Professional Documents

Culture Documents

Meaning & Evolution of Derivatives

Uploaded by

Abhijeet0 ratings0% found this document useful (0 votes)

11 views11 pagesCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views11 pagesMeaning & Evolution of Derivatives

Uploaded by

AbhijeetCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 11

UNIT-1

What is Derivatives?

Literal meaning of derivative is that something which is derived.

Simple one line it is that value/price which is derived from any

underlying asset.

The term ‘derivative’ indicates that it has no independent value,

i.e., its value is entirely derived from the value of the underlying

asset.

The underlying asset can be securities, commodities, bullion,

currency, livestock or anything else.

The Securities Contracts (Regulation) Act 1956 defines

‘derivative’ as under, ‘Derivative’ includes Security derived

from a debt instrument, share, loan whether secured or

unsecured, risk instrument or contract for differences or any other

form of security.

Dr. Mayank Malviya

Evolution of derivatives

It is difficult to trace out origin of futures trading since it is not

clearly established as to where and when the first forward market

came into existence.

Historically, it is evident that futures markets were developed

after the development of forward markets.

It is believed that the forward trading was in existence during

12th century in England and France.

Forward trading in rice was started in 17th century in Japan,

known as Cho-at-Mai a kind (rice trade-on-book) concentrated

around Dojima in Osaka, later on the trade in rice grew with a

high degree of standardization.

In 1730, this market got official recognition from the Tokugawa

Shogurate (last Feudal Japanese military Government). As such,

the Dojima rice market became the first futures market in the

sense that it was registered on organized exchange with the

standardized trading norms.

Dr. Mayank Malviya

The butter and eggs dealers of Chicago Produce

Exchange joined hands in 1898 to form the Chicago

Mercantile Exchange for futures trading.

The exchange provided a futures market for many

commodities including pork bellies (1961), live cattle

(1964), live hogs (1966), and feeder cattle (1971).

The International Monetary Market was formed as a

division of the Chicago Mercantile Exchange in 1972 for

futures trading in foreign currencies.

In 1982, it introduced a futures contract on the S&P 500

Stock Index.

Among these are the Chicago Rice and Cotton Exchange,

the New York Futures Exchange, the London

International Financial Futures Exchange, the Toronto

Futures Exchange and the Singapore International

Monetary Exchange takes place.

Dr. Mayank Malviya

During 1980’s, markets developed for options in foreign

exchange, options on stock indices, and options on futures

contracts.

The Philadelphia Stock Exchange(PHLX) is the premier

exchange for trading foreign exchange options. It is the oldest

stock exchange in US. Currently it is called as NASDAQ OMX

PHLX.

The Chicago Board Options Exchange trades options on the S&P

100 and the S&P 500 stock indices while the American Stock

Exchange trades options on the Major Market Stock Index, and

the New York Stock Exchange trades options on the NYSE

Index.

Most exchanges offering futures contracts now also offer options

on these futures contracts.

Thus, the Chicago Board of Trades offers options on commodity

futures, the Chicago Mercantile Exchange offers options on live

cattle futures, the International Monetary Market offers options

on foreign currency futures, and so on.

Dr. Mayank Malviya

The basic cause of future trading was to cover the price risk.

In earlier years, transporting goods from one market to other

markets took many months.

For example, in the 1800s, food grains produced in England sent

through ships to the United States which normally took few

months. Sometimes, during this time, the price changed due to

unfavourable events before the goods reached to the destination.

In such cases, the producers had to sell their goods at loss.

Therefore, the producers sought to avoid such price risk by

selling their goods future, or on a “to arrive” basis.

The basic idea behind this move at that time was simply to cover

future price risk.

On the opposite side, the speculator or other commercial firms

seeking to manage their price risk came forward to go for such

trading.

In this way, the future trading in commodities came into

existence.

Dr. Mayank Malviya

In the beginning, these future trading agreements were formed to

buy and sell food grains in the future for actual delivery at the

pre-determined price.

