Professional Documents

Culture Documents

Tos Qualex Sy2022 2023 2nd Year

Tos Qualex Sy2022 2023 2nd Year

Uploaded by

EllaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tos Qualex Sy2022 2023 2nd Year

Tos Qualex Sy2022 2023 2nd Year

Uploaded by

EllaCopyright:

Available Formats

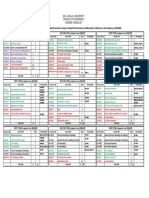

Laguna College

Department of Business Administration and Accountancy

Table of Specifications

in LC BSA Qualifying Examination

for S. Y. 2022 - 2023

(2nd Year Level)

Difficulty Level Easy (50%) Moderate (30%) Difficult (20%)

Bloom’s Taxonomy Remembering Understanding Applying Analyzing Evaluating Creating

LECPA Topics LECPA Subject LC's AE and PC Subjects/Topics No. of Items No. of Items (22) No. of Items (16) No. of Items (22) No. of Items (6) No. of Items (6) No. of Items (3)

The examinee can perform the following competencies under each

topic: 0

A. Development of Financial Reporting Framework, Standard-Setting Bodies and Regulation

of the Accountancy Profession Financial Accoutning and Reporting BME111 - Financial Accounting and Reporting Units 3 0

1. History, Development and Functions of the Standard-Setting Bodies Financial Accoutning and Reporting BME111 - Financial Accounting and Reporting Units 3 1 1

1.1 Explain the history, development and functions of IASB, IFRIC and SIC, FRSC AND PIC. Financial Accoutning and Reporting BME111 - Financial Accounting and Reporting Units 3 1 1

2. Regulation and Environment of the Accounting Profession in the Philippines Financial Accoutning and Reporting BME111 - Financial Accounting and Reporting Units 3 1 1

2.1 Explain the regulation and environment of the profession through the Professional Regulatory

Board of Accountancy, the accredited professional organization of professional accountants in the

Philippines and the sectors of the practice of accountancy profession and their accreditation Financial Accoutning and Reporting BME111 - Financial Accounting and Reporting Units 3 1 1

requirements.

B. Conceptual Framework, Accounting Process and Presentation of Financial Statements

Financial Accoutning and Reporting AE121 - Conceptual Framework and Accounting Standards Units 3 0

1. Conceptual Framework for Financial Reporting Financial Accoutning and Reporting AE121 - Conceptual Framework and Accounting Standards Units 3 1 1

1.1 Explain the objective and status of the Conceptual Framework together with the Qualitative

Characteristics of Useful Financial Information.

Financial Accoutning and Reporting AE121 - Conceptual Framework and Accounting Standards Units 3 1 1

1.2 Explain the definition of recognition and derecognition criteria and measurement bases for the

elements of the financial statements together with the concepts of capital and capital maintenance. Financial Accoutning and Reporting AE121 - Conceptual Framework and Accounting Standards Units 3 1 1

2. Accounting Process Financial Accoutning and Reporting AE121 - Conceptual Framework and Accounting Standards Units 3 0

2.1 Summarize the steps in the accounting process, the use of the special journals, general journal,

subsidiary ledgers and general ledgers and completing the accounting cycle, including use of Financial Accoutning and Reporting AE121 - Conceptual Framework and Accounting Standards Units 3 6 5 1

worksheet, adjusting entries, closing entries and reversing entries.

3. Presentation of Financial Statements Financial Accoutning and Reporting AE121 - Conceptual Framework and Accounting Standards Units 3 0

3.1 Apply the general features, describe the definition of elements and illustrate a classified statement AE121 - Conceptual Framework and Accounting Standards Units 3

of financial position. Financial Accoutning and Reporting 1 1

3.2 Apply the general features, describe the nature and function of expense, describe the components Financial Accoutning and Reporting AE121 - Conceptual Framework and Accounting Standards Units 3 1 1

of profit

3.3 Applyfrom

thecontinuing operations

general features, and the sections

describe components

and of discontinued

illustrate operations

the statement and flows

of cash illustrate

fromthe AE121 - Conceptual Framework and Accounting Standards Units 3

statement

operationsof comprehensive

both the direct andincome together

indirect with the statement of changes in equity.

methods.

Financial Accoutning and Reporting 1 1

3.4 Prepare Notes to the Financial Statements Financial Accoutning and Reporting AE121 - Conceptual Framework and Accounting Standards Units 3 1 1

3.5 Compute and Disclose Basic and Diluted Earnings Per Share Information. Financial Accoutning and Reporting AE121 - Conceptual Framework and Accounting Standards Units 3 0

C. Cash and other Financial Assets Financial Accoutning and Reporting AE212 - Intermediate Accounting 1 Units 6 0

1.

