Professional Documents

Culture Documents

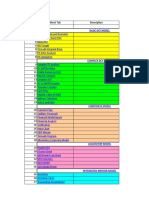

Index US CMA-Part2

Index US CMA-Part2

Uploaded by

ayyanar70 ratings0% found this document useful (0 votes)

13 views4 pagesThis document provides an overview of the topics and time allocated to various sections in a course on strategic financial management. The major sections covered include financial statement analysis, profitability analysis, special issues, long-term financial management, derivatives and cost of capital, raising capital, and working capital management. Time allotted ranges from a few minutes to over 3 hours for some sections. The document lists sub-topics within each section along with their scheduled timing in the course. Quizzes are also included throughout as assessment points.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides an overview of the topics and time allocated to various sections in a course on strategic financial management. The major sections covered include financial statement analysis, profitability analysis, special issues, long-term financial management, derivatives and cost of capital, raising capital, and working capital management. Time allotted ranges from a few minutes to over 3 hours for some sections. The document lists sub-topics within each section along with their scheduled timing in the course. Quizzes are also included throughout as assessment points.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

13 views4 pagesIndex US CMA-Part2

Index US CMA-Part2

Uploaded by

ayyanar7This document provides an overview of the topics and time allocated to various sections in a course on strategic financial management. The major sections covered include financial statement analysis, profitability analysis, special issues, long-term financial management, derivatives and cost of capital, raising capital, and working capital management. Time allotted ranges from a few minutes to over 3 hours for some sections. The document lists sub-topics within each section along with their scheduled timing in the course. Quizzes are also included throughout as assessment points.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 4

US CMA Part 2 - Strategic Financial Managment 57:09:46

Sr No Particulars Time Sr No Particulars Time

A Section A Financial Statement Analysis ( Page 1) 12:10:24 8 Quiz 6:25

1 1.Basic Financial Statement Analysis ( Page 7) 4:15:24 9 Receivables Factoring 3:18