Later on these agreements became transferable, and during the

American Civil War period, i.e., 1860 to 1865, it became

common place to sell and resell such agreements where actual

delivery of produce was not necessary.

Gradually, the traders realized that the agreements were easier to

buy and sell if the same were standardized in terms of quantity,

quality and place of delivery relating to food grains.

In the nineteenth century this activity was centered in Chicago

which was the main food grains marketing center in the United

States.

In this way, the modern futures contracts first came into existence

with the establishment of the Chicago Board of Trade (CBOT) in

the year 1848, and today, it is the largest futures market of the

world.

In 1865, the CBOT framed the general rules for such trading

which later on became a trendsetter for so many other markets.

Dr. Mayank Malviya

In 1874, the Chicago Produce Exchange was

established which provided the market for butter, eggs,

poultry, and other perishable agricultural products.

In the year 1877, the London Metal Exchange came

into existence, and today, it is the leading market in

metal trading both in spot as well as forward & future.

In the year 1898, the butter and egg dealers withdraw

from the Chicago Produce Exchange to form separately

the Chicago Butter and Egg Board, and thus, in 1919

this exchange was renamed as the Chicago Mercantile

Exchange (CME) and was reorganized for futures

trading.

Dr. Mayank Malviya

Although financial derivatives have been in operation since

long, but they have become a major force in financial

markets in the early 1970s.

The basic reason behind this development was the failure of

Brettonwood System and the fixed exchange rate regime

was broken down.

As a result, new exchange rate regime, i.e., floating rate

(flexible) system based upon market forces came into

existence.

But due to pressure of demand and supply on different

currencies, the exchange rates were constantly changing,

and often, substantially.

As a result, the business firms faced a new risk, known as

currency or foreign exchange risk.

Dr. Mayank Malviya

Another important reason for the instability in the

financial market was fluctuation in the short-term

interests.

This was mainly due to that most of the Government at

that time tried to manage foreign exchange fluctuations

through short-term interest rates and by maintaining

money supply targets, but which were contrary to each

other.

Further, the increased instability of short-term interest

rates created adverse impact on long-term interest

rates, and hence, instability in bond prices, because

they are largely determined by long-term interest rates.

The result is that it created another risk, named interest

rate risk, for both the issuers and the investors of debt

instruments.

Dr. Mayank Malviya

Interest rate fluctuations had not only created

instability in bond prices, but also in other long-

term assets such as, company stocks and shares.

Share prices are determined on the basis of

expected present values of future dividend

payments discounted at the appropriate discount

rate.

Discount rates are usually based on long-term

interest rates in the market.

So it increased instability in the long-term interest

rates caused enhanced fluctuations in the share

prices in the stock markets.

Further volatility in stock prices is reflected in the

volatility in stock market indices which causes

systematic risk or market risk.

Dr. Mayank Malviya

In the early 1970s, it is witnessed that the financial markets were

highly instable, as a result, so many financial derivatives have

been emerged as the means to manage the different types of risks

stated above, and also for taking advantage of it.

Hence, the first financial futures market was the International

Monetary Market, established in 1972 by the Chicago Mercantile

Exchange which was followed by the London International

Financial Futures Exchange in 1982.

The Forwards Contracts (Regulation) Act, 1952, regulates the

forward/futures contracts in commodities all over India.

As per this the Forward Markets Commission (FMC) continues

to have jurisdiction over commodity forward/futures contracts.

However when derivatives trading in securities was introduced in

2001, the term ‘security’ in the Securities Contracts (Regulation)

Act, 1956 (SCRA), was amended to include derivative contracts

in securities.

Consequently, regulation of derivatives came under the preview

of Securities & Exchange Board of India (SEBI) which

previously called as Stock Exchange Board of India.