1. Cash

Cash Financial Accoutning and Reporting AE212 - Intermediate Accounting 1 Units 6 0

1.1 Describe the nature and composition of cash

1.1 Describe

1.2 Prepare the nature

a bank and composition of cash

reconciliation Financial Accoutning and Reporting AE212 - Intermediate Accounting 1 Units 6 0

1.2 Prepare

1.3 Apply theaaccounting

bank reconciliation

for petty cash fund Financial Accoutning and Reporting AE212 - Intermediate Accounting 1 Units 6 1 1

2. Other

1.3 Apply Financial Assets (initial

the accounting recognition,

for petty basis for classification, subsequent measurement, reclassification

cash fund Financial Accoutning and Reporting AE212 - Intermediate Accounting 1 Units 6 1 1

and presentation in the financial statements)

2. Other Financial Assets (initial recognition, basis for classification, subsequent measurement,

2.1 Apply the recognition principles for financial assets at fair value through profit or loss, recognition

reclassification and presentation in thethrough

financial statements) Financial Accoutning and Reporting AE212 - Intermediate Accounting 1 Units 6 1 1

principles for financial assets at fair value other comprehensive income and recognition principles for

financial

2.1 Applyassets

theatrecognition

amortized cost.

principles for financial assets at fair value through profit or loss,

2.2 Measure principles

recognition trade and other receivablesassets

for financial including valuation

at fair using allowance

value through for doubtful accounts

other comprehensive incomeand transfer

and

of receivablesprinciples

(pledging, for

assignment

Financial Accoutning and Reporting AE212 - Intermediate Accounting 1 Units 6 1 1

recognition financialand factoring).

assets at amortized cost.

2.3 Measure other financial assets at amortized cost (including investment in bonds).

2.4 Discuss

2.2 Measure investment

trade andinother

associates and jointincluding

receivables venture valuation using allowance for doubtful accounts

and transfer of receivables (pledging, assignment and factoring). Financial Accoutning and Reporting AE212 - Intermediate Accounting 1 Units 6 1 1

2.3 Measure other financial assets at amortized cost (including investment in bonds). Financial Accoutning and Reporting AE212 - Intermediate Accounting 1 Units 6 1 1

2.4 Discuss investment in associates and joint venture Financial Accoutning and Reporting AE212 - Intermediate Accounting 1 Units 6 0

D. Non-financial Assets AE212 - Intermediate Accounting 1 Units 6

1. Inventories Financial Accoutning and Reporting 0

1.1 Describe the nature and determine the capitalizable cost at initial recognition; and, apply AE212 - Intermediate Accounting 1 Units 6

inventory cost flow assumptions and subsequent measurement at lower of cost or estimated selling Financial Accoutning and Reporting 1 1

price less cost to complete and sell.

1.2 Apply estimation procedures – gross profit and retail inventory method. Financial Accoutning and Reporting AE212 - Intermediate Accounting 1 Units 6 1 1

2. Property, plant and equipment AE212 - Intermediate Accounting 1 Units 6

Financial Accoutning and Reporting 1 1

2.1 Describe the nature and determine capitalizable cost at initial recognition; and measure borrowing costs

Financial Accoutning and Reporting AE212 - Intermediate Accounting 1 Units 6 1 1

2.2 Investment

3. Identify subsequent

property expenditures and apply subsequent measurement based on cost with consideration on

Financial Accoutning and Reporting AE212 - Intermediate Accounting 1 Units 6 1 1

depreciation,

3.1 Describe depreciation

the methods and

nature, determine changes incost

capitalizable useful life and

at initial depreciation

recognition, methods.

apply measurement subsequent to

4.

2.3 Intangible

Determine assets

Revaluation and Impairment Financial Accoutning and Reporting AE212 - Intermediate Accounting 1 Units 6 1 1

initial

4.1 recognition

Describe the using cost

nature, method

determine and fairand

capitalizable

account

value method

cost

forand

at initial

retirement

accountand disposals.

foridentify

recognition, subsequent expenditures,

5. Biological

derecognition assets

and reclassification. Financial Accoutning and Reporting AE212 - Intermediate Accounting 1 Units 6 0

apply

5.1 subsequent

Describe measurements

theassets

nature, for from

distinction finite bearer

lives assets

plants–and

amortization and indefinite

6. Non-current

lives assets, produce, held

determinedeterminefor saleand

impairment (or account

disposalfor

group) Financial Accoutning and Reporting AE212 - Intermediate Accounting 1 Units 6 0

agricultural

6.1 Describeexpenses

the nature capitalizable cost atderecognition.

initial recognition and applycost

subsequent

at initialmeasurement

7. Prepaid and– other

criteria for this classification,

assets determine capitalizable recognition, apply

Financial Accoutning and Reporting AE212 - Intermediate Accounting 1 Units 6 1 1

measurement

7.1 Cost

Describe and measure prepaid expenses and other assets.

