Professional Documents

Culture Documents

Bispap 20 G

Uploaded by

huỳnh tấn phátOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bispap 20 G

Uploaded by

huỳnh tấn phátCopyright:

Available Formats

China’s monetary and fiscal policy

Li Ruogu

In the past few years, the Chinese government has been pursuing an active fiscal policy to finance key

construction projects by issuing government debt. Meanwhile, sound monetary policy has been

implemented in coordination with the fiscal policy. With the coordination of the two policies, the trend

of deflation has been contained, economic restructuring accelerated and economic growth further

promoted.

China’s GDP exceeded RMB 10 trillion in 2002 - a historic breakthrough. In recent years, reform of the

fiscal revenue system has resulted in the steady growth of government revenue. In 2001, it amounted

to RMB 1.6 trillion, 5.6 times that in 1990. The proportion of government revenue to GDP increased

from 11% in 1994 - during the early stage of reform - to 17% in 2001. Significant progress has also

been made in reforming the management of government expenditure.

Despite the above achievements, there remain challenges facing China’s economic development,

which are mainly reflected in the slowdown of government revenue since the beginning of 2002, the

relatively high proportion of non-performing loans in the financial sector, weaker demand in rural areas

and persistent employment pressure. In addition, uncertainties over the global economic outlook have

had an impact on China’s exports and economic growth. To resolve these problems, the Chinese

government will continue to boost domestic demand through proactive fiscal policy and sound

monetary policy and further speed up economic restructuring and improve the quality and efficiency of

economic growth. Major developments in recent fiscal and monetary policies are as follows.

Monetary policy

Since the beginning of 2002, the People’s Bank of China (PBC) has been pursuing sound monetary

policy while promoting policy efficiency. The indirect policy instruments and mechanism have been

improved. During the year to September 2002, China’s broad money (M2) and narrow money (M1)

increased by 16.5% and 15.9% respectively. China’s base money has increased steadily and financial

institutions’ positions remain adequate. At the end of September 2002, the central bank’s base money

stood at RMB 3.97 trillion, representing an annual growth rate of 11.1%, an acceleration of

3.4 percentage points from a year earlier. The average excess reserve ratio of the financial institutions

was 4.9%, representing an adequate position and high liquidity. The loans granted by China’s financial

institutions have also grown rapidly, with improvements in lending structure and quality. On a

comparable basis, renminbi loans by all financial institutions (including foreign institutions) increased

by 14.2%, accelerating by 2.6 percentage points from end-2001 and registering the highest growth

since March 2001.

In the light of the current situation at home and abroad, the PBC will:

• use monetary policy instruments in a flexible manner to adjust money supply appropriately

and maintain reasonable growth in credit aggregates;

• promote the reform of the interest rate mechanism, and bring interest rates into full play in

adjustment of the demand and supply of funds, as well as in the optimisation of resource

allocation;

• improve the incentives applying to lending and corporate governance of commercial banks;

• and improve the RMB exchange rate formation system under the precondition of preserving

the stability of the RMB exchange rate.

BIS Papers No 20 107

Fiscal policy

In the light of the weak global recovery in early 2002, the Chinese government continued to pursue a

proactive fiscal policy to boost domestic demand. In the first three quarters, fiscal revenue increased

by 10.9% and expenditure by 17.6%, which is under the budget limits. Owing to the slowing revenue

and increasing expenditure, there is little room for further fiscal deficit reduction.

The slowing revenue is caused by the following factors:

• customs tariffs were reduced from 15.3% to 12% in line with China’s WTO commitment;

• the impact of lowering the securities stamp tax rate became increasingly evident in 2002;

• the banking and insurance business tax was further lowered by 1 percentage point in 2002.

The increase in expenditures is caused by the following factors:

• continued investment in projects funded by government bonds, western region development

and technical innovation;

• more resources directed to the social safety net;

• wage increases for civil servants;

• increased investment in agriculture, science and education.

