Professional Documents

Culture Documents

Acca Margianl and Absorption Costing Solution

Uploaded by

Kiri chris0 ratings0% found this document useful (0 votes)

15 views2 pagesCopyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

15 views2 pagesAcca Margianl and Absorption Costing Solution

Uploaded by

Kiri chrisCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 2

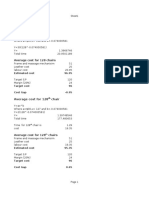

Example 1 $ $

Sales price per unit 1000

Less Varibale costs per unit

Dir material 300

Dir labour cost 205

Variable prod overhead 150

655

Contribution per unit 345

Example Margial Costing Profit Statement $ $

Sales value 212500 w1 Marginal cost of Prod

Less Marginal Cost of Sales Dir mat

Opening inventory 2150 Dir lab

Prod cost 129000 Var prod overhaed

Less closing inventory -23650

-107500

Less Other Variable costs(10%x212500) -21250

Contribution 83750

Less Fixed Costs (5000+30000) -35000

Profit 48750

EXAMPLE ABSOPTION COSTING PROFIT STATEMENT $ $

Sales value 212500

Less Absoption Cost of Sales

Opening inventroy(50*54) 2700

Prod cost(3000x54) 162000

Closing inventory(550x54) -29700 w1.

-135000 Overheads absobed

(Under)/Over absorbed overheards w1 3000 Actual Overheads incurred

Gross Profit 80500 Over

Less NON Production Overheads(5000+10%x212500) -26250

Profit 54250

EXAMPLE RECONCILIATION OF PROFITS $

Absorption costing profit 54250

Increase in inventory (500x11) -5500

Marginal costing Profit 48750

20

15

8

43

33000

30000

3000

You might also like

- Dec2014 Acc416Document2 pagesDec2014 Acc416Nurul NajlaNo ratings yet

- Session 2 Variance AnalysisDocument1 pageSession 2 Variance AnalysisKiri chrisNo ratings yet

- Costing Systems - Lessons ExamplesDocument15 pagesCosting Systems - Lessons ExamplesNicolasNo ratings yet

- Factory Over Head: Particular UNIT-1000 AmountDocument2 pagesFactory Over Head: Particular UNIT-1000 AmountPintu MaharanaNo ratings yet

- New Microsoft Excel WorksheetDocument2 pagesNew Microsoft Excel WorksheetPintu MaharanaNo ratings yet

- UntitledDocument3 pagesUntitledVatsal ChangoiwalaNo ratings yet

- Fin. Anal RafaelDocument6 pagesFin. Anal RafaelMarjonNo ratings yet

- Past Year 2019 Sem 2 Ans (ZW)Document4 pagesPast Year 2019 Sem 2 Ans (ZW)zhaoweiNo ratings yet

- Mas - Chapter 4 LessonsDocument5 pagesMas - Chapter 4 Lessonsalida17No ratings yet

- Marginal Costing NotesDocument7 pagesMarginal Costing NotesJul 480weshNo ratings yet

- Managerial Accounting NotesDocument6 pagesManagerial Accounting NotesMarilou GabayaNo ratings yet

- ASSIGNMENTDocument5 pagesASSIGNMENTUsran Ali BubinNo ratings yet

- 管理会计作业-Assignment 1 答案Document19 pages管理会计作业-Assignment 1 答案hzznNo ratings yet

- Week 2 - One Direction SolutionDocument2 pagesWeek 2 - One Direction SolutionrahimNo ratings yet

- Sba SemDocument9 pagesSba SemChelsa Mae AntonioNo ratings yet

- ASSIGNMENT - 2 AccountingDocument6 pagesASSIGNMENT - 2 AccountingZubair AhmedNo ratings yet

- Learning Curve: Average Cost For 128 ChairsDocument5 pagesLearning Curve: Average Cost For 128 ChairsFarman ShaikhNo ratings yet

- V & A Question Bank SolutionsDocument14 pagesV & A Question Bank SolutionsTamaraNo ratings yet

- Dorrit and Dorrbie Maufacturig AccountDocument5 pagesDorrit and Dorrbie Maufacturig AccountToniann GordonNo ratings yet

- Chap 008Document34 pagesChap 008alishamrozNo ratings yet

- Cost Accounting: C S F EOQDocument6 pagesCost Accounting: C S F EOQShehrozSTNo ratings yet

- Cost Sheet 1Document6 pagesCost Sheet 1Tamilselvi ANo ratings yet

- Homework 1Document11 pagesHomework 1Subham JainNo ratings yet

- LeverageszddzDocument10 pagesLeverageszddzKrutika JainNo ratings yet

- Cost Concepts - Cost SheetDocument24 pagesCost Concepts - Cost SheetFaraz SiddiquiNo ratings yet