V.

subsequent Accounting

to initial recognition and account for Reclassification and Derecognition Adavance Financial Accoutning and Reporting AE214 - Cost Accounting and Control Units 3 0

1. Describe the system of cost accumulation or costing system Adavance Financial Accoutning and Reporting AE214 - Cost Accounting and Control Units 3 0

1.1 Differentiate actual costing, normal costing, and standard costing Adavance Financial Accoutning and Reporting AE214 - Cost Accounting and Control Units 3 1 1

2. Job Order Costing Adavance Financial Accoutning and Reporting AE214 - Cost Accounting and Control Units 3 0

2.1 Record transactions using a job order costing procedures Adavance Financial Accoutning and Reporting AE214 - Cost Accounting and Control Units 3 0

2.2 Compute Cost of Goods Manufactured and Sold Adavance Financial Accoutning and Reporting AE214 - Cost Accounting and Control Units 3 1 1

2.3 Account for spoiled units and rework costs Adavance Financial Accoutning and Reporting AE214 - Cost Accounting and Control Units 3 1 1

2.4 Describe the cost accumulation procedures for materials, labor, and overhead Adavance Financial Accoutning and Reporting AE214 - Cost Accounting and Control Units 3 1 1

3. Process Costing System Adavance Financial Accoutning and Reporting AE214 - Cost Accounting and Control Units 3 0

3.1 Record transactions using a process costing procedures Adavance Financial Accoutning and Reporting AE214 - Cost Accounting and Control Units 3 0

3.2 Determine cost of production under Adavance Financial Accoutning and Reporting AE214 - Cost Accounting and Control Units 3 1 1

3.2.1 FIFO Adavance Financial Accoutning and Reporting AE214 - Cost Accounting and Control Units 3 1 1

3.2.2 Weighted Average Adavance Financial Accoutning and Reporting AE214 - Cost Accounting and Control Units 3 0

3.3 Account for lost units in scraps, wastes, spoilages, and reworks Adavance Financial Accoutning and Reporting AE214 - Cost Accounting and Control Units 3 0

3.3.1 Normal lost units-end of process Adavance Financial Accoutning and Reporting AE214 - Cost Accounting and Control Units 3 0

3.2.2 Abnormal lost units Adavance Financial Accoutning and Reporting AE214 - Cost Accounting and Control Units 3 0

3.4 Accumulate cost procedures for materials, labor, and overhead Adavance Financial Accoutning and Reporting AE214 - Cost Accounting and Control Units 3 0

4. Backflush / JIT Costing System Adavance Financial Accoutning and Reporting AE214 - Cost Accounting and Control Units 3 0

4.2 Prepare the journal entries Adavance Financial Accoutning and Reporting AE214 - Cost Accounting and Control Units 3 1 1

4.1 Determine cost of materials, labor, and overhead to be backflushed to finished goods Adavance Financial Accoutning and Reporting AE214 - Cost Accounting and Control Units 3 1 1

5 Activity-Based Costing System (ABC System) Adavance Financial Accoutning and Reporting AE214 - Cost Accounting and Control Units 3 0

5.1 Allocate cost using Activity Based Costing System versus Traditional costing Adavance Financial Accoutning and Reporting AE214 - Cost Accounting and Control Units 3 1 1

5.2 Compute total manufacturing cost and cost per unit using ABC and Traditional costing Adavance Financial Accoutning and Reporting AE214 - Cost Accounting and Control Units 3 0

5.3 Apply the concepts of activity levels, cost pools, and activity drivers Adavance Financial Accoutning and Reporting AE214 - Cost Accounting and Control Units 3 1 1

5.4 Determine cost pool rates and their application to overhead costs Adavance Financial Accoutning and Reporting AE214 - Cost Accounting and Control Units 3 0

6 Joint and By-Products Adavance Financial Accoutning and Reporting AE214 - Cost Accounting and Control Units 3 0

6.1 Compute and allocate joint (common) costs at the point of slit-off using: Adavance Financial Accoutning and Reporting AE214 - Cost Accounting and Control Units 3 0

6.1.1 Market (Sales) value method Adavance Financial Accoutning and Reporting AE214 - Cost Accounting and Control Units 3 1 1

6.1.1.1 Market Value at split-off point approach Adavance Financial Accoutning and Reporting AE214 - Cost Accounting and Control Units 3 1 1