Therefore, the budget deficit in 2002 will remain at the level of 3.3% of GDP.

While paying close attention to the explicit risks posed by the increase in the fiscal deficit and public

debt, the Chinese government is also aware of the implicit fiscal liabilities arising from non-performing

loans in the banking sector, the restructuring of state-owned enterprises, and the underfunded pension

system. Efforts will be made to address the medium-term fiscal risks by implementing a medium-term

budgetary framework and promoting various reforms, including the overhaul of the financial system,

the state-owned enterprises and the social safety net. We firmly believe that China’s medium-term

fiscal sustainability is strongly underpinned by sustained economic growth and a steady increase in

revenue as well as the people’s confidence in the government.

Coordination between monetary policy and fiscal policy

Monetary and fiscal policy must be well coordinated. This is particularly relevant to the bond market,

especially the government bond market, since it has become one of the most important channels for

the central bank to adjust the money supply. Currently, with base money standing at RMB 3 trillion,

and outstanding government debts at only RMB 2 trillion, the volume of bonds is insufficient to satisfy

the operational needs of the central bank’s monetary policy. Outstanding debts, consisting of long-

and medium-term debts and almost no short-term ones, will also affect the efficiency of the central

bank’s monetary operations. Furthermore, the products in the bond market lack diversity. Under these

circumstances, it will be hard for the central bank when conducting open market operations to take into

consideration the interests of all the parties involved. Therefore, coordination and communication

between the central bank and the Ministry of Finance are necessary in formulating and implementing

macroeconomic policies.

108 BIS Papers No 20

You might also like

- Road MapDocument7 pagesRoad Mapran2013No ratings yet

- Local Public Finance Management in the People's Republic of China: Challenges and OpportunitiesFrom EverandLocal Public Finance Management in the People's Republic of China: Challenges and OpportunitiesNo ratings yet

- môn tiền tệ ngân hàng bản hoàn chỉnhDocument6 pagesmôn tiền tệ ngân hàng bản hoàn chỉnhMy Nguyễn Thị TràNo ratings yet

- Fiscal Issues and Central Banks: Indonesia's ExperienceDocument4 pagesFiscal Issues and Central Banks: Indonesia's ExperiencevitconbhNo ratings yet

- China: Government Spending and Fiscal PolicyDocument3 pagesChina: Government Spending and Fiscal PolicyARNAB MANDALNo ratings yet

- Final Exam HamidDocument7 pagesFinal Exam HamidHome PhoneNo ratings yet

- Indian Economy Term PaperDocument12 pagesIndian Economy Term PaperSwarnali DuttaNo ratings yet

- Coordination of Monetary and Fiscal Policy: Rakesh KumarDocument11 pagesCoordination of Monetary and Fiscal Policy: Rakesh KumarShumaisa12No ratings yet

- BUSM 2565 Class NoteDocument9 pagesBUSM 2565 Class Notemaidx2603No ratings yet

- CBSL Releases Its Annual Report For Year 2022 eDocument13 pagesCBSL Releases Its Annual Report For Year 2022 eMichitha BandaraNo ratings yet

- 14 Thailand: Siri GanjarerndeeDocument43 pages14 Thailand: Siri GanjarerndeeowltbigNo ratings yet

- Management Discussion and Analysis 2015Document37 pagesManagement Discussion and Analysis 2015Rohit SharmaNo ratings yet

- Model of The State Bank of VietnamDocument6 pagesModel of The State Bank of VietnamMy Nguyễn Thị TràNo ratings yet

- By DRDocument3 pagesBy DRKhuram Shahzad CheemaNo ratings yet

- Fiscal Deficits Matter For Macroeconomic StabilityDocument3 pagesFiscal Deficits Matter For Macroeconomic StabilityMd. Johir Uddin ShohagNo ratings yet

- IMF - Statement at The Conclusion of An IMF Staff Mission To Myanmar - Nov2012Document1 pageIMF - Statement at The Conclusion of An IMF Staff Mission To Myanmar - Nov2012Ko Gree KyawNo ratings yet