Dr. Mayank Malviya

You might also like

- Financial DerivativesDocument15 pagesFinancial DerivativesVarun VermaNo ratings yet

- DerivativesDocument250 pagesDerivativesYashika SharmaNo ratings yet

- History of Derivative Markets: Learn How Derivatives Evolved and Where They Are TodayDocument20 pagesHistory of Derivative Markets: Learn How Derivatives Evolved and Where They Are TodaySibananda PanigrahiNo ratings yet

- DerivativesDocument48 pagesDerivativesJayant JoshiNo ratings yet

- FM 402 Financial DerivativesDocument34 pagesFM 402 Financial DerivativesbhaskarganeshNo ratings yet

- A Handbook On Derivatives PDFDocument35 pagesA Handbook On Derivatives PDFAccamumbai Acca Coaching50% (2)

- Synopsis of DerivativesDocument15 pagesSynopsis of DerivativesDhirendra ShuklaNo ratings yet

- The History of FuturesDocument4 pagesThe History of FuturesPranesh RaoNo ratings yet

- HISTORY OF DERIVATIVESDocument29 pagesHISTORY OF DERIVATIVEShanunesh100% (1)

- Derivatives in India Blackbook Project TYBFM 2015-2016Document54 pagesDerivatives in India Blackbook Project TYBFM 2015-2016Malay Dighe80% (35)

- Fin444.3 Assignment2 Id082011030Document6 pagesFin444.3 Assignment2 Id082011030Mollah Md NaimNo ratings yet

- Chapter - 1: DerivativesDocument60 pagesChapter - 1: DerivativesAnkita JainNo ratings yet

- Derivatives MarketDocument60 pagesDerivatives MarketKaustubh PatelNo ratings yet

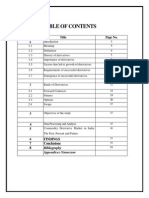

- Chapter No. Title Page No. 1: Findings 7 Conclusions 8Document58 pagesChapter No. Title Page No. 1: Findings 7 Conclusions 8Reu GeorgeNo ratings yet

- Killer Commodities: How to Cash in on the Hottest New Trading TrendsFrom EverandKiller Commodities: How to Cash in on the Hottest New Trading TrendsNo ratings yet

- Financial Derivatives: Mba Ii Year Iv SemesterDocument50 pagesFinancial Derivatives: Mba Ii Year Iv SemesterSailaja BhanuNo ratings yet

- Combined CDM NotesDocument118 pagesCombined CDM NotesMihiiiNo ratings yet

- Derivatives Future and OptionDocument20 pagesDerivatives Future and OptionSwayam PatilNo ratings yet

- Commodities Market1Document65 pagesCommodities Market1Tanguturu AnushaNo ratings yet

- A Study On Commodity Markets - Price Drivers of Gold and SilverDocument90 pagesA Study On Commodity Markets - Price Drivers of Gold and SilverHarsha Vardhini100% (2)

- History of Derivatives MarketsDocument1 pageHistory of Derivatives MarketsRajan NandolaNo ratings yet

- Manthan Report - Commodity SectorDocument22 pagesManthan Report - Commodity SectorAtul sharmaNo ratings yet

- Harsh ProjectDocument93 pagesHarsh Projecthasini_nandu12No ratings yet

- Introduction To Derivative SecuritiesDocument73 pagesIntroduction To Derivative SecuritiesNitesh MhatreNo ratings yet

- A Study On Commodity Markets Price Drivers of Gold and SilverDocument88 pagesA Study On Commodity Markets Price Drivers of Gold and SilvermeetNo ratings yet

- Mcom Derivatives.Document40 pagesMcom Derivatives.Shweta Sawant0% (1)

- Action in MarketplaceDocument27 pagesAction in Marketplaceanon_966435551No ratings yet

- Sales Representatives Manual Volume4 EnglishEdition PDFDocument203 pagesSales Representatives Manual Volume4 EnglishEdition PDFNarayana MurthyNo ratings yet

- Commodity Market Full NotesDocument83 pagesCommodity Market Full NotesHarshitha RNo ratings yet

- A Brief History of DerivativesDocument12 pagesA Brief History of DerivativesPranab SahooNo ratings yet