- CVP Analysis Q.1-10Document28 pagesCVP Analysis Q.1-10James WisleyNo ratings yet

- Jawaban No 4Document2 pagesJawaban No 4diaheka1712No ratings yet

- SolutionDocument3 pagesSolutionHilary GaureaNo ratings yet

- Should CSC Offer One Version? Which One at What Price? or Both at What Prices?Document17 pagesShould CSC Offer One Version? Which One at What Price? or Both at What Prices?SJNo ratings yet

- Ch8 PDFDocument11 pagesCh8 PDFGiang NguyenNo ratings yet

- AnswersDocument3 pagesAnswersYahya ZafarNo ratings yet

- MA007 AC&VC - Inventory Management-1Document50 pagesMA007 AC&VC - Inventory Management-1Ray LowNo ratings yet

- Illustration1: For The Production of 10000 Units of A Product, The Following Are The Budgeted ExpensesDocument4 pagesIllustration1: For The Production of 10000 Units of A Product, The Following Are The Budgeted ExpensesGabriel BelmonteNo ratings yet

- Zepher MemoDocument2 pagesZepher Memoewriteandread.businessNo ratings yet

- Diskusi Akuntansi Manajemen Oleh Kelompok 6 (EX 1&2 Variable Costing)Document3 pagesDiskusi Akuntansi Manajemen Oleh Kelompok 6 (EX 1&2 Variable Costing)Hafizd FadillahNo ratings yet

- F2 Long Test 2 SolutionsDocument14 pagesF2 Long Test 2 SolutionsRip IhtishamNo ratings yet

- Project MaDocument18 pagesProject MaBhuvneshwari RathoreNo ratings yet

- DAIBB Accounting 2020Document14 pagesDAIBB Accounting 2020BelalHossainNo ratings yet

- Less: Cost of Goods Sold: Capital ExpenditureDocument3 pagesLess: Cost of Goods Sold: Capital Expenditurefahim tusarNo ratings yet

- Solution NIngDocument3 pagesSolution NIngfahim tusarNo ratings yet

- Q: No: 45 (KAPLAN) Hapsburg Consolidated Statement of Financial Position: - Non - Current AssetsDocument4 pagesQ: No: 45 (KAPLAN) Hapsburg Consolidated Statement of Financial Position: - Non - Current AssetszarimanufacturingNo ratings yet

- Cost Accounting Assignment 2Document4 pagesCost Accounting Assignment 2leeroy mekiNo ratings yet

- 7Document8 pages7Indu DahalNo ratings yet

- HM ch15 Variable Costing Dan Full CostingDocument20 pagesHM ch15 Variable Costing Dan Full CostingSekarNo ratings yet

- Selling Price 25 Variable Cost 12 Fixed Cost 65000 FIND Break Even Point CSRDocument6 pagesSelling Price 25 Variable Cost 12 Fixed Cost 65000 FIND Break Even Point CSRSoumya Ranjan PandaNo ratings yet

- Accounting Entries For Intercompany TransactionDocument1 pageAccounting Entries For Intercompany TransactionUmer AzizNo ratings yet

- Cma ProblemsDocument25 pagesCma ProblemsPridhvi Raj ReddyNo ratings yet

- MacDocument14 pagesMacMansi TarkasNo ratings yet

- MA Hasnain Ginwala PGP-21-025Document18 pagesMA Hasnain Ginwala PGP-21-025Shashank AgarwalaNo ratings yet

- Oss Profit Retail Inventory MethodDocument4 pagesOss Profit Retail Inventory MethodLily of the ValleyNo ratings yet

- Manac3 Main Exam Memo June 2023Document9 pagesManac3 Main Exam Memo June 2023LuciaNo ratings yet

- MA1 Sample of Midterm TestDocument4 pagesMA1 Sample of Midterm TestLoan VũNo ratings yet

- Hospital Supply: Alternative Choice Decisions Differential CostingDocument13 pagesHospital Supply: Alternative Choice Decisions Differential Costingksandeep25No ratings yet

- Homework 3Document13 pagesHomework 3Subham JainNo ratings yet

- Day 2 Cost Template (My)Document36 pagesDay 2 Cost Template (My)Jhilmil JeswaniNo ratings yet

- Problem 8-41 1Document3 pagesProblem 8-41 1Jey JNo ratings yet

- Exercise 2Document3 pagesExercise 2Kathy LaiNo ratings yet

- Management Accounting - Exercises On VariancesDocument4 pagesManagement Accounting - Exercises On VariancesOdette CostantinoNo ratings yet