6.1.1.2 Hypothetical market value approach or approximated net realizable value approach Adavance Financial Accoutning and Reporting AE214 - Cost Accounting and Control Units 3 0

or net realizable

6.1.1.3 Average value method output) method

unit (production Adavance Financial Accoutning and Reporting AE214 - Cost Accounting and Control Units 3 0

6.1.1.4 Weighted average method Adavance Financial Accoutning and Reporting AE214 - Cost Accounting and Control Units 3 1 1

6.1.2 Methods of allocating Joint cost to by- products Adavance Financial Accoutning and Reporting AE214 - Cost Accounting and Control Units 3 0

6.1.2.1 No joint cost allocated to by- product Adavance Financial Accoutning and Reporting AE214 - Cost Accounting and Control Units 3 0

6.1.2.2 With joint costs allocated to by-product Adavance Financial Accoutning and Reporting AE214 - Cost Accounting and Control Units 3 0

7 Service Cost Allocation Adavance Financial Accoutning and Reporting AE214 - Cost Accounting and Control Units 3 0

7.1 Allocate service department costs using Adavance Financial Accoutning and Reporting AE214 - Cost Accounting and Control Units 3 0

7.1.1 Direct method Adavance Financial Accoutning and Reporting AE214 - Cost Accounting and Control Units 3 1 1

7.1.2 Step-down method Adavance Financial Accoutning and Reporting AE214 - Cost Accounting and Control Units 3 0

7.1.3 Reciprocal method Adavance Financial Accoutning and Reporting AE214 - Cost Accounting and Control Units 3 0

4.2. Determine the key elements of capital budgeting investment decisions (net

investment, operating cash flow and cost of capital) and evaluate the same using both Management Services AE213 - Financial Management Units 3 2 2

discounted and non-discounted cash flow techniques.

Y. Financial Management Management Services AE213 - Financial Management Units 3 0

1. Identify and describe the nature, objectives, and scope of financial management in making

business decisions. Management Services AE213 - Financial Management Units 3 1 1

2. Analyze and use financial data derived from financial statements in evaluating the

performance of the management and make business decisions. Management Services AE213 - Financial Management Units 3 1 1

3. Apply different working capital (cash, receivables, inventory, and other short-term resources)

management methods and techniques in making short-term business decisions. Management Services AE213 - Financial Management Units 3 1 1

4. Determine the key elements of capital budgeting investment decisions (net investment,

operating cash flow and cost of capital) and evaluate the same using both discounted and non- Management Services AE213 - Financial Management Units 3 1 1

discounted cash flow techniques.

Z. Economic Concepts Essential to Obtaining an Understanding of Entity’s Business and BME113 - Managerial Economics Units 3

Industry Management Services 0

1. Identify and describe the basic concepts of macroeconomics that are relevant in making

business decisions, and apply the concepts properly Management Services BME113 - Managerial Economics Units 3 1 1

2. Identify and describe the basic concepts of microeconomics that are relevant in making

business decisions, and apply the concepts properly. Management Services AE211 - Economic Development Units 3 2 1 1

AA. Law on Business Transactions RFBT BME122 - Law on Obligations and Contracts Units 3 0

1. . Obligations RFBT BME122 - Law on Obligations and Contracts Units 3 0

1.1 Describe obligations RFBT BME122 - Law on Obligations and Contracts Units 3 0

1.1.1 Apply the sources of obligations and their concepts RFBT BME122 - Law on Obligations and Contracts Units 3 1 1

1.1.3.1 Law RFBT BME122 - Law on Obligations and Contracts Units 3 1 1

1.1.3.2 Contracts RFBT BME122 - Law on Obligations and Contracts Units 3 1 1

1.1.3.3 Quasi-contracts RFBT BME122 - Law on Obligations and Contracts Units 3 0

1.1.3.4 Delicts RFBT BME122 - Law on Obligations and Contracts Units 3 0

1.1.3.5 Quasi-delicts RFBT BME122 - Law on Obligations and Contracts Units 3 1 1

1.1.2. Compare and apply the kinds of Obligations RFBT BME122 - Law on Obligations and Contracts Units 3 0

1.1.2.1. Pure/Conditional/Obligation with a Term RFBT BME122 - Law on Obligations and Contracts Units 3 1 1

1.1.2.2. Solidary /Joint Obligations RFBT BME122 - Law on Obligations and Contracts Units 3 1 1

1.1.2.3. Alternative/ Facultative Obligations RFBT BME122 - Law on Obligations and Contracts Units 3 0

1.1.2.4. Divisible/ Indivisible Obligations RFBT BME122 - Law on Obligations and Contracts Units 3 0

1.1.2.5. Obligation with a Penal Clause RFBT BME122 - Law on Obligations and Contracts Units 3 0

1.1.3 Describe the specific circumstances general affecting obligations in RFBT BME122 - Law on Obligations and Contracts Units 3 0