1 Introduction 33:44 10 Earnings Quality 8:28

2 Financial Ratio Analysis 13:8 11 Quiz 4:45

3 Liquidity Ratios 23:54 12 Book Value and Market Value 14:27

4 Quiz 17:41 13 Final Quiz 18:19

5 Solvency Ratio 11:30 14 Summary 5:10

6 Leverage Ratio 18:46 Section B.Corporate Finance (Page 302) 21:48:30

7 Leverage Ratios Example 6:31 1 Risk & Return 2:33:09

8 Leverage and Risk 6:50 1 Introduction 15:31

9 Capital Structure Ratio 5:36 2 Basic Of Computation Return 5:35

10 Earnings Coverage Ratios 10:58 3 Types of risks 8:16

11 Quiz 12:13 4 Quiz 8:50

12 Activity Ratios 34:39 5 Measurement Of Risk 17:2

13 Quiz 19:43 6 Portfolio Risk 19:46

14 Limitations of Ratio Analysis 4:37 7 Quiz 7:13

15 Final Quiz. 24:8 8 Diversification 11:6

16 Summary 11:26 9 Beta 5:33

2 Profitability Analysis (Page 147) 2:51:29 10 Capital Asset Pricing Model 5:5

1 Introduction 20:49 11 Quiz 10:51

2 Return on Invested Capital Ratios 16:58 12 Security Market Line 16:26

3 Basic EPS 20:23 13 Final Quiz 12:37

4 Diluted EPS - Example 9:56 14 Summary 9:18

5 Quiz 16:23 2.1 Long Term Financial Mgt - Bonds,Stock & Valuation (Page 400) 3:00:10

6 Market Ratio 12:26 1 Introduction 20:2

7 Sustainable Equity Growth 8:32 2 Bonds & Yield Curve 10:31

8 Quiz 20:21 3 Yield Curve Theories 16:26

9 Stability of Revenue 9:32 4 Uses of Yield Curve 3:58

10 Factors to be Considered in Income Measurement 4:1 5 Quiz 9:17

11 Revenue, Receivables and Inventories 4:40 6 Basic features of bonds 10:47

12 Final Quiz 21:53 7 Types of bonds 8:33

13 Summary 5:35 8 Advantages and disadvantages of bonds 3:30

3 Special issues (Page 231) 5:03:31 9 Duration & bond interest rate sensitivity 6:56

1 Introduction 4:36 10 Characteristics of bonds 7:37

2 Impact of Foreign Exchange Fluctuation 14:13 11 Quiz 6:7

3 Reporting and Functional Currency 7:8 12 Bond value & market interest rate 5:1

4 Impact of Foreign Subsidiary on FS 10:46 13 Valuation of bond 16:44

5 Quiz 12:39 14 Valuation of preference share 4:53

6 Impact of Inflation on Ratios 4:47 15 Earning Model Example 0:1

7 Changes in Accounting Treatment 8:30 16 Two stage dividend discount model 8:30

Sr No Particulars Time Sr No Particulars Time

17 Quiz Time 9:28 17 Summary 15:5

18 Comparable Valuation Model 1:9 4 Working Capital Management (Page 772) 4:32:56

19 Quiz 15:37 1 What is Working Capital 15:50

20 Summary 15:3 2 Operating and Cash Cycle 5:37

2.2 Long Term Financial Mgt- Derivative & Cost of Capital (Page 549) 3:18:59 3 Permanent and Temporary Working Capital 6:3