- Formula: (Individual Sales/total Sales) No of Sales in Units. No of Sales in Unit Per ProductDocument6 pagesFormula: (Individual Sales/total Sales) No of Sales in Units. No of Sales in Unit Per ProductChris MarasiganNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Refund FormsDocument2 pagesRefund FormsKiri chrisNo ratings yet

- Test 2 The Business EnvironmentDocument10 pagesTest 2 The Business EnvironmentKiri chrisNo ratings yet

- FA - Preparing Simple Consolidated Financial StatementsDocument13 pagesFA - Preparing Simple Consolidated Financial StatementsKiri chrisNo ratings yet

- Lecture 3 The Macro Economic EnvironmentDocument19 pagesLecture 3 The Macro Economic EnvironmentKiri chrisNo ratings yet

- Test 1 Business Organisations and Their StakeholdersDocument8 pagesTest 1 Business Organisations and Their StakeholdersKiri chrisNo ratings yet

- IFRS 9 Financial InstrumentsDocument38 pagesIFRS 9 Financial InstrumentsKiri chrisNo ratings yet

- Lecture 2 The Business EnvironmentDocument26 pagesLecture 2 The Business EnvironmentKiri chrisNo ratings yet

- Lecture 1 Business Organisations and Their StakeholdersDocument12 pagesLecture 1 Business Organisations and Their StakeholdersKiri chrisNo ratings yet

- Limited Companies - Capital Structure & Finance Costs HandoutDocument11 pagesLimited Companies - Capital Structure & Finance Costs HandoutKiri chrisNo ratings yet

- FR Lesson 1 TawandaDocument1 pageFR Lesson 1 TawandaKiri chrisNo ratings yet

- Cima Standard Costing Seesion 2 QuestionsDocument16 pagesCima Standard Costing Seesion 2 QuestionsKiri chrisNo ratings yet

- IFRS 15 Part 2 Performance Obligations Satisfied Over TimeDocument26 pagesIFRS 15 Part 2 Performance Obligations Satisfied Over TimeKiri chrisNo ratings yet

- IFRS 15 Part 2 Performance Obligations Satisfied Over Time QUESTIONSDocument13 pagesIFRS 15 Part 2 Performance Obligations Satisfied Over Time QUESTIONSKiri chrisNo ratings yet

- Ias 16Document33 pagesIas 16Kiri chris100% (1)

- Overhead Analysis QuestionsDocument9 pagesOverhead Analysis QuestionsKiri chrisNo ratings yet

- Ifrs 9 AnswersDocument2 pagesIfrs 9 AnswersKiri chrisNo ratings yet

- IAS 23 Borrrowing CostsDocument17 pagesIAS 23 Borrrowing CostsKiri chrisNo ratings yet

- IFRS 9 Financial InstrumentsDocument38 pagesIFRS 9 Financial InstrumentsKiri chrisNo ratings yet

- Capital BudgetingDocument1 pageCapital BudgetingKiri chrisNo ratings yet

- Ifrs 9 QuestionsDocument10 pagesIfrs 9 QuestionsKiri chrisNo ratings yet

- Overhead Analysis SolutionDocument1 pageOverhead Analysis SolutionKiri chrisNo ratings yet

- Cima Standard Costing and Variance Analysis Session 1 QuestionsDocument13 pagesCima Standard Costing and Variance Analysis Session 1 QuestionsKiri chrisNo ratings yet

- IFRS 15 Part 2 Perfomance Obligations Satisfied Over TimeDocument26 pagesIFRS 15 Part 2 Perfomance Obligations Satisfied Over TimeKiri chrisNo ratings yet

- Chesnut Model AnswerDocument2 pagesChesnut Model AnswerKiri chrisNo ratings yet

- Error Lesson WorkingsDocument4 pagesError Lesson WorkingsKiri chrisNo ratings yet

- Ias 23 Borrrowing Costs QuestionsDocument3 pagesIas 23 Borrrowing Costs QuestionsKiri chrisNo ratings yet

- Limited Companies - Capital Structure & Finance Costs HandoutDocument11 pagesLimited Companies - Capital Structure & Finance Costs HandoutKiri chrisNo ratings yet

- Ifrs 15Document2 pagesIfrs 15Kiri chrisNo ratings yet

- BANK RECONCILIATION STATEMENTS HandoutDocument14 pagesBANK RECONCILIATION STATEMENTS HandoutKiri chrisNo ratings yet

- IAS 23 Borrrowing CostsDocument17 pagesIAS 23 Borrrowing CostsKiri chrisNo ratings yet