1.1.3.1 Fortuitous Events RFBT BME122 - Law on Obligations and Contracts Units 3 0

1.1.3.2 Fraud RFBT BME122 - Law on Obligations and Contracts Units 3 1 1

1.1.3.3 Negligence RFBT BME122 - Law on Obligations and Contracts Units 3 0

1.1.3.4 Delay RFBT BME122 - Law on Obligations and Contracts Units 3 0

1.1.3.5 Breach of contract RFBT BME122 - Law on Obligations and Contracts Units 3 0

1.1.4 Discuss the nature and effects of Obligations RFBT BME122 - Law on Obligations and Contracts Units 3 0

1.1.4.1 Concurrent Obligations in obligations to give a specific/determinate thing RFBT BME122 - Law on Obligations and Contracts Units 3 0

1.1.4.2 Obligations to do or not to do RFBT BME122 - Law on Obligations and Contracts Units 3 0

1.1.4.3 Remedies in case of non-performance RFBT BME122 - Law on Obligations and Contracts Units 3 0

1.1.4.4 Damages RFBT BME122 - Law on Obligations and Contracts Units 3 0

1.1.5 Distinguish the extinguishment of obligation with special emphasis on RFBT BME122 - Law on Obligations and Contracts Units 3 0

1.1.5.1 Payment of debts of money RFBT BME122 - Law on Obligations and Contracts Units 3 0

1.1.5.2 Mercantile documents as means of payment RFBT BME122 - Law on Obligations and Contracts Units 3 0

1.1.5.3 Apply the special forms or mode of payment RFBT BME122 - Law on Obligations and Contracts Units 3 0

1.1.5.3.1 Dation in payment RFBT BME122 - Law on Obligations and Contracts Units 3 1 1

1.1.5.3.2 Application of payments RFBT BME122 - Law on Obligations and Contracts Units 3 0

1.1.5.3.3 Payment by cession RFBT BME122 - Law on Obligations and Contracts Units 3 1 1

1.1.5.3.4 Tender of payment and consignation RFBT BME122 - Law on Obligations and Contracts Units 3 0

1.1.5.4 Loss of the thing due, remission or condonation, confusion, compensation RFBT BME122 - Law on Obligations and Contracts Units 3 0

and novation

2. Contracts RFBT BME122 - Law on Obligations and Contracts Units 3 0

2.1. General Provisions RFBT BME122 - Law on Obligations and Contracts Units 3 0

2.1.1. Describe contracts RFBT BME122 - Law on Obligations and Contracts Units 3 0

2.1.2. Discuss the classification of contracts RFBT BME122 - Law on Obligations and Contracts Units 3 1 1

2.1.3. Identify the stages of contract RFBT BME122 - Law on Obligations and Contracts Units 3 0

2.1.4. Relate the Freedom to contract (establish stipulations) and limitation RFBT BME122 - Law on Obligations and Contracts Units 3 0

2.1.5. Identify who are persons bound RFBT BME122 - Law on Obligations and Contracts Units 3 0

2.2. Apply the essential requisites of contracts RFBT BME122 - Law on Obligations and Contracts Units 3 0

2.2.1. Consent RFBT BME122 - Law on Obligations and Contracts Units 3 0

2.2.2. Requisites RFBT BME122 - Law on Obligations and Contracts Units 3 1 1

2.2.3. Capacitated persons RFBT BME122 - Law on Obligations and Contracts Units 3 0

2.2.4. Vices of consent RFBT BME122 - Law on Obligations and Contracts Units 3 0

2.2.5. Objects of contracts RFBT BME122 - Law on Obligations and Contracts Units 3 0

2.2.6. Cause of considerations of contracts RFBT BME122 - Law on Obligations and Contracts Units 3 0

2.3. Determine the forms of contracts RFBT BME122 - Law on Obligations and Contracts Units 3 0

2.4. Discuss the reformation of instruments/contracts RFBT BME122 - Law on Obligations and Contracts Units 3 0

2.5. Discuss the interpretation of contracts RFBT BME122 - Law on Obligations and Contracts Units 3 0

2.6. Discuss and apply the defective contracts RFBT BME122 - Law on Obligations and Contracts Units 3 0

2.6.1. Resistible RFBT BME122 - Law on Obligations and Contracts Units 3 1 1

2.6.2. Voidable RFBT BME122 - Law on Obligations and Contracts Units 3 0

2.6.3. Unenforceable RFBT BME122 - Law on Obligations and Contracts Units 3 1 1

2.6.4. Void and inexistent RFBT BME122 - Law on Obligations and Contracts Units 3 0

You might also like

- Dwnload Full Principles of Financial Accounting Canadian 1st Edition Weygandt Solutions Manual PDFDocument27 pagesDwnload Full Principles of Financial Accounting Canadian 1st Edition Weygandt Solutions Manual PDFwelked.gourami8nu9d100% (11)