1 Introduction 12:51 4 Quiz 14:1

2 Forwards and futures 12:56 5 Cash Management 6:44

3 Long and Short positions 4:10 6 Speeding up collections 15:23

4 Quiz 7:8 7 Slowing down disbursements 4:55

5 Options 24:23 8 Marketable Securities 6:53

6 Exiting an Option 6:16 9 Baumol’s EOQ Model 13:58

7 Factors affecting the value of an option 13:46 10 Miller Orr Cash Management Model 3:22

8 Hedging with Options 8:23 11 Quiz 16:6

9 Swaps 12:16 12 Management of Accounts Receivable 16:10

10 Quiz 14:4 13 Monitoring Accounts Receivable 9:31

11 Cost of Capital 6:36 14 Quiz 17:23

12 Cost of each component of Capital 11:36 15 Management of Inventories 8:1

13 Marginal Cost of Capital 3:35 16 Economic Order Quantity 11:52

14 Cost of Capital - Examples 6:21 17 More Inventory Management Terms 11:53

15 Inflation, Interest Rates and Prices 3:33 18 Just in Time 4:26

16 Quiz 10:24 19 Quiz 12:41

17 Other sources of Long term Financing 10:11 20 Spontaneous form of short term credit 7:37

18 Final Quiz 15:9 21 Other Forms of Short Term Financing 10:19

19 Summary 15:21 22 Interest rates 8:53

3 Raising Capital (Page 669) 2:55:17 23 Final Quiz 23:25

1 Introduction 15:35 24 Summary 21:53

2 Functions of Financial Markets 5:25 5 Corporate Restructuring (Page 924) 2:25:41

3 Market Efficiency 8:38 1 Corporate Restructuring 5:4

4 Quiz 5:56 2 Mergers and Consolidation 8:31

5 Credit Rating Agencies 10:25 3 Acquisitions 12:33

6 Investment Banks 17:38 4 Advantages of Business Combinations 6:10

7 Initial Public Offering and Secondary Offering 2:30 5 Quiz 9:12

8 Quiz 7:54 6 Takeover Defences 4:8

9 Types of Dividend 13:18 7 Pre-Takeover Defenses 12:49

10 Dividend Policy 9:32 8 Post-Takeover Defence 9:13

11 Factors influencing Dividend Policy 4:28 9 Divestitures 17:25

12 Dividend Payment Process 9:32 10 Reasons for Restructuring 9:45

13 Stock Purchase 6:29 11 Synergies 3:13

14 Quiz 20:48 12 Quiz 14:23

15 Insider Trading 5:9 13 Valuation of a Business 9:1

16 Final Quiz 16:55 14 Quiz 6:3

Sr No Particulars Time Sr No Particulars Time

15 Summary 18:11 12 Exercise 9:3

6 International Finance (Page 1029) 3:02:18 13 Limiting Factor 10:5

1 Introduction 12:36 14 Quiz 17:4

2 Foreign Currency Exchange Rates 9:6 15 Essay Question 8:41

3 Exchange Rate Basics 6:50 16 Incomes Taxes and Marginal Analysis 1:27

4 Quiz 12:12 17 Final Quiz 22:56

5 Variable affecting Exchange Rates 18:17 18 Summary 6:56

6 Exchange Rate Risk 8:12 3 Pricing (Page 1314) 3:23:04

7 Managing Exchange Rate Risk 18:14 1 Introduction 14:7

8 Quiz 19:17 2 Elasticity of Demand 7:29

9 International Diversification 14:50 3 Measuring Elasticity of Demand 26:2

10 Payment methods in International Trades 10:41 4 Law of Supply 8:11

11 International Trade Financing Methods 28:57 5 Quiz 14:22

12 Final Quiz 12:5 6 Market Structure and Pricing 15:20

13 Summary 11:1 7 Long Run Pricing Strategy 13:26

Section C.Decision Analysis (Page 1143) 9:26:20 8 New Product Pricing Strategy 7:55