- Economic Development: A. GeneralDocument10 pagesEconomic Development: A. GeneralFRankie Bin GRanuleNo ratings yet

- Pakistan's Monetary Policy of 2022Document14 pagesPakistan's Monetary Policy of 2022Gohar KhalidNo ratings yet

- Macroeconomics Case Study: Chinese Macroeconomic Policy Position PaperDocument29 pagesMacroeconomics Case Study: Chinese Macroeconomic Policy Position PaperSani SalisuNo ratings yet

- Presentation Development 20Document8 pagesPresentation Development 20Hussain RizviNo ratings yet

- Monetary Policy of Pakistan: Submitted To: Mirza Aqeel BaigDocument9 pagesMonetary Policy of Pakistan: Submitted To: Mirza Aqeel BaigAli AmjadNo ratings yet

- The Financial Sector Policy StanceDocument7 pagesThe Financial Sector Policy Stanceশামছুদ্দিন চৌধুরী দেলোয়ারNo ratings yet

- Areas of Concern in IndiaDocument17 pagesAreas of Concern in IndiaElle Gio CasibangNo ratings yet

- Assignment On:: Context of Monetary Policy of BangladeshDocument8 pagesAssignment On:: Context of Monetary Policy of BangladeshIbrahim KholilNo ratings yet

- FinalDocument20 pagesFinalSonam Peldon (Business) [Cohort2020 RTC]No ratings yet

- Bangladesh Quarterly Economic Update - March 2012Document28 pagesBangladesh Quarterly Economic Update - March 2012Asian Development BankNo ratings yet

- Changing Economic RealitiesDocument17 pagesChanging Economic RealitiesmkhurramjahNo ratings yet

- Bangladesh Bank Monetary Policy For FY 2012Document13 pagesBangladesh Bank Monetary Policy For FY 2012Nurul Mostofa100% (1)

- The StateDocument7 pagesThe StategootliNo ratings yet

- Executive Summary: A. The Macro Financial EnvironmentDocument5 pagesExecutive Summary: A. The Macro Financial EnvironmentSajib DasNo ratings yet

- Monetary Policy of PakistanDocument25 pagesMonetary Policy of PakistanAli JumaniNo ratings yet

- Bispap122 JDocument9 pagesBispap122 JHashmita MistriNo ratings yet

- Monetary Policy, Inflation and Liquidity Crisis: Bangladesh Economic UpdateDocument17 pagesMonetary Policy, Inflation and Liquidity Crisis: Bangladesh Economic UpdateMuhammad Hasan ParvajNo ratings yet

- Red Jun 2014Document38 pagesRed Jun 2014hrnanaNo ratings yet

- Fiscal Policy, Public Debt Management and Government Bond Markets: The Case For The PhilippinesDocument15 pagesFiscal Policy, Public Debt Management and Government Bond Markets: The Case For The Philippinesashish1981No ratings yet

- China's Economic Trend Under The Impact of The EpidemicDocument10 pagesChina's Economic Trend Under The Impact of The EpidemicRumi AzhariNo ratings yet

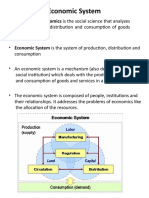

- Name: Efshal Ateeq Roll No: B-23232 Project: Ict Submitted To: Sir Rahat BukhariDocument5 pagesName: Efshal Ateeq Roll No: B-23232 Project: Ict Submitted To: Sir Rahat BukhariEfshal AtiqueNo ratings yet

- Presentation - How Did Uganda Address Economic and Budgetary Reformsx Lessons For South SudanDocument10 pagesPresentation - How Did Uganda Address Economic and Budgetary Reformsx Lessons For South SudanAbdirisaq MohamudNo ratings yet