- Principles of Financial Accounting Canadian 1st Edition Weygandt Solutions ManualDocument25 pagesPrinciples of Financial Accounting Canadian 1st Edition Weygandt Solutions ManualDavidBishopsryz100% (41)

- Legal Advice Letter SampleDocument4 pagesLegal Advice Letter SampleMichelle Hatol100% (5)

- Syllabus IntAcc 2&3Document8 pagesSyllabus IntAcc 2&3Valery Joy CerenadoNo ratings yet

- BS-AEF Double Degree ID 120Document27 pagesBS-AEF Double Degree ID 120Blu BNo ratings yet

- Bsa 121Document2 pagesBsa 121rdvgcyfjpgNo ratings yet

- Aei BsaDocument2 pagesAei BsaJulienne VinaraoNo ratings yet

- Aef BsaDocument2 pagesAef BsaJulienne VinaraoNo ratings yet

- R. A. Podar College of Commerce and Economics:, (Autonomous)Document45 pagesR. A. Podar College of Commerce and Economics:, (Autonomous)MANAS GAVHANENo ratings yet

- Tp-Btmp1533-Sem 2 2020.2021Document11 pagesTp-Btmp1533-Sem 2 2020.2021Carrot SusuNo ratings yet

- Cir Pac1163Document4 pagesCir Pac1163NUR AISYAH BINTINISWADI (BG)No ratings yet

- Solutions For Intermediate Accounting 15th Edition by KiesoDocument37 pagesSolutions For Intermediate Accounting 15th Edition by Kiesosadafidoudind100% (16)

- CAF Syllabus PDFDocument88 pagesCAF Syllabus PDFAbdullah AbidNo ratings yet

- CAF SyllabusDocument89 pagesCAF SyllabusFaheem MajeedNo ratings yet

- CAF 1 GridDocument5 pagesCAF 1 GridRiot SkinNo ratings yet

- Caf Syllabus Summary Certificate in Accounts and FinanceDocument89 pagesCaf Syllabus Summary Certificate in Accounts and Financesaad.office101No ratings yet

- لقطة شاشة ٢٠٢٤-٠١-١٤ في ٨.١٧.٥٦ مDocument5 pagesلقطة شاشة ٢٠٢٤-٠١-١٤ في ٨.١٧.٥٦ مbvwdzy9k2sNo ratings yet

- CAF SyllabusDocument89 pagesCAF Syllabusmanadish nawazNo ratings yet

- CPALE TOS Eff May 2019Document25 pagesCPALE TOS Eff May 2019Dale Abrams Dimataga75% (4)

- R. A. Podar College of Commerce and Economics:, (Autonomous)Document45 pagesR. A. Podar College of Commerce and Economics:, (Autonomous)Rashi thiNo ratings yet

- BOA TOS MAS - Revised.eaa.1Document3 pagesBOA TOS MAS - Revised.eaa.1kathleenNo ratings yet

- Table of Specifications Management Accounting & ServicesDocument3 pagesTable of Specifications Management Accounting & ServicesAnonymous PbzIFYXLgNo ratings yet

- Revised 2021 FM ProspectusDocument2 pagesRevised 2021 FM ProspectusGly JapNo ratings yet

- CAF SyllabusDocument88 pagesCAF SyllabusTeen CharaghNo ratings yet

- FAM 2022 - Course Plan - V4Document12 pagesFAM 2022 - Course Plan - V4bharath.bkNo ratings yet

- BS Accountancy 1Document2 pagesBS Accountancy 1Jana May Faustino MedranoNo ratings yet

- Bsba FMDocument2 pagesBsba FMPrecious DionisioNo ratings yet

- Aef ApcDocument2 pagesAef ApcJulienne VinaraoNo ratings yet

- FlowchartDocument2 pagesFlowchartSamuel HutchkinsNo ratings yet

- Far Syllabus PDFDocument25 pagesFar Syllabus PDFChristy Laiza AcuestaNo ratings yet

- Table of Specifications May 2019Document25 pagesTable of Specifications May 2019Justine Joyce Gabia90% (10)

- Table of Specifications Management Advisory Services: Remembering Understanding Application Analyzing Evaluating CreatingDocument25 pagesTable of Specifications Management Advisory Services: Remembering Understanding Application Analyzing Evaluating CreatingJoshua JoshNo ratings yet