1 Cost/Volume/Profit Analysis 2:34:22 9 Quiz 10:43

1 Introduction 19:0 10 Target Costing 8:28

2 Contribution Margin Ratio 13:9 11 Value Engineering 22:36

3 Fixed Variable Cost 15:24 12 Product Mix Pricing Strategy 8:9

4 CVP Analysis Practise Problems 19:16 13 Quiz Time 9:36

5 Quiz 11:33 14 Other Consideration in Pricing 4:36

6 CVP analysis with multiple Products 10:27 15 Final Quiz 14:33

7 CVP analysis & Sensitivity 16:44 16 Summary 17:31

8 Indifference Point 5:38 Section D.Risk Management (Page 1430) 2:41:35

9 Quiz 11:44 1 Enterprise Risk 2:41:35

10 Benefits & Limitation of CVP analysis 9:20 1 Introduction 19:23

11 Final Quiz 14:36 2 Capital Adequacy 17:19

12 Summary 7:31 3 Risk Identification 29:49

2 Marginal Analysis (Page 1214) 3:28:54 4 Risk Response 25:56

1 Introduction 18:55 5 Risk Monitoring 9:19

2 Understanding Relevance of Cost 15:25 6 Quiz 8:12

3 Relevant Cost & Revenues 15:1 7 Enterprise Risk Management 14:33

4 Exercise 8:44 8 COSO ERM 8:37

5 Quiz 14:11 9 Quiz 5:48

6 Shutdown Point 10:52 10 Benefits Of ERM 5:29

7 Add or Drop a Segment 5:38 11 Final Quiz 10:13

8 Sell or Process Further 12:45 12 Summary 6:57

9 Exercise 6:36 Section E.Investment Decisions (Page 1514) 5:31:03

10 Quiz 9:21 1 Capital Budgeting Process 2:14:45

11 Special Order Pricing 15:14 1 Introduction 12:49

Sr No Particulars Time Sr No Particulars Time

2 Relevant Costs 12:43 4 Quiz 9:5

3 Depreciation Tax Shields 9:5 5 Fraud Triangle 15:7

4 Cash Flow in Capital Budgeting 12:49 6 Final Quiz 7:9

5 Quiz 15:44 7 Summary 4:53

6 Effects of Inflation in Capital Budgeting 16:9 3 Ethical Considerations for the Organization (Page 1815) 3:38:08

7 Pay Back Method 9:5 1 Introduction 26:56

8 Quiz 8:57 2 FCPA Prohibits 8:3

9 Accounting Rate of Return 8:37 3 Examples of improper travel & entertainment 15:7

10 Final Quiz 22:23 4 SOX - Section 406 16:5

11 Summary 6:24 5 Organizational Code Of Conduct 36:19

2 Discounted Cash Flow Analysis (Page 1621) 3:16:18 6 Ethics and Internal Control 26:45

1 Investment Decisions 6:50 7 Quiz 8:37

2 Net Present Value 16:36 8 Monitoring Ethical Compliance 23:56

3 Internal Rate of Return 16:16 9 Group Think 34:20

4 IRR Example 12:37 10 Final Quiz 15:10

5 Quiz 15:50 11 Summary 6:50

6 NPV Profile 11:48

7 Profitability Index 18:10

8 Capital Rationing 4:27

9 Capital Budgeting Exercise 12:5

10 Quiz 17:21

11 Risk Analysis in capital Investments 8:37

12 Sensitivity Analysis 12:9

13 Simulation Analysis 5:0

14 Quiz 4:18

15 Decision Tree Analysis 9:38

16 Final Quiz 16:11

17 Summary 8:25

Section F.Professional Ethics (Page 1735) 5:31:54

1 Business Ethics 0:42:13

1 Introduction 7:53

2 Virtue vs Morality 6:7

3 Moral Philosophies 12:35

4 Factors Impacting Ethical Decision Making 7:53

5 Quiz 4:44

6 Summary 3:1

2 Ethical Considerations for MA and FM Professionals (Page 1774) 1:11:33

1 Introduction 15:59

2 Ethical Standards 12:53

3 Resolution Of Ethical Conflict 6:27

You might also like

- Internal Test 4 - CaseDocument6 pagesInternal Test 4 - CaseShivani Jadhav25% (8)

- Fundamentals of Corporate Finance 12th Edition Ross Test BankDocument35 pagesFundamentals of Corporate Finance 12th Edition Ross Test Bankadeliahue1q9kl100% (22)

- MGFC10 Cheat SheetDocument5 pagesMGFC10 Cheat SheetĐức Hải NguyễnNo ratings yet

- Risk MAnagement Alpha Sheet FinalDocument80 pagesRisk MAnagement Alpha Sheet FinalVinayak25% (4)

- Larry Williams Stock Trading and Investing Video GuideDocument4 pagesLarry Williams Stock Trading and Investing Video GuideDeepak KansalNo ratings yet

- Valuation and Risk ModelsDocument235 pagesValuation and Risk ModelsIdriss Armel Kougoum100% (2)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Applied Quantitative Finance Chris Kenyon Roland Stamm Discounting Libor CVA and Funding Interest Rate and Credit Pricing Palgrave Macmillan 2012 PDFDocument252 pagesApplied Quantitative Finance Chris Kenyon Roland Stamm Discounting Libor CVA and Funding Interest Rate and Credit Pricing Palgrave Macmillan 2012 PDFRohan Shanbhag100% (1)

- 083 11 542.pdfp03782 PDFDocument67 pages083 11 542.pdfp03782 PDFSultana LaboniNo ratings yet

- Chapters Description Page No. Chap-1Document3 pagesChapters Description Page No. Chap-1hasibNo ratings yet

- 1 Question Bank-1Document78 pages1 Question Bank-1Rutav DodiaNo ratings yet

- Table of ContentsDocument3 pagesTable of ContentsAliNo ratings yet

- AFAR List of VideosDocument12 pagesAFAR List of VideosAmy KimNo ratings yet

- Emv Case Study 1Document8 pagesEmv Case Study 1ViddhiNo ratings yet

- Mastering Attribution in Finance A Practitioners Guide To Risk-Based Analysis of Investment Returns (Financial Times Series) (Andrew Colin) (Z-Library)Document313 pagesMastering Attribution in Finance A Practitioners Guide To Risk-Based Analysis of Investment Returns (Financial Times Series) (Andrew Colin) (Z-Library)Pedro RicoNo ratings yet

- Blue PrintDocument1 pageBlue PrintShaik Safir AhmedNo ratings yet

- Market Lens 201127Document4 pagesMarket Lens 201127Om ShrikantNo ratings yet

- Param Finance LabDocument51 pagesParam Finance LabParampreet SinghNo ratings yet

- Corporate Valuation ConceptsDocument810 pagesCorporate Valuation ConceptsSupplies DepotNo ratings yet

- Moving AverageDocument2 pagesMoving AverageCyrylle ArenasNo ratings yet

- Tables of Contents: SL No. Title NODocument2 pagesTables of Contents: SL No. Title NOAsif Rajian Khan AponNo ratings yet

- PAF - Cost of Project AssesmentDocument18 pagesPAF - Cost of Project AssesmentVinayak SharmaNo ratings yet

- Project Report For Manufacturing & Trading of SpicesDocument10 pagesProject Report For Manufacturing & Trading of SpicesSHRUTI AGRAWALNo ratings yet

- Chapter 1: OverviewDocument4 pagesChapter 1: OverviewMarius MuresanNo ratings yet