- Commodity Derivatives in IndiaDocument3 pagesCommodity Derivatives in IndiaIntelivisto Consulting India Private LimitedNo ratings yet

- Removed Parts For RestructuringDocument5 pagesRemoved Parts For RestructuringAJ BlazaNo ratings yet

- Introduction to Securities Markets and Historical Development in IndiaDocument567 pagesIntroduction to Securities Markets and Historical Development in IndiaHarshill MattaNo ratings yet

- 1fta Forex Trading Course PDFDocument58 pages1fta Forex Trading Course PDFlcs1234678No ratings yet

- Unit - 1 - Introduction To DerivativesDocument14 pagesUnit - 1 - Introduction To Derivativesjose.timana77No ratings yet

- Financial DerivativesDocument309 pagesFinancial DerivativessuryaNo ratings yet

- Full Final ProjectDocument126 pagesFull Final ProjectBismiJKalamNo ratings yet

- Financial DerivativesDocument25 pagesFinancial DerivativesnarutomoogrNo ratings yet

- Derivatives in India Blackbook Project TYBFM 2015 2016Document55 pagesDerivatives in India Blackbook Project TYBFM 2015 2016TYBMS-A 3001 Ansh AgarwalNo ratings yet

- Performance Evaluation of Selected CommoditiesDocument73 pagesPerformance Evaluation of Selected CommoditiesMessiNo ratings yet

- Commodity MarketDocument8 pagesCommodity MarketDavid jsNo ratings yet

- Commodity Market ProjectDocument23 pagesCommodity Market ProjectVinay MeherNo ratings yet

- Commodity Market 6Document106 pagesCommodity Market 6Raghu BMNo ratings yet

- Commodity Markets ExplainedDocument4 pagesCommodity Markets ExplainedBretha KannaraoNo ratings yet

- Comodity Market in IndiaDocument6 pagesComodity Market in IndiaCrystal ScottNo ratings yet

- Gold Trading in Commodity MarketDocument67 pagesGold Trading in Commodity MarketManish BeraNo ratings yet

- A Study On The Derivatives Market in IndiaDocument11 pagesA Study On The Derivatives Market in IndiaAjinkya SonawaneNo ratings yet

- How to be a Forex Trading King: How To Be A Trading King, #2From EverandHow to be a Forex Trading King: How To Be A Trading King, #2No ratings yet

- An easy approach to the forex trading: An introductory guide on the Forex Trading and the most effective strategies to work in the currency marketFrom EverandAn easy approach to the forex trading: An introductory guide on the Forex Trading and the most effective strategies to work in the currency marketRating: 5 out of 5 stars5/5 (2)

- Blockchain: The Ultimate Guide to Understanding the Technology Behind Bitcoin and CryptocurrencyFrom EverandBlockchain: The Ultimate Guide to Understanding the Technology Behind Bitcoin and CryptocurrencyRating: 5 out of 5 stars5/5 (1)

- The Complete Guide to Investing in Commodity Trading & Futures: How to Earn High Rates of Returns SafelyFrom EverandThe Complete Guide to Investing in Commodity Trading & Futures: How to Earn High Rates of Returns SafelyRating: 3 out of 5 stars3/5 (1)

- Forex: Quick Starters Guide to Forex Trading: Quick Starters Guide To TradingFrom EverandForex: Quick Starters Guide to Forex Trading: Quick Starters Guide To TradingNo ratings yet

- Global Shocks: An Investment Guide for Turbulent MarketsFrom EverandGlobal Shocks: An Investment Guide for Turbulent MarketsNo ratings yet

- Foreign Exchange: A Practical Guide to the FX MarketsFrom EverandForeign Exchange: A Practical Guide to the FX MarketsRating: 5 out of 5 stars5/5 (2)

- Value Investing - A Presentation by Prof Sanjay BakshiDocument22 pagesValue Investing - A Presentation by Prof Sanjay BakshisubrataberaNo ratings yet

- Money MastersDocument108 pagesMoney Mastersapanisile14142100% (1)

