card DetailLandel SmithNo ratings yet

- Knowing God Intimately Joyce Meyer Christiandiet - Com .NGDocument343 pagesKnowing God Intimately Joyce Meyer Christiandiet - Com .NGadriana mariaNo ratings yet

- Module 26Document27 pagesModule 26Ven Zyndryx De JoyaNo ratings yet

- Xist PDFDocument2 pagesXist PDFAgustin Gago LopezNo ratings yet

- A Closer Look at The Cosmetics Industry and The Role of Marketing TranslationDocument5 pagesA Closer Look at The Cosmetics Industry and The Role of Marketing Translationagnes meilhacNo ratings yet

- 2009 - Mazars Insight Ifrs 5 enDocument36 pages2009 - Mazars Insight Ifrs 5 enSahar FekihNo ratings yet