- Financial Modelling Complete Internal Test 4Document6 pagesFinancial Modelling Complete Internal Test 4vaibhav100% (1)

- Letter of Transmittal Letter of Endorsement Acknowledgements Executive SummaryDocument3 pagesLetter of Transmittal Letter of Endorsement Acknowledgements Executive SummaryTaslima AktarNo ratings yet

- Abdullah Narejo Work Lec 03 Future Value Vs Present ValueDocument8 pagesAbdullah Narejo Work Lec 03 Future Value Vs Present ValueAbdullah NarejoNo ratings yet

- DT Master Plan: Do Everything & FinallyDocument5 pagesDT Master Plan: Do Everything & FinallyGurvinder Mann Singh PradhanNo ratings yet

- Perhitungan FiksDocument30 pagesPerhitungan FiksArya SaputraNo ratings yet

- Information Guide For Credit Institutions Using Target: July 2003Document177 pagesInformation Guide For Credit Institutions Using Target: July 2003Budi Haryanto AttaNo ratings yet

- Case Analysis: American Home Products CorporationDocument3 pagesCase Analysis: American Home Products CorporationYanbin CaoNo ratings yet

- Strategic Audit Report TNB Latest 1 PDFDocument64 pagesStrategic Audit Report TNB Latest 1 PDFpqcmgtNo ratings yet

- Task 1 and Task 2Document10 pagesTask 1 and Task 2Sarah BunoNo ratings yet

- TUGASDocument13 pagesTUGASAnas SutrinoNo ratings yet

- BLUE STAR LTD - Quantamental Equity Research Report-1Document1 pageBLUE STAR LTD - Quantamental Equity Research Report-1Vivek NambiarNo ratings yet

- AfDB - Policy Recommendations To Reverse Establishment of Start-Ups and Investment Vehicles Outside Egypt - Jan 2024Document56 pagesAfDB - Policy Recommendations To Reverse Establishment of Start-Ups and Investment Vehicles Outside Egypt - Jan 2024nancysamyNo ratings yet

- 1St Paper S.NO. Answer B C DDocument4 pages1St Paper S.NO. Answer B C DHarshitNo ratings yet

- 06 AnnualreportDocument76 pages06 AnnualreportmoshiricNo ratings yet

- Rasida PrelimDocument11 pagesRasida PrelimKibria RiyadeNo ratings yet

- Fundamentals and Technical Analysis of Equity Derivatives: A Project Report ONDocument71 pagesFundamentals and Technical Analysis of Equity Derivatives: A Project Report ONtarun nemalipuriNo ratings yet

- A2 Mbag183002Document24 pagesA2 Mbag183002Hashim EjazNo ratings yet

- PrefaceDocument7 pagesPrefaceAbdullah Al-MamunNo ratings yet

- SFM Last Day Revision Notes May 22Document6 pagesSFM Last Day Revision Notes May 22rahul.modi18No ratings yet

- MD & Ceo CFO CRO CIO: Note For Investment Operation CommitteeDocument4 pagesMD & Ceo CFO CRO CIO: Note For Investment Operation CommitteeAyushi somaniNo ratings yet

- PG 208: Vegetron Case: Assumptions Implementation Period (1 Yr) 0Document36 pagesPG 208: Vegetron Case: Assumptions Implementation Period (1 Yr) 0Deepannita ChakrabortyNo ratings yet

- Annual Report 2002Document59 pagesAnnual Report 2002Enamul HaqueNo ratings yet

- Financial Summary: (Historical) Name of Borrower May Tupac HardwareDocument3 pagesFinancial Summary: (Historical) Name of Borrower May Tupac HardwareDivina GammootNo ratings yet

- Credit Rationing in Microfinance: Stockholm School of EconomicsDocument55 pagesCredit Rationing in Microfinance: Stockholm School of EconomicsSridhar NerellaNo ratings yet

- Valuation MathDocument8 pagesValuation MathSantoshNo ratings yet

- Gantt ChartDocument3 pagesGantt ChartberthiadNo ratings yet

- AML Policy SampleDocument83 pagesAML Policy SampleGremar CacachoNo ratings yet

- Financial Performance Analysis of NRB Global Bank Limited: Dhaka International UniversityDocument65 pagesFinancial Performance Analysis of NRB Global Bank Limited: Dhaka International UniversityTowhid EclipseNo ratings yet