- Accounts G11 Term 1 2009Document2 pagesAccounts G11 Term 1 2009chicochaxNo ratings yet

- Master in Economics of Banking and Finance ProgramDocument2 pagesMaster in Economics of Banking and Finance ProgramtranglomangoNo ratings yet

- China 2023 Outlook After Winter Comes SpringDocument23 pagesChina 2023 Outlook After Winter Comes SpringBrian LwlNo ratings yet

- Siemens Audit Report PDFDocument43 pagesSiemens Audit Report PDFShameel IrshadNo ratings yet

- Pristine View 1Document28 pagesPristine View 1Michael Jordan80% (5)

- Don't Fight The Fed - A Wealth of Common SenseDocument4 pagesDon't Fight The Fed - A Wealth of Common SensebiddingersNo ratings yet

- PF Withdrawl Forms 19 SampleDocument2 pagesPF Withdrawl Forms 19 SamplePrasanta SahooNo ratings yet

- Japan Customs InformationDocument6 pagesJapan Customs InformationJawad HussainNo ratings yet

- Probabilistic Methods for Pricing Bonds and DerivativesDocument89 pagesProbabilistic Methods for Pricing Bonds and DerivativesWarren CullyNo ratings yet

- ACC20013 Week 4 Lecture SlidesDocument11 pagesACC20013 Week 4 Lecture SlidesMing KaiNo ratings yet

- Vetan Deyak Praptra Vittiya Niyam Sangrah, Khand-5, Bhag-1 See Chapter 6 Para-108, Chapter 7 Para-131Document10 pagesVetan Deyak Praptra Vittiya Niyam Sangrah, Khand-5, Bhag-1 See Chapter 6 Para-108, Chapter 7 Para-131Madan ChaturvediNo ratings yet

- Ch11 Corporation AccountingDocument101 pagesCh11 Corporation AccountingLoksa Restu Sianturi100% (1)

- Personal Assets: AssetDocument6 pagesPersonal Assets: AssetDipak NandeshwarNo ratings yet

- Banker Customer RelationshipDocument25 pagesBanker Customer Relationshiprajin_rammstein100% (1)

- Assignment On RFTBDocument7 pagesAssignment On RFTBMica Ella San DiegoNo ratings yet

- YTC Charting Patterns PosterDocument4 pagesYTC Charting Patterns Posterchetan666123100% (2)

- SiloDocument3 pagesSiloBilly ChandraNo ratings yet

- Headphone PDFDocument1 pageHeadphone PDFRohan BadeNo ratings yet

- Assingnment of International Trade Law ON Payment of International SalesDocument15 pagesAssingnment of International Trade Law ON Payment of International SalesManik Singh KapoorNo ratings yet

- Staff-Budget Preparation and ManagementDocument26 pagesStaff-Budget Preparation and ManagementRaniNo ratings yet

- Financial-Management Solved MCQs (Set-12)Document8 pagesFinancial-Management Solved MCQs (Set-12)IqraNo ratings yet

- Ind AS36 1Document2 pagesInd AS36 1Nishant NagpurkarNo ratings yet

- Sanction LetterDocument3 pagesSanction LetterOnis EnergyNo ratings yet

- Ey Opportunitiesand Challenges of The Indonesian Electrification Drive PDFDocument9 pagesEy Opportunitiesand Challenges of The Indonesian Electrification Drive PDFdaniel_awNo ratings yet

- FY 2019-20 BOA Approved BudgetDocument528 pagesFY 2019-20 BOA Approved BudgetHelen BennettNo ratings yet

- CH 18 Audit of The Acquisition and Payment Cycle PDFDocument13 pagesCH 18 Audit of The Acquisition and Payment Cycle PDFFred The Fish100% (1)

- Haresham BaharumDocument38 pagesHaresham Baharumjaharuddin.hannoverNo ratings yet

- Fundamental Analysis (IT Sector)Document44 pagesFundamental Analysis (IT Sector)Sehejmeet Singh NandaNo ratings yet