- Changes by The State Bank of Pakistan From 2019-2020: Ayesha Shoaib 18947 Muskaan ShekhaniDocument30 pagesChanges by The State Bank of Pakistan From 2019-2020: Ayesha Shoaib 18947 Muskaan ShekhaniSadia AbidNo ratings yet

- China Monetary Policy Report Quarter One, 2011Document57 pagesChina Monetary Policy Report Quarter One, 2011Kunal ChaudharyNo ratings yet

- MPS Apr 2012 EngDocument3 pagesMPS Apr 2012 Engbeyond_ecstasyNo ratings yet

- Highligts of Monetary PolicyDocument7 pagesHighligts of Monetary PolicySandesh KhatiwadaNo ratings yet

- Id 07Document3 pagesId 07Ayesha SiddikaNo ratings yet

- Id 07Document3 pagesId 07Ayesha SiddikaNo ratings yet

- Mohd Ebad Askari Unit 3 EEDocument4 pagesMohd Ebad Askari Unit 3 EEEyaminNo ratings yet

- Study of Macroeconomic Policies and Their Impact On Major Macro-Indicators of ChinaDocument10 pagesStudy of Macroeconomic Policies and Their Impact On Major Macro-Indicators of ChinaRatnesh MishraNo ratings yet

- Chapter - 3 Reserve Bank of India: Monetary Policy and InstrumentsDocument10 pagesChapter - 3 Reserve Bank of India: Monetary Policy and Instrumentsanusaya1988No ratings yet

- Financial Highlights of Pakistan Economy 08-09Document5 pagesFinancial Highlights of Pakistan Economy 08-09Waqar AliNo ratings yet

- MONETARY Policy of Pakistan AnalysisDocument24 pagesMONETARY Policy of Pakistan Analysisxaxif50% (2)

- 2007-8 Financial CrisesDocument4 pages2007-8 Financial CrisesHajira alamNo ratings yet

- Assignment - Credit PolicyDocument10 pagesAssignment - Credit PolicyNilesh VadherNo ratings yet

- Monetary Policy of BDDocument11 pagesMonetary Policy of BDMD Rifat ZahirNo ratings yet

- Kathmandu University School of Management: Pinchhe Tole, Gwarko, KathmanduDocument34 pagesKathmandu University School of Management: Pinchhe Tole, Gwarko, KathmanduYash AgrawalNo ratings yet

- Research Paper On Monetary Policy of PakistanDocument7 pagesResearch Paper On Monetary Policy of Pakistanefeh4a7z100% (1)

- Malaysia Economic Full Assignment 1Document26 pagesMalaysia Economic Full Assignment 1ViknesWaran50% (2)

- Η έκθεση-απάντηση της Ελληνικής κυβέρνησης στο Διεθνές Νομισματικό Ταμείο σχετικά με την παροχή οικονομικής αρωγής - Μάιος 2010Document81 pagesΗ έκθεση-απάντηση της Ελληνικής κυβέρνησης στο Διεθνές Νομισματικό Ταμείο σχετικά με την παροχή οικονομικής αρωγής - Μάιος 2010Peter NousiosNo ratings yet

- SL Debt Trap (30april2017)Document4 pagesSL Debt Trap (30april2017)Jagath SenaNo ratings yet

- Case Study Study On Tools Used by Monetary Policy and Fiscal Policy in BhutanDocument12 pagesCase Study Study On Tools Used by Monetary Policy and Fiscal Policy in BhutanSonam Peldon (Business) [Cohort2020 RTC]No ratings yet

- IS LM BPDocument17 pagesIS LM BPMAROUANE AbdelkaderNo ratings yet

- 3B Trans Tax1 10.13.21Document14 pages3B Trans Tax1 10.13.21DendenFajilagutanNo ratings yet

- Varieties of Neoliberalism in Brazil 2003 2019 PTG 23RDocument24 pagesVarieties of Neoliberalism in Brazil 2003 2019 PTG 23RStefany FerrazNo ratings yet