- Scope of Islamic Finance in UkDocument302 pagesScope of Islamic Finance in UkMonowar Hossain TanveerNo ratings yet

- Serial Number Number Chapter-01: Introduction: Objective of The Janata BankDocument3 pagesSerial Number Number Chapter-01: Introduction: Objective of The Janata BankMizanur RahamanNo ratings yet

- Table of ContentDocument5 pagesTable of Contentshaik iftiNo ratings yet

- (4th Edition) Chan S. Park-Contemporary Engineering Economics-Prentice Hall (2006) Page 3-17 & 357-359Document18 pages(4th Edition) Chan S. Park-Contemporary Engineering Economics-Prentice Hall (2006) Page 3-17 & 357-359aditiariantoNo ratings yet

- Edsgn 100 Report Project 1 DraftDocument25 pagesEdsgn 100 Report Project 1 Draftapi-401967342No ratings yet

- Table of ContentDocument4 pagesTable of ContentNoman MohosenNo ratings yet

- Mac2602 SG 2Document240 pagesMac2602 SG 2divyesh mehta100% (1)

- M1 14-AZ2 PENROSE Part 1 (Analysis) - BlankDocument5 pagesM1 14-AZ2 PENROSE Part 1 (Analysis) - BlankKhushi singhalNo ratings yet

- Operational MANUALDocument52 pagesOperational MANUALhenonw19No ratings yet

- Practical Risk Management: An Executive Guide to Avoiding Surprises and LossesFrom EverandPractical Risk Management: An Executive Guide to Avoiding Surprises and LossesNo ratings yet

- C Plus Plus Notes For ProfessionalsDocument706 pagesC Plus Plus Notes For ProfessionalsSukrit GhoraiNo ratings yet

- Pooja Celebration - Circular - 0001Document1 pagePooja Celebration - Circular - 0001ayyanar7No ratings yet

- Employment News English 02-12-2023Document64 pagesEmployment News English 02-12-2023ayyanar7No ratings yet

- B2B 012024 3 GSTR2B 04042024Document7 pagesB2B 012024 3 GSTR2B 04042024ayyanar7No ratings yet

- ITO Paper III - 2022Document33 pagesITO Paper III - 2022ayyanar7No ratings yet

- P9 RevDocument540 pagesP9 Revayyanar7100% (1)

- B2B 022024 1 GSTR2B 04042024Document7 pagesB2B 022024 1 GSTR2B 04042024ayyanar7No ratings yet

- Addendum 17A 2023Document1 pageAddendum 17A 2023ayyanar7No ratings yet

- Holiday List 2024Document5 pagesHoliday List 2024ayyanar7No ratings yet

- A Nicscc B04Document4 pagesA Nicscc B04ayyanar7No ratings yet

- OS Notes 2Document78 pagesOS Notes 2ayyanar7No ratings yet

- ResponseSheet NICSCC11529Document9 pagesResponseSheet NICSCC11529ayyanar7No ratings yet

- ITI Roles and RespDocument2 pagesITI Roles and Respayyanar7No ratings yet

- Section 50C-CA-Jagdish-PunjabiDocument58 pagesSection 50C-CA-Jagdish-Punjabiayyanar7No ratings yet

- ResponseSheet NICSCC11529Document1 pageResponseSheet NICSCC11529ayyanar7No ratings yet

- Faq Us CmaDocument4 pagesFaq Us Cmaayyanar7No ratings yet

- (PDF) Multiple Choice Questions On Wireless CommunicationDocument78 pages(PDF) Multiple Choice Questions On Wireless Communicationayyanar7No ratings yet

- 250+ Mobile Computings and Answers 03 February 2020Document24 pages250+ Mobile Computings and Answers 03 February 2020ayyanar7No ratings yet

- Advantages of Digital SystemsDocument26 pagesAdvantages of Digital Systemsayyanar7No ratings yet

- 21 Special Theory of Relativity Version 1Document17 pages21 Special Theory of Relativity Version 1ayyanar7100% (1)

- LGO Study Material - SAPOSTDocument30 pagesLGO Study Material - SAPOSTayyanar7No ratings yet