- Table of Specifications Management Advisory Services: Remembering Understanding Application Analyzing Evaluating CreatingDocument25 pagesTable of Specifications Management Advisory Services: Remembering Understanding Application Analyzing Evaluating CreatingJoshua JoshNo ratings yet

- CPALE TOS Eff May 2019Document25 pagesCPALE TOS Eff May 2019Joshua JoshNo ratings yet

- 2022-30 BOA TOS FinalDocument38 pages2022-30 BOA TOS Finalsara mejiaNo ratings yet

- Conceptual Framework For Financial Reporting: Assignment Classification Table (By Topic)Document43 pagesConceptual Framework For Financial Reporting: Assignment Classification Table (By Topic)Ching Yin HoNo ratings yet

- BSA Retention Policy PDFDocument17 pagesBSA Retention Policy PDFKezNo ratings yet

- 2008-09 BCA Structure & First YearDocument31 pages2008-09 BCA Structure & First YearmaneganeshNo ratings yet

- Acc C606Document9 pagesAcc C606Gailee VinNo ratings yet

- SOW Form 5 POA Term 2 2020 2021Document9 pagesSOW Form 5 POA Term 2 2020 2021Peta-Gay Brown-JohnsonNo ratings yet

- Remembering Understanding Analyzing Evaluating Creating: TotalDocument6 pagesRemembering Understanding Analyzing Evaluating Creating: TotalannarheaNo ratings yet

- Accounting SyllabusDocument62 pagesAccounting SyllabusAhasanul RahhatNo ratings yet

- Course Checklist ID 120 Bachelor of Science in Legal ManagementDocument2 pagesCourse Checklist ID 120 Bachelor of Science in Legal ManagementGil ChanNo ratings yet

- Table of Specifications - Financial Accounting and ReportingDocument1 pageTable of Specifications - Financial Accounting and ReportingEren CuestaNo ratings yet

- Format For Course Curriculum: Course Title: Course Code: Credit Units: 3 Level: UG Course ObjectivesDocument3 pagesFormat For Course Curriculum: Course Title: Course Code: Credit Units: 3 Level: UG Course Objectivesparakh malhotraNo ratings yet

- BBSC Curriculum From 2021 Intake Onwards - 0Document170 pagesBBSC Curriculum From 2021 Intake Onwards - 0Nishantha FernandoNo ratings yet

- IIE Bachelor of Accounting Factsheet 2020 V1Document2 pagesIIE Bachelor of Accounting Factsheet 2020 V1Sakila AkterNo ratings yet

- 2019-Intermediate Accounting IIIDocument5 pages2019-Intermediate Accounting IIIdewi nabilaNo ratings yet

- 2021 22 Bbs Exchange Student Module HandbookDocument119 pages2021 22 Bbs Exchange Student Module HandbookanastasiaaNo ratings yet

- Intermediate Accounting Kieso 13th Edition Solutions ManualDocument24 pagesIntermediate Accounting Kieso 13th Edition Solutions ManualJasonLewiscpkx100% (29)

- RPS - Akuntansi Keuangan MenengahDocument11 pagesRPS - Akuntansi Keuangan MenengahSales & CS MenikNo ratings yet

- Os Lii - IvDocument145 pagesOs Lii - Ivteshome neguseNo ratings yet

- CA Foundations Unit Guides 2024Document86 pagesCA Foundations Unit Guides 2024Anna LinNo ratings yet

- Dwnload Full Intermediate Accounting 16th Edition Kieso Solutions Manual PDFDocument6 pagesDwnload Full Intermediate Accounting 16th Edition Kieso Solutions Manual PDFspitznoglecorynn100% (11)

- BBA - 2020 - 2023 SyllabusDocument117 pagesBBA - 2020 - 2023 Syllabuswild worldNo ratings yet

- 2023 OL Subject ReportDocument133 pages2023 OL Subject ReportSand FossohNo ratings yet

- CA Foundations Unit Guide 2022Document88 pagesCA Foundations Unit Guide 2022Ahmed HamedNo ratings yet

- 3.BS Management AccountingDocument17 pages3.BS Management AccountingTurtle ArtNo ratings yet

- Final NEP FYBAF Syllabus 23 24Document86 pagesFinal NEP FYBAF Syllabus 23 24Jai ShahNo ratings yet

- Financial Steering: Valuation, KPI Management and the Interaction with IFRSFrom EverandFinancial Steering: Valuation, KPI Management and the Interaction with IFRSNo ratings yet

- Codification of Statements on Standards for Accounting and Review Services: Numbers 21-24From EverandCodification of Statements on Standards for Accounting and Review Services: Numbers 21-24No ratings yet