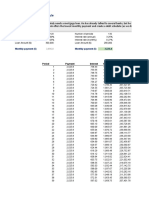

- 3.2 70. Exercise Loan Schedule SolvedDocument6 pages3.2 70. Exercise Loan Schedule SolvedAniket KarnNo ratings yet

- Mixed Economy 1Document7 pagesMixed Economy 1sanju balanavarNo ratings yet

- International Political Economy: R. FalknerDocument40 pagesInternational Political Economy: R. FalknerJuan Esteban Arratia SandovalNo ratings yet

- Felix and Sotelo Valencia - 2021Document44 pagesFelix and Sotelo Valencia - 2021Macias MaycoNo ratings yet

- Macroeconomics MCQ - Multiple Choice Questions - Shasyadhara AgricultureDocument15 pagesMacroeconomics MCQ - Multiple Choice Questions - Shasyadhara AgricultureK LawrenceNo ratings yet

- Macroeconomics 12thDocument120 pagesMacroeconomics 12thAlok SrivastavaNo ratings yet

- CMA B4.7 Bank LoansDocument13 pagesCMA B4.7 Bank LoansZeinabNo ratings yet

- Agriculture As An Economic Factor in Capitalist and Non-CapitalistDocument16 pagesAgriculture As An Economic Factor in Capitalist and Non-CapitalistElena Malimata80% (5)

- Test Resueltos MAcroDocument50 pagesTest Resueltos MAcroAlvaro MerayoNo ratings yet

- Zambelli, Stefano - Computable, Constructive and Behavioural Economic DynamicsDocument560 pagesZambelli, Stefano - Computable, Constructive and Behavioural Economic Dynamicsgustale scasoNo ratings yet

- Interest & AnnuityDocument29 pagesInterest & Annuityvikax90927No ratings yet

- Capitalism, Socialism, and Mixed Economy-Ppt-1Document24 pagesCapitalism, Socialism, and Mixed Economy-Ppt-1nandini swami100% (1)

- Economic System: Planned EconomyDocument8 pagesEconomic System: Planned EconomyHossain Mohammad Abin100% (2)

- Etextbook 978 0132992282 MacroeconomicsDocument61 pagesEtextbook 978 0132992282 Macroeconomicslee.ortiz429100% (50)

- Simple InterestDocument18 pagesSimple Interests.berido.142320.tcNo ratings yet

- ENGINEERING ECONOMY For Video 3Document22 pagesENGINEERING ECONOMY For Video 3Domingo, Jake VincentNo ratings yet

- HSIR EndsemDocument319 pagesHSIR EndsemMadhumitha VetrivelNo ratings yet

- International Political Economy Term Paper TopicsDocument6 pagesInternational Political Economy Term Paper TopicsafmzfxfaalkjcjNo ratings yet

- PHUONG Bao Ton Nu ThuDocument7 pagesPHUONG Bao Ton Nu ThuDaisy FreemanNo ratings yet

- Economics Paper 1 TZ1 SLDocument3 pagesEconomics Paper 1 TZ1 SLKanz MajNo ratings yet

- Mankiw-Test Chapter 22Document5 pagesMankiw-Test Chapter 22Nhật Lan PhươngNo ratings yet

- Se 710270Document5 pagesSe 710270xczq5gqwwhNo ratings yet

- Uts Epii 2022Document17 pagesUts Epii 2022Ranessa NurfadillahNo ratings yet

- 01.pertemuan 14bDocument24 pages01.pertemuan 14bDevina GabriellaNo ratings yet

- Theories of Exchange Rate Determination - NotesDocument12 pagesTheories of Exchange Rate Determination - NotesSewale AbateNo ratings yet

- Graded Quiz Unit 3 - Attempt Review - HomeDocument11 pagesGraded Quiz Unit 3 - Attempt Review - Homealonsofx18No ratings yet

- Principles of Socialist ManagementDocument9 pagesPrinciples of Socialist ManagementLavisha AroraNo ratings yet