- Gang Man NotificationDocument1 pageGang Man Notificationayyanar7No ratings yet

- 2017 21 Not en Assistant Conservator of ForestsDocument84 pages2017 21 Not en Assistant Conservator of Forestsayyanar7No ratings yet

- Cbleacpu 08Document10 pagesCbleacpu 08Agastya KarnwalNo ratings yet

- LECTURE 4 Discontinued OperationsDocument9 pagesLECTURE 4 Discontinued OperationsViky Rose EballeNo ratings yet

- BOEING 7e7Document5 pagesBOEING 7e7EVA Rental AdminNo ratings yet

- D23 FM Examiner's ReportDocument20 pagesD23 FM Examiner's ReportEshal KhanNo ratings yet

- TYBCom Sem VI Financial Accounting and Auditing Paper IX Financial AccountingDocument181 pagesTYBCom Sem VI Financial Accounting and Auditing Paper IX Financial Accountingarbazshaha121No ratings yet

- 100 LBO Model JargonsDocument16 pages100 LBO Model Jargonsnaghulk1No ratings yet

- Finman Pre Mid NotesDocument25 pagesFinman Pre Mid NotesFor ProjectsNo ratings yet

- Chapter 2 Statement of Comprehensive IncomeDocument14 pagesChapter 2 Statement of Comprehensive Incomemichelle cadiaoNo ratings yet

- Liquidity RatiosDocument14 pagesLiquidity RatiosAnon sonNo ratings yet

- Abfm CH 15 FullDocument20 pagesAbfm CH 15 Fullarjunjec123No ratings yet

- Cover: A Report ONDocument2 pagesCover: A Report ONAKASH DEEP MINZ (PGP 2016-18)No ratings yet

- FM DJB - RTP Nov 21Document14 pagesFM DJB - RTP Nov 21shubhamsingh143deepNo ratings yet

- BPP SBR Mock Exam - AnswerDocument14 pagesBPP SBR Mock Exam - AnswerrsubediaccastudentNo ratings yet

- Corporate FinanceDocument21 pagesCorporate FinanceJust for Silly UseNo ratings yet

- A Comparative Performance Analysis of Conventional and Islamic Exchange-Traded FundsDocument11 pagesA Comparative Performance Analysis of Conventional and Islamic Exchange-Traded FundsTijjani Ridwanulah AdewaleNo ratings yet

- ACC Group Assignment 1Document13 pagesACC Group Assignment 1aregahegn bisetNo ratings yet

- National University of Science and TechnologyDocument8 pagesNational University of Science and TechnologyPATIENCE MUSHONGANo ratings yet

- M3 PJM1204 - BusinessAnalysis P2 Fall 2022Document59 pagesM3 PJM1204 - BusinessAnalysis P2 Fall 2022Kedze BaronNo ratings yet

- Book1 DEVELOPERS 2023Document6 pagesBook1 DEVELOPERS 2023RUKHNo ratings yet

- Income Based ValuationDocument25 pagesIncome Based ValuationApril Joy ObedozaNo ratings yet

- Week 11 In-Class Exercise (Topic 9) - WORKSHEETDocument4 pagesWeek 11 In-Class Exercise (Topic 9) - WORKSHEETDương LêNo ratings yet

- Comprehensive ProblemDocument2 pagesComprehensive ProblemErik NavarroNo ratings yet

- Concepts of CostDocument29 pagesConcepts of CostkhanimNo ratings yet

- HEDGE FUND INSTITUTIONAL FORUM Public Funds Roundtable 2013Document5 pagesHEDGE FUND INSTITUTIONAL FORUM Public Funds Roundtable 2013RDH CorporationNo ratings yet

- Chapter 10 Property Plant EquipmentDocument27 pagesChapter 10 Property Plant EquipmentLancerAce22No ratings yet

- ch04 Homework SolutionDocument26 pagesch04 Homework SolutionPhúc NguyễnNo ratings yet

- 1.1 4 - Discounting Risky Cash FlowsDocument40 pages1.1 4 - Discounting Risky Cash Flowsmanoranjan838241No ratings yet

- Gulaq Gear 6 - For HDFCDocument1 pageGulaq Gear 6 - For HDFCriddhi SalviNo ratings yet