- Compilation of ScalesDocument10 pagesCompilation of ScalesEllaNo ratings yet

- Ntrnal QuizletDocument23 pagesNtrnal QuizletEllaNo ratings yet

- Data Coding Schemes and Ethics CodeDocument6 pagesData Coding Schemes and Ethics CodeEllaNo ratings yet

- Flexible BudgetingDocument46 pagesFlexible BudgetingEllaNo ratings yet

- Incremental AnalysisDocument40 pagesIncremental AnalysisEllaNo ratings yet

- (B117) LAW 100 - Estrada v. EscritorDocument2 pages(B117) LAW 100 - Estrada v. EscritormNo ratings yet

- MR Big Operations Briefing Paper - Dayna OrtlandDocument16 pagesMR Big Operations Briefing Paper - Dayna Ortlandapi-573225016No ratings yet

- 4713 17630 2 PBDocument8 pages4713 17630 2 PBhuertas.rafa9299No ratings yet

- Chapter 4 - Organisational Culture and DiversityDocument27 pagesChapter 4 - Organisational Culture and Diversitybangtam9903No ratings yet

- Tolentino V Secretary of FinanceDocument199 pagesTolentino V Secretary of FinanceMarc Dave AlcardeNo ratings yet

- Why Need A Global LanguageDocument4 pagesWhy Need A Global LanguageGabriel Dan BărbulețNo ratings yet

- Use of Technology and The Rule of Evidence in Law: Munish RathiDocument6 pagesUse of Technology and The Rule of Evidence in Law: Munish RathiDennis KimamboNo ratings yet

- Victor Wooten Latin GrooveDocument6 pagesVictor Wooten Latin GrooveMomsua MomsuaNo ratings yet

- Just Right GovernmentDocument6 pagesJust Right Governmentapi-231584882No ratings yet

- Cyber Frauds, Scams and Their VictimsDocument253 pagesCyber Frauds, Scams and Their Victimsarquivoslivros100% (1)

- Prelims in Reading in Philippine History (GE 2)Document16 pagesPrelims in Reading in Philippine History (GE 2)Florence De LeonNo ratings yet

- Law On Sales Discussion ProblemsDocument7 pagesLaw On Sales Discussion ProblemsJoana Christine BuenaventuraNo ratings yet

- Inner Asia Multi-Book Essays: Xinjiang Close-UpDocument9 pagesInner Asia Multi-Book Essays: Xinjiang Close-Upjuan carlos molano toroNo ratings yet

- Arroyo V People GR 220598Document116 pagesArroyo V People GR 220598Fatzie MendozaNo ratings yet

- Aquilino Q. Pimentel JR vs. COMELECDocument15 pagesAquilino Q. Pimentel JR vs. COMELECRenzo JamerNo ratings yet

- 80 Phil LJ697Document15 pages80 Phil LJ697Agent BlueNo ratings yet

- AG Outlines Proposals For Police Reform in MichiganDocument1 pageAG Outlines Proposals For Police Reform in MichiganWXYZ-TV Channel 7 DetroitNo ratings yet

- Taxation Matters Relating To Securities and DerivativesDocument60 pagesTaxation Matters Relating To Securities and DerivativesAnjali JainNo ratings yet

- Role of Income TaxDocument109 pagesRole of Income TaxS. M. IMRAN100% (1)

- Bora AGM 2023 - Notice and Agenda (To COB)Document4 pagesBora AGM 2023 - Notice and Agenda (To COB)Syazril AriefNo ratings yet

- Css Exam Prep GuideDocument297 pagesCss Exam Prep Guidedale huevoNo ratings yet

- Esdc Emp5519Document16 pagesEsdc Emp5519Manan MughalNo ratings yet

- Academic Nda Non-LiaisonDocument1 pageAcademic Nda Non-Liaisonkumarsanjeev.net9511100% (1)

- PIC COURSE SYLLABUS Theories & Perspective On AS (AS 41A)Document3 pagesPIC COURSE SYLLABUS Theories & Perspective On AS (AS 41A)Darwin TolentinoNo ratings yet

- 28.4.2010-Sparkline Jyoti HR Manual2 FINAL - ChangeDocument28 pages28.4.2010-Sparkline Jyoti HR Manual2 FINAL - ChangeHR RiboNo ratings yet

- The Partnership AgreementDocument4 pagesThe Partnership AgreementMelisa FatiNo ratings yet

- Police Powers DissertationDocument7 pagesPolice Powers DissertationPayForAPaperSingapore100% (2)

- Chapter 2 Issues and Challenges Experienced by The Members of The LGBTQ CommunityDocument7 pagesChapter 2 Issues and Challenges Experienced by The Members of The LGBTQ CommunityJan Mark CastilloNo ratings yet

- Chantilly DocumentDocument5 pagesChantilly DocumentAlbNo ratings yet